Professional Documents

Culture Documents

Amortization

Uploaded by

Buenaventura, Elijah B.0 ratings0% found this document useful (0 votes)

3 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesAmortization

Uploaded by

Buenaventura, Elijah B.Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Problem 1

1.) PV of the principal (4,000,000 x 0.77218) ₱ 3,088,720.00

PV of the interest payments

(4,000,000 x 6% x 2.53130) 607,512

Liability Component of the convertible debt ₱ 3,696,232.00

2.) Issue price ₱ 4,000,000.00

Less: Liability Component 3,696,232

Equity Component ₱ 303,768.00

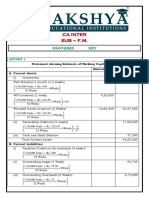

3.) Date Int. Paid Int. Exp. Discount Amort. CV

01/01/2022 ₱ 3,696,232

31/12/2022 ₱ 240,000.00 ₱ 332,661 ₱ 92,661 ₱ 3,788,893

31/12/2023 ₱ 240,000.00 ₱ 341,000 ₱ 101,000 ₱ 3,889,893

31/12/2024 ₱ 240,000.00 ₱ 350,090 ₱ 110,090 ₱ 3,999,984

Interest Expense - December 31, 2023 ₱ 341,000

4.) CV - Dec. 31, 2023 ₱ 3,889,893

Add: Equity Component 303,768

Total Consideration ₱ 4,193,661

Par value of ordinary share

(4,000 x 200 x 2) ₱ 1,600,000

Share premium - issuance ₱ 2,593,661

Problem 2

1.) Issue price ₱ 5,000,000

Multiply: Market value of 95 95%

CV on the date of issuance ₱ 4,750,000

2.) Issue price (5,000,000 x 103) ₱ 5,150,000

Market price (5,000,000 x 95) 4,750,000

Equity Component ₱ 400,000

3.) Cash (5,000,000 x 3%) ₱ 150,000

Multiply: 50

Total ₱ 7,500,000

Equity Component 400,000

Total Consideration ₱ 7,900,000

Par value of P25 (150,000 x 25) 3,750,000

Share Premium ₱ 4,150,000

Problem 3

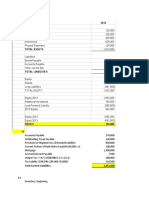

a. Retained Earnings 875,000

PPE 875,000

To reduce the amount of PPE

b. Retained Earnings 375,000

Other NCA 375,000

To reduce the amount of Other NCA

c. Ordinary Shares 2,000,000

Share Premium 2,000,000

To reduce the amount of Ordinary Shares

d. Share Premium 2,250,000

Retained Earnings 2,250,000

To offset deficit against the share premium

ASSETS LIABILITIES & EQUITY

Current Assets ₱ 1,375,000 Total Liabilities ₱ 1,500,000

PPE (Net) 2,500,000 Ordinary Shares 2,000,000

Other Non-Current Assets 125,000 Share Premium 500,000

Total Assets 1.) ₱ 4,000,000 Total Liabilities & Equity ₱ 4,000,000

2.) Share Premium

₱ 2,250,000 ₱ 2,000,000

750,000

2,250,000 2,750,000

₱ 500,000

3.) Retained Earnings

₱ 875,000

375,000

1,000,000

₱ 2,250,000 ₱ 2,250,000

You might also like

- FAR Problem Quiz 2Document3 pagesFAR Problem Quiz 2Ednalyn CruzNo ratings yet

- Intangible Assets QuizDocument3 pagesIntangible Assets QuizKarlo PalerNo ratings yet

- Answer Key ACCTG 202Document3 pagesAnswer Key ACCTG 202Sanilyn DomingoNo ratings yet

- Ass. Chapter 11 Shareholders Equity (Part 2)Document12 pagesAss. Chapter 11 Shareholders Equity (Part 2)Jea Ann CariñozaNo ratings yet

- Final Test - AnswersDocument6 pagesFinal Test - Answersnguyễn hiềnNo ratings yet

- Acctg Lab 5.Document4 pagesAcctg Lab 5.AngieNo ratings yet

- 30 5 To 30 6 Depletion Intermediate Accounting Volume 1 2021 Edition ValixDocument3 pages30 5 To 30 6 Depletion Intermediate Accounting Volume 1 2021 Edition ValixAway To PonderNo ratings yet

