Professional Documents

Culture Documents

Invoice

Uploaded by

Shubham ChauhanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Invoice

Uploaded by

Shubham ChauhanCopyright:

Available Formats

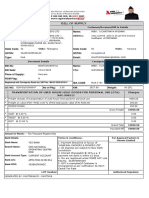

BILL OF SUPPLY

Supplier Details Customer/Receiver/Bill to Details

Name: AGARWAL PACKERS & MOVERS LTD Name: 8888 : SHUBHAM KUMAR

Address: MALEMAR ROAD,MALEMAR,DEREBAIL Address: 01/157 B12 MARNAMIKATTE

MANGALURU, KARNATAKA, 575013 MANGALURU, KARNATAKA

State Code: 29 State: Karnataka

GSTIN: 29AAFCA3559A1ZV GSTIN: Unregistered

Type: Paid Email: cbi575757@gmail.com

Document Details Consignee/Ship to Details

Bill No: BOSKA232408002 Name: 8888 : SHUBHAM KUMAR

Bill Date: 01 Jan 2024 City: MANGALURU

Place of Supply: Karnataka

RCM Flag: N

Registered with Carriage by Road Act, 2007 No : MH 01/CRA/2016/31 IBA CODE MUA-1783

GC NO: GCMNG232407157 No of Pkg: 09.00 KM: 09.00 Weight: 7.00 QTL

TRANSPORTATION OF USED HOUSE HOLD GOODS FOR PERSONAL USE (GTA) SAC-995711 Charges

* Freight charges of transportation of used house hold goods for personal use 2900.00

* Loading in truck charges 500.00

* Unloading from truck charges 500.00

* Packing charges (Inclusive of material used & cartage charges) 1300.00

* Freight on value (FOV- HHG) 3.00 % of the total goods value 157.00

* Stastical charges 0.00

* Surcharge @ 10.00 % 535.7

Gross Freight 5892.70

* CGST @ 6.00 % 0.00

* KAGST @ 6.00 % 0.00

* IGST @ 12.00 % 0.00

Rounding Off +0.30

Grand Total 5893.00

Amount in Words : - FIVE THOUSAND EIGHT HUNDRED NINTY THREE ONLY

Terms & Conditions:- Bank Details

• Payment Should be In favour of "AGARWAL PACKERS & Bank Name: AXIS BANK LTD

MOVERS LTD" Branch Name: CBB NEW DELHI

• All disputes are subject to New Delhi Jurisdiction

• Interest Chargeable @ 24% p.a. if payment not done in Bank Account Type: CASH CREDIT ACCOUNT

within 15 days Bank A/C: 921030057379682

• GST is exempted,if Customer is Unregistered as per Bank IFSC: UTIB0001609

notification 32/2017- Central Tax Rate

• We hereby declare that though our aggregate turnover in PAN: AAFCA3559A

any preceding financial year from 2017-18 onwards is more CIN: U63090MH2005PLC154749

than the aggregate turnover notified under sub-rule (4) of rule For Agarwal Packers & Movers Limited

48 of CGST Rules, 2017, we are not required to prepare an

invoice in terms of the provisions of the said sub-rule.

• We have taken registration under the CGST Act, 2017 and

have exercised the option to pay tax on services of GTA in

relation to transport of goods supplied by us during the

Financial Year 2023-2024 under forward charge.

LUT / ARN Number: AD290123009820F Authorised Signatory

Generated by: APM9264

-- THIS IS A COMPUTER GENERATED INVOICE, HENCE NO SIGNATURES ARE REQUIRED --

You might also like

- Bill of Supply: Name: Name: AddressDocument4 pagesBill of Supply: Name: Name: AddressNaveen Rajput100% (1)

- BOSTS192004731Document2 pagesBOSTS192004731Chaitu Rishan100% (1)

- Questions - Accounting For DepreciationDocument1 pageQuestions - Accounting For DepreciationOmari100% (1)

- Polycarbonate Sheet Rate AnalysisDocument2 pagesPolycarbonate Sheet Rate AnalysisVenkataramanaiah Puli0% (1)

- Bill of Supply: Name: Name: AddressDocument4 pagesBill of Supply: Name: Name: AddressNaveen Rajput100% (1)

