Professional Documents

Culture Documents

2277 Chapter 36

Uploaded by

tinotendazhuwao630 ratings0% found this document useful (0 votes)

2 views2 pagesOriginal Title

2277_Chapter_36

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pages2277 Chapter 36

Uploaded by

tinotendazhuwao63Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Chapter 36 Investment appraisal

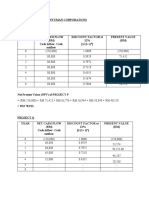

Q1 Joloss plc

Workings Milligan Bentine

Net receipts $000 Year 1 70 – (50 – 25) = 45 72 – (60 – 33) = 45

2 80 – (60 – 25) = 45 84 – (70 – 33) = 47

3 90 – (65 – 25) = 50 90 – (75 – 33) = 48

4 90 – (70 – 25) = 45 100 – (80 – 33) = 53

(i) Milligan Bentine

NPV

Factor (10%) Year $ $ $ $

1.000 0 (100 000) (100 000) (130 000) (130 000)

0.909 1 45 000 40 905 45 000 40 905

0.826 2 45 000 37 170 47 000 38 822

0.751 3 50 000 37 550 48 000 36 048

0.683 4 45 000 30 735 53 000 36 199

Net present values 46 360 21 974

(ii) Choose Milligan: greater NPV

(iii) IRR for Milligan

20% $

1.000 Year 0 (100 000)

0.833 1 37 485

0.694 2 31 230

0.579 3 28 950

0.482 4 21 690

19 355

IRR: 10% + (10% × 46 360

46 360

- 19 355

) = 27.2%

The machine meets the required return on outlay.

Q2 Jane Pannell Ltd

(a) Annual depreciation = $120 0004- $20 000 = $25 000

Average profit = $[80 000 – (46 000 + 25 000)] = $9000

ARR = 609000

000

× 100 = 15%

(b) NPV at 10% $

Year 0 Payment (120 000)

Years 1–4 $(80 000 – 46 000) × 3.169 107 746

Year 4 add $20 000 × 0.683 13 660

NPV 1 406

(c) At 15% $

Year 0 Payment (120 000)

Years 1–4 $(34 000 × 2.856) 97 104

Year 4 add $20 000 × 0.572 11 440

NPV (11 456)

IRR = 10% + (5% × 14061406

+ 11 456

) = 10.5%

You might also like

- FTP Finance Capital Budgeting AllDocument12 pagesFTP Finance Capital Budgeting AllRauful Sworan100% (1)

- Chapter 36Document2 pagesChapter 36kai68No ratings yet

- Project AppraisalDocument34 pagesProject AppraisalWilly Mwangi KiarieNo ratings yet

- Tax Chapter 3 AssignmentDocument5 pagesTax Chapter 3 AssignmentAriin TambunanNo ratings yet

- Or It Can Be Answered: ARR MethodDocument3 pagesOr It Can Be Answered: ARR MethodPranjal JaiswalNo ratings yet

- Solution of Tutorial 6Document4 pagesSolution of Tutorial 6Richard MidgleyNo ratings yet

- Chapter 17Document8 pagesChapter 17moonaafreenNo ratings yet

- CapitalBudgeting - Solved ProblemsDocument7 pagesCapitalBudgeting - Solved ProblemsDharmesh GoyalNo ratings yet

- Question 3, Ms - VinoDocument11 pagesQuestion 3, Ms - VinoPavitra RavyNo ratings yet

- 11042024154808Document15 pages11042024154808agarwalpawan1No ratings yet

- Investment Appraisal and Analysis Ide 2018Document4 pagesInvestment Appraisal and Analysis Ide 2018vincentNo ratings yet

- Bond Valuation Version 1.XlsbDocument14 pagesBond Valuation Version 1.XlsbAlie Dys100% (1)

- (MCOF19M028) CF AssignmentDocument5 pages(MCOF19M028) CF AssignmentFaaiz YousafNo ratings yet

- Answer - Capital BudgetingDocument19 pagesAnswer - Capital Budgetingchowchow123No ratings yet

- Assignment 2Document8 pagesAssignment 2Tawanda MakombeNo ratings yet

- MTP-1 6 KeyDocument16 pagesMTP-1 6 KeynazcomputersitsNo ratings yet

- Capital Budgeting - SolutionDocument5 pagesCapital Budgeting - SolutionAnchit JassalNo ratings yet

- Afm Capital Budgeting WorkoutDocument12 pagesAfm Capital Budgeting WorkoutDaniel HaileNo ratings yet

- ASE 3902 - IAS - Revised Syllabus - Answers To Specimen Paper 2008 16307Document8 pagesASE 3902 - IAS - Revised Syllabus - Answers To Specimen Paper 2008 16307WinnieOngNo ratings yet

- Cell Name Original Value Final ValueDocument13 pagesCell Name Original Value Final ValueAyman AlamNo ratings yet

