Professional Documents

Culture Documents

Group Case - Job Order Costing

Uploaded by

Rameir Angelo Catamora0 ratings0% found this document useful (0 votes)

7 views2 pagesThe document provides details of the inventory balances and transactions for Fortune Inc. for January 2023 using a job order costing system. Key events include purchases and issues of materials for jobs 101-103, return of materials, payroll and overhead costs, completion of jobs 101 and 102, sales of the completed jobs' products, cash collections, and payments of liabilities and expenses. The goal is to use the job order costing system to calculate the cost of goods sold and update inventory balances.

Original Description:

Original Title

Group Case_ Job Order Costing

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides details of the inventory balances and transactions for Fortune Inc. for January 2023 using a job order costing system. Key events include purchases and issues of materials for jobs 101-103, return of materials, payroll and overhead costs, completion of jobs 101 and 102, sales of the completed jobs' products, cash collections, and payments of liabilities and expenses. The goal is to use the job order costing system to calculate the cost of goods sold and update inventory balances.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesGroup Case - Job Order Costing

Uploaded by

Rameir Angelo CatamoraThe document provides details of the inventory balances and transactions for Fortune Inc. for January 2023 using a job order costing system. Key events include purchases and issues of materials for jobs 101-103, return of materials, payroll and overhead costs, completion of jobs 101 and 102, sales of the completed jobs' products, cash collections, and payments of liabilities and expenses. The goal is to use the job order costing system to calculate the cost of goods sold and update inventory balances.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

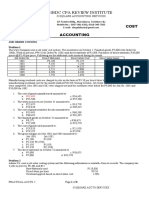

CASE ANALYSIS:JOB ORDER COSTING

The Fortune, Inc. has the following balances as of January 1, 2023

Materials =

P 4,900

Work in process 4,600

Finished goods 6,000

Details of the three (3) inventories are as follows:

Finished goods

Commodity of 2,000 units at P

= 3

Work in process - Job No. 101

Materials A – 200 units at P

= 5.00 = P= 1,000

Materials B – 175 units at P

= 4.00 = P= 700

Direct Labor – 290 hours at P= 5.00 = P

= 1,450

Factory overhead – 100% of direct labor costs = P

= 1,450

Materials

Material A – 600 units at P

= 5.00 = P 3,000

=

Material B – 350 units at P

= 4.00 = = 1,400

P

Indirect Material = 500.00

P

The transactions for the month of January 2019 are as follows:

1. Purchases for the month of January are as follows:

Material A – 600 units at P = 5.50

Material B – 800 units at P= 5.00

Indirect materials - P

= 700

2. Materials requisitioned and issued on a first in and first

out basis amounted to P

= 7,000.

Material A, 200 units (charged to Job 101)

Material B, 225 units (charged to Job 102)

Material B, 425 units (charged to Job 103)

Indirect materials amounted to P

= 1,000

3. Material B returned to vendors, 70 units at P= 5.00

4. Payroll during January amounted to P

= 10,300, of which P

= 2,000

is for Job 101; P= 4,000 is for Job 102, P= 2,000 is for Job

103 and P

= 2,300 as indirect labor.

Deductions are as follows:

SSS Premium - P 412

=

PHIC - = 225

P

Withholding taxes - = 1,050

P

5. Factory overhead is applied on the basis of 100% of direct

labor costs.

6. Jobs completed during the month – Job 101 for 3,000 units of

Commodity X and Job 102 for 5,000 units of Commodity Y.

7. Sales during January on FIFO basis – 4,000 units of Commodity

X at P

= 6.00 per unit and 4,000 units of Commodity Y at P

= 4.00

per unit.

8. Cash collections from customers amounted to P= 35,000.

9. Recorded the following liabilities.

Factory overhead - P

= 4,800

Selling expenses - P

= 2,100

General expenses - P

= 1,500

10. Paid accounts at P

= 9,500 and payroll for P

= 8,500.

