Professional Documents

Culture Documents

Calculating Break-Even Point

Uploaded by

Andre CandraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calculating Break-Even Point

Uploaded by

Andre CandraCopyright:

Available Formats

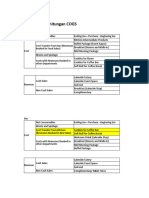

Break-even can be calculated in two ways:

CALCULATING The TOTAL SALES a business needs to make to cover costs and the

NUMBER OF UNITS a business must sell to cover costs

BREAK-EVEN POINT Here are a couple of examples of how to calculate the break-even point.

Olga’s bakery sells a loaf of bread for $4.00 Fixed costs - $1000 (total per month)

per unit. To calculate the break-even point,

Variable costs - $2.00 (per unit)

you need to know the fixed costs and the

variable costs per unit. Sale price - $4.00 (per unit)

1 CALCULATING THE

2 CALCULATING THE

BREAK-EVEN POINT IN TOTAL SALES BREAK-EVEN POINT IN NUMBER OF UNITS

Fixed Costs ÷ Contribution Margin = Total sales Fixed costs ÷ (Sale price per unit – Variable costs per unit)

Contribution Margin is the difference between the price 1000 ÷ ($4 - $2) = 500 number of units to break-even point

of a product and what it costs to make that product.

The calculation is as follows:

(Sale price per unit – Variable costs per unit ÷

Sale price per unit

To confirm this figure you can take the 500 units,

$1000 ÷ .50 = $2000 total sales to break-even point and multiply that by the $4.00 sales price,

to get the $2000 amount.

You might also like

- Break Even Analysis and MarkupDocument4 pagesBreak Even Analysis and Markupbenaoumeur benounaNo ratings yet

- Management AccountingDocument11 pagesManagement Accountingkrishnaparab1No ratings yet

- Variable Costing: VersusDocument22 pagesVariable Costing: VersusNathanaelNo ratings yet

- 1 CVP RelationshipDocument22 pages1 CVP RelationshipmedrekNo ratings yet

- CVP New + LastDocument19 pagesCVP New + LastDawit AmahaNo ratings yet

- Step 1:: Break-Even Worksheets: Dollar BasisDocument2 pagesStep 1:: Break-Even Worksheets: Dollar BasisHendro PranotoNo ratings yet

- Important Formulas For Break - Even Analysis: Selling Price Per Unit - Variable Cost Per UnitDocument4 pagesImportant Formulas For Break - Even Analysis: Selling Price Per Unit - Variable Cost Per UnitDevika GopiNo ratings yet

- Topic 1.1 Cost BehaviorDocument51 pagesTopic 1.1 Cost BehaviorGaleli PascualNo ratings yet

- Cost-Volume-Profit Analysis: A Managerial Planning Tool: Kelompok 2: Alifia Maya Savira Gamma Yuni NurvistaDocument21 pagesCost-Volume-Profit Analysis: A Managerial Planning Tool: Kelompok 2: Alifia Maya Savira Gamma Yuni Nurvistavira0% (1)

- BEA ProblemsDocument20 pagesBEA ProblemsGabriel BelmonteNo ratings yet

- Break Even AnalysisDocument3 pagesBreak Even AnalysisKEERTHANA RNo ratings yet

- What Is The Breakeven Point (BEP) ?Document4 pagesWhat Is The Breakeven Point (BEP) ?Muhammad NazmuddinNo ratings yet

- Notes CVP 2009, 2017Document13 pagesNotes CVP 2009, 2017Aaron ForbesNo ratings yet

- Chapter 4 Measuring Mix and Yield VariancesDocument10 pagesChapter 4 Measuring Mix and Yield VariancesEyuel SintayehuNo ratings yet

- END3972 Week4 v2Document20 pagesEND3972 Week4 v2Enes TürksalNo ratings yet

- CVP Analysis Notes 1Document4 pagesCVP Analysis Notes 1Potie RhymeszNo ratings yet

- Business & Finance Chapter-7 Part-02 PDFDocument12 pagesBusiness & Finance Chapter-7 Part-02 PDFRafidul IslamNo ratings yet

- COSTMAN - MidtermDocument23 pagesCOSTMAN - MidtermHoney MuliNo ratings yet

- Breakeven AnalysisDocument19 pagesBreakeven AnalysisJitenderKumarNo ratings yet

