Professional Documents

Culture Documents

CHAPTER-14 Cost5

Uploaded by

Louiza Kyla Arida0 ratings0% found this document useful (0 votes)

13 views2 pagesOriginal Title

CHAPTER-14 cost5

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views2 pagesCHAPTER-14 Cost5

Uploaded by

Louiza Kyla AridaCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

1

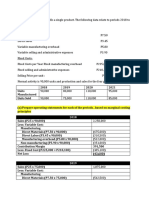

17.

20. (d)

By-Product A By-Product B

Sales P12,000 P 7,000

Manufacturing costs:

Before separation 6,500 2,700

After separation 2,200 1,800

Total 8,700 4,500

Gross profit P 3,300 P 2,500

21. (d)

Sales – Main Product: (10,000 P8) P80,000

Sales – By-Product 12,000

Total revenue for sales 92,000

Cost of sales:

Manufacturing costs: (12,000 x P5) P60,000

Less ending inventory (1,000 x P5) 5,000 55,000

Gross profit 37,000

Selling costs 20,000

Net income P17,000

22. (a)

Units produced: (30,000 + 15,000) 45,000

Unit sales price: (P45,000 / 30,000) P 1.50

Sales value at split off point – Product Red P67,500

23. (c)

Total costs – Department One:

Cost of Material X P144,000

Direct labor 21,000

Manufacturing overhead 15,000

Total joint costs P180,000

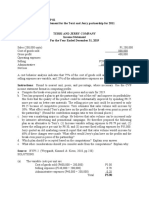

24. (a)

Sales Value Additional Adjusted Sales

Product Before Allocation Processing Costs Value at SOP

Red P 67,500 P 0 P 67,500

White 144,000 99,000 45,000

Blue 283,500 171,000 112,500

Total P225,000

Allocation of joint costs:

Red: (P67,500 / P225,000 x P180,000) P 54,000

White: (P45,000 / P225,000 x P180,000) 36,000

Blue: (P112,500 x P225,000 x P180,000) 90,000

Total P180,000

Cost of sales of Product White: (P36,000 + P99,000) P135,000

2

You might also like

- Cost Chapter 14Document15 pagesCost Chapter 14Marica ShaneNo ratings yet

- MAS Answer Key SolutionDocument6 pagesMAS Answer Key SolutionJonalyn JavierNo ratings yet

- MAS Assessment Exam Answer Key SolutionDocument7 pagesMAS Assessment Exam Answer Key SolutionJonalyn JavierNo ratings yet

- CHAPTER-14 Cost10Document1 pageCHAPTER-14 Cost10Louiza Kyla AridaNo ratings yet

- StratCostMgmt 4 - Mock Test For Quiz 1 Answer KeyDocument5 pagesStratCostMgmt 4 - Mock Test For Quiz 1 Answer KeyFoshAtokNo ratings yet

- YowDocument35 pagesYowJane Michelle Eman100% (1)

- Mas Test Bank SolutionDocument14 pagesMas Test Bank SolutionLyzaNo ratings yet

- Mas Test Bank SolutionDocument14 pagesMas Test Bank SolutionGem Alcos NicdaoNo ratings yet

- Chapter 1 ExercisesDocument18 pagesChapter 1 ExercisesJenny Brozas JuarezNo ratings yet

- Mas Test Bank SolutionDocument13 pagesMas Test Bank SolutionMark Jonah BachaoNo ratings yet

- Juarez, Jenny Brozas - Activity 1 MidtermDocument19 pagesJuarez, Jenny Brozas - Activity 1 MidtermJenny Brozas JuarezNo ratings yet

- Batch 18 1st Preboard (P1)Document14 pagesBatch 18 1st Preboard (P1)Jericho PedragosaNo ratings yet

- Answers 2014 Vol 3 CH 4 PDFDocument8 pagesAnswers 2014 Vol 3 CH 4 PDFLian Blakely CousinNo ratings yet

- Quiz Feb24Document5 pagesQuiz Feb24E RDNo ratings yet

- FinAcc3 Chap4Document9 pagesFinAcc3 Chap4Iyah AmranNo ratings yet

- Strategic Cost Management Exercises 12369Document2 pagesStrategic Cost Management Exercises 12369Arlene Diane OrozcoNo ratings yet

- SCM - 2ND Output FinalsDocument8 pagesSCM - 2ND Output FinalsChin FiguraNo ratings yet

- Salce Prelim Act102 E2Document8 pagesSalce Prelim Act102 E2Joshua P. SalceNo ratings yet

- Mas Solutions To Problems Solutions 2018 PDFDocument13 pagesMas Solutions To Problems Solutions 2018 PDFMIKKONo ratings yet