You might also like

- Afar 1 Comprehensive ProblemDocument2 pagesAfar 1 Comprehensive ProblemJames David Torres MateoNo ratings yet

- Job Order CostingDocument2 pagesJob Order CostingChyna Bee SasingNo ratings yet

- Job Order Costing - Del Rosario, Jameine SDocument42 pagesJob Order Costing - Del Rosario, Jameine SPatrick LanceNo ratings yet

- Job Order CostingDocument3 pagesJob Order CostingChris Aruh BorsalinaNo ratings yet

- 2nd ASSESSMENT-acctg105Document4 pages2nd ASSESSMENT-acctg105LovErsMaeBasergoNo ratings yet

- JOCDocument136 pagesJOCJames David Torres MateoNo ratings yet

- Costcon 2Document2 pagesCostcon 2Frances Clayne GonzalvoNo ratings yet

- MODULE 3 Job Order Costing PDFDocument9 pagesMODULE 3 Job Order Costing PDFjay mhonsaint100% (1)

- Unit Iii - Job Order Costing Lesson 1 - Concept and ApplicationDocument4 pagesUnit Iii - Job Order Costing Lesson 1 - Concept and ApplicationSol GomezNo ratings yet

- Cost Accounting MidtermDocument4 pagesCost Accounting MidtermAdam Smith100% (1)

- UCP - CA 03 - Cost Accounting CycleDocument6 pagesUCP - CA 03 - Cost Accounting CycleJoshua UmaliNo ratings yet

- Cost Accounting MidtermsDocument5 pagesCost Accounting MidtermsJerico Mamaradlo0% (3)

- Takehome QuizDocument3 pagesTakehome QuizGian CPANo ratings yet

- Job Order Costing ProblemsDocument15 pagesJob Order Costing ProblemsClarissa Teodoro100% (2)

- 3092624Document9 pages3092624mohitgaba19No ratings yet

- Cost Accounting ProblemsDocument3 pagesCost Accounting ProblemsJoshua S. Umali50% (4)

- Activity 1 Cost Concepts and Cost BehaviorDocument2 pagesActivity 1 Cost Concepts and Cost BehaviorLacie Hohenheim (Doraemon)No ratings yet

- Quiz 4Document3 pagesQuiz 4Brier Jaspin AguirreNo ratings yet

- Individual Activity: Activity No. 10: Multiple Choice QuestionsDocument2 pagesIndividual Activity: Activity No. 10: Multiple Choice QuestionsZenCamandang100% (1)

- Cost Accounting ProblemsDocument3 pagesCost Accounting ProblemsRowena TamboongNo ratings yet

- Cost Notes888Document29 pagesCost Notes888yojNo ratings yet

- Multiple Choice-Problems: Total 225,000Document13 pagesMultiple Choice-Problems: Total 225,000IT GAMING50% (2)

- PRAC TWO QuestionnaireDocument18 pagesPRAC TWO Questionnairekarina gayosNo ratings yet

- Practice Problems 2-Standard Costing and Variance Analysis-1Document2 pagesPractice Problems 2-Standard Costing and Variance Analysis-1Unknowingly AnonymousNo ratings yet

- Chapter 4Document7 pagesChapter 4Althea mary kate MorenoNo ratings yet

- Job Order Costing Quiz AnswerDocument7 pagesJob Order Costing Quiz AnswerElaine Joyce GarciaNo ratings yet

- ExercisesDocument3 pagesExercisesGerald B. GarciaNo ratings yet

- 3 Cost AccountingDocument7 pages3 Cost AccountingJason Bautista100% (1)

- Afar 1 Problem SolmanDocument12 pagesAfar 1 Problem SolmanJames David Torres MateoNo ratings yet

- Activity No. 10 Multiple ChoiceDocument3 pagesActivity No. 10 Multiple Choicejumaica felipeNo ratings yet

- Cost Accounting DrillsDocument13 pagesCost Accounting DrillsViky Rose EballeNo ratings yet

- Cost Accounting Theoretical Questions Nad Problem SolvingDocument23 pagesCost Accounting Theoretical Questions Nad Problem SolvingSofia Mae AlbercaNo ratings yet

- Practical Accounting 2Document6 pagesPractical Accounting 2Jessica Marie B. Mendoza0% (1)

