Professional Documents

Culture Documents

S S Group Private Limited

Uploaded by

Mohd AzmiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

S S Group Private Limited

Uploaded by

Mohd AzmiCopyright:

Available Formats

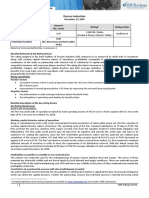

Press Release

S S Group Private Limited

April 08, 2021

Ratings

Amount

Facilities/Instruments Ratings1 Rating Action

(Rs. crore)

Long Term CARE BB; Stable

77.00 Assigned

Instruments (Double B; Outlook: Stable )

77.00

Total Facilities (Rs. Seventy-Seven

Crore Only)

Details of instruments/facilities in Annexure-1

Detailed Rationale and key rating drivers

The rating assigned to the bank facilities of S S Group Private Limited (SSGPL) takes into account slow sales momentum and

customer collection, high dependence on customer advances for the ongoing projects, stretched liquidity, project execution

risk and off-take risk and subdued Industry Scenario coupled with impact of Covid-19.

The ratings, however, takes comfort from experienced promoters with established track record of the group and location

advantage.

Key Rating Sensitivity

Positive Factors

Timely completion of the project within the estimated timelines

Ability to achieve increased sales velocity and strong collection efficiency

Negative factors

Reduction in sales velocity or collection efficiency

Detailed description of the key rating drivers

Key Rating Weaknesses

High dependence on customer advances for the ongoing projects

The cost of the projects is Rs. 1599 cr which is funded from various sources such as Promoter’s contribution (7% of the total

cost), Rs. 290 cr of debt (18% of the total cost) and the rest through customer advances that is 75% of the total project cost.

Till Dec 31, 2020, the company has collected Rs. 1530 cr which is 84% of the sales value. Thus, it shall be imperative for

SSGPL to achieve improvement in its sales momentum and to garner requisite amount of sales proceeds for timely

execution and completion of the project.

Project execution risk and off-take risk

Till Dec 31, 2020, the company has incurred Rs. 1237 cr out of the total Rs. 1599 cr that is, ~77% of the total project cost.

However, the company has incurred Rs. 766 cr out of the total Rs. 980 cr on the construction, that is, 78% of the total

construction cost, as compared to the last year wherein Rs. 459 cr were incurred out of the total of Rs. 1416 cr, that is, 32%

of the total project cost till Dec 31, 2018. Out of total saleable area of the projects of 47.57 lsf, the company has sold 35.59

lsf till Dec 31, 2020 i.e. ~75% (PY: 31%) of total area for sale value of ~Rs. 1812 cr.

Out of sale value of the sold area, SSGPL has realized Rs. 1530 cr i.e. 84% of sale value. With significant portion of the cost

yet to be incurred and major portion of some of the projects yet to be sold; the projects remains exposed to project

execution risk and off-take risk.

Slow sales momentum and customer collection

As on Dec 31, 2020, the company has 5 ongoing project of which 2 are almost complete viz. “The Hibiscus and “The

Coralwood & Almeria”. The company has sold 87% of area in these two project valued at Rs.1162 crore and has realized

Rs.1116 crore.

However the sales and collection momentum remained very slow in the other three project. In the project leaf the company

has sold 71% area valued at Rs.452 crore and has realized Rs. 253 crore and has balance receivable of Rs.199 crore. However

due to delay in project implementation, there has been slowdown in customer realization and the company has realized

Rs. 6.94 crore in the last 12 months from project Leaf. Also due to slower sales momentum, the company has taken

additional funding of Rs.110cr to complete the project.

The other two projects viz. Omnia and high point are commercial project with slow sales and collection momentum. In the

last 12 months ending Feb 2021, company has sold 0.25 lsf area and has received Rs.4 crores from these two projects.

Subdued industry scenario coupled with impact of Covid-19

1

Complete definitions of the ratings assigned are available at www.careratings.com and in other CARE publications.

1 CARE Ratings Limited

Press Release

With the on-going economic conditions, the real estate industry is currently facing issues on many fronts, including subdued

demand, curtailed funding options, rising costs, restricted supply due to delays in approvals, etc. thereby resulting in stress

on cash flows of developers. The industry has seen low demand in the recent past, primarily due to factors like sustained

high level of inflation leading to high interest rates and adverse impact on the buying power and affordability for the

consumers.

