Professional Documents

Culture Documents

Reyes Solution Adjusting Entry

Uploaded by

Justine Reyes0 ratings0% found this document useful (0 votes)

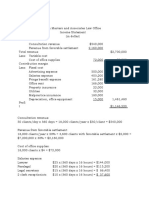

7 views4 pagesThe document contains adjusting entries for various expenses and revenues for different periods. Some of the adjustments are for prepaid expenses like insurance, rent and advertising to allocate the expenses to the correct period. Other adjustments are for accrued expenses like salaries, interest and depreciation expense. Inventory counts are also used to determine supplies expense. Revenues are adjusted for unearned amounts.

Original Description:

Original Title

Reyes-Solution-Adjusting-Entry

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains adjusting entries for various expenses and revenues for different periods. Some of the adjustments are for prepaid expenses like insurance, rent and advertising to allocate the expenses to the correct period. Other adjustments are for accrued expenses like salaries, interest and depreciation expense. Inventory counts are also used to determine supplies expense. Revenues are adjusted for unearned amounts.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views4 pagesReyes Solution Adjusting Entry

Uploaded by

Justine ReyesThe document contains adjusting entries for various expenses and revenues for different periods. Some of the adjustments are for prepaid expenses like insurance, rent and advertising to allocate the expenses to the correct period. Other adjustments are for accrued expenses like salaries, interest and depreciation expense. Inventory counts are also used to determine supplies expense. Revenues are adjusted for unearned amounts.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

a.

A review of insurance policies showed that P6,800 is unexpired at the

year-end.

b. An inventory of cleaning supplies showed P12,440 on hand.

c. Estimated depreciation on the building for the year is P128,000.

d. Accrued interest on the mortgage payable is P10,000.

e. On Sept. 1, the entity signed a contract, effective immediately with Bacolod

Doctor’s Hospital to dry clean, for a fixed monthly charge of P4,000, the

uniforms used by doctors in surgery. The hospital paid for four months’

services in advance.

f. Salaries are paid on Saturdays. The weekly payroll is P25,200. Assume

that Sept. 30 falls on a Thursday and the entity has a six-day pay week. up

ADJUSTING ENTRIES

Insurance Expense 27, 200

Prepaid Insurance 27, 200

Solution:

total/original cost of insurance (based on the trial balance) = 34,000

less: unexpired portion = 6,800

total expired portion = 27, 200

Cleaning Supplies Expense 61, 300

Cleaning Supplies 61, 300

Solution:

total/original cost of cleaning supplies = 73, 740

less: cleaning supplies on hand = 12, 440

consumed portion = 61, 300

Depreciation Expense-Building 128, 000

Accu. Depreciation-Building 128, 000

Interest Expense 10, 000

Interest Payable 10, 000

Unearned Cleaning Revenue 4, 000

Cleaning Revenue 4, 000

Salaries Expense 16, 800

Salaries Payable 16, 800

Solution:

25,200 ÷ 6 (six-day pay week) = 4, 200

4,200 × 4 (thursday) = 16, 800

a. Nov. 1, 2020, Riabulin paid Juanita Rabena RealtorsP360,000 for six

months rent on the office building commencing that date.

b. Office Supplies on hand at Dec. 31, 2020 amounted toP27,000.

c. Depreciation Expense for the furniture amounted toP75,000 for the year.

d. At Dec. 31, 2020, P105,000 salaries have accrued.

e. The P900,000 note payable was issued on Oct. 1, 2020. It will be repaid in

12 months together with interest at an annual rate of 24%.

ADJUSTING ENTRIES

Rent Expense 120, 000

Prepaid Rent 120, 000

Solution:

360,000 × 2/6 = 120, 000

2 = (Nov. to Dec.) 6 = (six months rent)

Office Supplies Expense 36, 000

Office Supplies 36, 000

Solution:

original cost of office supplies = 63, 000

less: office supplies on hand = 27, 000

office supplies used = 36, 000

Depreciation Expense-Furniture 75, 000

Acc. 75, 000

Depreciation-Furniture

Salaries Expense 105, 000

Salaries Payable 105, 000

Interest Expense 54, 000

Interest Payable 54, 000

Solution:

900,000 × 3/12 × 0.24 = 54, 000

3 = (Oct. to Dec.) 12 months= (will be repaid) 24% or 0.24 = (annual rate)

a. The P 360,000 prepaid advertising represents expenditure made on Nov. 1

2019 for monthly advertising over the next 18 months.

b. A count of the engineering supplies at May 31, 2020 amounted to 90,000

c. Depreciation on the surveying equipment amounted to 160,000.

d. One-third of the unearned survey revenues has been earned at the year-end.

e. At year-end salaries in the amount of 140,000 have accrued.

f. Interest of 60,000 on the notes payable has accrued at year-end.

