Professional Documents

Culture Documents

Sup August Exam

Uploaded by

sacey20.hbOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sup August Exam

Uploaded by

sacey20.hbCopyright:

Available Formats

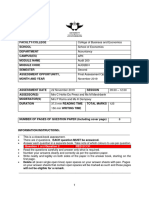

PROGRAMME : LLB

SUBJECT : TAX LAW

CODE : TLW41A0/BRE0011

DATE : EXAM

DURATION : 3 hours

TOTAL MARKS : 50

EXAMINER : PROF T LEGWAILA

MODERATOR : PROF J CALITZ

EXTERNAL EXAMINER : PROF C FRITZ (UNIVERSITY OF THE WITWATERSRAND)

INSTRUCTIONS:

1 Your answers must be substantiated in detail. You are required to explain the rationale for

your answers.

2 Type your answers and submit them on Blackboard. Only if you are unable to you are

allowed to submit via email to tlegwaila@uj.ac.za

3 This is an open-book examination. You may use any materials but are not allowed to share

information with other students.

4 You are not allowed to be in contact with other students.

5 Your answers will be tested for plagiarism in general and in respect of the answers of

other students.

6 Do not copy and paste from any sources. Answers must be provided in your own words.

7 Use quotation marks where literally quoting from sources.

Question 1 (30 marks)

Paul is an individual who is tax resident in South Africa because he is ordinarily resident in South

Africa. He is employed by SACo, a South African tax resident company. Due to gross negligence on

his part, Paul sustained injuries while discharging his employment duties at SACo’s premises. As a

result, his employment contract was terminated due to negligence and injuries that rendered him

unable to continue discharging his employment duties. Following an agreement between SACo and

Paul’s attorneys, SACo made the following payments to Paul:

1. R100 000 for compensation for injuries sustained by Paul, including medical expenses;

2. R20 000 for legal fees incurred by Paul in obtaining advice and representation in this matter;

and

3. R1 million as compensation for future loss of earnings by Paul.

Advise Paul and SACo on the tax implications of these payments for both Paul and SACo.

Question 2 (20 marks)

Sali is a non-resident individual who owns one hundred shares in Resego (Pty) Ltd, a South African

tax resident company. Resego (Pty) Ltd’s trade is mainly the manufacture and sale of curtains. Sali

acquired the shares in 2010 at the price of R2000 a share. Thus Sali paid R200 000 for the shares. In

March 2020 the company paid Sali a dividend of R400 000. Immediately after receipt of the

dividend, and anticipating the massive decline of the value of the shares due to COVID-19, Sali sold

all the shares in Resego (Pty) Ltd for R350 000.

Advise Sali on the tax implications of the above 2020 transactions.

You might also like

- Occupational Therapy Placements: A Pocket GuideFrom EverandOccupational Therapy Placements: A Pocket GuideRating: 5 out of 5 stars5/5 (1)

- Feb ExamDocument2 pagesFeb Examsacey20.hbNo ratings yet

- Feb Exam 2020Document2 pagesFeb Exam 2020sacey20.hbNo ratings yet

- Exam - SickDocument2 pagesExam - Sicksacey20.hbNo ratings yet

- Lop101 TL3 2022 01 MemoDocument8 pagesLop101 TL3 2022 01 MemoYolanda SofutheNo ratings yet

- 2018 June Special Exam EbDocument2 pages2018 June Special Exam Ebsacey20.hbNo ratings yet

- BL Assignment Sept 2023Document8 pagesBL Assignment Sept 2023Ngọc Phương TrịnhNo ratings yet

- Exam 1 2016 Questions and Answers PDFDocument18 pagesExam 1 2016 Questions and Answers PDFROBERT W. KEYNELNo ratings yet

- BL - Assignment 1Document7 pagesBL - Assignment 1Hoài Sơn VũNo ratings yet

- International School of Management and EconomicsDocument7 pagesInternational School of Management and EconomicsNhật LinhNo ratings yet

- LML6004 TASK 2 S1 2023 FinalDocument3 pagesLML6004 TASK 2 S1 2023 FinalchuhongchokNo ratings yet

- Uta4612 Project 1 Question 3Document5 pagesUta4612 Project 1 Question 3nicoleNo ratings yet

- LAW2040 2017-18 Sem1 SeminarsDocument13 pagesLAW2040 2017-18 Sem1 SeminarsFati Mir0% (1)

- LAW1106 Summative Coursework 2023Document5 pagesLAW1106 Summative Coursework 2023Jabachi NwaoguNo ratings yet

- LW322.docx Exam Questions For 2020 Sem 1Document4 pagesLW322.docx Exam Questions For 2020 Sem 1Manny RodriguezNo ratings yet

