Professional Documents

Culture Documents

TRIAL Potato Chips Factory Financial Model Excel Template v.1.0

Uploaded by

Param JothiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TRIAL Potato Chips Factory Financial Model Excel Template v.1.0

Uploaded by

Param JothiCopyright:

Available Formats

Model Name

Model Name

Go to the Table of Contents

Built with finmodelslab.com template Cover 03/04/2024

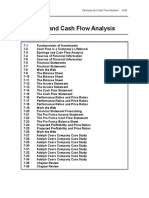

Table of Contents - Section & Sheet Titles

Model Name

Go to the Cover Sheet

1 Reports What each tab does

a. Financial Statements Summary On this tab you may get a quick glance at your Financial Statement Summary and have

a. a better understanding of the Income Statement, Cash Flow, and the Balance Sheet

a. as well as the Monthly view of a fiscal year, and the annual view of the five-year forecast.

b. DashBoard DashBoard tab gives you a snapshot of your business financial viability.

b. Core financials, Cash Flow data, Revenue Breakdown, Profitability forecasts, and

b. cumulative Cash Flow are shown there.

c. Top Revenue This tab displays your top revenue streams by product categories.

d. Top Expenses This tab displays your 4 biggest expense categories and the rest of the expenses as the "other".

e. Break Even Analysis Here you can compare your overall revenues with the expenses.

f. Valuation Displays your company’s estimated value based on Discounted Cash Flow method.

g. Financial Charts On this tab you can visually track your key financial figures in form of charts.

h. Operational Charts Here you may visually track your key performance indicators in form of charts.

i. Benchmark KPIs This tab shows a comparison of performance indicators in the model and in the industry.

j. Sources and Uses On this tab you can see the funding structure as well as sources and uses of the funds.

2 Assumptions and calculations

a. Seasonality Setup On this tab you can enter capacity utilization seasonality.

b. Cost of Goods Sold On this tab you can enter your COGS assumptions.

c. Variable Expenses Here you can fill up your variable expenses associated with revenue.

d. Fixed Expenses Enter fixed expenses and their annual growth rate.

e. Wages Fields to enter your employees assumptions: annual salary, taxes,

e. hire/fire dates, would-be annual FTEs, etc.

f. Development Expenses Here you can input Capital Expenses (CAPEX) for the business.

g. Capitalization Table Shareholder's ownership dilution is calculated here. This tab consists of 4 rounds of financing.

h. Book Assets Here you check internal calculations of the assets depreciation and the closing book value.

3 Statements

a. Income Statement On this tab you can see the monthly Income Statement report - Revenue, EBITDA, Net Profit.

b. Cash Flow Statement Here you can have a comprehensive Monthly Cash Flow Statement (direct method).

c. Cash Flow Statement (indirect method) Here you can have a comprehensive Monthly Cash Flow Statement (indirect method).

d. Balance Sheet The Balance Sheet Statement. Assets, Liabilities, and Equity are displayed.

e. Capital Here you see internal calculations of the loans, interest, and equity.

e. In case of capital return, please, use yellow entry line.

f. Outputs This is the engine of this tool. All core calculations are done here.

4 Setup

a. Time Series The tab to set up: Fiscal Year End, First Fiscal Year.

Built with finmodelslab.com template Table of Contents 03/04/2024

Change Log

Model Name

Go to the Table of Contents

v1.0 - 10 March 2021

Initial release

Built with finmodelslab.com template Change Log 03/04/2024

How To

Model Name

Go to the Table of Contents

This is a guide on how to use this tool.

For more information, consult https://finmodelslab.com or email henry@finmodelslab.com for the support.

Overall Business Model Principles

The Financial Model is designed to forecast an up to 60-month operating budget and

cash flows with a simple set of assumptions about hiring and expenses.

Cover

Here you may type in a name for your business model.

Time Series

Fiscal Year end in the business model - input the last month of the Fiscal Year.

If you don't need this, simply type in Dec.

Initial Fiscal Year in the business model - please, choose your first Fiscal Year.

If you have chosen Dec in the Fiscal Year End than your fiscal year corresponds to the calendar year.

DashBoard

On this tab you have to input your main production & pricing drivers.

CURRENCY, DENOMINATOR & TAX inputs

- Output Currency - insert your currency sign $/€/¥/£ or type in USD/EUR/GBP or any other abbreviation.

- Denomination - use denomination if you want to show outputs in thousands, millions or billions.

- Currency exchange rate - enter your up-to-date exchange rate of the currency in which

you want to display your financial report.

- The corporate tax rate is a really important indicator. So you definitely must input it.

In order to correctly forecast the inventory level, you should enter a safety stock assumption.

DEBTS and GRANT

- Debt assumption - here you can enter up to 3 different loans and a grant.

For a grant you just need to input an amount and select launch date.

Seasonality Setup

On this tab you can enter capacity utilization seasonality assumptions.

Cost of Goods Sold

On this tab you can enter your COGS assumptions.

Variable Expenses

Enter in the column Variable Expenses your would-be percentage of various spending from your total revenue.

Fixed Expenses

On this tab you can enter forecasted different fixed expenses in order to start running the business.

You have multiple options of when to start to accrue the expense and when to end accruing.

You may define periodicity of the accrue for each expense.

It could be one-time, daily, weekly, bi-weekly, monthly, quarterly and etc... This gives you the flexibility to manage expenses.

Wages

The wages tab easily allows you to calculate the expenses for the salaries of your personnel.

Use 1 line per employee/category and simply type in the hire date, fire date, and annual salary.

Next use the Number of Employees section to type in FTE count for each year.

An increase of FTEs means that you are going to hire additional FTE's.

In case of decrease FTEs means you fired some FTEs. New FTEs will be hired/fired on Jan of the relevant year.

If there are raises or changes in salaries, simply type in the Annual Salary Raise appropriate figures.

The program will automatically recalculate the changes made.

Finally, there are Monthly Bonus and Tax Rate columns where you can enter percentage of respective expenses.

Development Expenses

On this sheet you can see a table of business capital expenses.

You have to name categories, choose payment delay, and input the amount of expenses.

Capitalization Table

CapTable require some manual manipulation to be accurate.

The structure enables you to make the necessary modifications.

The CapTable takes you through multiple rounds of financings.

Showing how issued shares to new investors and cost per share impact the investment income.

After each round you will see the ownership, % changes. This is how the dilution works.

Book Assets

You may purchase some assets on a specific date and depreciate them across the entered amount of years using this tab.

Financial Statements Summary

The Summary sheet is a Summary of the key financial reports of your business model.

In addition you have the options to select a year to see detailed outputs.

Top Revenue

Here you can track how much money each category generates.

Top Expenses

Here you can track during the 5-year period 4 biggest expense categories and the "other" which is the rest of the expenses.

Break Even Analysis

Here you can track when your company is supposed to move to a new level.

When its overall revenues become bigger than expenses.

Valuation

Here you can evaluate distribution of current cash flow to Investors - Discounted Cash Flow method.

Financial Charts

Here you can visually track key financial performance over the five years period as well as 24 months period.

Operational Charts

On this tab you can track some internal operational indexes that can be useful for analysis of the internal activity of the business.

Benchmark KPIs

On this tab you can track the main performance indicators in the model and in the industry.

Sources and Uses

On this tab you can see the funding structure as well as sources and uses of the funds.

Built with finmodelslab.com template How to 03/04/2024

How To

Model Name

Go to the Table of Contents

Learn more at https://finmodelslab.com or email henry@finmodelslab.com with questions.

Built with finmodelslab.com template How to 03/04/2024

Time Series

Model Name

Go to the Table of Contents

Time Series - Assumptions

Fiscal Year End December

First Fiscal Year 2021

Your Business Model Start Date 1-Jan-21

Your Business Model End Date 31-Dec-25

THIS IS A TRIAL V

TO UNLOCK THIS R

PURCHASE PREMIUM

Built with finmodelslab.com template Time Series 03/04/2024

DashBoard CURRENCY, DENOMINATOR & TAX DEBT ASSUMPTIONS WORKING CAPITAL ASSUMPTIONS

Model Name Currency Inputs $ Loan Name Amount, $ Launch Term, M Interest, % Select Type Timeframe AR (Revenue) AP (COGS)

Go to Contents Currency Outputs $ Debt_1 1,000,000 Jan-21 36 6% Annuity 0 - 30 Days 50% 30%

Min Cash Month Feb-21 Denomination 1,000 Debt_2 31 - 60 Days 50% 70%

Min Cash ($'000) 1,231.3 Currency exch rate $ / $ 1.000 Debt_3 61 - 90 Days 0% 0%

Inventory, % 25.0% Corporate tax, % 10% Grant 90 - 120 Days 0% 0%

Core Inputs Revenue Breakdown ($'000) - 5 Years to December 2025 Profitability ($'000) - 5 Years to December 2025

Fiscal Year Launch 2021 2022 2023 2024 2025

Product types Production Volume Max Monthly Capacity, units

Product Type 1 Jan-21 1,000 1,100 1,210 1,331 1,464

Product Type 2 Jan-21 900 990 1,089 1,198 1,318

Product Type 3 Jan-21 800 880 968 1,065 1,171

THIS IS A TRIAL VERSION

Product Type 4 Jan-21 700 770 847 932 1,025

Product Type 5 Jan-22 500 550 605 666 732

Product types Average Monthly Capacity Utilization, %

Product Type 1 85% 85% 85% 85% 85%

Product Type 2 80% 80% 80% 80% 80%

Product Type 3 75% 75% 75% 75% 75%

Product Type 4 70% 70% 70% 70% 70%

TO UNLOCK THIS REPORT

Product Type 5 60% 60% 60% 60% 60%

Product types Product Sales Price per unit, $

Product Type 1 100.0 105.0 110.3 115.8 121.6

Product Type 2 90.0 94.5 99.2 104.2 109.4

Product Type 3 80.0 84.0 88.2 92.6 97.2

Product Type 4 70.0 73.5 77.2 81.0 85.1

Product Type 5 60.0 63.0 66.2 69.5 72.9

PURCHASE PREMIUM VERSION

Core Financials ($'000) Cash flow ($'000) - 5 Years to December 2025 Cumulative CashFlow ($'000) - 5 Years to December 2025

Fiscal Year 2021 2022 2023 2024 2025

Revenue 2,799 3,484 4,024 4,647 5,368

COGS (978) (1,174) (1,312) (1,466) (1,640)

GROSS MARGIN 1,822 2,310 2,712 3,181 3,728

GROSS MARGIN % 65% 66% 67% 68% 69%

Variable Expenses (532) (662) (765) (883) (1,020)

CONTRIBUTION MARGIN 1,290 1,648 1,947 2,298 2,708

CONTRIBUTION MARGIN % 46% 47% 48% 49% 50%

Salaries & Wages (538) (662) (789) (918) (1,049)

Fixed Expenditure (91) (91) (91) (91) (91)

NET MARGIN 661 895 1,068 1,290 1,568

NET MARGIN % 24% 26% 27% 28% 29%

EBITDA 661 895 1,068 1,290 1,568

EBITDA % 24% 26% 27% 28% 29%

Depreciation & Amortization (15.8) (8.8) (8.8) (8.5) (7.2)

EBIT 645 886 1,059 1,281 1,561

Net Interest Expense (48) (34) (13) (0) -

Net Profit Before Tax 597 852 1,046 1,281 1,561

Tax Expense (60) (85) (105) (128) (156)

