Professional Documents

Culture Documents

Capital Budgeting - Assignment

Uploaded by

Divyansh SaxenaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Budgeting - Assignment

Uploaded by

Divyansh SaxenaCopyright:

Available Formats

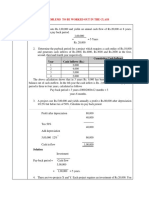

Assignment Capital Budgeting

A firm is considering a project for which the following details have been estimated:

• Initial Cost: Rs 50,000, • Life of the project: 5 Years, • Annual Sales (Units): 5,000

• Unit Price: Rs 70, • Variable Cost Per Unit (VCPU): Rs 10, • Overheads: Rs 20,000

• Depreciation: Rs 10,000 in all years, • Tax Rate: 30% • Discount Rate: 9%

Considering Salvage Value to be zero, find out the estimated operating cash flow

and workout the net present value (NPV) of the base case given above. Further, find

out the operating cash flow and NPV under the following scenarios as well:

Scenario Pessimistic Optimistic

Initial Cost 50000 50000

Annual Sales 2000 8000

Unit price 40 80

Variable cost 4 8

Overheads 40000 18000

Depreciation 10000 each year 10000 each year

Tax 30% 30%

Life of project 5 5

You might also like

- Hola Kola Solution Base AbhinavDocument17 pagesHola Kola Solution Base Abhinavnisha0% (2)

- Capital StructureDocument4 pagesCapital StructureSimran SidhuNo ratings yet

- Worldwide Paper Company: Case Solution Company BackgroundDocument4 pagesWorldwide Paper Company: Case Solution Company BackgroundJauhari WicaksonoNo ratings yet

- Taken From: Financial Management Book: Find Out The Net Cash Flow Under The Following Scenarios: (Build An Excel Model)Document1 pageTaken From: Financial Management Book: Find Out The Net Cash Flow Under The Following Scenarios: (Build An Excel Model)Jithin MohanNo ratings yet

- Worksheet 18Document2 pagesWorksheet 18Trianbh SharmaNo ratings yet

- Acccob3 k48 Hw4 Valdez NeoDocument6 pagesAcccob3 k48 Hw4 Valdez NeoneovaldezNo ratings yet

- Mgac CustomDocument123 pagesMgac CustomJoana TrinidadNo ratings yet

- FM Assignment 2Document3 pagesFM Assignment 2NOEL ThomasNo ratings yet

- ExerciseDocument7 pagesExercisekarthikNo ratings yet

- Chapter 4 CB Problems - IDocument11 pagesChapter 4 CB Problems - IRoy YadavNo ratings yet

- Capital Budgeting ExercisesDocument5 pagesCapital Budgeting ExercisesSophia ManglicmotNo ratings yet

- Chapter 4 PDFDocument33 pagesChapter 4 PDFAdda KadhilaNo ratings yet

- Instant Noodle CompanyDocument8 pagesInstant Noodle CompanyIsabella GimaoNo ratings yet

- Day 15 - CVP QuestionsDocument4 pagesDay 15 - CVP QuestionsRashmi Ranjan DashNo ratings yet

- LA2 CB Traditional Eval TechniquesDocument1 pageLA2 CB Traditional Eval TechniquesHarold Beltran DramayoNo ratings yet

- Option A Option B Location A Location B Million MillionDocument6 pagesOption A Option B Location A Location B Million MillionAkshita ChordiaNo ratings yet

- BE AnalysisDocument44 pagesBE Analysissahu.tukun003No ratings yet

- Excel WorkBookDocument60 pagesExcel WorkBookArnavNo ratings yet

- ModelDocument2 pagesModelashishmaharana188No ratings yet

- MAE RevisionDocument57 pagesMAE RevisionsaloniNo ratings yet

- Midt - Chap.8 LEVERAGE & Capial StructureDocument33 pagesMidt - Chap.8 LEVERAGE & Capial StructureJeanette FormenteraNo ratings yet

- Central College of Business Management: Mid Term Examination: February 2020Document2 pagesCentral College of Business Management: Mid Term Examination: February 2020UNik ROnz OFFICIALNo ratings yet

- Chapter 4 CB Problems - FDocument11 pagesChapter 4 CB Problems - FAkshat SinghNo ratings yet

- Problems On LeveragesDocument1 pageProblems On LeveragesDeepakNo ratings yet

- Leverages PDFDocument7 pagesLeverages PDFVaishnavi ShigvanNo ratings yet

- Lesson 1 CVP AnalysisDocument2 pagesLesson 1 CVP AnalysisLorille LeonesNo ratings yet

- Acn 4Document3 pagesAcn 4Navidul IslamNo ratings yet

- Aditya LabDocument62 pagesAditya Labasthapatel.akpNo ratings yet

- Unit 2 Problem SheetDocument9 pagesUnit 2 Problem SheetTejas ArgulewarNo ratings yet

