Professional Documents

Culture Documents

01 Act 1

Uploaded by

dimayugadesiree5Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

01 Act 1

Uploaded by

dimayugadesiree5Copyright:

Available Formats

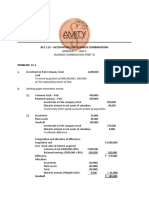

1. Compute the adjusted capital of X and Y using the bonus method.

(2 items)

X Y Partnership

Cash P200,000 P200,000

Accounts Receivable 60,000 60,000

Inventory 90,000 90,000

Land P1,200,000 1,200,000

Building (3,800,000 – 2,600,000 2,600,000

1,200,000)

Notes Payable (50,000) (50,000)

Total adjusted capital accounts 300,000 3,800,000 4,100,000

Actual Application of Agreed Capital

Contribution Bonus Method

X P300,000 (4,100,000 x 40%) P1,640,000

Y 3,800,000 (4,100,000 x 60%) 2,460,000

Total 4,100,000 4,100,000

2. Prepare the journal entries to record the contributions. (1 item)

Cash P200,000

Accounts Receivable 60,000

Inventory 90,000

Land 1,200,000

Building 2,600,000

Notes Payable P50,000

X, Capital 1,640,000

Y, Capital 2,460,000

3. Compute the amount of bonus. (1 item)

Agreed Capital P1,640,000

Less: Actual Contribution 300,000

Bonus P1,340,000

You might also like

- AfarDocument128 pagesAfarlloyd77% (57)

- Afar PDFDocument128 pagesAfar PDFMelyn Bustamante100% (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Sol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BDocument15 pagesSol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BChristian James RiveraNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- Sol. Man. - Chapter 11 - Partnership FormationDocument12 pagesSol. Man. - Chapter 11 - Partnership Formationpehik100% (2)

- P3.5 Different Forms of Business CombinationDocument8 pagesP3.5 Different Forms of Business CombinationAgnes CahyaNo ratings yet

- Advacc 1 Millan 2019 Advac 1 Special Transactions 2019Document11 pagesAdvacc 1 Millan 2019 Advac 1 Special Transactions 2019Charlene BolandresNo ratings yet

- Problem 23-1, Page 650 Erica Company: Required: # Debit CreditDocument14 pagesProblem 23-1, Page 650 Erica Company: Required: # Debit CreditDeanne LumakangNo ratings yet

- ACFAR Partnership ExercisesDocument12 pagesACFAR Partnership ExercisesJhannamae PamugasNo ratings yet

- PartnershipDocument7 pagesPartnershipShane Nayah100% (2)

- ProblemDocument30 pagesProblemJenika AtanacioNo ratings yet

- Solution Manual-Module 1: Acc 311 - Acctg For Special Transactions and Business CombinationsDocument11 pagesSolution Manual-Module 1: Acc 311 - Acctg For Special Transactions and Business CombinationsJoy SantosNo ratings yet

- Sol. Man. - Chapter 11 - Partnership FormationDocument12 pagesSol. Man. - Chapter 11 - Partnership FormationpehikNo ratings yet

- Solution Chapter 14Document26 pagesSolution Chapter 14grace guiuanNo ratings yet

- Intangible Assets Discussion MaterialDocument20 pagesIntangible Assets Discussion MaterialKougane SanNo ratings yet

- Adv Acc 2 Module 1 Topic1.2Document5 pagesAdv Acc 2 Module 1 Topic1.2James CantorneNo ratings yet

- Problem Relates To A Chapter AppendixDocument15 pagesProblem Relates To A Chapter AppendixsameerNo ratings yet

- BUSINESS COMBI (Activity On Goodwill Computation) - PALLERDocument5 pagesBUSINESS COMBI (Activity On Goodwill Computation) - PALLERGlayca PallerNo ratings yet

- Test Bank 3 - Ia 3Document25 pagesTest Bank 3 - Ia 3jessaNo ratings yet

- Acc2 CH11Document6 pagesAcc2 CH11Leah CalataNo ratings yet

- Buscom 3Document4 pagesBuscom 3dmangiginNo ratings yet

- 16 UNIT III LiquidationDocument20 pages16 UNIT III LiquidationLeslie Mae Vargas ZafeNo ratings yet

- A 1. FormationDocument3 pagesA 1. Formationmartinfaith958No ratings yet

- Assignment Ans KeyDocument8 pagesAssignment Ans KeyJay Mark Marcial JosolNo ratings yet

