Professional Documents

Culture Documents

Bhima and Brothers Bullion Private Limited FY19 FY18 FY17 FY16 Summary Income Statement

Uploaded by

Kamlakar AvhadOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bhima and Brothers Bullion Private Limited FY19 FY18 FY17 FY16 Summary Income Statement

Uploaded by

Kamlakar AvhadCopyright:

Available Formats

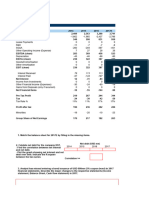

Bhima and Brothers Bullion Private Limited FY19 FY18 FY17 FY16

Summary Income Statement

Gross Revenues (+) 5,870 6,400 5,024 5,256

Revenue Growth (%) -8.3 27.4 -4.4 -9.9

Operating EBITDA (before income from associates) 355.1 432.2 436.0 480.8

Operating EBITDA Margin (%) 6.0 6.8 8.7 9.1

Operating EBITDAR 355 432 436 481

Operating EBITDAR Margin (%) 6.0 6.8 8.7 9.2

Operating EBIT 332 408 403 457.46

Operating EBIT Margin (%) 5.7 6.4 8.0 8.7

Gross Interest Expense 141 145 151 158

Pretax Income 194 266 256 318

Net Income 129 171 146 221

Summary Balance Sheet

Cash & Equivalents 27 18 14 13

Working Capital 2,256 2,199 2,149 1,634

Accounts Receivable 16 4 7 3

Inventory 2,259 2,204 2,156 1,887

Accounts Payable 20 9 13 256

Total Debt with Equity Credit 1,290 1,336 1,435 1,394

Short-Term Debt 1,273 1,246 1,276 1,239

Long-Term Senior Secured Debt 14 33 33 26

Long Term Senior Secured Debt 0 0 0 0

Long-Term Subordinated Debt 0 0 0 0

Other Debt 3 57 126 129

Equity Credit 0 0 0 0

Total Adjusted Debt with Equity Credit 1,290 1,336 1,435 1,396

Summary Cash Flow Statement

Operating EBITDA 355 432 436 481

Cash Interest -141 -145 -151 -158

Cash Tax -65 -95 -115 -97

Non-controlling Interest 0 0 0 0

Other Items Before FFO 2 -8 -8 2

Funds Flow from Operations 152 184 162 245

Change in Working Capital -57 -64 -456 3

Cash Flow from Operations 95 120 -293 248

Total Non-Operating/Non-Recurring Cash Flow 0 0 0 0

Capital Expenditures -19 -44 -37 -11

Common Dividends 0 0 0 0

Free Cash Flow 76 76 -330 237

Free Cash Flow Margin (%) 1.3 1.2 -6.6 4.5

Net Acquistions & Divestitures 0 0 0 0

Other Cash Flow Items -21 3 0 0

Cash Flow from Investing -41 -40 -37 -11

Net Debt Proceeds -46 0 0 0

Net Equity Proceeds 0 0 0 0

Cash Flow from Financing -46 23 290 -249

Total Change in Cash 8 4 1 -12

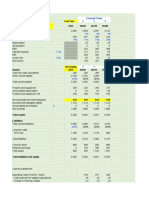

Coverage Ratios

FFO Interest Coverage 2.1 2.3 2.1 2.4

FFO Fixed Charge Coverage 2.1 2.3 2.1 2.4

Operating EBITDAR/Gross Interest Expense + Rents 2.5 3.0 2.9 3.0

Operating EBITDAR/Net Interest Expense + Rents 2.5 3.0 2.9 3.4

Operating EBITDA/Gross Interest Expense 2.5 3.0 2.9 3.1

Leverage Ratios

Total Adjusted Debt/Operating EBITDAR 3.6 3.1 3.3 2.9

Total Adjusted Net Debt/Operating EBITDAR 3.6 3.0 3.3 2.9

Total Debt with Equity Credit/Operating EBITDA 3.6 3.1 3.3 2.9

FFO Adjusted Leverage 4.4 4.1 4.6 3.6

FFO Adjusted Net Leverage 4.3 4.0 4.5 3.6

You might also like

- India Ratings Assigns Vishal Infraglobal IND BB-' Outlook StableDocument4 pagesIndia Ratings Assigns Vishal Infraglobal IND BB-' Outlook StableKishan PatelNo ratings yet

- 2006 2007 June 2008Document18 pages2006 2007 June 2008Rishabh GigrasNo ratings yet

- Qantas DataDocument31 pagesQantas DataChip choiNo ratings yet

- Figures in INR MN: FY14A FY15A FY16A FY17A AssetsDocument2 pagesFigures in INR MN: FY14A FY15A FY16A FY17A AssetsDeepakNo ratings yet

