Professional Documents

Culture Documents

Jotun A S FS 2022

Uploaded by

Info Riskma SolutionsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jotun A S FS 2022

Uploaded by

Info Riskma SolutionsCopyright:

Available Formats

Back to contents >

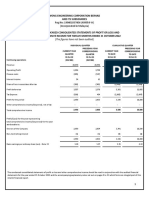

CONSOLIDATED INCOME STATEMENT CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(NOK million) Note 2022 2021 (NOK million) Note 2022 2021

Operating revenue 2.1 27 858 22 809 Profit for the year 2 167 2 111

Share of profit from associates and joint ventures 5.5 729 496

Cost of goods sold 2.1 -15 941 -12 480 Other comprehensive income not to be reclassified to profit

or loss in subsequent periods:

Payroll expenses 2.2 -3 686 -3 389

Actuarial gain/loss (-) on defined benefit pension plans (net of tax) 5.2 28 -8

Other operating expenses 2.3 -4 237 -3 421

Depreciation, amortisation and impairment 3.2, 3.3 -986 -876

Other comprehensive income to be reclassified to profit or

Operating profit 3 737 3 138 loss in subsequent periods:

Gain/loss (-) on hedge of net investments in foreign operations

Net financial items 4.3 -546 -248 (net of tax) 54 15

Profit before tax 3 191 2 890 Hyperinflation adjustment for the year ( and at 1 January) 5.10 319 -

Currency translation differences in foreign operations 274 -90

Income tax expense 5.1 -1 024 -779 Other comprehensive income for the year, net of tax 674 -83

Profit for the year 2 167 2 111

Total comprehensive income for the year 2 842 2 028

Profit for the year attributable to:

Equity holders of the parent company 2 056 1 998 Total comprehensive income attributable to:

Non-controlling interests 111 113 Equity holders of the parent company 2 766 1 913

Total 2 167 2 111 Non-controlling interests 76 115

Total 2 842 2 028

Operating revenue (NOK million)

Revenue growth (in %) Operating margin (in %)

27 858

22 809 3 489 3 737

19 652 21 070 3 138

17 660 2 320

1 361 16.6 %

13.8 % 13.4 %

22 % 11.8 %

11 % 7.7 %

8% 7% 8%

2018 2019 2020 2021 2022 2018 2019 2020 2021 2022

16 Jotun Annual Report 2022 Jotun Group

Back to contents >

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(NOK million) Note 31.12.2022 31.12.2021 (NOK million) Note 31.12.2022 31.12.2021

ASSETS EQUITY AND LIABILITIES

Non-current assets Equity

Deferred tax assets 5.1 410 386 Share capital 5.8 103 103

Other intangible assets 3.2 831 765 Other equity 14 010 12 014

Property, plant and equipment 3.3, 5.4 8 144 7 612 Non-controlling interests 380 352

Investments in associates and joint ventures 5.5 1 674 1 419 Total equity 14 493 12 468

Share investments 5.9 6 9

Other non-current financial receivables 4.1, 5.9 85 67 Non-current liabilities

Total non-current assets 11 151 10 257 Pension liabilities 5.2 251 296

Deferred tax liabilities 5.1 107 73

Current assets Provisions 3.7 125 188

Inventories 3.4 4 821 4 034 Interest-bearing debt 4.1, 5.9 2 292 2 995

Trade and other receivables 3.5, 5.9 7 071 5 753 Other non-current liabilities 22 15

Cash and cash equivalents 4.2, 5.9 3 312 3 388 Total non-current liabilities 2 797 3 567

Total current assets 15 204 13 175

Current liabilities

Total assets 26 355 23 432 Interest-bearing debt 4.1 2 796 2 266

Trade payables 5.9 3 489 2 926

Tax payable 5.1 397 227

Other current liabilities 3.6, 3.7, 5.9 2 383 1 979

Total current liabilities 9 065 7 398

Total liabilities 11 862 10 964

Total equity and liabilities 26 355 23 432

Sandefjord, Norway, 14 February 2023

The Board of Directors

Jotun A/S

Odd Gleditsch d.y. Einar Abrahamsen Bjørg Engevik Nilsen Terje Andersen

Chairman

Jannicke Nilsson Nicolai A. Eger Camilla Hagen Sørli Per Kristian Aagaard Morten Fon