- 3.3 MCQ - Job Order Costing (With Spoilage and Defective Goods)Document2 pages3.3 MCQ - Job Order Costing (With Spoilage and Defective Goods)Roselyn LumbaoNo ratings yet

- Assignment Cost-Answer Key PDFDocument4 pagesAssignment Cost-Answer Key PDFSheyyylaaa BabyNo ratings yet

- 05 Quiz 1-BARIACTODocument3 pages05 Quiz 1-BARIACTOdanibariactoNo ratings yet

- 3.1 Assignment - Job Order CostingDocument3 pages3.1 Assignment - Job Order CostingRoselyn LumbaoNo ratings yet

- Module 1 - Cost Concept and Terminology - With AnswersDocument21 pagesModule 1 - Cost Concept and Terminology - With AnswersKelvin CulajaráNo ratings yet

- 1 Manufacturing ExercisesDocument3 pages1 Manufacturing ExercisesRead this SecretNo ratings yet

- CVPDocument2 pagesCVPDan RyanNo ratings yet

- Activity # 2Document3 pagesActivity # 2Beboy TorregosaNo ratings yet

- Job Order Costing Work SheetDocument11 pagesJob Order Costing Work SheetEllah MaeNo ratings yet

- Job CostingDocument5 pagesJob CostingElizabethNo ratings yet

- 1Bdc Cpa Review Institute: Cost AccountingDocument8 pages1Bdc Cpa Review Institute: Cost AccountingJason BautistaNo ratings yet

- Budgeting ActivityDocument3 pagesBudgeting Activitykiara kiesh FosterNo ratings yet

- Worksheet ActivityDocument4 pagesWorksheet ActivityDonna Lyn BoncodinNo ratings yet

- Job Order Activity For Take HomeDocument12 pagesJob Order Activity For Take HomeRg Cyrus SerranoNo ratings yet

- Assignment (Page203) - Jamvy Fernandez - BSA2.1 - CY2Document2 pagesAssignment (Page203) - Jamvy Fernandez - BSA2.1 - CY2Jamvy Jose FernandezNo ratings yet

- Penyimpanan Barang Ke GudangDocument10 pagesPenyimpanan Barang Ke Gudangajeng.saraswatiNo ratings yet

- Job OrderDocument7 pagesJob OrderShannon Mojica100% (2)

- Cost of Goods Manufactured & SoldDocument17 pagesCost of Goods Manufactured & SoldMichael Brian TorresNo ratings yet

- Week 1 Activity Cost Classification and BehaviorDocument4 pagesWeek 1 Activity Cost Classification and BehaviorJosh YuuNo ratings yet

- Cost Accounting TudorDocument2 pagesCost Accounting TudorLorie RoncalNo ratings yet

- Oki Oki Use This As A Reference in Any of Your Activity As It May Deem Applicable - CompressDocument13 pagesOki Oki Use This As A Reference in Any of Your Activity As It May Deem Applicable - CompressjommaetiNo ratings yet

- Question Chapter3 Final 1Document16 pagesQuestion Chapter3 Final 1Mạnh Đỗ ĐứcNo ratings yet

- Quiz 2 - A331-321-334Document1 pageQuiz 2 - A331-321-334Nikki Garcia100% (1)

- HOBA2019QUIZ1MCDocument10 pagesHOBA2019QUIZ1MCjasfNo ratings yet

- Exercises - Materials and Labor VarianceDocument1 pageExercises - Materials and Labor VarianceJason RadamNo ratings yet

- Date Particular L/F Rs. RsDocument10 pagesDate Particular L/F Rs. RsAsad ButtNo ratings yet

- Partnership CompleteDocument6 pagesPartnership CompleteJoshua TorillaNo ratings yet

- Wilo Dealer Evaluation FormDocument4 pagesWilo Dealer Evaluation FormBala Ji GNo ratings yet

- QMS Internal External AuditDocument5 pagesQMS Internal External AuditNesanNo ratings yet

- Customer Asset Management at DHL in AsiaDocument3 pagesCustomer Asset Management at DHL in AsiaPhương Võ100% (1)