ADJUSTING ENTRIES

Advertising Expense 140, 000

Prepaid Advertising 140, 000

Solution:

360,000×7/18 = 140, 000

7 = (Nov. 1 2019 to May 31, 2020) 18 = (monthly advertising)

Supplies Expense 180, 000

Engineering Supplies 180, 000

Solution:

total/original cost of engineering supplies = 270,000

less: unconsumed engineering supplies = 90,000

consumed engineering supplies = 180, 000

Depreciation Expense 160, 000

Acc.. Depreciation-Survey 160, 000

Equip.

Unearned Survey Revenues 40, 000

Survey Revenues 40, 000

Solution:

total/original cost of unearned survey revenues = 120, 000

multiply: one-third of unearned survey revenues (120,000)

120,00 × 1 / 3 = 40,000

Salaries Expense 140, 000

Salaries Payable 140, 000

Interest Expense 60, 000

Interest Payable 60, 000

You might also like

- Answer Key - Quizzer On AJEDocument2 pagesAnswer Key - Quizzer On AJEClarissa De GuzmanNo ratings yet

- ACC10007 Sample Exam 2 - SolutionDocument10 pagesACC10007 Sample Exam 2 - SolutiondannielNo ratings yet

- Answer For Final PracticeDocument5 pagesAnswer For Final Practicedimas suryaNo ratings yet

- AccountingDocument20 pagesAccountingNehal NabilNo ratings yet

- Adjusting Entries - Sample Problem With AnswerDocument19 pagesAdjusting Entries - Sample Problem With AnswerMaDine 19100% (3)

- Module Title: Accounting Information For Business Module Number: Umad5H-15-2Document13 pagesModule Title: Accounting Information For Business Module Number: Umad5H-15-2Shubham AggarwalNo ratings yet

- PM Mock AnswersDocument16 pagesPM Mock AnswersMuhammad HussnainNo ratings yet

- Cheating 101Document1 pageCheating 101api-3744266No ratings yet

- CH 10 SolDocument7 pagesCH 10 SolNotty SingerNo ratings yet

- (Module 4) ProblemsDocument6 pages(Module 4) ProblemsYanie Dela Cruz100% (1)

- Requirement 1:: (Leave No Cells Blank - Be Certain To Enter "0" Wherever Required. Omit The "$" Sign in Your Response.)Document5 pagesRequirement 1:: (Leave No Cells Blank - Be Certain To Enter "0" Wherever Required. Omit The "$" Sign in Your Response.)Md AlimNo ratings yet

- Exercise. AdjustmentsDocument6 pagesExercise. AdjustmentsDavid Con Rivero79% (14)

- StratCostMgmt 4 - Mock Test For Quiz 1 Answer KeyDocument5 pagesStratCostMgmt 4 - Mock Test For Quiz 1 Answer KeyFoshAtokNo ratings yet

- Chapter 12 Managerial Accounting and Cost-Volume-Profit RelationshipsDocument15 pagesChapter 12 Managerial Accounting and Cost-Volume-Profit RelationshipsJue WernNo ratings yet

- (Lower of Production / Market Demand) (I × II) : © The Institute of Chartered Accountants of IndiaDocument14 pages(Lower of Production / Market Demand) (I × II) : © The Institute of Chartered Accountants of IndiaAnkitaNo ratings yet

- Nama: Nabila Indri Yani No. BP: 2010931037 Tugas 1: Analisis Dan Estimasi BiayaDocument4 pagesNama: Nabila Indri Yani No. BP: 2010931037 Tugas 1: Analisis Dan Estimasi BiayaInnabilaNo ratings yet

- Exercise 1 Key PDF Cost of Goods Sold InvenDocument1 pageExercise 1 Key PDF Cost of Goods Sold InvenAl BertNo ratings yet

- Demo Questions Topic 4 Capital BudgetingDocument6 pagesDemo Questions Topic 4 Capital BudgetingWeng ZhenHong DennisNo ratings yet

- Exercise 2 Cost Concepts With AnswersDocument6 pagesExercise 2 Cost Concepts With AnswersJayhan Palmones100% (3)

- Estimate How Much of The: Problem 3-15Document7 pagesEstimate How Much of The: Problem 3-15Cheveem Grace EmnaceNo ratings yet

