Professional Documents

Culture Documents

Costing Formula Chart (1) - 2

Uploaded by

Preeti MauryaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Costing Formula Chart (1) - 2

Uploaded by

Preeti MauryaCopyright:

Available Formats

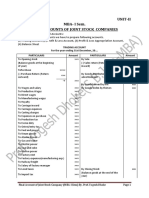

Total Semi- Variable Costs xxx New Recruitments Method (excluding replacements) = Note: Weighted Average Method should

ng replacements) = Note: Weighted Average Method should be preferred to

𝑁𝑜.𝑜𝑓 𝑁𝑒𝑤 𝑅𝑒𝑐𝑟𝑢𝑖𝑡𝑚𝑒𝑛𝑡𝑠 𝑎𝑡 𝑁𝑒𝑤 𝑉𝑎𝑐𝑎𝑛𝑐𝑖𝑒𝑠 𝑑𝑢𝑟𝑖𝑛𝑔 𝑡ℎ𝑒 𝑝𝑒𝑟𝑖𝑜𝑑 be used.

Less: Total Variable Cost (xxx) × 100

𝐴𝑣𝑔.𝑁𝑜.𝑜𝑓 𝐸𝑚𝑝𝑙𝑜𝑦𝑒𝑠𝑠 𝑜𝑛 𝑅𝑜𝑙𝑙 𝑑𝑢𝑟𝑖𝑛𝑔 𝑡ℎ𝑒 𝑝𝑒𝑟𝑖𝑜𝑑 360/12/52

(Variable Cost p.u × Output) Inventory Conversion Period = 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 𝑇𝑢𝑟𝑛𝑜𝑣𝑒𝑟 𝑅𝑎𝑡𝑖𝑜

Flux Method I =

Total Fixed Cost xxx 𝑵𝒖𝒎𝒃𝒆𝒓 𝒐𝒇 𝐒𝐞𝐩𝐞𝐫𝐚𝐭𝐢𝐨𝐧𝐬 +𝑵𝒖𝒎𝒃𝒆𝒓 𝒐𝒇 𝑹𝐞𝐩𝐥𝐚𝐜𝐞𝐦𝐞𝐧𝐭

× 100

KEY FACTOR/ LIMITING FACTOR/ PRINCIPAL BUDGET FACTOR 𝑨𝒗𝒈.𝑵𝒐.𝒐𝒇 𝑬𝒎𝒑𝒍𝒐𝒚𝒆𝒔𝒔 𝒐𝒏 𝑹𝒐𝒍𝒍 𝒅𝒖𝒓𝒊𝒏𝒈 𝒕𝒉𝒆 𝒑𝒆𝒓𝒊𝒐𝒅

Flux Method II = COMPREHENSIVE COST SHEET

𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 Seperations +𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝐴𝑐𝑐𝑒𝑠𝑠𝑖𝑜𝑛𝑠 Opening Stock of Raw Materials xxx

× 100

𝐴𝑣𝑔.𝑁𝑜.𝑜𝑓 𝐸𝑚𝑝𝑙𝑜𝑦𝑒𝑠𝑠 𝑜𝑛 𝑅𝑜𝑙𝑙 𝑑𝑢𝑟𝑖𝑛𝑔 𝑡ℎ𝑒 𝑝𝑒𝑟𝑖𝑜𝑑 Add: Purchases of Raw Materials (including xxx

EQUIVALENT ANNUAL LABOUR TURNOVER Carriage Inwards, Transit Insurance etc.)

Material is in Short Contribution p. u of

Equivalent Annual Labour Turnover = Less: Closing Stock of Raw Materials (xx)

Supply Material

𝑇𝑢𝑟𝑛𝑜𝑣𝑒𝑟 𝑟𝑎𝑡𝑒 𝑓𝑜𝑟 𝑡ℎ𝑒 𝑝𝑒𝑟𝑖𝑜𝑑 Raw Materials Consumed xxx

× 365

𝑁𝑜. 𝑜𝑓 𝑑𝑎𝑦𝑠 𝑖𝑛 𝑡ℎ𝑒 𝑝𝑒𝑟𝑖𝑜𝑑 Add: Direct/Productive Labour xxx

Skilled Labour is in Short Contribution per Labour Add: Direct/Chargeable Expenses xxx

Profit

sales

Suppy Hour

Prime Cost xxx

Key Factor

Add:Factory/Works/Manufacturing/Production xxx

Machine Capacity is in Contribution per Machine Selling & distribution overheads Overheads

Short Suppy Hour Gross Factory Cost/ Gross Works Cost xxx

Add: Opening Stock of work in Progress xxx

Administration Overheads Less: Closing Stock of work in Progress (xx)

