Professional Documents

Culture Documents

StratCostMgmt 4 - Mock Test For Quiz 1 Answer Key

Uploaded by

FoshAtokOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

StratCostMgmt 4 - Mock Test For Quiz 1 Answer Key

Uploaded by

FoshAtokCopyright:

Available Formats

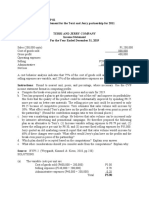

ABC Corporation

A. Direct materials used P150,000

Direct labor 80,000

Variable manufacturing overhead 30,000

Total P260,000

B. Direct materials used P150,000

Direct labor 80,000

Variable manufacturing overhead 30,000

Fixed manufacturing overhead 100,000

Total P360,000

C. 1. Fixed manufacturing overhead: P100,000

Fixed selling and administrative costs: P60,000

2. Fixed manufacturing overhead: (P100,000 ÷ 20,000 units) x 18,000 units = P90,000

Fixed selling and administrative costs: P60,000

D. Variable manufacturing costs: P150,000 + P80,000 + P30,000 = P260,000

Variable manufacturing costs per unit: P260,000 ÷ 20,000 units = P13

Contribution margin: P625,000 - [(18,000 x P13) + P51,000] = P340,000

DEF, Inc.

A. Variable production costs total P1,080,000 (P300,000 + P420,000 + P360,000), or

P18 per unit (P1,080,000 ÷ 60,000 units). Since 6,000 units remain in inventory [0 +

60,000 - (60,000 x 90%)], the ending finished goods totals P108,000 (6,000 x P18).

B. Sales revenue (60,000 units x 90% x P55) P2,970,000

Less: Variable cost of goods sold

(60,000 units x 90% x P18) P972,000

Variable selling and administrative 120,000 1,092,000

Contribution margin P1,878,000

The contribution margin is disclosed on a variable-costing income statement.

C. None. All fixed selling and administrative cost is treated as a period cost and

expensed against revenue.

D. The cost of a unit would increase by P10 (P600,000 ÷ 60,000 units) because of the

addition of fixed manufacturing overhead. Thus:

Sales revenue P2,970,000

Cost of goods sold (60,000 units x 90% x P28) 1,512,000

Gross margin P1,458,000

GHI Company

A. Ending finished-goods inventory (units): 0 + 100,000 - 90,000 = 10,000

Inventoriable costs under variable costing:

Direct materials used P400,000

Direct labor 200,000

Variable manufacturing overhead 120,000

Total P720,000

Variable cost per unit produced: P720,000 ÷ 100,000 units = P7.20 per unit

Ending inventory: 10,000 units x P7.20 = P72,000

B. Sales revenue (90,000 units x P15) P1,350,000

Less: Variable costs [(90,000 units x P7.20) + P45,000] 693,000

Contribution margin P 657,000

Less: Fixed costs (P250,000 + P300,000) 550,000

Net income P 107,000

C. Predetermined fixed overhead rate: P250,000 ÷ 100,000 units = P2.50

Absorption cost per unit: P7.20 + P2.50 = P9.70

Sales revenue (90,000 units x P15) P1,350,000

Less: Cost of goods sold (90,000 units x P9.70) 873,000

Gross margin P 477,000

Less: Operating costs (P300,000 + P45,000) 345,000

Net income P 132,000

JKL, Inc.

A. Ending finished-goods inventory: 0 + 200,000 - 170,000 = 30,000 units

B. Variable costing: 30,000 units x P18 = P540,000

Absorption costing:

Predetermined fixed overhead rate: P840,000 ÷ 200,000 units = P4.20;

30,000 units x (P18.00 + P4.20) = P666,000

C. Sales revenue (170,000 units x P48) P8,160,000

Less: Variable costs [170,000 units x (P18 + P7)] 4,250,000

Contribution margin P3,910,000

Less: Fixed costs (P840,000 + P925,000) 1,765,000

Net income P2,145,000

D. Sales revenue (170,000 units x P48) P8,160,000

Less: Cost of goods sold [170,000 units x (P18.00 + P4.20)] 3,774,000

Gross margin P4,386,000

Less: Operating costs [(170,000 units x P7) + P925,000] 2,115,000

Net income P2,271,000

MNO, Inc.

A. Sales (35,000 units) + ending finished-goods inventory (12,000 units) = production (47,000 units).

Note: There is no beginning finished-goods inventory.

B. Since planned and actual production figures are the same, Kim applied P3 to each unit

(P141,000 ÷ 47,000 units).