- 1Document8 pages1Indu DahalNo ratings yet

- Management AccountingDocument11 pagesManagement AccountingMd. Showkat IslamNo ratings yet

- CheatSheet 3FF3Document1 pageCheatSheet 3FF3Muntaha Rahman MayazNo ratings yet

- Assign Chap 2Document6 pagesAssign Chap 2Mustafa MuhamedNo ratings yet

- Discussion Question 2Document6 pagesDiscussion Question 2Sadhna MaharjanNo ratings yet

- Fin722 Papers Solved Finals Numerical Type: Find Stock Out CostDocument20 pagesFin722 Papers Solved Finals Numerical Type: Find Stock Out CostShrgeel HussainNo ratings yet

- Adjusting EntriesDocument14 pagesAdjusting Entriesmhrzyn27No ratings yet

- Accounting ProblemDocument3 pagesAccounting ProblemSuvaamNo ratings yet

- Additional Practice Exam Solution Updated Nov 19Document7 pagesAdditional Practice Exam Solution Updated Nov 19Shaunny BravoNo ratings yet

- Chapter 1-Test Material 3Document9 pagesChapter 1-Test Material 3Marcus MonocayNo ratings yet

- ACC10007 Sample Exam 1 Suggested Solution Question One - SolutionDocument10 pagesACC10007 Sample Exam 1 Suggested Solution Question One - SolutiondannielNo ratings yet

- % of Total Costs That Is Variable Variable Costs Fixed Costs Variable Cost Per UnitDocument3 pages% of Total Costs That Is Variable Variable Costs Fixed Costs Variable Cost Per UnitElliot RichardNo ratings yet

- Chapter 1 Introduction To Cost AccountingDocument9 pagesChapter 1 Introduction To Cost AccountingSteffany RoqueNo ratings yet

- Financial ManagementDocument9 pagesFinancial ManagementAtif SiddiquiNo ratings yet

- Computation For Exercise 1Document10 pagesComputation For Exercise 1Xyzra AlfonsoNo ratings yet

- Required: A. Break-Even Point in Units BEP in Units : Total Cost CM Per UnitDocument3 pagesRequired: A. Break-Even Point in Units BEP in Units : Total Cost CM Per UnitarisuNo ratings yet

- Cost AccountingDocument10 pagesCost AccountingDIANA IMADNo ratings yet

- Soultions - Chapter 3Document8 pagesSoultions - Chapter 3Naudia L. TurnbullNo ratings yet

- Costco1 - Assign 5Document7 pagesCostco1 - Assign 5Deryl GalveNo ratings yet

- Budgeting Activity - DayagDocument5 pagesBudgeting Activity - DayagAlexis Kaye DayagNo ratings yet

- Kayes Arman11-6265-Term PaperDocument7 pagesKayes Arman11-6265-Term PaperTAWHID ARMANNo ratings yet

- CalculatorDocument2 pagesCalculatorAdeel RanaNo ratings yet

- Adjusting Entry1 - AnswerDocument9 pagesAdjusting Entry1 - AnswerReighjon Ashley C. Tolentino100% (1)

- Case AnalysisDocument2 pagesCase AnalysisJoshua P. SalceNo ratings yet

- Overheads (A)Document8 pagesOverheads (A)Rabia SattarNo ratings yet

- VARAIBLE COSTING (Solutions)Document8 pagesVARAIBLE COSTING (Solutions)Mohammad UmairNo ratings yet

- Process Costing SampleDocument2 pagesProcess Costing SampleNoella Mae 01 GavinoNo ratings yet

- Key To Corrections - LEVEL 2 MODULE 1Document3 pagesKey To Corrections - LEVEL 2 MODULE 1UFO CatcherNo ratings yet

- Sol. Man. - Chapter 22 - Intangible Assets - Ia Part 1BDocument17 pagesSol. Man. - Chapter 22 - Intangible Assets - Ia Part 1BRezzan Joy Camara Mejia100% (3)

- Salce Prelim Act102 E2Document8 pagesSalce Prelim Act102 E2Joshua P. SalceNo ratings yet

- Cpa Review School of The Philippines Manila Advanced Financial Accounting and Reporting First Preboard Examination SolutionsDocument12 pagesCpa Review School of The Philippines Manila Advanced Financial Accounting and Reporting First Preboard Examination SolutionsSophia PerezNo ratings yet

- Acctg 6 CH 13Document11 pagesAcctg 6 CH 13Bea TiuNo ratings yet

- Course Name: 2T7 - Cost AccountingDocument56 pagesCourse Name: 2T7 - Cost Accountingjhggd100% (1)

