Professional Documents

Culture Documents

BAC 310 Management of Financial Institutions Past Papers 2

Uploaded by

etebark h/michale0 ratings0% found this document useful (0 votes)

34 views6 pagesmanagement-of-financial-institutions-past-papers-2 TEACHING

Original Title

BAC-310-management-of-financial-institutions-past-papers-2

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentmanagement-of-financial-institutions-past-papers-2 TEACHING

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

34 views6 pagesBAC 310 Management of Financial Institutions Past Papers 2

Uploaded by

etebark h/michalemanagement-of-financial-institutions-past-papers-2 TEACHING

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 6

$

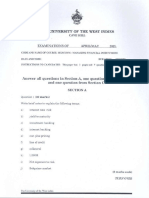

‘THE UNIVERSITY OF THE WEST INDIES

CAVE HILL

EXAMINATIONS OF APRIL/MAY 2015

CODE AND NAME OF COURSE: MGMT3076- MANAGING FINANCIAL INSTITUTIONS

DATE AND TIME: DURATION: 2 HOURS

INSTRUCTIONS TO CANDIDATES: This paper has 3 pages and 6 questions,

Answer any three (3) questions. Each is worth twenty five (25) marks.

QUESTION 4 (26 marks)

a) With the aid of a diagram, ciscuss how economic transactions between household savers of

funds and corporate users of funds would occur in a world without financial institutions, and

explain two functions performed by financiel institutions. [10]

b) Identify and discuss the five risks common to all financial institutions. (101

¢) With the aid of @ diagram, explain the loanable funds theory, and discuss how monetary

policy actions made by the central bank impacts on interest rates 15]

QUESTION 2 (25 marks)

2) Discuss the repricing model and identify the performance variable it focuses on. In addition,

prefly explain why the repricing model does not accurately measure @ financial institution's

interest rate risk exposure. 5)

) A financial institution nas an 8% bond in issue, redsemable in 5 years time at a premium of

10% (on $100 face value). Assuming that the current required interest rate is 10%,

calculate the (Macaulay) duration of the bond. (51

©) Suppose that the manager of a financial institution calculates the duration of the financial

institution's assets at 5 years and its liabilities at 3 years. Also suppose that the manager

jearns from the firm's economic forecasting unit that interest rates are expected to rise from

40 percent to 11 percent in the immediate future; that is

AR=1% = 0.01

1.10

RTO

MGMT3076 2015/1.

Th Iiniversity af the West Indies Course Code:

Page 2

Question 2 (con!

The financial institutions balance sheet is assumed to be:

ASSETS (§ millions) LIABILITIES (Smillions)

Assets = 100 Liabilities = 90

_ Equity = 10 a

700 ~ = 100 —

Required:

i, Calculate the potential loss to equity holders. 5]

ii, Prepare the market value balance sheat after the rise in rates by 1 percent [5]

iii Briefly discuss the ways in which the bank can immunize its balance sheet against

interest rate movements I

QUESTION 3 (25 marks)

a) Discuss the 5 C's of credit. (0)

b) Explain the purpose of credit scoring models and briefly discuss how these models assist

can a financial institution manager in better administering credit. 7

©) Suppose that a financial institution is considering the financial ratios of a potential client firm

These ratios are presented below:

Working capital/ total assets 0.30

Retained earnings! total assets 0,00

Earnings before interest and taxes/ total assets Xs = -0.90

Market value of equity! book value of long term debt 015

Sales/ total assets 2.10

The financial institution is considering using the Altman discriminant function shown below to

assess the creditworthiness of the potential cllent firm:

Z=12Kit 1.4K + 3.3 Xs + 0.6 Xe + 1.0 X5

Required:

Briefly discuss Altman's credit scoring model, Using the discriminant function above,

determine whether the firm should accept or reject the potential client based on estimated

default risk. 1)

27,0

‘The University of the West Indies Course Code:

|GMT3076 2015)...