President & CEO

Jotun Group Jotun Annual Report 2022 17

Back to contents >

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY CONSOLIDATED STATEMENT OF CASH FLOWS

EQUITY HOLDERS OF THE PARENT COMPANY (NOK million) Note 2022 2021

Non-con-

Share Other Translation trolling Total Cash flow from operating activities

(NOK million) Note capital equity differences Total interests equity

Operating profit 3 737 3 138

Equity as of 1 January 2021 103 9 989 710 10 802 326 11 128 Adjustments to reconcile operating profit to net cash flows:

Dividends 5.8 -599 -599 -93 -691 Share of profit from associates and joint ventures 2.2. 5.5 -729 -496

Profit for the year 1 998 1 998 113 2 111 Dividend paid from associates and joint ventures 5.5 600 727

Depreciation, amortisation and impairment 3.2, 3.3 986 876

Other comprehensive income 7 -92 -85 2 -83

Change in accruals, provisions and other 154 152

Share capital increase - - - 4 4

Working capital adjustments:

Equity as of 31 December 2021 103 11 396 618 12 116 352 12 468 Change in trade and other receivables -1 318 -774

Dividends 5.8 -770 -770 -70 -840 Change in trade payables 564 591

Change in inventories -787 -1 156

Profit for the year 2 056 2 056 111 2 167

Cash generated from operating activities 3 207 3 059

Other comprehensive income 400 310 710 -36 674

Interest received 4.3 45 21

Share capital increase - - - 23 23

Interest paid 4.3 -397 -168

Equity as of 31 December 2022 103 13 083 927 14 113 380 14 493

Other financial items -162 -128

Income tax payments -885 -816

Net cash flow from operating activities 1 809 1 968

Cash flow from investing activities

Proceeds from sale of property, plant and equipment 441 80

Purchase of property, plant and equipment 3.3 -1 161 -1 260

Purchase of intangible assets 3.2 -119 -103

Net cash flow from investing activities -839 -1 283

Cash and Cash equivalents

3 388 Cash flow from financing activities

3 312

Share capital increase in non-controlling interests 23 4

2 956

Proceeds from borrowings 1 030 2 284

Repayment of borrowings -1 321 -1 672

1 903 Payment of principal portion of lease liabilities -149 -141

Dividend paid to equity holders of the parent company 5.8 -770 -599

1 012 Dividend paid to non-controlling interests -70 -93

Net cash flow from financing activities -1 257 -217

Net increase / decrease (-) in cash and cash equivalents -287 469

Cash and cash equivalents as of 1 January 4.2 3 388 2 956

2018 2019 2020 2021 2022

Net currency translation effect 48 -37

Inflation effect on cash 5.10 164 -

Cash and cash equivalents as of 31 December 4.2 3 312 3 388

18 Jotun Annual Report 2022 Jotun Group

You might also like

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Harpreet KaurDocument2 pagesHarpreet KaurIT67% (3)

- Financial Statements (Unaudited) : Condensed Consolidated Income StatementDocument2 pagesFinancial Statements (Unaudited) : Condensed Consolidated Income Statement16paolitaNo ratings yet

- Ey Aarsrapport 2021 22 4Document1 pageEy Aarsrapport 2021 22 4Ronald RunruilNo ratings yet

- Good Hope PLC: Annual ReportDocument11 pagesGood Hope PLC: Annual ReporthvalolaNo ratings yet

- Financial Report Q1 2021Document21 pagesFinancial Report Q1 2021FiestaNo ratings yet

- Condensed Consolidated Income StatementDocument26 pagesCondensed Consolidated Income StatementIhdaNo ratings yet

- Bhima and Brothers Bullion Private Limited FY19 FY18 FY17 FY16 Summary Income StatementDocument2 pagesBhima and Brothers Bullion Private Limited FY19 FY18 FY17 FY16 Summary Income StatementKamlakar AvhadNo ratings yet

- FY Financial Report 2022Document107 pagesFY Financial Report 2022satkiratd24No ratings yet