The company is affected with the global pandemic as the construction work as well as the process work for on-going project

came to halt. However, the liquidity buffer was adequate. However, Delhi NCR’s realty landscape showed some recovery

in Jul-Sep 2020, i.e. soon after the gradual lifting of the nationwide lockdown. Brokers and developers reported a marked

improvement in the quality of leads during the quarter as serious homebuyers ventured into the market to conduct site

visits. Resultantly, monthly sales volume recovered by almost 50% in July. The recovery of the property market in Gurgaon

was quicker than the other zones in Delhi NCR.

Key Rating Strengths

Experienced promoters with established track record of the group

The promoter of the group, Mr. Sukhbir Singh Juanapuria (Chairman), has more than 25 years of experience in the real

estate industry. Mr. Ashok Singh Juanapuria (Managing Director and Chief Financial Officer) is the son of Mr. Sukhbir Singh

Jaunapuria; He has done MBA from Greenwich University, London and has more than 12 years of experience in the real

estate sector. He looks after the day to day affairs of the group and is supported by an experienced management team. S S

group has a long-standing presence in the real estate development in Delhi NCR market and has considerable presence

primarily in the Gurgaon region. As on Dec 2020, the group has developed real estate projects of around 42.07 lsf of saleable

area which includes seven residential and one commercial project, most of which was undertaken in Gurgaon region.

Location advantage with reasonable booking status for some of the ongoing projects

All the projects are group are located in the prominent location of Gurgaon having easy accessibility and good connectivity.

The projects have favorable location in terms of close proximity from the International Airport and also well-connected

through road and metro network. On account of the favorable location along-with the established track record of the group,

the project has been able to register reasonable sales.

The company has already sold about 79% ( The Hibiscus), 94% (PY: 76%) (The Coralwood & Almeria), 71% (PY: 74%) (The

Leaf), 56% (PY: 42%) (SS Omnia) and 11% (PY: 1%) (SS Highpoint) of the total saleable area as on Dec 31, 2020.

The total value of the sold area is Rs. 1812 cr out of which Rs. 1530 cr, i.e. ~84% of the total sale value has been received

by the company.

Liquidity analysis: Stretched

The company generates moderate cash flow from 2 out of five projects only and the sales and collection momentum

remained very slow in the other three projects. Also, the company has taken additional funding to meet the shortfall in the

customer collection.

The bank overdraft facility from SBI Bank amounting to Rs.15.00 crore (rated by CARE) has been withdrawn. Also, the

company has availed moratorium as provided by the bank in lines with RBI guidelines in wake of COVID-19.

Analytical approach: Standalone

Applicable Criteria

Criteria on assigning ‘outlook’ and ‘credit watch’ to Credit Ratings

CARE’s Policy on Default Recognition

CARE’s methodology for Real Estate Sector

Liquidity Analysis of Non-Financial Sector Entities

Financial ratios – Non-Financial Sector

About the Company

Incorporated in 1992, S S Group Private Limited (SSGPL) is engaged in the development of residential and commercial real

estate projects in Delhi NCR. SSGPL is the flagship company of the Gurgaon based ‘SS Group’. In past the group has

successfully completed seven residential and one commercial real estate projects with total saleable area of about 27.84

lsf, in Gurgaon region. The company is currently developing three residential/group housing projects and two commercial

projects namely “ The Hibiscus” in Sector 50, Gurgaon, “The Coralwood & Almeria” in Sector 84, Gurgaon, “The Leaf” in

sector 85, Gurgaon and 2 commercial projects “SS Omnia” and “SS Highpoint” at Sector-86, Gurgaon, Haryana.

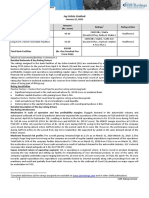

Brief Financials (Rs. crore) 31-03-2019 31-03-2020

A A

Total operating income 306.94 106.11

PBILDT 27.84 26.02

PAT 2.11 2.95

Overall gearing (times) 0.52 0.45

2 CARE Ratings Limited

Press Release

Brief Financials (Rs. crore) 31-03-2019 31-03-2020

A A

Interest coverage (times) 1.26 1.30

A: Audited

Status of non-cooperation with previous CRA: Not Applicable

Any other information: Not Applicable

Rating History (Last three years): Please refer Annexure-2

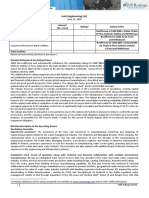

Annexure-1: Details of Instruments/Facilities

Size of

Rating assigned

Name of the Date of Coupon Maturity the Issue

along with Rating

Instrument Issuance Rate Date (Rs.