Page 3

QUESTION 4 (28 marks)

a. Discuss the RAROC Model and briefly explain how this model uses the concept of duration

to measure the tisk exposure of a loan fl

b. Discuss how loan portfolio risk differs from individual loan risks, and briefly identify and

explain the benefits of loan portfolio diversification, [10]

‘Suppose that a financial institution holds two loans with the following characteristics.

Loss to Expected

FI Given Default

Default | Frequency

5.5% 2.25% | 30% 35% | 0 2=-0.18

35 1.75 20 | 10

Annual Spread

between loan rate | Annual

and Fi's Costs of | Fees

| Funds

Required:

Using Moody's Analytics Portfolio Manager, calculate the return and risk on the two-asset

portfolio. v7

QUESTION 5 (25 marks)

a, Identify the five functions of a financial institution's capital. 61

. Explain what are contagious runs, In addition, briefly discuss some of the potentially serious

adverse social welfare effects of contagious runs. Finally, explain whether all types of

financial institutions face the same risk of contagious runs. [10]

¢, Discuss the moral hazard problem. Briefly explain how deposit insurance programmes

contribute to this problem, and identify and explain three ways a deposit insurance contrect

could be structured to reduce moral hazerd. [10]

QUESTION 6 (25 marks)

a, Discuss the Basel Agreement. (101

», Identify and explain the major features of the Basel lll capital requirements. Explain the

process of caiculating credit risk-adjusted on-balance sheet assets. [8]

Explain what are derivative contracts, and identify their value to managers of financial

institutions 7

END OF QUESTION PAPER

The University ofthe West Indies Course Code: MGMT3076 2018). /

Present Value Table

Praesent value of 1 ie. (L +1)"

Where discount rate

umber of periods until payrnert

Discount rate

Periods

to % 2% 9% ARKH TH BRK 10%

1 9990 O:980 0971 0962 O952 0943 0935 O92 O17 O99 1

2 0980 0961 0943 0925 O907 0890 O873 0857 O82 0826 2

3 O97] G92 0915 0889 OaGs OBO O816 O794 0772 O75 3

4 0961 0924 O888 0855 0823 0792 0763 0735 O708 0683 4

5 0951 0-906 0863 0822 O784 O747 O713 O681 0680 OE 5

6 0942 0888 0837 0790 746 0705 O66 0630 0596 O56 6

7 0933 0871 0813 0760 O71 0665 0623 0583 O517 O51 7

# 0923 0-853 0789 0731 0677 0627 0582 O50 0802 O467 8

3 0941 0-837 0-765 0703 0-545 0592 O84 0800 Oued 0424 9

10 0905 0820 O74 0676 O51 0558 O508 0463 0422 O386 10

ll 0896 G-8O4 «0.722 «0650 0585 0527 O75 0429 O88 0305

12 0887 0-783 OFOl 0625 O557 0497 Odd 0.397 0.356 O319 12

13 0879 0-773 OGBl 0601 0530 0489 O415 0368 0325 0290 13

14-0870 0.758 0661 0577 0505 O4s2 O88 OBO 0299 0263 14

15 OBE1 «0-743 «GAZ «(555 «OMBL «417 «0962 0-315 0275 0239 «15

() 1%: CHK SH LTR BK 1H 2K

1 0901 0-893 0885 0877 0870 0852 C855 O87 OBO 0833 1

2 0812 0797 O78 0769 O756 O743 0731 O718 0705 O84 2

3 0731 0712 0693 0675 O68 0-611 OS2t 0609 0599 0579 3

4 0659 0635 0613 0592 0572 0552 O53L 0516 0499 O48 4

5 0593 0667 0543 0519 0497 0.476 456 0437 O419 0402 5

6 0535 0-507 0480 0.456 0432 0410 030 0370 0352 0335 6

7 0482 0452 0425 0400 0376 0354 0333 0314 0295 0279 7

4 0434 O-dOd 0976 O51 0327 0305 0285 0256 0249 0233 8

9 0891 0-961 0333 O30R 0284 0263 0243 0225 0209 0194 9

1D 0852 0-822-295-0270 0247 0227 208 O191 O176 O152 10

1 OBI7 «0-287 0261 0237 «0215 «0195 0178 0162 148 0135 1D

12 0286 0-257 0231 0208 O187 0168 O152 0137 O12 O12 12

13° 0288 (0-229 0204 0182 0163 0145 0130 0116 0104 0093 13

140232 0205 0181 0160 Oldl 0125 O11] 0099 0083 0078 14

15 0209 0183 0160 0140 0123 D108 0095 0084 0074 0055 15

Present value of an annuity of 1

Where f = discount rate

nh = number of periods

‘Discount rate (1)

