Professional Documents

Culture Documents

RBI (Answer)

Uploaded by

thakkarsaurinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RBI (Answer)

Uploaded by

thakkarsaurinCopyright:

Available Formats

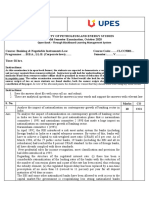

CS Executive

Economic, Business and Commercial Laws

Test Paper – 2

Reserve Bank of India Act, 1934

Time:- 45: Min [25 Marks]

5 Questions All Compulsory [5 Marks Each]

Question - 1

What are the functions of Reserve Bank of India ?

Answer

The functions of the Reserve Bank of India are as under:

Banking Functions.

Issue bank notes.

Monetary Policy Functions.

Public Debt Functions.

Foreign Exchange Management.

Banking Regulation & Supervision.

Regulation and Supervision of Non-Banking Financial Companies(NBFCs).

Regulation & Supervision of Co-operative banks.

Regulation of Derivatives and Money Market Instruments.

Payment and Settlement Functions.

Consumer Protection Functions.

Financial Inclusion and Development Functions.

Question - 2

Reserve Bank of India is a banker of banks. Comment.

Answer

From the perusal of following functions of Reserve Bank of India (RBI), it is rightly said that

Reserve Bank of India (RBI) is a Banker of Banks:

The Reserve Bank of India opens current accounts of banks with itself, enabling these banks to

maintain cash reserves as well as to carry out inter-bank transactions through these accounts.

Inter-bank accounts can also be settled by transfer of money through electronic fund transfer

system, such as, the Real Time Gross Settlement System (RTGS).

In addition, the Reserve Bank has also introduced the Centralised Funds Management System

(CFMS) to facilitate centralised funds enquiry and transfer of funds across Deposit Accounts

Department (DADs). This helps banks in their fund management as they can access information

on their balances maintained across different DADs from a single location.

As Banker of Banks, the Reserve Bank provides short-term loans and advances to selected banks,

when necessary, to facilitate lending to specific sectors and for specific purposes. These loans are

provided against promissory notes and other collateral given by the banks.

The Reserve Bank also acts as the ‘lender of last resort’. It can come to the rescue of a bank that is

solvent but faces temporary liquidity problems by supplying it with much needed liquidity when

no one else is willing to extend credit to that bank. The Reserve Bank extends this facility to

protect the interest of the depositors of the bank and to prevent possible failure of a bank, which

in turn may also affect other banks and institutions and can have an adverse impact on financial

stability and thus on the economy.

1.1 EBCL – Test Paper – 2

Question - 3

What are the regulations relating to acceptance of deposits by non-banking financial

companies conferred under chapter III B of the Reserve Bank of India Act, 1934 ?

Answer

Chapter III B of Reserve Bank of India Act, 1934 deals inte-alia with the regulation and

supervision of non-banking financial institutions and with the provisions relating to institutions

receiving deposits. Some of the important regulations relating to acceptance of deposits by Non-

Banking Financial Companies (NBFCs) are as under:

The NBFCs are allowed to accept/renew public deposits for a minimum period of 12 months

and maximum period of 60 months. They cannot accept deposits repayable on demand.

NBFCs cannot offer interest rates higher than the ceiling rate prescribed by Reserve Bank of

India from time to time.

NBFCs cannot offer gifts/incentives or any other additional benefit to the depositors.

NBFCs should have minimum investment grade credit rating.

The deposits with NBFCs are not insured.

The repayment of deposits by NBFCs is not guaranteed by Reserve Bank of India.

Certain mandatory disclosures are to be made about the NBFC in the Application form issued

by the NBFC soliciting deposits.

The said NBFC’s are also required to submit various returns from time to time in relation to

the said deposits.

Question - 4

How is the Monetary Policy Committee constituted under the Reserve Bank of India Act,

1934 ? What are its functions ? Explain.

Answer

Section 45ZB of the Reserve Bank of India Act, 1934 empowers the Central Government to

constitute the Monetary Policy Committee of the Reserve Bank of India.

The Monetary Policy Committee shall consist of the following Members, namely:—

1. The Governor of the Bank—Chairperson, ex officio.

2. Deputy Governor of the Bank, in charge of Monetary Policy—Member, ex officio.

3. One officer of the Bank to be nominated by the Central Board—Member, ex officio.

4. Three persons to be appointed by the Central Government—Members.

The Monetary Policy Committee shall determine the Policy Rate required to achieve the inflation

target. The decision of the Monetary Policy Committee shall be binding on the Reserve Bank of

India and the RBI is required to publish a document explaining the steps to be taken to

implement the decisions of the Monetary Policy Committee.