Outlook

crore)

CARE BB; Stable

Debt-Non-convertible Debenture - 17.05% August 2023 77.00

Annexure-2: Rating History of last three years

Current Ratings Rating history

Date(s) Date(s)

Name of the Type Rating Date(s) & Date(s) & & &

Sr. Amount

Instrument/Bank Rating(s) Rating(s) Rating(s) Rating(s)

No. Outstanding

Facilities assigned in assigned in assigned assigned

(Rs. crore)

2021-2022 2020-2021 in 2019- in 2018-

2020 2019

1)CARE BB; 1)CARE

Stable; ISSUER BB+;

1)Withdrawn

Fund-based - LT-Bank NOT Stable

1. LT - - (01-Apr-21) -

Overdraft COOPERATING* (04-Apr-

(06-May-20) 19)

1)CARE A4; 1)CARE

CARE 1)CARE A4 ISSUER NOT A4+

Non-fund-based - ST-

2. ST 20.00 A4 (01-Apr-21) COOPERATING* (04-Apr- -

Bank Guarantees

(06-May-20) 19)

CARE

Debt-Non-convertible

BB;

3. Debenture/Subordinate LT 77.00 - - - -

Stable

Debt

Annexure-3: Detailed explanation of covenants of the rated instrument / facilities: Not Applicable

Annexure 4: Complexity level of various instruments rated for this Company

Sr.

Name of the Instrument Complexity Level

No.

1. Debt-Non-convertible Debenture Simple

3 CARE Ratings Limited

Press Release

Note on complexity levels of the rated instrument: CARE has classified instruments rated by it on the basis of complexity. This

classification is available at www.careratings.com. Investors/market intermediaries/regulators or others are welcome to write to

care@careratings.com for any clarifications.

Contact us

Media Contact

Mradul Mishra

Contact no.: +91-22-6837 4424

Email ID: mradul.mishra@careratings.com

Analyst Contact

Mr. Amit Jindal

Contact no.: +91- 11-4533 3228

Email ID: amit.jindal@careratings.com

Relationship Contact

Name: Ms. Swati Agrawal

Contact no.: +91-11-4533 3200

Email ID: swati.agrawal@careratings.com

About CARE Ratings:

CARE Ratings commenced operations in April 1993 and over two decades, it has established itself as one of the leading credit rating

agencies in India. CARE is registered with the Securities and Exchange Board of India (SEBI) and also recognized as an External Credit

Assessment Institution (ECAI) by the Reserve Bank of India (RBI). CARE Ratings is proud of its rightful place in the Indian capital market

built around investor confidence. CARE Ratings provides the entire spectrum of credit rating that helps the corporates to raise capital for

their various requirements and assists the investors to form an informed investment decision based on the credit risk and their own risk-

return expectations. Our rating and grading service offerings leverage our domain and analytical expertise backed by the methodologies

congruent with the international best practices.

Disclaimer

CARE’s ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are

not recommendations to sanction, renew, disburse or recall the concerned bank facilities or to buy, sell or hold any

security. CARE’s ratings do not convey suitability or price for the investor. CARE’s ratings do not constitute an audit on

the rated entity. CARE has based its ratings/outlooks on information obtained from sources believed by it to be accurate

and reliable. CARE does not, however, guarantee the accuracy, adequacy or completeness of any information and is not

responsible for any errors or omissions or for the results obtained from the use of such information. Most entities whose

bank facilities/instruments are rated by CARE have paid a credit rating fee, based on the amount and type of bank

facilities/instruments. CARE or its subsidiaries/associates may also have other commercial transactions with the entity.

In case of partnership/proprietary concerns, the rating /outlook assigned by CARE is, inter-alia, based on the capital

deployed by the partners/proprietor and the financial strength of the firm at present. The rating/outlook may undergo

change in case of withdrawal of capital or the unsecured loans brought in by the partners/proprietor in addition to the

financial performance and other relevant factors. CARE is not responsible for any errors and states that it has no financial

liability whatsoever to the users of CARE’s rating.