- Multiple Choice Questions - PROBLEMS Provide Your Solutions: Commented (1) : BDocument2 pagesMultiple Choice Questions - PROBLEMS Provide Your Solutions: Commented (1) : BSittie Sarah BangonNo ratings yet

- Last Na NiDocument5 pagesLast Na NiNatalie SerranoNo ratings yet

- Tugas 4 Lambertus HelliDocument6 pagesTugas 4 Lambertus HelliLambertus ZoNo ratings yet

- Costco1 - Assign 5Document7 pagesCostco1 - Assign 5Deryl GalveNo ratings yet

- Act.4-8 Ae23Document6 pagesAct.4-8 Ae23Damian Sheila MaeNo ratings yet

- Income Statement and OCI - Exercises - AnswerDocument3 pagesIncome Statement and OCI - Exercises - AnswerYstefani ValderamaNo ratings yet

- Mock Boards Answers AfarDocument5 pagesMock Boards Answers AfarKenneth DiabordoNo ratings yet

- (Mas) Week1 Solutions ManualDocument17 pages(Mas) Week1 Solutions ManualBeef Testosterone100% (1)

- Answers To Activity 1Document5 pagesAnswers To Activity 1jangjangNo ratings yet

- MA REV 1 Finals Dec 2017Document33 pagesMA REV 1 Finals Dec 2017Dale PonceNo ratings yet

- ADDITIONAL PROBLEMS-CVP AnalysisDocument4 pagesADDITIONAL PROBLEMS-CVP AnalysisFerb CruzadaNo ratings yet

- Job Order Costing SolutionDocument9 pagesJob Order Costing SolutionMariah VillanNo ratings yet

- Solution 1sttermDocument3 pagesSolution 1sttermE RDNo ratings yet

- CH 6 SolutionsDocument4 pagesCH 6 SolutionsGabriel PanoNo ratings yet

- Ma Bep01Document4 pagesMa Bep01Grace SimonNo ratings yet

- Problem 9 43Document5 pagesProblem 9 43SuperNo ratings yet

- Mas Solutions To Problems Solutions 2018Document14 pagesMas Solutions To Problems Solutions 2018Jahanna Martorillas0% (1)

- Mock Test 3 Online AnswerDocument4 pagesMock Test 3 Online AnswerLucia XIIINo ratings yet

- Ansay, Allyson Charissa T. - BSA 2 - Job Order CostingDocument9 pagesAnsay, Allyson Charissa T. - BSA 2 - Job Order Costingカイ みゆきNo ratings yet

- Mas TestbanksDocument25 pagesMas TestbanksKristine Esplana ToraldeNo ratings yet

- Juarez, Jenny Brozas - Activity 2 MidtermDocument4 pagesJuarez, Jenny Brozas - Activity 2 MidtermJenny Brozas JuarezNo ratings yet

- Answer Key Midterm Exam Cost Acounting With Solutions PART IIDocument7 pagesAnswer Key Midterm Exam Cost Acounting With Solutions PART IINoel Carpio100% (1)

- WK 2c Lesson 2 Problem Solving IllustrationDocument2 pagesWK 2c Lesson 2 Problem Solving IllustrationRosethel Grace GallardoNo ratings yet

- Ma - Bep01 - LucioDocument4 pagesMa - Bep01 - LucioGrace SimonNo ratings yet

- Cost Accounting AssignmentDocument6 pagesCost Accounting AssignmentCharles BarcelaNo ratings yet

- Answer Key:: Do It Yourself (Enabling Activity 1)Document6 pagesAnswer Key:: Do It Yourself (Enabling Activity 1)Joseph PamaongNo ratings yet

- Joint and by Product ExercisesDocument2 pagesJoint and by Product ExercisesAnsherina AquinoNo ratings yet

- AnswersDocument4 pagesAnswersAbdulmajed Unda MimbantasNo ratings yet

- SCM 2nd Output Finals SCMDocument9 pagesSCM 2nd Output Finals SCMMargie Garcia LausaNo ratings yet

- BUSE 3 - Practice ProblemDocument8 pagesBUSE 3 - Practice ProblemPang SiulienNo ratings yet

- Afar SolutionsDocument4 pagesAfar SolutionsSheena BaylosisNo ratings yet

- Bacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesDocument7 pagesBacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesQueenie Rose BacolodNo ratings yet

- 2017 Vol 3 CH 9 AnsDocument3 pages2017 Vol 3 CH 9 AnsDiola QuilingNo ratings yet

- MCMCDocument6 pagesMCMCIT GAMINGNo ratings yet

- Forest Products: Advanced Technologies and Economic AnalysesFrom EverandForest Products: Advanced Technologies and Economic AnalysesNo ratings yet

