Professional Documents

Culture Documents

MCQ On Capital Structure 626f7b3f99ef5dca9191151c

MCQ On Capital Structure 626f7b3f99ef5dca9191151c

Uploaded by

Manjula B K AI0022330 ratings0% found this document useful (0 votes)

11 views21 pagesOriginal Title

mcq-on-capital-structure--626f7b3f99ef5dca9191151c (1)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views21 pagesMCQ On Capital Structure 626f7b3f99ef5dca9191151c

MCQ On Capital Structure 626f7b3f99ef5dca9191151c

Uploaded by

Manjula B K AI002233Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

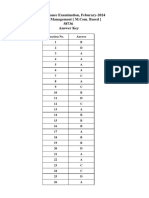

You are on page 1of 21

Dee Cra)

Capital Structure Questions

Latest Capital Structure MCO Objective Questions

a

c

PIPE ABA Rel ial

Start Complete Exam Preparation

Cee roe

Weoaa eae Se a

Give: {= os

Download App

Loerie rs

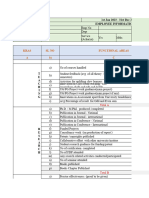

Question 1:

View this Question Online >

Which of the following influence the organisation structure and hence, should be clearly

defined?

1. Objectives

2. Span of Control

3. ScalarPrinciple

4, Specialisation

5. None of the above/More thafione of theabove.

Answer (Detailed SoltitionBelow)

Option 1): Objectives

X

coaching

India's Super Teachers for all

govt. exams Under One Roof

C= uase Sed

Capital Structure Question 1 Detailed Solution

The correct answer is Objectives.

© Key Points

+ The organization structure of acompany should be aligned with its objectives.

+ The objectives of the organization define its purpose, direction, and goals

+ They guide the decision-making processand provide a framework for allocating resources and

designing the structure of the organization.

+ The objectives help determine the various functions, departments, and positions within the

organization.

+ They influence the division of labor, coordination mechanisms,reporting relationships, and the

overall hierarchy,

+ Clear and well-defined objectives provide a basisfor designing an effective and efficient

organization structure.

© Additional_Information 5

Span of Control:

+ Span of control refers to the number of subordinates that a manager can effectively supervise.

+ It determines the levels of hierarchy and the extent of authority. and responsibility within the

organization .

+ Defining the span of control helps in de ng the optimal number of subordinates that a

manager can manage efficiently and ensiifegip et there isa proper balance between

supervision and autonomy.

Scalar Principle:

+ The scalarprinciple is a management principle that statesthat there should be a clear and

unbroken line of authority from the highest to the lowest levels of the organization.

+ It emphasizesthe hierarchical structure and the chain of command within the organization.

+ Clearly defining the scalarprinciple ensuresa clear flow of authority and responsibility,

avoiding confusion and conflictsin decision-making and communication

Specialization:

+ Specializationrefersto the division of labour and the assignmentof specifictasksand

responsibilitiesto individuals or departments based on their expertise and skills.

+ It allowsindividuals to focus on their areas of specializationand become more proficient in

their respective roles.

+ Defining specializationwithin the organization structure ensures that there is clarity in roles

and responsibilities,and tasksare assigned to individuals or departments based on their

capabilities.

A Mistake Points

According to official question paper, the correct answer is described as option 4 but the

‘most relevant answer is option 1. Hence, ithas been updated.

a

ieee anu Rect

Pela meu) (CM beim ere- relied)

eee ete

hee kes apse

Roscoe

Download App

‘Question Bank Prise

Question 2:

View this Question Online >

Assertion (A): According to the trade-off theory of capital structure, a company should aim to

strike a balance between the benefits and costsof debt financing.

Reason (R): Debt financing provides tex advantages through ‘interest deductibility, but it also

exposesthe company to financial distresscosts.

1. Both the assertionand reason are true, afid the reason is the correct explanation of the

assertion. -

2. Both the assertionand reason ére true, but the reason is not the correct explanation of the

assertion.

~~ assertionis true, but the reasonis false.