- HCPLDocument145 pagesHCPLShivamVermaNo ratings yet

- Section 54ED, Income Tax Act, 1961 2015: Explanation.-For The Purposes of This Sub SectionDocument2 pagesSection 54ED, Income Tax Act, 1961 2015: Explanation.-For The Purposes of This Sub SectionSushil GuptaNo ratings yet

- Client/shipper Visit (New Shipper & Twice A Year For Regular Client) (Commercial Team)Document2 pagesClient/shipper Visit (New Shipper & Twice A Year For Regular Client) (Commercial Team)PT. Estupedo Agri MakmurNo ratings yet

- Strictly Dominant StrategyDocument4 pagesStrictly Dominant StrategyRayan RahmanNo ratings yet

- (BANKING LAWS) Classification of BanksDocument3 pages(BANKING LAWS) Classification of BanksZyril MarchanNo ratings yet

- Fair Trade Provides Models For Corporate Social ResponsibilityDocument4 pagesFair Trade Provides Models For Corporate Social ResponsibilityShivani TomarNo ratings yet

- SWOT and PestleDocument4 pagesSWOT and PestlePankaj GargNo ratings yet

- Film FinancingDocument10 pagesFilm Financingjaikishan86100% (2)

- E. Zobel vs. CADocument3 pagesE. Zobel vs. CAkkk0% (1)

- Annex F WaiverDocument2 pagesAnnex F WaiverMaela Maala Mendoza82% (11)

- GCSE AQA Business Studies Unit 2 - RevisionDocument31 pagesGCSE AQA Business Studies Unit 2 - RevisionwizlanNo ratings yet

- Consumer Behaviour and STP NotesDocument10 pagesConsumer Behaviour and STP NotesAnonymous wMppXCM0No ratings yet

- Intel Overclocking GuideDocument36 pagesIntel Overclocking Guidemohit616No ratings yet

- شیشه پاک کن ضد مهDocument1 pageشیشه پاک کن ضد مهrezaNo ratings yet

- StraMa Worksheet 12 Internal Factor Evaluation MatrixDocument6 pagesStraMa Worksheet 12 Internal Factor Evaluation MatrixDiazmean SoteloNo ratings yet

- 5b3b0c0283739 BPI IR 2017 Senior Management and Corporate Governance 6Document20 pages5b3b0c0283739 BPI IR 2017 Senior Management and Corporate Governance 6John Karlo CamineroNo ratings yet

- BancassuranceDocument22 pagesBancassuranceViral JainNo ratings yet

- Whitepaper NFTDocument19 pagesWhitepaper NFTWillard Delos SantosNo ratings yet

- Sample ProblemsDocument9 pagesSample Problemsbea dinglasan0% (1)

- New Product Introduction in The Fast Moving Industry - Critical Success Factors - A Case Study of PZ Cussons Ghana LimitedDocument82 pagesNew Product Introduction in The Fast Moving Industry - Critical Success Factors - A Case Study of PZ Cussons Ghana LimitedSantosh KakadNo ratings yet

- Automatic Account DeterminationDocument17 pagesAutomatic Account Determinationsaif78692100% (1)

- CAE Parc Aviation Ethiopian Airlines - B777 Captain - Terms and Conditio...Document5 pagesCAE Parc Aviation Ethiopian Airlines - B777 Captain - Terms and Conditio...Marcos BantelNo ratings yet

- Organization DevelopmentDocument23 pagesOrganization DevelopmentSowmiya LakshmiNo ratings yet

- WIN INDIA 2015 - Exhibion CatalogueDocument304 pagesWIN INDIA 2015 - Exhibion CatalogueJeremiah EliorNo ratings yet

- Combating Counterfeit Drugs A Report of The Food and Drug AdministrationDocument37 pagesCombating Counterfeit Drugs A Report of The Food and Drug AdministrationnephylymNo ratings yet

- 10 - Strike and Assumption of Jurisdiction at The WorkplaceDocument2 pages10 - Strike and Assumption of Jurisdiction at The WorkplaceIls DoleNo ratings yet