Net Profit After Tax 537 767 941 1,153 1,405

Net Profit After Tax % 19% 22% 23% 25% 26%

Operating Cash Flows 478 756 934 1,142 1,390

Cash 1,442 1,866 2,448 3,561 4,950

Built with finmodelslab.com template Dashboard 03/04/2024

Financial Statements Summary

Model Name Select detailed year: 2021

Go to the Table of Contents

Income Statement ($'000) - 5 Years to December 2025 Income Statement ($'000) - 2021

Year Ending 2021 2022 2023 2024 2025 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Revenue 2,799 3,484 4,024 4,647 5,368 197 209 220 232 244 248 255 251 246 239 237 220

Growth % 24% 16% 16% 15% - 6% 6% 5% 5% 2% 3% (2%) (2%) (3%) (1%) (7%)

COGS (978) (1,174) (1,312) (1,466) (1,640) (69) (73) (77) (81) (85) (87) (89) (88) (86) (83) (83) (77)

% of Revenue (35%) (34%) (33%) (32%) (31%) (35%) (35%) (35%) (35%) (35%) (35%) (35%) (35%) (35%) (35%) (35%) (35%)

GROSS MARGIN 1,822 2,310 2,712 3,181 3,728 128 136 143 151 159 162 166 163 160 156 154 143

GROSS MARGIN % 65% 66% 67% 68% 69% 65% 65% 65% 65% 65% 65% 65% 65% 65% 65% 65% 65%

Variable Expenses (532) (662) (765) (883) (1,020) (37) (40) (42) (44) (46) (47) (49) (48) (47) (45) (45) (42)

% of Revenue (19%) (19%) (19%) (19%) (19%) (19%) (19%) (19%) (19%) (19%) (19%) (19%) (19%) (19%) (19%) (19%) (19%)

THIS IS A TRIAL VERSION

CONTRIBUTION MARGIN 1,290 1,648 1,947 2,298 2,708 91 96 102 107 112 114 118 116 113 110 109 102

CONTRIBUTION MARGIN % 46% 47% 48% 49% 50% 46% 46% 46% 46% 46% 46% 46% 46% 46% 46% 46% 46%

Salaries & Wages (538) (662) (789) (918) (1,049) (45) (45) (45) (45) (45) (45) (45) (45) (45) (45) (45) (45)

% of Revenue (19%) (19%) (20%) (20%) (20%) (23%) (21%) (20%) (19%) (18%) (18%) (18%) (18%) (18%) (19%) (19%) (20%)

Fixed Expenses (91) (91) (91) (91) (91) (8) (8) (8) (8) (8) (8) (8) (8) (8) (8) (8) (8)

% of Revenue (3%) (3%) (2%) (2%) (2%) (4%) (4%) (3%) (3%) (3%) (3%) (3%) (3%) (3%) (3%) (3%) (3%)

EBITDA 661 895 1,068 1,290 1,568 38 44 49 55 60 62 65 63 61 58 57 49

TO UNLOCK THIS REPORT

EBITDA % 24% 26% 27% 28% 29% 20% 21% 22% 23% 25% 25% 26% 25% 25% 24% 24% 22%

Depreciation & Amortization (16) (9) (9) (8) (7) (1) (1) (1) (1) (1) (1) (1) (1) (1) (1) (1) (1)

EBIT 645 886 1,059 1,281 1,561 37 43 48 53 59 61 64 62 60 56 55 48

Net Interest Expense (48) (34) (13) (0) - - (5) (5) (5) (5) (4) (4) (4) (4) (4) (4) (4)

Net Profit Before Tax 597 852 1,046 1,281 1,561 37 38 43 48 54 56 60 58 56 52 52 44

Tax Expense (60) (85) (105) (128) (156) (4) (4) (4) (5) (5) (6) (6) (6) (6) (5) (5) (4)

Net Profit After Tax 537 767 941 1,153 1,405 33 34 39 44 49 51 54 52 50 47 46 40

PURCHASE PREMIUM VERSION

Net Profit After Tax % 19% 22% 23% 25% 26% 17% 16% 18% 19% 20% 20% 21% 21% 20% 20% 20% 18%

Income Statement ($'000) - 5 Years to December 2025 Income Statement ($'000) - 2021

Built with finmodelslab.com template Financial Statements Summary 03/04/2024

Financial Statements Summary

Model Name Select detailed year: 2021

Go to the Table of Contents

Balance Sheet ($'000) - 5 Years to December 2025 Balance Sheet ($'000) - 2021

Year Ending 2021 2022 2023 2024 2025 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Current Assets 1,571 2,027 2,633 3,772 5,194 1,358 1,354 1,376 1,402 1,435 1,468 1,504 1,536 1,565 1,591 1,616 1,571

Non-Current Assets 33 24 16 7 (0) 48 46 45 44 42 41 40 38 37 36 35 33

Total Assets 1,605 2,051 2,648 3,780 5,194 1,405 1,400 1,421 1,446 1,477 1,509 1,544 1,574 1,602 1,626 1,651 1,605

Current Liabilities 54 65 72 81 90 72 59 66 73 82 88 96 101 105 109 113 54

Non-Current Liabilities 713 382 30 0 0 1,000 975 949 923 898 872 846 819 793 767 740 713

Total Liabilities 767 447 103 81 90 1,072 1,033 1,015 997 979 960 942 920 898 875 853 767

Net Assets 837 1,604 2,546 3,699 5,104 333 367 406 450 498 549 602 654 704 751 798 837

THIS IS A TRIAL VERSION

Net Current Assets 1,517 1,962 2,560 3,692 5,104 1,286 1,295 1,310 1,329 1,353 1,379 1,408 1,435 1,460 1,482 1,503 1,517

Ordinary Equity 300 300 300 300 300 300 300 300 300 300 300 300 300 300 300 300 300

Other Equity - - - - - (0) (0) (0) - 0 (0) (0) (0) 0 - (0) -

Retained Profits 537 1,304 2,246 3,399 4,804 33 67 106 150 198 249 302 354 404 451 498 537

Total Equity 837 1,604 2,546 3,699 5,104 333 367 406 450 498 549 602 654 704 751 798 837

Balance Sheet ($'000) - 5 Years to December 2025 Balance Sheet ($'000) - 2021

TO UNLOCK THIS REPORT

PURCHASE PREMIUM VERSION

Built with finmodelslab.com template Financial Statements Summary 03/04/2024

Financial Statements Summary

Model Name Select detailed year: 2021

Go to the Table of Contents

Cash Flow Statement ($'000) - 5 Years to December 2025 Cash Flow Statement ($'000) - 2021

Year Ending 2021 2022 2023 2024 2025 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Cash Receipts 2,689 3,457 4,002 4,623 5,339 99 203 215 226 238 246 252 253 248 243 238 229

Cash Payments (2,104) (2,582) (2,951) (3,352) (3,793) (128) (163) (169) (176) (182) (186) (189) (188) (186) (182) (180) (174)

Other Operating Cash Flows (108) (119) (118) (128) (156) - (5) (5) (5) (5) (4) (4) (4) (4) (4) (4) (63)

Operating Cash Flows 478 756 934 1,142 1,390 (29) 35 40 46 51 56 58 60 58 56 54 (9)

Capital Expenditure (49) - - - - (29) (20) - - - - - - - - - -

Other Investing Cash Flows - - - - - - - - - - - - - - - - -

Investing Cash Flows (49) - - - - (29) (20) - - - - - - - - - -

THIS IS A TRIAL VERSION

Debt Drawdowns/(Repayments) 713 (331) (352) (30) - 1,000 (25) (26) (26) (26) (26) (26) (26) (26) (26) (27) (27)

Equity Raisings/(Buybacks) 300 - - - - 300 - - - - - - - - - - -

Other Financing Cash Flows - - - - - - - - - - - - - - - - -

Financing Cash Flows 1,013 (331) (352) (30) - 1,300 (25) (26) (26) (26) (26) (26) (26) (26) (26) (27) (27)

Change in Cash Held 1,442 424 582 1,112 1,390 1,242 (11) 15 20 25 30 32 34 32 30 27 (35)

Closing Cash 1,442 1,866 2,448 3,561 4,950 1,242 1,231 1,246 1,266 1,292 1,322 1,354 1,388 1,420 1,450 1,477 1,442

TO UNLOCK THIS REPORT

Cash Flow Statement ($'000) - 5 Years to December 2025 Cash Flow Statement ($'000) - 2021

PURCHASE PREMIUM VERSION

Built with finmodelslab.com template Financial Statements Summary 03/04/2024

Top Revenue

Model Name

Go to the Table of Contents

Revenue Summary ($'000) - 5 Years to December 2025

2021 2022 2023 2024 2025 2021 2022 2023 2024 2025

Product Type 1 1,025 1,184 1,368 1,579 1,824 36.6% 34.0% 34.0% 34.0% 34.0%

Product Type 2 781 903 1,043 1,204 1,391 27.9% 25.9% 25.9% 25.9% 25.9%

Product Type 3 579 669 772 892 1,030 20.7% 19.2% 19.2% 19.2% 19.2%

Product Type 4 414 478 552 637 736 14.8% 13.7% 13.7% 13.7% 13.7%

Product Type 5 - 251 290 334 386 - 7.2% 7.2% 7.2% 7.2%

THIS IS A TRIAL VERSION

Total Revenue 2,799 3,484 4,024 4,647 5,368 100.0% 100.0% 100.0% 100.0% 100.0%

Revenue Summary ($'000) - 5 Years to December 2025

TO UNLOCK THIS REPORT

PURCHASE PREMIUM VERSIO

Built with finmodelslab.com template Top Revenue 03/04/2024

PURCHASE PREMIUM VERSIO

Top Revenue

Model Name

Go to the Table of Contents

Revenue Depth ($'000) - 2022 Monthly Run-Rate ($'000) - 2022

2022

THIS IS A TRIAL VERSION

TO UNLOCK THIS REPORT

PURCHASE PREMIUM VERSIO

Revenue Bridge ($'000) - 2021 Total Revenue to 2025 Total Revenue

2021 2025

Built with finmodelslab.com template Top Revenue 03/04/2024

Top Expenses

Model Name

Go to the Table of Contents

Top 5 Expense Categories ($'000) - 5 Years to December 2025

2021 2022 2023 2024 2025 2021 2022 2023 2024 2025

Salaries and Wages 538 662 789 918 1,049 41.9% 42.9% 44.5% 45.3% 45.2%

Warehouse Expenses 280 348 402 465 537 21.8% 22.6% 22.7% 22.9% 23.1%

Losses 140 174 201 232 268 10.9% 11.3% 11.4% 11.5% 11.6%

Other variable expenses 84 105 121 139 161 6.5% 6.8% 6.8% 6.9% 6.9%

Other 242 253 258 274 308 18.8% 16.4% 14.5% 13.5% 13.2%

THIS IS A TRIAL VERSIO

Total Expenses 1,284 1,543 1,771 2,028 2,323 100% 100% 100% 100% 100%

Top 5 Expense Categories ($'000) - 5 Years to December 2025

TO UNLOCK THIS REPOR

PURCHASE PREMIUM VERS

Expenses Depth ($'000) - 2021 Monthly Run-Rate ($'000) - 2021

2021

Expenses Bridge ($'000) - 2021 Total Expenses to 2025 Total Expenses

2021 2025

Built with finmodelslab.com template Top Expenses 03/04/2024

Break Even Analysis

Model Name

Go to the Table of Contents

Break Even Chart ($'000)

THIS IS A TRIAL VERS

TO UNLOCK THIS REPO

PURCHASE PREMIUM VER

Break Even Calculation ($'000)