- Restructuring at Neiman Marcus Group (A) Bankruptcy ValuationDocument66 pagesRestructuring at Neiman Marcus Group (A) Bankruptcy ValuationShaikh Saifullah KhalidNo ratings yet

- CBSValuationChallenge InvestorsDocument60 pagesCBSValuationChallenge InvestorsVkNo ratings yet

- Financial Model 3 Statement Model - Final - MotilalDocument13 pagesFinancial Model 3 Statement Model - Final - MotilalSouvik BardhanNo ratings yet

- Hull Fund 9 Ech 12 Problem SolutionsDocument8 pagesHull Fund 9 Ech 12 Problem SolutionsJitendra YadavNo ratings yet

- INR Crore FY 16 FY 17 FY 18 FY 19 FY 20Document5 pagesINR Crore FY 16 FY 17 FY 18 FY 19 FY 20Shivani SinghNo ratings yet

- Jotun A S FS 2022Document3 pagesJotun A S FS 2022Info Riskma SolutionsNo ratings yet

- Just Dial Financial Model Projections CompleteDocument13 pagesJust Dial Financial Model Projections Completerakhi narulaNo ratings yet

- ABC Cement FM (Final)Document24 pagesABC Cement FM (Final)Muhammad Ismail (Father Name:Abdul Rahman)No ratings yet

- Coca-Cola and Pepsi Economic Analysis ReportDocument39 pagesCoca-Cola and Pepsi Economic Analysis ReportJing Xiong67% (3)

- Netflix Inc. Balance Sheet and Income Statement Analysis (2015-2018Document16 pagesNetflix Inc. Balance Sheet and Income Statement Analysis (2015-2018Lorena JaupiNo ratings yet

- Anchor Compa CommonDocument14 pagesAnchor Compa CommonCY ParkNo ratings yet

- VIB - Section2 - Group5 - Final Project - ExcelDocument70 pagesVIB - Section2 - Group5 - Final Project - ExcelShrishti GoyalNo ratings yet

- Colgate ModelDocument19 pagesColgate ModelRajat Agarwal100% (1)

- FY Financial Report 2022Document107 pagesFY Financial Report 2022satkiratd24No ratings yet

- Just Dial's financial performance over 8 yearsDocument16 pagesJust Dial's financial performance over 8 yearsDaksh MehraNo ratings yet

- Updated Excel Case StudyDocument4 pagesUpdated Excel Case Studydheerajvish1995No ratings yet

- 247806Document51 pages247806Jack ToutNo ratings yet

- Ratio Analysis Summary Particulars Mar '17 Mar '18 Mar '19 Revenue Growth Profitability RatiosDocument10 pagesRatio Analysis Summary Particulars Mar '17 Mar '18 Mar '19 Revenue Growth Profitability RatiosKAVYA GUPTANo ratings yet

- Accounting Information System HomeWork 1 Jazan UniversityDocument7 pagesAccounting Information System HomeWork 1 Jazan Universityabdullah.masmaliNo ratings yet

- Apollo Tyres FSADocument12 pagesApollo Tyres FSAChirag GugnaniNo ratings yet

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument6 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AHamzah HakeemNo ratings yet

- Lyon Corporation Cash Forecast For July, Year 6 Beginning Cash Balance 20Document9 pagesLyon Corporation Cash Forecast For July, Year 6 Beginning Cash Balance 20leniNo ratings yet

- Starbucks DataDocument32 pagesStarbucks DatabrainsphereNo ratings yet

- Acct 401 Tutorial Set FiveDocument13 pagesAcct 401 Tutorial Set FiveStudy GirlNo ratings yet

- Aiswarya Rachy Johnson p19105 Group GDocument10 pagesAiswarya Rachy Johnson p19105 Group GAthulya SanthoshNo ratings yet

- Balance Sheet: Total Assets Total EquityDocument6 pagesBalance Sheet: Total Assets Total EquityDeepak MatlaniNo ratings yet

- Hartalega Holdings Berhad (Malaysia) : Source: - WVB - Financial Standard For Industrial CompaniesDocument6 pagesHartalega Holdings Berhad (Malaysia) : Source: - WVB - Financial Standard For Industrial CompaniesJUWAIRIA BINTI SADIKNo ratings yet

- Comparative Income Statements and Balance Sheets For Merck ($ Millions) FollowDocument6 pagesComparative Income Statements and Balance Sheets For Merck ($ Millions) FollowIman naufalNo ratings yet

- Ezz Steel Ratio Analysis - Fall21Document10 pagesEzz Steel Ratio Analysis - Fall21farahNo ratings yet

- Orient Overseas (International) Limited Corporate ProfileDocument207 pagesOrient Overseas (International) Limited Corporate ProfileVincent KohNo ratings yet

- FIN448 DCFwWACC SolutionDocument9 pagesFIN448 DCFwWACC SolutionAndrewNo ratings yet

