Professional Documents

Culture Documents

RMC No. 19-2022 Annex A-2

Uploaded by

Darla EnriquezOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RMC No. 19-2022 Annex A-2

Uploaded by

Darla EnriquezCopyright:

Available Formats

t'rt t $l. tl;trri'l,r .a,H I'iti u-l-l } {$.iq{-.u s- *t .-"iiEEC-a '.

;'t"

\

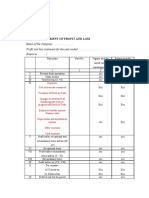

Ind ividual Shareholders' Book

Particulars Transferee's Book

l!!g entr-r/ies shall be per individual shareholder of the absorbed corporation)

Journal Investment in (name_Sf_trcnifqfcg) xxx xx Investment in (issuing corp- {b:t shares of stock) xxx.xx

Entry to Investment in (nry1,S-_Old6SJrtving corpotation) xxx.xx PPE - Land & [mprovement (fbr real props) xxx.xx

Record the Dividend lncome (net of FWf on dividend) xxx.xx Others Assets (as applicable) xxx.xx

Tax-Free Liabilities xxx.xx

Exchange Stock

Capital xxx.xx

Additional Paid-ln Capital xxx.xx

To record the Tax-Free Exchange (TFE) of investment in To record the Tax-Free Exchange (TFE) of real properties,

(share lvpS:) shares of (Uame issulng corporati ) with investment in (share lvpe) shares of (name issuing corp/s),

aggregate fair market value of P*_ in exchange for and other assets with aggregate fair market value of

(tvpe and no. of share) of (name of.transferee) with par P-,includingliabilitiesassumedresuItingfrom

value of P-- per share. merger, in exchange for (t-vpe-and no. of share) of (name of

transferee) with par value of P-- per share.

Balance

Sheet Notes Investment includes (no. and type of share/s) with par Real properties, investment in (no. and type of share/s)

Entry value of P_--in (name of transferee) resulting of (issuing corporatign/s) and other assets were acquired

from the Tax-Free Exchange of investment in (no. and through merger as evidenced by PIan of Merger and

t-vpe of share/s) of (issuing corporatiory's) covered by Articles of Merger, including the increase of the

Stock Certificate No/s. which were Authorized Capital Stock of (name of transferee),

acquired for the total cost of (substituted basis) and approved by the Securities and Exchange Commission

which have fair market value as of the date of on (date). The total acquisition cosVsubstituted cost to

exchange amounting to P--. (name of transferee) of the investmenUs amounts to

(FMV at the time of exqhange). The real properties,

investmentls and other assets were previously covered

by Transfer Certificate of Title and Stock Certificate

No/s. issued by (issuing corporationls) and

are now presently covered by Stock Certificate No/s.

constituting (no. and type of share/s) [total]

shares in the name of (name of transferee).

Proforma Cash or Accounts receivables xxx.xx Cash or Accounts receivables xxx.xx

Entries to lnvestment in (name of transferee) xxx.xx Investment in (name of issuing corporation) / PPE -

Record Gain on Sale of Investment xxx.xx Land & lmprovement I Other Assets xxx.xx

Subsequent Gain on Sale of Investment xxx.xx

Sale i

Transfer To record subsequent sale / transfer of real properties,

To record subsequent sale / transfer of investment acquired investment/s and/or other assets acquired thru Tax-Free

thru Ta,r-Free Exchange

Current xxx.xx

Current xxx.xx Tax Payable xxx.xx

Tax Payable xxx.xx

Provision for Tax as follows: Provision for tax as follows:

Tar Type Tax Rate* Multiply By Amount Tar Type Tax Rate* Multiply By Amount

Gains realized on

SYo on P100,000 and Gains realized on

r) Nct Capital Gains Tax r) Net Capital Gains Tar t5% subsequentsale

I 0% on cxcess TFE

of invcstment/s

Selling Pnce of

FMV of invls at investment at thc

OR Stock Transaction Tax ll2 of l% OR Stock Transaction Tax 6llD of lo/,

thc timc of TFE timc of

xxx.xx subsequent salc xxx.x:

Total Tax Payable EIIJI

Gains realized on

2) Nct Capital Gains Tax t5% subscquent sale

of investmcnUs

Tax Type Rate Multiply By Amount

Selling Pricc of Wittrholding Tax I.-5% to 60/, per RR No. 6

r)

invcstment st thc ONETT 200 I

OR Stock Transaction Tax 6110 of lo/o Fair Markcl

time of

subsequcnt salc xxx.Lt Value (FMV) of xx.xx

thc propcrtfiics

Documentary Stamp

l.SYofor cr,ery P1,000 at thc tirnc of

2)

Total Trx Payable Tax (DST) subsequcnt salc /

u&II and fractional part thercof

transfcr

x

Valuc-Added Tax

3) t2%

' If subscquent salc/s of invcstmcnt/s ryas/wcrc made beforc January l. 201 I, (VAT) xxx.\x

thc tax rates uscd in thc computation of Nct Capital Cains Tax and Stock Total Trx Payahlc IITIJT

Transaction Tax at thc time o[tax-free cxchangc shall apply.