C. Sales revenue P770,000

Gross margin 210,000

Cost of goods sold P560,000

D. Kim attached P13 to each unit. This figure can be derived by analyzing cost of goods sold:

Cost of goods sold P560,000

Fixed cost in cost of goods sold (35,000 units x P3) 105,000

Variable cost of goods sold P455,000

P455,000 ÷ 35,000 units = P13

The same P13 figure can be obtained by studying the ending finished-good inventory:

Ending finished-goods inventory P192,000

Fixed cost (12,000 units x P3) 36,000

Variable cost P156,000

P156,000 ÷ 12,000 units = P13

PQR Company

A. The difference between absorption costing and variable costing lies in the treatment

of fixed manufacturing overhead. Under absorption costing, fixed manufacturing

overhead is a product cost and attached to each unit produced. In contrast, under

variable costing, it is written off (expensed) as a period cost.

B. Since the number of units sold equals the number of units produced, variable- and

absorption-income figures are the same: P110,000.

C. With sales of 7,500 units and production of 7,100 units, income computed under

absorption costing includes P16,000 (400 units x P40) of prior-period fixed

manufacturing overhead. Absorption income is therefore P162,000 (P178,000 -

P16,000).

STU Corporation

A. Absorption- and variable costing income will be the same amount when inventory

levels are unchanged. Thus, sales totaled 18,000 units.

B. The difference between absorption-costing income and variable-costing income is

P84,000 (7,000 units x P12). Given that inventories are rising, variable-costing net

income will amount to P236,000 (P320,000 - P84,000).

C. The P30,000 difference in income (P250,000 - P220,000) is explained by the change in

inventory units, multiplied by the fixed overhead per unit. Thus, the inventory

changed by 2,500 units (P30,000 ÷ P12). Given that absorption income is less than

income computed by the variable-costing method, inventory levels must have

decreased, resulting in an ending inventory level of 11,500 units (14,000 - 2,500).

VWX Corporation

A. Direct materials (20,000 units x P18) P 360,000

Direct labor 160,000

Variable manufacturing overhead 280,000

Fixed manufacturing overhead 340,000

Selling and administrative costs 430,000

Total P1,570,000

B. The year-end inventory of 2,500 units (20,000 - 17,500) is costed as follows:

Absorption Variable Throughput

Costing Costing Costing

Direct materials P 360,000 P360,000 P360,000

Direct labor 160,000 160,000

Variable manufacturing overhead 280,000 280,000

Fixed manufacturing overhead 340,000

Total product cost P1,140,000 P800,000 P360,000

Cost per unit (Total ÷ 20,000 units) P57 P40 P18

Year-end inventory (2,500 units x cost

per unit) P142,500 P100,000 P45,000

C. The total costs would be allocated between the current period's income

statement and the year-end inventory on the balance sheet. Thus:

Absorption costing: P1,570,000 - P142,500 = P1,427,500

Variable costing: P1,570,000 - P100,000 = P1,470,000

Throughput costing: P1,570,000 - P45,000 = P1,525,000

D. Throughput income: Sales revenue (17,500 units x P95) - P1,525,000 = P137,500

XYZ Corporation

A. Throughput costing is a technique that assigns only the unit-level spending

amounts for direct costs as the cost of products or services. In this case, direct

materials is the only item that qualifies as a throughput cost.

B. Ending inventory: 0 + 40,000 units - 35,000 units = 5,000 units; 5,000 units x P20 =

P100,000

C. XYZ Corporation

Throughput-Costing Income Statement

For the Year Ended December 31, 20x1

Sales revenue (35,000 units x P80) P2,800,000

Less: Cost of goods sold (35,000 units x P20) 700,000

Gross margin/Throughput margin P2,100,000

Less: Operating costs

Direct labor P 215,000

Variable manufacturing overhead 340,000

Fixed manufacturing overhead 528,000

Variable selling and administrative costs (35,000 units x P8) 280,000

Fixed selling and administrative costs 220,000

Total operating costs P1,583,000

Net income P 517,000

AMV Company

A. The absorption cost is P29.50 [P19.50 + (P100,000 10,000 units)], and the variable cost is

P19.50.