Sales Quantity is in Short

Contribution Per Unit

Cost of production

Supply Net Factory Cost/ Net Works Cost xxx

Cost of sales

Factory Add: Office & Administration Overheads xxx

Cost of Production xxx

Sales Value is the Limiting

P/V Ratio Overheads Add: Opening Stock of finished Goods xxx

Factory cost

Factor

Less: Closing Stock of Finished goods xxx

Direct Cost of Goods Sold xxx

Prime cost

Expenses Add: Selling and Distribution Overheads xxx

𝐶𝑜𝑛𝑡𝑟𝑖𝑏𝑢𝑡𝑖𝑜𝑛 Direct Cost of Sales xxx

Ranking = Add: Profits xxx

𝐾𝑒𝑦 𝐹𝑎𝑐𝑡𝑜𝑟 Labour

Direct Sales xxx

Material

INTEGRATED AND NON – INTEGRATED ACCOUNTING SYSTEM

INTEGRATED ACCOUNTING NON-INTEGRATED ACCOUNTING INTEGRATED ACCOUNTING NON-INTEGRATED ACCOUNTING

1. Materials Purchased 1. Materials Purchased on 14. Transportation of 14. Transportation of

on Credit/ for Cash: Credit/ for Cash: Incoming Material / Incoming Material /

Carriage/ Freight Carriage/ Freight

a) For Stock: a) For Stock:

Inwards: Inwards:

Stores Ledger Control A/c Dr. xxx Stores Ledger Control A/c Dr. xxx

To Sundry Creditors/Cash A/c xxx To General Ledger Adj. A/c xxx Production O/H Control A/c / Production O/H Control A/c /

Stores Ledger Control A/c Dr. xxx Stores Ledger Control A/c Dr. xxx

b) For Special Jobs: b) For Special Jobs: To Cash A/c xxx To General Ledger Adj. A/c xxx

WIP Ledger Control A/c Dr. xxx WIP Ledger Control A/c Dr. xxx

To Sundry Creditors/Cash A/c xxx To General Ledger Adj. A/c xxx 15. Labour Cost: 15. Labour Cost:

a) Total Wages & a) Total Wages & Salaries

2. Materials Issued: 2. Materials Issued: Salaries Paid Paid (including

(including Employer’s contribution

a) Direct Material c) Direct Material Employer’s to various funds)

WIP Ledger Control A/c Dr. xxx WIP Ledger Control A/c Dr. xxx contribution to Wages & Salaries

To Stores Ledger A/c xxx To Stores Ledger Adjustment A/c xxx various funds) Control A/c Dr. xxx

Wages & Salaries xxx To General Ledger xxx

b) Indirect Material d) Indirect Material Control A/c Dr. Adjustment A/c

Relevant Overhead A/c Dr. xxx Respective Overhead A/c Dr. xxx To Cash A/c/ xxx

To Stores Ledger Control A/c xxx To Stores Ledger Control A/c xxx Accrued Wages &

Salaries A/c A/c

3.

Materials Returned 3. Materials Returned to b) Allocation of Direct b) Allocation of Direct &

to Supplier Supplier: & Indirect Labour Indirect Labour Cost:

Creditors A/c Dr. xxx General Ledger Adj. A/c Dr. xxx Cost: Work-in-Progress Ledger

To Stores Ledger Control A/c xxx To Stores Ledger Control A/c xxx Work-in-Progress Control A/c (DL) Dr. xxx

4. Materials Returned 4. Materials Returned Ledger Control A/c xxx Respective Overhead

from Shop Floor: from Shop Floor: (DL) Dr. Control A/c (IL) Dr. xxx

Stores Ledger Control A/c Dr. xxx Stores Ledger Adj. A/c Dr. xxx Respective To wages & Salaries xxx

To WIP Ledger Control A/c xxx To WIP Ledger Control A/c xxx Overhead Ledger Control A/c

Control A/c (IL) Dr. xxx

To wages & Salaries xxx

Control A/c

16. Direct Expenses 16. Direct Expenses

(Paid/Accrued): (Paid/Accrued):

5.