- Break-Even Analysis/Cvp AnalysisDocument41 pagesBreak-Even Analysis/Cvp AnalysisMehwish ziadNo ratings yet

- HMCost3e SM Ch16Document35 pagesHMCost3e SM Ch16Bung Qomar100% (2)

- 03-04-2012Document62 pages03-04-2012Adeel AliNo ratings yet

- 1.cost Volume Profit AnalysisDocument9 pages1.cost Volume Profit AnalysisgishaNo ratings yet

- FM 225 Kulang 4Document4 pagesFM 225 Kulang 4Karen AlonsagayNo ratings yet

- Kinney8e PPT Ch09Document36 pagesKinney8e PPT Ch09Ashraf ZamanNo ratings yet

- Marginal CostingDocument40 pagesMarginal CostingVaresh KapoorNo ratings yet

- Break Even AnalysisDocument19 pagesBreak Even AnalysissaadsaaidNo ratings yet

- Unit 2 Break Even AnalysisDocument20 pagesUnit 2 Break Even AnalysisBARATH RONALDONo ratings yet

- Forma EducationDocument6 pagesForma EducationAhmed KhalidNo ratings yet

- Cost Volume Profit AnalysisDocument5 pagesCost Volume Profit AnalysisJames Ryan AlzonaNo ratings yet

- Important Formula To Learn: Formulas and ExamplesDocument3 pagesImportant Formula To Learn: Formulas and Examplescatherine wisartaNo ratings yet

- 4b. Cost-Volume-Profit CR PDFDocument26 pages4b. Cost-Volume-Profit CR PDFRhea Mae AmitNo ratings yet

- F5-CVP-1 AccaDocument10 pagesF5-CVP-1 AccaAmna HussainNo ratings yet

- Break Even Changes To The MarketDocument7 pagesBreak Even Changes To The MarketCalistus FernandoNo ratings yet

- Ch7 CVPDocument26 pagesCh7 CVPbekbek12No ratings yet

- Management Accounting Chapter 3 (Cost-Volume-Profit Chapter22)Document59 pagesManagement Accounting Chapter 3 (Cost-Volume-Profit Chapter22)yimerNo ratings yet

- Gma711 Management Accounting (Cost Volume Profit Analysis Report)Document29 pagesGma711 Management Accounting (Cost Volume Profit Analysis Report)Summer Edriane B. GonzalesNo ratings yet

- Break Even Analysis Excel Template: Visit: EmailDocument9 pagesBreak Even Analysis Excel Template: Visit: EmailOFFADNo ratings yet

- Method For Analyzing Cost BehaviorDocument6 pagesMethod For Analyzing Cost BehaviorkashanpirzadaNo ratings yet

- Management and SocialDocument4 pagesManagement and Socialali202101No ratings yet

- Break-Even Point ReportingDocument30 pagesBreak-Even Point ReportingaikoNo ratings yet

- Break Even PointDocument29 pagesBreak Even PointDanbryanNo ratings yet

- Module 7 CVP Analysis SolutionsDocument12 pagesModule 7 CVP Analysis SolutionsChiran AdhikariNo ratings yet

- Lecture 4b Cost Volume Profit EditedDocument24 pagesLecture 4b Cost Volume Profit EditedJinnie QuebrarNo ratings yet

- CPVDocument5 pagesCPVPrasetyo AdityaNo ratings yet

- Application of Break Even Analysis To Single Products: Unit 2 SectionDocument8 pagesApplication of Break Even Analysis To Single Products: Unit 2 SectionBabamu Kalmoni JaatoNo ratings yet

- BE Analysis - StudentsDocument8 pagesBE Analysis - Studentsdanspoors05No ratings yet

- Fina and Mana Accounting Chapter FourDocument77 pagesFina and Mana Accounting Chapter FourAklilu TadesseNo ratings yet

- Chapter Five 111Document76 pagesChapter Five 111Ras DawitNo ratings yet

- BEP N CVP AnalysisDocument49 pagesBEP N CVP AnalysisJamaeca Ann MalsiNo ratings yet

- Công TH CDocument19 pagesCông TH Ckim oanhNo ratings yet

- University of London (LSE) : Cost-Volume-Profit / Break-Even AnalysisDocument15 pagesUniversity of London (LSE) : Cost-Volume-Profit / Break-Even AnalysisDương DươngNo ratings yet

