Professional Documents

Culture Documents

Manufacturing

Uploaded by

Amit SharmaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Manufacturing

Uploaded by

Amit SharmaCopyright:

Available Formats

ICICI Prudential Manufacturing Fund Category

(An Open Ended Equity Scheme following manufacturing theme.) Thematic

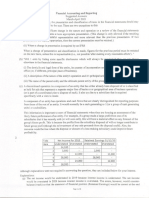

Returns of ICICI Prudential Manufacturing Fund - Growth Option as on December 31, 2023

Style Box Particulars 1 Year 3 Years 5 Years Since inception

CAGR Current CAGR Current CAGR Current CAGR Current

(%) Value of (%) Value of (%) Value of (%) Value of

Investment Investment Investment Investment

of Rs. 10000 of Rs. 10000 of Rs. 10000 of Rs. 10000

Style

Value Blend Growth Scheme 47.35 14719.65 32.09 23012.77 21.59 26561.89 21.00 27040.00

Size Nifty India Manufacturing TRI (Benchmark) 34.98 13486.81 24.99 19502.75 18.65 23505.82 18.64 24406.83

Large

Nifty 50 TRI (Additional Benchmark) 21.36 12130.02 17.24 16101.26 16.25 21220.00 16.87 22564.96

Mid NAV (Rs.) Per Unit (as on December 29,2023 : 27.04) 18.37 11.75 10.18 10.00

Notes:

Small 1. Different plans shall have different expense structure. The performance details provided herein are of ICICI Prudential Manufacturing Fund.

2. The scheme is currently managed by Anish Tawakley & Lalit Kumar. Mr. Anish Tawakley has been managing this fund since Oct 2018. Total Schemes managed by the Fund Manager is 6 (6

are jointly managed).

Mr. Lalit Kumar has been managing this fund since Nov 2023. Total Schemes managed by the Fund Manager is 8 (6 are jointly managed). Refer annexure from page no. 108 for performance

Diversified of other schemes currently managed by Anish Tawakley & Lalit Kumar.

3. Date of inception: 11-Oct-2018.

4. Past performance may or may not be sustained in future and the same may not necessarily provide the basis for comparison with other investment.

5. Load is not considered for computation of returns.

6. In case, the start/end date of the concerned period is a nonbusiness date (NBD), the NAV of the previous date is considered for computation of returns. The NAV per unit shown in the table is

as on the start date of the said period

7. The performance of the scheme is benchmarked to the Total Return variant of the Index.

8. Additionally, Mr. Lalit Kumar has been appointed as the fund manager wef November 1, 2023.

9. Investors please note that the name of the benchmark of the Scheme has changed to Nifty India Manufacturing TRI with effect from October 01, 2023.

Scheme Details

Fund Managers** : Inception/Allotment date: 11-Oct-18 Exit load for Redemption / Switch out

Mr. Anish Tawakley (Managing this fund :- Lumpsum & SIP / STP / SWP Option

since Oct 2018 & Overall 28 years 1% of applicable NAV if redeemed/switch out

of experience) Monthly AAUM as on 31-Dec-23 : Rs. 2,063.08 crores within 1 year Nil – if redeemed/switched

Lalit Kumar ` out after 1 year.

Closing AUM as on 31-Dec-23 : Rs. 2,291.92 crores

(Managing this fund since Nov, 2023 & (w.e.f. 1st Jan 2019)

Overall 13 years of experience) (w.e.f. November 1, 2023 )

Application Amount for fresh Subscription :

Rs.5,000 (plus in multiples of Re.1)

Total Expense Ratio @@ : No. of folios

Min.Addl.Investment : Other : 2.05% p. a. in the Scheme :

Indicative Investment Horizon: 5 years & above Direct : 0.92% p. a. 92,610

Rs.1,000 (plus in multiples of Re.1)

`

NAV (As on 29-Dec-23): Growth Option : Rs. 27.04 IDCW Option : 20.65 Direct Plan Growth Option : Rs. 28.61 Direct Plan IDCW Option : 22.13 ` `