- Reviewer Cost PrelimsDocument10 pagesReviewer Cost PrelimsClarence John G. BelzaNo ratings yet

- Management AccountingDocument11 pagesManagement AccountingMalikwaheedNo ratings yet

- Working CapitalDocument38 pagesWorking CapitalMonicaNo ratings yet

- Transfer PricingDocument2 pagesTransfer PricingAva DasNo ratings yet

- COST BEHAVIOR (Solution)Document5 pagesCOST BEHAVIOR (Solution)Mustafa ArshadNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Let's Practise: Maths Workbook Coursebook 7From EverandLet's Practise: Maths Workbook Coursebook 7No ratings yet

- Owners Manual Air Bike Unlimited Mag 402013Document28 pagesOwners Manual Air Bike Unlimited Mag 402013David ChanNo ratings yet

- BSBITU314 Assessment Workbook FIllableDocument51 pagesBSBITU314 Assessment Workbook FIllableAryan SinglaNo ratings yet

- Espree I Class Korr3Document22 pagesEspree I Class Korr3hgaucherNo ratings yet

- Semi Detailed Lesson PlanDocument2 pagesSemi Detailed Lesson PlanJean-jean Dela Cruz CamatNo ratings yet

- Eurocode 3: Design of Steel Structures "ReadyDocument26 pagesEurocode 3: Design of Steel Structures "Readywazydotnet80% (10)

- Dreaded Attack - Voyages Community Map Rules v1Document2 pagesDreaded Attack - Voyages Community Map Rules v1jNo ratings yet

- Эквивалентная Схема Мотра Теслы с Thomas2020Document7 pagesЭквивалентная Схема Мотра Теслы с Thomas2020Алексей ЯмаNo ratings yet

- Hand Out Fire SurpressDocument69 pagesHand Out Fire SurpressSeptiawanWandaNo ratings yet

- International Security Notes International Security NotesDocument34 pagesInternational Security Notes International Security NotesBEeNaNo ratings yet

- 52 - JB CHP Trigen - V01Document33 pages52 - JB CHP Trigen - V01July E. Maldonado M.No ratings yet

- Gracie Warhurst WarhurstDocument1 pageGracie Warhurst Warhurstapi-439916871No ratings yet

- Surgery - 2020 With CorrectionDocument70 pagesSurgery - 2020 With CorrectionBaraa KassisNo ratings yet

- NIQS BESMM 4 BillDocument85 pagesNIQS BESMM 4 BillAliNo ratings yet

- List of Some Common Surgical TermsDocument5 pagesList of Some Common Surgical TermsShakil MahmodNo ratings yet

- Binge Eating Disorder ANNADocument12 pagesBinge Eating Disorder ANNAloloasbNo ratings yet

- Transportasi Distribusi MigasDocument25 pagesTransportasi Distribusi MigasDian Permatasari100% (1)

- 1Document3 pages1Stook01701No ratings yet

- SecuritizationDocument46 pagesSecuritizationHitesh MoreNo ratings yet

- Convection Transfer EquationsDocument9 pagesConvection Transfer EquationsA.N.M. Mominul Islam MukutNo ratings yet

- Retail Banking Black BookDocument95 pagesRetail Banking Black Bookomprakash shindeNo ratings yet

- Poetry UnitDocument212 pagesPoetry Unittrovatore48100% (2)

- Disclosure To Promote The Right To InformationDocument11 pagesDisclosure To Promote The Right To InformationnmclaughNo ratings yet

- 10 Killer Tips For Transcribing Jazz Solos - Jazz AdviceDocument21 pages10 Killer Tips For Transcribing Jazz Solos - Jazz Advicecdmb100% (2)

- TraceDocument5 pagesTraceNorma TellezNo ratings yet

- EGurukul - RetinaDocument23 pagesEGurukul - RetinaOscar Daniel Mendez100% (1)

- Midi Pro Adapter ManualDocument34 pagesMidi Pro Adapter ManualUli ZukowskiNo ratings yet

- Native VLAN and Default VLANDocument6 pagesNative VLAN and Default VLANAaliyah WinkyNo ratings yet

- Understanding PTS Security PDFDocument37 pagesUnderstanding PTS Security PDFNeon LogicNo ratings yet

- BARUDocument53 pagesBARUhueuaNo ratings yet

- Playing With Pop-Ups - The Art of Dimensional, Moving Paper DesignsDocument147 pagesPlaying With Pop-Ups - The Art of Dimensional, Moving Paper DesignsSara100% (4)