Professional Documents

Culture Documents

Gr.1 Wage Supplements Handout

Gr.1 Wage Supplements Handout

Uploaded by

Gracelyn QuigaoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gr.1 Wage Supplements Handout

Gr.1 Wage Supplements Handout

Uploaded by

Gracelyn QuigaoCopyright:

Available Formats

P.

1/2

COMPENSATION ADMINISTRATION

WAGE SUPPLEMENTS

GROUP 1

People are a vital asset to an organization, and compensation and benefits are essential

pillars of a team member's satisfaction in the workplace. Offering a wage supplements can be a

competitive advantage, motivate employees, and help contribute to employees' financial security.

Wage Supplements

When some workers are benefitted by payments and contributions of their employers

which are not direct payments for work performed on the job, although in an indirect way, they

represent rewards for services rendered.

Some of the major types of extra remuneration or benefits received by employees are pay

for vacations and holidays wherein work was not rendered, sick and old age benefits that are

provided by law, and bonuses other than those paid as a reward for extra output or time spent on

the job.

FORMS & EXAMPLES OF WAGE SUPPLEMENTS

I. Profit Sharing

Profit sharing is an “agreement (formal or informal) freely entered into by which

employees received a share fixed in advance of the profits.”

Others describe it as “payments in the form of cash, stock, options, or warrants.

TYPES OF PROFIT SHARING SCHEMES

1. Profit sharing alone

2. Profit sharing with co-partnership

3. Profit sharing with some kind of co-partnership through ownership of shares in the company by

employees.

ADVANTAGES OF PROFIT SHARING

1. To encourage employee efficiency and stimulate more production.

2. To secure more flexibility in the payroll

P. 2/2

3. To reduce labor turnover.

4. To encourage unionism or at least minimize its militancy, strikes and other forms of industrial

unrest become prevented since employees feel they have a stake in the profitable operation of the

enterprise.

II. EMPLOYEE COVERAGE AND BENEFITS

Employee groups such as officers and top executives, department head and supervisors,

salaries clerical workers, and hourly paid workers, professionals and production and maintenance

employees (non-union) are often covered.

KIND OF BENEFITS

VESTING

DISBURSEMENT

GROWTH OF PROFIT SHARING PROGRAMS

III. SPECIAL BONUSES

Some employees secure other types of bonuses which are not directly related to production

standards or work schedules.

Christmas Bonuses

Production Bonus System

Halsey Plan

IV. COST OF LIVING ALLOWANCES

-Under the Labor Code of the Philippines, a "cost of living allowance" is granted to workers

as a lump sum payment that is adjusted based on the cost of living index.

-Its purpose is to maintain wage levels during times of recession and provide workers with

additional income equivalent to the increase in the cost of living.

-Paid sick leave is also provided under labor laws and collective bargaining agreements.

You might also like

- Distortion FormulaDocument11 pagesDistortion FormulaWindy Awe Malapit88% (8)

- Employment Rulebook (Pravilnik o Radu)Document26 pagesEmployment Rulebook (Pravilnik o Radu)Tvrtko Kotromanic100% (3)

- Starbucks vs. McDonald's Compensation Analysis Case StudyDocument4 pagesStarbucks vs. McDonald's Compensation Analysis Case Studytinalauren24100% (1)

- Strikes and Lockouts ReviewerDocument8 pagesStrikes and Lockouts ReviewerkarenNo ratings yet

- Basic PayDocument2 pagesBasic PaySeema ModiNo ratings yet

- Unit 4 Compensation Management and Employee RetentionDocument14 pagesUnit 4 Compensation Management and Employee Retentionkumar sahityaNo ratings yet

- Unit-3 HRMDocument39 pagesUnit-3 HRMdpssmrutipravadashNo ratings yet

- Pablico - Chapter 7 - Wps OfficeDocument2 pagesPablico - Chapter 7 - Wps OfficeTam SykesNo ratings yet

- CompensationDocument64 pagesCompensationDr. A John WilliamNo ratings yet

- Chapter 5 Compensation and BenefitDocument29 pagesChapter 5 Compensation and BenefitMarc Franz R. BurceNo ratings yet

- ESOPDocument40 pagesESOPsimonebandrawala9No ratings yet

- Compensating Human ResourcesDocument13 pagesCompensating Human ResourcesM RABOY,JOHN NEIL D.No ratings yet

- Fringe BenefitDocument6 pagesFringe BenefitSweta MishraNo ratings yet

- BobbDocument3 pagesBobbJustine angelesNo ratings yet

- Principles of Fringes: Significant Benefit and Service ProgrammesDocument5 pagesPrinciples of Fringes: Significant Benefit and Service ProgrammesAakash DeepNo ratings yet

- Difference Between Compensation and BenefitsDocument5 pagesDifference Between Compensation and BenefitsAIMA zulfiqarNo ratings yet

- Introduction To CompensationDocument105 pagesIntroduction To CompensationgedorjeramNo ratings yet