- Break Even Analysis Is The Critical Tool For Determining The Capacity A Facility Must Have ToDocument4 pagesBreak Even Analysis Is The Critical Tool For Determining The Capacity A Facility Must Have ToJoven QuibalNo ratings yet

- MGT 102 Case Study 2Document5 pagesMGT 102 Case Study 2Bharat ParmarNo ratings yet

- Cost Volume Profit AnalysisDocument9 pagesCost Volume Profit AnalysisAryh Grace Tan100% (1)

- MUTYA BACARRO (BasCal)Document7 pagesMUTYA BACARRO (BasCal)Mark LillardNo ratings yet

- 3 - BREAK EVEN ANALYSIS - UploadDocument5 pages3 - BREAK EVEN ANALYSIS - Uploadniaz kilamNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Glossary of Cash Flow TermsDocument2 pagesGlossary of Cash Flow TermsAndre CandraNo ratings yet

- Formula - COGSDocument2 pagesFormula - COGSAndre CandraNo ratings yet

- Test QuizDocument7 pagesTest QuizAndre CandraNo ratings yet

- Setting Up Your Instagram AccountDocument2 pagesSetting Up Your Instagram AccountAndre CandraNo ratings yet

- Building RelationshipDocument1 pageBuilding RelationshipAndre CandraNo ratings yet

- Tea Flavor DescriptorsDocument5 pagesTea Flavor DescriptorsAndre CandraNo ratings yet

- 10 4 Intro To Recruitment and SelectionDocument2 pages10 4 Intro To Recruitment and SelectionAndre CandraNo ratings yet

- Tea - Food Pairing GuideDocument1 pageTea - Food Pairing GuideAndre CandraNo ratings yet

- Building A Following On InstagramDocument3 pagesBuilding A Following On InstagramAndre CandraNo ratings yet

- Systems TemplateDocument1 pageSystems TemplateAndre CandraNo ratings yet

- Tea Cupping Evaluation SheetDocument1 pageTea Cupping Evaluation SheetAndre CandraNo ratings yet

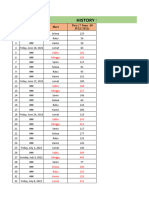

- Kitchen Order Guide ExampleDocument15 pagesKitchen Order Guide ExampleAndre CandraNo ratings yet

- General Daily ChecklistDocument1 pageGeneral Daily ChecklistAndre CandraNo ratings yet

- 1036 TFG Facilitator Guidelines LuxuryDocument3 pages1036 TFG Facilitator Guidelines LuxuryAndre CandraNo ratings yet

- Assesment Delivering Excellent ServiceDocument4 pagesAssesment Delivering Excellent ServiceAndre CandraNo ratings yet

- Drafting Your OutlineDocument1 pageDrafting Your OutlineAndre CandraNo ratings yet

- Dumplings - The Top 50 Most Delicious Dumpling Recipes (PDFDrive)Document88 pagesDumplings - The Top 50 Most Delicious Dumpling Recipes (PDFDrive)Andre CandraNo ratings yet

- Hand WashingDocument1 pageHand WashingAndre CandraNo ratings yet

- Email Subject LinesDocument2 pagesEmail Subject LinesAndre CandraNo ratings yet

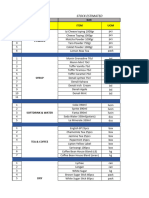

- Ikan Pool MenuDocument1 pageIkan Pool MenuAndre CandraNo ratings yet

- Swapping Nouns For VerbsDocument1 pageSwapping Nouns For VerbsAndre CandraNo ratings yet

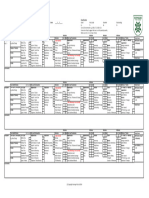

- Demand Forecast PlanDocument18 pagesDemand Forecast PlanAndre CandraNo ratings yet

- DRAFT v2 Incentives and Metrics - F and B ServiceDocument1 pageDRAFT v2 Incentives and Metrics - F and B ServiceAndre CandraNo ratings yet

- DS-V1 Updated Food Menu Price List 12 Agustus 2023Document285 pagesDS-V1 Updated Food Menu Price List 12 Agustus 2023Andre CandraNo ratings yet

- Min Max Stock BAR Low-High-Peak Season Edt DSDocument6 pagesMin Max Stock BAR Low-High-Peak Season Edt DSAndre CandraNo ratings yet