Professional Documents

Culture Documents

Audit Cycle

Uploaded by

joseph90865Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit Cycle

Uploaded by

joseph90865Copyright:

Available Formats

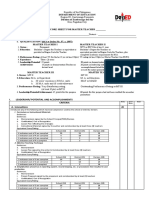

Pre-Engagement Planning (PSAs 200)

1. PSA 200 Overall Objectives of the Independent Auditor and the Conduct of an Audit in

Accordance with International Standards in Auditing.

2. PSA 210 Agreeing the Terms of Audit Engagements

3. PSA 220 Quality Control for Audits of Historical Financial Statements

4. PSA 230 Audit Documentation

5. PSA 240 The Auditor’s Responsibility to Consider Fraud in Audit of Financial Statements.

6. PSA 250 Consideration of Laws and Regulations in an Audit of Financial Statements

7. PSA 260 Communication with Those Charged with Governance

8. PSA 265 Communicating Deficiencies in Internal Control to Those Charged with

Governance Management

Engagement Planning (PSAs 300/400)

1. PSA 300 Planning an Audit of Financial Statements

2. PSA 315 Identifying and Assessing the Risks of Material Misstatement through

Understanding the Entity and Its Environment

3. PSA 320 Materiality in Planning and Performing an Audit

4. PSA 330 The Auditor’s Responses to Assessed Risks

5. PSA 402 Audit Considerations Relating to Entities using Service Organizations

Fieldwork (PSAs 500/600)

1. PSA 500 Audit Evidence

2. PSA 501 Audit Evidence – Additional Considerations on Specific Items

3. PSA 505 External Confirmations

4. PSA 510 Initial Audit Engagements-Opening Balances

5. PSA 520 Analytical Procedures

6. PSA 530 Audit Sampling

7. PSA 540 Auditing Accounting Estimates, Including Fair Value Accounting estimates, and

Related Disclosures

8. PSA 550 Related Parties

9. PSA 560 Subsequent Events

10. PSA 570 Going Concern

11. PSA 580 Written Representations

12. PSA 600 Special Considerations – Audits of Group Financial Statements (Including the

work of Component Auditors)

13. PSA 610 Using the Work of an Internal Auditors

14. PSA 620 Using the Work of an Expert

Reporting (PSAs 700/800)

1. PSA 700 The Independent Auditor’s Report on a Complete Set of General-Purpose

Financial Statements

2. PSA 705 Modifications to Opinion in the Independent Auditor’s Report

3. PSA 706 Emphasis of Matter Paragraphs and Other Matter Paragraphs in the

Independent Auditor’s Report

4. PSA 710 Comparative Information – Corresponding Figures and Comparative Financial

Statements

5. PSA 720 The Auditor’s Responsibility Relating to Other Information in Documents

Containing Audited Financial Statements

6. PSA 800 Special Considerations – Audits of Financial Statements Prepared in Accordance

with Special Purpose Frameworks

7. PSA 805 Special Considerations – Audits of Single Financial Statements and Specific

Elements, Accounts of Items of a Financial Statement

8. PSA 810 Engagements to Report on Summary Financial Statements

You might also like

- 21 Day Level Up Challenge My PathDocument52 pages21 Day Level Up Challenge My PathDavid Stark100% (1)

- ACT 141-Module 2-Auditing Standards and RA 9298Document53 pagesACT 141-Module 2-Auditing Standards and RA 9298Jade Angelie FloresNo ratings yet

- 2007 AP Statistics Multiple Choice ExamDocument17 pages2007 AP Statistics Multiple Choice ExamJalaj SoodNo ratings yet

- Introduction To Nervous SystemDocument4 pagesIntroduction To Nervous SystemErnie G. Bautista II, RN, MD100% (1)

- Questions Related To CodesDocument10 pagesQuestions Related To CodesMayur Mandrekar100% (1)

- Philippine Standards On Auditing (Psas)Document2 pagesPhilippine Standards On Auditing (Psas)Levi Emmanuel Veloso BravoNo ratings yet

- Patrick Califia Speaking Sex To Power Perverts Freethinkers and The Politics of Sex The Politics of Pleasure and PerversityDocument443 pagesPatrick Califia Speaking Sex To Power Perverts Freethinkers and The Politics of Sex The Politics of Pleasure and PerversityStefanos PopofNo ratings yet