Fiscal Year 2021 2022 2023 2024 2025

Revenue 2,799 3,484 4,024 4,647 5,368

COGS (978) (1,174) (1,312) (1,466) (1,640)

Gross Margin 1,822 2,310 2,712 3,181 3,728

Variable Expenses (532) (662) (765) (883) (1,020)

Net Margin 1,290 1,648 1,947 2,298 2,708

EBITDA 661 895 1,068 1,290 1,568

Break Even level 1,503 1,682 1,863 2,056 2,274

Net Profit Before Tax 597 852 1,046 1,281 1,561

Net Profit Before Tax % 21.3% 24.5% 26.0% 27.6% 29.1%

Net Profit After Tax 537 767 941 1,153 1,405

Net Profit After Tax % 19.2% 22.0% 23.4% 24.8% 26.2%

Built with finmodelslab.com template Break Even Analysis 03/04/2024

Valuation

Model Name

Go to the Table of Contents

9.58339351300583

WACC Calculation

Cost of Capital

Cost of Resource

Resources Share

Loans 6.0% 76.9% Terminal Valuation Method EBITDA X

Equity 10.0% 23.1% Multiple of Method 5.00

Tax Rate 10.0%

Weighted avg cost of capital (WACC) 6.5%

THIS IS A TRIAL VERS

Free Cash Flow Calculation ($'000)

Free Cash Flow ($'000)

31-Dec-21 31-Dec-22 31-Dec-23 31-Dec-24 31-Dec-25

Financial year 2021 2022 2023 2024 2025

Operating Income 645 886 1,059 1,281 1,561

TO UNLOCK THIS REPO

Tax Expense (60) (85) (105) (128) (156)

Tax-Effected EBIT (Earnings Before Interest) 585 801 955 1,153 1,405

Plus: Depreciation Expense 16 9 9 8 7

Capital Expenditures (49) - - - -

Accounts Receivable 1,400 1,742 2,012 2,324 2,684

Inventory 244 294 328 367 410

Current Liabilities (54) (65) (72) (81) (90)

Non-Current Liabilities (713) (382) (30) (0) (0)

PURCHASE PREMIUM VER

Changes in Working Capital (877) (712) (649) (372) (394)

Unlevered Free Cash Flow (325) 98 315 790 1,018

Free Cash Flow Valuation ($'000)

Discounted Cash Flow ($'000)

Financial year 2021 2022 2023 2024 2025

Terminal Value 7,841

Present Value of Unlevered Free Cash Flow (305) 86 261 615 6,478

NPV based on year 5 7,135

Multiplicator evaluation 10x

Built with finmodelslab.com template Valuation 03/04/2024

Financial Charts

Model Name

Go to the Table of Contents

24 months 5 years

THIS IS A TRIAL VERSION

TO UNLOCK THIS REPORT

PURCHASE PREMIUM VERSION

Built with finmodelslab.com template Financial Charts 03/04/2024

Financial Charts

Model Name

Go to the Table of Contents

24 months 5 years

THIS IS A TRIAL VERSION

TO UNLOCK THIS REPORT

PURCHASE PREMIUM VERSION

Built with finmodelslab.com template Financial Charts 03/04/2024

Operational Charts

Model Name

Go to the Table of Contents

24 months 5 years

THIS IS A TRIAL VERSION

TO UNLOCK THIS REPORT

PURCHASE PREMIUM VERSION

Built with finmodelslab.com template Operational Charts 03/04/2024

Benchmark KPIs

Model Name

Go to the Table of Contents

KPI's KPI's

Industry 2021 2022 2023 2024 2025

Gross margin, % 70.0% 65.1% 66.3% 67.4% 68.5% 69.5%

Contribution margin, % 50.0% 46.1% 47.3% 48.4% 49.5% 50.5%

EBITDA, % 30.0% 23.6% 25.7% 26.5% 27.8% 29.2%

Net Profit, % 25.0% 19.2% 22.0% 23.4% 24.8% 26.2%

Salaries & Wages, % of Revenue 20.0% 19.2% 19.0% 19.6% 19.7% 19.5%

THIS IS A TRIAL VERS

TO UNLOCK THIS REPO

KPI's

PURCHASE PREMIUM VER

KPI's

Built with finmodelslab.com template KPI`s 03/04/2024

Sources and Uses

Model Name

Go to the Table of Contents

Funding Structure ($'000)

Debts 1,000.0 76.9% Debts

Equity 300.0 23.1% Equity

Total Funding 1,300.0 100.0%

Gearing (debt to equity) 3.3x

Debts

THIS IS A TRIAL

Sources of Funds ($'000)

Debt_1

TO UNLOCK THIS

Debt_1 1,000.0 76.9% Debt_2

Debt_2 - - Debt_3

Debt_3 - - Grant

Grant - - Founders

Total Debts 1,000.0 76.9% Series A

Series B

Equity Series C

Founders 300.0 23.1%

PURCHASE PREMIU

Series A - -

Series B - -

Series C - -

Total Equity 300.0 23.1%

Total Funding 1,300.0 100.0%

Sources and Uses ($'000)

First 24 months

Sources Uses

Revenue receipts 6,145.6 82.5% COGS 2,110.0 28.3%

Debt Drawdowns 1,000.0 13.4% Variable Expenses 1,193.7 16.0%

Equity Raisings 300.0 4.0% Fixed Expenses 181.2 2.4%

Salaries & Wages 1,200.8 16.1%

Debt Repayments 618.0 8.3%

Interest Paid 81.7 1.1%

Corporate Tax Paid 144.9 1.9%

Capital Expenditure 49.0 0.7%

Cash in Bank 1,866.2 25.1%

Total Sources 7,445.6 100.0% Total Uses 7,445.6 100.0%

Built with finmodelslab.com template Sources and Uses 03/04/2024

Income Statement

Model Name

Go to the Table of Contents

Fiscal year 2021 2021 2021 2021 2021 2021 2021 2021 2021 2021 2021 2021

Month ### Jan-21 Feb-21 Mar-21 Apr-21 May-21 Jun-21 Jul-21 Aug-21 Sep-21 Oct-21 Nov-21 Dec-21

Income Statement, $

Revenue

Product Type 1 72,250 76,500 80,750 85,000 89,250 90,950 93,500 91,800 90,100 87,550 86,700 80,750

Product Type 2 55,080 58,320 61,560 64,800 68,040 69,336 71,280 69,984 68,688 66,744 66,096 61,560

Product Type 3 40,800 43,200 45,600 48,000 50,400 51,360 52,800 51,840 50,880 49,440 48,960 45,600

Product Type 4 29,155 30,870 32,585 34,300 36,015 36,701 37,730 37,044 36,358 35,329 34,986 32,585

THIS IS A TRIAL VER

Product Type 5 - - - - - - - - - - - -

Total Revenue 197,285 208,890 220,495 232,100 243,705 248,347 255,310 250,668 246,026 239,063 236,742 220,495

COGS

Product Type 1 (26,010) (27,540) (29,070) (30,600) (32,130) (32,742) (33,660) (33,048) (32,436) (31,518) (31,212) (29,070)

Product Type 2 (19,168) (20,295) (21,423) (22,550) (23,678) (24,129) (24,805) (24,354) (23,903) (23,227) (23,001) (21,423)

Product Type 3 (13,880) (14,697) (15,513) (16,330) (17,146) (17,473) (17,963) (17,636) (17,309) (16,819) (16,656) (15,513)

TO UNLOCK THIS RE

Product Type 4 (9,838) (10,416) (10,995) (11,574) (12,152) (12,384) (12,731) (12,499) (12,268) (11,921) (11,805) (10,995)

Product Type 5 - - - - - - - - - - - -

Total COGS (68,896) (72,948) (77,001) (81,054) (85,106) (86,727) (89,159) (87,538) (85,917) (83,485) (82,675) (77,001)

Gross Margin

Product Type 1 46,240 48,960 51,680 54,400 57,120 58,208 59,840 58,752 57,664 56,032 55,488 51,680

Product Type 2 35,912 38,025 40,137 42,250 44,362 45,207 46,475 45,630 44,785 43,517 43,095 40,137

PURCHASE PREMIUM V

Product Type 3 26,920 28,503 30,087 31,670 33,254 33,887 34,837 34,204 33,571 32,621 32,304 30,087

Product Type 4 19,317 20,454 21,590 22,726 23,863 24,317 24,999 24,545 24,090 23,408 23,181 21,590

Product Type 5 - - - - - - - - - - - -

Total Gross Margin 128,389 135,942 143,494 151,046 158,599 161,620 166,151 163,130 160,109 155,578 154,067 143,494

Total Variable Expenses (37,484) (39,689) (41,894) (44,099) (46,304) (47,186) (48,509) (47,627) (46,745) (45,422) (44,981) (41,894)

Total Salary and Wages (44,871) (44,871) (44,871) (44,871) (44,871) (44,871) (44,871) (44,871) (44,871) (44,871) (44,871) (44,871)

Total Fixed Expenses (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550)

EBITDA 38,484 43,832 49,179 54,527 59,874 62,013 65,221 63,082 60,943 57,735 56,666 49,179

Total Depreciation & Amortization (1,315) (1,315) (1,315) (1,315) (1,315) (1,315) (1,315) (1,315) (1,315) (1,315) (1,315) (1,315)

EBIT 37,169 42,517 47,864 53,211 58,559 60,698 63,906 61,767 59,628 56,420 55,350 47,864

Interest Expense - (5,000) (4,873) (4,745) (4,617) (4,488) (4,358) (4,228) (4,097) (3,965) (3,833) (3,700)

Net Profit Before Tax 37,169 37,517 42,991 48,466 53,942 56,210 59,548 57,539 55,531 52,455 51,517 44,164

Tax Expense (3,717) (3,752) (4,299) (4,847) (5,394) (5,621) (5,955) (5,754) (5,553) (5,245) (5,152) (4,416)

Net Profit After Tax 33,452 33,765 38,692 43,620 48,548 50,589 53,593 51,785 49,978 47,209 46,366 39,748

Built with finmodelslab.com template Income Statement 03/04/2024

Income Statement

Model Name

Go to the Table of Contents

Fiscal year 2022 2022 2022 2022 2022 2022 2022 2022 2022 2022 2022 2022

Month ### Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22

Income Statement, $

Revenue

Product Type 1 83,449 88,358 93,266 98,175 103,084 105,047 107,993 106,029 104,066 101,120 100,139 93,266

Product Type 2 63,617 67,360 71,102 74,844 78,586 80,083 82,328 80,832 79,335 77,089 76,341 71,102

Product Type 3 47,124 49,896 52,668 55,440 58,212 59,321 60,984 59,875 58,766 57,103 56,549 52,668

Product Type 4 33,674 35,655 37,636 39,617 41,597 42,390 43,578 42,786 41,993 40,805 40,409 37,636

RIAL VERSION

THIS IS A TRIAL VER

Product Type 5 17,672 18,711 19,751 20,790 21,830 22,245 22,869 22,453 22,037 21,414 21,206 19,751

Total Revenue 245,536 259,979 274,422 288,866 303,309 309,086 317,752 311,975 306,197 297,531 294,643 274,422

COGS

Product Type 1 (29,088) (30,799) (32,510) (34,221) (35,932) (36,616) (37,643) (36,959) (36,274) (35,248) (34,905) (32,510)

Product Type 2 (21,412) (22,671) (23,931) (25,190) (26,450) (26,954) (27,709) (27,206) (26,702) (25,946) (25,694) (23,931)

