Professional Documents

Culture Documents

PWC - PWC - Future Proof Declaration

Uploaded by

iqtehdar saiyedOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PWC - PWC - Future Proof Declaration

Uploaded by

iqtehdar saiyedCopyright:

Available Formats

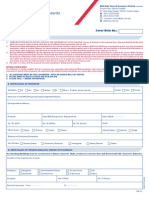

DECLARATION FOR INSURANCE PREMIUM, INVESTMENTS & RENT DUE AFTER

1st JANUARY 2024

Employee Name: Iqtehdar Saiyed

Employee Code: 101112489

PAN F X G P S 3 9 8 7 A

I hereby confirm that the following investments are due for payment after the cut-off

dates laid out by you for proof submission and therefore request you to consider the

same for the tax computation purpose for the financial year 2023 – 2024. I undertake

that I will be depositing these premium /investment/rent payments and obtain the

receipts as per the due dates or by 31st March 2024. I will be held responsible for any

consequences of not remitting these payments and any liabilities arise out of this.

Particulars Policy No. / Folio Amount Remarks

No. / Account No.

Insurance Premium:*

919451603 15,222 Will be paid

928899167 15,222 in March

MF - ELSS (SIP)

80CCC (Pension plan)*

Tuition Fees

80 D (Medical

Insurance)*

January 2024 February 2024 March 2024

Rs. 25000 Rs. 25000 Rs. 25000

Rent payable

Declaration: I certify that all the above details are true and correct and I am fully aware

of the relevant income tax laws in force regarding the nature of proofs required to claim

exemption under the above heads. Proofs for the same will be submitted before 5th

March 2024 in Allsec portal.

Signature of the employee

Date: 12/12/2023

You might also like

- Education Loan InterestDocument1 pageEducation Loan Interestravi lingam100% (2)

- Self Declaration For Future ProofDocument1 pageSelf Declaration For Future ProofHarish KumarNo ratings yet

- Investment Declaration Form - 2022-2023Document3 pagesInvestment Declaration Form - 2022-2023Bharathi KNo ratings yet

- Iffco TokioDocument2 pagesIffco Tokioneel55% (11)

- Insurance Premium Payment Certification: E-Policy ServiceDocument2 pagesInsurance Premium Payment Certification: E-Policy ServiceMuntana TewpaingamNo ratings yet

- InsuranceDocument3 pagesInsurancePinakin Puranik0% (2)

- ADW Self Declaration For Future ProofDocument1 pageADW Self Declaration For Future Proofabbajpai38No ratings yet

- Self Declaration For Future Proof2Document2 pagesSelf Declaration For Future Proof2Mohan kishoreNo ratings yet

- Declaration For Future ProofsDocument1 pageDeclaration For Future ProofsMohamed NazimNo ratings yet

- Self Declaration For Future PFDocument1 pageSelf Declaration For Future PFrrajrenjithNo ratings yet

- Self Declaration For Future ProofDocument1 pageSelf Declaration For Future ProofjasNo ratings yet

- Future DecDocument1 pageFuture DecMano HarNo ratings yet

- Declaration For Future PaymentDocument4 pagesDeclaration For Future PaymentsrikanthNo ratings yet

- AZN Self Declaration For Future Proof PDFDocument1 pageAZN Self Declaration For Future Proof PDFApoorv AgarwalNo ratings yet

- Tax Proof FormsDocument1 pageTax Proof FormsKUNAL AMAZONNo ratings yet

- D091963615 16928640576314369 ProposalDocument5 pagesD091963615 16928640576314369 ProposalDevanshu GoswamiNo ratings yet

- Tax Proof FormsDocument1 pageTax Proof FormsguruNo ratings yet

- Worker's Compensation PolicyDocument19 pagesWorker's Compensation Policyroshanparammal4No ratings yet

- Condiciones Particulares Ivan Bautista Bernal (2620) inDocument10 pagesCondiciones Particulares Ivan Bautista Bernal (2620) in68y2wczjc5No ratings yet

- Declaration - For - Due Date After Cut Off DateDocument1 pageDeclaration - For - Due Date After Cut Off DateJitender MadanNo ratings yet

- Annexure IV Future Investment DeclarationDocument2 pagesAnnexure IV Future Investment DeclarationBhooma Shayan100% (1)

- Tax Proof FormsDocument1 pageTax Proof Formssaika tabbasumNo ratings yet

- Instruction For Submitting ProofsDocument3 pagesInstruction For Submitting Proofssastrylanka_1980No ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailschethanchethanmn8No ratings yet