4. Theassertionis false, but the reason is true.

5. None of the above

Answer (Detailed Solution Below)

Option 1: Both the assertionand reason are true, and the reasonis the correct explanation of the

assertion.

Capital Structure Question 2 Detailed Solution

The correct answer is Both the assertion and reason are true, and the reason is the correct

explanation of the assertion.

© Key Points

Assertion (A): According to the trade-off theory of capital structure, a company should. sim

to strike a balance between the benefits and costs of debt financing. @

The trade-off theory of capital structure suggeststhat a company should strivéto find theioptimal

mix of debt and equity financing. The assertionis true because the trade-off theory highlights the

importance of balancing the benefits and costsassociatedwith debt financing.

st deductibility, but it

Reason (R): Debt financing provides tax advantages. through: inter

also exposes the company to financial distress costs.

The reason is also true because debt financing provides taxadvantages through interest

deductibility, which can lower the company's tax burden. However, it also exposesthe company to

financial distresscosts,such as the rigigeg cefault and associatedcosts. Therefore, the reason

provides a correct explanation for the @sertion

Important Points

+ The trade-off theory of capital structure suggeststhat companies should aim to strike a

balance between the benefits and costsof debt financing. The assertionis true because the

trade- off theory recognizes that there are advantagesto using debt asa source of financing,

such as the tax deductibility of interest payments, which can lower the company's tax burden

and increaseits cashflows.

+ However, the reason is alsotrue and provides the correct explanation for the assertion. Debt

financing exposesa company to financial distresscosts, which can ariseif the company is

unable to meet its debt obligations. These costsinclude potential bankruptcy costs,such as

legal feesand the loss of reputation, aswell as the potential lossof future financing

opportunities due to a damaged crecit rating

+ Therefore in order to optimize the capital structure, companies need to carefully consider the

trade-off between the tax advantages of debt financing and the potential financial distress

costsassociatedwith it. They should aim-to find the right mix of debt and equity that

minimizes the overall cost of capital and maximizesthe velue of the firm.

India’s #1 Learning Platform CR errno tea

Start Complete Exam Preparation

[ ives sted Dag

poco Question Bank Exh

Download App

Question 3:

View this Question Online >

Assertion (A): According to the trade-off theory of capital structure, a company should aim to

strike a balance between the benefits and costsof debt financit

Reason (R): Debt financing provides tex advantages through interest deductibility, but it elso

exposesthe company to financial distresscosts.

1. Both the assertionand reason some reason is the correct explanation of the

assertion. O

2. Both the schoo are true, but the reason isnot the correct explanation of the

asserti S

e assertionis true, but the reason is false.

4. The assertionis felse,but the reason is true.

Answer (Detailed Solution Below)

Option 1: Both the assertionand reason are true, and the reason is the correct explanation of the

assertion.

Capital Structure Question 3 Detailed Solution

The correct answer is Both the assertion and reason are true, and the reason is the correct

explanation of the assertion.

© Key Points

Assertion (A): According to the trade-off theory of capital structure, a company should aim

to strike a balance between the benefits and costs of debt financing.

The trade- off theory of capital structure suggeststhat a company should strive to find tt

mix of debt and equity financing. The assertionis true because the trade-off theory highlight

importance of balancing the benefits and costsassociatedwith debt financing. e

Reason (R): Debt financing provides tax advantages through int lity, but it

also exposes the company to financial distress costs. ry

The reason is also true because debt financing provide: es through interest

deductibility, which can lower the company's tax b 1, it alsoexposesthe company to

financial distresscosts,such as the risk of de! cae iatedcosts. Therefore, the reason

provides a correct explanation for the asserti

» Important Points ~

+ The trade-off theory of capital structure suggests that companies should aim to strike a

balance between the benefits and costsof debt financing. The assertionis true because the

trade-off theory recognizes that there are advantages to using debt asa source of financing,

sch ns the ‘tea. dachiclibilliy of inisfast payments whicli can lower the comnatiy's taxburden

and increaseits cash flows.