Portfolio as on December 31, 2023 Quantitative Indicators

Company/Issuer Rating % to % to NAV Company/Issuer Rating % to % to NAV Average Dividend Yield :

NAV Derivatives NAV Derivatives

0.98

Equity Shares 91.92% 1.23% Personal Products 0.83%

Aerospace & Defense 2.81% Procter & Gamble Hygiene and

• Hindustan Aeronautics Ltd. 2.81% Health Care Ltd. 0.83% Annual Portfolio Turnover Ratio :

Auto Components 3.87% Petroleum Products 8.36% Equity - 0.31 times

Motherson Sumi Systems Ltd. 1.50% • Reliance Industries Ltd. 4.27%

Schaeffler India Ltd. 1.23% Hindustan Petroleum Corporation Ltd. 2.46% Std Dev

TVS Holdings Ltd. 1.14% Bharat Petroleum Corporation Ltd. 1.63% Sharpe Ratio : Portfolio Beta :

Automobiles 14.44% Pharmaceuticals & Biotechnology 10.35% (Annualised) :

1.51 0.97

• Maruti Suzuki India Ltd. 6.21% • Sun Pharmaceutical Industries Ltd. 4.15% 14.70%

• Hero Motocorp Ltd. 3.34% Alkem Laboratories Ltd. 1.89%

The figures are not netted for derivative transactions.

• Tata Motors Ltd. - DVR 2.80% Zydus Lifesciences Ltd. 1.59% Risk-free rate based on the last Overnight MIBOR cut-off of 6.90%.

Tata Motors Ltd. 1.25% Aurobindo Pharma Ltd. 1.39% @@ Total Expense Ratio is as on the last day of the month.

Bajaj Auto Ltd. 0.84% Lupin Ltd. 1.32% **In addition to the fund manager managing this fund, overseas investment is managed by Ms.

Sharmila D'mello.

Cement & Cement Products 9.32% Power 0.79% Investors are requested to note that the scheme has undergone changes in fundamental

• Ultratech Cement Ltd. 6.54% NTPC Ltd. 0.79% attributes with effect from closure of business of August 27, 2021.

Refer page no 100 to 107 for details on option, entry load, SWP, STP/Flex STP & minimum

JK Cement Ltd. 1.02% Index Futures/Options 1.23% redemption amount pertaining to the scheme.

Grasim Industries Ltd. 0.99% Nifty 50 Index - Futures 1.23% For IDCW History : Refer page no. from 125 to 130, For SIP Returns : Refer page no. from 119 to

Ambuja Cements Ltd. 0.77% Treasury Bills 1.08% 123, For Investment Objective : Refer page no. from 131 to 133.

Construction 3.84% 364 Days Treasury Bill 2024 SOV 0.54%

• Larsen & Toubro Ltd. 3.84% 91 Days Treasury Bill 2024 SOV 0.32%

Consumable Fuels 1.54% 182 Days Treasury Bill 2024 SOV 0.21%

Coal India Ltd. 1.54% Equity less than 1% of corpus 9.48%

Diversified 0.70% Short Term Debt and net

3M India Ltd. 0.70% current assets 5.77%

Electrical Equipment 3.19% Total Net Assets 100.00% Riskometer

• Siemens Ltd. 3.19%

Ferrous Metals 5.86% • Top Ten Holdings This product labelling is applicable only to the scheme

JSW Steel Ltd. 2.63% Securities and the corresponding derivative exposure with less than 1% This Product is suitable for investors who are seeking*:

Tata Steel Ltd. 2.07% to NAV, have been clubbed together with a consolidated limit of 10%. • Long term wealth creation

Jindal Stainless Ltd. 1.16% Derivatives are considered at exposure value. • An open ended equity scheme that aims to provide capital appreciation by

Fertilizers & Agrochemicals 1.71% investing in equity and equity related securities of companies engaged in

Sumitomo Chemical India Ltd. 0.90% Top 5 Stock Holdings manufacturing theme.