Material transferred 5. Material transferred WIP Ledger Control A/c Dr. xxx WIP Ledger Control A/c Dr. xxx

from one job to from one job to another To Cash A/c/ Accrued xxx To General Ledger Adj. A/c xxx

another job: job: Expenses A/c

WIP of Transferee Job A/c Dr. xxx WIP of Transferee Job A/c Dr. xxx 17. Overheads Incurred 17. Overheads Incurred

To WIP of Transferor Job A/c xxx To WIP of Transferor Job A/c xxx (Paid/ Accrued): (Paid/ Accrued):

6. Sales of Material: 6. Sales of Material:

Relevant O/H Control A/c Dr. xxx Respective O/H Control A/c Dr. xxx

Cash/Debtors A/c Dr. xxx General Ledger Adj. A/c Dr. xxx To Cash A/c xxx To General Ledger Adj. A/c xxx

To Stores Ledger Control A/c xxx To Stores Ledger Control A/c xxx 18. O/H Recovered: 18. O/H Recovered:

Note: Loss on sale will be Note: Loss on sale will be debited WIP Ledger Control A/c Dr. xxx WIP Ledger Control A/c Dr. xxx

debited & profit on sale will & profit on sale will be credited to (For Works Overheads (For Works Overheads

be credited to costing profit & costing profit & Loss A/c Recovered) Recovered)

Loss A/c Finished Goods Ledger Finished Goods Ledger Control

Control A/c Dr. xxx A/c Dr. xxx

7.

Normal Loss of 7. Normal Loss of Material

(For Administration (For Administration Overheads

Material kept in kept in storeroom:

Overheads Recovered) Recovered)

storeroom:

Cost of Sales A/c Dr. xxx Cost of Sales A/c Dr. xxx

Factory O/H Control A/c Dr. xxx Factory O/H Control A/c Dr. xxx

(For Selling and Distribution (For Selling and Distribution

Or Or

Overheads Recovered) Overheads Recovered)

WIP Ledger Control A/c Dr. xxx WIP Ledger Control A/c Dr. xxx

To Relevant O/H Control A/c xxx To Respective O/H Control A/c xxx

To Stores Ledger Control A/c xxx To Stores Ledger Control A/c xxx

19. Administration 19. Administration

8. Abnormal Loss of 8. Abnormal Loss of

Overheads allocated Overheads allocated to

Materials kept in Materials kept in

to production: production:

Storeroom: Storeroom:

Costing P & L A/c Dr. xxx Costing P & L A/c Dr. xxx

To Stores Ledger Control A/c xxx To Stores Ledger Control A/c xxx

20. Sales Return: 20. Sales Return:

You might also like

- CH 2 Activity-Based CostingDocument45 pagesCH 2 Activity-Based Costingrusfazairaaf100% (1)

- Cost Sheet FormatDocument1 pageCost Sheet Formatvenkataswamynath channa71% (35)

- QUS 210 - Tendering & Estimating IIDocument17 pagesQUS 210 - Tendering & Estimating IINam Le100% (5)

- Business Plan Egg Tray Making in NigeriaDocument19 pagesBusiness Plan Egg Tray Making in Nigeriakabo busanang100% (1)

- Mathematics For Economics and Business Administration FormulasDocument1 pageMathematics For Economics and Business Administration FormulasVasile RusuNo ratings yet

- Manufacturing AccountsDocument3 pagesManufacturing AccountsSimba MuhondeNo ratings yet

- POA FormatsDocument8 pagesPOA FormatsFreakshow38No ratings yet

- Estimates - JongoyDocument37 pagesEstimates - JongoyJea MosenabreNo ratings yet

- Chapter 10aDocument81 pagesChapter 10aAlec Trevelyan100% (3)

- Manage Construction Costing System of ProjectsDocument53 pagesManage Construction Costing System of ProjectsYihun abrahamNo ratings yet

- SAP Controlling OverviewDocument59 pagesSAP Controlling Overview29614180% (5)

- Ac 4104 - Strategic Cost ManagementDocument26 pagesAc 4104 - Strategic Cost ManagementLikzy Redberry100% (2)

- Company Name - STRATEGIC PLAN FOR THE YEAR 2014-15 Implementing Continuous Improvement Solutions Which Supports The Vision and MissionDocument7 pagesCompany Name - STRATEGIC PLAN FOR THE YEAR 2014-15 Implementing Continuous Improvement Solutions Which Supports The Vision and MissionAhmed M. Hashim100% (1)

- Understanding Results Analysis For WIP: Introduction and Configuration GuideDocument3 pagesUnderstanding Results Analysis For WIP: Introduction and Configuration GuidegildlreiNo ratings yet

- MAC2601 StudyGuide1of2 PDFDocument386 pagesMAC2601 StudyGuide1of2 PDFDINEO PRUDENCE NONG100% (1)

- MA Session 6 PDFDocument48 pagesMA Session 6 PDFArkaprabha GhoshNo ratings yet

- Manufacturing Accounts Notes and QuestionsDocument31 pagesManufacturing Accounts Notes and QuestionsRoshan RamkhalawonNo ratings yet