- CHAPTER 9 Written ReportDocument17 pagesCHAPTER 9 Written ReportSharina Mhyca SamonteNo ratings yet

- Incentives and BenefitsDocument14 pagesIncentives and BenefitsAditya PandeyNo ratings yet

- Introduction To Pay SystemDocument25 pagesIntroduction To Pay SystemSubhashNo ratings yet

- Revmat Group 4Document8 pagesRevmat Group 4Pagud, Christine Angela C.No ratings yet

- Name: Jincky C. Almendras - Bsba Ii Instructress: Mrs. Remedios M. Famador Ph.D. HRDM-5Document7 pagesName: Jincky C. Almendras - Bsba Ii Instructress: Mrs. Remedios M. Famador Ph.D. HRDM-5Joel Nicser SingeNo ratings yet

- Unit 3 Bba 404Document46 pagesUnit 3 Bba 404King KingNo ratings yet

- Perquisites and Fringe BenefitsDocument6 pagesPerquisites and Fringe BenefitsPrithwiraj Deb100% (7)

- Submitted To: Amita Sharma Submitted By: Aditya Kumar Section-A Enrollment No. - 16flicddno1006Document14 pagesSubmitted To: Amita Sharma Submitted By: Aditya Kumar Section-A Enrollment No. - 16flicddno1006Aditya PandeyNo ratings yet

- Compensation MGTDocument39 pagesCompensation MGT81 ganesh patekarNo ratings yet

- DIB 2253, DHR 1323, DBM 1243 - Chapter 8 Compensation and BenefitsDocument36 pagesDIB 2253, DHR 1323, DBM 1243 - Chapter 8 Compensation and BenefitsNency MosesNo ratings yet

- CM Fourth UnitDocument32 pagesCM Fourth UnitBhúmîkå ßîshtNo ratings yet

- Enteria Joemil HRM Finals Assignment Activity 3Document2 pagesEnteria Joemil HRM Finals Assignment Activity 3JM EnteriaNo ratings yet

- Mba HRM Notes Compensation Management Part 2Document4 pagesMba HRM Notes Compensation Management Part 2Madhukar SaxenaNo ratings yet

- HRMG Unit-4Document8 pagesHRMG Unit-4rakshit konchadaNo ratings yet

- IJRPR6882Document6 pagesIJRPR6882bolatconceptNo ratings yet

- Management OF Fringe BenefitsDocument14 pagesManagement OF Fringe BenefitsPuja KumariNo ratings yet

- Chapter 9 THE MANAGEMENT OF EMPLOYEE BENEFITS SERVICESDocument25 pagesChapter 9 THE MANAGEMENT OF EMPLOYEE BENEFITS SERVICESmariantrinidad98No ratings yet

- ComMgt ch02 Reward SystemDocument24 pagesComMgt ch02 Reward SystemFarhana MituNo ratings yet

- Meaning of Fringe BenefitsDocument3 pagesMeaning of Fringe BenefitsAnirudh SaindaneNo ratings yet

- CH 5Document57 pagesCH 5Micky TrầnNo ratings yet

- Session 3Document44 pagesSession 3Marielle Ace Gole CruzNo ratings yet

- HRM-Compensation and BenefitsDocument2 pagesHRM-Compensation and BenefitsAndrew PonteNo ratings yet

- B. Com (Hons) III Year: School of Open LearningDocument137 pagesB. Com (Hons) III Year: School of Open LearningÑàdààñ ShubhàmNo ratings yet

- Topic 7 BenefitDocument11 pagesTopic 7 BenefitMAWIIINo ratings yet

- CH 7Document5 pagesCH 7hailu mekonenNo ratings yet

- SynopsisDocument6 pagesSynopsisjitesh12345No ratings yet

- Unit 1 CMDocument5 pagesUnit 1 CMinduNo ratings yet

- Compensation MGT 260214Document224 pagesCompensation MGT 260214Thiru VenkatNo ratings yet

- Creative CompensationDocument7 pagesCreative Compensationdua khanNo ratings yet

- Synopsis of CompensationDocument15 pagesSynopsis of CompensationShipra Jain0% (2)

- Roque Module No.3 PDFDocument2 pagesRoque Module No.3 PDFElcied RoqueNo ratings yet

- CPM Unit - IDocument11 pagesCPM Unit - Imba departmentNo ratings yet

- Com MGT chp#1Document3 pagesCom MGT chp#1tajjamulspamNo ratings yet

- Employee BenefitsDocument15 pagesEmployee BenefitsEd FeranilNo ratings yet

- Unit - 4 HRMDocument10 pagesUnit - 4 HRMAatif AatifNo ratings yet

- Compensation Management NoteDocument57 pagesCompensation Management NoteAishwaryaSantoshNo ratings yet

- Employee CompensationDocument2 pagesEmployee CompensationVikrantNo ratings yet

- Chapter 5 HRMDocument47 pagesChapter 5 HRMJennalynNo ratings yet

- What AreFringe BenefitsDocument4 pagesWhat AreFringe BenefitsAssif HassanNo ratings yet

