Professional Documents

Culture Documents

BAC 310 Management of Financial Institutions Past Papers 3

Uploaded by

etebark h/michale0 ratings0% found this document useful (0 votes)

11 views6 pagesLecture note on management-of-financial-institutions-past-papers-2

Original Title

BAC-310-management-of-financial-institutions-past-papers-3

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLecture note on management-of-financial-institutions-past-papers-2

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views6 pagesBAC 310 Management of Financial Institutions Past Papers 3

Uploaded by

etebark h/michaleLecture note on management-of-financial-institutions-past-papers-2

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 6

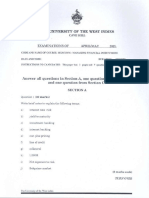

THE UNIVERSITY OF THE WEST INDIES

CAVE HILL

EXAMINATIONS OF APRIL/MAY 201.

CODE AND NAME OF COURSE: MGMT3076 - MANAGING FINANCIAL INSTITUTIONS,

DATE AND TIME: DURATION: 2 HOURS

INSTRUCTIONS TO CANDIDATES: ‘This paper has 5 pages and € questions.

Answer ALL questions in Section A, one (1) question from Section B and one (1)

question from Section C

Section A

Question 1 (30 marks)

Write brief notes to explain five of the following terms associated with financial institutions

() CAMELS

(ii) Commercial banks

(iil) Fee based services

(iv) CFATF

(x) Regional Government Securities Market

(vi) Mutual funds

(vii) “politically exposed persons” (PEPS)

(viii) E-banking

(x) Nominal interest rate

(x) Asset Liability Management

TURN OVER

Indies

Page 2

Section B

Answer one (1) question from this section,

Question 2. (20 marks)

a)

(i) Fxplain the term “collateral” as it relates to loans. (2 marks)

(ii) Give 3 examples of assets which are acceptable as collateral. (3 marks)

(iii) Tdentify 2 items which are not suitable to be used as collateral and explain

why. (3 marks)

Donald Burnett has recently completed a degree in Hospitality Studies at the

Barbados Community College. He decided to join with his girlfriend Sylvia Arthur

who graduated a few years ago from UWI, Cave Hill with a degree in Accounting,

to opena Vegetarian Restaurant ina busy hotel area on the south coast of Barbados.

Sylvia has been working since graduation with a leading accounting firm. Donald

‘hopes to rent a building, buthe intends to buy all the equipment. It is estimated to

cost $100,000Bds . He is seeking a Joan for $90,000 as Sylvia's savings only amount

to $10,000; he has nothing to put except his expertise. Take the role of the loan

officer at The Baptist Credit Union to which he has applied for a loan. Sylvia has

saved her money with this credit union.

List six questions that you would ask Donald and Sylvia about the proposed

restaurant in order to reach a decision about granting them the loan. Explain why

each one is important. (12 marks)

Question 3 (20 marks)

3)

%)

‘What does the acronym PEARLS mean in relation to credit unions? (5 marks)

Access the performance of City of Bridgetown Credit Union as at 31 December,

2011, using five () of the usual benchmarks for Credit Unions set by the World

Council of Credit Unions (WCCU).

TURN OVER

.e University of the West Indies Course Cod MGMT3076 2013

Page3

City of Bridgetown Co-operative Credit Union Limited

Consolidated Statement of Financial Position

As of 31 March 2011

(expressed in Barbaclos dollars)

Restated

Notes 2011 2010

Assets

Cash and cash equivalents 5 $10,214,359 $ 19,027,366

‘Accounts receivable and prepaid expanses 9 697,472 624,212

Deferred charges 65,206 49,913

Interest due and acerued 1127540 1,440,523

Investments 7 23,538,346 16,553,875

Investiment in associated company 6 1,552,018 1,345,797

Loans to members 8 260,898,573 244,746,209

Property, plant and equipment 10 11,883,367 12,530,224

Investment property u 7,300,000 7,300,000

Development land for resale 12 2.895.644 —_2,268,890

1$320,172,525 $305,887,009

Liabilities

‘Accounts payable and accrued expenses 4S 1411339 8 2,482,222

Interest payable 364,107 479,060

‘Members’ deposits 13 200,218,035 184,033,941

Loan payable 15 6271,778 6,244,445

Liabilities qualifying as regulatory capital 16 7,125,303 __19,923,535

285,596,562 _ 273,863,203,

Members’ equity

‘Stabstory reserve w 18,386,443 16,866,530

Special funds 18 7,908,440 7,879,058

‘Savings and loans benefit fund 19 647,039 532,086

Fair value reserves 490,087 (201,386)