+ However, the reason is alsotrue and provides the correct explanation for the assertion. Debt

financing exposesa company to financial distresscosts, which can ariseif the company is

unable to meet its debt obligations. These costsinclude potential bankruptcy costs, such as

legal feesand the lossof reputation, as well as the potential lossof future financing

Opportunities due to a damaged credit rating.

+ Therefore, in order to optimize the capital structure, companiesneed to carefully consider the

trade-off between the tax advantages of debt financing and the potential financial distress

costsassociatedwith it. They should aim to find the right mix of debt and equity that

minimizes the overall cost of capital and maximizesthe value of the firm.

&

India's #1 Learning Platform Oa ee cso tout

Start Complete Exam Preparation

ees eer

Download App

Question 4:

View this Question Online >

Which of the following influence the organisation structure and hence, should be clearly

defined?

1. Objectives

2. Span of Control

3. ScalarPrinciple

4. Specialisation’

A. (Detailed Solution Below)

Option 1 : Objectives

Capital Structure Question 4 Detailed Solution

The correct answer is Objectives.

@ Key Points

+ The organization structure of a company should be aligned with its objectives.

+ The objectives of the organization define its purpose, direction, and goals.

+ They guide the decision-making processand provide a framework for allocating resourcesand

designing the structure of the organization.

+ The objectives help determine the various functions, departments, and positions within the

organization

+ They influence the division of labor, coordination mechanisms,reporting relationships, and the

overall hierarchy.

* Clear and well-defined objectives provide a basisfor designing an effectiveand efficient

organization structure.

©; Additional_Information

‘Span of Control:

+ Span of control refers to the number of subordinates that a manager can effectively supervise.

+ It determines the levels of hierarchy and the extent of authority and responsibility within the

organization. : ¥

* Defining the span of control helps in determining the optimal number of subordinates that a

Manager can manage efficiently and ensures that there Isa proper balance between

supervision and autonomy. ‘

Scalar Principle:

unbroken line of authority from. hest to the lowestlevels of the organization.

+ It emphasizesthe hierarchical and the chain of command within the organization.

+ Clearly defining the scelarprinciple ensuresa clear flow of authority and responsibility,

avoiding confusion and conflictsin decision-making and communication

+ The scalarprinciple is yaa that statesthat there should be a clear and

‘Specialization:

+ Specialization refersto the division of labour and the assignmentof specifictasksand

responsibilitiesto individuals or departments based on their expertise and skills.

+ It allowsindividuals to focus on their areas of specializationand become more proficient in

their respective roles.

+ Defining specializationwithin the organization structure ensuresthat there is clarity in roles

and responsibilities and tasksare assigned{o individuals or departments based on their

capabilities.

A Mistake Points

‘According to official question paper, the correct answer is described as option 4 but the

most relevant answer is option 1. Hence, ithas been updated.

Cal

CR ARR Rell RE cena

Start Complete Exam Preparation

rae

Clee

Download App

Question 5:

View this Question Online > i

The Capital Theory Enables Managersto make wise & Decisions ?

—" Investment

3. Income and Expenditure

4. Demand and Supply

Answer (Detailed Solution Below)

Option 2: Capital & Investment

Capital Structure Question 5 Detailed Solution

The correct answeris Capital & Investment.

@ Key Points

+ The capital theory is the study of models of economic change.

+ It displaysthe connection between current economic decisions and subsequent levels of

output, and it showshow the parts of economic theory, production, slams distribution, etc.,

relate to each other in @ dynamic context

+ The traditional theory of capital structure saysthat for any éompany or investment, there is

an optimel mix of debt and equity financing thet minimizesthe WACC and maximizesvalue.

+ The Capital Theory Enables Managers to make wise Capital & Investment Decisions.

+ Under this theory, the optimal capital structureocourswhere the marginal costof debt is equal

to the marginal cost of equity. ‘A od

+ Thistheory depends on assumptionsthat imply

varies with respectto the d f leverage.

&; Additional_Information

+ Capital is @ broad term for anything that gives its owner value or advantage, like a factory

and its equipment, intellectual property like patents, or a company's or person's financial

assets.Even though money itself can be called capital, the word is usually used to describe

money used to make things or invest.

