Professional Documents

Culture Documents

(Econ 101) TheMonetarySystem

(Econ 101) TheMonetarySystem

Uploaded by

Tricia KiethOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(Econ 101) TheMonetarySystem

(Econ 101) TheMonetarySystem

Uploaded by

Tricia KiethCopyright:

Available Formats

📝

The Monetary System

Book Ch. (page)

Class Econ 101

Zoom link - Passcode

Date: @September 22, 2020

Topic: The Monetary System

Recall Notes

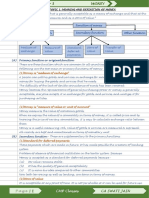

Reserves are Definitions of Money

liabilities of the M0 to M4 (arranged by liquidity, M0 most liquid and M4 least

central bank

liquid)

Liquidity - easy convertibility to cash

M0 - Base/Reserve Money

Currency in circulation + bank reserves

Bank reserves = cash in bank vaults + banks' reserve

balances or deposits with the BSP, including those in the

demand deposit account (DDA)

DDA = deposits of banks and other financial institutions

with the BSP to comply with reserve requirement

Note: M0 is NOT a subset of M1 because bank reserves

are not counted in M1

M1 - Narrow Money

The Monetary System 1

Currency in circulation (outside of depository corporations)

+ peso demand deposits (e.g. ATM accounts)

M2 - Broad Money

M1 + peso savings and time deposits

M3 - Broad Money Liabilities

M2 + peso deposit substitutes, such as promissory notes

and commercial papers (i.e. securities other than shares

included in broad money)

M4 - M3 + transferrable and other deposits in foreign currency

Essentially, M (money supply) = C (currency in circulation) + D

(deposits varying in liquidity)

Functions of Money

1. Medium of exchange (used for transactions)

2. Store of value (used to transfer purchasing power from

present to future)

3. Unit of account (unit by which prices and values are

measured)

Kinds of Money

1. Commodity Money - money with intrinsic value, can be

used to barter (e.g. gold, cows)

2. Fiat money - no intrinsic value, valuable only by gov't

decree, under control of central bank

"legal tender" - must be accepted as payment

3. Digital currencies (e.g. bitcoin) - no intrinsic value nor

backing by gov't decree, outside of control of central bank

accepted only by social convention

The Monetary System 2

Demand for Money - governed by 3 motives

1. Transactions demand for money - people demand money

to buy or sell goods and services

2. Precautionary demand for money - people may hold money

for contingencies

3. Speculative demand for money - people hold money rather

than bonds or other interest-bearing assets if they

anticipate the value of those assets will drop

1 and 2 are in line with Classical Theory - transactions and

precautionary demand for money increase with people's

incomes (positively related)

3 is a Keynesian concept - money is treated as another asset.

People choose to hold their wealth either in money or in bonds

(interest-bearing)

If people anticipate a decrease in bond prices, they will

unload their bond holdings to increase their money

holdings, avoiding capital losses from the price decrease of

bonds

When interest rates increase, people will hold their wealth

in bonds, lessening the demand for money

Negative relationship between interest rate and demand for

money

Money Multiplier

Fractional-reserve banking system - banks hold a fraction of the

money deposited as reserves and lend out the rest

Reserves - deposits that banks have received but not loaned

out

The Monetary System 3

Reserve ratio - fraction of deposits that banks hold as reserves

Note that reserves are LIABILITIES OF THE CENTRAL BANK

("pananagutan ng bangko sentral")

Banks hold reserves for:

Required reserves - to satisfy minimum reserve ratio

requirement of central bank

Excess reserves - precaution for unanticipated withdrawals

of bank deposits; as buffers against economic uncertainty;

due to absence of productive financing

When a bank lends money, that money is generally deposited

into another bank, creating more deposits and more reserves.