- True or False: Multiple ChoiceDocument10 pagesTrue or False: Multiple ChoiceダニエルNo ratings yet

- AC3202 WK2 Exercises SolutionsDocument11 pagesAC3202 WK2 Exercises SolutionsLong LongNo ratings yet

- Sol. Man. - Chapter 4 Provisions, Cont. Liabs. & Cont. AssetsDocument10 pagesSol. Man. - Chapter 4 Provisions, Cont. Liabs. & Cont. AssetsMiguel Amihan100% (1)

- Chapter 11 Shareholders' 2Document13 pagesChapter 11 Shareholders' 2Thalia Rhine AberteNo ratings yet

- Genuime Company Required 1 Debit CreditDocument15 pagesGenuime Company Required 1 Debit CreditAnonnNo ratings yet

- 3.business Plan Divident and Grought ABDocument26 pages3.business Plan Divident and Grought ABmiradvance studyNo ratings yet

- Quiz 3solutionDocument5 pagesQuiz 3solutionAhsan IqbalNo ratings yet

- Problem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalDocument23 pagesProblem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalAngelica DizonNo ratings yet

- Shadden PanaoDocument5 pagesShadden PanaoJoebin Corporal LopezNo ratings yet

- CH 11 - CF Estimation Mini Case Sols Excel 14edDocument36 pagesCH 11 - CF Estimation Mini Case Sols Excel 14edأثير مخوNo ratings yet

- Sol. Man. - Chapter 4 Provisions, Cont. Liabs. & Cont. AssetsDocument9 pagesSol. Man. - Chapter 4 Provisions, Cont. Liabs. & Cont. AssetsEinez B. CarilloNo ratings yet

- Module 5: Assignment: 2. Bond Discount (P6,000,000 X .04)Document3 pagesModule 5: Assignment: 2. Bond Discount (P6,000,000 X .04)Camille BonaguaNo ratings yet

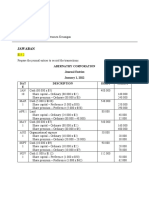

- Jawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditDocument6 pagesJawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditChupa HesNo ratings yet

- Problem 1 Journal EntryDocument4 pagesProblem 1 Journal EntrySarah Nelle PasaoNo ratings yet

- CORRECTED SOL. MAN. - CHAPTER 15 - ACCOUNTING FOR CORPORATIONS PROB 2-3 CompleteDocument8 pagesCORRECTED SOL. MAN. - CHAPTER 15 - ACCOUNTING FOR CORPORATIONS PROB 2-3 Completeruth san joseNo ratings yet

- United Metal: Initial Outlay (IO) CalculationDocument3 pagesUnited Metal: Initial Outlay (IO) CalculationMarjina Binte Abbas BrishtiNo ratings yet

- 1 Treasury Shares: PROBLEM 21-1 Requirement 1Document11 pages1 Treasury Shares: PROBLEM 21-1 Requirement 1Bella RonahNo ratings yet

- Leases SolManDocument15 pagesLeases SolManElaine Joyce GarciaNo ratings yet

- AA Chapter2Document6 pagesAA Chapter2Nikki GarciaNo ratings yet

- A) Determine The Weighted Average Number of Common SharesDocument7 pagesA) Determine The Weighted Average Number of Common SharesClyde Ian Brett PeñaNo ratings yet

- Sol. Man. - Chapter 15 - Accounting For CorporationsDocument15 pagesSol. Man. - Chapter 15 - Accounting For Corporationspehik100% (1)

- Chapter 7 - Compound Financial Instrument (FAR6)Document5 pagesChapter 7 - Compound Financial Instrument (FAR6)Honeylet SigesmundoNo ratings yet

- Fair Value Fair ValueDocument4 pagesFair Value Fair ValueJay Ann DomeNo ratings yet

- Assignment 2 - SolutionsDocument6 pagesAssignment 2 - SolutionsSiying GuNo ratings yet

- Sol. Man. - Chapter 11 She 2Document14 pagesSol. Man. - Chapter 11 She 2finn mertensNo ratings yet

- Income & Expense SummaryDocument18 pagesIncome & Expense SummaryCrestina100% (3)

- 05 - Task Performance - 1-InterAcctng2Document2 pages05 - Task Performance - 1-InterAcctng2Jomari EscarillaNo ratings yet