Our ratings do not factor in any rating related trigger clauses as per the terms of the facility/instrument, which may

involve acceleration of payments in case of rating downgrades. However, if any such clauses are introduced and if

triggered, the ratings may see volatility and sharp downgrades.

**For detailed Rationale Report and subscription information, please contact us at www.careratings.com

4 CARE Ratings Limited

You might also like

- Hindustan - Associates - 4 Tanishq Stores in UPDocument5 pagesHindustan - Associates - 4 Tanishq Stores in UPJai PhookanNo ratings yet

- Innovative Infrastructure Financing through Value Capture in IndonesiaFrom EverandInnovative Infrastructure Financing through Value Capture in IndonesiaRating: 5 out of 5 stars5/5 (1)

- Prayag Polymers Private LimitedDocument4 pagesPrayag Polymers Private Limitednandinimishra6168No ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- Dewan Housing Finance Corporation Limited: Summary of Rating ActionDocument7 pagesDewan Housing Finance Corporation Limited: Summary of Rating ActionJawahar MNo ratings yet

- Shapoorji Pallonji and Company Private LimitedDocument5 pagesShapoorji Pallonji and Company Private LimitedPrabhakar DubeyNo ratings yet

- Housing Development Finance Corporation LimitedDocument6 pagesHousing Development Finance Corporation LimitedTejpal SainiNo ratings yet

- Neelkanth Salt Chem India Private LimitedDocument5 pagesNeelkanth Salt Chem India Private LimitedcharananwarNo ratings yet

- Mega Steel IndustriesDocument4 pagesMega Steel IndustrieshseckalpeshNo ratings yet

- Shanta Holdings Limited-PtdDocument13 pagesShanta Holdings Limited-PtdnasirNo ratings yet

- Sun Home Appliances Private - R - 25082020Document7 pagesSun Home Appliances Private - R - 25082020DarshanNo ratings yet

- Amarth Ifestyle RetailingDocument5 pagesAmarth Ifestyle Retailingheera lal thakurNo ratings yet

- Press Release CSL Finance LimitedDocument4 pagesPress Release CSL Finance LimitedPositive ThinkerNo ratings yet

- Ambika Brickwell LLP-10!04!2019Document5 pagesAmbika Brickwell LLP-10!04!2019arc14consultantNo ratings yet

- Prime Urban ICRA April 17Document7 pagesPrime Urban ICRA April 17BALMERNo ratings yet

- Ian Renewable Energy Development Agency Limited - IPO NoteDocument11 pagesIan Renewable Energy Development Agency Limited - IPO NotedeepaksinghbishtNo ratings yet

- Jay Ushin Limited: Rationale-Press ReleaseDocument4 pagesJay Ushin Limited: Rationale-Press Releaseravi.youNo ratings yet

- Press Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Data CentrumNo ratings yet

- Airvision India Private Limited - R - 25082020Document7 pagesAirvision India Private Limited - R - 25082020DarshanNo ratings yet

- JP Infra Mumbai 23dec2021Document6 pagesJP Infra Mumbai 23dec2021Rishabh MehtaNo ratings yet

- Shaily Engineering Plastics Limited-09-25-2019Document4 pagesShaily Engineering Plastics Limited-09-25-2019Ashutosh Gupta100% (1)

- Naresh Kumar and Company Private LimitedDocument5 pagesNaresh Kumar and Company Private LimitedKunalNo ratings yet

- Emcer Tiles Private LimitedDocument4 pagesEmcer Tiles Private LimitedRudra RoyNo ratings yet

- Document Service V2Document6 pagesDocument Service V2UTSAV DUBEYNo ratings yet

- IIFL Home Finance LimitedDocument6 pagesIIFL Home Finance LimitedSumonto BagchiNo ratings yet

- Parasakti - IndRa - Dec 2022 - BBB+Document5 pagesParasakti - IndRa - Dec 2022 - BBB+SaranNo ratings yet

- Champion Commercial Company LimitedDocument7 pagesChampion Commercial Company LimitedCedric KerkettaNo ratings yet

- Muthoot Finance LimitedDocument11 pagesMuthoot Finance LimitedKhasimvali ShaikNo ratings yet

- Onshore Construction Company Private LimitedDocument7 pagesOnshore Construction Company Private Limitedhesham zakiNo ratings yet