Product Type 3 (15,486) (16,397) (17,308) (18,219) (19,130) (19,495) (20,041) (19,677) (19,312) (18,766) (18,584) (17,308)

THIS REPORT

TO UNLOCK THIS RE

Product Type 4 (10,962) (11,606) (12,251) (12,896) (13,541) (13,799) (14,186) (13,928) (13,670) (13,283) (13,154) (12,251)

Product Type 5 (5,808) (6,150) (6,491) (6,833) (7,175) (7,311) (7,516) (7,380) (7,243) (7,038) (6,970) (6,491)

Total COGS (82,756) (87,624) (92,492) (97,360) (102,228) (104,175) (107,096) (105,148) (103,201) (100,280) (99,307) (92,492)

Gross Margin

Product Type 1 54,361 57,559 60,756 63,954 67,152 68,431 70,349 69,070 67,791 65,873 65,233 60,756

Product Type 2 42,206 44,688 47,171 49,654 52,136 53,129 54,619 53,626 52,633 51,143 50,647 47,171

EMIUM VERSION

PURCHASE PREMIUM V

Product Type 3 31,638 33,499 35,360 37,221 39,082 39,826 40,943 40,198 39,454 38,337 37,965 35,360

Product Type 4 22,712 24,048 25,384 26,721 28,057 28,591 29,393 28,858 28,324 27,522 27,255 25,384

Product Type 5 11,863 12,561 13,259 13,957 14,655 14,934 15,353 15,073 14,794 14,376 14,236 13,259

Total Gross Margin 162,780 172,355 181,931 191,506 201,081 204,911 210,656 206,826 202,996 197,251 195,336 181,931

Total Variable Expenses (46,652) (49,396) (52,140) (54,884) (57,629) (58,726) (60,373) (59,275) (58,178) (56,531) (55,982) (52,140)

Total Salary and Wages (55,196) (55,196) (55,196) (55,196) (55,196) (55,196) (55,196) (55,196) (55,196) (55,196) (55,196) (55,196)

Total Fixed Expenses (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550)

EBITDA 53,382 60,213 67,044 73,875 80,706 83,439 87,537 84,805 82,073 77,974 76,608 67,044

Total Depreciation & Amortization (732) (732) (732) (732) (732) (732) (732) (732) (732) (732) (732) (732)

EBIT 52,650 59,481 66,312 73,143 79,974 82,707 86,805 84,073 81,341 77,242 75,876 66,312

Interest Expense (3,566) (3,432) (3,297) (3,161) (3,025) (2,888) (2,751) (2,612) (2,473) (2,333) (2,193) (2,052)

Net Profit Before Tax 49,084 56,049 63,015 69,982 76,949 79,819 84,055 81,461 78,867 74,909 73,683 64,260

Tax Expense (4,908) (5,605) (6,302) (6,998) (7,695) (7,982) (8,405) (8,146) (7,887) (7,491) (7,368) (6,426)

Net Profit After Tax 44,175 50,444 56,714 62,984 69,254 71,837 75,649 73,315 70,981 67,418 66,315 57,834

Built with finmodelslab.com template Income Statement 03/04/2024

Income Statement

Model Name

Go to the Table of Contents

Fiscal year 2023 2023 2023 2023 2023 2023 2023 2023 2023 2023 2023 2023

Month ### Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 Sep-23 Oct-23 Nov-23 Dec-23

Income Statement, $

Revenue

Product Type 1 96,383 102,053 107,723 113,392 119,062 121,330 124,731 122,463 120,196 116,794 115,660 107,723

Product Type 2 73,478 77,800 82,123 86,445 90,767 92,496 95,089 93,360 91,632 89,038 88,174 82,123

Product Type 3 54,428 57,630 60,832 64,033 67,235 68,516 70,437 69,156 67,875 65,954 65,314 60,832

Product Type 4 38,893 41,181 43,469 45,757 48,045 48,960 50,333 49,418 48,502 47,130 46,672 43,469

THIS IS A TRIAL VER

Product Type 5 20,411 21,611 22,812 24,012 25,213 25,693 26,414 25,933 25,453 24,733 24,493 22,812

Total Revenue 283,594 300,276 316,958 333,640 350,322 356,994 367,004 360,331 353,658 343,649 340,312 316,958

COGS

Product Type 1 (32,547) (34,462) (36,377) (38,291) (40,206) (40,971) (42,120) (41,354) (40,589) (39,440) (39,057) (36,377)

Product Type 2 (23,931) (25,339) (26,746) (28,154) (29,562) (30,125) (30,969) (30,406) (29,843) (28,999) (28,717) (26,746)

Product Type 3 (17,287) (18,304) (19,321) (20,337) (21,354) (21,761) (22,371) (21,964) (21,558) (20,948) (20,744) (19,321)

TO UNLOCK THIS RE

Product Type 4 (12,220) (12,939) (13,657) (14,376) (15,095) (15,383) (15,814) (15,526) (15,239) (14,807) (14,664) (13,657)

Product Type 5 (6,466) (6,846) (7,226) (7,606) (7,987) (8,139) (8,367) (8,215) (8,063) (7,835) (7,759) (7,226)

Total COGS (92,450) (97,889) (103,327) (108,765) (114,203) (116,379) (119,642) (117,466) (115,291) (112,028) (110,940) (103,327)

Gross Margin

Product Type 1 63,836 67,591 71,346 75,101 78,856 80,358 82,611 81,109 79,607 77,354 76,603 71,346

Product Type 2 49,547 52,462 55,376 58,291 61,205 62,371 64,120 62,954 61,788 60,040 59,457 55,376

PURCHASE PREMIUM V

Product Type 3 37,141 39,326 41,511 43,696 45,881 46,754 48,065 47,191 46,317 45,007 44,570 41,511

Product Type 4 26,674 28,243 29,812 31,381 32,950 33,578 34,519 33,891 33,264 32,322 32,008 29,812

Product Type 5 13,945 14,765 15,586 16,406 17,226 17,554 18,047 17,718 17,390 16,898 16,734 15,586

Total Gross Margin 191,143 202,387 213,631 224,874 236,118 240,616 247,362 242,864 238,367 231,621 229,372 213,631

Total Variable Expenses (53,883) (57,052) (60,222) (63,392) (66,561) (67,829) (69,731) (68,463) (67,195) (65,293) (64,659) (60,222)

Total Salary and Wages (65,732) (65,732) (65,732) (65,732) (65,732) (65,732) (65,732) (65,732) (65,732) (65,732) (65,732) (65,732)

Total Fixed Expenses (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550)

EBITDA 63,979 72,053 80,127 88,201 96,275 99,505 104,350 101,120 97,890 93,046 91,431 80,127

Total Depreciation & Amortization (732) (732) (732) (732) (732) (732) (732) (732) (732) (732) (732) (732)

EBIT 63,247 71,321 79,395 87,469 95,544 98,773 103,618 100,388 97,158 92,314 90,699 79,395

Interest Expense (1,910) (1,767) (1,624) (1,480) (1,335) (1,190) (1,044) (897) (749) (601) (452) (302)

Net Profit Before Tax 61,337 69,554 77,771 85,989 94,208 97,583 102,574 99,491 96,409 91,713 90,247 79,093

Tax Expense (6,134) (6,955) (7,777) (8,599) (9,421) (9,758) (10,257) (9,949) (9,641) (9,171) (9,025) (7,909)

Net Profit After Tax 55,203 62,598 69,994 77,390 84,787 87,825 92,317 89,542 86,768 82,542 81,223 71,184

Built with finmodelslab.com template Income Statement 03/04/2024

Income Statement

Model Name

Go to the Table of Contents

Fiscal year 2024 2024 2024 2024 2024 2024 2024 2024 2024 2024 2024 2024

Month ### Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Oct-24 Nov-24 Dec-24

Income Statement, $

Revenue

Product Type 1 111,323 117,871 124,420 130,968 137,516 140,136 144,065 141,445 138,826 134,897 133,587 124,420

Product Type 2 84,867 89,859 94,852 99,844 104,836 106,833 109,828 107,831 105,834 102,839 101,841 94,852

Product Type 3 62,865 66,563 70,260 73,958 77,656 79,135 81,354 79,875 78,396 76,177 75,438 70,260

Product Type 4 44,922 47,564 50,207 52,849 55,492 56,549 58,134 57,077 56,020 54,435 53,906 50,207

THIS IS A TRIAL VER

Product Type 5 23,574 24,961 26,348 27,734 29,121 29,676 30,508 29,953 29,398 28,566 28,289 26,348

Total Revenue 327,551 346,818 366,086 385,354 404,621 412,329 423,889 416,182 408,475 396,914 393,061 366,086

COGS

Product Type 1 (36,438) (38,582) (40,725) (42,869) (45,012) (45,869) (47,155) (46,298) (45,441) (44,155) (43,726) (40,725)

Product Type 2 (26,760) (28,335) (29,909) (31,483) (33,057) (33,687) (34,631) (34,001) (33,372) (32,427) (32,112) (29,909)

Product Type 3 (19,307) (20,442) (21,578) (22,714) (23,849) (24,303) (24,985) (24,531) (24,076) (23,395) (23,168) (21,578)

TO UNLOCK THIS RE

Product Type 4 (13,629) (14,431) (15,232) (16,034) (16,836) (17,156) (17,637) (17,317) (16,996) (16,515) (16,355) (15,232)

Product Type 5 (7,200) (7,624) (8,048) (8,471) (8,895) (9,064) (9,318) (9,149) (8,979) (8,725) (8,641) (8,048)

Total COGS (103,335) (109,413) (115,492) (121,570) (127,649) (130,080) (133,727) (131,296) (128,864) (125,217) (124,001) (115,492)

Gross Margin

Product Type 1 74,884 79,289 83,694 88,099 92,504 94,266 96,909 95,147 93,385 90,742 89,861 83,694

Product Type 2 58,107 61,525 64,943 68,361 71,779 73,146 75,197 73,830 72,463 70,412 69,728 64,943

PURCHASE PREMIUM V

Product Type 3 43,558 46,120 48,683 51,245 53,807 54,832 56,369 55,344 54,319 52,782 52,270 48,683

Product Type 4 31,293 33,134 34,975 36,815 38,656 39,392 40,497 39,761 39,024 37,920 37,552 34,975

Product Type 5 16,374 17,337 18,300 19,263 20,226 20,612 21,190 20,804 20,419 19,841 19,649 18,300

Total Gross Margin 224,216 237,405 250,595 263,784 276,973 282,249 290,162 284,886 279,611 271,697 269,059 250,595

Total Variable Expenses (62,235) (65,895) (69,556) (73,217) (76,878) (78,342) (80,539) (79,075) (77,610) (75,414) (74,682) (69,556)

Total Salary and Wages (76,481) (76,481) (76,481) (76,481) (76,481) (76,481) (76,481) (76,481) (76,481) (76,481) (76,481) (76,481)

Total Fixed Expenses (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550)

EBITDA 77,951 87,479 97,008 106,536 116,064 119,876 125,593 121,781 117,970 112,253 110,347 97,008

Total Depreciation & Amortization (704) (704) (704) (704) (704) (704) (704) (704) (704) (704) (704) (704)

EBIT 77,247 86,775 96,303 105,832 115,360 119,171 124,888 121,077 117,266 111,549 109,643 96,303

Interest Expense (151) - - - - - - - - - - -

Net Profit Before Tax 77,095 86,775 96,303 105,832 115,360 119,171 124,888 121,077 117,266 111,549 109,643 96,303