- The Following Are The Financial Statements (Along With Common Sized Analysis) of XYZ LTDDocument3 pagesThe Following Are The Financial Statements (Along With Common Sized Analysis) of XYZ LTDDeloresNo ratings yet

- Financial AccountingDocument21 pagesFinancial AccountingMariam KupravaNo ratings yet

- Ratio Analysis TemplateDocument20 pagesRatio Analysis TemplatenishantNo ratings yet

- 4 Years of Financial Data - v4Document25 pages4 Years of Financial Data - v4khusus downloadNo ratings yet

- Asf ExcleDocument6 pagesAsf ExcleAnam AbrarNo ratings yet

- Shiksha: Non-Current AssetsDocument4 pagesShiksha: Non-Current AssetsdebojyotiNo ratings yet

- Midterm Excel Worksheet Olivieri Version 2Document21 pagesMidterm Excel Worksheet Olivieri Version 2Emanuele OlivieriNo ratings yet

- A Simple Model: Integrating Financial StatementsDocument10 pagesA Simple Model: Integrating Financial Statementssps fetrNo ratings yet

- SELECTED FINANCIAL DATA 2006-2002Document1 pageSELECTED FINANCIAL DATA 2006-2002junerubinNo ratings yet

- Vienna Insurance Group Key Financials 6M 2015: Year-To-DateDocument12 pagesVienna Insurance Group Key Financials 6M 2015: Year-To-DateTamara HorvatNo ratings yet

- Gone Rural Historical Financials Reveal Growth Over TimeDocument31 pagesGone Rural Historical Financials Reveal Growth Over TimeHumphrey OsaigbeNo ratings yet

- Dalmia Bharat Sugar and Industries Ltd.Document19 pagesDalmia Bharat Sugar and Industries Ltd.Shweta GargNo ratings yet

- 07. Nke Model Di VincompleteDocument10 pages07. Nke Model Di VincompletesalambakirNo ratings yet

- Bajaj Finserv Ltd. (India) : SourceDocument5 pagesBajaj Finserv Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Fujita Kanko Financial SummaryDocument5 pagesFujita Kanko Financial SummaryDamTokyoNo ratings yet

- Unless Otherwise Specified, All Financials Are in INR LakhsDocument8 pagesUnless Otherwise Specified, All Financials Are in INR LakhsShirish BaisaneNo ratings yet

- COH Financial Report and ProjectionsDocument9 pagesCOH Financial Report and ProjectionsLim JaehwanNo ratings yet

- Total Revenue: Income StatementDocument4 pagesTotal Revenue: Income Statementmonica asifNo ratings yet

- HGS Q1FY2020 Financial HighlightsDocument4 pagesHGS Q1FY2020 Financial HighlightsChirag LaxmanNo ratings yet

- Colgate Financial Statements AnalysisDocument5 pagesColgate Financial Statements AnalysisPavithra SankolNo ratings yet

- Bharti Airtel Case Study: Varun Parashar 36A Gaurav Pathak 11B Rajarshi Dasgupta 28B Rishabh Shukla 29BDocument4 pagesBharti Airtel Case Study: Varun Parashar 36A Gaurav Pathak 11B Rajarshi Dasgupta 28B Rishabh Shukla 29Brishabh shuklaNo ratings yet

- A - Case Study: Dreaming Corp.: The Financial Statements of Dreaming Corp. Are The Following (In K )Document7 pagesA - Case Study: Dreaming Corp.: The Financial Statements of Dreaming Corp. Are The Following (In K )Mohamed Lamine SanohNo ratings yet

- Financial Management AssignmentDocument5 pagesFinancial Management AssignmentSREEJITH RNo ratings yet

- Coca-Cola and Best Buy Income Statements and Financial ProjectionsDocument9 pagesCoca-Cola and Best Buy Income Statements and Financial ProjectionsEvelDerizkyNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Essel MiningDocument10 pagesEssel MiningKamlakar AvhadNo ratings yet

- Drama in The Classroom Project - Archana AvhadDocument9 pagesDrama in The Classroom Project - Archana AvhadKamlakar AvhadNo ratings yet

- RELIANCE Working Capital ManagementDocument76 pagesRELIANCE Working Capital ManagementKamlakar AvhadNo ratings yet

- Importance of Drama in Pre-School Education: Aysem TombakDocument7 pagesImportance of Drama in Pre-School Education: Aysem TombakKamlakar AvhadNo ratings yet

- VCA Sanctioned ProjectsDocument23 pagesVCA Sanctioned ProjectsKamlakar AvhadNo ratings yet

- The 2012 FedEx Ketchum Social Business StudyDocument40 pagesThe 2012 FedEx Ketchum Social Business StudyEric PrenenNo ratings yet

- Government of West Bengal Ration Card DetailsDocument1 pageGovernment of West Bengal Ration Card DetailsGopal SarkarNo ratings yet

- Sample Project ReportDocument77 pagesSample Project ReportChavda ashwinNo ratings yet

- Geology and age of the Parguaza rapakivi granite, VenezuelaDocument6 pagesGeology and age of the Parguaza rapakivi granite, VenezuelaCoordinador de GeoquímicaNo ratings yet

- Floor MatsDocument3 pagesFloor MatsGhayas JawedNo ratings yet

- Enclosure No. 6: Election Application PacketDocument8 pagesEnclosure No. 6: Election Application PacketLen LegaspiNo ratings yet

- Tata Cellular V UOI: So Unreasonable That No Reasonable Person Acting Reasonably Could Have Made It)Document2 pagesTata Cellular V UOI: So Unreasonable That No Reasonable Person Acting Reasonably Could Have Made It)heretostudyNo ratings yet

- 5 Short MustWatch Motivational Videos For TeachersrccymDocument4 pages5 Short MustWatch Motivational Videos For Teachersrccymfoxpeak8No ratings yet

- How Chips Are DesignedDocument46 pagesHow Chips Are DesignedAli AhmadNo ratings yet

- Case Study of Vietinbank Dao Hoang NamDocument14 pagesCase Study of Vietinbank Dao Hoang NamNam ĐàoNo ratings yet

- Operation Manuals HCWA10NEGQ - Wired ControllerDocument2 pagesOperation Manuals HCWA10NEGQ - Wired Controllerchamara wijesuriyaNo ratings yet

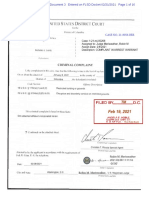

- Lentz Criminal ComplaintDocument16 pagesLentz Criminal ComplaintKristen Faith SchneiderNo ratings yet

- SSRN Id983401Document43 pagesSSRN Id983401LeilaNo ratings yet

- The King's Avatar - A Compilatio - Butterfly BlueDocument8,647 pagesThe King's Avatar - A Compilatio - Butterfly BlueDarka gamesNo ratings yet

- Drive Unit TENH EH 10003, 225, 50/60Hz 400/440V: Qty. Description Specification Material Size DT Doc IdDocument1 pageDrive Unit TENH EH 10003, 225, 50/60Hz 400/440V: Qty. Description Specification Material Size DT Doc IdKarikalan JayNo ratings yet

- Event Management Study Material Free PDFDocument2 pagesEvent Management Study Material Free PDFKim0% (1)

- EJN-00625 Installation of Manual Pull Valves in Deluge Systems For SOLPEDocument4 pagesEJN-00625 Installation of Manual Pull Valves in Deluge Systems For SOLPESARAVANAN ARUMUGAMNo ratings yet

- Impact On Cocoon Quality Improvement.1Document10 pagesImpact On Cocoon Quality Improvement.1Naveen NtrNo ratings yet

- Serena Berman PW Res - 2020Document2 pagesSerena Berman PW Res - 2020Serena BermanNo ratings yet

- Space Management Guidelines: Brief SummaryDocument17 pagesSpace Management Guidelines: Brief SummaryMOHD JIDINo ratings yet

- Theory of Planned Behaviour (TPB)Document18 pagesTheory of Planned Behaviour (TPB)Afiq Wahyu AjiNo ratings yet

- Sample Letter - P.D. 705 Vis-A-Vis R.A. 10951Document3 pagesSample Letter - P.D. 705 Vis-A-Vis R.A. 10951Pauline Mae AranetaNo ratings yet

- FLIX Booking 1068813091Document2 pagesFLIX Booking 1068813091Pavan SadaraNo ratings yet

- Tribology Aspects in Angular Transmission Systems: Hypoid GearsDocument7 pagesTribology Aspects in Angular Transmission Systems: Hypoid GearspiruumainNo ratings yet

- ChecklistDocument2 pagesChecklistKyra AlesonNo ratings yet

- Much NeedeDocument11 pagesMuch NeedeRijul KarkiNo ratings yet

- Jasmine Nagata Smart GoalsDocument5 pagesJasmine Nagata Smart Goalsapi-319625868No ratings yet

- Certificate of Analysis - Certified Reference Material: Cetyl PalmitateDocument6 pagesCertificate of Analysis - Certified Reference Material: Cetyl PalmitateRachel McArdleNo ratings yet

- As 2669-1983 Sulphuric Acid For Use in Lead-Acid BatteriesDocument7 pagesAs 2669-1983 Sulphuric Acid For Use in Lead-Acid BatteriesSAI Global - APACNo ratings yet

- 20 5880100Document2 pages20 5880100'Theodora GeorgianaNo ratings yet