- Tax Invoice: WWW - Timbl.co - inDocument1 pageTax Invoice: WWW - Timbl.co - inAshish Kumar RawatNo ratings yet

- Final Examination (Final)Document10 pagesFinal Examination (Final)Michelle Vinoray Pascual0% (2)

- CreditCard Statement 04-02-2020T22 02 46Document1 pageCreditCard Statement 04-02-2020T22 02 46Sheikh Shoaib67% (3)

- Consignment Invoice No GCBNG232407156Document2 pagesConsignment Invoice No GCBNG232407156rnsatechNo ratings yet

- Agarwal Packer ResearchDocument1 pageAgarwal Packer Researchyash.lakdawalaNo ratings yet

- Apml Bosmp222315505Document2 pagesApml Bosmp222315505Ridha GuptaNo ratings yet

- Transport BillDocument4 pagesTransport Billprashil parmarNo ratings yet

- BOSAP232400999Document2 pagesBOSAP232400999Rajesh Kumar SharmaNo ratings yet

- 29AAFCA3559A1ZV: Transportation of Used Household Goods For Personal Use (Gta) Sac-996511Document3 pages29AAFCA3559A1ZV: Transportation of Used Household Goods For Personal Use (Gta) Sac-996511javedNo ratings yet

- Click HereDocument3 pagesClick HerecdnaveenNo ratings yet

- APML - RecieptDocument3 pagesAPML - RecieptShiva Kant VermaNo ratings yet

- FF Mugalpur Urf Aghwanpur Mustahk Near Norani Maszid Tatarpur Moradabad (Part) MORADABAD 244504 Dist. - Moradabad 99XXXX9686Document2 pagesFF Mugalpur Urf Aghwanpur Mustahk Near Norani Maszid Tatarpur Moradabad (Part) MORADABAD 244504 Dist. - Moradabad 99XXXX9686arshadnsdl8No ratings yet

- Apl Movers & Packers CLICK HEREDocument3 pagesApl Movers & Packers CLICK HEREAnkit RanjanNo ratings yet

- Sarai Khajur FF, Near Bilali Masjid Moradabad (Part) MORADABAD 244504 Dist. - Moradabad 96XXXX7417Document2 pagesSarai Khajur FF, Near Bilali Masjid Moradabad (Part) MORADABAD 244504 Dist. - Moradabad 96XXXX7417zh91140No ratings yet

- Nitco Invoice No.-4907245361Document2 pagesNitco Invoice No.-4907245361rohanNo ratings yet

- Summary of Charges For This Bill Period: Amit GuptaDocument3 pagesSummary of Charges For This Bill Period: Amit GuptaRiya AggarwalNo ratings yet

- Lease Rent Satguru 01.01.23-31.12.23Document1 pageLease Rent Satguru 01.01.23-31.12.23sourabh nawaniNo ratings yet

- 2208237918Document1 page2208237918NEW GENERATIONSNo ratings yet

- Invoice: Click Here To Download Seller InvoiceDocument2 pagesInvoice: Click Here To Download Seller InvoicearyandjNo ratings yet

- GST 1056 2019 20. Ckecp Mohali P&M and IrDocument1 pageGST 1056 2019 20. Ckecp Mohali P&M and IrEntertainment AbhiNo ratings yet

- Invoice 1269569215Document2 pagesInvoice 1269569215vikas9849No ratings yet

- Emergency Amount After Due Date: 18002669944 (Tollfree) (022) - 68759400, (022) - 24012400Document2 pagesEmergency Amount After Due Date: 18002669944 (Tollfree) (022) - 68759400, (022) - 24012400jaswal.jagdevNo ratings yet

- ST SupO 3069 2022 23 193255Document1 pageST SupO 3069 2022 23 193255Rajat SharmaNo ratings yet

- R C Brothers Enterprises.: Quotation/PIDocument1 pageR C Brothers Enterprises.: Quotation/PIchandra mouliNo ratings yet

- Nvoice 4000025727 9359298 PDFDocument2 pagesNvoice 4000025727 9359298 PDFajit23nayakNo ratings yet

- Supertech Spares &servicesDocument1 pageSupertech Spares &servicesSoumilNo ratings yet

