Professional Documents

Culture Documents

Revision of Accounting Midterm Official

Revision of Accounting Midterm Official

Uploaded by

23005504Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revision of Accounting Midterm Official

Revision of Accounting Midterm Official

Uploaded by

23005504Copyright:

Available Formats

lOMoARcPSD|30946431

Revision of Accounting Midterm Official

Principles of Accounting (Trường Đại học Kinh tế Thành phố Hồ Chí Minh)

Scan to open on Studocu

Studocu is not sponsored or endorsed by any college or university

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

INTERNATIONAL SCHOOL OF BUSINESS

Revision on Principle of

Accounting

BY ISB ACADEMIC TEAM

For further information and step-by-step guide to solving problems, please kindly

refer to Tutoring Videos uploaded on ISB Academic Team Facebook fanpage.

Under no circumstances should one copy this document without author’s permission.

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 1 1

CHAPTER 1 : ACCOUNTING IN ACTION

LO1: Identify the activities and users associated with accounting.

- Accounting consists of 3 basic activities in the economic event of the organization to interested

users – it:

Identifies the economic events relevant to its business.

Records systematic and chronological diary events.

Communicates the collected information by financial reports.

An accounting process includes bookkeeping function.

- Two groups of users of financial information: internal and external users.

Internal users: people inside the company who need detailed information on a timely

basis. Normally, Managerial Accounting provides reports that contain the information.

External users: people outside the company who commonly are investors and creditors.

Financial Accounting provides the information that external users need.

LO2: Explain the building blocks of accounting: ethics, principles, and assumptions.

- Ethnics in financial reporting

- Generally Accepted Accounting Principles (GAAP) – Standards that are generally accepted and

universally practiced. These standards indicate how to report economic events.

- Standard-setting bodies:

Financial Accounting Standards Board (FASB)

Securities and Exchange Commission (SEC)

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 1 2

International Accounting Standards Board (IASB)

- Measurement principles:

HISTORICAL COST PRINCIPLE (or cost principle) dictates that companies record

assets at their cost.

FAIR VALUE PRINCIPLE states that assets and liabilities should be reported at fair

value (the price received to sell an asset or settle a liability).

Selection of which principle to follow generally relates to trade-offs between relevance and

faithful representation.

- Assumptions provide a foundation for accounting process. Two main assumptions:

MONETARY UNIT ASSUMPTION requires that companies include in the accounting

records only transaction data that can be expressed in terms of money.

ECONOMIC ENTITY ASSUMPTION requires that activities of the entity be kept

separate and distinct from the activities of its owner and all other economic entities.

► Proprietorship

► Partnership

► Corporation

- Forms of business ownership:

Proprietorship:

► Owned by one person.

► Owner is often manager/operator.

► Owner receives any profits, suffers any losses, and is personally liable for all debts.

Partnership:

► Owned by two or more persons

► Often retail and service-type businesses.

► Generally unlimited personal liability.

► Partnership agreement.

Corporation:

► Ownership divided into shares of stock.

► Separate legal entity organized under state corporation law.

► Limited liability.

LO3: State the accounting equation, and define its components.

- Assets:

Resources a business owns.

Provide future services or benefits.

Cash, Supplies, Equipment, etc.

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 1 3

- Liabilities:

Claims against assets (debts and obligations).

Creditors (party to whom money is owed).

Accounts Payable, Notes Payable, Salaries and Wages Payable, etc.

- Owner’s Equity:

Ownership claim on total assets.

Referred to as residual equity.

Investment by owners and revenues (+)

Drawings and expenses (-).

LO3:State the accounting equation, and define its components.

Assets Liabilities Owner’s Equity

+ + + + + = + + + - + -

Cash Account Supplies Equipment Prepaid Account Notes Capital Drawing Revenu Expense

Receivable Expense Payable Payabl e

e

LO4:Analyze the effects of business transactions on the accounting equation.

1/Investment by + = +

owner

2/Buy equip. - + =

for cash

3/Buy Supplies + = +

on credit

4/Services + = +

perform for

cash

5/Buy = + -

advertisements

on credit

6/Services + + = +

perform for

cash and credit

7/Pay expenses - = -

8/ Pay Account - = -

Payable

9/ Receive cash + - =

on account

10/ Withdraw - = -

cash by owner

11/ Borrow + = +

cash from bank

on Notes

Payable

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 1 4

Notes:

Account Receivable: They (outside) pay later >< Account Payable: I (the company) pay

later

Liabilities also includes Taxes Payable, Salary and Wages Payable, Unearned Service

Revenue,…

- Transactions are a business’s economic events recorded by accountants.

May be external or internal.

Not all activities represent transactions.

Each transaction has a dual effect on the accounting equation.

LO5: Four financial statements

- Income Statement: (NI=R-Ex) presents revenue and expenses -> net income or net loss

- Owner’s Equity Statement: (OES= C - D + R - Ex = C - D + NI) summarize changes in

owner’s equity (Capital, Drawing, Revenue, Expense)

- Balance Sheet: (A= L + E) reports Asset, Liabilities and Owner’s Equity at a specific

date

- Statement of Cash Flow: chap 17

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 1 5

RECOMMENDED PROBLEMS:

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 1 6

ANSWER:

2. Decrease in owner’s equity and Decrease in Asset

3. Increase in Assets and Increase in Liabilities

4. Increase in Assets and Increase in Owner’s Equity

5. Decrease in owner’s equity and Decrease in Asset

6. Increase in Assets and Increase in Owner’s Equity

7. Increase in Liabilities and Decrease in Owner’s Equity

8. Decrease in Cash and Increase in Equipment => A balance in Asset

9. Increase in Assets and Increase in Owner’s Equity

ANSWER:

