Professional Documents

Culture Documents

CHAPTER 18 Problem 3

CHAPTER 18 Problem 3

Uploaded by

pdmallari12Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CHAPTER 18 Problem 3

CHAPTER 18 Problem 3

Uploaded by

pdmallari12Copyright:

Available Formats

CHAPTER 18-3

Two real estate companies, Lin and Kid (the parties) set up a separate vehicle (LK) for the purpose of acquiring

and operating a shopping mall. The contractual arrangement between the parties establishes joint control of the

activities that are conducted in LK. The legal form of LK is that LK, not the parties, has rights to the assets, and

obligations for the liabilities, relating to the arrangement. The activities of the arrangement include the rental of

the retail units, managing the car park, maintaining the mall and its equipment, such as escalators, and

establishing the reputation and customer base for the mall as a whole.

The terms of the contractual arrangement are such that:

a. Entity LK owns the shopping mall.

b. The liability of each party is limited to the unpaid amount of their capital contribution.

c. The parties have the right to sell or pledge their interest in the entity LK.

d. Each party receives a share of the income from operating the shopping mall (which is the rental income net of

the operating costs and expenses) in accordance with its interests in entity LK.

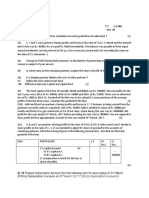

Summary transactions of the joint arrangement are as follows:

2017 2018

Contributions:

Company Lin P10 million P -

Company Kid 10 million -

Rental Income 4 million 5 million

Costs and Expenses 2 million 2 million

Dividends Declared and Paid 1 million

Required: Prepare journal entries in the books of Companies Lin and Kid to record their interest in the joint

arrangement for 2017 and 2018.

CAPITAL RATIO(10/20)

Solution:

Company Lin INCOME - C&E

2017:

Investment in Joint Venture 10,000,000

Cash 10,000,000

To record investment in the joint venture.

Investment in Joint Venture 1,000,000

Income in Joint Venture [(4,000,000-2,000,000)x10/20] 1,000,000

To record share in the net income of LK.

2018:

Cash 500,000

Investment in Joint Venture (1,000,000x10/20) 500,000

To record dividends received.

Investment in Joint Venture 1,500,000

Income from Joint Venture [(5,000,000-2,000,000)x10/20] 1,500,000

To record share in the net income of LK.

Investment in Joint Venture account balance:

2017 (10,000,000+1,000,000) P 11,000,000

2018 (11,000,000-500,000+1,500,000) P 12,000,000

Company Kid

2017:

Investment in Joint Venture 10,000,000

Cash 10,000,000

To record investment in the joint venture.

Investment in Joint Venture 1,000,000

Income in Joint Venture [(4,000,000-2,000,000)x10/20] 1,000,000

To record share in the net income of LK.

2018:

Cash 500,000

Investment in Joint Venture (1,000,000x10/20) 500,000

To record dividends received.

Investment in Joint Venture 1,500,000

Income from Joint Venture [(5,000,000-2,000,000)x10/20] 1,500,000

To record share in the net income of LK.

Investment in Joint Venture account balance:

2017 (10,000,000+1,000,000) P 11,000,000

2018 (11,000,000-500,000+1,500,000) P 12,000,000

You might also like

- Affidavit SAMPLE of BC Beneficial Ownership Wi PhotoDocument3 pagesAffidavit SAMPLE of BC Beneficial Ownership Wi Photoricetech91% (35)

- Commercial Contracting Study NotesDocument46 pagesCommercial Contracting Study NotesJoan Foster100% (1)

- May 2017Document7 pagesMay 2017Patrick Arazo0% (1)

- This Study Resource Was: Quiz 16Document7 pagesThis Study Resource Was: Quiz 16Jeff GonzalesNo ratings yet

- Chapter 18 CompilationDocument21 pagesChapter 18 CompilationMaria Licuanan0% (1)

- L 1Document5 pagesL 1Elizabeth Espinosa ManilagNo ratings yet

- Activity 3 CAMINGAWAN BSMA 2B PDFDocument7 pagesActivity 3 CAMINGAWAN BSMA 2B PDFMiconNo ratings yet

- Specific Financial Reporting Questions & Answers: Suggested Solution 1Document37 pagesSpecific Financial Reporting Questions & Answers: Suggested Solution 1Tawanda Tatenda Herbert100% (2)

- Final Quiz 1 Set A With AnswerDocument9 pagesFinal Quiz 1 Set A With Answer11mahogany.hazelnicoletiticNo ratings yet

- Abc-Consolidation (Date of Acquisition)Document2 pagesAbc-Consolidation (Date of Acquisition)Leonardo Mercader0% (1)

- May 2017 PDF FreeDocument7 pagesMay 2017 PDF FreeJorenz UndagNo ratings yet

- May 2017 PDF FreeDocument7 pagesMay 2017 PDF FreeJorenz UndagNo ratings yet

- Intermediate Accounting Chapter 17 and 18Document9 pagesIntermediate Accounting Chapter 17 and 18avilastephjaneNo ratings yet