- Abson Packaging & Transport Solution: Tax InvoiceDocument1 pageAbson Packaging & Transport Solution: Tax InvoicerupeshshaddiNo ratings yet

- Inv 0019Document1 pageInv 0019urkirannandaNo ratings yet

- 188 GatewayDocument1 page188 GatewaygatewayasiallpNo ratings yet

- Proforma Invoice - Raw Material Feeding System - (16!07!21) UFLEXDocument1 pageProforma Invoice - Raw Material Feeding System - (16!07!21) UFLEXminni choubeyNo ratings yet

- SG112Document1 pageSG112rohanNo ratings yet

- FormatDocument1 pageFormatAadarsh RajNo ratings yet

- Car Insurance Claim ProcessDocument1 pageCar Insurance Claim ProcessMɽ Ħëʌɽt ĦʌckəɤNo ratings yet

- Santro InvoiceDocument1 pageSantro InvoiceMɽ Ħëʌɽt ĦʌckəɤNo ratings yet

- Domestic All GADocument1 pageDomestic All GAknpranchi111No ratings yet

- 2208238380Document1 page2208238380NEW GENERATIONSNo ratings yet

- Purchase Order: Bill To Address Ship To AddressDocument4 pagesPurchase Order: Bill To Address Ship To Addressarvind.tiwariNo ratings yet

- Bill SepDocument2 pagesBill SepAbhishek GorisariaNo ratings yet

- PO - 1A, 2B, 3E MS Railing MaterialsDocument3 pagesPO - 1A, 2B, 3E MS Railing Materialsabir senguptaNo ratings yet

- Tax Invoice: Gift From: Gift To: Customer CommentsDocument1 pageTax Invoice: Gift From: Gift To: Customer Commentsanshul sharmaNo ratings yet

- Piped Natural Gas Invoice DomesticDocument2 pagesPiped Natural Gas Invoice DomesticBalasubramanian GurunathanNo ratings yet

- Inv 2Document1 pageInv 2M MNo ratings yet

- Router Invoice Dual BandDocument1 pageRouter Invoice Dual Bandtousiff100% (1)

- BNTC - Sales BNTC 0885 23 24Document1 pageBNTC - Sales BNTC 0885 23 24sarbarthamukherjee222No ratings yet

- Warshi Bill No-3297Document1 pageWarshi Bill No-3297Aafak KhanNo ratings yet

- Tax InvoiceDocument2 pagesTax InvoiceAbhishekNo ratings yet

- MP 0001Document1 pageMP 0001Design DevelopmentNo ratings yet

- MRC Logistics PVT LTD.: DeclarationDocument3 pagesMRC Logistics PVT LTD.: DeclarationgeethashajunairNo ratings yet

- VensysDocument2 pagesVensysservice.dsmartNo ratings yet

- Invoice Voucher: Address - 3RD FLOOR, SUITE NO. D/1, B-8, SECTOR 2, NOIDA, Gautam Buddha Nagar, Uttar Pradesh, 201301Document1 pageInvoice Voucher: Address - 3RD FLOOR, SUITE NO. D/1, B-8, SECTOR 2, NOIDA, Gautam Buddha Nagar, Uttar Pradesh, 201301jainanmol0410No ratings yet

- M/S Jai Mata Di Construction & Suppliers: Tax InvoiceDocument10 pagesM/S Jai Mata Di Construction & Suppliers: Tax InvoiceHARSHIT GUPTANo ratings yet

- L AkshayDocument1 pageL AkshaymksioclNo ratings yet

- Kalyan Jewellers Thanjavur Invoice Dec-2020Document1 pageKalyan Jewellers Thanjavur Invoice Dec-2020get getrNo ratings yet

- Dfo March'25Document1 pageDfo March'25Vikas SrivastavaNo ratings yet

- Hanuman. GST Invoice-2Document1 pageHanuman. GST Invoice-2deyanshu7No ratings yet

- Tax Invoice P K EnterprisesDocument2 pagesTax Invoice P K EnterprisesSanjay LoyalkaNo ratings yet

- To PrintDocument1 pageTo PrintrajasthanexpiryNo ratings yet

- Montage Enterprises PVT LTD.: Tax InvoiceDocument1 pageMontage Enterprises PVT LTD.: Tax Invoicewasu sheebuNo ratings yet