- Solution ManualDocument12 pagesSolution ManualReyna BaculioNo ratings yet

- Cfin 4 4th Edition Besley Solutions ManualDocument8 pagesCfin 4 4th Edition Besley Solutions Manualwadeperlid9d98k100% (29)

- PDF Actos y Condiciones Inseguras Soporte Cap CompressDocument16 pagesPDF Actos y Condiciones Inseguras Soporte Cap CompressDaniel SotoNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Final (Old) Course: Group - I Paper - 2: Strategic Financial Management Suggested Answers/Hints 1. (A)Document12 pagesTest Series: April, 2021 Mock Test Paper 2 Final (Old) Course: Group - I Paper - 2: Strategic Financial Management Suggested Answers/Hints 1. (A)Menuka SiwaNo ratings yet

- Assignment 4 - Cost of Capital and Capital BudgetiDocument5 pagesAssignment 4 - Cost of Capital and Capital BudgetiBrian AlalaNo ratings yet

- Forum Analisa Investasi - Asfianingsih (43118210060)Document1 pageForum Analisa Investasi - Asfianingsih (43118210060)Asfianingsih 28No ratings yet

- Net Present ValueDocument6 pagesNet Present ValueIshita KapadiaNo ratings yet

- Financial Planning and Control AssignmentDocument3 pagesFinancial Planning and Control AssignmentnkwatalindiweNo ratings yet

- Corporate Finance-5NC01 Assignment Type Individual Coursework 2022Document12 pagesCorporate Finance-5NC01 Assignment Type Individual Coursework 2022Uzzwal GhimireNo ratings yet

- Commercial Arithmetic (Solution) PDFDocument6 pagesCommercial Arithmetic (Solution) PDFagnelwaghelaNo ratings yet

- ACCC504 Quiz1 HernandezDocument9 pagesACCC504 Quiz1 HernandezDigna HernandezNo ratings yet

- Advanced Capital Budgeting 3 HW - Q6Document4 pagesAdvanced Capital Budgeting 3 HW - Q6sairad1999No ratings yet

- Capital Budgeting ExamplesDocument16 pagesCapital Budgeting ExamplesMuhammad azeemNo ratings yet

- Corporate Finance Solution Chapter 6Document9 pagesCorporate Finance Solution Chapter 6Kunal KumarNo ratings yet

- Inclass Solutions 5Document2 pagesInclass Solutions 5AceNo ratings yet

- F9 Mock Exam June 2020 - Answers PDFDocument9 pagesF9 Mock Exam June 2020 - Answers PDFNguyễn Quốc TuấnNo ratings yet

- XVCVDocument3 pagesXVCVJPNo ratings yet

- XVCVDocument3 pagesXVCVJPNo ratings yet

- Issues in Capital Budgeting: 9-1 Project Investment NPV PIDocument6 pagesIssues in Capital Budgeting: 9-1 Project Investment NPV PILyam Cruz FernandezNo ratings yet

- 3815capital Budgeting TechniqueDocument51 pages3815capital Budgeting TechniqueMUHMMAD ARSALAN 13728No ratings yet

- WACC & PaybackDocument9 pagesWACC & PaybackBelle Dela CruzNo ratings yet

- CF 2Document26 pagesCF 2PUSHKAL AGGARWALNo ratings yet

- BTDocument6 pagesBTthanhlong2692000No ratings yet

- Financial Management Assignment 2Document6 pagesFinancial Management Assignment 2Sayaf ArbabNo ratings yet

- A-Levels Accounting 2023 AnswersDocument14 pagesA-Levels Accounting 2023 AnswerschauromweaNo ratings yet

- Accounts Receivable Management Set A SolutionsDocument20 pagesAccounts Receivable Management Set A Solutions김우림No ratings yet

- Session - 047Document9 pagesSession - 047Abcdef GhNo ratings yet

- Name: Course: SEGI Course Code: UCLAN Module Code: Registration Number Institution: Lecturer: Due Date: Student SignatureDocument8 pagesName: Course: SEGI Course Code: UCLAN Module Code: Registration Number Institution: Lecturer: Due Date: Student SignatureErick KinotiNo ratings yet

- Managerial Economics (Chapter 14)Document4 pagesManagerial Economics (Chapter 14)api-3703724No ratings yet

- Es - Group 8Document4 pagesEs - Group 8Papa NketsiahNo ratings yet

- CA Inter FM SM A MTP 2 May 2024 Castudynotes ComDocument19 pagesCA Inter FM SM A MTP 2 May 2024 Castudynotes ComsanjanavijjapuNo ratings yet

- Appendix 4.1Document2 pagesAppendix 4.1pooNo ratings yet

- NLP My NotesDocument16 pagesNLP My NotesLương NguyễnNo ratings yet

- Practice Problems Ch12 PDFDocument57 pagesPractice Problems Ch12 PDFzoeyNo ratings yet

- Chapter 05Document26 pagesChapter 05slee11829% (7)

- Finance Student 11Document14 pagesFinance Student 11yany kamalNo ratings yet

- Valuing Capital Investment ProjectsDocument13 pagesValuing Capital Investment ProjectsSiddhesh MahadikNo ratings yet