UPL Ltd. 0.82% Ultratech Cement Ltd. 6.54%

Healthcare Services 1.34% Scheme Benchmark

Maruti Suzuki India Ltd. 6.21% (Nifty India Manufacturing TRI)

Syngene International Ltd. 1.34% Reliance Industries Ltd. 4.27%

Industrial Products 8.36% M

ate oderately

M

ate oderately

Sun Pharmaceutical Industries Ltd. 4.15% Moder High Moder High

• Cummins India Ltd. 3.02% H H

Larsen & Toubro Ltd. 3.84% ig ig

Mo ow to

Mo ow to

Bharat Forge Ltd. 1.97%

ate

ate

h h

der

der

L

Grindwell Norton Ltd. 0.92%

Very

Very

Top 5 Sector Holdings

Low

Low

High

High

Carborundum Universal Ltd. 0.90%

AIA Engineering Ltd. 0.84% Automobile And Auto Components 16.98%

Timken India Ltd. 0.71% Capital Goods 16.28% Investors understand that their principal Benchmark riskometer is at

Non - Ferrous Metals 2.75% Oil, Gas & Consumable Fuels 13.40% will be at Very High risk Very High risk.

Hindalco Industries Ltd. 2.75% Healthcare 12.37% *Investors should consult their financial advisers if in doubt about whether the

Oil 2.37% product is suitable for them.

Oil India Ltd. 2.37% Construction Materials 9.92%

38

You might also like

- Business Plan of FOODHUBDocument12 pagesBusiness Plan of FOODHUBAmit SharmaNo ratings yet

- Income GeneratorDocument18 pagesIncome GeneratoramareswarNo ratings yet

- Marketing Strategy For ICICI Prudential AMC To Become Topmost Preferred AMC in DebtDocument42 pagesMarketing Strategy For ICICI Prudential AMC To Become Topmost Preferred AMC in DebtAmit SharmaNo ratings yet

- BOH Quants v2Document135 pagesBOH Quants v2jelosalita3No ratings yet

- Mutual Fund Portfolio AnalysisDocument6 pagesMutual Fund Portfolio AnalysisIm CandlestickNo ratings yet

- Returns of ICICI Prudential Bluechip Fund - Growth Option As On June 30, 2021Document2 pagesReturns of ICICI Prudential Bluechip Fund - Growth Option As On June 30, 2021CuriousMan87No ratings yet

- Icici Prudential Thematic Advantage Fund (Fof)Document2 pagesIcici Prudential Thematic Advantage Fund (Fof)Ankita GargNo ratings yet

- ICICI Pru Balanced Advantage Fund - PortfolioDocument2 pagesICICI Pru Balanced Advantage Fund - PortfolioSunil ChaudharyNo ratings yet

- Midcap FundDocument1 pageMidcap FundAmit SharmaNo ratings yet

- Returns of ICICI Prudential Nifty Index Fund - Growth Option As On June 30, 2021Document2 pagesReturns of ICICI Prudential Nifty Index Fund - Growth Option As On June 30, 2021CuriousMan87No ratings yet

- Infrastructure FundDocument2 pagesInfrastructure FundankushNo ratings yet

- ICICI Prudential Value Discovery Fund: An Open Ended Diversified Equity FundDocument2 pagesICICI Prudential Value Discovery Fund: An Open Ended Diversified Equity FundnivethakarthikNo ratings yet

- Bluechip FundDocument2 pagesBluechip FundAmit SharmaNo ratings yet

- Infrastructure FundDocument2 pagesInfrastructure FundAmit SharmaNo ratings yet

- ICICI Prudential Corporate Bond FundDocument2 pagesICICI Prudential Corporate Bond FundAbhinavNo ratings yet