1–c

2–d

3–b

4–b

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 1 7

5–d

6–b

7–e

8–f

ANSWER:

Date Assets = Liabilities Owner’s Equity

+ + + + = + + +

- + -

Cash Account Supplies Equipment Account (Notes Owner’s

Drawing Revenue Expense

Receivable Payable Payable) Capital

5/1 + +7,000

7,000

5/2 -900 -900

5/3 +600 +600

5/5 -125 -125

5/9 +4,000 +4,000

5/12 - -1,000

1,000

5/15 +5,400 +5,400

5/17 -2,500 -2,500

5/20 -600 -600

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 1 8

5/23 +4,000 -4,000

5/26 +5,000 +5,000

5/29 +4,200 +4,200

5/30 -275 -275

b/ MATRIX CONSULTING

Income Statement

For the month of May

Revenue

Service revenue $9,400

Expense

Rent expense $900

Advertising Expense $125

Salaries Expense $2,500

Utilities Expense $275

Total Expense $3,800

Net income $5,600

c/ MATRIX CONSULTING

Balance Sheet

For the month of May

Assets

Cash $14,600

Account Receivable $1,400

Supplies $600

Equipment $4,200

Total Assets $20,800

Liabilities and Owner's Equity

Liabilities

Note Payable $5,000

Account Payable $4,200

Total Liabilities $9,200

Owner's Equity

Owner's Capital $7,000

Net income $5,600

Less: Drawing ($1,000)

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 1 9

Total Owner's Equity $11,600

Total Liabilities and Owner's Equity $20,800

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 2 10

Chapter 2: The Recording Process

LO1: Account definition and its purposes:

An Account: an individual accounting record of increases and decreases in a specific

asset, liability, or owner’s equity item.

Ex: There are accounts for Cash, Accounts Receivable, Account Payable, Revenue, etc.

T account: an account’s simplest form, consists of three parts: (1) a title, (2) a left side

(Debit side) and (3) a right side (Credit side).

LO2: Define Debits and Credits and their purposes:

Debit (Dr.): the left side of an account.

→ Debiting the account: the act of entering an amount on the left side of an account

Credit (Cr.): the right side of an account.

→ Crediting the account: the act of entering an amount on the right side of an account

*Note: The terms Debit and Credit do not mean increase and decrease. They just refer to the

place where entries are made in accounts.

When comparing the totals of the two sides, an account show:

Debit balance: if the totals of the debis > the credit.

Credit balance: if the totals of the credit > the debit.

Ex: Cash account show a debit balance.

Debit and Credit Procedure:

Keeping in mind that both sides of the basic equation (Assets = Liabilities + Owner’s Equity)

must be equal. → When transactions are made, they affect two or more accounts to keep the

equation in balance. In other words, debits must equal credits → Double-entry system.

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 2 11

*Note: The (+) side is the normal balance of an account.

LO3: Basic steps in recording process.

1. Analyze each transaction

2. Enter transaction in a journal (*)

3. Transfer journal information to ledger (**) account

LO4: Definition of a journal and its purposes.

(*) The Journal: the book of original entry. For each transaction the journal shows the debit and

credit effects on specific accounts. → General journal: the most basic form of journal.

⇒ Journalizing: entering transaction data in the journal.

Advantages of the journal:

1. Disclose the complete effects of a transaction.

2. Provide a chronological record (time order).

3. Help to prevent and locate errors.

Example of a journal and its components:

1. The date of the transaction.

2. The debit account title is entered in the extreme left margin, and the debit amount in the

Debit column

3. The credit account title is entered one letter from the extreme left margin, and the credit

amount in the Credit column.

4. A brief explanation of the transaction.

5. Ref column used to enter the account number.

A Simple Entry: an entry involves only two accounts, one credit and one debit.

A Compound Entry: an entry that requires three or more accounts.

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 2 12

* Example of a compound entry:

LO5: Definition of a ledger and its purposes.

(**) The ledger: the entire group of accounts maintained by a company. → General ledger:

contain all the assets, liabilities, and owner’s equity accounts.

⇒ Posting: transferring journal entries to the ledger accounts. Below is a posting process:

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 2 13

LO6: Preparing a trial balance and its purposes:

A Trial Balance: is a list of accounts and their balances at a given time.

→ The trial balance (1) proves the mathematical equality of debits and credit after posting, may

also (2) uncover errors in journalizing and posting, (3) is useful in the preparation of financial

statements.

Step for preparing a trial balance:

1. List the account titles and their balances in the appropriate debit or credit column.

2. Total the debit and credit columns.

3. Prove the equality of the two columns.

*Note: the order of presentation in the trial balance is:

Assets

Liabilities

Owner’s equity

Revenues

Expenses

*Example of a trial balance:

Limitation of a Trial Balance:

Mistakes may NOT be identified with Trial Balance if...