Tax Expense (7,710) (8,678) (9,630) (10,583) (11,536) (11,917) (12,489) (12,108) (11,727) (11,155) (10,964) (9,630)

Net Profit After Tax 69,386 78,098 86,673 95,249 103,824 107,254 112,400 108,969 105,539 100,394 98,679 86,673

Built with finmodelslab.com template Income Statement 03/04/2024

Income Statement

Model Name

Go to the Table of Contents

Fiscal year 2025 2025 2025 2025 2025 2025 2025 2025 2025 2025 2025 2025

Month ### Jan-25 Feb-25 Mar-25 Apr-25 May-25 Jun-25 Jul-25 Aug-25 Sep-25 Oct-25 Nov-25 Dec-25

Income Statement, $

Revenue

Product Type 1 128,578 136,141 143,705 151,268 158,831 161,857 166,395 163,369 160,344 155,806 154,293 143,705

Product Type 2 98,022 103,788 109,554 115,320 121,086 123,392 126,852 124,545 122,239 118,779 117,626 109,554

Product Type 3 72,609 76,880 81,151 85,422 89,693 91,401 93,964 92,256 90,547 87,985 87,130 81,151

Product Type 4 51,885 54,937 57,989 61,041 64,093 65,314 67,145 65,924 64,704 62,872 62,262 57,989

THIS IS A TRIAL VER

Product Type 5 27,228 28,830 30,432 32,033 33,635 34,276 35,237 34,596 33,955 32,994 32,674 30,432

Total Revenue 378,321 400,575 422,829 445,084 467,338 476,239 489,592 480,690 471,789 458,436 453,985 422,829

COGS

Product Type 1 (40,817) (43,218) (45,619) (48,020) (50,421) (51,381) (52,822) (51,861) (50,901) (49,460) (48,980) (45,619)

Product Type 2 (29,941) (31,702) (33,463) (35,224) (36,985) (37,690) (38,747) (38,042) (37,338) (36,281) (35,929) (33,463)

Product Type 3 (21,573) (22,842) (24,111) (25,380) (26,649) (27,157) (27,918) (27,411) (26,903) (26,142) (25,888) (24,111)

TO UNLOCK THIS RE

Product Type 4 (15,208) (16,102) (16,997) (17,892) (18,786) (19,144) (19,681) (19,323) (18,965) (18,428) (18,249) (16,997)

Product Type 5 (8,023) (8,494) (8,966) (9,438) (9,910) (10,099) (10,382) (10,193) (10,005) (9,721) (9,627) (8,966)

Total COGS (115,561) (122,359) (129,157) (135,954) (142,752) (145,471) (149,550) (146,831) (144,112) (140,033) (138,673) (129,157)

Gross Margin

Product Type 1 87,761 92,923 98,086 103,248 108,411 110,476 113,573 111,508 109,443 106,346 105,313 98,086

Product Type 2 68,081 72,086 76,091 80,095 84,100 85,702 88,105 86,503 84,901 82,498 81,697 76,091

PURCHASE PREMIUM V

Product Type 3 51,035 54,037 57,040 60,042 63,044 64,245 66,046 64,845 63,644 61,843 61,242 57,040

Product Type 4 36,677 38,834 40,992 43,149 45,307 46,170 47,464 46,601 45,738 44,444 44,012 40,992

Product Type 5 19,206 20,335 21,465 22,595 23,725 24,177 24,854 24,402 23,951 23,273 23,047 21,465

Total Gross Margin 262,760 278,216 293,673 309,129 324,586 330,768 340,042 333,860 327,677 318,403 315,312 293,673

Total Variable Expenses (71,881) (76,109) (80,338) (84,566) (88,794) (90,486) (93,022) (91,331) (89,640) (87,103) (86,257) (80,338)

Total Salary and Wages (87,447) (87,447) (87,447) (87,447) (87,447) (87,447) (87,447) (87,447) (87,447) (87,447) (87,447) (87,447)

Total Fixed Expenses (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550) (7,550)

EBITDA 95,882 107,110 118,338 129,566 140,795 145,286 152,023 147,532 143,040 136,303 134,058 118,338

Total Depreciation & Amortization (600) (600) (600) (600) (600) (600) (600) (600) (600) (600) (600) (600)

EBIT 95,282 106,510 117,738 128,966 140,195 144,686 151,423 146,932 142,440 135,703 133,458 117,738

Interest Expense - - - - - - - - - - - -

Net Profit Before Tax 95,282 106,510 117,738 128,966 140,195 144,686 151,423 146,932 142,440 135,703 133,458 117,738

Tax Expense (9,528) (10,651) (11,774) (12,897) (14,019) (14,469) (15,142) (14,693) (14,244) (13,570) (13,346) (11,774)

Net Profit After Tax 85,754 95,859 105,964 116,070 126,175 130,217 136,281 132,238 128,196 122,133 120,112 105,964

Built with finmodelslab.com template Income Statement 03/04/2024

Cash Flow Statement

Model Name

Go to the Table of Contents

Fiscal year 2021 2021 2021 2021 2021 2021 2021 2021 2021 2021 2021 2021

Month Jan-21 Feb-21 Mar-21 Apr-21 May-21 Jun-21 Jul-21 Aug-21 Sep-21 Oct-21 Nov-21 Dec-21

Cash Flow Statement, $

Cash Flow from Operating Activities

Cash Receipts 98,643 203,088 214,693 226,298 237,903 246,026 251,829 252,989 248,347 242,545 237,903 228,619

Cash Payments (127,798) (163,234) (169,492) (175,750) (182,007) (185,605) (188,994) (188,315) (185,812) (182,422) (180,441) (173,869)

Interest Paid - (5,000) (4,873) (4,745) (4,617) (4,488) (4,358) (4,228) (4,097) (3,965) (3,833) (3,700)

Corporate Tax Paid - - - - - - - - - - - (59,705)

THIS IS A TRIAL VERSI

CASH INFLOW 98,643 203,088 214,693 226,298 237,903 246,026 251,829 252,989 248,347 242,545 237,903 228,619

CASH OUTFLOW (127,798) (168,234) (174,365) (180,495) (186,624) (190,092) (193,353) (192,543) (189,909) (186,387) (184,274) (237,274)

Net Cash Flow from Operating Activities (29,155) 34,853 40,328 45,803 51,278 55,934 58,476 60,446 58,438 56,157 53,628 (8,655)

Cash Flow from Investing Activities

Fixed Assets Capital Expenditure (29,000) (20,000) - - - - - - - - - -

Net Cash Flow from Investing Activities (29,000) (20,000) - - - - - - - - - -

TO UNLOCK THIS REPO

Cash Flow from Financing Activities

Debt Drawdowns 1,000,000 - - - - - - - - - - -

Debt Repayments - (25,422) (25,549) (25,677) (25,805) (25,934) (26,064) (26,194) (26,325) (26,457) (26,589) (26,722)

Ordinary Equity Raisings 300,000 - - - - - - - - - - -

Ordinary Equity Buybacks - - - - - - - - - - - -

Ordinary Equity Dividends Paid - - - - - - - - - - - -

Other Financing Cash Flows - - - - - - - - - - - -

PURCHASE PREMIUM VER

Net Cash Flow from Financing Activities 1,300,000 (25,422) (25,549) (25,677) (25,805) (25,934) (26,064) (26,194) (26,325) (26,457) (26,589) (26,722)

Net Increase/(Decrease) in Cash Held 1,241,845 (10,569) 14,778 20,126 25,473 29,999 32,412 34,252 32,113 29,700 27,039 (35,377)

Interest on Cash Breakdown

Net Cash Flow from Investing Activities (29,000) (20,000) - - - - - - - - - -

Net Cash Flow from Financing Activities 1,300,000 (25,422) (25,549) (25,677) (25,805) (25,934) (26,064) (26,194) (26,325) (26,457) (26,589) (26,722)

Cash Receipts 98,643 203,088 214,693 226,298 237,903 246,026 251,829 252,989 248,347 242,545 237,903 228,619

Cash Payments (127,798) (163,234) (169,492) (175,750) (182,007) (185,605) (188,994) (188,315) (185,812) (182,422) (180,441) (173,869)

Change in Cash (Pre-Corporate Tax & Interest on Cash) 1,241,845 (5,569) 19,651 24,871 30,090 34,487 36,770 38,480 36,210 33,665 30,872 28,027

Interest Paid - (5,000) (4,873) (4,745) (4,617) (4,488) (4,358) (4,228) (4,097) (3,965) (3,833) (3,700)

Corporate Tax Paid - - - - - - - - - - - (59,705)

Net Increase/(Decrease) in Cash Held 1,241,845 (10,569) 14,778 20,126 25,473 29,999 32,412 34,252 32,113 29,700 27,039 (35,377)

Built with finmodelslab.com template Cash Flow Statement 03/04/2024

Cash Flow Statement

Model Name

Go to the Table of Contents

Fiscal year 2022 2022 2022 2022 2022 2022 2022 2022 2022 2022 2022 2022

Month Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22

Cash Flow Statement, $

Cash Flow from Operating Activities

Cash Receipts 233,015 252,757 267,201 281,644 296,087 306,197 313,419 314,863 309,086 301,864 296,087 284,533

Cash Payments (189,564) (197,575) (205,187) (212,800) (220,412) (224,771) (228,900) (228,046) (225,001) (220,872) (218,473) (210,445)

Interest Paid (3,566) (3,432) (3,297) (3,161) (3,025) (2,888) (2,751) (2,612) (2,473) (2,333) (2,193) (2,052)

Corporate Tax Paid - - - - - - - - - - - (85,213)

RIAL VERSION

THIS IS A TRIAL VERSI

CASH INFLOW 233,015 252,757 267,201 281,644 296,087 306,197 313,419 314,863 309,086 301,864 296,087 284,533

CASH OUTFLOW (193,130) (201,007) (208,485) (215,961) (223,437) (227,659) (231,651) (230,658) (227,474) (223,205) (220,666) (297,710)

Net Cash Flow from Operating Activities 39,885 51,750 58,716 65,683 72,650 78,538 81,768 84,205 81,612 78,659 75,421 (13,177)

Cash Flow from Investing Activities

Fixed Assets Capital Expenditure - - - - - - - - - - - -

Net Cash Flow from Investing Activities - - - - - - - - - - - -

THIS REPORT

TO UNLOCK THIS REPO

Cash Flow from Financing Activities

Debt Drawdowns - - - - - - - - - - - -

Debt Repayments (26,856) (26,990) (27,125) (27,260) (27,397) (27,534) (27,671) (27,810) (27,949) (28,089) (28,229) (28,370)

Ordinary Equity Raisings - - - - - - - - - - - -

Ordinary Equity Buybacks - - - - - - - - - - - -

Ordinary Equity Dividends Paid - - - - - - - - - - - -

Other Financing Cash Flows - - - - - - - - - - - -

EMIUM VERSION

PURCHASE PREMIUM VER

Net Cash Flow from Financing Activities (26,856) (26,990) (27,125) (27,260) (27,397) (27,534) (27,671) (27,810) (27,949) (28,089) (28,229) (28,370)

Net Increase/(Decrease) in Cash Held 13,029 24,760 31,591 38,422 45,253 51,004 54,097 56,395 53,663 50,571 47,192 (41,548)

Interest on Cash Breakdown

Net Cash Flow from Investing Activities - - - - - - - - - - - -

Net Cash Flow from Financing Activities (26,856) (26,990) (27,125) (27,260) (27,397) (27,534) (27,671) (27,810) (27,949) (28,089) (28,229) (28,370)