- cpr03 Lesechos 16165 964001 Consolidated Financial Statements SE 2020Document66 pagescpr03 Lesechos 16165 964001 Consolidated Financial Statements SE 2020kjbewdjNo ratings yet

- Bharti Airtel Case Study: Varun Parashar 36A Gaurav Pathak 11B Rajarshi Dasgupta 28B Rishabh Shukla 29BDocument4 pagesBharti Airtel Case Study: Varun Parashar 36A Gaurav Pathak 11B Rajarshi Dasgupta 28B Rishabh Shukla 29Brishabh shuklaNo ratings yet

- BMW Group Income Statements H1 2018Document13 pagesBMW Group Income Statements H1 2018Bharath Simha ReddyNo ratings yet

- Glenmark Life Sciences Limited (GLS) : Q2-FY22 Result UpdateDocument9 pagesGlenmark Life Sciences Limited (GLS) : Q2-FY22 Result UpdateAkatsuki DNo ratings yet

- Generali YE20 Supplementary Financial InformationDocument31 pagesGenerali YE20 Supplementary Financial InformationMislav GudeljNo ratings yet

- Quarterly Report on Financial Results and OperationsDocument21 pagesQuarterly Report on Financial Results and OperationsSuresh KumarNo ratings yet

- Audited Financial Result 2019 2020Document22 pagesAudited Financial Result 2019 2020Avrajit SarkarNo ratings yet

- JHM 1Qtr21 Financial Report (Amendment)Document13 pagesJHM 1Qtr21 Financial Report (Amendment)Ooi Gim SengNo ratings yet

- Lanka Realty Investments PLC: Interim Financial Statements 31ST DECEMBER 2021Document12 pagesLanka Realty Investments PLC: Interim Financial Statements 31ST DECEMBER 2021girihellNo ratings yet

- Ey Aarsrapport 2021 22Document40 pagesEy Aarsrapport 2021 22IrinaElenaCososchiNo ratings yet

- Just Dial Financial Model Projections CompleteDocument13 pagesJust Dial Financial Model Projections Completerakhi narulaNo ratings yet

- Raymond Limited Financial StatementsDocument85 pagesRaymond Limited Financial StatementsVinay KukrejaNo ratings yet

- Group Income StatementDocument1 pageGroup Income StatementAJNAZ PACIFICNo ratings yet

- 7050 Wong QR 2022-10-31 Wecfrq4fy2022 - 2122247081Document13 pages7050 Wong QR 2022-10-31 Wecfrq4fy2022 - 2122247081Quint WongNo ratings yet

- Hull Fund 9 Ech 12 Problem SolutionsDocument8 pagesHull Fund 9 Ech 12 Problem SolutionsJitendra YadavNo ratings yet

- DirectorsreportDocument13 pagesDirectorsreportSuri KunalNo ratings yet

- 2019 LBG q1 Ims CombinedDocument19 pages2019 LBG q1 Ims CombinedsaxobobNo ratings yet

- Interim Management StatementDocument10 pagesInterim Management StatementsaxobobNo ratings yet

- Walmart Financial Statements AnalysisDocument5 pagesWalmart Financial Statements AnalysisAhmad IqbalNo ratings yet

- Financial StatementsDocument92 pagesFinancial StatementsJaspreet KaurNo ratings yet

- Eng Interim Report q4 2011 TablesDocument1 pageEng Interim Report q4 2011 TablessamNo ratings yet

- 2022 Volkswagen Income S.Document1 page2022 Volkswagen Income S.AbdullahNo ratings yet

- UntitledDocument4 pagesUntitledKiran NaiduNo ratings yet

- Komplett q4 2022 ReportDocument33 pagesKomplett q4 2022 ReportMaria PolyuhanychNo ratings yet

- BCTC UnileverDocument6 pagesBCTC Unilever04 - Bùi Thị Thanh Mai - DHTM14A4HNNo ratings yet

- Consolidated Financial Statements of Volkswagen AG As of December 31 2022Document429 pagesConsolidated Financial Statements of Volkswagen AG As of December 31 2022AbdullahNo ratings yet

- EV Annual Report 2021 22Document69 pagesEV Annual Report 2021 22deepakturi2002No ratings yet