1. A transaction is not journalized.

2. A correct journal entry is not posted.

3. A journal entry is posted twice.

4. Incorrect accounts are used in journalizing or posting.

5. Offsetting errors are made in recording the amount of a transaction.

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 2 14

EXERCISE

P2-1A:

GENERAL JOURNAL

Date Account Titles and Explanations Debit Credit

Mar 1 Cash 20,000

Owner’s Capital 20,000

3 Land 12,000

Buildings 2,000

Equipment 1,000

Cash 15,000

5 Advertising Expense 900

Cash 900

6 Prepaid Insurance 600

Cash 600

10 Equipment 1,050

Account Payable 1,050

18 Cash 1,100

ServiceService Revenue 1,100

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 2 15

19 Cash 1,500

Unearned Service Revenue 1,500

25 Owner’s Drawing 800

Cash 800

30 Salaries and Wages Expenses 250

Cash 250

Account Payable 1,050

Cash 1,050

31 Cash 2,700

Service Revenue 2,700

P2-2A:

a. GENERAL JOURNAL

Date Account Titles and Explanations Ref Debit Credit

Apr 1 Cash 101 20,000

Owner’s Capital 301 20,000

2 Rent Expenses 729 1,100

Cash 101 1,100

3 Supplies 126 4,000

4,000

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 2 16

Account Payable 201

10

Account Receivable 112 5,100 5,100

Service Revenue 400

11

Cash 101 1,000 1,000

Unearned Service Revenue 209

20

Cash 101 2,100 2,100

Service Revenue 400

30

2,800 2,800

Salaries and Wages Expense 726

Cash 101

2,400 2,400

Account Payable 201

Cash 101

(b)

GENERAL LEDGER

Cash No.101

Date Debit Credit Balance

Apr 1 20,000 20,000

2 1,100 18,900

11 1,000 19,900

20 2,100 22,000

30 2,800 19,200

2,400 16,800

Account Receivable No.112

Date Debit Credit Balance

Apr 10 5,100 5,100

Supply No.126

Date Debit Credit Balance

Apr 3 4,000 4,000

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 2 17

Account Payable No.201

Date Debit Credit Balance

Apr 3 4,000 4,000

30 2,400 1,600

Unearned Service Revenue No.209

Date Debit Credit Balance

Apr 11 1,000 1,000

Owner’s Capital No.301

Date Debit Credit Balance

Apr 1 20,000 20,000

Service Revenue No.400

Date Debit Credit Balance

Apr 10 5,100 5,100

20 2,100 7,200

Salaries and Wages Expenses No.726

Date Debit Credit Balance

Apr 30 2,800 2,800

Rent Expenses No.729

Date Debit Credit Balance

Apr 2 1,100 1,100

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 2 18

(c)

EMILY VALLEY

Trial Balance

Apr 30, 2017

Debit Credit

Cash $ 16,800

Account Receivable 5,100

Supply 4,000

Account Payable $ 1,600

Unearned Service Revenue 1,000

Owner’s Capital 20,000

Service Revenue 7,200

Salaries and Wages Expenses 2,800

Rent Expenses 1,100

$ 29,800 $ 29,800

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 3 19

Chapter 3: ADJUSTING THE ACCOUNTS

LO1: The accrual basis of accounting and the reasons for adjusting entries

Time Period Assumption = Periodicity Assumption: artificial time periods of a

business economic life. Generally a month, a quarter, or a year.

Fiscal and Calendar Years:

Fiscal: accounting time period that is one year in length. Ex: maybe from 4 Dec,

th

2017 to 4 Dec, 2018

th

Calendar: 1 Jan, 2020 31 Dec, 2020

st th

Accrual vs Cash – Basis Accounting

Cash – basis:

Record revenue when they receive cash.

Record expenses when they pay out cash.

Not in accordance with GAAP.

Accrual – basis:

Recognize revenue when they perform service.

Recognize expenses when incurred (rather than when paid).

In accordance with GAAP.

GAAP relationships in revenue and expense recognition

Types of Adjusting Entries:

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 3 20

Deferrals Accruals

1. Prepaid Expenses 1. Accrued Revenues

Expenses paid in cash before they Revenues for services performed but not yet

are used or consumed. received in cash or recorded.

2. Unearned Revenues 2. Accrued Expenses

Cash received before services are Expenses incurred but not yet paid in cash

performed. or recorded.

→ Adjusting entries ensure that the revenue recognition and expense recognition

principles are followed and complete the data of a trial balance (which may not

contain up-to-date data).

LO2: Adjusting entries for deferrals

Deferrals: Expenses or revenues that are recognized at a date later than the point when cash was

originally exchanged. Example: Cash is received today, Revenue & Expense are recognized

tomorrow.

1. Prepaid Expense: is recorded as an asset.

Prepaid expenses recorded in asset accounts have been used → need for

adjustment.

Entries: Dr. Assets (insurance, supplies, depreciation...) / Cr. Cash

Adjusting entries: Dr. Expenses / Cr. Assets or Contra Assets

Supplies:

Ex: Pioneer Advertising purchase supplies costing $2,500 on Oct 5. Pioneer recorded the

payment by debiting Supplies (and crediting Cash). This account shows a balance of $2,500 in

the Oct 31 trial balance. An inventory count at the close of business on Oct 31 reveals that

$1,000 of supplies are still on hand. Prepare adjusting entries.

Oct 31 Supplies Expense (Equity) $1,500

Supplies (Asset) $1,500

Insurance:

Ex: On Oct 4, Pioneer Advertising paid $600 for a one-year fire insurance policy.

Coverage began on Oct 1. Pioneer recorded the payment by increasing (debiting) Prepaid

Insurance. This account shows a balance of $600 in the Oct 31 trial balance. Insurance of $50

($600 ÷ 12) expires each month. Prepare adjusting entries on Oct 31.

Oct 31 Insurance Expense (E) $50

Prepaid Insurance (A) $50

Depreciation:

*Depreciation: the process of allocating the cost of an asset to expense over its useful life.

Ex: For Pioneer Advertising, assume that depreciation on the equipment is $480 a year,

or $40 per month.