Undivided surplus 7,143,952 _6.947,518

34,575,963 32,023,806

$32,172,525 $205,887.09

The accompanying notes form an integral part of these consolidated financial statements

? President Ay: fle. Secretary

‘Adlai Stevenson,

TURN OVER

The University of the West Indies

MGMT3076 2013.

Page 4

City of Bridgetown Co-operative Credit Union Limited

Consolidated Statement of Comprehensive Income

Year ended 31 March 2011

(expressed in Barbados dollars)

Restated

Notes 2011 2010

Interest income (expenses)

Interest on loans $21,194,254 $21,561,238

Interest expense ~ member doposits (6533413) (6,561,320)

Interest expense —loan payable 15 (365.185) (401.852)

14,295,655 14,598,056

Other income

Fair value gain on investment property u - 5,646,275

Investment income 996,239 1,469,133

Rent 334,101 336,258

Income from direct services 963,962 1,187,061

Gain on disposal of plant and equipment 31,504 8

Commissions 34,110 20,682

2.350.916 _8,629.452

Net interest and other income 16,655,572 23,227,518

Expenditure

Operating expenses (per schedule) 11,259,019 11,693,135

Provision for impaired loans 8 "700,000 3,753,000

Savings and Joan protection 9 360,000 360.000

Impairment loss on available-for-sele investment 277,778 :

‘Loan Joss recovery expenses 31,804 1,216

‘Affiliation dues 75,000 _75,000

‘Total expenditure 12,703,601 15,882,351

Net surplus before the following items 3.951.971 7,345,167

Equity share of associated company's profits 6 290978 = __330.979

Net surplus before distributions 4.241.949 7,676,146

Distributions 20 1,977,090) _(3.243,241)

Net surplus 2,268,899 4,432,905

Other comprehensive income

— 120.530 (249.246)

Total comprehensive surplus S_2685.382 $4,183,559

The accompanying notes form an integral part of these consolidated financial statements

(Change in fair velue of available-for-sale investments

The University of the West Indies Course Code: MGMT3076

Page 5

Section C

Answer one (1) question from this section,

Question 4 (20 marks)

a) Discuss the requirements of financial institutions to be ableto be in compliance with

KYC (Know Your Customer) regulations for businesses. (12 marks)

b) _ Explain the risks associated with e-business from a banking perspective.

(8 marks)

Question 5 (20 marks)

Discuss the issues that are taken into consideration when assessing the solvency of

insurance companies. (10 marks)

>) Explain the change in Capital Adequacy requirements for financial institutions

between Basel I, Il and IT. (10 marks)

Question 6 (20 marks)

“ATCA isan important landmark in establishing a common intergovernment approach

to combating tax evasion” Dr Trevor Carmichael (IBES December 2012 Newsletter)

Discuss the impending challenges and opportunities of the FATCA for commercial banks

in the Caribbean region. (20 marks)

END OF QUESTION PAPER

‘The University of the West Indies Course Cade: MGMT3075 2013...

Page

Section C

Answer one (1) question from this section.

Question 4 (20 marks)

a) Discuss therequirements of financial institutions to be ableto be in compliance with

KYC (Know Your Customer) regulations for businesses. (12 marks)

b) Explain the risks associated with e-business from a banking perspective

(6 marks)

Question 5 (20 marks)

a) Discuss the issues that are taken into consideration when assessing the solvency of

insurance companies. (10 marks)

6) Explain the change in Capital Adequacy requirements for financial institutions

between Basel L, II and III. (10 marks)

Question 6 (20 marks)

“TCA is an important landmark in establishing a conunon intergovernment approach

to combating tax evasion” Dy Trevor Carmichael (BFS December 2012 Newsletter)

Discuss the impending challenges and opportunities of the FATCA for commercial banks

in the Caribbean region, (20 marks)

END OF QUESTION PAPER

‘The University of the West Indies Course Code: MGMT3076 2013)...