When a bank makes a loan from its reserves, the money supply

increases

Money multiplier - increase in money supply that the banking

system generates with a peso-increase of reserves

ΔM = (1/RRD) ∗ ΔR0

interpreted as the change in money supply is equal to

1/RRD times initial change in reserves

where RRD = required reserve deposit ratio

Simple money multiplier - reciprocal of RRD (i.e. 1/RRD)

ex. if RRD ratio is 20% or 1/5, then simple money multiplier

is 5

The Monetary System 4

implies that every peso increase in bank reserves increase

the money supply five times

2 assumptions in deriving simple money multiplier:

1. Banks do not hold excess reserves

2. Agents prefer to deposit the loans they take out instead of

holding them in cash

To derive a more realistic money multiplier (letting go of above

assumptions):

B - monetary base or M0

RRD - required reserves deposit ratio

ERD - excess reserves deposit ratio

CD - currency deposit ratio (ito ata yung ratio of their

money na hinohold ng tao instead of depositing)

M - money supply

By definition:

M=C+D

B=C+R

R = RR + ER

The Monetary System 5

Check pic above for formula of money multiplier m and M=mB

C is currency in circulation, does not include bank reserves

What happens to M if CD, RRD, or ERD is increased, with B

constant?

reduces the m (money multiplier)

Money supply M decreases, B constant

How changes in ratios affect the money supply M:

Examples (connected):

The Monetary System 6

Central bank's control of money supply is not precise

Central bank deals with two problems due to fractional-reserve

banking:

central bank can't control the amount of money households

choose to hold as deposits in banks

central bank can't control the amount of money banks

choose to lend

Monetary Policy

set of measures by central bank to influence liquidity levels

of the economy (money supply)

The Monetary System 7

Central bank - regulates banks to follow laws

acts as a lender of last resort for other banks

conducts monetary policy by regulating money supply

BSP - inflation-targeting regime starting 2002

to achieve its inflation target, BSP announces an explicit

target bandwidth. For 2015-2020, bandwidth is at 3% +/-

1%. This means inflation should only be from 2% to 4%, or

else BSP will conduct monetary policy

BSP uses core inflation to define its inflation target

Core inflation - CPI less volatile components

Volatile components - goods that are prone to supply

disturbances (outside of control of BSP, since BSP can only

affect demand side)

BSP Monetary Policy Tools

Overnight RRP & RP Rates

The Monetary System 8

RRP rate- interest rate for BSP borrowing from

other banks (key policy rate of BSP). Increasing

RRP encourages other banks to lend to BSP,

decreasing the money supply

RP rate - interest rate for BSP lending to other

banks

Increasing either RRP or RP rate are both

contractionary monetary policies

Reserve requirements

Increasing reserve req - contractionary MP

Decreasing reserve req - expansionary MP

Rediscount window - credit facility by the BSP to help

banks meet temporary liquidity needs

Increasing rediscount rate - contractionary MP

Decreasing rediscount rate - expansionary MP

Open Market Operations (OMO) - sale/purchase of

government securities by BSP in secondary market

Secondary market - market for securities that have

already been issued by Treasury and bought by

institutions

Open market sales - contractionary MP

Open market purchases - expansionary MP

The Monetary System 9

Overnight deposit facilities (O/N DF) - used to absorb

excess liquidity

Excess liquidity can result from a lot of foreign

deposits (inflows), basically madaming liquid cash

in the monetary system that's not being used

productively (?).

O/N DF rate = RRP rate - 0.50 percentage point

O/N DF rate should be the ceiling of O/N interbank

rate (rate at which banks lend to each other)

If inflation is above bandwidth - raise O/N DF rate,

and vice versa

Term deposit facilities (TDF) - deposit facilities by BSP

to absorb excess liquidity

If inflation is above bandwidth - raise TDF rate to

attract deposits

previously called special deposit account (SDA)

Essentially the same as overnight deposit facility,

but longer term (O/N is short term)

Summary of BSP tools:

The Monetary System 10

📌 SUMMARY:

The Monetary System 11

You might also like

- Eureka Wow - Money-And-Financial-MarketsDocument208 pagesEureka Wow - Money-And-Financial-MarketsParul RajNo ratings yet

- Modern Money Mechanics PDFDocument40 pagesModern Money Mechanics PDFwestelm12No ratings yet

- XAT - The History of MoneyDocument25 pagesXAT - The History of Moneyskhicks100% (1)

- Money Fraud 101Document83 pagesMoney Fraud 101alexjamesinfo100% (3)

- Chapter - 29 ECO121Document39 pagesChapter - 29 ECO121Le Pham Khanh Ha (K17 HCM)No ratings yet