Question - 5

Discuss the market operations used by the Reserve Bank of India for operationalising

the monetary policy.

Answer

The Reserve Bank of India operationalises its monetary policy through its operationsin government

securities, foreign exchange and money markets.

Open Market Operations : Open Market Operations in the form of outright purchase/ sale of

Government securities are an important tool of the Reserve Bank’s monetary management. The

Bank carries out such operations in the secondary market on the electronic Negotiated Dealing

System – Order Matching (NDS-OM) platform by placingbids and/or taking the offers for securities.

Liquidity Adjustment Facility Auctions : The liquidity management operations are aimed at

modulating liquidity conditions such that the overnight rates in the money market remains within

the informal corridor set by the repo and reverse repo rates for the liquidity adjustment facility

(LAF) operations. In a repo transaction, the Reserve Bank infuses liquidity into the system by

taking securities as collateral, while in a reverse repo transaction it absorbs liquidity from the system

with the Reserve Bank providing securitiesto the counter parties.

Market Stabilisation Scheme : The Market Stabilisation Scheme (MSS) was introduced in April

2004 under which Government of India dated securities/treasury bills could be issued to absorb

surplus structural/ durable liquidity created by the Reserve Bank’s foreign exchange operations.

1.2 EBCL – Test Paper – 2

MSS operations are a sterilisation tool used for offsetting the liquidity impact created by

intervention in the foreign exchange markets.

1.3 EBCL – Test Paper – 2

You might also like

- Session. 2. Functions of RBIDocument11 pagesSession. 2. Functions of RBIArbazuddin shaikNo ratings yet

- Bhagwan Mahavir College of Commrace and Management StudiesDocument37 pagesBhagwan Mahavir College of Commrace and Management Studiesdhruvi kakadiaNo ratings yet

- RBI and Its FunctionsDocument14 pagesRBI and Its FunctionsSuchandra SarkarNo ratings yet

- 18MBAFM301: Mr. Varun K Assistant Professor Department of Business Administration MITE, MoodbidriDocument36 pages18MBAFM301: Mr. Varun K Assistant Professor Department of Business Administration MITE, MoodbidriHariprasad bhatNo ratings yet

- PreambleDocument7 pagesPreambleSudhir Kumar SinghNo ratings yet

- Functions of Reserve Bank of IndiaDocument18 pagesFunctions of Reserve Bank of IndiayargyalNo ratings yet

- Module 3: Central BankDocument47 pagesModule 3: Central Bankpoorvi agrawalNo ratings yet

- LAB - Study Note - 3Document19 pagesLAB - Study Note - 3ANANDMAYEE TRIPATHY PGP 2021-23 Batch100% (1)

- 52Document4 pages52R SNo ratings yet

- Module 4 Eco Sem 3Document18 pagesModule 4 Eco Sem 3sruthikadug22No ratings yet

- Core Principles For Effective Banking Supervision: An Assessment of The Position in India ForewordDocument23 pagesCore Principles For Effective Banking Supervision: An Assessment of The Position in India ForewordSherin A AbrahamNo ratings yet

- CRR SLRDocument25 pagesCRR SLRSamhitha KandlakuntaNo ratings yet

- Roll No.-103 SAP ID - 500071323: Open Book - Through Blackboard Learning Management SystemDocument4 pagesRoll No.-103 SAP ID - 500071323: Open Book - Through Blackboard Learning Management SystemAryan DevNo ratings yet

- Regulatory Role of RBI and Its Monitory PolicyDocument19 pagesRegulatory Role of RBI and Its Monitory PolicyManish Bhoir100% (1)

- IIBFDocument106 pagesIIBFRajan NandolaNo ratings yet

- Stryker Corporation: Capital BudgetingDocument4 pagesStryker Corporation: Capital BudgetingShakthi RaghaviNo ratings yet

- m1-2 Regulation, Rbi, Func, PolicyDocument15 pagesm1-2 Regulation, Rbi, Func, PolicyMEENUNo ratings yet

- Chapter 2 - Rbi, Sebi, IrdaDocument66 pagesChapter 2 - Rbi, Sebi, IrdasejalNo ratings yet

- Unit - II - Banking RegulationDocument14 pagesUnit - II - Banking RegulationShreya PushkarnaNo ratings yet

- Chapter - 3 Reserve Bank of India Act, 1934: Raghuram RajanDocument7 pagesChapter - 3 Reserve Bank of India Act, 1934: Raghuram Rajanpriyanka aroraNo ratings yet