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Auditing Model ExamDocument33 pagesAuditing Model Exametebark h/michaleNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Determinants of Micro and Small Enterprises Growth in Ethiopia PDFDocument14 pagesDeterminants of Micro and Small Enterprises Growth in Ethiopia PDFetebark h/michaleNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- CCB StratPlanDocument37 pagesCCB StratPlanMary Grace Siducon PenalesNo ratings yet

- 1 Strategic PlanDocument49 pages1 Strategic Planetebark h/michaleNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Fintech Business and Paymentsstrategy PDFDocument30 pagesFintech Business and Paymentsstrategy PDFetebark h/michaleNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- RFQ Services 031Document4 pagesRFQ Services 031etebark h/michaleNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Best Micro Small and Medium Enterprises Accessto Finance Constraintsin Ethiopia DemandSide AnalysisDocument15 pagesBest Micro Small and Medium Enterprises Accessto Finance Constraintsin Ethiopia DemandSide Analysisetebark h/michaleNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Supply Chain Financing Adoption ServyDocument23 pagesSupply Chain Financing Adoption Servyetebark h/michaleNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Dilla University College of Business & Economics: Organizational BehaviourDocument228 pagesDilla University College of Business & Economics: Organizational Behaviouretebark h/michaleNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Complete Guide To Business LoansDocument15 pagesA Complete Guide To Business Loansetebark h/michaleNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- BAC 310 Management of Financial Institutions Past Papers 9Document4 pagesBAC 310 Management of Financial Institutions Past Papers 9etebark h/michaleNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- BookChapterSupplyChainFinance May2022Document9 pagesBookChapterSupplyChainFinance May2022etebark h/michaleNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Ethiopia SMEs Close Market HelloopayDocument10 pagesEthiopia SMEs Close Market Helloopayetebark h/michaleNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- SCF Knowledge Guide FinalDocument85 pagesSCF Knowledge Guide Finaletebark h/michaleNo ratings yet

- Chapter 2Document114 pagesChapter 2etebark h/michaleNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Assignment For Weekend and NightDocument1 pageAssignment For Weekend and Nightetebark h/michaleNo ratings yet

- Econometrics AssignmentDocument2 pagesEconometrics Assignmentetebark h/michaleNo ratings yet

- BAC 310 Management of Financial Institutions Past Papers 7Document3 pagesBAC 310 Management of Financial Institutions Past Papers 7etebark h/michaleNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Chapter 1Document71 pagesChapter 1etebark h/michaleNo ratings yet

- HRM HandoutDocument98 pagesHRM Handoutetebark h/michaleNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Human Resource ManagementDocument87 pagesHuman Resource Managementetebark h/michaleNo ratings yet

- BAC 310 Management of Financial Institutions Past Papers 2Document6 pagesBAC 310 Management of Financial Institutions Past Papers 2etebark h/michaleNo ratings yet

- Abcd MasterRealtorPresentation4Document75 pagesAbcd MasterRealtorPresentation4etebark h/michaleNo ratings yet

- Anderson MOU Between VACO Office and Local VA FacilitesDocument34 pagesAnderson MOU Between VACO Office and Local VA Facilitesetebark h/michaleNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Econometrics For ManagementDocument53 pagesEconometrics For Managementetebark h/michaleNo ratings yet

- Growing TogetherDocument43 pagesGrowing Togetheretebark h/michaleNo ratings yet

- UNIT - 4 CAPITALs - TreDocument20 pagesUNIT - 4 CAPITALs - Treetebark h/michaleNo ratings yet

- Mid Exam Business CommunicationDocument2 pagesMid Exam Business Communicationetebark h/michaleNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Lending DIBI Mw09Document22 pagesLending DIBI Mw09etebark h/michaleNo ratings yet

- Credit AnalysisDocument15 pagesCredit Analysisetebark h/michale100% (1)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)