- Ra092018 - Let (Catarman-Sec - Physical Science) PDFDocument2 pagesRa092018 - Let (Catarman-Sec - Physical Science) PDFPhilBoardResultsNo ratings yet

- OAH Chief Admin Law Judge Raymond Krause's Letter Denying Reconsideration of Newman & Parry ComplaintDocument4 pagesOAH Chief Admin Law Judge Raymond Krause's Letter Denying Reconsideration of Newman & Parry ComplaintSally Jo SorensenNo ratings yet

- Offences Against Property (Final Notes)Document5 pagesOffences Against Property (Final Notes)Stuti KuzurNo ratings yet

- Riyaz-ul-Quds - 2 of 2Document399 pagesRiyaz-ul-Quds - 2 of 2Syed-Rizwan Rizvi100% (1)

- GPO CRECB 1985 pt13 2 3 PDFDocument81 pagesGPO CRECB 1985 pt13 2 3 PDFRebeccaNo ratings yet

- The TribulationsDocument17 pagesThe TribulationsStephen Miller MagawiNo ratings yet

- Samang Sinumpaang Salaysay) With The CHR Against The Petitioners, Asking The Late CHRDocument4 pagesSamang Sinumpaang Salaysay) With The CHR Against The Petitioners, Asking The Late CHRIan RonquilloNo ratings yet

- Hiwot Demissie Proposal FinalDocument35 pagesHiwot Demissie Proposal Finalwondimu100% (4)

- BAC (Oral Com. 9)Document3 pagesBAC (Oral Com. 9)Rica MartinezNo ratings yet

- Page 59 BIR Inclusion Non-IndividualDocument1 pagePage 59 BIR Inclusion Non-IndividualHans LeeNo ratings yet

- Account SettingsDocument19 pagesAccount SettingsPatrick Brillante DE Leon0% (5)

- 渣打改地址hk ca051gDocument2 pages渣打改地址hk ca051gwingsyuen311No ratings yet

- Biography of Hazrat Sahwi Shah Sahib HyderabadDocument6 pagesBiography of Hazrat Sahwi Shah Sahib HyderabadMohammed Abdul Hafeez, B.Com., Hyderabad, IndiaNo ratings yet

- Bola Kontra Droga SK Post Activity ReportDocument4 pagesBola Kontra Droga SK Post Activity Reportsantoschristianpol6No ratings yet

- Baron, Marcia Pettit, Philip & Michael Slote - Three Methods of EthicsDocument293 pagesBaron, Marcia Pettit, Philip & Michael Slote - Three Methods of EthicsmserranoNo ratings yet

- Coral Ipx OfficeDocument450 pagesCoral Ipx OfficeMirceaNo ratings yet

- Calalang v. WilliamsDocument3 pagesCalalang v. WilliamsGem AusteroNo ratings yet

- AML Rule Tuning Applying Statistical Risk Based Approach To Achieve Higher Alert Efficiency U Luccehtti PDFDocument15 pagesAML Rule Tuning Applying Statistical Risk Based Approach To Achieve Higher Alert Efficiency U Luccehtti PDFFelix ChanNo ratings yet

- Shubham Singh BhadoriyaDocument3 pagesShubham Singh BhadoriyaThe Cultural CommitteeNo ratings yet

- RefugeDocument101 pagesRefugesusanooo001No ratings yet

- Chandler's Ford ShootingDocument6 pagesChandler's Ford Shootingca_luisgNo ratings yet

- The Scarlet Letter Study QuestionsDocument6 pagesThe Scarlet Letter Study Questionsapi-268562470100% (1)

- ConsRev NPC Vs ManalastasDocument2 pagesConsRev NPC Vs ManalastasLudica OjaNo ratings yet

- Mobilization and Empowerment of Marginalized Women in South AsiaDocument32 pagesMobilization and Empowerment of Marginalized Women in South AsiaaalsNo ratings yet

- Chapter 1 - Accounting For Business CombinationsDocument6 pagesChapter 1 - Accounting For Business CombinationsLyaNo ratings yet

- Causes of The RevoltDocument9 pagesCauses of The RevoltSatish KumarNo ratings yet