- Accounting For Manufacturing FirmDocument13 pagesAccounting For Manufacturing Firmnadwa dariahNo ratings yet

- A Cost Sheet Depicts The Following FactsDocument18 pagesA Cost Sheet Depicts The Following Factsharsh singhNo ratings yet

- Cost Accounting NotesDocument97 pagesCost Accounting NotesSumiya AkterNo ratings yet

- Cost SheetDocument6 pagesCost SheetabhineshNo ratings yet

- CA & CMA StatementsDocument2 pagesCA & CMA StatementsArsalan KhalidNo ratings yet

- Purpose / Reasons of Preparing Departmental Accounts:: Less: Sales Returns/ Returns InwardsDocument1 pagePurpose / Reasons of Preparing Departmental Accounts:: Less: Sales Returns/ Returns InwardsTan Shu YuinNo ratings yet

- Financial StatementDocument19 pagesFinancial StatementCS SNo ratings yet

- Cost Accounting: An IntroductionDocument24 pagesCost Accounting: An IntroductionAritra DeyNo ratings yet

- Cost Accounting: An IntroductionDocument38 pagesCost Accounting: An IntroductionSwastik SahooNo ratings yet

- Acc ReviewerDocument36 pagesAcc ReviewerDia BaronNo ratings yet

- Cost Accountancy (3rd) 1Document2 pagesCost Accountancy (3rd) 1Imran Mohammed GNo ratings yet

- Manufacturing AccountDocument2 pagesManufacturing Accountmeelas123100% (2)

- A2 Accounting Revision KitDocument135 pagesA2 Accounting Revision KitWaniya AmirNo ratings yet

- Cfap-04 BFD Summary Sheets by Sir Abdul Azeem CompiledDocument37 pagesCfap-04 BFD Summary Sheets by Sir Abdul Azeem CompiledZainioNo ratings yet

- Accounting For Manufacturing Operations: MGT 113 - Managerial Accounting Instructor: Ms. HdmirandaDocument2 pagesAccounting For Manufacturing Operations: MGT 113 - Managerial Accounting Instructor: Ms. HdmirandaKeziah Eldene VilloraNo ratings yet

- UNIT II Final Account CollegeDocument36 pagesUNIT II Final Account CollegeyogeshNo ratings yet

- Video Description 1565 2019-02-27 151226 PDFDocument169 pagesVideo Description 1565 2019-02-27 151226 PDFADITYA JAINNo ratings yet

- Specimen of Cost SheetDocument3 pagesSpecimen of Cost SheetReema MahtoNo ratings yet

- Departmental TradingDocument1 pageDepartmental Tradingmeelas123No ratings yet

- Working PaperDocument1 pageWorking PaperAshNo ratings yet

- Cost Sheet FormatDocument2 pagesCost Sheet Formatksagar_20100% (1)

- Manufacturing ExerciseDocument12 pagesManufacturing Exercisethava470% (2)

- CH - 3 Cost AccountingDocument23 pagesCH - 3 Cost AccountingKhushali OzaNo ratings yet

- Blank Cost SheetDocument2 pagesBlank Cost SheetDebopriyo RoyNo ratings yet

- Share Based CompensationDocument3 pagesShare Based CompensationPj Dela VegaNo ratings yet

- Note 2absorption vs. Variable CostingDocument1 pageNote 2absorption vs. Variable CostingTel Aviv AňoverNo ratings yet

- CLASS Cost SheetDocument38 pagesCLASS Cost Sheetyogesh50% (2)

- Balance Sheet AccountancyDocument18 pagesBalance Sheet AccountancyMeenuNo ratings yet

- Cost SheetDocument1 pageCost Sheetmick84100% (1)

- Final Accounts: PruningDocument27 pagesFinal Accounts: PruningSarmad Sadiq E4 42No ratings yet

- MATH101 EquationsDocument26 pagesMATH101 Equationsamr khaledNo ratings yet

- Cost SheetDocument21 pagesCost SheetSmriti SahuNo ratings yet

- 20201104044854Document27 pages20201104044854hasharawanNo ratings yet

- Statement of Cost: Particulars AmountDocument1 pageStatement of Cost: Particulars AmountPiyush NarulaNo ratings yet

- F5 Cenit Online Notes P1Document23 pagesF5 Cenit Online Notes P1Izhar MumtazNo ratings yet

- Cost and Cost SheetDocument10 pagesCost and Cost Sheetirfpav06No ratings yet

- Share-Based CompensationDocument2 pagesShare-Based Compensationdria olivaNo ratings yet

- Schedule of Cost of Goods ProducedDocument1 pageSchedule of Cost of Goods Producedalena persadNo ratings yet

