Professional Documents

Culture Documents

Cases Chapter 3 - FA

Cases Chapter 3 - FA

Uploaded by

matthew amadeusCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cases Chapter 3 - FA

Cases Chapter 3 - FA

Uploaded by

matthew amadeusCopyright:

Available Formats

1.

Financial Statement Analysis Case

Vodafone Group plc. Vodafone is based in the United Kingdom. Selected data from

Vodafone’s 2012 annual report follows (pounds in millions).

2012 2011 2010

Revenues £46,417 £45,884 £44,47

Gross profit % 32.04% 32.84% 33.80%

Operating profit £11,187 £5,596 £9,480

Operating cash flow less capital expenditures 8,459 9,173 9,145

Profit (loss) 7,003 7,870 8,618

In its 2012 annual report, Vodafone states, “Our leading performance is based on 3 core

strengths . . . . The successful implementation of our strategy to generate liquidity or free cash

flow from non-controlled interests.”

Instructions

(a) Compute the percentage change in sales, operating profit, net cash flow, and net earnings

from year to year for the years presented.

(b) Evaluate Vodafone’s performance. Which trend seems most favorable ? Which trend

seems least favorable? What are the implications of these trends for Vodafone’s strategy ?

Explain.

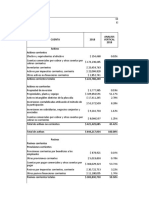

2. Accounting, Analysis, and Principles

The Amato Theater is nearing the end of the year and is preparing for a meeting with its

bankers to discuss the renewal of a loan. The accounts listed appeared in the December 31,

2015, trial balance as follows :

Debit Credit

Prepaid Advertising £ 6,000

Equipment 192,000

Accumulated Depreciation—Equipment £ 60,000

Notes Payable 90,000

Unearned Service Revenue 17,500

Service Revenue 360,000

Advertising Expense 18,680

Salaries and Wages Expense 67,600

Interest Expense 1,400

Additional information is available as follows.

1. The equipment has an estimated useful life of 16 years and a residual value of £40,000 at

the end of that time. Amato uses the straight-line method for depreciation.

2. The note payable is a one-year note given to the bank January 31 and bearing interest at

10%. Interest is calculated on a monthly basis.

3. The theater sold 350 coupon ticket books at £50 each. Two hundred ticket books were used

in 2015. One hundred fifty of these ticket books can be used only for admission any time

after January 1, 2016. The cash received was recorded as Unearned Service Revenue.

4. Advertising paid in advance was £6,000 and was debited to Prepaid Advertising. The

company has used £2,500 of the advertising as of December 31, 2015.

5. Salaries and wages accrued but unpaid at December 31, 2015, were £3,500.

Accounting

Prepare any adjusting journal entries necessary for the year ended December 31, 2015.

Analysis

Determine Amato’s income before and after recording the adjusting entries. Use your

analysis to explain why Amato’s bankers should be willing to wait for Amato to complete its

year-end adjustment process before making a decision on the loan renewal.

Principles

Although Amato’s bankers are willing to wait for the adjustment process to be completed

before they receive financial information, they would like to receive financial reports more

frequently than annually or even quarterly. What trade-offs, in terms of relevance and faithful

representation, are inherent is preparing financial statements for shorter accounting time

periods ?

***

You might also like

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- Fundamentals of ABM 1Document164 pagesFundamentals of ABM 1Marissa Dulay - Sitanos67% (15)

- Grant Thornton Patisserie Valerie Final ReportDocument65 pagesGrant Thornton Patisserie Valerie Final ReportJason Bramwell100% (1)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Commercial Banking Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Banking Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- The Valuation of Digital Intangibles: Technology, Marketing and InternetFrom EverandThe Valuation of Digital Intangibles: Technology, Marketing and InternetNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Sound Recording Studio Revenues World Summary: Market Values & Financials by CountryFrom EverandSound Recording Studio Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Business Service Center Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Service Center Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Activities Related to Credit Intermediation Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandActivities Related to Credit Intermediation Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Operating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16From EverandOperating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16No ratings yet

- Individual Assignment Case Chapter 4 - Aisyah Nuralam 29123362Document3 pagesIndividual Assignment Case Chapter 4 - Aisyah Nuralam 29123362Aisyah NuralamNo ratings yet

- Essay AnalysisDocument5 pagesEssay AnalysisAisyah NuralamNo ratings yet

- Aisyah Nuralam - Resume Recruitment of A StarDocument2 pagesAisyah Nuralam - Resume Recruitment of A StarAisyah NuralamNo ratings yet

- Individual Assignment 4A - Aisyah Nuralam 29123362Document4 pagesIndividual Assignment 4A - Aisyah Nuralam 29123362Aisyah NuralamNo ratings yet

- Individual Assignment Case Chapter 3 - Aisyah Nuralam 29123362Document3 pagesIndividual Assignment Case Chapter 3 - Aisyah Nuralam 29123362Aisyah NuralamNo ratings yet

- Jose Antonio MorenoDocument1 pageJose Antonio MorenoAisyah NuralamNo ratings yet