B. Volume variance = budgeted fixed overhead - fixed overhead applied

= P100,000 - (12,500 units x P10)

= P(25,000) or P25,000F

OR

Volume variance = (Normal/Budgeted capacity – Actual production) x FOH rate

= (10,000 – 12,500) x P10

= P(25,000) or P25,000F

C. AMV Company

Absorption-Costing Income Statement

For the Year Ended December 31, 20xx

Sales revenue (11,000 units x P30) P330,000

Less: Cost of goods sold (11,000 units x P29.50) 324,500

Gross margin (at standard) P 5,500

Add: Fixed-overhead volume variance 25,000

Gross margin (at actual) P 30,500

Less: Operating expenses [(11,000 units x P0.50) + P5,000] 10,500

Net income P 20,000

AMV Company

Variable-Costing Income Statement

For the Year Ended December 31, 20xx

Sales revenue (11,000 units x P30) P330,000

Less: Var. cost of goods sold (11,000 units x P19.50) P214,500

Var. operating expenses (11,000 units x P0.50) 5,500 220,000

Contribution margin P110,000

Less: Fixed costs (P100,000 + P5,000) 105,000

Net income P 5,000

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Juarez, Jenny Brozas - Activity 1 MidtermDocument19 pagesJuarez, Jenny Brozas - Activity 1 MidtermJenny Brozas JuarezNo ratings yet

- Chapter 1 ExercisesDocument18 pagesChapter 1 ExercisesJenny Brozas JuarezNo ratings yet

- MAS Assessment Exam Answer Key SolutionDocument7 pagesMAS Assessment Exam Answer Key SolutionJonalyn JavierNo ratings yet

- MAS Answer Key SolutionDocument6 pagesMAS Answer Key SolutionJonalyn JavierNo ratings yet

- Strategic Cost Management Exercises 12369Document2 pagesStrategic Cost Management Exercises 12369Arlene Diane OrozcoNo ratings yet

- Mas Test Bank SolutionDocument13 pagesMas Test Bank SolutionMark Jonah BachaoNo ratings yet

- Mas Test Bank SolutionDocument14 pagesMas Test Bank SolutionLyzaNo ratings yet

- Mas Test Bank SolutionDocument14 pagesMas Test Bank SolutionGem Alcos NicdaoNo ratings yet

- Cost Chapter 14Document15 pagesCost Chapter 14Marica ShaneNo ratings yet

- Act.4-8 Ae23Document6 pagesAct.4-8 Ae23Damian Sheila MaeNo ratings yet

- ADDITIONAL PROBLEMS-CVP AnalysisDocument4 pagesADDITIONAL PROBLEMS-CVP AnalysisFerb CruzadaNo ratings yet

- Management Advisory Services Solution to ProblemDocument13 pagesManagement Advisory Services Solution to ProblemMIKKONo ratings yet

- Cost Management Case Study: Absorption vs Variable CostingDocument6 pagesCost Management Case Study: Absorption vs Variable CostingBella RonahNo ratings yet

- Cost Assignment PDFDocument6 pagesCost Assignment PDFBella RonahNo ratings yet

- ACA 211: Calculating Ending Inventory After FireDocument2 pagesACA 211: Calculating Ending Inventory After FireRosethel Grace GallardoNo ratings yet

- CHAPTER-14 Cost5Document2 pagesCHAPTER-14 Cost5Louiza Kyla AridaNo ratings yet

- Mas Solutions To Problems Solutions 2018Document14 pagesMas Solutions To Problems Solutions 2018Jahanna Martorillas0% (1)

- Week 2 Independent Learning Answer KeyDocument2 pagesWeek 2 Independent Learning Answer KeyCarla GarciaNo ratings yet

- Juarez, Jenny Brozas - Activity 2 MidtermDocument4 pagesJuarez, Jenny Brozas - Activity 2 MidtermJenny Brozas JuarezNo ratings yet

- Lesson 3 Sample Problem #3Document3 pagesLesson 3 Sample Problem #3not funny didn't laughNo ratings yet

- Cis PTDocument3 pagesCis PTAlyza LansanganNo ratings yet

- (Mas) Week1 Solutions ManualDocument17 pages(Mas) Week1 Solutions ManualBeef Testosterone100% (1)

- Decrease in Income P155,000 CDocument2 pagesDecrease in Income P155,000 CAngeline RamirezNo ratings yet

- Jose Rizal Memorial State University Main Campus, Dapitan City College of Business and AccountancyDocument6 pagesJose Rizal Memorial State University Main Campus, Dapitan City College of Business and AccountancyBernadette CaduyacNo ratings yet

- Exercise 1 (Variable and Absorption Costing Unit Product Costs and Income Statements)Document7 pagesExercise 1 (Variable and Absorption Costing Unit Product Costs and Income Statements)Bella RonahNo ratings yet

- GABATO-GENIE-ROSE-P. ACT121Assignment PDFDocument7 pagesGABATO-GENIE-ROSE-P. ACT121Assignment PDFBella RonahNo ratings yet