- Consolidated Financial Statements As of December 31 2020Document86 pagesConsolidated Financial Statements As of December 31 2020Raka AryawanNo ratings yet

- Top Glove 2020, 2021Document3 pagesTop Glove 2020, 2021nabil izzatNo ratings yet

- Gone Rural Historical Financials Reveal Growth Over TimeDocument31 pagesGone Rural Historical Financials Reveal Growth Over TimeHumphrey OsaigbeNo ratings yet

- Q1 FY23 Financial TablesDocument11 pagesQ1 FY23 Financial TablesDennis AngNo ratings yet

- CF-Export-26-02-2024 40Document12 pagesCF-Export-26-02-2024 40v4d4f8hkc2No ratings yet

- Boskalis Annual Report 2021Document170 pagesBoskalis Annual Report 2021ZeinaNo ratings yet

- Also Hy2023 en VIDocument21 pagesAlso Hy2023 en VImihirbhojani603No ratings yet

- Financial Statements Kodak Q3 2022Document3 pagesFinancial Statements Kodak Q3 2022GARCÍA GUTIERREZ NOEMINo ratings yet

- Plaquette Annuelle 31 Decembre 2022 EN VdefsDocument80 pagesPlaquette Annuelle 31 Decembre 2022 EN VdefsAbdcNo ratings yet

- C Audited Standalone and Consolidated Financial Statements of Tata Steel Limited For Fy 2022 23Document325 pagesC Audited Standalone and Consolidated Financial Statements of Tata Steel Limited For Fy 2022 23yash rajNo ratings yet

- Colgate Financial Statements AnalysisDocument5 pagesColgate Financial Statements AnalysisPavithra SankolNo ratings yet

- Unaudited Consolidated Financial Results For The Quarter Ended 31 March 2010Document4 pagesUnaudited Consolidated Financial Results For The Quarter Ended 31 March 2010poloNo ratings yet

- Ss 6Document20 pagesSs 6Trần Nguyễn Quỳnh GiaoNo ratings yet

- Axis Bank - AR21 - DRDocument17 pagesAxis Bank - AR21 - DRRakeshNo ratings yet

- UEMedgenta 2021 Financial ResultsDocument4 pagesUEMedgenta 2021 Financial Resultsariash mohdNo ratings yet

- CIA Cia3 AppbDocument4 pagesCIA Cia3 AppbertugrulrizvanNo ratings yet

- Cocoaland Holdings Berhad: (Incorporated in Malaysia)Document15 pagesCocoaland Holdings Berhad: (Incorporated in Malaysia)Sajeetha MadhavanNo ratings yet

- MAERSK - Annual Report - 2022Document4 pagesMAERSK - Annual Report - 2022ccs sandeepNo ratings yet

- KPI_Q1_FY24_june2023Document12 pagesKPI_Q1_FY24_june2023tapas.patel1No ratings yet

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 June 2019Document13 pagesSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 June 2019Nilupul BasnayakeNo ratings yet

- Bayerische Landesbank: Global Detailed FormatDocument23 pagesBayerische Landesbank: Global Detailed FormatRawaaNo ratings yet

- RCOM 4thconsoliated 09-10Document3 pagesRCOM 4thconsoliated 09-10Goutam YenupuriNo ratings yet

- Danone 2020 Full Year Consolidated Financial Statements and Related NotesDocument62 pagesDanone 2020 Full Year Consolidated Financial Statements and Related NotesHager SalahNo ratings yet

- Ecobank Ghana Limited: Un-Audited Financial Statements For The Three-Month Period Ended 31 March 2022Document8 pagesEcobank Ghana Limited: Un-Audited Financial Statements For The Three-Month Period Ended 31 March 2022Fuaad DodooNo ratings yet

- BKT PDFDocument28 pagesBKT PDFnikhilNo ratings yet

- Project Report Ritesh SonawaneDocument66 pagesProject Report Ritesh SonawaneRitesh SonawaneNo ratings yet

- 014 - Manila Water (2018)Document268 pages014 - Manila Water (2018)Glen Carlo VillanuevaNo ratings yet