*Gain on sale of property/ics is subjcct to Normal Corporatc Incomc Tax

OCIT)

* Computation of Gain Realisd on Subscquent Sale of Investment:

Sclling Pricc xxx.xx *FMV at thc time of subsequent salc / transfer refcrs to the selling price. zonal

[rss: Cost (Substitutcd Basis) r;1lJx valuc or the valuc rcflcctcd in thc tax declaration. rvhichcver is highcst.

Net Capital Gain on salc of unlistcd shares tr;[;tr

Per RMO 17-2016, the substitutcd basis of the etock or securities

received by &e transfcror on a kr-frec exchange shall bc as

follorvs: ) Thc onginal basis of the propcrty, stock or securities to

(I

be transferred: (2) Less: (a) monq'rcccivc4 if any, and (b) the fair

market value of the other prope6'received, if any: (3)Plus: (a) thc

BU

amor.mt trcated as dividend of the sharcholder, if anv, and (b) the

amount of any gain that was recognized on the cxchange, if any.

]n I

I FEB ff4 ?fi22

. l!9ymt1/

I

-v-\JVl'1r.\ &

FECoRDS MG f. OiVtSt ON

You might also like

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Micro Notes On A2 IAL AccountingDocument15 pagesMicro Notes On A2 IAL AccountingRajibul Haque Shumon100% (2)

- Lehman BrothersDocument22 pagesLehman BrothersSunil PurohitNo ratings yet

- ACYAVA 2 Formula SheetDocument13 pagesACYAVA 2 Formula SheetN SNo ratings yet

- Practical Auditing by Empleo 2022 Chapter 4 Receivables Related RevenuesDocument55 pagesPractical Auditing by Empleo 2022 Chapter 4 Receivables Related RevenuesDarence IndayaNo ratings yet

- Moyer FINANZAS CUESTIONARIODocument26 pagesMoyer FINANZAS CUESTIONARIOMariana Cordova100% (2)

- STD Insurance Commission VUL REVIEWER Answer Key 1.2Document12 pagesSTD Insurance Commission VUL REVIEWER Answer Key 1.2Shenna PalajeNo ratings yet

- What Does International Monetary FundDocument4 pagesWhat Does International Monetary FundSanthosh T KarthickNo ratings yet

- CCVO TemplateDocument1 pageCCVO Templatejohnopigo95% (19)

- Home Validate: B3 (A (I) ) Individuals - I.individual Shareholders Holding Nominal Share Capital Up To Rs. 2 LakhsDocument1 pageHome Validate: B3 (A (I) ) Individuals - I.individual Shareholders Holding Nominal Share Capital Up To Rs. 2 LakhsSivakumar KandasamyNo ratings yet

- Income Taxation Chapter 9Document11 pagesIncome Taxation Chapter 9Kim Patrice NavarraNo ratings yet

- RegulateDocument9 pagesRegulateLinxi ChenNo ratings yet

- AEL - Shareholding Pattern - 30Document6 pagesAEL - Shareholding Pattern - 30Viraj DobriyalNo ratings yet

- Preweek Practice ProblemsDocument18 pagesPreweek Practice ProblemsElai grace FernandezNo ratings yet

- Shareholding Pattern 30 Dec 2023Document5 pagesShareholding Pattern 30 Dec 2023radhekrishnatradersamanNo ratings yet

- Shareholding Pattern For Dec22 PDFDocument8 pagesShareholding Pattern For Dec22 PDFPankhuri AggarwalNo ratings yet

- SHP WebDocument5 pagesSHP WebAditya SinghNo ratings yet

- Shareholding Pattern Under Regulation 31 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015Document5 pagesShareholding Pattern Under Regulation 31 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015Udit AgrawalNo ratings yet

- 2.2 Audit of InvestmentsDocument1 page2.2 Audit of Investmentsantonette seradNo ratings yet

- Chapter 4 - CompleteDocument15 pagesChapter 4 - Completemohsin razaNo ratings yet

- Shareholding Pattern 31mar17 Bac14d4d6eDocument6 pagesShareholding Pattern 31mar17 Bac14d4d6eSAM SAMNo ratings yet

- Shareholding Pattern Under Regulation 31 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015Document6 pagesShareholding Pattern Under Regulation 31 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015akendravermaNo ratings yet