- Information Systems Auditing: The IS Audit Reporting ProcessFrom EverandInformation Systems Auditing: The IS Audit Reporting ProcessRating: 4.5 out of 5 stars4.5/5 (3)

- Standards On Auditing Handwritten NotesDocument90 pagesStandards On Auditing Handwritten Notesneeraj sharmaNo ratings yet

- Scaffolding-Fixed and Mobile: Safety Operating ProceduresDocument1 pageScaffolding-Fixed and Mobile: Safety Operating Proceduresmohammed muzammilNo ratings yet

- Internal Auditing - PSA SummaryDocument42 pagesInternal Auditing - PSA Summaryjinkyjoyamorin100% (1)

- Philippine Standards On AuditingDocument11 pagesPhilippine Standards On AuditingNe Bz100% (1)

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- 004 Torillo v. LeogardoDocument2 pages004 Torillo v. LeogardoylessinNo ratings yet

- Interpretation and Application of International Standards on AuditingFrom EverandInterpretation and Application of International Standards on AuditingNo ratings yet

- Psa 200 PDFDocument7 pagesPsa 200 PDFDanzen Bueno ImusNo ratings yet

- Chapter 8 Sensation and PerceptionDocument66 pagesChapter 8 Sensation and Perceptionapi-726122866No ratings yet

- I. Leadership/ Potential and Accomplishments Criteria A. InnovationsDocument5 pagesI. Leadership/ Potential and Accomplishments Criteria A. InnovationsDEXTER LLOYD CATIAG100% (1)

- Zurita - Summary Table For PSAsDocument2 pagesZurita - Summary Table For PSAsNove Jane ZuritaNo ratings yet

- 2009 List of Audit StandardsDocument1 page2009 List of Audit Standardszoe regina castroNo ratings yet

- International Standard of AuditingDocument4 pagesInternational Standard of AuditingSuvro AvroNo ratings yet

- PSADocument4 pagesPSAAllyssa Mae DelaRosa UchihaNo ratings yet

- PSA ListDocument1 pagePSA ListVia Montante100% (1)

- Audit (ISA)Document1 pageAudit (ISA)Wirdha Annisa HasibuanNo ratings yet

- Audit Misc. MidtermsDocument2 pagesAudit Misc. MidtermsHyacinth FNo ratings yet

- Philippine Standards On AuditingDocument2 pagesPhilippine Standards On Auditingsarahjanecaballero02No ratings yet

- Bos 62008Document2 pagesBos 62008daamansuneja2No ratings yet

- AICPA - Develops Standards For Audits ofDocument3 pagesAICPA - Develops Standards For Audits ofAngela PaduaNo ratings yet

- List of IsaDocument4 pagesList of IsaangelNo ratings yet

- International Standards On AuditingDocument3 pagesInternational Standards On AuditingLarasati FarumiNo ratings yet

- Current ISAS and Other Standards: Number TitleDocument2 pagesCurrent ISAS and Other Standards: Number TitleRamsha ZahidNo ratings yet

- Auditing Standards, Statements and Guidance Notes - An OverviewDocument64 pagesAuditing Standards, Statements and Guidance Notes - An OverviewPraneethNo ratings yet

- Audit Theory PSADocument87 pagesAudit Theory PSAlongixNo ratings yet

- Lecture 4-5-240 - Fraud - Compatibility ModeDocument35 pagesLecture 4-5-240 - Fraud - Compatibility ModeSourav MahadiNo ratings yet

- List of Standards AudTHEDocument2 pagesList of Standards AudTHEJehannah BaratNo ratings yet

- Audit PMDocument93 pagesAudit PMAYUSHNo ratings yet

- CAF Audit Section Wise WeightageDocument8 pagesCAF Audit Section Wise WeightageNaresh KumarNo ratings yet

- Auditing Standards, Statements and Guidance Notes - An OverviewDocument54 pagesAuditing Standards, Statements and Guidance Notes - An OverviewManish JindalNo ratings yet

- Standards Full by Prof. Khushboo SanghaviDocument76 pagesStandards Full by Prof. Khushboo Sanghavivishnuverma100% (4)

- Philippine School of Business Administration: Auditing Theory Checklist (May, 2021 CPA Exam) TitleDocument3 pagesPhilippine School of Business Administration: Auditing Theory Checklist (May, 2021 CPA Exam) TitleAbdulmajed Unda MimbantasNo ratings yet