Oct 31 Depreciation Expense (E) $40

Accumulated Depreciation (Equipment) (A) $40

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 3 21

*Accumulated Depreciation is a contra asset account.

*Book value = cost of asset - its accumulated depreciation.

2. Unearned Revenue: is recorded as a liability because the service has not

been performed.

Entries: Dr. Cash / Cr. Unearned Revenue

Adjusting entries: Dr. Unearned Revenue / Cr. Revenue

Ex: Pioneer Advertising received $1,200 on Oct 2 from R. Knox for advertising services

expected to be completed by Dec 31. Unearned Service Revenue shows a balance of $1,200 in

the October 31 trial balance. Analysis reveals that the company performed $400 of services in

October.

Oct 31 Unearned Service Revenues (Liability account) $400

Service Revenue (Equity account) $400

LO3: Adjusting entries for accruals

Accruals: Record Revenues for services performed but not yet recorded (accrued revenues); and

Expenses incurred but not yet paid or recorded (accrued expenses)

For example :Cash is received tomorrow, Revenue & Expense are recognized today.

1. Accrued Revenues:

Adjusting entries: Dr. Assets / Cr. Revenues

Ex: In October Pioneer Advertising performed services worth $200 that were not billed

to clients on or before Oct 31.

Oct 31 Accounts Receivable (Asset) $200

Service Revenue (Equity) $200

2. Accrued Expenses:

Adjusting entries: Dr. Expenses / Cr. Liability

Accrued Interest

Ex: Pioneer Advertising signed a three-month note payable in the amount of $5,000 on

Oct 1. The note requires Pioneer to pay interest at an annual rate of 12%.

* Interest = Face Value of Note * Annual Interest Rate * Time in Terms of One Year

= $5,000 * 12% * 1/12

= $50

Oct 31 Interest Expense (E) $50

Interest Payable (L) $50

Accrued wages and salaries:

Salaries and Wages Expense (E)

Salaries and Wages Payable (L)

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 3 22

Summary of Basic Relationships:

LO4: Adjusted Trial Balance

The same as Trial Balance, but is prepared after all adjusting entries are journalized.

Is the primary basis for the preparation of financial statements.

Notes:

+ Pay attention to the time period (usually a month).

+ Use the fair value only (not the original value).

EXERCISES

E3-3: Carillo Industries collected $108,000 from customers in 2017. Of the amount

collected $25,000 was for services performed in 2016. In addition, Carillo performed services

worth $36,000 in 2017, which will not be collected until 2018.

Carillo Industries also paid $72,000 for expenses in 2017. Of the amount paid, $30,000 was for

expenses incurred on account in 2016. In addition, Carillo incurred $42,000 if expenses in 2017,

which will not be paid until 2018.

a. Compute 2017 cash-basis net income.

b. Compute 2017 accrual-basis net income.

a) 2017 cash-basis net income

Revenues = $108,000

Expenses = $72,000

Net income = $108,000 - $72,000 = $36,000

b) 2017 accrual-basis net income

Revenues = $108,000 - $25,000 + $36,000 = $119,000

Expenses = $72,000 - $30,000 + $42,000 = $84,000

Net income = $119,000 - $84,000 = $35,000

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 3 23

E3-7: The ledger of Passehl Rental Agency on March 31 of the current year includes the selected

accounts, shown below, before adjusting entries have been prepared.

Debit Credit

Prepaid Insurance $ 3,600

Supplies 2,800

Accumulated

Depreciation - Equipment 8,400

Notes Payable 20,000

Unearned Rent Revenue 10,200

Rent Revenue 60,000

Interest Expense -

Salaries and Wages Expense 14,000

An analysis of the accounts shows the following.

1. The equipment depreciates $400 per month.

2. One-third of the unearned rent revenue was earned during the quarter.

3. Interest of $500 is accrued on the notes payable.

4. Supplies on hand total $750.

5. Insurance expires at the rate of $300 per month.

Prepare the adjusting entries on March 31, assuming that adjusting entries are made quarterly.

Additional accounts are Depreciation Expense, Insurance Expense, Interest Payable, and

Supplies Expense.

No. Date Account Titles and Explanation Debit Credit

Mar. Depreciation Expense $1,200

1. 31 Accumulated Depreciation - Equipment $1,200

($400 x 3 = $1,200)

*Because adjusting entries are made quarterly, the depreciation

amount needed to record is the total depreciation expense of each

of the 3 months during the quarter, which is $400 x 3.

2. Mar. Unearned Rent Revenue $3,400

31 Rent Revenue $3,400

($10,200 / 3 = $3,400)

3. Mar. Interest Expense $500

31 Interest Payable $500

4. Mar. Supplies Expense $2,050

31 Supplies $2,050

($2,800 - $750 = $2,050)

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 3 24

5. Mar. Insurance Expense $900

31 Prepaid Insurance $900

($300 x 3 = $900)

*Because adjusting entries are made quarterly, the insurance

amount needed to record is the total insurance expense of each of

the 3 months during the quarter, which is $300 x 3.

E3-10: The income statement of Montee Co. for the month of July shows net income of $1,400

based on Service Revenue $5,500, Salaries and Wages Expense $2,300, Supplies Expense

$1,200 and Utilities Expense $600. In reviewing the statement, you discover the following.

1. Insurance expired during July of $400 was omitted.

2. Supplies expense includes $250 of supplies that are still on hand at July 31.

3. Depreciation on equipment of $150 was omitted

4. Accrued but unpaid salaries and wages at July 31 of $300 were not included.

5. Services performed but unrecorded totaled $650.

Prepare a correct income statement for July 2017.

MONTEE CO.