- Axis Equity FundDocument44 pagesAxis Equity FundyogeshgharpureNo ratings yet

- ArbitrageDocument3 pagesArbitrageAmit SharmaNo ratings yet

- Value DiscoveryDocument2 pagesValue DiscoveryAmit SharmaNo ratings yet

- Wealth-Insight - Oct 2023Document68 pagesWealth-Insight - Oct 2023Amit KauriNo ratings yet

- HDFC Top 100 Fund - Proven Track Record - 05 OctDocument2 pagesHDFC Top 100 Fund - Proven Track Record - 05 OctManju Bhashini M RNo ratings yet

- Wealth-Insight - Oct 2023Document68 pagesWealth-Insight - Oct 2023Vikas AbhyankarNo ratings yet

- Wealth-Insight - Oct 2023Document68 pagesWealth-Insight - Oct 2023srini vasuNo ratings yet

- Mutual Fund Insight Mar 2024Document108 pagesMutual Fund Insight Mar 2024Pavan CharakNo ratings yet

- Wealth Insight - Mar 2024Document78 pagesWealth Insight - Mar 2024ranucNo ratings yet

- Wealth-Insight - Mar 2024Document76 pagesWealth-Insight - Mar 2024Pavan CharakNo ratings yet

- Fund Facts - HDFC Focused 30 Fund - July 2021Document2 pagesFund Facts - HDFC Focused 30 Fund - July 2021Tarun TiwariNo ratings yet

- HDFC Children's Gift Fund Leaflet (As On 31st March 2023)Document4 pagesHDFC Children's Gift Fund Leaflet (As On 31st March 2023)DeepakNo ratings yet

- Multi Asset FundDocument3 pagesMulti Asset FundAmit SharmaNo ratings yet

- HDFC Gilt Fund - Performance Leaflet (As of June 30, 2021)Document1 pageHDFC Gilt Fund - Performance Leaflet (As of June 30, 2021)kumarkg1No ratings yet

- Fund Facts - HDFC TaxSaver - February 2022Document2 pagesFund Facts - HDFC TaxSaver - February 2022Tarun TiwariNo ratings yet

- Kotak Standard Multicap Fund: (An Open Ended Multi Cap Scheme)Document2 pagesKotak Standard Multicap Fund: (An Open Ended Multi Cap Scheme)Akshat JainNo ratings yet

- Proteanegovtechnologieslimitedrhp Ibcomments v2 2023Document11 pagesProteanegovtechnologieslimitedrhp Ibcomments v2 2023mohit_999No ratings yet

- Sound Investment+Time+Patience Wealth Creation - HDFC Top 100 Fund Leaflet (As On 31st Oct 2022)Document2 pagesSound Investment+Time+Patience Wealth Creation - HDFC Top 100 Fund Leaflet (As On 31st Oct 2022)Rajat GuptaNo ratings yet

- Seven Stocks To Profit From The Rebirth of IndiaDocument37 pagesSeven Stocks To Profit From The Rebirth of Indiarusheekesh3497No ratings yet

- Latent View Analytics Limited Ipo: All You Need To Know AboutDocument7 pagesLatent View Analytics Limited Ipo: All You Need To Know AboutPeterNo ratings yet

- Fund Pointers - HDFC Banking & PSU Debt Fund - March 2020Document2 pagesFund Pointers - HDFC Banking & PSU Debt Fund - March 2020GNo ratings yet

- Leaflet Flexi Cap FundDocument4 pagesLeaflet Flexi Cap FundBhaskar Reddy NvsNo ratings yet

- L&T India Value FundDocument1 pageL&T India Value Fundjaspreet AnandNo ratings yet

- Invesco India Caterpillar PortfolioDocument1 pageInvesco India Caterpillar PortfolioAnkurNo ratings yet

- Mirae Asset India Opportunities Fund (MAIOF) : Product Update December 2017Document2 pagesMirae Asset India Opportunities Fund (MAIOF) : Product Update December 2017pramodkrishnaNo ratings yet

- Infrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundDocument2 pagesInfrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundGaurangNo ratings yet