- HRM Chapter 7Document7 pagesHRM Chapter 7Girma TadessseNo ratings yet

- CHAPTER 7. Compensation and BenefitsDocument4 pagesCHAPTER 7. Compensation and BenefitsArriana JutajeroNo ratings yet

- COMPENSATIONDocument12 pagesCOMPENSATIONAbinash MNo ratings yet

- Unit 5Document11 pagesUnit 5Vijaya Bhanu MouriceNo ratings yet

- Employee CompensationDocument75 pagesEmployee CompensationGitu SinghNo ratings yet

- Wages and SalaryDocument12 pagesWages and SalaryPrema SNo ratings yet

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryFrom EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryNo ratings yet

- Compensation Systems, Job Performance, and How to Ask for a Pay RaiseFrom EverandCompensation Systems, Job Performance, and How to Ask for a Pay RaiseNo ratings yet

- Tunjangan Layanan Pribadi Dan Rumah Keluarga Dan Program Tunjangan FleksibelDocument16 pagesTunjangan Layanan Pribadi Dan Rumah Keluarga Dan Program Tunjangan FleksibelFarahNo ratings yet

- Module IV Chapter 2 Compensation ManagementDocument9 pagesModule IV Chapter 2 Compensation ManagementSonia Dann KuruvillaNo ratings yet

- Emerging Trends of IRDocument2 pagesEmerging Trends of IRMeenakshi ChoudharyNo ratings yet

- SalaryDocument13 pagesSalaryErik Treasuryvala100% (1)

- KE Staff Benefits Summary RecruitmentDocument5 pagesKE Staff Benefits Summary RecruitmentTiago ViergeverNo ratings yet

- Industrial RelationsDocument39 pagesIndustrial RelationsbijayNo ratings yet

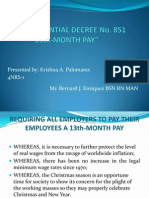

- PRESIDENTIAL DECREE No.851Document11 pagesPRESIDENTIAL DECREE No.851Krishna PalomaresNo ratings yet

- Human Resource Management Staff Course (HRMSC) Lecture On Introduction To Human Resource ManagementDocument47 pagesHuman Resource Management Staff Course (HRMSC) Lecture On Introduction To Human Resource ManagementSeph AgetroNo ratings yet

- Human Resource Information System (Hris) PlanningDocument26 pagesHuman Resource Information System (Hris) PlanningAde MuseNo ratings yet

- Executive Compensation: Presented By-Sunakshi Rattan Abhishek KanwarDocument17 pagesExecutive Compensation: Presented By-Sunakshi Rattan Abhishek KanwarSunakshiRattanNo ratings yet

- Shweta AAI Report PDFDocument22 pagesShweta AAI Report PDFShweta singhNo ratings yet

- BSBHRM513 (Task 2)Document12 pagesBSBHRM513 (Task 2)Shar KhanNo ratings yet

- Daily Accomplishment Report: Law Office Nenita Dela Cruz Tuazon Attorney at Law Notary PublicDocument26 pagesDaily Accomplishment Report: Law Office Nenita Dela Cruz Tuazon Attorney at Law Notary PublicLigen SetiarNo ratings yet

- Income Tax: Ca - Cma - Cs Inter / EPDocument55 pagesIncome Tax: Ca - Cma - Cs Inter / EPINDIRA GHOSHNo ratings yet

- Learn French The Fast and Fun WayDocument250 pagesLearn French The Fast and Fun WayHùng Anh LươngNo ratings yet

- Labour Law I - Lock Out, Judicial Approach - Sai Suvedhya R. - 2018LLB076Document14 pagesLabour Law I - Lock Out, Judicial Approach - Sai Suvedhya R. - 2018LLB076Suvedhya ReddyNo ratings yet

- Compensation PPT Group 5Document33 pagesCompensation PPT Group 5ekansh gargNo ratings yet

- LABOUR COSTING With AnswersDocument53 pagesLABOUR COSTING With AnswersHafsa Hayat100% (2)

- Training & Development VocabularyDocument2 pagesTraining & Development VocabularyNu Driz EnglishNo ratings yet

- BEC Vantage Module 2.1 ReadingDocument2 pagesBEC Vantage Module 2.1 Readingcarrie ph88No ratings yet

- 2023 08 International Payroll GuideDocument46 pages2023 08 International Payroll Guidesgideon681No ratings yet

- Code On Wages 2019 - NotesDocument3 pagesCode On Wages 2019 - NotesAnand ReddyNo ratings yet

- Motivation and Reward SystemDocument25 pagesMotivation and Reward SystemAbhinav JhaNo ratings yet

- HRMG 3205 Topic 6Document5 pagesHRMG 3205 Topic 6ChristinaNo ratings yet

- MBR Sufyan ZafarDocument5 pagesMBR Sufyan ZafarAbdul AhadNo ratings yet

- Job Order Direct LaborDocument23 pagesJob Order Direct LaborMaria Raven Joy ValmadridNo ratings yet