(Adjusted) Income Statement

For the Year Ended December 31, 2017

Revenues

Service revenue ($5,500 + $650) $6,150

Expenses

Salaries & wages expense ($2,300 + $300) $2,600

Insurance expense 400

Supplies expense ($1,200 - $250) 950

Utilities expense 600

Depreciation expense 150

Total expenses (4,700)

Net income $1,450

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 4 25

Chap 4 : COMPLETING THE ACCOUNTING CYCLE

LO2: PREPARE CLOSING ENTRIES AND A POST-CLOSING TRIAL BALANCE

a) Closing entries

Temporary -> R.E.D -> R (Revenue). E (Expense). D (Drawing) -> closed

4 steps:

1/ Debit Revenue, Credit Income Summary

2/ Debit Income Summary, Credit Expenses

3/ Debit Income Summary, Credit Capital

4/ Debit Capital, Credit Drawing

b) Post-closing Trial Balance:

- Report Owner’s Capital only (at the end of Trial Balance), instead of Revenue, Expenses,

Drawing

LO3: EXPLAIN THE STEPS IN THE ACCOUNTING CYCLE AND HOW TO

PREPARE CORRECTING ENTRIES

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 4 26

LO4: IDENTIFY THE SECTIONS OF A CLASSIFIED BALANCE SHEET

Current Assets

- Cash

- Investments (short-term)

- Receivables (Notes Receivables, Accounts Receivables, Interest Receivables)

- Inventories

- Prepaid Expense (Supplies, Insurance)

Long-term Investments

- Investments for stocks and bonds of other companies

- Long-term assets (land or building that the company don’t currently use)

- Long-term Note Receivable

Property, Plant and Equipment

- Land

- Building

- Machines

- Equipment

- Furniture

- Accumulated Depreciation

Intangible Assets

- Goodwill

- Patents

- Copyrights

- Trade mark (Trade names)

Current Liabilities

- Account Payable

- Salary and Wages Payable

- Notes Payable

- Interest Payable

- Income taxes Payable

- Current maturities of long-term obligations

Long-term Liabilities

- Bonds Payable

- Mortgages Payable

- Long-term Notes Payable

- Lease Liabilities

- Pension Liabilities

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 4 27

Owner’s Equity

- Stockholders’ equity

----------

EXERCISES

E 4-1

The trial balance columns of the worksheet for Dixon Company on June 30,

2017, are as follows.

Other data:

1. A physical count reveals $500 of supplies on hand.

2. $100 of the unearned revenue is still unearned at month-end.

3. Accrued salaries are $210.

Instructions

Enter the trial balance on a worksheet and complete the worksheet.

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 4 28

DIXON COMPANY

Worksheet

For the Month Ended June 30, 2017

Adj. Trial Income

Account Titles Trial Balance Adjustments Balance Statement Balance Sheet

Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr.

Cash 2,320 2,320 2,320

Accounts

Receivable 2,440 2,440 2,440

(a)

Supplies 1,880 1,380 500 500

Accounts

Payable 1,120 1,120 1,120

Unearned

Service

Revenue 240 (b) 140 100 100

Owner’s

Capital 3,600 3,600 3,600

Service

Revenue 2,400 (b) 140 2,540 2,540

Salaries and

Wages

Expense 560 (c) 210 770 770

Miscellaneous

Expense 160 160 160

Totals 7,360 7,360

Supplies (a)

Expense 1,380 1,380 1,380

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 4 29

Salaries and (c)

Wages Payable 210 210 210

Totals 1,730 1,730 7,570 7,570 2,310 2,540 5,260 5,030

Net Income 230 230

Totals 2,540 2,540 5,260 5,260

E 4-2

The adjusted trial balance columns of the worksheet for Savaglia Company

are as follows.

Instructions

Complete the worksheet.

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 4 30

SAVAGLIA COMPANY

(Partial) Worksheet

For the Month Ended April 30, 2017

Adjusted Trial Income

Balance Statement Balance Sheet

Account Titles Dr. Cr. Dr. Cr. Dr. Cr.

Cash 10,000 10,000

Accounts Receivable 7,840 7,840

Prepaid Rent 2,280 2,280

Equipment 23,050 23,050

Accum. Depreciation—

Equipment 4,900 4,900

Notes Payable 5,700 5,700

Accounts Payable 4,920 4,920

Owner’s Capital 27,960 27,960

Owner’s Drawings 3,650 3,650

Service Revenue 15,590 15,590

Salaries and Wages Expense

10,840 10,840

Rent Expense 760 760

Depreciation Expense 650 650

Interest Expense 57 57

Interest Payable 57 57

Totals 59,127 59,127 12,307 15,590 46,820 43,537

Net Income 3,283 3,283

Totals 15,590 15,590 46,820 46,820

P 4-1A

The trial balance columns of the worksheet for Warren Roofing at March 31,

2017, are as follows.

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 4 31

Other data:

1. A physical count reveals only $480 of roofing supplies on hand.

2. Depreciation for March is $250.

3. Unearned revenue amounted to $260 on March 31.

4. Accrued salaries are $700.

Instructions

(a) Enter the trial balance on a worksheet and complete the worksheet.

(b) Prepare an income statement and owner’s equity statement for the month

of March and a classified balance sheet on March 31. T. Warren made an

additional investment in the business of $10,000 in March.

(c) Journalize the adjusting entries from the adjustments columns of the

worksheet.

(d) Journalize the closing entries from the financial statement columns of the

worksheet.