+ Aninvestment is the purchase of goods that are not consumed today but are used in the

ee aN MT OR SGT ge aN ee a a aT

1 the costof elther debt or equity financing

See Pes ances gee eee, See NT ES

that the assetwill provide income further or will later be sold at a higher cost price for a profit.

Hence, the Capital Theory Enables Managers to make wise Capital & Investment Decisions.

a

eee ee

Pela (CM elma teh iced)

Bins Mock Tests

MasterCl eresietcg Pretty

Download App

Question 6

is a combination of various sources of capital.

1. Capital structure

2. Capitalization

3. Financial Structure

4 A...

Answer (Detailed Solution Below)

Option 1 : Capital structure

Capital Structure Question 6 Detailed Solution

Correct answeris Capital structure.

@ Key Points

Capital structure-

eDOCS

\View this Question online >

+ The specific ratio of debt to equity utilized to fund a company's assetsand activitiesis

referred to asits capital structure.

ES Re oa er ee arn ON eRe Eee eee ee SE Cee

+ It works asa base to determine required rate of return.

©; Additional_Information

Capitalization c

+ A costis included in the value of an essétusing the accounting technique known as

capitalization, and is then ceducted during the asset'suseful life rather than being deducted at

the time the “esas

Financial structure-

+ In order to meet the company's long-term and short-term capital needs, the financial

structure refersto the sourcesof capital and the percentage of financing that comes from

short-term liabilities, short-term debt, long-term debt, and equity.

Amortization-

+ Amortization is the process of gradually allocating an asset'spurchase price to an expense

over the course of the asset'santicipated useful life, moving the assetfrom the balance sheet

to the income statement.

rd

CR ABR UT Rell)

Start Complete Exam Preparation

Ree eet

Pray Par

Crete Hi era Ga cc

Download App

Question 7:

View this Question Online >

Which of the following capital structure consistof zero debt components in the structure

mix?

1. Pyramid Shaped Capital Structure

a A... Shaped Capital Structure

3. Horizontal Capital Structure

4. VerticalCapital Structure

Answer (Detailed Solution Below)

Option 3: Horizontal Capital Structure

Capital Structure Question 7 Detailed Solution

The correct answeris Horizontal Capital Structure

Key—Points—

Horizontal capital Structure:

+ Expansion of the firr ich equity and retained earnings only.

+ In a Horizontal Capital “o, the firm has zero debt components in the capital structure

mix.

+ The structure is quite stable.

+ Expansion of the firm takes in a lateral manner, i.e. through equity or retained earnings

only.

- The absence of debt results in the lack of financial leverage

+ Probability of disturbance of the structure is very less.

+ In simple words, all the funds required for a particular project are brought out by the

‘owners only.

* The firm hasno il of debt in the financial mix.

x

Rae Reel CRS eer

PSE Ta meee clumsy elated)

Pea ented Mock Tests

rears pre

Question 8:

View this Question Online >

The capital structure is influenced by the of various Sources of capital.

1. Lg

Restrictivecovenants

2. Taxadvantage

CWB coors

4.

None of the Above

Answer (Detailed Solution Below)

Option 3:

Cost of capital

Capital Structure Question 8 Detailed Solution

The Correct answeris Cost of capital’

©, oy Poiete-

+ Capital structure describesthe debt and/or equity used by a company to fund its operations

and finance its assetsis referred to asits capital structure.

Cost of capital:

+ The cost of capital is the rate of return that a company must achieve in order to justify the

cost of a capital project, as buying new equipment or building anew building.

* The cost of capital includes ‘st of both equity and debt, weighted according to the

preferred or existing capital re of the company.

Restrictive covenants: Thisoption isincorrect becauseRestrictive covenants are not a factor

that influences the Capital structure.

Tax advantage: This option isincorrect becauseCapital structure describesthe debt and/or

equity used by a company to fund its operations and finance its assetsis referred to asits capital

structure.

Cost of capital: This option is correct because The costof capitalincludes the cost of both equity

and debt, weighted according to the preferred or existing capital structure of the company.