- Micro Mid Terms Revision (EC1101E)Document6 pagesMicro Mid Terms Revision (EC1101E)ongnigel88No ratings yet

- 2 Grade English Section: Money & BankingDocument15 pages2 Grade English Section: Money & Bankingاحمد صلاحNo ratings yet

- Lecture 7 Banking, Money and Monetary PolicyDocument37 pagesLecture 7 Banking, Money and Monetary Policyshajea aliNo ratings yet

- Chapter 4 (The Monetary System What It Is and How It Works)Document9 pagesChapter 4 (The Monetary System What It Is and How It Works)Nurun Nabi MahmudNo ratings yet

- 2022 M23 Macro Chap 2 MoneyDocument35 pages2022 M23 Macro Chap 2 MoneyUpamanyu BasuNo ratings yet

- BankingDocument44 pagesBankingAdwaith c AnandNo ratings yet

- Topic 4-MoneyDocument30 pagesTopic 4-MoneyNUR ZHALIENA RAZHALINo ratings yet

- Lecture 6 - International Monetary EconDocument31 pagesLecture 6 - International Monetary EconYiğit Rasim ÖzdemirNo ratings yet

- Chapter 4 The Monetary System. What It Is and How It WorksDocument6 pagesChapter 4 The Monetary System. What It Is and How It WorksJoana Marie CalderonNo ratings yet

- Money and Banking 22-23Document17 pagesMoney and Banking 22-23larissa nazarethNo ratings yet

- MONEYDocument5 pagesMONEYShazia SadhikaliNo ratings yet

- Lecture 7 Banking, Money and Monetary PolicyDocument36 pagesLecture 7 Banking, Money and Monetary PolicyAvinash PrashadNo ratings yet

- Mruna SirDocument32 pagesMruna Sirprabh17No ratings yet

- Chapter 11 MoneyDocument22 pagesChapter 11 MoneySV Saras DewiNo ratings yet

- Chap 04Document51 pagesChap 04Yiğit KocamanNo ratings yet

- Session 8 and 9 Money, Money Supply, and Money DemandDocument86 pagesSession 8 and 9 Money, Money Supply, and Money DemandhmsbegaleNo ratings yet

- 2 - Econ 190.2 - What Is Money PDFDocument7 pages2 - Econ 190.2 - What Is Money PDFErielle SibayanNo ratings yet

- Ch10 Lecture and Textbook NotesDocument9 pagesCh10 Lecture and Textbook Notes47fwhvhc6kNo ratings yet

- 7 MoneyDocument33 pages7 Moneykunjal pasariNo ratings yet

- Chapter 4 Money Banks (First) PPTDocument22 pagesChapter 4 Money Banks (First) PPTSoha HassanNo ratings yet

- Real Value 1/the Average Price Level in The EconomyDocument7 pagesReal Value 1/the Average Price Level in The EconomyMamitoNo ratings yet

- Money, Banks, and The Central Bank: FUQINTRD 683W: Global Markets and InstitutionsDocument51 pagesMoney, Banks, and The Central Bank: FUQINTRD 683W: Global Markets and InstitutionsNaresh KumarNo ratings yet

- Monetary Policy NoteDocument6 pagesMonetary Policy NoteMS NagNo ratings yet

- Accbp 100 ReviewerDocument3 pagesAccbp 100 ReviewerKissey EstrellaNo ratings yet

- CH 13Document7 pagesCH 13thanhtra023No ratings yet

- Topic 4A-Money & BankingDocument37 pagesTopic 4A-Money & BankingPradeep VarshneyNo ratings yet

- The Monetary System: in This Chapter, Look For The Answers To These QuestionsDocument12 pagesThe Monetary System: in This Chapter, Look For The Answers To These QuestionshoangchuNo ratings yet

- Analysis of Money MarketDocument35 pagesAnalysis of Money MarketchikkuNo ratings yet

- BEE (2019-20) Handout 07 (Monetary Policy)Document4 pagesBEE (2019-20) Handout 07 (Monetary Policy)LAVISH DHINGRANo ratings yet

- MONEY Demand and Supply of MoneyDocument63 pagesMONEY Demand and Supply of MoneySwagat MohantyNo ratings yet