Cash Receipts 233,015 252,757 267,201 281,644 296,087 306,197 313,419 314,863 309,086 301,864 296,087 284,533

Cash Payments (189,564) (197,575) (205,187) (212,800) (220,412) (224,771) (228,900) (228,046) (225,001) (220,872) (218,473) (210,445)

Change in Cash (Pre-Corporate Tax & Interest on Cash) 16,596 28,192 34,888 41,584 48,278 53,893 56,847 59,008 56,136 52,904 49,385 45,717

Interest Paid (3,566) (3,432) (3,297) (3,161) (3,025) (2,888) (2,751) (2,612) (2,473) (2,333) (2,193) (2,052)

Corporate Tax Paid - - - - - - - - - - - (85,213)

Net Increase/(Decrease) in Cash Held 13,029 24,760 31,591 38,422 45,253 51,004 54,097 56,395 53,663 50,571 47,192 (41,548)

Built with finmodelslab.com template Cash Flow Statement 03/04/2024

Cash Flow Statement

Model Name

Go to the Table of Contents

Fiscal year 2023 2023 2023 2023 2023 2023 2023 2023 2023 2023 2023 2023

Month Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 Sep-23 Oct-23 Nov-23 Dec-23

Cash Flow Statement, $

Cash Flow from Operating Activities

Cash Receipts 279,008 291,935 308,617 325,299 341,981 353,658 361,999 363,667 356,994 348,653 341,981 328,635

Cash Payments (219,633) (225,775) (234,383) (242,991) (251,599) (256,510) (261,186) (260,190) (256,747) (252,071) (249,371) (240,257)

Interest Paid (1,910) (1,767) (1,624) (1,480) (1,335) (1,190) (1,044) (897) (749) (601) (452) (302)

Corporate Tax Paid - - - - - - - - - - - (104,597)

THIS IS A TRIAL VERSI

CASH INFLOW 279,008 291,935 308,617 325,299 341,981 353,658 361,999 363,667 356,994 348,653 341,981 328,635

CASH OUTFLOW (221,543) (227,543) (236,007) (244,471) (252,934) (257,700) (262,229) (261,087) (257,496) (252,672) (249,823) (345,156)

Net Cash Flow from Operating Activities 57,465 64,392 72,609 80,827 89,046 95,958 99,770 102,581 99,499 95,981 92,158 (16,521)

Cash Flow from Investing Activities

Fixed Assets Capital Expenditure - - - - - - - - - - - -

Net Cash Flow from Investing Activities - - - - - - - - - - - -

TO UNLOCK THIS REPO

Cash Flow from Financing Activities

Debt Drawdowns - - - - - - - - - - - -

Debt Repayments (28,512) (28,655) (28,798) (28,942) (29,087) (29,232) (29,378) (29,525) (29,673) (29,821) (29,970) (30,120)

Ordinary Equity Raisings - - - - - - - - - - - -

Ordinary Equity Buybacks - - - - - - - - - - - -

Ordinary Equity Dividends Paid - - - - - - - - - - - -

Other Financing Cash Flows - - - - - - - - - - - -

PURCHASE PREMIUM VER

Net Cash Flow from Financing Activities (28,512) (28,655) (28,798) (28,942) (29,087) (29,232) (29,378) (29,525) (29,673) (29,821) (29,970) (30,120)

Net Increase/(Decrease) in Cash Held 28,953 35,737 43,811 51,886 59,960 66,726 70,391 73,056 69,826 66,160 62,188 (46,640)

Interest on Cash Breakdown

Net Cash Flow from Investing Activities - - - - - - - - - - - -

Net Cash Flow from Financing Activities (28,512) (28,655) (28,798) (28,942) (29,087) (29,232) (29,378) (29,525) (29,673) (29,821) (29,970) (30,120)

Cash Receipts 279,008 291,935 308,617 325,299 341,981 353,658 361,999 363,667 356,994 348,653 341,981 328,635

Cash Payments (219,633) (225,775) (234,383) (242,991) (251,599) (256,510) (261,186) (260,190) (256,747) (252,071) (249,371) (240,257)

Change in Cash (Pre-Corporate Tax & Interest on Cash) 30,863 37,505 45,436 53,366 61,295 67,916 71,435 73,952 70,575 66,761 62,640 58,259

Interest Paid (1,910) (1,767) (1,624) (1,480) (1,335) (1,190) (1,044) (897) (749) (601) (452) (302)

Corporate Tax Paid - - - - - - - - - - - (104,597)

Net Increase/(Decrease) in Cash Held 28,953 35,737 43,811 51,886 59,960 66,726 70,391 73,056 69,826 66,160 62,188 (46,640)

Built with finmodelslab.com template Cash Flow Statement 03/04/2024

Cash Flow Statement

Model Name

Go to the Table of Contents

Fiscal year 2024 2024 2024 2024 2024 2024 2024 2024 2024 2024 2024 2024

Month Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Oct-24 Nov-24 Dec-24

Cash Flow Statement, $

Cash Flow from Operating Activities

Cash Receipts 322,254 337,185 356,452 375,720 394,988 408,475 418,109 420,036 412,329 402,695 394,988 379,573

Cash Payments (249,596) (256,604) (266,343) (276,083) (285,822) (291,359) (296,655) (295,495) (291,599) (286,303) (283,261) (272,908)

Interest Paid (151) - - - - - - - - - - -

Corporate Tax Paid - - - - - - - - - - - (128,126)

THIS IS A TRIAL VERSI

CASH INFLOW 322,254 337,185 356,452 375,720 394,988 408,475 418,109 420,036 412,329 402,695 394,988 379,573

CASH OUTFLOW (249,748) (256,604) (266,343) (276,083) (285,822) (291,359) (296,655) (295,495) (291,599) (286,303) (283,261) (401,034)

Net Cash Flow from Operating Activities 72,506 80,581 90,109 99,637 109,166 117,116 121,453 124,541 120,729 116,392 111,727 (21,461)

Cash Flow from Investing Activities

Fixed Assets Capital Expenditure - - - - - - - - - - - -

Net Cash Flow from Investing Activities - - - - - - - - - - - -

TO UNLOCK THIS REPO

Cash Flow from Financing Activities

Debt Drawdowns - - - - - - - - - - - -

Debt Repayments (30,271) - - - - - - - - - - -

Ordinary Equity Raisings - - - - - - - - - - - -

Ordinary Equity Buybacks - - - - - - - - - - - -

Ordinary Equity Dividends Paid - - - - - - - - - - - -

Other Financing Cash Flows - - - - - - - - - - - -

PURCHASE PREMIUM VER

Net Cash Flow from Financing Activities (30,271) - - - - - - - - - - -

Net Increase/(Decrease) in Cash Held 42,236 80,581 90,109 99,637 109,166 117,116 121,453 124,541 120,729 116,392 111,727 (21,461)

Interest on Cash Breakdown

Net Cash Flow from Investing Activities - - - - - - - - - - - -

Net Cash Flow from Financing Activities (30,271) - - - - - - - - - - -

Cash Receipts 322,254 337,185 356,452 375,720 394,988 408,475 418,109 420,036 412,329 402,695 394,988 379,573

Cash Payments (249,596) (256,604) (266,343) (276,083) (285,822) (291,359) (296,655) (295,495) (291,599) (286,303) (283,261) (272,908)

Change in Cash (Pre-Corporate Tax & Interest on Cash) 42,387 80,581 90,109 99,637 109,166 117,116 121,453 124,541 120,729 116,392 111,727 106,665

Interest Paid (151) - - - - - - - - - - -

Corporate Tax Paid - - - - - - - - - - - (128,126)

Net Increase/(Decrease) in Cash Held 42,236 80,581 90,109 99,637 109,166 117,116 121,453 124,541 120,729 116,392 111,727 (21,461)

Built with finmodelslab.com template Cash Flow Statement 03/04/2024

Cash Flow Statement

Model Name

Go to the Table of Contents

Fiscal year 2025 2025 2025 2025 2025 2025 2025 2025 2025 2025 2025 2025

Month Jan-25 Feb-25 Mar-25 Apr-25 May-25 Jun-25 Jul-25 Aug-25 Sep-25 Oct-25 Nov-25 Dec-25

Cash Flow Statement, $

Cash Flow from Operating Activities

Cash Receipts 372,204 389,448 411,702 433,957 456,211 471,789 482,916 485,141 476,239 465,112 456,211 438,407

Cash Payments (282,408) (290,406) (301,432) (312,458) (323,484) (329,730) (335,734) (334,382) (329,972) (323,968) (320,539) (308,774)

Interest Paid - - - - - - - - - - - -

Corporate Tax Paid - - - - - - - - - - - (156,107)

THIS IS A TRIAL VERSI

CASH INFLOW 372,204 389,448 411,702 433,957 456,211 471,789 482,916 485,141 476,239 465,112 456,211 438,407

CASH OUTFLOW (282,408) (290,406) (301,432) (312,458) (323,484) (329,730) (335,734) (334,382) (329,972) (323,968) (320,539) (464,881)

Net Cash Flow from Operating Activities 89,796 99,042 110,270 121,498 132,727 142,059 147,182 150,759 146,268 141,144 135,671 (26,473)

Cash Flow from Investing Activities

Fixed Assets Capital Expenditure - - - - - - - - - - - -

Net Cash Flow from Investing Activities - - - - - - - - - - - -

TO UNLOCK THIS REPO

Cash Flow from Financing Activities

Debt Drawdowns - - - - - - - - - - - -

Debt Repayments - - - - - - - - - - - -

Ordinary Equity Raisings - - - - - - - - - - - -

Ordinary Equity Buybacks - - - - - - - - - - - -

Ordinary Equity Dividends Paid - - - - - - - - - - - -

Other Financing Cash Flows - - - - - - - - - - - -

PURCHASE PREMIUM VER

Net Cash Flow from Financing Activities - - - - - - - - - - - -

Net Increase/(Decrease) in Cash Held 89,796 99,042 110,270 121,498 132,727 142,059 147,182 150,759 146,268 141,144 135,671 (26,473)

Interest on Cash Breakdown

Net Cash Flow from Investing Activities - - - - - - - - - - - -

Net Cash Flow from Financing Activities - - - - - - - - - - - -

Cash Receipts 372,204 389,448 411,702 433,957 456,211 471,789 482,916 485,141 476,239 465,112 456,211 438,407

Cash Payments (282,408) (290,406) (301,432) (312,458) (323,484) (329,730) (335,734) (334,382) (329,972) (323,968) (320,539) (308,774)

Change in Cash (Pre-Corporate Tax & Interest on Cash) 89,796 99,042 110,270 121,498 132,727 142,059 147,182 150,759 146,268 141,144 135,671 129,634

Interest Paid - - - - - - - - - - - -

Corporate Tax Paid - - - - - - - - - - - (156,107)

Net Increase/(Decrease) in Cash Held 89,796 99,042 110,270 121,498 132,727 142,059 147,182 150,759 146,268 141,144 135,671 (26,473)

Built with finmodelslab.com template Cash Flow Statement 03/04/2024

Cash Flow Statement (indirect method)

Model Name

Go to the Table of Contents

Fiscal year 2021 2021 2021 2021 2021 2021 2021 2021 2021 2021 2021 2021

Month Jan-21 Feb-21 Mar-21 Apr-21 May-21 Jun-21 Jul-21 Aug-21 Sep-21 Oct-21 Nov-21 Dec-21