- Problems in Relevant CostingDocument20 pagesProblems in Relevant CostingJem ValmonteNo ratings yet

- CVP Analysis in One ProductDocument6 pagesCVP Analysis in One ProductShaira GampongNo ratings yet

- Mas TestbanksDocument25 pagesMas TestbanksKristine Esplana ToraldeNo ratings yet

- SCM - 2ND Output FinalsDocument8 pagesSCM - 2ND Output FinalsChin FiguraNo ratings yet

- Relevant Costing Exercises - KingDocument7 pagesRelevant Costing Exercises - KingAlexis KingNo ratings yet

- EXercise VC1Document6 pagesEXercise VC1Abdulmajed Unda Mimbantas100% (1)

- Chapter 4Document3 pagesChapter 4?????100% (1)

- Break even analysis and CVP decision making exampleDocument11 pagesBreak even analysis and CVP decision making exampleArly Kurt TorresNo ratings yet

- Solution To Activity 2Document3 pagesSolution To Activity 2Lee Thomas Arvey FernandoNo ratings yet

- Strategic Cost Management - Quiz 3Document4 pagesStrategic Cost Management - Quiz 3Roschelle MiguelNo ratings yet

- Batch 18 1st Preboard (P1)Document14 pagesBatch 18 1st Preboard (P1)Jericho PedragosaNo ratings yet

- Sample Problems On Relevant CostsDocument9 pagesSample Problems On Relevant CostsJames Ryan AlzonaNo ratings yet

- Answer KeyDocument2 pagesAnswer KeySHAZ NAY GULAYNo ratings yet

- MA REV 1 Finals Dec 2017Document33 pagesMA REV 1 Finals Dec 2017Dale PonceNo ratings yet

- Final PB87 Sol. MASDocument2 pagesFinal PB87 Sol. MASLJ AggabaoNo ratings yet

- Ma - Bep01 - LucioDocument4 pagesMa - Bep01 - LucioGrace SimonNo ratings yet

- Variable Costing: This Accounting Materials Are Brought To You byDocument18 pagesVariable Costing: This Accounting Materials Are Brought To You byjeodhyNo ratings yet

- Managerial Analysis: CVP 01 Break-EvenDocument4 pagesManagerial Analysis: CVP 01 Break-EvenGrace SimonNo ratings yet

- Exercise 1 and 2Document7 pagesExercise 1 and 2Nigussie BerhanuNo ratings yet

- Solution To Exercise Strategic Analysis of Operating IncomeDocument4 pagesSolution To Exercise Strategic Analysis of Operating IncomeTONG, HANS KENNETH N.No ratings yet

- Quiz Feb24Document5 pagesQuiz Feb24E RDNo ratings yet

- Job Order Costing SolutionDocument9 pagesJob Order Costing SolutionMariah VillanNo ratings yet

- Variable & Absorption Costing LectureDocument11 pagesVariable & Absorption Costing LectureElisha Dhowry PascualNo ratings yet

- YowDocument35 pagesYowJane Michelle Eman100% (1)

- AnswersDocument4 pagesAnswersAbdulmajed Unda MimbantasNo ratings yet

- BUSE 3 - Practice ProblemDocument8 pagesBUSE 3 - Practice ProblemPang SiulienNo ratings yet

- MAC2601-SuggestedsolutionOct November2013Document12 pagesMAC2601-SuggestedsolutionOct November2013DINEO PRUDENCE NONGNo ratings yet

- It App NotesDocument20 pagesIt App NotesFoshAtokNo ratings yet

- Ca 51012 Fin Man Quiz 1 - Example of Application Type QuestionsDocument3 pagesCa 51012 Fin Man Quiz 1 - Example of Application Type QuestionsFoshAtokNo ratings yet

- Oblicon Module 1Document16 pagesOblicon Module 1FoshAtokNo ratings yet

- Formative AssessmentDocument5 pagesFormative AssessmentFoshAtokNo ratings yet

- Management Accounting Insights for Decision MakingDocument13 pagesManagement Accounting Insights for Decision MakingFoshAtokNo ratings yet

- Problem 9-21 (Pp. 420-421) : 1. Should The Owner Feel Frustrated With The Variance Reports? ExplainDocument3 pagesProblem 9-21 (Pp. 420-421) : 1. Should The Owner Feel Frustrated With The Variance Reports? ExplainCj SernaNo ratings yet

