Professional Documents

Culture Documents

Assignment 1 - Reclassification of Financial Asset

Uploaded by

21100698Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 1 - Reclassification of Financial Asset

Uploaded by

21100698Copyright:

Available Formats

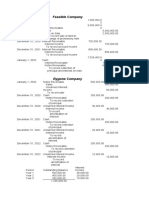

PROBLEM 21-1

PREPARE A TABLE OF AMMORTIZATION USING AFFECTIVE INTEREST METHOD

Date Interest Received Interest Income Discount Ammortization

Jan-01-2021

Dec-31-2021 300,000 373,488 73,488

Dec-31-2022 300,000 379,367 79,367

Dec-21-2023 300,000 385,716 85,716

Dec-21-2024 300,000 392,829 92,892

COMPUTE THE UNREALIZED GAIN FOR 2021

12-31-2021 Fair Value 5,250,000

12-31-2021 Carrying Amount -4,742,088

2021 Unrealized Gain 507,912

COMPUTE THE UNREALIZED GAIN FOR 2022

Dec-31-2022 Fair Value 5,500,000

Dec-31-2022 Carrying Amount -4,821,455

Dec-31-2022 Cummulative Unrealized Gain 678,545

2021 Unrealized Gain -507,912

2022 Unrealized Gain 170,633

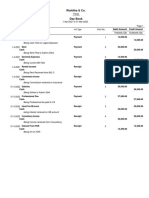

PREPARE JOURNAL ENTRIES

2021

01-Jan Financial Asset - FVOCI 4,668,600

Cash 4,668,600

Dec-31 Cash 300,000

Interest Income 300,000

Dec-31 Financial Asset - FVOCI 73,488

Interest Income 73,488

Dec-31 Financial Asset - FVOCI 507,912

Unrealized Gain - OCI 507,912

2022

Dec-31 Cash 300,000

Interest Income 300,000

Dec-31 Financial Asset - FVOCI 79,367

Interest Income 79,367

Dec-31 Financial Asset - FVOCI 170,633

Unrealized Gain - OCI 170,633

2023

Jan-22 Bond Investment 5,500,000

Financial Asset - FVOCI 5,500,000

Dec-31 Cash 300,000

Interest Income 300,000

Dec-31 Bond Investment - FVOCI 85,716

Interest Income 85,716

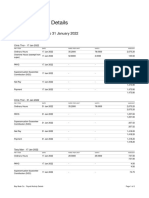

PROBLEM 21-2

PREPARE A TABLE OF AMMORTIZATION USING THE EFFECTIVE INTEREST METHOD

Date Interest Received Interest Income Discount Ammortization

Jan-01-2021

Dec-31-2021 160,000 190,000 30,000

Dec-31-2022 160,000 193,000 33,000

Dec-31-2023 160,000 123,000 37,000

COMPUTE UNREALIZED GAIN

12-31-2021 Fair Value 2,200,000

12-31-2021 Carrying Amount -1,930,000

2021 Unrealized Gain 270,000

12-31-2022 Fair Value 2,400,000

12-31-2022 Carrying Amount -1,963,000

2022 Cummulative Unrealized Gain 437,000

PREPARE JOURNAL ENTRIES

2021

01-Jan Bond Investment 1,900,000

Cash 1,900,000

Dec-31 Cash 160,000

Interest Income 160,000

Dec-31 Bond Investment 30,000

Interest Income 30,000

Dec-31 Financial Asset - FVOCI 270,000

Unrealized Gain - OCI 270,000

2022

01-Jan Financial Asset - FVOCI 2,200,000

Bond Investment 2,200,000

Dec-31 Cash 160,000

Interest Income 160,000

Dec-31 Financial Asset - FVOCI 33,000

Interest Income 33,000

Dec-31 Financial Asset - FVOCI 167,000

Unrealized Gain - OCI 167,000

PROBLEM 21-3

Date Interest Received Interest Income Discount Ammortization

Jan-01-2021

Dec-31-2021 300,000 272,400 -27,600

Dec-31-2022 300,000 270,192 -29,808

Dec-31-2023 300,000 267,807 -32,193

Dec-31-2024 300,000 265,232 -34,768

COMPUTE FOR THE LOSS ON RECLASSIFICATION

01-01-2023 Fair Value 2,845,000

01-01-2023 Carrying Amount -3,347,592

Loss on Reclassification -502,592

PREPARE JOURNAL ENTRIES

2021

Jan-01 Bond Investment 3,405,000

Cash 3,405,000

Dec-31 Cash 300,000

Interest Income 300,000

12-Dec Interest Income 27,600

Bond Investment 27,600

2022

Dec-31 Cash 300,000

Interest Income 300,000

Dec-31 Interest Income 29,808

Bond Investment 29,808

Dec-31 Loss on Reclassification 502,592

Financial Asset - FVPL 502,592

2023

01-Jan Financial Asset - FVPL 2,845,000

Bond Investment 2,845,000

Dec-31 Cash 300,000

Interest Income 300,000

Dec-31 Interest Income 32,193