- Investment in Equities Versus Investment in Mutual FundDocument37 pagesInvestment in Equities Versus Investment in Mutual FundBob PanjabiNo ratings yet

- Absl Amc IpoDocument4 pagesAbsl Amc IpoRounak KhubchandaniNo ratings yet

- IPO Diary January'2021Document19 pagesIPO Diary January'2021Rakshan ShahNo ratings yet

- Udayshivakumar Infra Limited: All You Need To Know AboutDocument8 pagesUdayshivakumar Infra Limited: All You Need To Know AboutShreyclassNo ratings yet

- ICICI Securities Ltd. - PCG HNI Note - SMIFS ResearchDocument11 pagesICICI Securities Ltd. - PCG HNI Note - SMIFS ResearchShweta ChaudharyNo ratings yet

- Aditya Birla Sun Life Amc Limited: All You Need To Know AboutDocument7 pagesAditya Birla Sun Life Amc Limited: All You Need To Know AboutSarfarazNo ratings yet

- Wealth Insight - Feb 2024Document84 pagesWealth Insight - Feb 2024Karthi KeyanNo ratings yet

- GoColors IPO Note AngelOneDocument7 pagesGoColors IPO Note AngelOnedjfreakyNo ratings yet

- IREDADocument8 pagesIREDAGorilla GondaNo ratings yet

- Mutual Fund Insight Nov 2022Document214 pagesMutual Fund Insight Nov 2022Sonic LabelsNo ratings yet

- Wealth-Insight - Feb 2024Document84 pagesWealth-Insight - Feb 2024Pavan CharakNo ratings yet

- ICICI Bank StockaxisDocument9 pagesICICI Bank StockaxisdarshanmadeNo ratings yet

- Mirae Asset Emerging Bluechip Fund (MAEBF) : Product Update April 2019Document2 pagesMirae Asset Emerging Bluechip Fund (MAEBF) : Product Update April 2019Sudheer GangisettyNo ratings yet

- Edelweiss Weekly Newsletter July 28 2023Document2 pagesEdelweiss Weekly Newsletter July 28 2023rameese muhammedNo ratings yet

- Wealth-Insight - Apr 2021 PDFDocument64 pagesWealth-Insight - Apr 2021 PDFGanshNo ratings yet

- Sbi Banking and Financial Services Fund Factsheet (August-2021-415-1)Document1 pageSbi Banking and Financial Services Fund Factsheet (August-2021-415-1)charan ThakurNo ratings yet

- Strategic Financial Management PDFDocument18 pagesStrategic Financial Management PDFUpkar SinghNo ratings yet

- SIP-Performance-Sheet - FocusedSchemes - June2023 - Axis - BankDocument4 pagesSIP-Performance-Sheet - FocusedSchemes - June2023 - Axis - BankAtharva UppalwarNo ratings yet

- The Best Stock To Add To Your Portfolio This Month Is Here!: OCTOBER 2020Document9 pagesThe Best Stock To Add To Your Portfolio This Month Is Here!: OCTOBER 2020Vighnesh KurupNo ratings yet

- LIC - IPO - RetailDocument8 pagesLIC - IPO - RetailMSME SULABH TUMAKURUNo ratings yet

- Wealth-Insight - Feb 2024Document84 pagesWealth-Insight - Feb 2024Premnath YadavNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Bluechip FundDocument2 pagesBluechip FundAmit SharmaNo ratings yet

- Infrastructure FundDocument2 pagesInfrastructure FundAmit SharmaNo ratings yet

- Brigham EFM5 ch07 PPTDocument22 pagesBrigham EFM5 ch07 PPTFaris ZulkifliNo ratings yet

- 1-Activities EcoDocument6 pages1-Activities EcombondoNo ratings yet

- MM 102 103 ReviewerDocument11 pagesMM 102 103 Reviewerchristelsoberano73No ratings yet

- Budget Analysis ReportDocument7 pagesBudget Analysis ReportRahul KumarNo ratings yet