- RBI Functions: 1. Monopoly of Note IssueDocument5 pagesRBI Functions: 1. Monopoly of Note Issueshivam shandilyaNo ratings yet

- Special Entities Accounting and Innovation Accounting: Project ConceptDocument21 pagesSpecial Entities Accounting and Innovation Accounting: Project ConceptSanket AgarwalNo ratings yet

- Miscellaneous Important Points-1Document21 pagesMiscellaneous Important Points-1bhavishyat kumawatNo ratings yet

- Commercial Application ProjectDocument12 pagesCommercial Application ProjectMridul MoolchandaniNo ratings yet

- Banking Sector in India: Sr. No. Title Page NoDocument15 pagesBanking Sector in India: Sr. No. Title Page NorohanNo ratings yet

- Rbiitsmonetarypolicy 090917083338 Phpapp01Document23 pagesRbiitsmonetarypolicy 090917083338 Phpapp01Choudhary Abdul HamidNo ratings yet

- Fund Front Office: Definition: Cash Reserve Ratio (CRR) in Terms of Section 42 (1) of The Reserve Bank of India ActDocument17 pagesFund Front Office: Definition: Cash Reserve Ratio (CRR) in Terms of Section 42 (1) of The Reserve Bank of India ActSouravMalikNo ratings yet

- Chapter 3. Lecture 3.1 RBI, 1934Document4 pagesChapter 3. Lecture 3.1 RBI, 1934vibhuNo ratings yet

- Central Bank of IndiaDocument5 pagesCentral Bank of Indiagauravbansall567No ratings yet

- Banking & FIsDocument12 pagesBanking & FIsAmbalika SmitiNo ratings yet

- Reseacrch Paper PojectDocument2 pagesReseacrch Paper PojectPradnya ShejwalNo ratings yet

- Rbi PDFDocument4 pagesRbi PDFUmar AbdullahNo ratings yet

- Index On BoxesDocument76 pagesIndex On BoxesAmritNo ratings yet

- Credit Control by RBIDocument10 pagesCredit Control by RBIRishi exportsNo ratings yet

- Reserve Bank of India: HistoryDocument4 pagesReserve Bank of India: HistoryEku Nahoi HoilepeNo ratings yet

- Regulatory Bodies of India PDFDocument54 pagesRegulatory Bodies of India PDFSourabh Kumar SinghNo ratings yet

- Banking NotesDocument12 pagesBanking NotesChiranjive Ravindra JagadalNo ratings yet

- Central Banking: Chapter-5Document15 pagesCentral Banking: Chapter-5Ruthvik RevanthNo ratings yet

- Econ 01 RbiDocument10 pagesEcon 01 Rbipuneya sachdevaNo ratings yet

- Structure and Functions of Reserve Bank of IndiaDocument24 pagesStructure and Functions of Reserve Bank of Indiasridevi gopalakrishnanNo ratings yet

- Meaning: Function of RBIDocument5 pagesMeaning: Function of RBIAnu GuptaNo ratings yet

- Fim Chapter 2Document26 pagesFim Chapter 2Piyu VyasNo ratings yet

- Module-III Banking Regulation: Course OutlineDocument36 pagesModule-III Banking Regulation: Course OutlineSanjay ParidaNo ratings yet

- RRB Po GK Power CapsuleDocument59 pagesRRB Po GK Power CapsuleDetective ArunNo ratings yet

- RRB Po Clerk Capsule 2015Document59 pagesRRB Po Clerk Capsule 2015Abhishek GeraNo ratings yet

- Overview of Indian Financial SystemDocument6 pagesOverview of Indian Financial Systemhitesh prithianiNo ratings yet

- Central BankDocument10 pagesCentral BankyjgjbhhbNo ratings yet

- Commercial Bank ManagementDocument8 pagesCommercial Bank ManagementShilpika ShettyNo ratings yet

- Traditional Functions B. Monopoly of Note IssueDocument10 pagesTraditional Functions B. Monopoly of Note IssueSaishankar SanaboinaNo ratings yet

- Banking Law Qestion Paper AnswersDocument101 pagesBanking Law Qestion Paper AnswersThrishul MaheshNo ratings yet

- Capsule For Sbi Po Mainsrrbrbi 2015Document54 pagesCapsule For Sbi Po Mainsrrbrbi 2015kamalesh123No ratings yet

- Reserve Bank of IndiaDocument28 pagesReserve Bank of Indiazara_naveed92No ratings yet

- Khanna Committee IonsDocument15 pagesKhanna Committee Ionsvikas1978No ratings yet