- TaxationDocument7 pagesTaxationDorothy ApolinarioNo ratings yet

- 162 PresummativeDocument5 pages162 PresummativeMeichigo SwadeeNo ratings yet

- Solved Problems: OlutionDocument5 pagesSolved Problems: OlutionSavoir PenNo ratings yet

- Poem PoemDocument5 pagesPoem PoemElizabeth Espinosa ManilagNo ratings yet

- Date of Record: December 1, 2019 December 27, 2019Document11 pagesDate of Record: December 1, 2019 December 27, 2019Allana Mier100% (2)

- Finance CAP Task 2: Answer 1Document4 pagesFinance CAP Task 2: Answer 1Ankit KanwarNo ratings yet

- RERETESTDocument4 pagesRERETESTshveta0% (1)

- IAET TaxationDocument2 pagesIAET TaxationRandy Manzano100% (1)

- 162 PreSummative2Document4 pages162 PreSummative2Alvin John San JuanNo ratings yet

- Corporate FinanceDocument9 pagesCorporate FinancePrince HussainNo ratings yet

- Special TransactionsDocument5 pagesSpecial TransactionsJehannahBarat100% (1)

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- FABM2 LESSON 3 Statement of Changes in EquityDocument4 pagesFABM2 LESSON 3 Statement of Changes in EquityArjay CorderoNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- This Study Resource Was: Chool of Usiness Conomics Otal ArksDocument9 pagesThis Study Resource Was: Chool of Usiness Conomics Otal Arkscsolution0% (2)

- CBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot QuestionsDocument6 pagesCBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot Questionsdakshrwt06No ratings yet

- PDF May 2017 - CompressDocument7 pagesPDF May 2017 - Compresscasual viewerNo ratings yet

- Balbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseDocument9 pagesBalbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseBella RonahNo ratings yet

- CA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersDocument25 pagesCA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersIshmael FofanahNo ratings yet

- Mergers and AcquisitionsDocument9 pagesMergers and AcquisitionsJessica RaboNo ratings yet

- Answers, Solutions and ClarificationsDocument4 pagesAnswers, Solutions and ClarificationsAnnie Lind100% (1)

- FR 2018 Paper FinalDocument65 pagesFR 2018 Paper FinalshashalalaxiangNo ratings yet

- 1 Partnership-YTDocument7 pages1 Partnership-YTSherwin DueNo ratings yet

- Lec 2Document5 pagesLec 2ahmedgalalabdalbaath2003No ratings yet

- Model Test Paper 13Document15 pagesModel Test Paper 13ganeshNo ratings yet

- Afar 104 Installment SalesDocument3 pagesAfar 104 Installment SalesReyn Saplad PeralesNo ratings yet

- Guided Exercises Investment in AssociateDocument2 pagesGuided Exercises Investment in AssociateMireya YueNo ratings yet

- Quiz Chapter16Document7 pagesQuiz Chapter16d7366517No ratings yet

- Ias 28: Investment in Associates and Joint VenturesDocument7 pagesIas 28: Investment in Associates and Joint VenturesDzulija TalipanNo ratings yet

- Rifky Kurniadi Suharli TP1 W2 S3 R2Document4 pagesRifky Kurniadi Suharli TP1 W2 S3 R2Rahmat Rama DhoniNo ratings yet

- CFS Company Has The Following Details For Two-Year Period, 2019 and 2018Document7 pagesCFS Company Has The Following Details For Two-Year Period, 2019 and 2018MiconNo ratings yet

- Model Test Paper - 1 IPCC Group-I Paper - 4 Taxation May - 2017Document28 pagesModel Test Paper - 1 IPCC Group-I Paper - 4 Taxation May - 2017Kshitij AgrawalNo ratings yet

- Module-2 Capital Structure Theories.Document43 pagesModule-2 Capital Structure Theories.vinit PatidarNo ratings yet

- Soln PT2 Acc XII (Session 2023-24)Document14 pagesSoln PT2 Acc XII (Session 2023-24)Vaidehi BagraNo ratings yet

- Reporting & Interpreting Investments in Other CorporationsDocument12 pagesReporting & Interpreting Investments in Other CorporationslelydiNo ratings yet

- Tax Reviewer 3Document4 pagesTax Reviewer 3tooru oikawaNo ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- Special Accounting Topics For Business CombinationDocument4 pagesSpecial Accounting Topics For Business CombinationMixx MineNo ratings yet

- Unit II Partnership DissolutionDocument17 pagesUnit II Partnership DissolutionNovylyn AldaveNo ratings yet

- Chapter 17 and 18 - Investment in Associates What Is An Associate? Accounting Procedures of Investment in AssociateDocument2 pagesChapter 17 and 18 - Investment in Associates What Is An Associate? Accounting Procedures of Investment in AssociateRanee DeeNo ratings yet

- Understanding Financial Statements: Student - Feedback@sti - EduDocument6 pagesUnderstanding Financial Statements: Student - Feedback@sti - Eduvince mendozaNo ratings yet