- Eks 9 en 2015 01 14Document157 pagesEks 9 en 2015 01 14aykutNo ratings yet

- 7 Eleven Store Nantun District - Google SearchDocument1 page7 Eleven Store Nantun District - Google SearchArleen MallillinNo ratings yet

- 2023list of Corporations For Placement Under Delinquency StatusDocument18,768 pages2023list of Corporations For Placement Under Delinquency StatusMark Anthony CasupangNo ratings yet

- List of Key Indian Office HoldersDocument15 pagesList of Key Indian Office HoldersRohit KumarNo ratings yet

- LABOR STANDARDS REVIEW MCQDocument5 pagesLABOR STANDARDS REVIEW MCQLiza MelgarNo ratings yet

- Chapter 9: Legal Challenges of Entrepreneurial Ventures: True/FalseDocument6 pagesChapter 9: Legal Challenges of Entrepreneurial Ventures: True/Falseelizabeth bernalesNo ratings yet

- Barangay transparency monitoring form titleDocument1 pageBarangay transparency monitoring form titleOmar Dizon100% (1)

- Target Market AnalysisDocument6 pagesTarget Market AnalysisAllyssa LaquindanumNo ratings yet

- Responsibility AccountingDocument4 pagesResponsibility AccountingEllise FreniereNo ratings yet

- Ir l04 U06 TestDocument5 pagesIr l04 U06 TestghostarixNo ratings yet

- Construction of Health Center ProjectDocument50 pagesConstruction of Health Center ProjectChinangNo ratings yet

- Survey of Portland Cement Consumption by of Portland Cement Consumption 1stDocument45 pagesSurvey of Portland Cement Consumption by of Portland Cement Consumption 1stHimerozNo ratings yet

- MICE - A New Paradigm For TourismDocument69 pagesMICE - A New Paradigm For TourismRoy Cabarles100% (1)

- IueDocument1 pageIueabhayNo ratings yet

- Macroeconomics Encapsulated in Three Models (Recovered)Document33 pagesMacroeconomics Encapsulated in Three Models (Recovered)Katherine Asis NatinoNo ratings yet

- OD Interventions PDFDocument11 pagesOD Interventions PDFimranpathan30100% (3)

- Becoming an Operations Consultant in 40 StepsDocument2 pagesBecoming an Operations Consultant in 40 StepsNicolae NistorNo ratings yet

- SW One DXP Cost Sheet (4.5BHK+Utility) Phase 2Document1 pageSW One DXP Cost Sheet (4.5BHK+Utility) Phase 2assetcafe7No ratings yet

- Export Oriented UnitsDocument10 pagesExport Oriented UnitsMansi GuptaNo ratings yet

- Vinamilk Yogurt Report 2019: CTCP Sữa Việt Nam (Vinamilk)Document24 pagesVinamilk Yogurt Report 2019: CTCP Sữa Việt Nam (Vinamilk)Nguyễn Hoàng TrườngNo ratings yet

- Assignment 3 - Practice 3 CVP Analysis - Multi-ProductDocument2 pagesAssignment 3 - Practice 3 CVP Analysis - Multi-Productjoint accountNo ratings yet

- Market Research and Analysis of Favorite Plus Ceramic Tiles Pvt. LtdDocument46 pagesMarket Research and Analysis of Favorite Plus Ceramic Tiles Pvt. LtdMahendra PatadiaNo ratings yet

- Platinum Sponsorship - P100, 000.00 and UpDocument1 pagePlatinum Sponsorship - P100, 000.00 and UpGina Lee Mingrajal SantosNo ratings yet

- Nepal Health Service Act 2053 BSDocument72 pagesNepal Health Service Act 2053 BSDinesh YadavNo ratings yet

- WillaWare v Jesichris ManufacturingDocument2 pagesWillaWare v Jesichris ManufacturingloschudentNo ratings yet

- MBA and MSC RESEARCH PROPOSALDocument19 pagesMBA and MSC RESEARCH PROPOSALmuthomi.bookshop.storeNo ratings yet

- Request For Quotation 11316: Please Submit Your Response ToDocument10 pagesRequest For Quotation 11316: Please Submit Your Response ToNaser FarhatNo ratings yet

- ACCT3203 Week 5 Tutorial Questions Customer Profitability Analysis & Quality S2 2022Document12 pagesACCT3203 Week 5 Tutorial Questions Customer Profitability Analysis & Quality S2 2022Jingwen YangNo ratings yet

- Institute of Management Studies and Research: KLE Society'sDocument22 pagesInstitute of Management Studies and Research: KLE Society'sRutuja HukkeriNo ratings yet