- Catatan - Managerial Accounting and Cost ConceptsDocument1 pageCatatan - Managerial Accounting and Cost ConceptsAisyah NuralamNo ratings yet

- Individual Assignment 1A - Aisyah Nuralam 29123362Document4 pagesIndividual Assignment 1A - Aisyah Nuralam 29123362Aisyah NuralamNo ratings yet

- Aisyah Nuralam - Resume Case StudyDocument1 pageAisyah Nuralam - Resume Case StudyAisyah NuralamNo ratings yet

- Individual Assignment 2A - Aisyah Nuralam 29123362Document4 pagesIndividual Assignment 2A - Aisyah Nuralam 29123362Aisyah NuralamNo ratings yet

- Individual Assignment 3A - Aisyah Nuralam 29123362Document3 pagesIndividual Assignment 3A - Aisyah Nuralam 29123362Aisyah NuralamNo ratings yet

- Support Cours Audit 2ème PartieDocument28 pagesSupport Cours Audit 2ème PartieNourredine SabriNo ratings yet

- Art. 435-455Document5 pagesArt. 435-455J҉O҉N҉A҉TH҉AN El crackNo ratings yet

- AT 13 - Materiality in Plannng and Performing An AuditDocument3 pagesAT 13 - Materiality in Plannng and Performing An AuditGlenn DeTorresNo ratings yet

- Sesión 26 - Revelación y Presentación de Los Estados FinancierosDocument28 pagesSesión 26 - Revelación y Presentación de Los Estados FinancierosVirginia Maritza Choqueza UchasaraNo ratings yet

- Sample Management Letter - CDFI FundDocument3 pagesSample Management Letter - CDFI FundJOHN MARK ARGUELLESNo ratings yet

- Solventar HimacDocument2 pagesSolventar Himacyesenia isabel perez mendezNo ratings yet

- Gremlin PLC Enonce VF AFDocument15 pagesGremlin PLC Enonce VF AFKalilou TraNo ratings yet

- Analysis and Use of Financial StatementsDocument227 pagesAnalysis and Use of Financial StatementsJorkosNo ratings yet

- 2.sujet 2 ECO-Corrigé (RR50)Document5 pages2.sujet 2 ECO-Corrigé (RR50)samira zaidiNo ratings yet

- Trabajo Final SeminarioDocument8 pagesTrabajo Final SeminarioLinette pricely Travieso Suarez100% (1)

- Assignment in Internal ControlDocument2 pagesAssignment in Internal ControlMAG MAGNo ratings yet

- Apollo PlanningDocument8 pagesApollo PlanningFlavia BorjaNo ratings yet

- BSBFIA412 - AssessmentPi 2Document17 pagesBSBFIA412 - AssessmentPi 2Pattaniya KosayothinNo ratings yet

- Slides Sur La Technique de La Consolidation Des ComptesDocument36 pagesSlides Sur La Technique de La Consolidation Des ComptesYannickEkaniNo ratings yet

- Actividad 1Document20 pagesActividad 1Michel Bryant Suarez BahenaNo ratings yet

- Part 1 - Financial Statements AnalysisDocument38 pagesPart 1 - Financial Statements AnalysisAjmal KhanNo ratings yet

- Holding Co Notes 1Document15 pagesHolding Co Notes 1idealNo ratings yet

- UNIDAD 4 - Contabilidad Básica Microempresas UMET2021Document10 pagesUNIDAD 4 - Contabilidad Básica Microempresas UMET2021Darío CárdenasNo ratings yet

- Chapter 10 Test BankDocument48 pagesChapter 10 Test BankRujean Salar AltejarNo ratings yet

- Diferencias Principales en Las Normas de Contabilidad Entre NIF, US GAAP e IFRSDocument30 pagesDiferencias Principales en Las Normas de Contabilidad Entre NIF, US GAAP e IFRSMaximo GutierrezNo ratings yet

- CuadroDocument9 pagesCuadrocristian cifuentesNo ratings yet

- Chap3 Méthode de ConsolidationDocument17 pagesChap3 Méthode de ConsolidationOsmän Abdøu IbrNo ratings yet

- Financial Reporting: © The Institute of Chartered Accountants of IndiaDocument5 pagesFinancial Reporting: © The Institute of Chartered Accountants of IndiaRITZ BROWNNo ratings yet

- Balance CEMENTOS ARGOSDocument9 pagesBalance CEMENTOS ARGOSMARIANNo ratings yet

- chp11 CaseDocument2 pageschp11 CaseSittie Ainna Acmed UnteNo ratings yet

- Donde R. Salazar, Cpa: Independent Auditors' Report The Board of Directors Seabutterfly IncDocument2 pagesDonde R. Salazar, Cpa: Independent Auditors' Report The Board of Directors Seabutterfly IncJheza Mae PitogoNo ratings yet

- Fun Acc - Chapter 2Document6 pagesFun Acc - Chapter 2Mizpah Montevirgen - PachecoNo ratings yet

- Basis For Qualified OpinionDocument1 pageBasis For Qualified OpinionannNo ratings yet