- Ia3 FinalsDocument4 pagesIa3 FinalsGeraldine MayoNo ratings yet

- CH SolutionsDocument6 pagesCH SolutionsPink MagentaNo ratings yet

- AC13.1.2 Module 1 Answer KeyDocument6 pagesAC13.1.2 Module 1 Answer KeyDianaNo ratings yet

- Intermediate Accounting 2Document4 pagesIntermediate Accounting 2MARRIETTE JOY ABADNo ratings yet

- Jawaban Review Uts Inter 2 - FixDocument8 pagesJawaban Review Uts Inter 2 - FixCaratmelonaNo ratings yet

- Sol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BDocument15 pagesSol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BChristian James RiveraNo ratings yet

- Fin Acc n6 Int. Exam 2017 s2 MGDocument7 pagesFin Acc n6 Int. Exam 2017 s2 MGprofessional accountantsNo ratings yet

- Accounting AssignmentDocument13 pagesAccounting AssignmentPetrinaNo ratings yet

- Suggested Solutions June 2008Document11 pagesSuggested Solutions June 2008kalowekamoNo ratings yet

- Acc 2 - AssignmentDocument8 pagesAcc 2 - AssignmentvincentNo ratings yet

- Dac 318 AssignmentDocument6 pagesDac 318 AssignmentLenny MuttsNo ratings yet

- Chapter 3 SolutionsDocument7 pagesChapter 3 Solutionshassan.murad63% (8)

- For Classroom Discussion: SolutionDocument4 pagesFor Classroom Discussion: SolutionMisherene MagpileNo ratings yet

- Answers Lt2Document4 pagesAnswers Lt2scryx bloodNo ratings yet

- Group 5Document16 pagesGroup 5Amelia AndrianiNo ratings yet

- W14 - As8 Maranan, A2aDocument3 pagesW14 - As8 Maranan, A2aJere Mae MarananNo ratings yet

- Vdocuments - MX - Answers Chapter 3 Vol 2 RvsedDocument13 pagesVdocuments - MX - Answers Chapter 3 Vol 2 RvsedmirayNo ratings yet

- Ca Inter-F.m.03-07-2023-KeyDocument3 pagesCa Inter-F.m.03-07-2023-KeyChintuNo ratings yet

- Smart Pushcart FINANCIAL PLAN DraftDocument8 pagesSmart Pushcart FINANCIAL PLAN DraftKyle TimonNo ratings yet

- Compound Financial InstrumentDocument2 pagesCompound Financial Instrumenthae1234No ratings yet

- Probs 22Document3 pagesProbs 22kyle GNo ratings yet

- Requirement Nos. 1 To 4: PROBLEM NO. 1 - Conviction CorporationDocument8 pagesRequirement Nos. 1 To 4: PROBLEM NO. 1 - Conviction CorporationMaeNo ratings yet

- Finals Quiz Assignment Private Equity Valuation Methods With AnswersDocument7 pagesFinals Quiz Assignment Private Equity Valuation Methods With AnswersRille Estrada CabanesNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- CIS ReviewDocument22 pagesCIS ReviewBuenaventura, Elijah B.No ratings yet

- Loss Contingency, Debt Restructuring, Asset SwapDocument2 pagesLoss Contingency, Debt Restructuring, Asset SwapBuenaventura, Elijah B.No ratings yet

- SPECIALIZEDDocument4 pagesSPECIALIZEDBuenaventura, Elijah B.No ratings yet

- PREA4Document9 pagesPREA4Buenaventura, Elijah B.No ratings yet

- Countries Can Be Roughly Divided Into Three Groups: Stage 1Document5 pagesCountries Can Be Roughly Divided Into Three Groups: Stage 1Buenaventura, Elijah B.No ratings yet

- A The 2016 Sales of Cumberland Industries Were 455 000 000 OperatingDocument2 pagesA The 2016 Sales of Cumberland Industries Were 455 000 000 OperatingAmit PandeyNo ratings yet

- Consolidated Financial Statements-Date of AcquisitionDocument57 pagesConsolidated Financial Statements-Date of AcquisitionDirga DarmawanNo ratings yet

- Quiz IntAccDocument12 pagesQuiz IntAccTrixie HicaldeNo ratings yet

- Toaz - Info October 2016 Advanced Financial Accounting Reporting Final Pre Boarddocx PRDocument18 pagesToaz - Info October 2016 Advanced Financial Accounting Reporting Final Pre Boarddocx PRrodell pabloNo ratings yet