- 2020 Basic Legal Ethics Final ExamDocument29 pages2020 Basic Legal Ethics Final ExamNj Concepcion Robeniol100% (2)

- Peer Educator Volunteer Application Form 2015Document5 pagesPeer Educator Volunteer Application Form 2015alivarmazyarNo ratings yet

- LEGAL ETHICS - 2012 Bar Exam MCQ PDFDocument30 pagesLEGAL ETHICS - 2012 Bar Exam MCQ PDF8LYN LAWNo ratings yet

- 1 June - Update On Trust Cases 2020 v.3Document2 pages1 June - Update On Trust Cases 2020 v.3Darren PoNo ratings yet

- MCL Labour Law Workbook Semester 1 2022Document22 pagesMCL Labour Law Workbook Semester 1 2022debongz manonoNo ratings yet

- Information Guide 2023Document99 pagesInformation Guide 2023Lumkelo NxumaloNo ratings yet

- PC Room (A303/B) : Sefat - Law@green - Edu.bdDocument7 pagesPC Room (A303/B) : Sefat - Law@green - Edu.bdNayem MiaziNo ratings yet

- Trial & Litigation - TUT 102Document5 pagesTrial & Litigation - TUT 102Tia LakhrajNo ratings yet

- EVIDENCE Course GuideDocument4 pagesEVIDENCE Course GuideJustine RaagasNo ratings yet

- Tutorial Q Tri 2 17 - 18Document12 pagesTutorial Q Tri 2 17 - 18Lyana Sulaiman100% (1)

- 2022 Civil Course OutlineDocument14 pages2022 Civil Course Outline3906345No ratings yet

- 2023 CMLC 041 Module Outline FinalmoderatedDocument11 pages2023 CMLC 041 Module Outline FinalmoderatedFaint MokgokongNo ratings yet

- 2015 Commercial Law Hand in Assessment 2015-2Document4 pages2015 Commercial Law Hand in Assessment 2015-2Mohammad ShoaibNo ratings yet

- Bautista, Michael John Training AgreementDocument1 pageBautista, Michael John Training AgreementMonNo ratings yet

- Virtual Internship Training Agreement: College of Computer StudiesDocument1 pageVirtual Internship Training Agreement: College of Computer StudiesMonNo ratings yet

- Basic Labor and Employment Education CourseDocument9 pagesBasic Labor and Employment Education CourseJennifer Tan Marcial100% (2)

- 2012 Bar ExaminationsDocument182 pages2012 Bar ExaminationsLarry BugaringNo ratings yet

- Abv 320 Exam 2015Document6 pagesAbv 320 Exam 2015Gloria CharlesNo ratings yet

- 2023 Group AssignmentDocument14 pages2023 Group AssignmentRavineshNo ratings yet

- The Chartered Institute of Legal Executives Unit 15 - Civil LitigationDocument8 pagesThe Chartered Institute of Legal Executives Unit 15 - Civil LitigationantcbeNo ratings yet

- Lcp4801 - May June 2022 Exam PaperDocument7 pagesLcp4801 - May June 2022 Exam Papercharmainemosima1No ratings yet

- Part A BarDocument137 pagesPart A BarkertzunhkNo ratings yet

- TLI4801 TL102 AssignmentsDocument5 pagesTLI4801 TL102 Assignmentscedric shibambuNo ratings yet

- Evidence and Procedure - Coursework BriefDocument6 pagesEvidence and Procedure - Coursework Briefpokandi.fbNo ratings yet

- Statement of Affairs Instructions and Form1may2016Document2 pagesStatement of Affairs Instructions and Form1may2016Hang TuahNo ratings yet

- L 212 Commercial Law II Assignment 1.09.2020Document2 pagesL 212 Commercial Law II Assignment 1.09.2020yxygks5yr9No ratings yet

- 2012 Bar ExaminationsDocument246 pages2012 Bar ExaminationsCeleste Lorenzana-AlicanteNo ratings yet

- Crocels's Contract With Swansea UniversityDocument2 pagesCrocels's Contract With Swansea UniversityJonathan BishopNo ratings yet

- SPC Pil Midterm Exams BDocument5 pagesSPC Pil Midterm Exams BPrincess Felipe IsonNo ratings yet

- LLIN2613 Assignment 2023Document2 pagesLLIN2613 Assignment 20232022082438No ratings yet

- Tutorial Letter 201/1/2019: Business Practice and Workplace Ethics (BWE1501) Semester 1 Department of JurisprudenceDocument13 pagesTutorial Letter 201/1/2019: Business Practice and Workplace Ethics (BWE1501) Semester 1 Department of Jurisprudencehelli mthanwani50% (2)