None of the Above: Thisoption is incorrect because one of the above options is incorrect.

ae

ie anu Bec

Start Complete Exam Preparation

aCe a cet

Gikees ohes Par

[ests Coro Ext:

ownload App

Question 9:

View this Question Online >

Name the decision which affectsboth the profitability and the financial risk.

1. Financial planning decision

2 ~~" decision

3. Capital structure decision

4. Allof the above

Answer (Detailed Solution Below)

Option 3 : Capital structure decision

Capital Structure Question 9 Detailed Solution

The correct answeris Capital structure decision

© KeyPoints—

+ Capital Structure, means arranging capital from various sources in order to meet the

need for long-term funds for the business.

+ It combines equities, rence share capital, long-term loans, debentures, retained

eamings, and various other long-term sources of funds.

+ Capital structure refers to ‘= proportion of each of these sources of funds in the capital,

which the company should raise or arrange to carry out its businesseffectively.

+ Thus, capital structure is extremely important.

+ Capital structure decisionsor practiceshave a significant role to play in corporate financial

management.

re

eee eau)

Start Complete Exam Preparation

CBee com

ele bes bee

MasterC! resieacrig Exeter)

Jownload App

Question 10:

View this Question Online >

The minimum required rate of earnings or the capital expenditure cut-off rate is:

1

Cost of capital

2.

Working capital”

~

Equity capital

4.

None of the above

Answer (Detailed Solution Below)

Option 1:

Cost of capital

Capital Structure Question 10 Detailed Solution

The Correct answeris ‘Cost of capital’.

Cost of capital:

+ The cost of capital is the rate of return that a Company must achieve in order to justify the

cost of a capital project, such as buying new equipment or building anew building.

+ The costof capital includes the cost of both equity and debt, weighted according to the

preferred or existing capital eof the company.

#® Important Points

srasisaae cial Sinema arses ean cca te a a i am a

company must achieve in order to justify the cost of a capital project, such as buying new

equipment or building anew building.

Working capital: Thisoption is incorrect because Working Capital means the difference between

Current assetsand Current Liabilities

Equity capital: This option is incorrect because Any company's long-term financing sources are

equity shares. Thesesharesare available to the general public and are not redeemable

None of the Above: Thisoption is incorrect because one of the above option is incorrect.

Fo

ieee anu Reet

Start Complete Exam Pr

16,00, 449 Student

if rari ented Dac

err Cress Exot

jownload App

Question 11:

View this Question Online >

Capital structure shows

1. Debtor-creditor ratio

2. Debt- equityyratio. =

3. PB ccctren assetsratio

4. Interest coverage ratio

Answer (Detailed Solution Below)

Option 2: Debt- equity ratio

Capital Structure Question 11 Detailed Solution

The correct answeris Debt-equity ratio

© Key_Points—

Capital structure refers to the specific mix of debt and equity used to finance a company's

assetsand operations. Fram a corporate perspective, equity represents a more expensive,

permanent source of capital with greater financial flexibi

+ The arrangement of capital by using different sourcesof long term funds which consistsof two

broad types, equity a t

+ The different types ig are raised by a firm include preference shares, equity

shares, retained ea ng-term loans etc.

+ The debt-to-equity (D/E) ratio compares a company’s total liabilities to its shareholder

‘equity and can be uses to eveluate how much leverage a company is using.

+ Higher-leverage ratios tend to indicate a company or stock with higher risk to

‘shareholders.

+ However, the D/E ratio is difficult to compare across industry groups where ideal

amounts of debt will vary.

- Investors will often modify the D/E ratio to focuson long-term debt only becausethe risks

associatedwith long- term liabilities are different than short-term debt and payables.

&

Ss

rN

India’s #1 Learning Platform “Saal Ea ay

Pela meri) M Cima lle h iced)

Capo ocd eles

uizzes

Us} Mastercl Coa iets

Download App

Question 12:

View this Question Online >

Which of the following influence the organisation structure and hence, should be clearly

defined?

1. Objectives

2. Span of Control

3. ScalarPrinciple 9 ,

4. Specialisation

xr. (Detailed Solution Below)

Option 1: Objectives

Capital Structure Question 12 Detailed Solution

The correct answer is Objectives.