- Lecture 7 Money & Banks Econ1020Document19 pagesLecture 7 Money & Banks Econ1020Farah Abdel AzizNo ratings yet

- Money & Banking NotesDocument15 pagesMoney & Banking Noteslarissa nazarethNo ratings yet

- Money and BankingDocument5 pagesMoney and BankingAlans TechnicalNo ratings yet

- InfoDocument18 pagesInfoKeshiva RamnathNo ratings yet

- Unit 6 Money and BankingDocument70 pagesUnit 6 Money and BankingTrần Diệu MinhNo ratings yet

- Money and Monetary AggregatesDocument40 pagesMoney and Monetary AggregatesEnric MontesaNo ratings yet

- Cc-6 (High Powered Money) - 2Document10 pagesCc-6 (High Powered Money) - 2sommelierNo ratings yet

- Business Finance ReviewerDocument4 pagesBusiness Finance ReviewerJanna rae BionganNo ratings yet

- M7 MoneyDocument35 pagesM7 MoneyJohnny SinsNo ratings yet

- 5money & BankingDocument53 pages5money & Bankingshikshita jainNo ratings yet

- Chapter 29-The Monetary SystemDocument40 pagesChapter 29-The Monetary SystemHuy TranNo ratings yet

- Chapter 3 - Money and Banking PDFDocument5 pagesChapter 3 - Money and Banking PDFPankaj SharmaNo ratings yet

- Mrunal Sir's Economy 2020 Batch - Handout PDFDocument32 pagesMrunal Sir's Economy 2020 Batch - Handout PDFssattyyaammNo ratings yet

- Macroeconomics: Post Graduate Programme Debojyoti MazumderDocument14 pagesMacroeconomics: Post Graduate Programme Debojyoti MazumderaspNo ratings yet

- Money PDFDocument26 pagesMoney PDFDevaang ShuklaNo ratings yet

- Module 2Document33 pagesModule 2DHWANI DEDHIANo ratings yet

- Barter SystemDocument27 pagesBarter SystemimadNo ratings yet

- MoneyDocument3 pagesMoneySahanaNo ratings yet

- Money & BankingDocument33 pagesMoney & BankingGeeta GhaiNo ratings yet

- Unit - 8: Monetary Theory Concept of Money SupplyDocument10 pagesUnit - 8: Monetary Theory Concept of Money SupplySamin maharjanNo ratings yet

- Classwork Week 13 MoneyDocument6 pagesClasswork Week 13 MoneyProfessorNo ratings yet

- Money, Banking & The Financial SystemDocument32 pagesMoney, Banking & The Financial SystemniklynNo ratings yet

- Session 6 - Money Market EquilibriumDocument8 pagesSession 6 - Money Market EquilibriumNikhil kumarNo ratings yet

- Monetary PolicyDocument49 pagesMonetary PolicyHà MaiNo ratings yet

- Chapter 10Document13 pagesChapter 10Jhensele S42noNo ratings yet

- Chapter 23 - Money and The Financial SystemDocument4 pagesChapter 23 - Money and The Financial SystemTumblr_userNo ratings yet

- HANDOUT1Document5 pagesHANDOUT1Tricia KiethNo ratings yet

- Marginals and Chain RuleDocument5 pagesMarginals and Chain RuleTricia KiethNo ratings yet

- Yam V Ca Digest PDF FreeDocument1 pageYam V Ca Digest PDF FreeTricia KiethNo ratings yet

- Pcalifornia Bus Lines Vs State InvestmentDocument3 pagesPcalifornia Bus Lines Vs State InvestmentTricia KiethNo ratings yet

- PRCPT 07Document6 pagesPRCPT 07Tricia KiethNo ratings yet

- Mishkin Chap 5Document30 pagesMishkin Chap 5Tricia KiethNo ratings yet

- (Econ) UnemploymentDocument10 pages(Econ) UnemploymentTricia KiethNo ratings yet

- Econ 101 Topic 11Document8 pagesEcon 101 Topic 11Tricia KiethNo ratings yet

- (Econ) Classical - TheoryDocument23 pages(Econ) Classical - TheoryTricia KiethNo ratings yet

