Professional Documents

Culture Documents

Condonation

Uploaded by

RiaZ MoHamMaD0 ratings0% found this document useful (0 votes)

6 views1 pageThe appellant, Neelendra Singh Chauhan, is requesting that the Commissioner of Income Tax condones the delay in filing an appeal against the assessment order for the 2020-21 tax year. The appellant received the assessment order on November 30, 2021 but failed to file the appeal by the due date of November 29, 2022. This was due to Covid-19 related medical issues experienced by the appellant as well as losing access to the accountant's email where notifications were sent. The delay is being requested to be condoned as the circumstances were beyond the appellant's control and the appeal matter is based on decided case laws.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe appellant, Neelendra Singh Chauhan, is requesting that the Commissioner of Income Tax condones the delay in filing an appeal against the assessment order for the 2020-21 tax year. The appellant received the assessment order on November 30, 2021 but failed to file the appeal by the due date of November 29, 2022. This was due to Covid-19 related medical issues experienced by the appellant as well as losing access to the accountant's email where notifications were sent. The delay is being requested to be condoned as the circumstances were beyond the appellant's control and the appeal matter is based on decided case laws.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageCondonation

Uploaded by

RiaZ MoHamMaDThe appellant, Neelendra Singh Chauhan, is requesting that the Commissioner of Income Tax condones the delay in filing an appeal against the assessment order for the 2020-21 tax year. The appellant received the assessment order on November 30, 2021 but failed to file the appeal by the due date of November 29, 2022. This was due to Covid-19 related medical issues experienced by the appellant as well as losing access to the accountant's email where notifications were sent. The delay is being requested to be condoned as the circumstances were beyond the appellant's control and the appeal matter is based on decided case laws.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

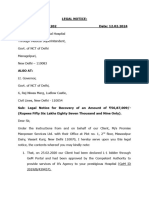

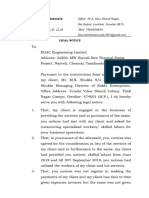

Commissioner of Income Tax (Appeals),

National Faceless Appeal Centre

New Delhi

Respected Sir,

Reg:

Neelendra Singh Chauhan (‘the Appellant’)

PAN: AHEPC8919M

Assessment Year (‘AY’): 2020-21

Previous Year Ended: 31st March 2019

Sub: Petition for condonation of Delay in Filing the Appeal

My above-named client is assessed to income-tax by the Assessing Officer, Circle/Ward. 6(1)

Civic Center New Delhi.

My client received the assessment order and demand notice for assessment year 2020-21 on

30/11/2021 Being aggrieved by the said order he ought to have filed the appeal on

29/11/2022 However, he could not do so for the following reasons:

I. Covid-19 Medical Emergency-

As you know that covid was on its peak and client was down with medical emergency

due to which assessee could not concentrate on his business and consequently could not

file the appeal on time.

II. Email Access: -

Access to our official email was in with the our accountant and unfortunately we lost our

accountant in covid-19 due to which intimation was not seen on time which is why would

not file appeal on time.

The delay in appeal was caused by circumstances beyond our control and subject matter in

our appeal is already based on the decided case laws. I would request your honor to condone

the same and admit it.

Thanking you,

Yours faithfully,

For AGAM and Associates.

Chartered Accountants

CA Akshay Mittal

On behalf of Sh. Neelendra Singh Chauhan

Enclosure: As above

You might also like

- Proposal - Accounting ServicesDocument3 pagesProposal - Accounting ServicesJean Fajardo Badillo100% (1)

- Mock QuizDocument11 pagesMock QuizMichelle MarquezNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- C.T.A. Case No. 9076 - Keansburg Marketing Corp. v. CIRDocument31 pagesC.T.A. Case No. 9076 - Keansburg Marketing Corp. v. CIRcaren kay b. adolfoNo ratings yet

- Employee Hardship Fund Grant ApplicationDocument2 pagesEmployee Hardship Fund Grant Application_clinton100% (2)