- Summary of StandardsDocument3 pagesSummary of StandardsYumi KumikoNo ratings yet

- Bangladesh Standards On AuditingDocument2 pagesBangladesh Standards On AuditingWan Nie50% (6)

- Psa Updates: The New Auditing StandardsDocument16 pagesPsa Updates: The New Auditing StandardsMae AstovezaNo ratings yet

- All ISADocument30 pagesAll ISANTurin1435No ratings yet

- New AARSDocument520 pagesNew AARSRohab MuhammadNo ratings yet

- ggPSA 700 (Rev.)Document101 pagesggPSA 700 (Rev.)Angel TumamaoNo ratings yet

- Homework 4Document3 pagesHomework 4Sokha ThornNo ratings yet

- PsaDocument2 pagesPsaMarikh RianoNo ratings yet

- November 2018 Final ExaminationDocument13 pagesNovember 2018 Final Examinationcherry008No ratings yet

- Day 1 Audit Report (Day 1)Document31 pagesDay 1 Audit Report (Day 1)Farman Shaikh100% (1)

- ABSTRACTDocument7 pagesABSTRACTСалтанат МакажановаNo ratings yet

- F8-P7 Examinable Standards For 2016-17 Updated PDFDocument3 pagesF8-P7 Examinable Standards For 2016-17 Updated PDFCool Rapper100% (1)

- Nama: Hestina Dwi Sari Rumahorbo NIM: 2014017067 Kelas: 4A3 (Akuntansi)Document14 pagesNama: Hestina Dwi Sari Rumahorbo NIM: 2014017067 Kelas: 4A3 (Akuntansi)Ato SumartoNo ratings yet

- List of Auditing and Assurance Standards: Old Aas No New Sa Title of Standard On AuditingDocument4 pagesList of Auditing and Assurance Standards: Old Aas No New Sa Title of Standard On AuditingVivek SharmaNo ratings yet

- PSQCS, Framework, Psas, Papss, Psres, Psaes, PsrssDocument3 pagesPSQCS, Framework, Psas, Papss, Psres, Psaes, PsrssELAIZA BASHNo ratings yet

- Standards B: Forming An Opinion and Reporting On Financial StatementsDocument35 pagesStandards B: Forming An Opinion and Reporting On Financial StatementsnikNo ratings yet

- New and Revised Sri Lanka Auditing StandardsDocument4 pagesNew and Revised Sri Lanka Auditing Standardsmayuran910100% (1)

- Syllabus - AuditingDocument4 pagesSyllabus - Auditingrandyblanza2014No ratings yet

- Aaa Acca Study Hub PDFDocument393 pagesAaa Acca Study Hub PDFKevinNo ratings yet

- 12 Handout 1Document6 pages12 Handout 1Jamealla SabasNo ratings yet

- (Effective October 2006 Examination) : The Cpa Licensure Examination Syllabus - Auditing TheoryDocument7 pages(Effective October 2006 Examination) : The Cpa Licensure Examination Syllabus - Auditing TheoryJanine Bernadette C. Bautista3180270No ratings yet

- Standards On Auditing Checklist SWDocument144 pagesStandards On Auditing Checklist SWNeville BuhariwallaNo ratings yet

- Auditing Theory SkeletonDocument6 pagesAuditing Theory SkeletonMaricar PinedaNo ratings yet

- PSA 805 Revised and RedraftedDocument21 pagesPSA 805 Revised and RedraftedShairamae CerdeñaNo ratings yet

- Exposure Draft: Proposed Statement On Auditing StandardsDocument40 pagesExposure Draft: Proposed Statement On Auditing StandardspatriciaNo ratings yet

- Codification of Statements on Auditing Standards: Numbers 122 to 133, January 2018From EverandCodification of Statements on Auditing Standards: Numbers 122 to 133, January 2018No ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Risk Assessment MCQ WithoutDocument5 pagesRisk Assessment MCQ WithoutJomar Carlo CasupangNo ratings yet

- QUIZ RISK MATERIALITY WithoutDocument3 pagesQUIZ RISK MATERIALITY Withoutjoseph90865No ratings yet

- Simplex Max Samples in ExcelDocument2 pagesSimplex Max Samples in Exceljoseph90865No ratings yet

- Simplex MinimizationDocument5 pagesSimplex Minimizationjoseph90865No ratings yet