- People's Republic of Bangladesh Preparatory Survey On Renewable Energy Development Project Final ReportDocument310 pagesPeople's Republic of Bangladesh Preparatory Survey On Renewable Energy Development Project Final ReportShahin NescoNo ratings yet

- The Impact of Reward Management Systems on Employee Retention: The Case of CURE HospitalDocument73 pagesThe Impact of Reward Management Systems on Employee Retention: The Case of CURE HospitalDerbew TesfaNo ratings yet

- Indian Labour Market Outline: Regional Dimension and Employment StatusDocument11 pagesIndian Labour Market Outline: Regional Dimension and Employment StatusAnurag JayswalNo ratings yet

- Journal of Business Research 117 (2020) 163-175Document13 pagesJournal of Business Research 117 (2020) 163-175NicolasNo ratings yet

- Business Combination - TheoriesDocument11 pagesBusiness Combination - TheoriesMILLARE, Teddy Glo B.No ratings yet

- Franchise Accounting - DoneDocument3 pagesFranchise Accounting - DoneJymldy EnclnNo ratings yet

- Proforma Invoice: Ser. No. HS Code Detail Description of Machineries Model Q'Ty Unit Price (USD$) Total Amount (USD$)Document3 pagesProforma Invoice: Ser. No. HS Code Detail Description of Machineries Model Q'Ty Unit Price (USD$) Total Amount (USD$)OLIYADNo ratings yet

- Module 6 Strat MGTDocument15 pagesModule 6 Strat MGTAllen Gevryel Ragged A. GabrielNo ratings yet

- Organization Development and Change 10th Edition Cummings Test Bank 1Document36 pagesOrganization Development and Change 10th Edition Cummings Test Bank 1carolynthompsonpbragjqyfe100% (25)

- Friedman and Freeman MaterialsDocument3 pagesFriedman and Freeman MaterialsHieu LeNo ratings yet

- Ocean v. Blue Cross 11Document32 pagesOcean v. Blue Cross 11Satyam JainNo ratings yet

- Property Law-II ProjectDocument19 pagesProperty Law-II ProjectVanshita GuptaNo ratings yet

- Conflict Minerals Reporting Template (CMRT) : Link To Terms & ConditionsDocument3 pagesConflict Minerals Reporting Template (CMRT) : Link To Terms & ConditionsDevika raksheNo ratings yet

- MEFA Unit – 2 Notes on Demand, Supply and EquilibriumDocument21 pagesMEFA Unit – 2 Notes on Demand, Supply and EquilibriumMuskan TambiNo ratings yet

- Paying BankerDocument5 pagesPaying BankerPrajwalNo ratings yet

- Patterson 1999Document18 pagesPatterson 1999Teodora Maria DeseagaNo ratings yet

- Project (Role of Commercial Bank)Document5 pagesProject (Role of Commercial Bank)souvikNo ratings yet

- IMSLP320605-PMLP518792-opus 33 Ave SantissimaDocument1 pageIMSLP320605-PMLP518792-opus 33 Ave SantissimaoloqornoNo ratings yet

- ToolsDocument52 pagesToolsLisa Marie CaballeroNo ratings yet

- American Friends Final ShowDocument23 pagesAmerican Friends Final Showmoses njengaNo ratings yet

- PharmAnal 4Document35 pagesPharmAnal 4Aaron Jhulian SimbitNo ratings yet

- JP Morgan Industrials ConferenceDocument19 pagesJP Morgan Industrials ConferenceJames BrianNo ratings yet

- Fast TrackDocument45 pagesFast TrackSAUMYA MNo ratings yet

- Calculate Cash and Cash Equivalents for Financial ReportingDocument127 pagesCalculate Cash and Cash Equivalents for Financial Reportingcherry blossomNo ratings yet

- Indian Textile Industry: Opportunities, Challenges and SuggestionsDocument16 pagesIndian Textile Industry: Opportunities, Challenges and SuggestionsGadha GopalNo ratings yet

- Electric Car Jack Mini Project ReportDocument35 pagesElectric Car Jack Mini Project ReportSneha ChaudharyNo ratings yet

- 10 Activity 1 Costing PricingDocument3 pages10 Activity 1 Costing PricingErika SalasNo ratings yet