- Therese Zyra Lipang - Worksheet Activity - 10 Column WsDocument4 pagesTherese Zyra Lipang - Worksheet Activity - 10 Column WsJuvelyn Repaso100% (1)

- Paw and Saw DownstreamDocument3 pagesPaw and Saw DownstreamLorie Roncal JimenezNo ratings yet

- Business Combinations - Net Asset AcquisitionDocument15 pagesBusiness Combinations - Net Asset AcquisitionLyca Mae CubangbangNo ratings yet

- On January 1Document4 pagesOn January 1Kryzzel Anne JonNo ratings yet

- Resource Company Required Debit Credit 2020 Rock and Gravel PropertyDocument10 pagesResource Company Required Debit Credit 2020 Rock and Gravel PropertyAnonnNo ratings yet

- Chapter 2 Partnership Operations 2021 EditionDocument17 pagesChapter 2 Partnership Operations 2021 Editionregine bacabagNo ratings yet

- PANOPIO Activity1 BLOCK3209Document6 pagesPANOPIO Activity1 BLOCK3209panopiojessiemae4No ratings yet

- Mahusay, Bsa 315, Module 1-CaseletsDocument9 pagesMahusay, Bsa 315, Module 1-CaseletsJeth MahusayNo ratings yet

- Let's Check: Ex. 1 Ex. 2Document3 pagesLet's Check: Ex. 1 Ex. 2irahQNo ratings yet

- Chapter 1 - Teacher's Manual - Afar Part 1-1Document10 pagesChapter 1 - Teacher's Manual - Afar Part 1-1Mayeth BotinNo ratings yet

- Sol Man Chapter 11 She Part 2 2021 - CompressDocument27 pagesSol Man Chapter 11 She Part 2 2021 - CompressDump DumpNo ratings yet

- FA Piecemeal ... SumsDocument10 pagesFA Piecemeal ... Sumspurvi doshiNo ratings yet

- Quiz 3 Acctg For Business Combination - EntriesDocument6 pagesQuiz 3 Acctg For Business Combination - EntriesNhicoleChoiNo ratings yet

- Acc 113 - Accounting For Business CombinationsDocument8 pagesAcc 113 - Accounting For Business CombinationsAlthea CagakitNo ratings yet

- Additional ProblemDocument3 pagesAdditional ProblemLabLab ChattoNo ratings yet

- Parcor ExplanationDocument5 pagesParcor ExplanationjulionocheadjeNo ratings yet

- Chapter 4 - AssigmentDocument2 pagesChapter 4 - AssigmentKryzzel Anne JonNo ratings yet

- F M ADocument11 pagesF M AAjay SahooNo ratings yet

- Bus. Combi Probs and SolnDocument3 pagesBus. Combi Probs and SolnRyan Prado AndayaNo ratings yet

- Contoh Akuisisi 100% Dan 100% Metode Cost (Tan Lee)Document10 pagesContoh Akuisisi 100% Dan 100% Metode Cost (Tan Lee)Kusnul WidiyaniNo ratings yet

- Vending Machines SolutionDocument6 pagesVending Machines SolutionizquierdofacturaNo ratings yet

- Acg5205 Solutions Ch.16 - Christensen 12eDocument10 pagesAcg5205 Solutions Ch.16 - Christensen 12eRyan NguyenNo ratings yet

- BADVAC2X Review (Partnership Formation-Dissolution) - P1Document15 pagesBADVAC2X Review (Partnership Formation-Dissolution) - P1Reymark SadoyNo ratings yet

- Far Partnership CH12Document4 pagesFar Partnership CH12she kioraNo ratings yet

- Name: Section: Date:: Angel SantaDocument5 pagesName: Section: Date:: Angel SantaJoebet DebuyanNo ratings yet

- Lesson Title: Business Combination (Part 1) : Learning Targets: MDocument4 pagesLesson Title: Business Combination (Part 1) : Learning Targets: MjhammyNo ratings yet

- LEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Document2 pagesLEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Kim FloresNo ratings yet

- Chap 14 1-2Document4 pagesChap 14 1-2Buenaventura, Lara Jane T.No ratings yet

- Problems Partnership FormationDocument11 pagesProblems Partnership FormationJunaly PanagaNo ratings yet