- 40-23-0012664-00 20230820 PCDocument1 page40-23-0012664-00 20230820 PCMukesh ThakurNo ratings yet

- Investment Declaration Form (Hemarus)Document4 pagesInvestment Declaration Form (Hemarus)Shashi NaganurNo ratings yet

- Guide ITProof SubmissionDocument9 pagesGuide ITProof SubmissionSrikanthNo ratings yet

- Payment Receipt: Service - Helpdesk@maxlifeinsuranceDocument1 pagePayment Receipt: Service - Helpdesk@maxlifeinsuranceSHIRIDI SAI INDUSTRIESNo ratings yet

- Policy Doc 2022Document1 pagePolicy Doc 2022fyersa1No ratings yet

- Investment PlanDocument1 pageInvestment PlanNitin AgarwalNo ratings yet

- Standing Instruction Form Through IndusInd Bank Account-2Document1 pageStanding Instruction Form Through IndusInd Bank Account-2SonuNo ratings yet

- Kotak PolicyDocument2 pagesKotak Policybhavesh patilNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsAnkush DeNo ratings yet

- Documents For Supporting InvestmentsDocument1 pageDocuments For Supporting InvestmentsPrasad KrrNo ratings yet

- 21 21 0593825 01 PDFDocument2 pages21 21 0593825 01 PDFtamil2oooNo ratings yet

- MotorWelcome (SODY14PC01) PDFDocument10 pagesMotorWelcome (SODY14PC01) PDFDimitris ElefsinaNo ratings yet

- DP 790457Document1 pageDP 790457Nelson D. HampacNo ratings yet

- Payment Alteration FormDocument3 pagesPayment Alteration FormTan KM0% (1)

- 2024 EdDocument10 pages2024 EdJosé Andrés Concepción TorresNo ratings yet

- 2023 Itr SushmithakuppusamiDocument18 pages2023 Itr SushmithakuppusamidennisNo ratings yet

- Bajaj AL-Premium Receipts2Document1 pageBajaj AL-Premium Receipts2Anil KumarNo ratings yet

- Premium Payment AcknowledgementDocument1 pagePremium Payment Acknowledgementashokkumar3363No ratings yet

- Vehicle Insurance 2nd YearDocument2 pagesVehicle Insurance 2nd YearVivek KuppusamyNo ratings yet

- Interest CertificateDocument1 pageInterest CertificateSuvajit ChakrabartyNo ratings yet

- b616c - MR Zamir Haider Shah Satr 2021-2022 SignedDocument14 pagesb616c - MR Zamir Haider Shah Satr 2021-2022 SignedJaved ShahNo ratings yet

- Amendment To Service Agreement - Nurse - UnifiedDocument7 pagesAmendment To Service Agreement - Nurse - UnifiedMyk Xavier AlbaoNo ratings yet

- QwebgDocument2 pagesQwebgJayden EnzoNo ratings yet

- Payment Acknowledgement: Policy DetailsDocument1 pagePayment Acknowledgement: Policy DetailsBikram NongmaithemNo ratings yet

- Guide ITProof SubmissionDocument9 pagesGuide ITProof SubmissionSajid Raza RizviNo ratings yet

- Proposal - SmartHome Optimum (1) AXADocument8 pagesProposal - SmartHome Optimum (1) AXAshunmugathason100% (1)

- Form12BB FY2122Document3 pagesForm12BB FY2122Anurag pradhanNo ratings yet

- 2018 EldDocument3 pages2018 Eldmuhammad afiqNo ratings yet

- Tax Proof Submission FY 2021-22Document10 pagesTax Proof Submission FY 2021-22cutieedivyaNo ratings yet

- Manual Contract For Nakshe Makshe-V8Document9 pagesManual Contract For Nakshe Makshe-V8dhruvslg86No ratings yet

- 2023 Itr PravinvallikaduDocument18 pages2023 Itr PravinvallikadudennisNo ratings yet

- Policy and Payment Details: Premium Paid CertificateDocument1 pagePolicy and Payment Details: Premium Paid CertificateAbhishek Kumar SinghNo ratings yet

- Application For A Bank Guarantee: Please SelectDocument6 pagesApplication For A Bank Guarantee: Please SelectGulrana AlamNo ratings yet

- PolicyDocument1 pagePolicyfyersa1No ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet