Professional Documents

Culture Documents

FB County Tax Statement-2022

Uploaded by

Sageer Abdulla0 ratings0% found this document useful (0 votes)

5 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageFB County Tax Statement-2022

Uploaded by

Sageer AbdullaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

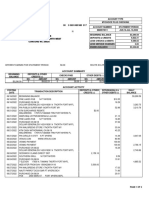

2022 YEAR TAX STATEMENT

CARMEN P. TURNER, MPA

FORT BEND COUNTY TAX ASSESSOR/ COLLECTOR

1317 EUGENE HEIMANN CIRCLE

RICHMOND, TEXAS 77469-3623

PHONE NO. (281) 341-3710

Mail To: Legal Description:

ABDULLA SAGEER PERUMAYIL & TINTU JA TARA SEC 3, BLOCK 11, LOT 30

6803 RENFRO DR

RICHMOND, TX 77469-5956

Legal Acres: .0000

Account No: 8695-03-011-0300-901 Parcel Address: 6803 RENFRO DR

CAD No: R16980 As of Date: 01/09/2023 Print Date: 01/09/2023 Printed By: ACT_INQ

Market Value Appraised Assessed Capped Homesite AG/TIM Non-Qualifying

Land Improvement Value Value Value Value Market Value Value

$24,200 $170,020 $194,220 $194,220 $0 $194,220 $0 $0

Taxing Assessed Exemptions Taxable Tax

Unit Value (100%) Code Value Value Rate Tax

LAMAR C I S D- OPERATING $194,220 $0 $194,220 1.242000 $2,412.21

FORT BEND CO DRAINAGE $194,220 $0 $194,220 0.012900 $25.05

FORT BEND CO GEN FND $194,220 $0 $194,220 0.438300 $851.27

~~8695030110300901.2022_.pdf~~ Total 2022 Tax: $3,288.53

Total 2022 Levy Paid To Date: $0.00

2022 Levy Due: $3,288.53

Exemptions: Total 2022 Due: $3,288.53

AMOUNT DUE IF PAID BY THE END OF: Taxes become delinquent on February 01, 2023.

01/31/2023 0% 02/28/2023 7% 03/31/2023 9% 04/30/2023 11% 05/31/2023 13% 06/30/2023 15%

$3,288.53 $3,518.72 $3,584.49 $3,650.27 $3,716.05 $3,781.81

IF YOU ARE 65 YEARS OF AGE OR OLDER OR ARE DISABLED AND THE PROPERTY DESCRIBED IN THIS DOCUMENT IS YOUR RESIDENCE

HOMESTEAD, YOU SHOULD CONTACT THE APPRAISAL DISTRICT REGARDING ANY ENTITLEMENT YOU MAY HAVE TO A POSTPONEMENT IN THE

PAYMENT OF THESE TAXES.

School Information :

LAMAR C I S D- OPERATING 2022 M&O .85460000 I&S .38740000 Total 1.2420000 2021 M&O .87200000 I&S .37000000 Total 1.2420000

TO PAY BY CREDIT CARD VISIT WWW.FORTBENDCOUNTYTX.GOV/TAXOFFICE

CREDIT CARD PAYMENTS ARE CHARGED 2.09% CONVENIENCE FEE PER ACCOUNT BY GRANT STREET. NO FEE CHARGED FOR E-CHECK.

PLEASE CUT AT THE DOTTED LINE AND RETURN THIS PORTION WITH YOUR PAYMENT. 7.1.59

AMOUNT DUE IF PAID BY THE END OF: Print Date: 01/09/2023

01/31/2023 0% 02/28/2023 7% 03/31/2023 9% 04/30/2023 11% 05/31/2023 13% 06/30/2023 15%

$3,288.53 $3,518.72 $3,584.49 $3,650.27 $3,716.05 $3,781.81

PLEASE NOTE YOUR ACCOUNT NUMBER ON YOUR CHECK AND MAKE CHECKS PAYABLE TO:

CARMEN P. TURNER, MPA

FORT BEND COUNTY TAX ASSESSOR/COLLECTOR

1317 EUGENE HEIMANN CIRCLE

RICHMOND, TEXAS 77469-3623 *8695030110300901*

8695-03-011-0300-901 AMOUNT PAID:

ABDULLA SAGEER PERUMAYIL & TINTU JA

6803 RENFRO DR

RICHMOND, TX 77469-5956

$__________________._____

0000000R16980 047 0000328853 0000351872 0000358449 0000365027 5

You might also like

- TD Statement Mar To AprrDocument4 pagesTD Statement Mar To Aprrslimple Smiles100% (2)

- PDFDocument1 pagePDFBrian SmithNo ratings yet

- Sampath Card Estatement 2020-10-28-4051226 PDFDocument1 pageSampath Card Estatement 2020-10-28-4051226 PDFBuddhika Gihan Wijerathne0% (1)

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableAyanna Sellers100% (5)

- American ExpressDocument5 pagesAmerican ExpressKelley100% (1)

- Best Buy Usa OriginalllDocument1 pageBest Buy Usa OriginalllmedNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- A0x8akqPTbqMfGpKj 26Zg BB Course1 Week4 Workbook-V2.02Document8 pagesA0x8akqPTbqMfGpKj 26Zg BB Course1 Week4 Workbook-V2.02Zihad HossainNo ratings yet

- Carsons Deed Tax BillDocument14 pagesCarsons Deed Tax BillBurton PhillipsNo ratings yet

- Document 3Document2 pagesDocument 3garrettloehrNo ratings yet

- Bill To:: CO - BrightonDocument3 pagesBill To:: CO - BrightonCATHY BURK100% (2)

- Payment Information Summary of Account ActivityDocument4 pagesPayment Information Summary of Account Activityluz rodriguezNo ratings yet

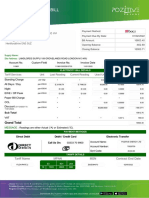

- Invoice for iPhone XS Max sale and upgrade with installment planDocument1 pageInvoice for iPhone XS Max sale and upgrade with installment planMichel Gandhi100% (2)

- Att Obaida Iphone 11 - 063125Document3 pagesAtt Obaida Iphone 11 - 063125Kondombo67% (3)

- Advance Financial Management-Vandana SohoniDocument6 pagesAdvance Financial Management-Vandana SohoniSangram JagtapNo ratings yet

- Differences Between Forward, Futures and OptionsDocument10 pagesDifferences Between Forward, Futures and OptionsDIANA CABALLERONo ratings yet

- Tax Bill 2022Document1 pageTax Bill 2022LOUNGE HOMENo ratings yet

- Documento de Propiedad en Texas, Estados UnidosDocument1 pageDocumento de Propiedad en Texas, Estados UnidosArmandoInfoNo ratings yet

- 2022 Property Tax Statement for 405 Flintrock WayDocument1 page2022 Property Tax Statement for 405 Flintrock WayLOUNGE HOMENo ratings yet

- 2023 Web Tax Statement: Owner ID: Parcel ID: Sequence: Account #: Owner Interest: Legal DescriptionDocument1 page2023 Web Tax Statement: Owner ID: Parcel ID: Sequence: Account #: Owner Interest: Legal Descriptionp13607091No ratings yet

- Reprinted Tax Receipt for Wilson PropertiesDocument2 pagesReprinted Tax Receipt for Wilson PropertiesChelsea KayeNo ratings yet

- Lease Extra Invoice 10:13-10:20:22Document3 pagesLease Extra Invoice 10:13-10:20:22loejustriNo ratings yet

- Income Tax - Computation - 2021Document26 pagesIncome Tax - Computation - 2021umasankarNo ratings yet

- Fetch Statementand NoticesDocument4 pagesFetch Statementand NoticesElizabethNo ratings yet

- ATT - USA X 256gbDocument4 pagesATT - USA X 256gbLavish SoodNo ratings yet

- ATT - USA X 256gbDocument3 pagesATT - USA X 256gbLavish SoodNo ratings yet

- CheckingDocument4 pagesCheckingAlexander Barno AlexNo ratings yet

- JPMCStatementDocument4 pagesJPMCStatementesteysi775No ratings yet

- February BOA StatementDocument4 pagesFebruary BOA StatementhayyandaiNo ratings yet

- Att Iphone XR 64goDocument3 pagesAtt Iphone XR 64goReagan LuyindulaNo ratings yet

- Paystub 2 DanielleDocument1 pagePaystub 2 DanielleKristina Mosley-FryeNo ratings yet

- KPQooo 000132800000 R 071 B1815 CA88621Document1 pageKPQooo 000132800000 R 071 B1815 CA88621freddieaddaeNo ratings yet

- Chase Bank Statement SummaryDocument2 pagesChase Bank Statement SummaryAn Šp0% (1)

- Jaider Gomez - Hoja 1Document6 pagesJaider Gomez - Hoja 1gjake0263No ratings yet

- Justice Brown: One Thousand Four Hundred Nine Dollars and 45/100 Justice BrownDocument1 pageJustice Brown: One Thousand Four Hundred Nine Dollars and 45/100 Justice BrownLindsay SimmsNo ratings yet

- Estmt - 2019 08 26Document8 pagesEstmt - 2019 08 26Sandra RíosNo ratings yet

- Statement 2023 07 09Document4 pagesStatement 2023 07 09blackson knightsonNo ratings yet

- Earnings Statement: Non NegotiableDocument1 pageEarnings Statement: Non NegotiableKang Kim100% (1)

- USAA CLASSIC CHECKING - SampleDocument3 pagesUSAA CLASSIC CHECKING - SampleJosey WilliamsNo ratings yet

- Statement of Taxes DueDocument1 pageStatement of Taxes DueCynthia McCoyNo ratings yet

- Bill To:: 2237 Prairie Center Pkwy, Unit A Brighton CO United States 80601 (720) 685-3229 Merchant ID:8024442645Document3 pagesBill To:: 2237 Prairie Center Pkwy, Unit A Brighton CO United States 80601 (720) 685-3229 Merchant ID:8024442645sorabangsNo ratings yet

- Rogers Wireless billDocument8 pagesRogers Wireless billgraemescottjohnsonNo ratings yet

- Att Iphone XR 64goDocument3 pagesAtt Iphone XR 64goReagan Luyindula100% (2)

- ATT - USA-11 PRO MAX-64gbDocument3 pagesATT - USA-11 PRO MAX-64gbJonathanNo ratings yet

- ACCOUNT SUMMARY As of Jul 24, 2020Document4 pagesACCOUNT SUMMARY As of Jul 24, 2020Mayara FazaniNo ratings yet

- Billing Detail: Late PaymentDocument1 pageBilling Detail: Late Paymenttheodore moses antoine beyNo ratings yet

- TempBillDocument1 pageTempBillNilesh UmaretiyaNo ratings yet

- Prichard Election AddressDocument1 pagePrichard Election AddressRob PortNo ratings yet

- Data PDFDocument5 pagesData PDFmalikjamshaidNo ratings yet

- Your Account Statement: Payment Information Summary of Account ActivityDocument4 pagesYour Account Statement: Payment Information Summary of Account ActivityAndreina VillalobosNo ratings yet

- Estatement 2020021813Document1 pageEstatement 2020021813ALL IN ONE. BOOLIWOOd SONGNo ratings yet

- Neto $38,049 I.V.A. (19%) $7,229 Exento $0 Monto Total $45,278 Cuota $0 Total A Pagar $45,278Document6 pagesNeto $38,049 I.V.A. (19%) $7,229 Exento $0 Monto Total $45,278 Cuota $0 Total A Pagar $45,278Rodrigo Reyes GutierrezNo ratings yet

- Estatement Chase AprilDocument6 pagesEstatement Chase AprilAtta ur RehmanNo ratings yet