- DocubDocument24 pagesDocubGayli Cortiguerra100% (1)

- Tax Clearance - FAQDocument5 pagesTax Clearance - FAQSarmila RavichandranNo ratings yet

- Relief Assistance Programme - Covid-19 Request Form: Customer DetailsDocument1 pageRelief Assistance Programme - Covid-19 Request Form: Customer DetailsHarryNo ratings yet

- Legal Notice To SGM HospitalDocument9 pagesLegal Notice To SGM HospitalAnanaya SachdevaNo ratings yet

- Team Energy Corporation V CIR - DigestDocument1 pageTeam Energy Corporation V CIR - DigestKate GaroNo ratings yet

- Appeal Tax Procedure (Malaysia)Document2 pagesAppeal Tax Procedure (Malaysia)Zati TyNo ratings yet

- TAXQUIZ25Document3 pagesTAXQUIZ25Aeron Rai RoqueNo ratings yet

- Case Digest On Taxation 1Document32 pagesCase Digest On Taxation 1Carl Vincent QuitorianoNo ratings yet

- 123court Petition K eDocument11 pages123court Petition K eAhmed GopangNo ratings yet

- Online Form Submission (Registration-Id: 11924772501) : 2 MessagesDocument1 pageOnline Form Submission (Registration-Id: 11924772501) : 2 MessagesDigvijay ChauhanNo ratings yet

- Case CommentaryDocument7 pagesCase CommentaryHritik KashyapNo ratings yet

- Judgment: Ms. Henna George and Ms. Purti Gupta, AdvocatesDocument14 pagesJudgment: Ms. Henna George and Ms. Purti Gupta, AdvocatesvlgsaaaNo ratings yet

- National Company Law Appellate Tribunal (From New Delhi) (F.B.)Document5 pagesNational Company Law Appellate Tribunal (From New Delhi) (F.B.)ashutosh srivastavaNo ratings yet

- PGDTP ParnaDocument73 pagesPGDTP ParnaRi ChNo ratings yet

- Cir Vs PNB DigestDocument3 pagesCir Vs PNB DigestKaye Almeida100% (1)

- Award 32252 PDFDocument32 pagesAward 32252 PDFaverroes7No ratings yet

- 96Document1 page96Cindy ApriliaNo ratings yet

- Fau Presentation-1Document4 pagesFau Presentation-1Ambrose ApolinaryNo ratings yet

- Recent Tax Case DigestDocument13 pagesRecent Tax Case DigestKrisLarrNo ratings yet

- Information Regarding Net Income and Savings For The Financial Year 2019-20,2020-21,2021-22Document3 pagesInformation Regarding Net Income and Savings For The Financial Year 2019-20,2020-21,2021-22Mangesh JoshiNo ratings yet

- Case Digest On Taxation 1Document32 pagesCase Digest On Taxation 1YeahboiNo ratings yet

- CIR V Mindanao II Geothermal PartnershipDocument2 pagesCIR V Mindanao II Geothermal PartnershipGwynneth Grace LasayNo ratings yet

- Tax LawDocument8 pagesTax LawAmie Jane MirandaNo ratings yet

- ReSA B44 TAX Final PB Exam Questions Answers and SolutionsDocument14 pagesReSA B44 TAX Final PB Exam Questions Answers and SolutionsDhainne EnriquezNo ratings yet

- Enq - Report Shiva Rdo PDPLDocument2 pagesEnq - Report Shiva Rdo PDPLdropeddapalliNo ratings yet

- CIR Vs FirstDocument2 pagesCIR Vs Firstshookt panboiNo ratings yet

- 5 - CIR vs. Hon. Raul M. GonzalezDocument6 pages5 - CIR vs. Hon. Raul M. GonzalezJaye Querubin-FernandezNo ratings yet

- Relief Assistance Programme - Covid-19 Request Form: Customer DetailsDocument1 pageRelief Assistance Programme - Covid-19 Request Form: Customer DetailsMuhammad HafizNo ratings yet