Cash Flow Statement, $

THIS IS A TRIAL VERSI

TO UNLOCK THIS REPO

PURCHASE PREMIUM VER

Built with finmodelslab.com template Cash Flow Statement 03/04/2024

Cash Flow Statement (indirect method)

Model Name

Go to the Table of Contents

Fiscal year 2022 2022 2022 2022 2022 2022 2022 2022 2022 2022 2022 2022

Month Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22

Cash Flow Statement, $

RIAL VERSION

THIS IS A TRIAL VERSI

K THIS REPORT

TO UNLOCK THIS REPO

EMIUM VERSION

PURCHASE PREMIUM VER

Built with finmodelslab.com template Cash Flow Statement 03/04/2024

Cash Flow Statement (indirect method)

Model Name

Go to the Table of Contents

Fiscal year 2023 2023 2023 2023 2023 2023 2023 2023 2023 2023 2023 2023

Month Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 Sep-23 Oct-23 Nov-23 Dec-23

Cash Flow Statement, $

THIS IS A TRIAL VERSI

TO UNLOCK THIS REPO

PURCHASE PREMIUM VER

Built with finmodelslab.com template Cash Flow Statement 03/04/2024

Cash Flow Statement (indirect method)

Model Name

Go to the Table of Contents

Fiscal year 2024 2024 2024 2024 2024 2024 2024 2024 2024 2024 2024

Month Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Oct-24 Nov-24

Cash Flow Statement, $

THIS IS A TRIAL VERSI

TO UNLOCK THIS REPO

PURCHASE PREMIUM VER

Built with finmodelslab.com template Cash Flow Statement 03/04/2024

Cash Flow Statement (indirect method)

Model Name

Go to the Table of Contents

Fiscal year 2024

Month Dec-24

Cash Flow Statement, $

THIS IS A TRIAL VERSI

TO UNLOCK THIS REPO

PURCHASE PREMIUM VER

Built with finmodelslab.com template Cash Flow Statement 03/04/2024

Cash Flow Statement (indirect method)

Model Name

Go to the Table of Contents

Fiscal year 2025 2025 2025 2025 2025 2025 2025 2025 2025 2025 2025

Month Jan-25 Feb-25 Mar-25 Apr-25 May-25 Jun-25 Jul-25 Aug-25 Sep-25 Oct-25 Nov-25

Cash Flow Statement, $

THIS IS A TRIAL VERSI

TO UNLOCK THIS REPO

PURCHASE PREMIUM VER

Built with finmodelslab.com template Cash Flow Statement 03/04/2024

Cash Flow Statement (indirect method)

Model Name

Go to the Table of Contents

Fiscal year 2025

Month Dec-25

Cash Flow Statement, $

THIS IS A TRIAL VERSI

TO UNLOCK THIS REPO

PURCHASE PREMIUM VER

Built with finmodelslab.com template Cash Flow Statement 03/04/2024

Balance Sheet

Model Name

Go to the Table of Contents

Fiscal year 2021 2021 2021 2021 2021 2021 2021 2021 2021 2021 2021 2021

Month Jan-21 Feb-21 Mar-21 Apr-21 May-21 Jun-21 Jul-21 Aug-21 Sep-21 Oct-21 Nov-21 Dec-21

Balance Sheet, $

Current Assets

Cash 1,241,845 1,231,276 1,246,055 1,266,180 1,291,654 1,321,653 1,354,065 1,388,317 1,420,430 1,450,130 1,477,170 1,441,792

Accounts Receivable 98,643 104,445 110,248 116,050 121,853 124,174 127,655 125,334 123,013 119,532 118,371 110,248

Inventory 17,224 18,237 19,250 20,263 21,277 21,682 22,290 21,884 21,479 20,871 20,669 19,250

THIS IS A TRIAL VER

Total Current Assets 1,357,711 1,353,958 1,375,552 1,402,494 1,434,783 1,467,508 1,504,010 1,535,535 1,564,922 1,590,533 1,616,209 1,571,290

Non-Current Assets

Assets Closing Net Book Value 47,685 46,369 45,054 43,739 42,424 41,108 39,793 38,478 37,163 35,847 34,532 33,217

CAPEX Prepayment - - - - - - - - - - - -

Fixed Assets 47,685 46,369 45,054 43,739 42,424 41,108 39,793 38,478 37,163 35,847 34,532 33,217

Total Non-Current Assets 47,685 46,369 45,054 43,739 42,424 41,108 39,793 38,478 37,163 35,847 34,532 33,217

Total Assets 1,405,396 1,400,328 1,420,606 1,446,233 1,477,206 1,508,617 1,543,803 1,574,013 1,602,085 1,626,380 1,650,741 1,604,507

TO UNLOCK THIS RE

Current Liabilities

CAPEX Payable 20,000 - - - - - - - - - - -

Accounts Payable 48,227 51,064 53,901 56,738 59,574 60,709 62,411 61,277 60,142 58,440 57,872 53,901

Corporate Tax Payable 3,717 7,469 11,768 16,614 22,008 27,629 33,584 39,338 44,891 50,137 55,289 -

Total Current Liabilities 71,944 58,532 65,668 73,352 81,583 88,339 95,996 100,615 105,033 108,576 113,161 53,901

Non-Current Liabilities

PURCHASE PREMIUM V

Debt 1,000,000 974,578 949,029 923,352 897,547 871,613 845,549 819,355 793,030 766,573 739,984 713,262

Other Non-Current Liabilities - - - - - - - - - - - -

Total Non-Current Liabilities 1,000,000 974,578 949,029 923,352 897,547 871,613 845,549 819,355 793,030 766,573 739,984 713,262

Total Liabilities 1,071,944 1,033,110 1,014,697 996,704 979,130 959,951 941,545 919,969 898,063 875,149 853,145 767,162

Net Assets 333,452 367,217 405,909 449,529 498,076 548,665 602,258 654,044 704,022 751,231 797,597 837,344

Ordinary Equity 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000

Retained Profits 33,452 67,217 105,909 149,529 198,076 248,665 302,258 354,044 404,022 451,231 497,597 537,344

Total Equity 333,452 367,217 405,909 449,529 498,076 548,665 602,258 654,044 704,022 751,231 797,597 837,344

Built with finmodelslab.com template Balance Sheet 03/04/2024

Balance Sheet

Model Name

Go to the Table of Contents

Fiscal year 2022 2022 2022 2022 2022 2022 2022 2022 2022 2022 2022 2022

Month Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22

Balance Sheet, $

Current Assets

Cash 1,454,822 1,479,582 1,511,173 1,549,595 1,594,848 1,645,853 1,699,950 1,756,345 1,810,008 1,860,579 1,907,771 1,866,223

Accounts Receivable 122,768 129,989 137,211 144,433 151,654 154,543 158,876 155,987 153,099 148,766 147,321 137,211

Inventory 20,689 21,906 23,123 24,340 25,557 26,044 26,774 26,287 25,800 25,070 24,827 23,123

TRIAL VERSION

THIS IS A TRIAL VER

Total Current Assets 1,598,278 1,631,477 1,671,507 1,718,368 1,772,060 1,826,440 1,885,600 1,938,620 1,988,907 2,034,414 2,079,919 2,026,557

Non-Current Assets

Assets Closing Net Book Value 32,485 31,753 31,021 30,289 29,557 28,825 28,093 27,361 26,629 25,897 25,165 24,433

CAPEX Prepayment - - - - - - - - - - - -

Fixed Assets 32,485 31,753 31,021 30,289 29,557 28,825 28,093 27,361 26,629 25,897 25,165 24,433

Total Non-Current Assets 32,485 31,753 31,021 30,289 29,557 28,825 28,093 27,361 26,629 25,897 25,165 24,433

Total Assets 1,630,763 1,663,230 1,702,528 1,748,657 1,801,617 1,855,265 1,913,693 1,965,981 2,015,536 2,060,312 2,105,084 2,050,990

K THIS REPORT

TO UNLOCK THIS RE

Current Liabilities

CAPEX Payable - - - - - - - - - - - -

Accounts Payable 57,929 61,337 64,744 68,152 71,559 72,922 74,967 73,604 72,241 70,196 69,515 64,744

Corporate Tax Payable 4,908 10,513 16,815 23,813 31,508 39,490 47,895 56,041 63,928 71,419 78,787 -

Total Current Liabilities 62,837 71,850 81,559 91,965 103,067 112,412 122,862 129,645 136,169 141,615 148,302 64,744

Non-Current Liabilities

REMIUM VERSION

PURCHASE PREMIUM V

Debt 686,406 659,416 632,291 605,031 577,634 550,100 522,429 494,619 466,670 438,582 410,353 381,982

Other Non-Current Liabilities - - - - - - - - - - - -

Total Non-Current Liabilities 686,406 659,416 632,291 605,031 577,634 550,100 522,429 494,619 466,670 438,582 410,353 381,982

Total Liabilities 749,243 731,266 713,850 696,996 680,701 662,512 645,291 624,264 602,839 580,197 558,655 446,727

Net Assets 881,520 931,964 988,677 1,051,661 1,120,915 1,192,752 1,268,402 1,341,716 1,412,697 1,480,115 1,546,429 1,604,264

Ordinary Equity 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000

Retained Profits 581,520 631,964 688,677 751,661 820,915 892,752 968,402 1,041,716 1,112,697 1,180,115 1,246,429 1,304,264

Total Equity 881,520 931,964 988,677 1,051,661 1,120,915 1,192,752 1,268,402 1,341,716 1,412,697 1,480,115 1,546,429 1,604,264

Built with finmodelslab.com template Balance Sheet 03/04/2024

Balance Sheet

Model Name

Go to the Table of Contents

Fiscal year 2023 2023 2023 2023 2023 2023 2023 2023 2023 2023 2023 2023

Month Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 Sep-23 Oct-23 Nov-23 Dec-23

Balance Sheet, $

Current Assets

Cash 1,895,176 1,930,913 1,974,724 2,026,610 2,086,570 2,153,296 2,223,687 2,296,743 2,366,568 2,432,729 2,494,916 2,448,276

Accounts Receivable 141,797 150,138 158,479 166,820 175,161 178,497 183,502 180,165 176,829 171,824 170,156 158,479

Inventory 23,113 24,472 25,832 27,191 28,551 29,095 29,910 29,367 28,823 28,007 27,735 25,832

THIS IS A TRIAL VER

Total Current Assets 2,060,085 2,105,523 2,159,035 2,220,621 2,290,282 2,360,887 2,437,099 2,506,275 2,572,220 2,632,560 2,692,808 2,632,587

Non-Current Assets

Assets Closing Net Book Value 23,701 22,969 22,238 21,506 20,774 20,042 19,310 18,578 17,846 17,114 16,382 15,650

CAPEX Prepayment - - - - - - - - - - - -

Fixed Assets 23,701 22,969 22,238 21,506 20,774 20,042 19,310 18,578 17,846 17,114 16,382 15,650

Total Non-Current Assets 23,701 22,969 22,238 21,506 20,774 20,042 19,310 18,578 17,846 17,114 16,382 15,650

Total Assets 2,083,786 2,128,492 2,181,273 2,242,127 2,311,055 2,380,929 2,456,409 2,524,852 2,590,066 2,649,674 2,709,190 2,648,237

TO UNLOCK THIS RE

Current Liabilities

CAPEX Payable - - - - - - - - - - - -

Accounts Payable 64,715 68,522 72,329 76,136 79,942 81,465 83,749 82,226 80,704 78,420 77,658 72,329