- Capital BudgetingDocument19 pagesCapital BudgetingJfieid EjejfjNo ratings yet

- SumsDocument25 pagesSumsNeedhi NagwekarNo ratings yet

- E5.18 Contribution Margin Per Unit Fixed ExpensesDocument5 pagesE5.18 Contribution Margin Per Unit Fixed ExpensesK59 Lai Hoang SonNo ratings yet

- Diaper Case StudyDocument5 pagesDiaper Case StudyAbhijeet SarodeNo ratings yet

- Salvage Value Useful Life Accumulated YearsDocument10 pagesSalvage Value Useful Life Accumulated Yearsmiljane perdizoNo ratings yet

- Regulation Amendment Notification 15 August 2019Document3 pagesRegulation Amendment Notification 15 August 2019Shiran MahadeoNo ratings yet

- 1 2 3 4 5 Revenues Operating Expenses: Salaries Raw Material (Cost of Product) DepreciationDocument16 pages1 2 3 4 5 Revenues Operating Expenses: Salaries Raw Material (Cost of Product) DepreciationВадим АнисимовNo ratings yet

- Iron & Sanitary Store: Small Business ProfileDocument4 pagesIron & Sanitary Store: Small Business ProfileTahir MahmoodNo ratings yet

- Group 2-Fin 6000BDocument7 pagesGroup 2-Fin 6000BBellindah wNo ratings yet

- Budgets & Budgetary ControlDocument10 pagesBudgets & Budgetary Controlsimranarora2007No ratings yet

- MARGINAL COSTIN1 Auto SavedDocument6 pagesMARGINAL COSTIN1 Auto SavedVedant RaneNo ratings yet

- Mcom QP Amd 40 MarksDocument2 pagesMcom QP Amd 40 Marksirfanahmed.dbaNo ratings yet

- Book 1Document4 pagesBook 1Swapan Kumar SahaNo ratings yet

- Capital Budgeting-ClassDocument91 pagesCapital Budgeting-ClassAditi AgrawalNo ratings yet

- Problems For Marginal CostingDocument6 pagesProblems For Marginal CostingPramod Bhardwaj100% (1)

- Numericals On Capital BudgetingDocument3 pagesNumericals On Capital BudgetingRevati ShindeNo ratings yet

- Finals Unit 4 Exercise - Variable and Absorption CostingDocument2 pagesFinals Unit 4 Exercise - Variable and Absorption CostingMelo RiegoNo ratings yet

- Quiz No. 4 - Variable and Absorption CostingDocument2 pagesQuiz No. 4 - Variable and Absorption CostingRio Cyrel CelleroNo ratings yet

- ) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%Document4 pages) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%kfbhgikNo ratings yet

- FM Lab Week 8Document2 pagesFM Lab Week 8M shahjamal QureshiNo ratings yet

- Valuation Workshop v0.1Document13 pagesValuation Workshop v0.1Dinesh RajpurohitNo ratings yet

- Scenario Summary: Changing Cells: Result CellsDocument8 pagesScenario Summary: Changing Cells: Result CellsAMIT BANSALNo ratings yet

- Scenario Summary: Changing Cells: Result CellsDocument8 pagesScenario Summary: Changing Cells: Result CellsAMIT BANSALNo ratings yet

- Capital Budgeting - Select ExercisesDocument12 pagesCapital Budgeting - Select ExercisesNitin MauryaNo ratings yet

- Problems On Marginal CostingDocument7 pagesProblems On Marginal Costingrathanreddy2002No ratings yet

- Unit III-PROBLEMSDocument6 pagesUnit III-PROBLEMSPranav GaikwadNo ratings yet

- ExelDocument5 pagesExelmadhuraNo ratings yet

- Key QuestionDocument2 pagesKey QuestionRajesh MongerNo ratings yet

- SCM 2nd RecitDocument5 pagesSCM 2nd RecitMaxine ConstantinoNo ratings yet

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaNo ratings yet

- Samriddhi Ki OreDocument2 pagesSamriddhi Ki OreDivyansh SaxenaNo ratings yet

- Cover Letter For Internship at Kotak MahindraDocument1 pageCover Letter For Internship at Kotak MahindraDivyansh SaxenaNo ratings yet

- Sky Air Food WastageDocument2 pagesSky Air Food WastageDivyansh SaxenaNo ratings yet

- Divyansh SaxenaDocument1 pageDivyansh SaxenaDivyansh SaxenaNo ratings yet

- ImraanDocument14 pagesImraanDivyansh SaxenaNo ratings yet

- 65c4e449d5289 EcoVision CaseSubmissionRoundDocument8 pages65c4e449d5289 EcoVision CaseSubmissionRoundDivyansh SaxenaNo ratings yet

- Panasonic's B2B Business A Comprehensive ReportDocument11 pagesPanasonic's B2B Business A Comprehensive ReportDivyansh SaxenaNo ratings yet

- Deepfake Case StudyDocument23 pagesDeepfake Case StudyDivyansh SaxenaNo ratings yet