- General Information: EET Iieaseprii (Tlegibi, FDocument11 pagesGeneral Information: EET Iieaseprii (Tlegibi, Faliyah2 sanchezNo ratings yet

- State of Owners EquityDocument1 pageState of Owners EquitylancealcarazNo ratings yet

- Installment SalesDocument2 pagesInstallment SalesShaira BugayongNo ratings yet

- SCL SHP 31 12 2022Document8 pagesSCL SHP 31 12 2022indraseenayya chilakalaNo ratings yet

- Introduction To Financial Statement Analysis ReviewwerDocument3 pagesIntroduction To Financial Statement Analysis ReviewwerMatthew PanganNo ratings yet

- SHP WebsiteDocument5 pagesSHP WebsiteAditya SinghNo ratings yet

- SHP WebsiteDocument7 pagesSHP WebsiteAditya SinghNo ratings yet

- Holding of Specified Securities Annexure - I: 532822 / IDEA / Equity Shares Vodafone Idea LimitedDocument6 pagesHolding of Specified Securities Annexure - I: 532822 / IDEA / Equity Shares Vodafone Idea LimitedDhanush Kumar RamanNo ratings yet

- Form 31 - Return Containing Particulars of Substantial Shareholders Officers For Companies' Global Register of Beneficial OwnershipDocument2 pagesForm 31 - Return Containing Particulars of Substantial Shareholders Officers For Companies' Global Register of Beneficial OwnershipehsanandsaadNo ratings yet

- Law On Sales1Document21 pagesLaw On Sales1Kirsty SicamNo ratings yet

- Cost Estimation-1Document5 pagesCost Estimation-1Ha M ZaNo ratings yet

- Kil SHP September21Document11 pagesKil SHP September21indraseenayya chilakalaNo ratings yet

- 20201104044854Document27 pages20201104044854hasharawanNo ratings yet

- INDOREDocument4 pagesINDORElapreeservicesNo ratings yet

- FMA Topic 1,2Document2 pagesFMA Topic 1,2YuNo ratings yet

- S.Y.J.C. (Commerce) Book-Kkeping & Accoutancy Partnership Final Accounts Compiled By: Prof. Bosco FernandesDocument11 pagesS.Y.J.C. (Commerce) Book-Kkeping & Accoutancy Partnership Final Accounts Compiled By: Prof. Bosco FernandesDheer BhanushaliNo ratings yet

- RoadmapDocument2 pagesRoadmaplamslamNo ratings yet

- Assignment 4Document2 pagesAssignment 4Kanye WestNo ratings yet

- 5.consolidated SOCI - AAFRDocument11 pages5.consolidated SOCI - AAFRAli OptimisticNo ratings yet

- ShareDocument11 pagesShareShivam KambojNo ratings yet

- Shareholding Pattern 30062022Document8 pagesShareholding Pattern 30062022indraseenayya chilakalaNo ratings yet

- Pro-Forma For CorporationDocument3 pagesPro-Forma For CorporationZariyah RiegoNo ratings yet

- Explanations On StatementsDocument3 pagesExplanations On StatementsSimphiwe NandoNo ratings yet

- English Form 01Document21 pagesEnglish Form 01setegnNo ratings yet

- Imaas Annual Return 2007-08Document9 pagesImaas Annual Return 2007-08rkaclientsNo ratings yet

- S. No. Particulars Yes/NoDocument9 pagesS. No. Particulars Yes/Noankur_371530434No ratings yet

- Tugas - Kadek SudianggartawanDocument8 pagesTugas - Kadek Sudianggartawan11Kadek SudianggartawanNo ratings yet

- Cost Sheet 2 TemplateDocument2 pagesCost Sheet 2 Template20G024 EBNESAR ANTO ANo ratings yet

- ACTBFAR - Unit 1 - Manufacturing - Part 3 - Financial Statements - Study Guide PDFDocument7 pagesACTBFAR - Unit 1 - Manufacturing - Part 3 - Financial Statements - Study Guide PDFAlyx Gabrielle GocoNo ratings yet

- Part Ii - Statement of Profit and LossDocument3 pagesPart Ii - Statement of Profit and LossSaumyajit DeyNo ratings yet

- Substantive Procedures - Audit of PPEDocument2 pagesSubstantive Procedures - Audit of PPEAnonymityNo ratings yet

- Etf..Ry - ZD ...... I,) .Document2 pagesEtf..Ry - ZD ...... I,) .Satendra TiwariNo ratings yet

- Lecture 2Document31 pagesLecture 2tomas.ruizkNo ratings yet

- Capital Gain 8th SemDocument10 pagesCapital Gain 8th SemAuthor SatyaNo ratings yet