- Summary of ChargesDocument8 pagesSummary of ChargesShailendra DwiwediNo ratings yet

- Cir vs. Dash Eng'g Phils., GR No. 184145 (Dec. 11, 2013)Document4 pagesCir vs. Dash Eng'g Phils., GR No. 184145 (Dec. 11, 2013)JERepaldoNo ratings yet

- Quiz TaxDocument5 pagesQuiz TaxRaven DahlenNo ratings yet

- FSM Cinema IncDocument3 pagesFSM Cinema IncluckyNo ratings yet

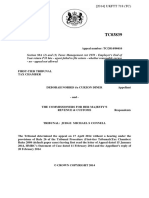

- TC 03839Document7 pagesTC 03839Syed AhmadNo ratings yet

- Letter TwoDocument5 pagesLetter TwoAjay ParakhNo ratings yet

- Instructions ORIGDocument1 pageInstructions ORIGJericho NadanzaNo ratings yet

- Chapter 8 Tax AdministrationDocument14 pagesChapter 8 Tax AdministrationHazlina Hussein100% (1)

- WRITTEN WARNING-Uno Merch Napay 100820Document1 pageWRITTEN WARNING-Uno Merch Napay 100820aira alyssa caballeroNo ratings yet

- Unitel Vs CirDocument2 pagesUnitel Vs Cirian ballartaNo ratings yet

- RuPay Insurance Program FY 2020-21 RuPay Classic CardsDocument23 pagesRuPay Insurance Program FY 2020-21 RuPay Classic Cardsindrajit sinhaNo ratings yet

- LEGAL NOTICE - Rakhi EnterprisesDocument9 pagesLEGAL NOTICE - Rakhi Enterprisespindada10201No ratings yet

- Anmol Singh Anand Advocate: Your Notice, Dated 10/10/2022, Given by You On Behalf of Your ClientsDocument3 pagesAnmol Singh Anand Advocate: Your Notice, Dated 10/10/2022, Given by You On Behalf of Your ClientsADV Anmol Singh anandNo ratings yet

- Instructions of DdaDocument2 pagesInstructions of DdaRAHUL ANANDNo ratings yet

- Raghav Bahl CA Email 11 May 2019 12:06 PMDocument1 pageRaghav Bahl CA Email 11 May 2019 12:06 PMThe QuintNo ratings yet

- Administrative Remedies (Protesting of Assessment, Recovery of Excess or Erroneously Paid Taxes, Request For The Compromise, Abatement or Refund or Credit of Taxes, Request For Rulings)Document2 pagesAdministrative Remedies (Protesting of Assessment, Recovery of Excess or Erroneously Paid Taxes, Request For The Compromise, Abatement or Refund or Credit of Taxes, Request For Rulings)darlene floresNo ratings yet

- Untitled DocumentDocument15 pagesUntitled DocumentNasnia UrabNo ratings yet

- Last Set For Pre-MidtermsDocument4 pagesLast Set For Pre-MidtermsBrigette DomingoNo ratings yet

- Sangeeta Goel vs. Roidec India Chemicals Private Limited PDFDocument10 pagesSangeeta Goel vs. Roidec India Chemicals Private Limited PDFshwetaNo ratings yet

- Ursabia TaxDocument3 pagesUrsabia TaxHarry PeterNo ratings yet

- CIR V Gonzales 2010Document4 pagesCIR V Gonzales 2010Frederick Xavier LimNo ratings yet

- Sample Demand Letter For Unpaid BalanceDocument1 pageSample Demand Letter For Unpaid BalanceRia Kriselle Francia PabaleNo ratings yet

- SC009Document10 pagesSC009santoshkumarNo ratings yet

- CBK V CIR GR198729-30Document2 pagesCBK V CIR GR198729-30Espie TorresNo ratings yet

- AVIDocument1 pageAVIRavi RajaNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)