- 121 - Notes Q3Document8 pages121 - Notes Q3Tricia KiethNo ratings yet

- (Revised) Officer of Bank Financial Institution AffidavitDocument1 page(Revised) Officer of Bank Financial Institution Affidavitin1or100% (8)

- Chapter 23 - Money and The Financial SystemDocument4 pagesChapter 23 - Money and The Financial SystemTumblr_userNo ratings yet

- 2011 - Mises On Fractional Reserves (A Review of Huerta de Soto's Argument)Document40 pages2011 - Mises On Fractional Reserves (A Review of Huerta de Soto's Argument)Nicolas CachanoskyNo ratings yet

- Rip-Off by The Federal Reserve (Revised)Document13 pagesRip-Off by The Federal Reserve (Revised)Oldereb100% (2)

- Macro-Chapter 16 - UnlockedDocument10 pagesMacro-Chapter 16 - UnlockedTrúc LinhNo ratings yet

- Being Skeptical - Robert KiyosakiDocument63 pagesBeing Skeptical - Robert KiyosakiMati MazzuferiNo ratings yet

- Monetary Policy and Money SupplyDocument68 pagesMonetary Policy and Money SupplypearlksrNo ratings yet

- SALVATION THROUGH INFLATION - The Economics of Social Credit - Gary NorthDocument333 pagesSALVATION THROUGH INFLATION - The Economics of Social Credit - Gary NorthA.J. MacDonald, Jr.No ratings yet

- The Money GameDocument13 pagesThe Money GameMuneeb AliNo ratings yet

- Introduction To The Forex Market - Dirk Du ToitDocument82 pagesIntroduction To The Forex Market - Dirk Du Toitneagucosmin50% (2)

- We The Sheeple vs. The BankstersDocument177 pagesWe The Sheeple vs. The BankstersLAUREN J TRATAR100% (6)

- Biblical MoneyDocument23 pagesBiblical MoneyKarina BagdasarovaNo ratings yet

- Chapter 29 The Monetary SystemDocument49 pagesChapter 29 The Monetary SystemNgoc Tra Le BaoNo ratings yet

- TEST-8: Lesson 3 Monetary SystemDocument26 pagesTEST-8: Lesson 3 Monetary SystemDeepak ShahNo ratings yet

- What Do Banks Do - What Should They Do - and What Policies Are Needed To Ensure Best Results For The Real EconomyDocument31 pagesWhat Do Banks Do - What Should They Do - and What Policies Are Needed To Ensure Best Results For The Real EconomyjoebloggsscribdNo ratings yet

- Andrew Jackson - Where Does Money Come From - Positive Money PDF FromDocument374 pagesAndrew Jackson - Where Does Money Come From - Positive Money PDF FromLocal Money86% (7)

- Financial Institutions DefinitionDocument3 pagesFinancial Institutions DefinitionRabaa DooriiNo ratings yet

- Chapter 7Document17 pagesChapter 7Yasin IsikNo ratings yet

- 12-13. Money MarketDocument45 pages12-13. Money MarketLakshmi NairNo ratings yet

- Money SupplyDocument31 pagesMoney SupplyDivya JainNo ratings yet

- BankingDocument68 pagesBankingK59 Nguyen Thi Thu HaNo ratings yet

- Reviewer MPCBDocument7 pagesReviewer MPCBMJ NuarinNo ratings yet

- Appendix I - On Whether Honest Banking Can Cause Business CyclesDocument5 pagesAppendix I - On Whether Honest Banking Can Cause Business CyclesdtuurNo ratings yet

- Ch. 9 Money Creation by Topic Past Paper Marking SchemeDocument3 pagesCh. 9 Money Creation by Topic Past Paper Marking SchemeyanaaNo ratings yet

- Wolf, M. (Financial Times) - Strip Private Banks of Their Power To Create Money (2014)Document12 pagesWolf, M. (Financial Times) - Strip Private Banks of Their Power To Create Money (2014)Sam SamNo ratings yet

- Money and Financial Markets Eurekahow NotesDocument52 pagesMoney and Financial Markets Eurekahow NotesDebajyoti SamajpatiNo ratings yet

- The Monetary SystemDocument50 pagesThe Monetary SystemRohit Goyal100% (1)