0% found this document useful (0 votes)

309 views3 pagesIndividual Assignment Case Chapter 4 - Aisyah Nuralam 29123362

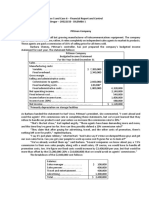

The new assistant controller's report for the Finishing Department costs was incorrect. The report showed a high unit cost of $25.71 per unit completed. The document summarizes redoing the cost report correctly using a weighted average method. It calculates the equivalent units and costs for beginning work in process, costs added, units completed and transferred out, and ending work in process. It explains the unit cost was incorrectly calculated by the assistant by dividing total cost only by units completed instead of calculating equivalent units from each cost component.

Uploaded by

Aisyah NuralamCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

309 views3 pagesIndividual Assignment Case Chapter 4 - Aisyah Nuralam 29123362

The new assistant controller's report for the Finishing Department costs was incorrect. The report showed a high unit cost of $25.71 per unit completed. The document summarizes redoing the cost report correctly using a weighted average method. It calculates the equivalent units and costs for beginning work in process, costs added, units completed and transferred out, and ending work in process. It explains the unit cost was incorrectly calculated by the assistant by dividing total cost only by units completed instead of calculating equivalent units from each cost component.

Uploaded by

Aisyah NuralamCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd