Professional Documents

Culture Documents

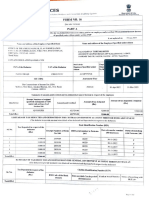

W2 - 2316 (1) - Unlocked

Uploaded by

Enrico Torres Jr. JrOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

W2 - 2316 (1) - Unlocked

Uploaded by

Enrico Torres Jr. JrCopyright:

Available Formats

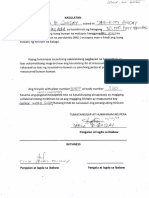

Tcj be accQ mpli stied undg substit uted fi 11 ng.......................................................................................................

METRO-DASMA

'~ i I declare.underthe penalties of perjuryttiat I amgudifed under substituted fling of

ENRICOR.TORRESJR

BIR Form

Empioyee No. Over frinted Nare

agnature

Certificate of Compensation

2316

Repub lb: a ng Pilipinas Kagayvaran

ng Pananal^ii

Kayvenihan ng Rentas Internas

Payment/Tax Withheld

For Compensation Payment With or Without TaxWithheld July 2OO0CENCS)

1

For the Year 2 For the Period 0

(YYYY) 20141 ► From (MMDD) (08 To (MM/DD) 11231 1

Part I Employee Infor mil on Part IV-B 6

El* tai I cof Compen aUon hoom* and Tai '/Ulili^ld from Fro wntBnployor

Amount

3 Taxpayer Identification

No. 258 933 1 421 000 1 ■ J 1

A. NGN-TA3{ABLE/EKEMPT COMPENSATION INCOME

4 Employee's

* Name (List Name, First Name, Middle Hame^ 5 RDO Code 1

32 Basic Salary/

TORRES JR, ENRICO ROYOL Statutory Minimum Wage 0.00

6 Registered Address EA Zip Code Ivfninun tfifege Eaner (MU'i.i'E)

c/0 IQOR PHILIPPINES INC.

SB Local Home Address 6C Zip Code

Holiday PayCMWE)

0.00

BIk 5 Lot 23 Tierra Vista Sudb. Langkaan Dasmarina 34 □ vertim e P ay (lyWE) 3i

Muntinluna Citv_________________________________ 0.00

GD Foreign Address______________________________________ 6E Zip Code

____I____k____I

Night Shift Differential (fyWE) 0.00

____

7 Date of Birth (MM/DD/WYV) Hazard Pay (lyW^

109 118 I 19 , 891 0.00

13th Month Pay and 37

3 Exemption Status □*□ Single Other Benefits 3,041.86

BA Is the wi fe claiming the addifio nal e xempfi

I Married De Minimis Benefits

________________________________________ qualified dependent children?

No

12,970.10

10 Name of (Qualified Dependent Children 11 Das ofBirth (MM/DB/YYYY)

33 SSS, eSIS, PHIC aPag-ibig 33

1 1 1 1 1 Contributions, a Union Dues

3,803.50

1 1 1 1 1 (Brployee shae only)

1 1 1 1 1

12 Stautory Minimum Wage rae per day 12

1 1 1 1 1 40 Salaries a Other Forms of

Compensation

40 0.00

43 Staaory Minimum Wage rae per morth 13 41 Total NorrTaxable/Exempt 41

Compensation Income 19,815.46

14 Minimum Wage Earner imhose compensaion is eKema ftom

tax and na s to income tax E. TAMABLE COMPENSATION INCOME

REGULAR

FSrt II Employer hformiion fFTesent I

15 Taxpayer

Identification

16 Employer's Name

►234 I 1988 1175 I 1 . . . 1 42 Basic Salary

& Other Inc.

42

49,214.19

No.

I

IQOR PHILIPPINES INC? 43 Representation 43

0.00

17 Registered Address 17AZip Code

44

BUILDING 36 & 37, BERTAPHIL II COMPOUND, J. A. SANTOS

> AVE. CLARK, PAMPANGA________________________________

44 Trans p ortaion

0.00

CTl Main Employer

0.00

a.

45 Cost of Living Allowance 45

Fart III_________________Emi er hformaionSecondary Employer

us

46 Fi>sed Housing Allowance 46

IS Ta::p ay er Identification

0.00

No.

13 Employers Name 1 .. 47 I Others ('Specify')

47A 474

0.00

30 Registered Address 20A Zip Code 47E 47E

0.00

SUPPLEMENTARY

Ffert IV-A Summary

4S Commission 43

0.00

2 Gross Corrpensaticn hccfre fem 2 73,302.45

1 fresent Errdover fkem 41 plus item 1

2 Less: Total Not> Taxable/ 2 19,815.46 43 Profit Sharing 43 0.00

2 Ejerrpt fkem41') 2

2 Taxable Compensation Income 2 53,486.99

3 tom Piesent Brrployer (Item 55) 3 S 0.00

2 Add: TaxableCompetTsation 2 _______0.00 50 Fees Including Director's Fees

O

1 Income from Previous Employer 4

2 Oross Taxable 2 53,486.99 51 Taxable 13th Month Pay and 5 0.00

5 Compensation Income 5 Other Benefits 1

2 Less: Total Exemptions 2 50,000.00

6 6 0.00

2 Less: Premium Paid on Health nib 2 0.00 52 Hazard Pay $

7 HasplU kvkrm Clfniplcatifc) 7

2 Net Taxable 2 3,486.99 53 Overtime Pay 53 4,272.80

3 Compensation Income 3

2

3

Tax Due

3

2 174.35 54 Others (Specify)

Amourrt of Taxes Withheld

3Q

5

174.35 0.00

S 3QA Present Employer 4 [54A

A

SO

A

5

4 0.00

I54E 0.00

336 Previous Employer B E

3 Total Amount of Taxes 'Withheld 3 174.35

55 Total Taxable Compensation

Income

55 53,486.99

1 As adjusted 1

We declare, underthe irirry.fhathis certilcae has been made in good ^hh, yeriled by us, and to the best of orr knowledge and belia, isfnje and correct

pursuant tothe provisions c (aFTrfepnafcRevenue Code, as amended, and regulaiors issued under authorftythereof. I

56 M. the SAMS^tTTyp FINANCE)

■ 1,1 , ,

ftssent Btiployerf Arfhctii^d Agent Sigratre Over FVirted tbme

CUNFUKMt:

57 ENRICO R. TORRES JR Date Signed [

CTC No. or Briplovee agnaure Over Printed Na™ I Anoua Pad

Bvproyvv Race of Issue Dae of Issue F

I deolaiE, under the pennies a perjury, tfiathe infbimaicn herein stasd as reported

under BIR Fonn No. 16D4CF which has been filed with the Bcneau of htemal Revenue. hcome Tai RettmsfBIR Fortn No. 17DD'), since I received pcrely compensation income

tom only one employer ri the Phils, tor the calendar vear;1hat fates have been correctly

withheld by my errployer (tax due egu^s tax withheld^ tfiatthe BIR Form No. 16D4CF

53____________________________________________________________ tied by my errployerto the BIR shal constitute as myincometax lettm; and that BIR Fornn

Piesent &rployei/ Arthoriied Agent Sigrahre Over Rinted bbme No. 2316 shall serve the same purpose as if BIR Form No. 17DD had been tied

(Head of Accounthg/ Human Resource or Auhorized Representative) pursuant to the provisions of RR No. 3-2[)02, as arended.

SB

You might also like

- BIR Form 2307Document1 pageBIR Form 2307Aizhel Villegas ArcipeNo ratings yet

- Self, IdentityDocument32 pagesSelf, IdentityJohnpaul Maranan de Guzman100% (2)

- Redundancy and the Law: A Short Guide to the Law on Dismissal with and Without Notice, and Rights Under the Redundancy Payments Act, 1965From EverandRedundancy and the Law: A Short Guide to the Law on Dismissal with and Without Notice, and Rights Under the Redundancy Payments Act, 1965Rating: 4 out of 5 stars4/5 (1)