- Inbound 7295798484489846826Document53 pagesInbound 7295798484489846826gorgshae228No ratings yet

- Wepik Unveiling The Foundation of Segmentation Understanding The Basis For Effective Targeting 2023091013163701q7Document11 pagesWepik Unveiling The Foundation of Segmentation Understanding The Basis For Effective Targeting 2023091013163701q7Mahesh Prasad mNo ratings yet

- Tutorial 4 QuestionsDocument3 pagesTutorial 4 QuestionshrfjbjrfrfNo ratings yet

- Partnership OperationsDocument27 pagesPartnership OperationsAbc xyzNo ratings yet

- Practical Financial Accounting - Volume 1 (Condrado T. Valix)Document369 pagesPractical Financial Accounting - Volume 1 (Condrado T. Valix)Josh CruzNo ratings yet

- Notes On AMLADocument2 pagesNotes On AMLAMQA lawNo ratings yet

- BUS 2202 Written Assignment Unit 1Document7 pagesBUS 2202 Written Assignment Unit 1Cherry HtunNo ratings yet

- E MarketingDocument35 pagesE MarketingNinia Celso CelloNo ratings yet

- Paper 18: Corporate Financial Reporting (CFR) 100 MarksDocument3 pagesPaper 18: Corporate Financial Reporting (CFR) 100 MarksSridhanyas kitchenNo ratings yet

- Ch-2 FINANCIAL STATEMENTS ANALYSIS ANDocument10 pagesCh-2 FINANCIAL STATEMENTS ANALYSIS ANAnamika TripathiNo ratings yet

- KISI PT Aneka Tambang TBK (ANTM) Steady Gold PricesDocument13 pagesKISI PT Aneka Tambang TBK (ANTM) Steady Gold PricesKacang GorengNo ratings yet

- ICT 2022 Mentorship - Free DownloadableDocument297 pagesICT 2022 Mentorship - Free DownloadableSlw habbos100% (1)

- Zero Cost CollarsDocument3 pagesZero Cost CollarsRishabh ValechaNo ratings yet

- Quasimodo: Supply and Demand, Engulf AtioDocument3 pagesQuasimodo: Supply and Demand, Engulf Atiocai.patrykNo ratings yet

- Chapter 3Document24 pagesChapter 3kietlet0No ratings yet

- IPODocument10 pagesIPO483-ROHIT SURAPALLINo ratings yet

- Full Download Ebook PDF Marketing Communications Touchpoints Sharing and Disruption 8th Edition PDFDocument41 pagesFull Download Ebook PDF Marketing Communications Touchpoints Sharing and Disruption 8th Edition PDFemanuel.applebury214100% (32)

- FAR - March-April-2021Document8 pagesFAR - March-April-2021Towhidul IslamNo ratings yet

- EnggRoom Code E-BusinessDocument11 pagesEnggRoom Code E-Businessfsocitey010No ratings yet

- Obalana W09GroupAssignmentDocument9 pagesObalana W09GroupAssignmentwilliamslaw123 WilliamsNo ratings yet

- Journalism of Courage: Wednesday, January 11, 2023, New Delhi, Late City, 24 PagesDocument24 pagesJournalism of Courage: Wednesday, January 11, 2023, New Delhi, Late City, 24 PagesVarsha YenareNo ratings yet

- Problem Set 4Document11 pagesProblem Set 4Ngọc NguyễnNo ratings yet

- AYALA - Commercial Banking 3Document3 pagesAYALA - Commercial Banking 3French D. AyalaNo ratings yet

- Raghav Joshi - QUESTIONS TO BE ANSWERED FOR MARKETING MANAGEMENTDocument8 pagesRaghav Joshi - QUESTIONS TO BE ANSWERED FOR MARKETING MANAGEMENTRaghav JoshiNo ratings yet

- Summer Internship Project Report On CentricityDocument56 pagesSummer Internship Project Report On CentricityDipak KumarNo ratings yet