- AP 001 A.2 Proof of Cash Prob 2Document1 pageAP 001 A.2 Proof of Cash Prob 2joseph90865No ratings yet

- Engagement ServicesDocument3 pagesEngagement Servicesjoseph90865No ratings yet

- Lecture 4 Psa 315Document1 pageLecture 4 Psa 315joseph90865No ratings yet

- BMC 301 ReflectionDocument1 pageBMC 301 Reflectionjoseph90865No ratings yet

- Engagement ServicesDocument3 pagesEngagement Servicesjoseph90865No ratings yet

- AP 001 A.1 Bank Reconciliation Prob 1Document2 pagesAP 001 A.1 Bank Reconciliation Prob 1Loid Gumera LenchicoNo ratings yet

- Capital Structure and Leverage ExercisesDocument2 pagesCapital Structure and Leverage Exercisesjoseph90865No ratings yet

- 1-1FlowCharts For HaccpDocument3 pages1-1FlowCharts For HaccpPeter George0% (1)

- Important Topics RTCDocument18 pagesImportant Topics RTCjoydeep12No ratings yet

- Material Science & Metallurgy: Third Semester B.E. Degree (CBCS) Examination, Dec.2016/Jan.2017Document2 pagesMaterial Science & Metallurgy: Third Semester B.E. Degree (CBCS) Examination, Dec.2016/Jan.2017Shaikh MuzaffarNo ratings yet

- Diesel Generator 350-To-500-Kw-Specs-SheetDocument9 pagesDiesel Generator 350-To-500-Kw-Specs-SheetamrNo ratings yet

- Mount Kenya University: Department: School of Social SciencesDocument4 pagesMount Kenya University: Department: School of Social SciencesLETISIA FATUMANo ratings yet

- Tolerance Chart: (Maximum Permissible Error)Document3 pagesTolerance Chart: (Maximum Permissible Error)arif_setyaw4nNo ratings yet

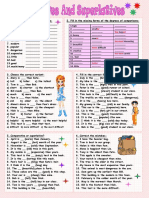

- Comparatives and SuperlativesDocument2 pagesComparatives and Superlativesjcarlosgf60% (5)

- Sex Education in The PhilippinesDocument3 pagesSex Education in The PhilippinesChinchin CañeteNo ratings yet

- Selection and Ranking of Rail Vehicle Components For Optimal Lightweighting Using Composite MaterialsDocument14 pagesSelection and Ranking of Rail Vehicle Components For Optimal Lightweighting Using Composite MaterialsAwan AJaNo ratings yet

- Ra Radtech Cdo July2018Document4 pagesRa Radtech Cdo July2018Angelo MercedeNo ratings yet

- Desalting Opportunity CrudesDocument8 pagesDesalting Opportunity CrudesTheophile MegueptchieNo ratings yet

- SCOPE OF PRACTICE FOR TCAM PRACTITONERS - V - 01Document22 pagesSCOPE OF PRACTICE FOR TCAM PRACTITONERS - V - 01shakkiryousufNo ratings yet

- Manualevu VheDocument60 pagesManualevu VheThariqNo ratings yet

- 17.8 Inheritance IGCSE CIE Biology Ext Theory MS - LDocument9 pages17.8 Inheritance IGCSE CIE Biology Ext Theory MS - LBlessing TshumaNo ratings yet

- Design and Implementation of Bioamplifier For Portable ECG DeviceDocument19 pagesDesign and Implementation of Bioamplifier For Portable ECG Devicej4everNo ratings yet

- 1 s2.0 S0378517311000226 MainDocument9 pages1 s2.0 S0378517311000226 MainFIRMAN MUHARAMNo ratings yet

- Pizza Hut and Dominos - A Comparative AnalysisDocument19 pagesPizza Hut and Dominos - A Comparative AnalysisSarvesh Kumar GautamNo ratings yet

- Flexible Learnin G: Group 3 Bsed-Math 2Document48 pagesFlexible Learnin G: Group 3 Bsed-Math 2Niña Gel Gomez AparecioNo ratings yet

- College RecipesDocument29 pagesCollege RecipeskrunziNo ratings yet

- vdYoyHdeTKeL7EhJwoXE - Insomnia PH SlidesDocument40 pagesvdYoyHdeTKeL7EhJwoXE - Insomnia PH SlidesKreshnik IdrizajNo ratings yet