- Assessment Brief Law of TortsDocument6 pagesAssessment Brief Law of TortsHossain Ali Al-RaziNo ratings yet

- Unisa Bcompt Fac3703 Past Exams and SolDocument9 pagesUnisa Bcompt Fac3703 Past Exams and SolDanny MahomaneNo ratings yet

- Examiner's Report: LW ENG Corporate and Business Law Based On Exams From January To June 2019Document3 pagesExaminer's Report: LW ENG Corporate and Business Law Based On Exams From January To June 2019zulaa bNo ratings yet

- 2012 Delegate Brochure - Froensic ScienceDocument6 pages2012 Delegate Brochure - Froensic ScienceNeo Mervyn MonahengNo ratings yet

- LW 111 Assessment and Marking Guide For AssessmentDocument9 pagesLW 111 Assessment and Marking Guide For AssessmentLila EsauNo ratings yet

- Law of Property Study GuideDocument23 pagesLaw of Property Study GuideThabz2450% (2)

- Abst Particpants Manual Oct 2014 2Document200 pagesAbst Particpants Manual Oct 2014 2Arniel RiveraNo ratings yet

- ADMS2610 SyllabusDocument12 pagesADMS2610 SyllabusFinchley SangNo ratings yet

- LW3606A AssignmentDocument3 pagesLW3606A AssignmentViola TsangNo ratings yet

- Answers To Assignment 1 2 PDFDocument7 pagesAnswers To Assignment 1 2 PDFROBERT W. KEYNELNo ratings yet

- Ucp4622 Group Assignment Tri 2 17 - 18Document5 pagesUcp4622 Group Assignment Tri 2 17 - 18Ivan TeyNo ratings yet

- Private InternationMain Examination UJ Memorandum 2020Document12 pagesPrivate InternationMain Examination UJ Memorandum 2020NathiNo ratings yet

- 11 June - Connected TransactionsDocument2 pages11 June - Connected TransactionsDarren PoNo ratings yet

- Learner Guide CMAA030 2023Document20 pagesLearner Guide CMAA030 2023sacey20.hbNo ratings yet

- Exam - SpecialDocument2 pagesExam - Specialsacey20.hbNo ratings yet

- Uj 38854+SOURCE1+SOURCE1.1Document8 pagesUj 38854+SOURCE1+SOURCE1.1sacey20.hbNo ratings yet

- Module 2 PART ADocument27 pagesModule 2 PART Asacey20.hbNo ratings yet

- Module 6 - Portfolio Management and CAPMDocument32 pagesModule 6 - Portfolio Management and CAPMsacey20.hbNo ratings yet

- TEST 2 CAUC 031 - QP FINAL 2021 With Ms. Debras CommentsDocument6 pagesTEST 2 CAUC 031 - QP FINAL 2021 With Ms. Debras Commentssacey20.hbNo ratings yet

- Uj 16944+SOURCE1+SOURCE1.2Document11 pagesUj 16944+SOURCE1+SOURCE1.2sacey20.hbNo ratings yet

- Uj 35806+SOURCE1+SOURCE1.1Document3 pagesUj 35806+SOURCE1+SOURCE1.1sacey20.hbNo ratings yet

- Uj 38361+SOURCE1+SOURCE1.1Document9 pagesUj 38361+SOURCE1+SOURCE1.1sacey20.hbNo ratings yet

- Uj 38122+SOURCE1+SOURCE1.1Document13 pagesUj 38122+SOURCE1+SOURCE1.1sacey20.hbNo ratings yet

- Uj 17576+SOURCE1+SOURCE1.1Document8 pagesUj 17576+SOURCE1+SOURCE1.1sacey20.hbNo ratings yet

- Uj 32635+SOURCE1+SOURCE1.1Document22 pagesUj 32635+SOURCE1+SOURCE1.1sacey20.hbNo ratings yet

- Uj 38483+SOURCE1+SOURCE1.1Document18 pagesUj 38483+SOURCE1+SOURCE1.1sacey20.hbNo ratings yet

- FAC11A1Document9 pagesFAC11A1sacey20.hbNo ratings yet

- Fac11a1 SuppDocument9 pagesFac11a1 Suppsacey20.hbNo ratings yet

- Nexia SABTBusinessin SAGuideDocument68 pagesNexia SABTBusinessin SAGuidesacey20.hbNo ratings yet

- Rothy's v. Birdies - Order Denying SJDocument13 pagesRothy's v. Birdies - Order Denying SJSarah BursteinNo ratings yet

- Peoria County Booking Sheet 02/17/15Document8 pagesPeoria County Booking Sheet 02/17/15Journal Star police documentsNo ratings yet