- Att Usa PDFDocument3 pagesAtt Usa PDFČårl-Ünløćkēr EdouardNo ratings yet

- Chase Bank Statement SummaryDocument8 pagesChase Bank Statement SummaryJames O. LeGrosNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformFrom EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformNo ratings yet

- Clarke and Ginsburg (1975) The Political Economy of HousingDocument19 pagesClarke and Ginsburg (1975) The Political Economy of HousingGong JianNo ratings yet

- Key Features of EPF Act 1952Document3 pagesKey Features of EPF Act 1952Fency Jenus67% (3)

- International Oil Market and Oil Trading: Litasco SaDocument15 pagesInternational Oil Market and Oil Trading: Litasco Sasushilk28No ratings yet

- Certificate of InsuranceDocument4 pagesCertificate of InsuranceChandra SekharNo ratings yet

- Lecture 2 Is in The EnterpriseDocument44 pagesLecture 2 Is in The EnterpriseAludahNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument50 pages© The Institute of Chartered Accountants of Indiaprabhawagarwalla9690No ratings yet

- ICICI Merger Creates India's 2nd Largest BankDocument23 pagesICICI Merger Creates India's 2nd Largest BanksomilNo ratings yet

- Words Related With Business AdministrationDocument181 pagesWords Related With Business AdministrationRamazan MaçinNo ratings yet

- Chapter 2 - Understanding The Balance SheetDocument54 pagesChapter 2 - Understanding The Balance SheetMinh Anh NgNo ratings yet

- COMM324-03 Investing in Tesla Stock Run-UpDocument2 pagesCOMM324-03 Investing in Tesla Stock Run-UpKendra HalmanNo ratings yet

- CowlDocument3 pagesCowlPrasetyo Indra SuronoNo ratings yet

- IIML Stratos Competition GuidelinesDocument12 pagesIIML Stratos Competition GuidelinessharadvasistaNo ratings yet

- Internship Report On "Loan Disbursement Procedure of Grameen Bank "Document38 pagesInternship Report On "Loan Disbursement Procedure of Grameen Bank "Boby PodderNo ratings yet

- Ark Autonomous Technology & Robotics Etf Arkq Holdings PDFDocument1 pageArk Autonomous Technology & Robotics Etf Arkq Holdings PDFandrew2020rNo ratings yet

- Cash Flow Analysis and StatementDocument127 pagesCash Flow Analysis and Statementsnhk679546100% (6)

- Quiz Leases Part 1Document2 pagesQuiz Leases Part 1Jhanelle Marquez75% (4)

- Investment QuizDocument5 pagesInvestment QuizMohib AliNo ratings yet

- Hilton SamplechapterDocument41 pagesHilton SamplechapterNinikKurniatyNo ratings yet

- Credit ControlDocument5 pagesCredit ControlHimanshu GargNo ratings yet

- Pag-Ibig Mp2 Application FormDocument2 pagesPag-Ibig Mp2 Application Formroy czar pableoNo ratings yet

- Hutchison Whampoa Case ReportDocument6 pagesHutchison Whampoa Case ReporttsjakabNo ratings yet

- Warrant Buffet: Investment StrategyDocument16 pagesWarrant Buffet: Investment StrategyYassir SlaouiNo ratings yet

- Al-Ghazi Tractors Ltd (AGTL) Balance Sheet and Financial Ratios AnalysisDocument13 pagesAl-Ghazi Tractors Ltd (AGTL) Balance Sheet and Financial Ratios AnalysisM.ShahnamNo ratings yet

- Post-Departure ActivitiesDocument16 pagesPost-Departure ActivitiesMary Cherill UmaliNo ratings yet

- Integrated and Non Integrated System of AccountingDocument46 pagesIntegrated and Non Integrated System of AccountingGanesh Nikam67% (3)

- DENALOANSCHEMESDocument4 pagesDENALOANSCHEMESHardikPatelNo ratings yet