Periods

1% BK TMB OM 10.

1 0990 9989 0971 0962 0952 0942 0935 0.026 0917 O90 1

2 170 1942 1913 1996 1969 1993 1808 1783 1789 1735 2

3 2941 2884 2820 2775 2723 2673 262 2577 2531 2487 3

4 3902 3808 3717 3630 3546 3465 3387 2212 3240 3170 4

5 4852 4713 4580 4052 4929 4212 4200 3093 3800 3701 5

5 5795 5601 5417 5242 S076 4917 ATT 4623 4aBG 4955

7 6728 6472 62% 6002 5785 S82 5389 5206 5033 4868 7

3 74652 7325 7.020 6733 E463 6210 5971 S747 5535 5335 8

5 BEGG R162 7786 7435 7108 6802 6515 6247 5995 5759 9

10 «G71 8983-8580 BIll «7722 «7-360 7024 6710 G4lB 6145 10

lL 10-37-9787 «9-253 B7ED «8306 7-887 7499 7139 G85 6495 11

12 1126 «1088 9054 9985 8863 BB4 7943 7-536 7:16) GEld 12

12° 1213 «219510639986 «9394 Babs 8359 7.904 74BT 7103 13

14 1300«-1211,«1180 «10-85 899 «9-295 B75 BRA 7 7BG 7357 14

15 «1387 1285 «1194 1112 1038 «9-712 «910d «8559 BOG] 7606 «15

(m) 11% 1H HTH 1K 20%

1 090] 0803 O€85 0877 O870 0862 OBS O47 OBO C833 1

2 1713 69D 1668 1647 1626 1605 «1885 LE66 TM? 15% 2

3 Bade 2402-2361 2922-2283 -2ME 2210 2178 2140 2106 3

4 3102 9037 2974 2914 2855 2798 2743 2690 2639 2588 4

5 «3696 3605 3517 3433 3352 3274 3199 3127 3058 2991 5

5 4231 4211 3998 3889 3784 3685 3589 3498 S410 296 6

7 @712 4564 4423 4285 4160 4039 9922 3812 3705 2605 7

8 514s 4968 TSE «4639 HBT ABA 2074073954 SRF 8

3 5537 $328 §192 4945 4772 4607 4451 4903 4163 4031 9

10 5BB9 5H5D 5426 S216 5019 4893 4659 A4ad 4399 4192 10

ll 6207 5938 5687 S453 S234 5029 4835 465E Aug5 4927 11

12 6492 6194 «5918 SGE0 F421 B107 4.088 4.793 4611 4430 12

12 G750 6424 6122 5842 58583 5342 S118 A010 A715 4533 13

14-6982 6628 6-902 6002 «S72 «SMeg «8279 «500 «ARO? L611 = 14

157101 GBl1 6452 G:1d2 BAT SS7S 5.42 8002 A875 4675 15

Duration Model

x N

Sch xDEXt SPV, xt

i -5

D=

x DF, xPv,

med

AE = -ID, - D,kixax®

TeR

Modern Portfolio Theory

Wie = Py wae,

al jal

LUX X 010)

Fl fl

Moody's Analytics (KMV) Portfolio Manager Model

R; = Als, - E(L)) = AlS|- [EDF, « LGD]

G, = UL;= op * LGD, = [EDF,(1-EDF}]* x LGD,

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Credit AnalysisDocument15 pagesCredit Analysisetebark h/michale100% (1)

- Auditing Model ExamDocument33 pagesAuditing Model Exametebark h/michaleNo ratings yet

- Determinants of Micro and Small Enterprises Growth in Ethiopia PDFDocument14 pagesDeterminants of Micro and Small Enterprises Growth in Ethiopia PDFetebark h/michaleNo ratings yet

- CCB StratPlanDocument37 pagesCCB StratPlanMary Grace Siducon PenalesNo ratings yet

- 1 Strategic PlanDocument49 pages1 Strategic Planetebark h/michaleNo ratings yet

- Fintech Business and Paymentsstrategy PDFDocument30 pagesFintech Business and Paymentsstrategy PDFetebark h/michaleNo ratings yet

- RFQ Services 031Document4 pagesRFQ Services 031etebark h/michaleNo ratings yet

- Best Micro Small and Medium Enterprises Accessto Finance Constraintsin Ethiopia DemandSide AnalysisDocument15 pagesBest Micro Small and Medium Enterprises Accessto Finance Constraintsin Ethiopia DemandSide Analysisetebark h/michaleNo ratings yet

- Supply Chain Financing Adoption ServyDocument23 pagesSupply Chain Financing Adoption Servyetebark h/michaleNo ratings yet

- Dilla University College of Business & Economics: Organizational BehaviourDocument228 pagesDilla University College of Business & Economics: Organizational Behaviouretebark h/michaleNo ratings yet

- A Complete Guide To Business LoansDocument15 pagesA Complete Guide To Business Loansetebark h/michaleNo ratings yet

- BAC 310 Management of Financial Institutions Past Papers 9Document4 pagesBAC 310 Management of Financial Institutions Past Papers 9etebark h/michaleNo ratings yet

- BookChapterSupplyChainFinance May2022Document9 pagesBookChapterSupplyChainFinance May2022etebark h/michaleNo ratings yet

- Ethiopia SMEs Close Market HelloopayDocument10 pagesEthiopia SMEs Close Market Helloopayetebark h/michaleNo ratings yet

- SCF Knowledge Guide FinalDocument85 pagesSCF Knowledge Guide Finaletebark h/michaleNo ratings yet

- Chapter 2Document114 pagesChapter 2etebark h/michaleNo ratings yet

- Assignment For Weekend and NightDocument1 pageAssignment For Weekend and Nightetebark h/michaleNo ratings yet

- Econometrics AssignmentDocument2 pagesEconometrics Assignmentetebark h/michaleNo ratings yet

- BAC 310 Management of Financial Institutions Past Papers 7Document3 pagesBAC 310 Management of Financial Institutions Past Papers 7etebark h/michaleNo ratings yet

- Chapter 1Document71 pagesChapter 1etebark h/michaleNo ratings yet

- HRM HandoutDocument98 pagesHRM Handoutetebark h/michaleNo ratings yet

- Human Resource ManagementDocument87 pagesHuman Resource Managementetebark h/michaleNo ratings yet

- BAC 310 Management of Financial Institutions Past Papers 3Document6 pagesBAC 310 Management of Financial Institutions Past Papers 3etebark h/michaleNo ratings yet

- Abcd MasterRealtorPresentation4Document75 pagesAbcd MasterRealtorPresentation4etebark h/michaleNo ratings yet

- Anderson MOU Between VACO Office and Local VA FacilitesDocument34 pagesAnderson MOU Between VACO Office and Local VA Facilitesetebark h/michaleNo ratings yet

- Econometrics For ManagementDocument53 pagesEconometrics For Managementetebark h/michaleNo ratings yet

- Growing TogetherDocument43 pagesGrowing Togetheretebark h/michaleNo ratings yet

- UNIT - 4 CAPITALs - TreDocument20 pagesUNIT - 4 CAPITALs - Treetebark h/michaleNo ratings yet

- Mid Exam Business CommunicationDocument2 pagesMid Exam Business Communicationetebark h/michaleNo ratings yet

- Lending DIBI Mw09Document22 pagesLending DIBI Mw09etebark h/michaleNo ratings yet