- Absorption MarginalDocument17 pagesAbsorption MarginalSHIVANSH BANSALNo ratings yet

- Solution Cost SheetDocument54 pagesSolution Cost SheetAniket Vangule0% (1)

- Control & Correction of Errors RevisionDocument3 pagesControl & Correction of Errors RevisionGrand Meme VinesNo ratings yet

- ACCN4 - Further Aspects of Management AccountingDocument16 pagesACCN4 - Further Aspects of Management AccountingS ONo ratings yet

- Format of Trading Profit Loss Account Balance Sheet PDFDocument6 pagesFormat of Trading Profit Loss Account Balance Sheet PDFsonika7100% (1)

- Cost Marathon Notes Session 1 Pranav PopatDocument71 pagesCost Marathon Notes Session 1 Pranav PopatRohit bhulNo ratings yet

- Hand Out 3 - Adjusting EntriesDocument1 pageHand Out 3 - Adjusting EntriesEloiza AlcaldeNo ratings yet

- Manufacturing Presentation 1Document6 pagesManufacturing Presentation 1tshenolochristianNo ratings yet

- Direct and Absorption Costing NotesDocument14 pagesDirect and Absorption Costing NotesAnru PienaarNo ratings yet

- Marginal & Absorption Costing ST Academy With SolutionDocument14 pagesMarginal & Absorption Costing ST Academy With SolutionFaisal KhanNo ratings yet

- Statement of Comprehensive IncomeDocument6 pagesStatement of Comprehensive IncomeChinchin Ilagan DatayloNo ratings yet

- Product CostDocument2 pagesProduct Costsyuhada ismailNo ratings yet

- Cost SheetDocument21 pagesCost SheetSmriti SahuNo ratings yet

- Inventories: Indian Accounting Standard (Ind AS) 2Document10 pagesInventories: Indian Accounting Standard (Ind AS) 2Bathina Srinivasa RaoNo ratings yet

- Chapter 3 - ABCDocument50 pagesChapter 3 - ABCRizwanahParwinNo ratings yet

- CH 09Document43 pagesCH 09Binar Arum NurmawatiNo ratings yet

- Hilton 11e Chap004 PPT-STUDocument42 pagesHilton 11e Chap004 PPT-STULạnh LùngNo ratings yet

- Financial Accounting Management Accounting Primary Users Purpose of InformationDocument3 pagesFinancial Accounting Management Accounting Primary Users Purpose of Informationpanda 1No ratings yet

- Management Advisory ServicesDocument4 pagesManagement Advisory ServicesYaj CruzadaNo ratings yet

- Group 10 - Chapter 12 - Group Assignment No. 10 Exercises 1 & 2 Pages 331 - 334Document31 pagesGroup 10 - Chapter 12 - Group Assignment No. 10 Exercises 1 & 2 Pages 331 - 334Carla TalanganNo ratings yet

- Fcma MTQSDocument11 pagesFcma MTQSRoqayya Fayyaz100% (1)

- ACT121 - Topic 2Document2 pagesACT121 - Topic 2Juan FrivaldoNo ratings yet

- Property, Plant and Equipment: Ppe - Pas 16 Tangible Assets PurposesDocument5 pagesProperty, Plant and Equipment: Ppe - Pas 16 Tangible Assets PurposesJp Combis0% (1)

- Cost & Management Accounting - MGT402 Quiz 1Document63 pagesCost & Management Accounting - MGT402 Quiz 1Ayesha NaureenNo ratings yet

- Nirani Sugars:: Analysis and Classification of CostDocument4 pagesNirani Sugars:: Analysis and Classification of CostpoonamNo ratings yet

- Arabic Gum Processing Industry PDFDocument73 pagesArabic Gum Processing Industry PDFdrpigaNo ratings yet

- (C) Present Value of Future Benefits: Multiple Choice Questions (MCQS)Document8 pages(C) Present Value of Future Benefits: Multiple Choice Questions (MCQS)Z the officerNo ratings yet

- AFIN210 Midterm Exam 2017Document5 pagesAFIN210 Midterm Exam 2017William C ManelaNo ratings yet

- Cost Accounting ExercisesDocument1 pageCost Accounting ExercisesJosephina Catipon BelenNo ratings yet

- Working Capital ManagementDocument7 pagesWorking Capital ManagementEduwiz Mänagemënt EdücatîonNo ratings yet

- Cost Accounting: Definition, Scope, Objectives and Significance of Cost AccountingDocument31 pagesCost Accounting: Definition, Scope, Objectives and Significance of Cost AccountingSachin SawhneyNo ratings yet