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 4 32

(a)

WARREN ROOFING

Worksheet

For the Month Ended March 31, 2017

Adjusted Income

Account Titles Trial Balance Adjustments Trial Balance Statement Balance Sheet

Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr.

Cash 4,500 4,500 4,500

Accounts Receivable 3,200 3,200 3,200

Supplies 2,000 (a) 1,520 480 480

Equipment 11,000 11,000 11,000

Accumulated Depreciation

—Equipment

1,250 (b) 250 1,500 1,500

Accounts Payable

2,500 2,500 2,500

Unearned Service Revenue

550 (c) 290 260 260

Owner’s Capital

12,900 12,900 12,900

Owner’s Drawings

1,100 1,100 1,100

Service Revenue

6,300 (c) 290 6,590 6,590

Salaries and Wages

Expense

1,300 (d) 700 2,000 2,000

Miscellaneous Expense

400 400 400

Totals

23,500 23,500

Supplies Expense

(a) 1,520 1,520 1,520

Depreciation Expense

(b) 250 250 250

Salaries and Wages

Payable

(d) 700 700 700

Totals

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 4 33

Net Income 2,760 2,760 24,450 24,450 4,170 6,590 20,280 17,860

Totals 2,420 2,420

6,590 6,590 20,280 20,280

Key: (a) Supplies Used; (b) Depreciation Expensed; (c) Service Revenue Recognized; (d)

Salaries Accrued.

(b) WARREN ROOFING

Income Statement

For the Month Ended March 31, 2017

Revenues

Service revenue $6,590

Expenses

Salaries and wages expense $2,000

Supplies expense 1,520

Miscellaneous expense 400

Depreciation expense 250

Total expenses 4,170

Net income $2,420

WARREN ROOFING

Owner’s Equity Statement

For the Month Ended March 31, 2017

Owner’s Capital, March 1 $ 2,900

Investments 10,000

Add: Net income 2,420

12,420

15,320

Less: Drawings 1,100

Owner’s Capital, March 31 $14,220

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 4 34

WARREN ROOFING

Balance Sheet

March 31, 2017

Assets

Current assets

Cash $4,500

Accounts receivable 3,200

Supplies 480

Total current assets $ 8,180

Property, plant, and equipment

Equipment 11,000

Less: Accum. depreciation—equipment 1,500 9,500

Total assets $17,680

WARREN ROOFING

Balance Sheet (Continued)

March 31, 2017

Liabilities and Owner’s Equity

Current liabilities

Accounts payable $2,500

Salaries and wages payable 700

Unearned service revenue 260

Total current liabilities $ 3,460

Owner’s equity

Owner’s capital 14,220

Total liabilities and owner’s equity $17,680

(c) Mar. 31Supplies Expense 1,520

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Chap 4 35

Supplies 1,520

31 Depreciation Expense 250

Accumulated Depreciation—

Equipment 250

31 Unearned Service Revenue 290

Service Revenue 290

31 Salaries and Wages Expense 700

Salaries and Wages Payable 700

(d) Mar. 31Service Revenue 6,590

Income Summary 6,590

31 Income Summary 4,170

Salaries and Wages Expense 2,000

Supplies Expense 1,520

Depreciation Expense 250

Miscellaneous Expense 400

31 Income Summary 2,420

Owner’s Capital 2,420

31 Owner’s Capital 1,100

Owner’s Drawing 1,100

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

lOMoARcPSD|30946431

Reference

Kieso, D. E. , Kim, P. D. , Weygandt, J. J. , (2015). Principle of Accounting (12th)

Best PDF Encryption Reviews

Downloaded by Uyên Ph?m (phamuyenn05@gmail.com)

You might also like

- Financial Literacy and Preparedness: Claire C. Imperial Nicole I. Encinas Michael D. Paitan Angielyn A. CubillasDocument37 pagesFinancial Literacy and Preparedness: Claire C. Imperial Nicole I. Encinas Michael D. Paitan Angielyn A. CubillasMichael Data Paitan100% (5)

- International FinanceDocument10 pagesInternational FinancelabelllavistaaNo ratings yet

- Chargeback PresentationDocument10 pagesChargeback PresentationDaniel PireNo ratings yet

- Lecture Slides - Chapter 1 2Document66 pagesLecture Slides - Chapter 1 2Van Dat100% (1)

- Dow Theory Letter 100708Document6 pagesDow Theory Letter 100708Richard Banks100% (1)

- Far ReviewerDocument21 pagesFar Reviewerbea kullinNo ratings yet

- Review On Basic AccountingDocument17 pagesReview On Basic AccountingGrace100% (2)

- Level III Mock Exam Questions 2017ADocument24 pagesLevel III Mock Exam Questions 2017AElie Yabroudi50% (2)

- Quizzes PremidDocument80 pagesQuizzes PremidJosh Sean Kervin SevillaNo ratings yet

- Leases Part 1 (Accounting by Lessees)Document22 pagesLeases Part 1 (Accounting by Lessees)Queen ValleNo ratings yet

- Chapter Two Part TwoDocument175 pagesChapter Two Part TwoWelday GebremichaelNo ratings yet

- Stability RatioDocument27 pagesStability RatioashokkeeliNo ratings yet

- Revision On Principle of Accounting: by Isb Academic TeamDocument37 pagesRevision On Principle of Accounting: by Isb Academic TeamDoan BùiNo ratings yet

- REVISION PaDocument54 pagesREVISION PaNgoc Nguyen ThanhNo ratings yet

- FIA 141 - Introduction To Financial Accounting-1 - 2Document20 pagesFIA 141 - Introduction To Financial Accounting-1 - 24313256No ratings yet