- GEN4Document7 pagesGEN4Mylene HeragaNo ratings yet

- Chap 17 1 3 SolutionsDocument5 pagesChap 17 1 3 Solutionspdmallari12No ratings yet

- CPA 10 June 2019 SolutionsDocument15 pagesCPA 10 June 2019 SolutionsJacob Baraka OngengNo ratings yet

- May-June 2011Document10 pagesMay-June 2011Usuf JabedNo ratings yet

- Investment in Associates& Reclassification - AnswersDocument5 pagesInvestment in Associates& Reclassification - AnswersyelenaNo ratings yet

- Level 2 DifficultDocument4 pagesLevel 2 DifficultSamuel FerolinoNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Chap 15Document17 pagesChap 15pdmallari12No ratings yet

- Chap 17 4 6Document3 pagesChap 17 4 6pdmallari12No ratings yet

- Chapter 18 Problem 2Document1 pageChapter 18 Problem 2pdmallari12No ratings yet

- X08 Budgeting-1Document21 pagesX08 Budgeting-1pdmallari12No ratings yet

- Estate Tax MCQSDocument43 pagesEstate Tax MCQSpdmallari12No ratings yet

- Sample Last Will and Testament PDFDocument10 pagesSample Last Will and Testament PDFSalomeNo ratings yet

- EBCL Distinguish BetweenDocument39 pagesEBCL Distinguish BetweenNilam GhadgeNo ratings yet

- Reyes vs. Atty. GubatanDocument5 pagesReyes vs. Atty. GubatanCaleb Josh PacanaNo ratings yet

- Transportation Laws Page 31Document22 pagesTransportation Laws Page 31Shieremell DiazNo ratings yet

- FAC1503 - 2023 - Learning Unit 7Document38 pagesFAC1503 - 2023 - Learning Unit 7Tiisetso MofokengNo ratings yet

- 9 Sampaguita V JalwindorDocument1 page9 Sampaguita V JalwindorFatima AreejNo ratings yet

- LTD - Latest Jurisprudence - SF NavarroDocument2 pagesLTD - Latest Jurisprudence - SF NavarroRustom IbanezNo ratings yet

- Sales Topic 1Document55 pagesSales Topic 1Choi LyraNo ratings yet

- Tri-Partite AgreementDocument39 pagesTri-Partite AgreementRohit NilawarNo ratings yet

- Barbri Hypos PDFDocument84 pagesBarbri Hypos PDFno contractNo ratings yet

- Titman CH 16 - Dividend PolicyDocument55 pagesTitman CH 16 - Dividend PolicyIKA RAHMAWATINo ratings yet

- Alcaraz vs. Tangga-AnDocument7 pagesAlcaraz vs. Tangga-AnAnisah AquilaNo ratings yet

- Case 25: The Heirs of Reyes vs. ReyesDocument3 pagesCase 25: The Heirs of Reyes vs. ReyesJames Gaddao100% (1)

- Encumbrance CertificateDocument4 pagesEncumbrance CertificatesanjNo ratings yet

- CHAN LINTE v. Law UnionDocument3 pagesCHAN LINTE v. Law Unionchappy_leigh118No ratings yet

- Sameer Overseas v. CabilesDocument2 pagesSameer Overseas v. CabilesJoseph Lorenz AsuncionNo ratings yet

- Maxims of Equity and Their ApplicationDocument23 pagesMaxims of Equity and Their ApplicationPulok DkNo ratings yet

- Non Exclusive Management AgreementDocument29 pagesNon Exclusive Management AgreementVan DoNo ratings yet

- UP LAW BOC Commercial Law Pre WeekDocument42 pagesUP LAW BOC Commercial Law Pre WeekImee CallaoNo ratings yet

- Correction Deed: in Favour ofDocument3 pagesCorrection Deed: in Favour ofShunna BhaiNo ratings yet

- Conflict of Laws OutlineDocument32 pagesConflict of Laws OutlineseabreezeNo ratings yet

- Manila Surety and Fidelity Co V AlmedaDocument4 pagesManila Surety and Fidelity Co V AlmedaRhenfacel ManlegroNo ratings yet

- Final Ko To Umayos KaDocument37 pagesFinal Ko To Umayos Kakenjie krisNo ratings yet

- 13 Mathematics of Finance - Simple InterestDocument20 pages13 Mathematics of Finance - Simple InterestWenio Regino ManondoNo ratings yet

- OJT - WAIVER of Parents 2022 - ObarDocument1 pageOJT - WAIVER of Parents 2022 - ObarCharlie RiveraNo ratings yet

- Filinvest vs. Philippine AcetyleneDocument2 pagesFilinvest vs. Philippine AcetyleneRonwell Lim100% (1)

- Terra Lago CC&R'S, Terra LagoDocument103 pagesTerra Lago CC&R'S, Terra LagoBrian DaviesNo ratings yet

- Genpact Services Vs FalsecoDocument2 pagesGenpact Services Vs FalsecoLara DelleNo ratings yet