- Tamilnadu Genera Tion and Distribution Corpora Tion: I. Security Deposit DetailsDocument1 pageTamilnadu Genera Tion and Distribution Corpora Tion: I. Security Deposit DetailssamaadhuNo ratings yet

- 1701Q BIR Form PDFDocument3 pages1701Q BIR Form PDFJihani A. SalicNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- TM 9-816 AUTOCAR U 7144Document280 pagesTM 9-816 AUTOCAR U 7144Advocate100% (1)

- CPA Reviewer in Taxation (2022) - Tabag SearchableDocument628 pagesCPA Reviewer in Taxation (2022) - Tabag SearchableTOBIT JEHAZIEL SILVESTRENo ratings yet

- Kevin The Dino: Free Crochet PatternDocument3 pagesKevin The Dino: Free Crochet PatternMarina Assa100% (4)

- Unit 20-The ISM CodeDocument150 pagesUnit 20-The ISM CodeBisrat100% (5)

- Before The Hon'Ble Supereme Court of IndiaDocument32 pagesBefore The Hon'Ble Supereme Court of IndiaAnkit Singh0% (2)

- 01 03 16 106 057 588 000 000863 958 243 New Morales Glass Supply 03 31 16 01 05 16 102 214 389 000 000863 958 243 New Kent Lumber & Hardware 05 31 16Document15 pages01 03 16 106 057 588 000 000863 958 243 New Morales Glass Supply 03 31 16 01 05 16 102 214 389 000 000863 958 243 New Kent Lumber & Hardware 05 31 16Jobel Sibal CapunfuerzaNo ratings yet

- Certificate of Final Tax Withheld at SourceDocument2 pagesCertificate of Final Tax Withheld at SourceBarangay SamputNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument1 pageCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasMARJONNo ratings yet

- Form 2306 Witn Computation Electric BillDocument3 pagesForm 2306 Witn Computation Electric BillJanus Salinas100% (2)

- Record of Employment (Roe) : Payroll DepartmentDocument2 pagesRecord of Employment (Roe) : Payroll Departmentcaadani5005No ratings yet

- BIR Form 2307 PDFDocument1 pageBIR Form 2307 PDFAizhel Villegas ArcipeNo ratings yet

- BIR Form 2307 PDFDocument1 pageBIR Form 2307 PDFAizhel Villegas ArcipeNo ratings yet

- Abayao-Worwor Furniture ShopDocument4 pagesAbayao-Worwor Furniture ShopBen Carlo RamosNo ratings yet

- 06-2023 Bill DR Office, NRTDocument12 pages06-2023 Bill DR Office, NRTHird High SchoolNo ratings yet

- BIR Form 1604cfDocument3 pagesBIR Form 1604cfMaryjean PoquizNo ratings yet

- Adobe Scan 01 Aug 2023Document6 pagesAdobe Scan 01 Aug 2023Soffiya SoffiyaNo ratings yet

- 2306Document2 pages2306Anonymous e1WB7mAVJNo ratings yet

- Certificate of Tax Withheld at Source: CreditableDocument10 pagesCertificate of Tax Withheld at Source: CreditableKEVINNo ratings yet

- 1099-r Taxable Amount Example - Google SearchDocument1 page1099-r Taxable Amount Example - Google SearchAnthony KevinNo ratings yet

- Aa Aluminum Supply Inc.Document5 pagesAa Aluminum Supply Inc.Ben Carlo RamosNo ratings yet

- 4TH QTR 2018 2307 z1 PDFDocument1 page4TH QTR 2018 2307 z1 PDFchristianNo ratings yet

- Certificate of Final Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Final Tax Withheld at Source: Kawanihan NG Rentas Internasben carlo ramos srNo ratings yet

- 968 Glass & Aluminum Co.Document10 pages968 Glass & Aluminum Co.Ben Carlo RamosNo ratings yet

- Bir 16385 16382Document1 pageBir 16385 16382Ryzen LlameNo ratings yet

- Itr-V Aaifp5094r 2009-10 97108320300909Document1 pageItr-V Aaifp5094r 2009-10 97108320300909dharmendraganatra2No ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument3 pagesCertificate of Creditable Tax Withheld at SourceAnn Gladdys QuiocoNo ratings yet

- Img 001Document1 pageImg 001Joy MadrilenoNo ratings yet

- Img 20211003 0002Document12 pagesImg 20211003 0002Civie Jomel QuidayNo ratings yet

- 2307 LessorDocument3 pages2307 LessorPaul EspinosaNo ratings yet

- All Ways Graphic and Printing PressDocument15 pagesAll Ways Graphic and Printing Pressben carlo ramos srNo ratings yet

- Aa Aluminum Supply, Inc.Document10 pagesAa Aluminum Supply, Inc.ben carlo ramos srNo ratings yet

- Bir 2306 FormDocument47 pagesBir 2306 FormTheresa Faye De GuzmanNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Marfrancisco, Pinamalayan, Oriental MindoroDocument5 pagesCertificate of Creditable Tax Withheld at Source: Marfrancisco, Pinamalayan, Oriental MindoroChristcelda lozadaNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument26 pagesCertificate of Compensation Payment/Tax WithheldLalai SaflorNo ratings yet

- State Mobile Ward Status Preparedate Email-Id: Computation Total IncomeDocument4 pagesState Mobile Ward Status Preparedate Email-Id: Computation Total IncomejayminNo ratings yet

- Deliverable Acceptance FormDocument1 pageDeliverable Acceptance FormRyan LincayNo ratings yet

- Dimensional Service Corporation 2307Document3 pagesDimensional Service Corporation 2307Randy RosasNo ratings yet

- 2306Document7 pages2306jenny silvinoNo ratings yet

- 2307 Engrs'Document112 pages2307 Engrs'Kenneth Cyrus OlivarNo ratings yet

- E FilingDocument4 pagesE FilingAvigyan BasuNo ratings yet

- Bir Form 1600 FinalDocument4 pagesBir Form 1600 Finaljhonnamaemaygue08No ratings yet

- EFPS Home - EFiling and Payment SystemDocument2 pagesEFPS Home - EFiling and Payment SystemJinkieNo ratings yet

- Bacolod Es 1600 Feb 2023 PDFDocument1 pageBacolod Es 1600 Feb 2023 PDFAnalyn DomingoNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageJanhvi SaxenaNo ratings yet

- Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document4 pagesFill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Emelyn Ventura SantosNo ratings yet

- Airfreight 2100, Inc.Document2 pagesAirfreight 2100, Inc.ben carlo ramos srNo ratings yet

- 2307 Jan 2018 ENCS v3Document2 pages2307 Jan 2018 ENCS v3Mark Patrics Comentan VerderaNo ratings yet

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document32 pagesCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Sakura AvhrynNo ratings yet

- 2307 - Rent My CarDocument10 pages2307 - Rent My CarSoeletraNo ratings yet

- Ferrer 0000 12312022Document1 pageFerrer 0000 12312022Vincent FerrerNo ratings yet

- Smart 2306Document2 pagesSmart 2306Billing ZamboecozoneNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAlvin AbilleNo ratings yet

- Ewt Form For Parts MalolosDocument5 pagesEwt Form For Parts MalolosSKYGO MALOLOSNo ratings yet

- Bir Form 2307Document8 pagesBir Form 2307Alex CalannoNo ratings yet

- Bir 2306 PLDTDocument9 pagesBir 2306 PLDTKevinjhen ManaloNo ratings yet

- Certificate of Creditable Tax Withheld at Source: San Fermin, Cauayan City, IsabelaDocument8 pagesCertificate of Creditable Tax Withheld at Source: San Fermin, Cauayan City, IsabelaRV Truck and Heavy Equipment Parts SupplyNo ratings yet

- Capital Gains Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document2 pagesCapital Gains Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"GSAFINNo ratings yet

- The level of protection provided by Chinese labour law compared to German labour lawFrom EverandThe level of protection provided by Chinese labour law compared to German labour lawNo ratings yet