- Tejano - Finals FMDocument4 pagesTejano - Finals FMMe CarlJNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Instructor's Manual to Accompany CALCULUS WITH ANALYTIC GEOMETRYFrom EverandInstructor's Manual to Accompany CALCULUS WITH ANALYTIC GEOMETRYNo ratings yet

- Project Managmt Cash Flow Payback PeriodDocument29 pagesProject Managmt Cash Flow Payback PeriodPhebieon MukwenhaNo ratings yet

- Net Present ValueDocument21 pagesNet Present ValueMatthew LgkaroNo ratings yet

- EEM PapersDocument18 pagesEEM PapersHrishikesh Bhavsar100% (1)

- Engineering EconomicsDocument24 pagesEngineering EconomicsSurya Prakash Reddy PutluruNo ratings yet

- Engineering Economy: MS-326 Theory Credit Hours 2Document23 pagesEngineering Economy: MS-326 Theory Credit Hours 2Jhala420No ratings yet

- Bhagawati Hydropower Development Co. Ltd.Document54 pagesBhagawati Hydropower Development Co. Ltd.ombahadur KumhalNo ratings yet

- 18CEO302J Modern Civil Engineering EconomicsDocument2 pages18CEO302J Modern Civil Engineering EconomicsmekalaNo ratings yet

- Worksheet #7 - Basic Economy Study Methods (Part I)Document3 pagesWorksheet #7 - Basic Economy Study Methods (Part I)Russel BubanNo ratings yet

- AAU 104 - Cost Engineering: Course DescriptionDocument2 pagesAAU 104 - Cost Engineering: Course DescriptionZain ZulfiqarNo ratings yet

- A. Menghitung NPV Dan Irr Project A Dan Project BDocument2 pagesA. Menghitung NPV Dan Irr Project A Dan Project Bsiti sundariNo ratings yet

- LM1 Bes4 P 20-2Document3 pagesLM1 Bes4 P 20-2Darlene RaferNo ratings yet

- OBE SYLLABUS ES6 ECE 1st Sem AY2023 2024Document9 pagesOBE SYLLABUS ES6 ECE 1st Sem AY2023 2024Iroha IsshikiNo ratings yet

- Problem 1: Department of Civil Engineering Ateneo de Naga UniversityDocument7 pagesProblem 1: Department of Civil Engineering Ateneo de Naga UniversityAlexander P BelkaNo ratings yet

- Engineering Economics: Valerie Tardiff and Paul Jensen Operations Research Models and MethodsDocument11 pagesEngineering Economics: Valerie Tardiff and Paul Jensen Operations Research Models and MethodsJanneNo ratings yet

- Problem Set 1 With Solution - Introduction To Engineering EconomyDocument6 pagesProblem Set 1 With Solution - Introduction To Engineering EconomyNoel So jrNo ratings yet

- B313 Engineering Economics Updated PDF 1Document30 pagesB313 Engineering Economics Updated PDF 1Sisyloen OirasorNo ratings yet

- PEB4102 Chapter 1Document37 pagesPEB4102 Chapter 1LimNo ratings yet

- Chapter 6 - Investment Evaluation (Engineering Economics)Document53 pagesChapter 6 - Investment Evaluation (Engineering Economics)Bahredin AbdellaNo ratings yet

- Raymond R. Mayer Production Management PDFDocument707 pagesRaymond R. Mayer Production Management PDFyoung wyack100% (1)

- Sample Midterm Exam For Engineering Economics PDFDocument9 pagesSample Midterm Exam For Engineering Economics PDFAyah RamiNo ratings yet

- Capital Budgeting NumericalsDocument20 pagesCapital Budgeting NumericalsAanchal SinghalNo ratings yet

- Iecep Manila PRC Geas EecoDocument26 pagesIecep Manila PRC Geas EecoMark Anthony RagayNo ratings yet

- IE 305 Syllabus Spring 2018Document6 pagesIE 305 Syllabus Spring 2018Alvin RymashNo ratings yet

- 1.1 Engineering Economy FundamentalsDocument21 pages1.1 Engineering Economy Fundamentalsyookarina8No ratings yet

- Engineering Economics Learning PlanDocument3 pagesEngineering Economics Learning PlanJim Agcaoili LindaNo ratings yet

- Engg Econ - Part 1Document22 pagesEngg Econ - Part 1Math Dandridge Ventura0% (1)

- Basics of Engineering EconomicsDocument19 pagesBasics of Engineering EconomicsTricia Mae CatapangNo ratings yet

- Engineering Economics and Finacial Management (HUM 3051) Jul 2022Document6 pagesEngineering Economics and Finacial Management (HUM 3051) Jul 2022uday KiranNo ratings yet

- Week 10 - CE40Document2 pagesWeek 10 - CE40Mhel CenidozaNo ratings yet

- The Basics of Capital BudgetingDocument35 pagesThe Basics of Capital BudgetingFebriannNo ratings yet