- Credit Authorisation SchemeDocument6 pagesCredit Authorisation SchemeOngwang KonyakNo ratings yet

- Digital Assignment-1 Subject Code-Bmt1013 Subject Name - Banking and InsuranceDocument9 pagesDigital Assignment-1 Subject Code-Bmt1013 Subject Name - Banking and InsuranceSwethaNo ratings yet

- Establishment of Reserve Bank of IndiaDocument7 pagesEstablishment of Reserve Bank of IndialoganathanNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Personal FinanceDocument5 pagesPersonal FinanceFred Jaff Fryan RosalNo ratings yet

- Last 6 Months RBI in News Part 2 NiharDocument6 pagesLast 6 Months RBI in News Part 2 NiharbuhhbubuhgNo ratings yet

- Tentative Comp - Egsismo - Eml - 2005425303 - Pring, Robert V - Deped Tarlac Province - TarDocument1 pageTentative Comp - Egsismo - Eml - 2005425303 - Pring, Robert V - Deped Tarlac Province - TarNgirp Alliv TreborNo ratings yet

- SI CI (1) Simple Interest, Compound InterstDocument3 pagesSI CI (1) Simple Interest, Compound Interstdiksahu wfeeNo ratings yet

- Grade Sheet - October 2015 GraduatingDocument19 pagesGrade Sheet - October 2015 GraduatingEppie SeverinoNo ratings yet

- Chair Ids PLDocument3 pagesChair Ids PLHarry SinghNo ratings yet

- CIRFormDocument3 pagesCIRFormVina Mae AtaldeNo ratings yet

- Budget Sheet AcccDocument1 pageBudget Sheet AcccJohn GoodenNo ratings yet

- 2023 18 10 13 23 04 Statement - 1697615584687Document28 pages2023 18 10 13 23 04 Statement - 1697615584687Rahul MunnaNo ratings yet

- LUYỆN TẬP BT CÓ CÔNG THỨC - TTCKDocument11 pagesLUYỆN TẬP BT CÓ CÔNG THỨC - TTCKLâm Thị Như ÝNo ratings yet

- Transaction Statement 6523cd38 1d29 A757 A256 1050ec5d7e03 en Ie F2ccceDocument1 pageTransaction Statement 6523cd38 1d29 A757 A256 1050ec5d7e03 en Ie F2ccceragduarte25No ratings yet

- GST ChallanDocument2 pagesGST ChallanGajendrakumarHNo ratings yet

- TermsDocument3 pagesTermsVuNo ratings yet

- 2018 07 26 08 12 24 532 - 1926212275 - PDFDocument6 pages2018 07 26 08 12 24 532 - 1926212275 - PDFRAKESHNo ratings yet

- L4, TVM SupplementDocument28 pagesL4, TVM SupplementYelzhan ShaikhiyevNo ratings yet

- Credit & Collection ReviewerDocument4 pagesCredit & Collection ReviewerChantelle IshiNo ratings yet

- Credit Transactions - PNB Vs MallorcaDocument2 pagesCredit Transactions - PNB Vs MallorcaJp tan britoNo ratings yet

- Salary SlipDocument1 pageSalary SlipJames Jones100% (1)

- 3 Months Account StatementDocument12 pages3 Months Account StatementshilpapanjwaniNo ratings yet

- JAIIB Genius Week 9 2023Document10 pagesJAIIB Genius Week 9 2023SIBE SNo ratings yet

- Case StudyDocument2 pagesCase Studybthanks376No ratings yet

- Corporate Liquidation Answer SheetDocument4 pagesCorporate Liquidation Answer SheetsatyaNo ratings yet

- Employees OrientationDocument26 pagesEmployees OrientationRojila luitelNo ratings yet

- Idbi BANK Home LoanDocument11 pagesIdbi BANK Home LoanHarshal MohinkarNo ratings yet

- Process Unclaimed Deposits Inoperative AccountsDocument2 pagesProcess Unclaimed Deposits Inoperative Accountssanking11No ratings yet

- PFG Credit Card Design Solution-Part 2 Gaurav ChaturvediDocument4 pagesPFG Credit Card Design Solution-Part 2 Gaurav Chaturvedikkiiidd0% (1)

- Bank Statment Wells FargoDocument7 pagesBank Statment Wells FargoYu ShilohNo ratings yet

- CHAPTER 2 StudentsDocument13 pagesCHAPTER 2 Studentsirenep banhan21No ratings yet

- SN An SKMDocument11 pagesSN An SKMcanNo ratings yet

- NZ Om Display PRT PDFDocument12 pagesNZ Om Display PRT PDFVikash Kumar MeenaNo ratings yet