- SubSonex Brochure 121614-WebDocument2 pagesSubSonex Brochure 121614-WebandriaerospaceNo ratings yet

- Module 1 - Introduction To The Hospitality IndustryDocument7 pagesModule 1 - Introduction To The Hospitality IndustryLourdes NiñoNo ratings yet

- Sysmex Report 2021: Fiscal 2020 (April 1, 2020 To March 31, 2021)Document49 pagesSysmex Report 2021: Fiscal 2020 (April 1, 2020 To March 31, 2021)郑伟健No ratings yet

- Quarter 3: Performance Test 1Document2 pagesQuarter 3: Performance Test 1CLARIBEL BUENAVENTURANo ratings yet

- EF3e Int Filetest 010a Answer SheetDocument1 pageEF3e Int Filetest 010a Answer SheetRomanNo ratings yet

- All You Need To Know About Track Visitor PermitsDocument2 pagesAll You Need To Know About Track Visitor PermitsGabriel BroascaNo ratings yet

- MR CliffordDocument9 pagesMR CliffordSalva MariaNo ratings yet

- The University of Alabama PowerpointDocument18 pagesThe University of Alabama Powerpointapi-305346442No ratings yet

- Joshi 1985Document30 pagesJoshi 1985Om ChadhaNo ratings yet

- (Asian Connections) Prasenjit Duara - The Crisis of Global Modernity - Asian Traditions and A Sustainable Future-Cambridge University Press (2015)Document339 pages(Asian Connections) Prasenjit Duara - The Crisis of Global Modernity - Asian Traditions and A Sustainable Future-Cambridge University Press (2015)MichaelCarloVillasNo ratings yet

- Class - Viii R Zoom Meeting Links 12.07.23Document1 pageClass - Viii R Zoom Meeting Links 12.07.23AK ContinentalNo ratings yet

- 21 Century Literature From The Philippines and The WorldDocument15 pages21 Century Literature From The Philippines and The WorldJill MaguddayaoNo ratings yet

- (Ang FORM Na Ito Ay LIBRE at Maaaring Kopyahin) : Republic of The Philippines 11 Judicial RegionDocument10 pages(Ang FORM Na Ito Ay LIBRE at Maaaring Kopyahin) : Republic of The Philippines 11 Judicial RegionKristoffer AsetreNo ratings yet

- Modul 1 - Let - S ExploreDocument48 pagesModul 1 - Let - S ExploreJo NienieNo ratings yet

- Code of Virginia Code - Chapter 3. Actions - See Article 7 - Motor Vehicle AccidentsDocument15 pagesCode of Virginia Code - Chapter 3. Actions - See Article 7 - Motor Vehicle AccidentsCK in DCNo ratings yet

- 10.3.11 Packet Tracer - Configure A ZPFDocument4 pages10.3.11 Packet Tracer - Configure A ZPFFerrari 5432No ratings yet

- FFFDocument12 pagesFFFever.nevadaNo ratings yet

- Yield CurveDocument9 pagesYield Curvejackie555No ratings yet

- Garza Jose Burnes ResumeDocument1 pageGarza Jose Burnes Resumeapi-306775695No ratings yet

- Nursing EntrepDocument16 pagesNursing EntrepSHEENA VASQUEZNo ratings yet

- PowerUp Prelims Test Series - Batch 8finalDocument12 pagesPowerUp Prelims Test Series - Batch 8finalmuthumaniNo ratings yet

- Oxford Excellence For Cambridge AS & A LevelDocument78 pagesOxford Excellence For Cambridge AS & A LevelRishi KumarNo ratings yet

- BFS Property Listing For Posting As of 06.09.2017-Public-Final PDFDocument28 pagesBFS Property Listing For Posting As of 06.09.2017-Public-Final PDFkerwin100% (1)

- Eage Banking Change of Address FormDocument2 pagesEage Banking Change of Address FormKushaal SainNo ratings yet

- TPM - Bill N MaggardDocument107 pagesTPM - Bill N MaggardAnghelo AlcaldeNo ratings yet