- Study Session 05: Shemal MustaphaDocument11 pagesStudy Session 05: Shemal MustaphafirefxyNo ratings yet

- Stock StatementDocument4 pagesStock StatementRAJEEV BHATIANo ratings yet

- Unit FDocument73 pagesUnit Fsprayzza tvNo ratings yet

- Int Acc 3Document4 pagesInt Acc 3FranchNo ratings yet

- Vessel Ship Bill of Sale FormDocument1 pageVessel Ship Bill of Sale FormDeelora AhmadNo ratings yet

- 01IMG - aLFALAH (Part Ratio)Document10 pages01IMG - aLFALAH (Part Ratio)Nur AthirahNo ratings yet

- Format of Trading Profit Loss Account Balance Sheet PDFDocument6 pagesFormat of Trading Profit Loss Account Balance Sheet PDFsonika7100% (1)

- Annexure-I: SR - No. Particulars Yes NoDocument6 pagesAnnexure-I: SR - No. Particulars Yes NovenkatNo ratings yet

- Tokenization of Real Estate AssetsDocument2 pagesTokenization of Real Estate AssetsSheine Girao-SaponNo ratings yet

- Determinants of Budget Deficit in EthiopiaDocument29 pagesDeterminants of Budget Deficit in EthiopiaBereket Desalegn100% (3)

- Canara HSBC (10 - 15)Document4 pagesCanara HSBC (10 - 15)AbhishekNo ratings yet

- Balance SheetDocument3 pagesBalance SheetDina JurķeNo ratings yet

- PDFDocument2 pagesPDFRubab ShaikhNo ratings yet

- Credit Risk ManagementDocument56 pagesCredit Risk ManagementMazen AlbsharaNo ratings yet

- Comparitive Balance Sheet of ITC Assets Current AssetsDocument4 pagesComparitive Balance Sheet of ITC Assets Current AssetsArun BineshNo ratings yet

- Installment Payment Agreement With Penalty InterestDocument2 pagesInstallment Payment Agreement With Penalty InterestAmado III VallejoNo ratings yet

- Module 4 Statement of Financial Performance For LMSDocument15 pagesModule 4 Statement of Financial Performance For LMSGAZA MARY ANGELINENo ratings yet

- Lehman Brothers Case StudyDocument5 pagesLehman Brothers Case StudykrishhonlineNo ratings yet

- Financial Application: Portfolio SelectionDocument16 pagesFinancial Application: Portfolio SelectionTeree ZuNo ratings yet

- Homework For Next ClassDocument3 pagesHomework For Next ClassSimo El Kettani20% (5)

- Contingent Bill of The ................................................................ DepartmentDocument1 pageContingent Bill of The ................................................................ DepartmentrhengongNo ratings yet

- Welcome To HDFC Bank NetBanking 1 PDFDocument2 pagesWelcome To HDFC Bank NetBanking 1 PDFArup GhoshNo ratings yet

- FuA II Chapter 2Document32 pagesFuA II Chapter 2YasinNo ratings yet

- Take Home Exam 1 Cash and Cash EquivalentsDocument2 pagesTake Home Exam 1 Cash and Cash EquivalentsJi Eun VinceNo ratings yet

- 400 To 500Document5 pages400 To 500Anonymous h2rz52No ratings yet

- BTS203 - Income Tax Return For Employees Manual VersionDocument2 pagesBTS203 - Income Tax Return For Employees Manual VersionMarz CuculNo ratings yet

- Tax Invoice: BUTI000000859424 Dec. 23, 2017, 5:53 P.MDocument2 pagesTax Invoice: BUTI000000859424 Dec. 23, 2017, 5:53 P.MSridharan VenkatNo ratings yet

- Midterm Exam Inter1 - Sem20222 Solution OutlineDocument15 pagesMidterm Exam Inter1 - Sem20222 Solution OutlineVanessa vnssNo ratings yet

- Brandon HillDocument7 pagesBrandon HillAnonymous DvwlEco09iNo ratings yet

- Indian Equity MArketDocument16 pagesIndian Equity MArketAshi RanaNo ratings yet

- Mandate Form For Electronic Transfer of Claim/Refund/Commission/Other PaymentsDocument2 pagesMandate Form For Electronic Transfer of Claim/Refund/Commission/Other Paymentsjoshua francisNo ratings yet

- Golomt Bank Report - 2003 EnglishDocument43 pagesGolomt Bank Report - 2003 EnglishBarsbold100% (8)

- Investment Environment & Securities MarketDocument28 pagesInvestment Environment & Securities MarketProf. Suyog ChachadNo ratings yet

- Business Finance - 12 - Third - Week 1Document12 pagesBusiness Finance - 12 - Third - Week 1AngelicaHermoParasNo ratings yet