Corporate Tax Payable 6,134 13,089 20,866 29,465 38,886 48,644 58,902 68,851 78,492 87,663 96,688 -

Total Current Liabilities 70,849 81,611 93,195 105,601 118,828 130,109 142,651 151,077 159,195 166,083 174,346 72,329

Non-Current Liabilities

PURCHASE PREMIUM V

Debt 353,470 324,816 296,018 267,076 237,990 208,758 179,379 149,854 120,182 90,361 60,391 30,271

Other Non-Current Liabilities - - - - - - - - - - - -

Total Non-Current Liabilities 353,470 324,816 296,018 267,076 237,990 208,758 179,379 149,854 120,182 90,361 60,391 30,271

Total Liabilities 424,319 406,427 389,213 372,677 356,818 338,867 322,030 300,932 279,377 256,443 234,737 102,599

Net Assets 1,659,467 1,722,065 1,792,059 1,869,450 1,954,237 2,042,062 2,134,379 2,223,921 2,310,689 2,393,231 2,474,453 2,545,637

Ordinary Equity 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000

Retained Profits 1,359,467 1,422,065 1,492,059 1,569,450 1,654,237 1,742,062 1,834,379 1,923,921 2,010,689 2,093,231 2,174,453 2,245,637

Total Equity 1,659,467 1,722,065 1,792,059 1,869,450 1,954,237 2,042,062 2,134,379 2,223,921 2,310,689 2,393,231 2,474,453 2,545,637

Built with finmodelslab.com template Balance Sheet 03/04/2024

Balance Sheet

Model Name

Go to the Table of Contents

Fiscal year 2024 2024 2024 2024 2024 2024 2024 2024 2024 2024 2024 2024

Month Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Oct-24 Nov-24 Dec-24

Balance Sheet, $

Current Assets

Cash 2,490,512 2,571,093 2,661,202 2,760,839 2,870,005 2,987,121 3,108,574 3,233,115 3,353,844 3,470,236 3,581,963 3,560,502

Accounts Receivable 163,775 173,409 183,043 192,677 202,311 206,164 211,945 208,091 204,238 198,457 196,530 183,043

Inventory 25,834 27,353 28,873 30,393 31,912 32,520 33,432 32,824 32,216 31,304 31,000 28,873

THIS IS A TRIAL VER

Total Current Assets 2,680,121 2,771,855 2,873,118 2,983,908 3,104,228 3,225,805 3,353,951 3,474,030 3,590,298 3,699,998 3,809,494 3,772,418

Non-Current Assets

Assets Closing Net Book Value 14,946 14,242 13,538 12,833 12,129 11,425 10,721 10,017 9,313 8,608 7,904 7,200

CAPEX Prepayment - - - - - - - - - - - -

Fixed Assets 14,946 14,242 13,538 12,833 12,129 11,425 10,721 10,017 9,313 8,608 7,904 7,200

Total Non-Current Assets 14,946 14,242 13,538 12,833 12,129 11,425 10,721 10,017 9,313 8,608 7,904 7,200

Total Assets 2,695,067 2,786,097 2,886,655 2,996,742 3,116,357 3,237,230 3,364,671 3,484,046 3,599,610 3,708,606 3,817,398 3,779,618

TO UNLOCK THIS RE

Current Liabilities

CAPEX Payable - - - - - - - - - - - -

Accounts Payable 72,334 76,589 80,844 85,099 89,354 91,056 93,609 91,907 90,205 87,652 86,801 80,844

Corporate Tax Payable 7,710 16,387 26,017 36,601 48,137 60,054 72,543 84,650 96,377 107,532 118,496 -

Total Current Liabilities 80,044 92,976 106,861 121,700 137,491 151,110 166,151 176,557 186,582 195,184 205,297 80,844

Non-Current Liabilities

PURCHASE PREMIUM V

Debt 0 0 0 0 0 0 0 0 0 0 0 0

Other Non-Current Liabilities - - - - - - - - - - - -

Total Non-Current Liabilities 0 0 0 0 0 0 0 0 0 0 0 0

Total Liabilities 80,044 92,976 106,861 121,700 137,491 151,110 166,151 176,557 186,582 195,184 205,297 80,844

Net Assets 2,615,023 2,693,121 2,779,794 2,875,042 2,978,866 3,086,120 3,198,520 3,307,489 3,413,028 3,513,422 3,612,101 3,698,774

Ordinary Equity 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000

Retained Profits 2,315,023 2,393,121 2,479,794 2,575,042 2,678,866 2,786,120 2,898,520 3,007,489 3,113,028 3,213,422 3,312,101 3,398,774

Total Equity 2,615,023 2,693,121 2,779,794 2,875,042 2,978,866 3,086,120 3,198,520 3,307,489 3,413,028 3,513,422 3,612,101 3,698,774

Built with finmodelslab.com template Balance Sheet 03/04/2024

Balance Sheet

Model Name

Go to the Table of Contents

Fiscal year 2025 2025 2025 2025 2025 2025 2025 2025 2025 2025 2025

Month Jan-25 Feb-25 Mar-25 Apr-25 May-25 Jun-25 Jul-25 Aug-25 Sep-25 Oct-25 Nov-25

Balance Sheet, $

Current Assets

Cash 3,650,298 3,749,340 3,859,610 3,981,108 4,113,835 4,255,894 4,403,076 4,553,834 4,700,102 4,841,246 4,976,917

Accounts Receivable 189,161 200,288 211,415 222,542 233,669 238,120 244,796 240,345 235,894 229,218 226,993

Inventory 28,890 30,590 32,289 33,989 35,688 36,368 37,387 36,708 36,028 35,008 34,668

THIS IS A TRIAL VER

Total Current Assets 3,868,349 3,980,217 4,103,314 4,237,639 4,383,192 4,530,381 4,685,259 4,830,887 4,972,024 5,105,472 5,238,578

Non-Current Assets

Assets Closing Net Book Value 6,600 6,000 5,400 4,800 4,200 3,600 3,000 2,400 1,800 1,200 600

CAPEX Prepayment - - - - - - - - - - -

Fixed Assets 6,600 6,000 5,400 4,800 4,200 3,600 3,000 2,400 1,800 1,200 600

Total Non-Current Assets 6,600 6,000 5,400 4,800 4,200 3,600 3,000 2,400 1,800 1,200 600

Total Assets 3,874,949 3,986,217 4,108,714 4,242,439 4,387,392 4,533,981 4,688,259 4,833,287 4,973,824 5,106,672 5,239,178

TO UNLOCK THIS RE

Current Liabilities

CAPEX Payable - - - - - - - - - - -

Accounts Payable 80,893 85,651 90,410 95,168 99,926 101,830 104,685 102,781 100,878 98,023 97,071

Corporate Tax Payable 9,528 20,179 31,953 44,850 58,869 73,338 88,480 103,173 117,417 130,988 144,333

Total Current Liabilities 90,421 105,830 122,363 140,018 158,796 175,167 193,165 205,955 218,295 229,011 241,405

Non-Current Liabilities

PURCHASE PREMIUM V

Debt 0 0 0 0 0 0 0 0 0 0 0

Other Non-Current Liabilities - - - - - - - - - - -

Total Non-Current Liabilities 0 0 0 0 0 0 0 0 0 0 0

Total Liabilities 90,421 105,830 122,363 140,018 158,796 175,167 193,165 205,955 218,295 229,011 241,405

Net Assets 3,784,528 3,880,387 3,986,351 4,102,421 4,228,596 4,358,814 4,495,094 4,627,333 4,755,529 4,877,662 4,997,774

Ordinary Equity 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000 300,000

Retained Profits 3,484,528 3,580,387 3,686,351 3,802,421 3,928,596 4,058,814 4,195,094 4,327,333 4,455,529 4,577,662 4,697,774

Total Equity 3,784,528 3,880,387 3,986,351 4,102,421 4,228,596 4,358,814 4,495,094 4,627,333 4,755,529 4,877,662 4,997,774

Built with finmodelslab.com template Balance Sheet 03/04/2024

Balance Sheet

Model Name

Go to the Table of Contents

Fiscal year 2025

Month Dec-25

Balance Sheet, $

Current Assets

Cash 4,950,444

Accounts Receivable 211,415

Inventory 32,289

THIS IS A TRIAL VER

Total Current Assets 5,194,148

Non-Current Assets

Assets Closing Net Book Value (0)

CAPEX Prepayment -

Fixed Assets (0)

Total Non-Current Assets (0)

Total Assets 5,194,148

TO UNLOCK THIS RE

Current Liabilities

CAPEX Payable -

Accounts Payable 90,410

Corporate Tax Payable -

Total Current Liabilities 90,410

Non-Current Liabilities

PURCHASE PREMIUM V

Debt 0

Other Non-Current Liabilities -

Total Non-Current Liabilities 0

Total Liabilities 90,410

Net Assets 5,103,738

Ordinary Equity 300,000

Retained Profits 4,803,738

Total Equity 5,103,738

Built with finmodelslab.com template Balance Sheet 03/04/2024

Seasonality Setup

Model Name

Go to the Table of Contents

Capacity Utilization Seasonality Assumptions

Month Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Seasonality -15.0% -10.0% -5.0% 0.0% +5.0% +7.0% +10.0% +8.0% +6.0% +3.0% +2.0% -5.0%

THIS IS A TRIAL VER

TO UNLOCK THIS REP

PURCHASE PREMIUM VE

Built with finmodelslab.com template Seasonality Setup 03/04/2024

Cost of Goods Sold

Model Name

Go to the Table of Contents

Fiscal year 2021 2021 2021 2021 2021 2021 2021 2021 2021 2021 2021 2021

Month Jan-21 Feb-21 Mar-21 Apr-21 May-21 Jun-21 Jul-21 Aug-21 Sep-21 Oct-21 Nov-21 Dec-21

COGS - Assumptions, $

Product Product Product Product Product

Categories

Type 1 Type 2 Type 3 Type 4 Type 5

COGS_Placeholder1 as % of Revenue 5.0% 4.5% 4.1% 3.6% 3.3%

COGS_Placeholder2 as % of Revenue 4.0% 3.6% 3.2% 2.9% 2.6%

THIS IS A TRIAL VERSION

COGS_Placeholder3 as % of Revenue 3.0% 2.7% 2.4% 2.2% 2.0%

COGS_Placeholder4 as % of Revenue

COGS_Placeholder5 as % of Revenue

COGS_Placeholder6 as % of Revenue

COGS_Placeholder7 as % of Revenue

COGS_Placeholder8 as % of Revenue

COGS_Placeholder9 as % of Revenue

TO UNLOCK THIS REPORT

COGS_Placeholder10 as % of Revenue

Total COGS as % of Revenue 12.0% 10.8% 9.7% 8.7% 7.9%

COGS_Placeholder11 as $ per unit 10.0 9.0 8.1 7.3 6.6

COGS_Placeholder12 as $ per unit 9.0 8.1 7.3 6.6 5.9

COGS_Placeholder13 as $ per unit 5.0 4.5 4.1 3.6 3.3

COGS_Placeholder14 as $ per unit

COGS_Placeholder15 as $ per unit

PURCHASE PREMIUM VERSI

COGS_Placeholder16 as $ per unit

COGS_Placeholder17 as $ per unit

COGS_Placeholder18 as $ per unit

COGS_Placeholder19 as $ per unit

COGS_Placeholder20 as $ per unit

Total COGS as $ per unit 24.0 21.6 19.4 17.5 15.7

COGS, $

Categories