- Fa Ta For Practicing and ReviewDocument9 pagesFa Ta For Practicing and ReviewThảo NguyênNo ratings yet

- Lecture Slides - Chapter 1 2Document69 pagesLecture Slides - Chapter 1 2Nhi BuiNo ratings yet

- MBAB 5P01 - Chapter 1Document3 pagesMBAB 5P01 - Chapter 1Priya MehtaNo ratings yet

- Accounting C2 Lesson 2 PDFDocument6 pagesAccounting C2 Lesson 2 PDFJake ShimNo ratings yet

- Ch02. Accounting EquationDocument22 pagesCh02. Accounting EquationHải TrầnNo ratings yet

- Tài liệu của Trần Khoa - K46 - FNC05 - Khoa Tài chính - Trường Kinh Doanh - Đại học UEHDocument24 pagesTài liệu của Trần Khoa - K46 - FNC05 - Khoa Tài chính - Trường Kinh Doanh - Đại học UEHQúy ChâuNo ratings yet

- FABM1 Module C3Document11 pagesFABM1 Module C3Nathan CapsaNo ratings yet

- Lecture Slides - Chapter 1 & 2Document66 pagesLecture Slides - Chapter 1 & 2Phan Đỗ QuỳnhNo ratings yet

- 2 - The Accounting ProcessDocument4 pages2 - The Accounting ProcessWea AmorNo ratings yet

- Fundamentals of Accounting Notes Types of Businesses and UsesDocument4 pagesFundamentals of Accounting Notes Types of Businesses and UsesSALENE WHYTENo ratings yet

- Accounting:: Recording, Analysing and SummarisingDocument37 pagesAccounting:: Recording, Analysing and SummarisingNguyen Ngoc MaiNo ratings yet

- Accounting in ActionDocument42 pagesAccounting in ActionMuhammad TausiqueNo ratings yet

- Accounting Grade 10 - 12 How To Teach Acc EquationDocument11 pagesAccounting Grade 10 - 12 How To Teach Acc Equationnkambulentokozo55No ratings yet

- Financial Accounting and ReportingDocument27 pagesFinancial Accounting and ReportingAlexandra Nicole IsaacNo ratings yet

- Far Reviewer 1Document13 pagesFar Reviewer 1Allyza May Gaspar0% (1)

- Transaction Analysis & Financial StatementDocument26 pagesTransaction Analysis & Financial StatementFahim Ahmed RatulNo ratings yet

- Accounting Chapter 1 Sec 8,9,10 UpdatedDocument36 pagesAccounting Chapter 1 Sec 8,9,10 Updatedrashedkhan1722No ratings yet

- Review On Basic Accounting - CompressDocument17 pagesReview On Basic Accounting - CompressAzure Premiums100% (1)

- Chapter 1 - Acctg NotesDocument6 pagesChapter 1 - Acctg Notesfennyl婷.No ratings yet

- Accounting 1Document59 pagesAccounting 1Teodora IrimiaNo ratings yet

- Chapter 01Document51 pagesChapter 01abdullah naseerNo ratings yet

- Financial AccountingDocument7 pagesFinancial Accountingsaralbaker0814No ratings yet

- Topic 2 (Acc)Document48 pagesTopic 2 (Acc)Nur Adnin KhairaniNo ratings yet

- Supplementary 1 - Financial StatementsDocument21 pagesSupplementary 1 - Financial StatementsQuốc Khánh100% (1)

- AFM CH 2Document58 pagesAFM CH 2Birhanu MengisteNo ratings yet

- Finance+Webinar 13.12.2022++updatedDocument42 pagesFinance+Webinar 13.12.2022++updatedJasmine ChoudharyNo ratings yet

- FINA4050 Class 6 Financial Modeling Basics PDFDocument26 pagesFINA4050 Class 6 Financial Modeling Basics PDFJai PaulNo ratings yet

- Branches of Accounting: BOOKKEEPING - Is A Mechanical Task Involving The Collection of BasicDocument21 pagesBranches of Accounting: BOOKKEEPING - Is A Mechanical Task Involving The Collection of BasicDejen Nonog SalvadorNo ratings yet

- Chapter 1Document25 pagesChapter 1chanreaksmeytepNo ratings yet

- Accountancy: Shaheen Falcons Pu CollegeDocument13 pagesAccountancy: Shaheen Falcons Pu CollegeMohammed RayyanNo ratings yet

- Far Reviewer Lecture Notes 1 - CompressDocument21 pagesFar Reviewer Lecture Notes 1 - CompressAzure PremiumsNo ratings yet

- Financial Accounting and ReportingDocument12 pagesFinancial Accounting and ReportingDiane GarciaNo ratings yet

- Definition of AccountingDocument27 pagesDefinition of AccountingAlexandra Nicole IsaacNo ratings yet

- Three Persons or Entities in The World of Commerce // Forms of Business OrganizationDocument16 pagesThree Persons or Entities in The World of Commerce // Forms of Business OrganizationChristian Joseph CantiladoNo ratings yet

- Topic 1 2Document16 pagesTopic 1 2lala lianNo ratings yet

- Acc Module 2 Classification of AccountsDocument3 pagesAcc Module 2 Classification of AccountsEbina WhiteNo ratings yet

- Learning Outcome and Programme Learning Objectives (Plos)Document64 pagesLearning Outcome and Programme Learning Objectives (Plos)ANGEL ROBIN RCBSNo ratings yet

- Week 4 - Accounting and FinanceDocument21 pagesWeek 4 - Accounting and FinanceTharra ZNo ratings yet