© Key Points

+ The organization structure of a company should be aligned with its objectives.

+ The objectives of the organization define its purpose, direction, end goals.

+ They guide the decision-making processand provide a framework for allocating resourcesand

designing the structure of the organization.

+ The objectives help determine the various functions, departments, and positions within the

organization.

+ They influence the division of labor, coordination mechanisms,reporting relationships, and the

overall hierarchy.

+ Clear and well-defined objectives provide a basisfor designing an effectiveand efficient

organization structure.

6; Additional_Information

‘Span of Control: go

+ Span of control refers to the number of subordinates that a manager can effectivel supervise.

+ It determines the levels of hierarchy and the extent of authority and responsibilty ithin the

organization.

+ Defining the span of control helps in determining the optimal number Ridl bordinates that a

manager can manage efficiently and ensures that there ey balance between

supervision and autonomy.

Scalar Principle:

unbroken line of authority from hest to the lowestlevels of the organization.

+ It emphasizesthe hierarchical ‘and the chain of command within the organization.

* Clearly defining the scelarprinciple ensuresa clear flow of authority and responsibility,

avoiding confusion and conflictsin decision-making and communication.

+ The scalarprinciple is et iple that statesthat there should be a clear and

Specialization:

* Specializationrefers to the division of labour and the assignmentof specifictasksand

responsibilitiesto individuals or departments based on their expertise and skills.

+ It allowsindividuals to focus on their areas of specializationand become more proficient in

their respective roles.

+ Defining specializationwithin the organization structure ensuresthat there is clarity in roles

and responsibilities,and tasksare assignedto individuals or departments based on their

capabllities.

A Mistake Points

According to official question paper, the correct answer is described as option 4 but the

most relevant answer is option 1. Hence, it has been updated.

eee ene eto Pee

PSE Ta meee clumsy elated)

rie

Question 13:

View this Question Online >

The composition of a firms capitalization is referred to as.

1. Capital structure m4

2. Capital budgeting

3 ms

4

None of the Above

Answer (Detailed Solution Below)

Option 1: Capital structure

Capital Structure Question 13 Detailed Solution

The Correct answeris ‘Capital structure’

@

Capital structure:

+ Capital structure describesthe debt and/or equity used by a company to fund its operations

and finance its assetsis referred to asits capital structure.

+ Firms must make tradeoffs when deciding whether to finance operations with debt or equity,

and managers mustbalance the two to‘find the optimal capital structure.

- Poi a)

Capital re: Thisoption isCortect because Capital structure cescribesthe debt and/or

equity used by a company to fund its operations and finance its assetsis referred to asits capital

structure.

Capital budgeting: Thisoption isincorrect becauseThe term Capital budgeting is the processby

which a project or investment of a company evaluates.

Equity shares: This option is incorrect because Any company’s long-term financing sources are

equity shares . Thesesharesare available to the general public and are not redeemable

None of the Above: Thisoption is incorrect because one of the above options is incorrect.

India’s #1 Learning Platform

Start Complete Exam Preparation

CCC CD coi

end Jc

rhea (HB) Gistn oan

Download App

Exerc 2)

Gree

Question 14:

View this Question Online >

is a combination of various sources of capital.

1. Capital structure

2. Capitalization ,

3. Financial Structure,

Answer (Detailed Solution Below)

Option 1: Capital structure

Capital Structure Question 14 Detailed Solution

Correct answeris Capital structure.

© Key Points

Capital structure-

+ The specific ratio of debt to equity utilized to und a company’s assetsand activitiesis

referred to asits capital structure.

+ A ideal capital structure should have minimum cost of capital.

+ It works asa base to determine required rate of return.

@ Agaitional inrormation

Capitalization-

+ A ccostis included in the value of an assetusing the accounting technique known as

capitalization, and is then cecucted during the asset'susefullife rather than being deducted at

the time the osu

Financial structure-

+ In order to meet the company's long-term and short-term capital needs, the financial

structure refersto the sourcesof capital and the percentage of financing that comes from

short-term liabilities, short-term debt. long-term debt, and equity.