- Michelle Janavs Asks To Serve Term at HomeDocument18 pagesMichelle Janavs Asks To Serve Term at HomeKhristopher J. BrooksNo ratings yet

- PL AG & State of MI Response - To Motion To Change Venue 2020-01-27Document13 pagesPL AG & State of MI Response - To Motion To Change Venue 2020-01-27Dave BondyNo ratings yet

- HF7E16HKEHDocument9 pagesHF7E16HKEHMarc Gerald TorresNo ratings yet

- Complaint For Sum of MoneyDocument3 pagesComplaint For Sum of MoneyLudica Oja0% (1)

- San Beda Memory Aid - InsuranceDocument24 pagesSan Beda Memory Aid - InsurancebreeH20No ratings yet

- Partnership Agreement Apostolic Technologies: 1. Name and BusinessDocument5 pagesPartnership Agreement Apostolic Technologies: 1. Name and BusinessApostolic TechnologiesNo ratings yet

- Ganesh B - OFFER LETTER - 061123Document10 pagesGanesh B - OFFER LETTER - 061123ravi995916No ratings yet

- Corporation Law Notes by AquinoDocument3 pagesCorporation Law Notes by Aquinopinky paroliganNo ratings yet

- Contracts: Legal FormsDocument88 pagesContracts: Legal Formsdaryl canozaNo ratings yet

- Pilapil Vs Ibay Somera - BALLESTA - EDocument2 pagesPilapil Vs Ibay Somera - BALLESTA - EVince Llamazares LupangoNo ratings yet

- G.R. No. 160889. April 27, 2007. Dr. Milagros L. Cantre, Petitioner, vs. Sps. John David Z. GO and NORA S. GO, RespondentsDocument13 pagesG.R. No. 160889. April 27, 2007. Dr. Milagros L. Cantre, Petitioner, vs. Sps. John David Z. GO and NORA S. GO, RespondentsRhea Ibañez - IlalimNo ratings yet

- URBAN BANK V PEÑA PDFDocument6 pagesURBAN BANK V PEÑA PDFJessicaNo ratings yet

- Rule 81 - Warner vs. LuzonDocument2 pagesRule 81 - Warner vs. LuzonMhaliNo ratings yet

- Correction of Clerical Errors - Rule 108Document21 pagesCorrection of Clerical Errors - Rule 108Marian's PreloveNo ratings yet

- People v. Bibat, G.R. No. 124319 PDFDocument6 pagesPeople v. Bibat, G.R. No. 124319 PDFGia DirectoNo ratings yet

- Sears Bankruptcy PDFDocument5 pagesSears Bankruptcy PDFNavneet KaurNo ratings yet

- Complaint & Jury DemandDocument19 pagesComplaint & Jury DemandWXYZ-TV Channel 7 Detroit100% (1)

- Formaran vs. Ong (July 8, 2013)Document9 pagesFormaran vs. Ong (July 8, 2013)Cla SaguilNo ratings yet

- Professional Skill Development Activity Interpretation of Statutes Amity Law School, DelhiDocument7 pagesProfessional Skill Development Activity Interpretation of Statutes Amity Law School, Delhivarunendra pandeyNo ratings yet

- Complaint For Declaratory and Injunctive ReliefDocument46 pagesComplaint For Declaratory and Injunctive ReliefLaw&CrimeNo ratings yet

- Special Court of Review in Re Etta MullinDocument29 pagesSpecial Court of Review in Re Etta MullinMichael Lowe, Attorney at LawNo ratings yet

- Family Law in Zambia - Chapter 10 - AdoptionDocument8 pagesFamily Law in Zambia - Chapter 10 - AdoptionZoe The PoetNo ratings yet

- Principle of Natural Justice (Project)Document5 pagesPrinciple of Natural Justice (Project)Abbas HaiderNo ratings yet

- Headout PP 209316Document1 pageHeadout PP 209316risingstar organizerNo ratings yet

- KP Form No. 6Document2 pagesKP Form No. 6Anob EhijNo ratings yet

- Project Document Cover Sheet: United Nations Peacebuilding Support Office (PBSO) / Peacebuilding Fund (PBF)Document66 pagesProject Document Cover Sheet: United Nations Peacebuilding Support Office (PBSO) / Peacebuilding Fund (PBF)Rafif Muhammad RizqullahNo ratings yet

- Privilege Against Self-Incrimination: A Common Law RightDocument26 pagesPrivilege Against Self-Incrimination: A Common Law RightJamal La RoseNo ratings yet

- NLJ House Style 2011Document7 pagesNLJ House Style 2011Irene GomachasNo ratings yet