- Quiz No. 2 FSA Oral Recits Quiz3Document1 pageQuiz No. 2 FSA Oral Recits Quiz3Louiza Kyla AridaNo ratings yet

- TB 6Document2 pagesTB 6Louiza Kyla AridaNo ratings yet

- TB 5Document2 pagesTB 5Louiza Kyla AridaNo ratings yet

- Chapter 14 Cost6Document1 pageChapter 14 Cost6Louiza Kyla AridaNo ratings yet

- You Exec - KPI Dashboards Pt1 FreeDocument11 pagesYou Exec - KPI Dashboards Pt1 FreeManishNo ratings yet

- Macroeconomics 15th Edition Mcconnell Solutions ManualDocument17 pagesMacroeconomics 15th Edition Mcconnell Solutions Manualdencuongpow5100% (24)

- Chapter 2Document7 pagesChapter 2cerayNo ratings yet

- Chapter 3Document8 pagesChapter 3Eunice SerneoNo ratings yet

- Preparing and Using Financial StatementsDocument33 pagesPreparing and Using Financial StatementsMuhammad Imran50% (2)

- Chapter-1-Group1 Carra Yna Gahol Title DefenseDocument10 pagesChapter-1-Group1 Carra Yna Gahol Title DefenseRegienald BryantNo ratings yet

- Accounting For Income Taxes Pt. 2: Temporary DifferencesDocument23 pagesAccounting For Income Taxes Pt. 2: Temporary Differenceskrisha milloNo ratings yet

- KLBF LK TW Ii 2020Document150 pagesKLBF LK TW Ii 2020Nida Maulida HaviyaNo ratings yet

- Summary of IVth Schedule - Companies Ordinance 1984Document17 pagesSummary of IVth Schedule - Companies Ordinance 1984Platonic50% (2)

- Laporan Keuangan PT IndoasidatamaDocument205 pagesLaporan Keuangan PT IndoasidatamaHardi RizkonNo ratings yet

- PIS - Livestock Raising - Swine, Goat, Poultry, Etc.Document1 pagePIS - Livestock Raising - Swine, Goat, Poultry, Etc.HermisNo ratings yet

- GDPDocument2 pagesGDPSonia GuptaNo ratings yet

- Karla Company Comprehensive IncomeDocument3 pagesKarla Company Comprehensive Incomeakiko dilemNo ratings yet

- Managerial Accounting - Hallstead Jewelers CaseDocument2 pagesManagerial Accounting - Hallstead Jewelers Casesxzhou23100% (1)

- Urban Sprawl in MalaysiaDocument12 pagesUrban Sprawl in Malaysiayeahuey100% (2)

- Not For Profit IonDocument23 pagesNot For Profit Ioncarahul89No ratings yet

- Approaches For SCBADocument12 pagesApproaches For SCBAAseem1100% (3)

- Finals - II. Deductions & ExemptionsDocument13 pagesFinals - II. Deductions & ExemptionsJovince Daño DoceNo ratings yet

- Parkson Retail Asia Limited 2021 Annual ReportDocument190 pagesParkson Retail Asia Limited 2021 Annual ReportDY LeeNo ratings yet

- Bulletin de SeptembreDocument2 pagesBulletin de SeptembreJoyce Warren NåňãNo ratings yet

- Futa Post UtmeDocument133 pagesFuta Post UtmeEAO TECHNo ratings yet

- Meeting 1Document9 pagesMeeting 1erlina nurliaNo ratings yet

- KELOMPOK 5 (CHAPTER 17) RevDocument40 pagesKELOMPOK 5 (CHAPTER 17) Revnandya rizkyNo ratings yet

- Profit and GainDocument3 pagesProfit and GainS K MahapatraNo ratings yet

- IAS1 ExamplesDocument7 pagesIAS1 ExamplesHồ Đan ThụcNo ratings yet

- Interest Rate Spread On Bank Profitability: The Case of Ghanaian BanksDocument12 pagesInterest Rate Spread On Bank Profitability: The Case of Ghanaian BanksKiller BrothersNo ratings yet

- Learning Objective 11-1: Chapter 11 Current Liabilities and PayrollDocument50 pagesLearning Objective 11-1: Chapter 11 Current Liabilities and PayrollMarqaz MarqazNo ratings yet

- Nathan - Tankus - The New Monetary PolicyDocument47 pagesNathan - Tankus - The New Monetary PolicycjflemingNo ratings yet

- Tut #21 - International Trade (Answers) - No CSQDocument47 pagesTut #21 - International Trade (Answers) - No CSQChristie Ann WeeNo ratings yet

- Project Report On: Tax Avoidence and Tax EvasionDocument3 pagesProject Report On: Tax Avoidence and Tax EvasionAnupam BeoharNo ratings yet