Amortization

+ Amortization is the process of graduzlly allocating an asset'spurchase price to an expense

over the course of the asset'santicipated useful life, moving the assetfrom the balance sheet

to the income statement.

Teer Eee Oe aR rae

Start Complete Exam Preparation

eee (ere Go ee

Download App

Question 15:

View this Question Online >

The firm's market value is the result of.

t

Decisionson dividends ‘

Es

Decisionson working capital

~

Capital budgeting decisions

Risk versus return trade-off

Answer (Detailed Solution Below)

Option 4

Risk versus return trade- off

Capital Structure Question 15 Detailed Solution

@

Risk versus return trade-off:

‘The Correct answeris ‘Risk versus return trade-off’. N\A G

+ The risk-retum tradeoff statesthat as risk increa he potential retum.

~ Low levels of uncertainty or risk are associat potential returns, whereas high

levels.

+ In short Making decisions jn such the balance of risk and return is optimized

is called Risk versus retui - off.

>

Decisions on dividends: This Option is Incorrect becausedividend Decision of the firms

influenced the shareholder's perception and Wealth Creation.

Decisions on working capital: This Option is Incorrect because Working Capital is the Capital

required for day to day businessoperation.

Capital budgeting decisions: ThisOption is Incorrect becauselong term investments decision is

taken based on Capital budgeting.

Risk versus return trade-off: This Option is correct because Individuals associate ow levels of

uncertainty or risk ate associatedwith low potential returns, whereas high levels

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Report On Debate Competion On Management ClassDocument5 pagesReport On Debate Competion On Management ClassManjula B K AI002233No ratings yet

- MCQ On Research Methodology 5eea6a0d39140f30f369e1a5Document24 pagesMCQ On Research Methodology 5eea6a0d39140f30f369e1a5Manjula B K AI002233No ratings yet

- (M - Com - Based) BUSINESS MANAGEMENTDocument2 pages(M - Com - Based) BUSINESS MANAGEMENTManjula B K AI002233No ratings yet

- Environmental Science & Digital Fluency SyllabusDocument11 pagesEnvironmental Science & Digital Fluency SyllabusManjula B K AI002233No ratings yet

- Business Management (M-Com Based) - PD-33 58736Document11 pagesBusiness Management (M-Com Based) - PD-33 58736Manjula B K AI002233No ratings yet

- Certificate of ParticipationDocument1 pageCertificate of ParticipationManjula B K AI002233No ratings yet

- Ph.D-2023-24 Eng-NotificationDocument3 pagesPh.D-2023-24 Eng-NotificationManjula B K AI002233No ratings yet

- Faculty Assessemnt Form - 2023Document6 pagesFaculty Assessemnt Form - 2023Manjula B K AI002233No ratings yet

- MBA Syllabus 2020 21Document123 pagesMBA Syllabus 2020 21Manjula B K AI002233No ratings yet

- Artificial Intelligence in Finance IndustryDocument4 pagesArtificial Intelligence in Finance IndustryManjula B K AI002233No ratings yet

- FACULTY CCEC August MonthDocument57 pagesFACULTY CCEC August MonthManjula B K AI002233No ratings yet

- Unit 03 Notes (Uuddfinal)Document12 pagesUnit 03 Notes (Uuddfinal)Manjula B K AI002233No ratings yet

- Unit 02 Notes (Uuff Final)Document19 pagesUnit 02 Notes (Uuff Final)Manjula B K AI002233No ratings yet

- ESR UG Courses 1Document1 pageESR UG Courses 1Manjula B K AI002233No ratings yet

- MCQ On Principles of Management 626f79d561006ea756b75a92Document21 pagesMCQ On Principles of Management 626f79d561006ea756b75a92Manjula B K AI002233No ratings yet

- Unit 01 Notes (Uudd Final)Document23 pagesUnit 01 Notes (Uudd Final)Manjula B K AI002233No ratings yet

- Unit 04 Notes (Uudd Fibnal)Document5 pagesUnit 04 Notes (Uudd Fibnal)Manjula B K AI002233No ratings yet