- QA Before Week 8 Tute PDFDocument21 pagesQA Before Week 8 Tute PDFShek Kwun HeiNo ratings yet

- Acca SBR s21 NotesDocument153 pagesAcca SBR s21 NotesCharul Chugh100% (1)

- AFN - Sample Probs 3Document4 pagesAFN - Sample Probs 3John Brown100% (2)

- LLLLLLPPPPDocument31 pagesLLLLLLPPPPWaylan Basungit0% (1)

- Khadim India Limited Annual Report 2018 19Document5 pagesKhadim India Limited Annual Report 2018 19Harshul Bansal0% (1)

- Financial Statement Analysis - FIN621 Mid Term Paper Session-1Document10 pagesFinancial Statement Analysis - FIN621 Mid Term Paper Session-1Zeeshan JunejoNo ratings yet

- Chapter 06, Modern Advanced Accounting-Review Q & ExrDocument33 pagesChapter 06, Modern Advanced Accounting-Review Q & Exrrlg481488% (16)

- Account Information Form: For Corporations and Partnerships in GeneralDocument6 pagesAccount Information Form: For Corporations and Partnerships in GeneralErichSantosValdeviesoNo ratings yet

- Acct 04AHW Exercises Chapter1Document3 pagesAcct 04AHW Exercises Chapter1Chris Trevino100% (2)

- SAP FICO Training DocumentDocument148 pagesSAP FICO Training DocumentraguNo ratings yet

- Akuntansi Chapter 4Document23 pagesAkuntansi Chapter 4Alfian Rizal MahendraNo ratings yet

- Lyon Corporation Cash Forecast For July, Year 6 Beginning Cash Balance 20Document9 pagesLyon Corporation Cash Forecast For July, Year 6 Beginning Cash Balance 20leniNo ratings yet

- TACC507GroupAssignmentReportandPresentation 82339240Document6 pagesTACC507GroupAssignmentReportandPresentation 82339240Zain NaeemNo ratings yet

- Hero Moto Corp Financial AnalysisDocument16 pagesHero Moto Corp Financial AnalysisUmeshchandu4a9No ratings yet

- Answer To ExercisesDocument40 pagesAnswer To ExercisesmarieieiemNo ratings yet

- Project On HDFC BankDocument104 pagesProject On HDFC BankBalaji100% (2)

- The Accounting Cycle: Reporting Financial Results: Mcgraw-Hill/IrwinDocument23 pagesThe Accounting Cycle: Reporting Financial Results: Mcgraw-Hill/IrwinDuae ZahraNo ratings yet

- Colegio de San Juan de Letran: NAME - SECTIONDocument9 pagesColegio de San Juan de Letran: NAME - SECTIONmaria evangelistaNo ratings yet

- Tugas Kelompok Ke-2 (Minggu 5)Document8 pagesTugas Kelompok Ke-2 (Minggu 5)Savina SyachNo ratings yet

- Practical Financial Management 7th Edition Lasher Solution ManualDocument27 pagesPractical Financial Management 7th Edition Lasher Solution Manualharold100% (20)

- Consolidation Techniques and Procedures: Preparing The WorksheetDocument25 pagesConsolidation Techniques and Procedures: Preparing The WorksheetArisBachtiarNo ratings yet

- Errors: Objectives: Define and Identify Types of Errors. Give Examples of ErrorsDocument31 pagesErrors: Objectives: Define and Identify Types of Errors. Give Examples of ErrorsPang SiulienNo ratings yet

- Accounting Concepts and Applications 11th Edition Albrecht Test BankDocument25 pagesAccounting Concepts and Applications 11th Edition Albrecht Test BankMichelleHarrisjspr100% (44)

- Chap 1Document32 pagesChap 1chaugiang phamquynhNo ratings yet

- Accounting For GP of Company 1Document14 pagesAccounting For GP of Company 1zayyar htooNo ratings yet

- Group 2 Case 1 Assignment Bubble Bee Organic The Need For Pro Forma Financial Modeling SupplDocument13 pagesGroup 2 Case 1 Assignment Bubble Bee Organic The Need For Pro Forma Financial Modeling SupplSarah WuNo ratings yet