- Roha Dyechem Private Limited: Rating RationaleDocument8 pagesRoha Dyechem Private Limited: Rating RationaleForall PainNo ratings yet

- Rustomjee Realty Private LimitedDocument7 pagesRustomjee Realty Private LimitedScribdNo ratings yet

- Rajendra Singh Bhamboo Infra Private LimitedDocument5 pagesRajendra Singh Bhamboo Infra Private LimitedBABU LAL CHOUDHARYNo ratings yet

- Acknit Industries Limited: Summary of Rating ActionDocument7 pagesAcknit Industries Limited: Summary of Rating ActionprasanthNo ratings yet

- Care Rating Sterling - Addlife - India - Private - LimitedDocument6 pagesCare Rating Sterling - Addlife - India - Private - Limitedrahul.tibrewalNo ratings yet

- Press Release Jash Engineering LTD.: Details of Instruments/ Facilities in Annexure-1Document6 pagesPress Release Jash Engineering LTD.: Details of Instruments/ Facilities in Annexure-1ArunVenkatachalamNo ratings yet

- Ashwini Infradevelopments Private LimitedDocument6 pagesAshwini Infradevelopments Private Limitedkrushna.maneNo ratings yet

- Aria CR Jun21Document5 pagesAria CR Jun21swamih.knightfrankNo ratings yet

- Vivriti Capital Private Limited PDFDocument9 pagesVivriti Capital Private Limited PDFIb SulochanaNo ratings yet

- Shri Balaji Rollings Private LimDocument4 pagesShri Balaji Rollings Private LimData CentrumNo ratings yet

- Bharat Hotels LimitedDocument7 pagesBharat Hotels LimitedjagadeeshNo ratings yet

- Poddar Diamonds Limited-09-29-2017Document4 pagesPoddar Diamonds Limited-09-29-2017tridev kant tripathiNo ratings yet

- Aria CR Dec 19Document4 pagesAria CR Dec 19swamih.knightfrankNo ratings yet

- Press Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Document6 pagesPress Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Patel ZeelNo ratings yet

- L.G. Balakrishnan & Bros Limited: Summary of Rating ActionDocument7 pagesL.G. Balakrishnan & Bros Limited: Summary of Rating ActionChromoNo ratings yet

- Della Adventure R 17112017Document7 pagesDella Adventure R 17112017Anil KanojiaNo ratings yet

- Rating Rationale - Hero Steel Oct 2019Document4 pagesRating Rationale - Hero Steel Oct 2019Puneet367No ratings yet

- Press Release Dilip Buildcon Limited: Details of Instruments/facilities in Annexure-1Document7 pagesPress Release Dilip Buildcon Limited: Details of Instruments/facilities in Annexure-1deeptiNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Mehala Machines India LimitedDocument4 pagesMehala Machines India LimitedKarthikeyan RK SwamyNo ratings yet

- Sunlex Fabrics Private Limited - Care RatingsDocument6 pagesSunlex Fabrics Private Limited - Care RatingsManeet GoyalNo ratings yet

- Super Spinning Mills Limited-09-08-2020Document4 pagesSuper Spinning Mills Limited-09-08-2020Positive ThinkerNo ratings yet

- Solairedirect Energy India Private LimitedDocument6 pagesSolairedirect Energy India Private LimitedAfzal AneesNo ratings yet

- Press Release Vijay Sales (India) Private Limited: Experienced PromotersDocument4 pagesPress Release Vijay Sales (India) Private Limited: Experienced PromoterssriharikosaNo ratings yet

- Sanghi Jewellers PVT - R - 20102020Document7 pagesSanghi Jewellers PVT - R - 20102020DarshanNo ratings yet

- Baf PPT Fy23 Q3Document71 pagesBaf PPT Fy23 Q3Sanjay BhatNo ratings yet

- Tehri Pulp and Paper 5feb2021Document6 pagesTehri Pulp and Paper 5feb2021Ck WilliumNo ratings yet

- Ganesha Ecosphere Limited-01-29-2019Document6 pagesGanesha Ecosphere Limited-01-29-2019gangashaharNo ratings yet

- Vijay Sales (India) Private LimitedDocument5 pagesVijay Sales (India) Private LimitedAakanksha RaiNo ratings yet

- Satya Stone Exports-01!24!2020Document4 pagesSatya Stone Exports-01!24!2020vasfee.7172No ratings yet