- The Accounting Equation and Double-Entry SystemDocument17 pagesThe Accounting Equation and Double-Entry SystemPATRICIA COLINANo ratings yet

- FABM PrelimDocument5 pagesFABM PrelimIvana CianeNo ratings yet

- 5 Major Accounts - Miss JeDocument83 pages5 Major Accounts - Miss Jeje-ann montejoNo ratings yet

- FAR Chapter3 - FinalDocument18 pagesFAR Chapter3 - FinalCharlemagne Jared RobielosNo ratings yet

- Acctg Overview - 012023Document6 pagesAcctg Overview - 012023Czamille Rivera GonzagaNo ratings yet

- Accounting 1-4Document37 pagesAccounting 1-4Abed M. SallamNo ratings yet

- 3 The Accounting EquationDocument26 pages3 The Accounting EquationJohn Alfred CastinoNo ratings yet

- Accounting Test Notes-1Document6 pagesAccounting Test Notes-1coolio_94No ratings yet

- MAF CH 2 NEWDocument58 pagesMAF CH 2 NEWAsegid H/meskelNo ratings yet

- BBFA1103 Topic 3 Accounting Cycle - NoteDocument13 pagesBBFA1103 Topic 3 Accounting Cycle - Noteknea9999No ratings yet

- Learning Activity Sheet No. 1: Don Carlos, Bukidnon Senior High School Department First Quarter School Year 2020-2021Document7 pagesLearning Activity Sheet No. 1: Don Carlos, Bukidnon Senior High School Department First Quarter School Year 2020-2021Mylene HeragaNo ratings yet

- FARreviewerDocument5 pagesFARreviewerKimNo ratings yet

- Chap 1Document7 pagesChap 1Trang TrầnNo ratings yet

- CPA Financial Accounting and Reporting: Second EditionFrom EverandCPA Financial Accounting and Reporting: Second EditionNo ratings yet

- Formula AnnuityDocument9 pagesFormula AnnuityReese Victoria C. TorresNo ratings yet

- Settlement Letter 5798468 2023-01-31Document2 pagesSettlement Letter 5798468 2023-01-31Rajput HareshNo ratings yet

- UntitledDocument3 pagesUntitledCarylChooNo ratings yet

- ENGRO FERTILIZERS - Aiman JamilDocument25 pagesENGRO FERTILIZERS - Aiman JamilRosenna99No ratings yet

- The Government Tele Communication R 03102017Document7 pagesThe Government Tele Communication R 03102017SandeeploguNo ratings yet

- FINS 2624 Quiz 2 Attempt 2 PDFDocument3 pagesFINS 2624 Quiz 2 Attempt 2 PDFsagarox7No ratings yet

- Introduction of Guest SpeakerDocument2 pagesIntroduction of Guest SpeakerAldrin Jay BalangatanNo ratings yet

- Lecture 2 - Central Bank and Its FunctionsDocument20 pagesLecture 2 - Central Bank and Its FunctionsLeyli MelikovaNo ratings yet

- Thesis Credit CardDocument6 pagesThesis Credit Cardbk1xaf0p100% (2)

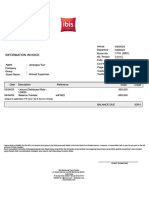

- Information Invoice: Subject To Applicable 21% Govt. Tax & Service ChargeDocument1 pageInformation Invoice: Subject To Applicable 21% Govt. Tax & Service Chargehijrah maju jayaNo ratings yet

- Activity 9. Understanding The Normal Balances Is Just A Guide For You To Correctly Analyze The Effect ofDocument4 pagesActivity 9. Understanding The Normal Balances Is Just A Guide For You To Correctly Analyze The Effect ofDonabelle MarimonNo ratings yet

- Money Market WordDocument18 pagesMoney Market Wordshrikant_b1No ratings yet

- GR 170865 PNB Vs Chee ChongDocument7 pagesGR 170865 PNB Vs Chee Chongmaria lourdes lopenaNo ratings yet

- Pleasant Summit Land Corporation, in 88-1373 v. Commissioner of Internal Revenue. George Prussin and Sharon Prussin, in 88-1377 v. Commissioner of Internal Revenue, 863 F.2d 263, 3rd Cir. (1988)Document26 pagesPleasant Summit Land Corporation, in 88-1373 v. Commissioner of Internal Revenue. George Prussin and Sharon Prussin, in 88-1377 v. Commissioner of Internal Revenue, 863 F.2d 263, 3rd Cir. (1988)Scribd Government DocsNo ratings yet

- Idx Monthly December 2020Document130 pagesIdx Monthly December 2020anji prabowoNo ratings yet

- International Economics 18Th Edition Thomas Pugel Full ChapterDocument67 pagesInternational Economics 18Th Edition Thomas Pugel Full Chapterjames.bell185No ratings yet

- Credit Management ReportDocument28 pagesCredit Management ReportSohail AkramNo ratings yet

- A Brief History of Central Banking in AlbaniaDocument32 pagesA Brief History of Central Banking in AlbaniaRezwanah KhalidNo ratings yet

- 2023 06 08 10 10 08apr 23 - 524004Document19 pages2023 06 08 10 10 08apr 23 - 524004k. prudhvi rajNo ratings yet

- Agenda Chile Day New York - Toronto 2023Document3 pagesAgenda Chile Day New York - Toronto 2023Maximiliano Ortizdezarate MontenegroNo ratings yet

- Asaan AccountopeningDocument7 pagesAsaan AccountopeningAbdullah IbrahimNo ratings yet

- Chapter 23Document6 pagesChapter 23bridge1985No ratings yet