Bond Investment 32,193

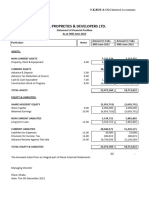

PROBLEM 21-4

WHAT AMOUNT SHOULD BE REPORTED AS INTEREST INCOME FOR 2021

Interest Income for 2021 (6,000,000x9) 540,000

WHAT AMOUNT OF UNREALIZED LOSS SHOULD BE RECOGNIZED IN THE INCOME STATEMENT FOR 2021

12-31-2021 Fair Value 5,450,000

12-31-2021 Carrying Amount -5,550,000

2022 Unrealized Loss 100,000

WHAT AMOUNT OF UNREALIZED GAIN SHOULD BE RECOGNIZED IN THE INCOME STATEMENT FOR 2022

12-31-2022 Fair Value 6,150,000

12-31-2021 Carrying Amount -5,450,000

2022 Unrealized Gain 700,000

PREPARE JOURNAL ENTRIES

2021

01-Jan Financial Asset - FVPL 5,550,000

Cash 5,550,000

Dec-31 Cash 540,000

Interest Income 540,000

Dec-31 Unrealized Loss 100,000

Financial Asset - FVPL 100,000

2022

Dec-31 Cash 540,000

Interest Income 540,000

Dec-31 Financial Asset - FVPL 700,000

Unrealized Gain 700,000

2023

01-Jan Bond Investment 6,150,000

Financial Asset - FVPL 6,150,000

Dec-31 Cash 540,000

Interest Income 540,000

Dec-31 Interest Income 48,000

Bond Investment 48,000

PROBLEM 21-5

WHAT AMOUNT SHOULD BE REPORTED AS INTEREST INCOME FOR 2021

Interest Income for 2021 260,100 (4,335,000x6%)

WHAT AMOUNT OF UNREALIZED LOSS SHOULD BE RECOGNIZED IN OCI FOR 2021

01-01-2021 CA 4,335,000

Ammortization Cost

Interest Income 260,100

Interest Received -320,000 -59,900

12-31-2021 CA 4,275,100

12-31-2021 Fair Value 3,870,000

12-31-2021 CA -4,275,100

Unrealized loss in OCI for 2021 -405,100

WHAT AMOUNT SHOULD BE REPORTED AS INTEREST INCOME FOR 2022

Interest Income for 2022 320,000 (4,000,000x8%)

WHAT AMOUNT IS INCLUDED IN PROFIT OR LOSS IN 2022 AS A RESULT OF RECLASSIFICATION

12-31-2022 Fair Value 3,615,000

12-31-2021 Carrying Amount -3,870,000

Unrealized Loss in 2019 included in PNL -255,000

Reclassified from OCI to PNL -405,100

Profit or loss inluded In 2022 -660,100

PREPARE JOURNAL ENTRY

2021

01-Jan Financial Asset - FVOCI 4,335,000

Cash 4,335,000

Dec-31 Cash 320,000

Interest Income 320,000

Dec-31 Interest Income 59,900

Financial Asset - FVOCI 59,900

Dec-31 Unrealized Loss - OCI 405,100

Financial Asset - FVOCI 405,100

2022

01-Jan Financial Asset - FVPL 3,870,000

Financial Asset - FVOCI 3,870,000

Dec-31 Unrealized Loss - PL 255,000

Financial Asset - FVOCI 255,000

Dec-31 Unrealized Loss - PL 405,100

Unrealized Loss - OCI 405,100

PROBLEM 21-6

WHAT AMOUNT SHOULD BE REPORTED AS INTEREST INCOME FOR 2021

Interest Income for 2021 240,000 (4,000,000x6%)

WHAT AMOUNT OF UNREALIZED LOSS SHOULD BE REPORTED IN THE INCOME STATEMENT FOR 2021

12-31-2021 Fair Value 3,490,000

12-31-2021 Carrying Amount -3,530,000

Unrealized loss included in PNL 2021 -40,000

WHAT AMOUNT OF UNREALIZED LOSS SHOULD BE RECOGNIZED IN OCI FOR 2022

01-01-2021 CA 3,490,000

Ammortization Cost 349,000

Interest Income(3,490,000x10%) -240,000 109,000

Interest Income(4,000,000x6%) 3,599,000

12-31-2021 Fair Value 3,425,000

12-31-2021 Carrying Amount -3,599,000

Unrealized Loss in OCI for 2022 -174,000

PREPARE JOURNAL ENTRIES

2021

01-Jan Financial Asset - FVPL 3,530,000

Cash 3,530,000

Dec-31 Cash 240,000

Interest Income 240,000

Dec-31 Unrealized Loss - PNL 40,000

Financial Asset - FVPL 40,000

2022

01-Jan Financial Asset - FVOCI 3,490,000

Financial Asset - FVPL 3,490,000

Dec-31 Cash 240,000

Interest Income 240,000

Dec-31 Financial Asset - FVOCI 109,000

Interest Income 109,000

Dec-31 Unrealized Loss - OCI 174,000

Financial Asset - FVOCI 174,000

Carrying Amount

4,668,600

4,742,088

4,821,455

4,907,171

5,000,000

Carrying Amount

1,900,000

1,930,000

1,963,000

2,000,000

Carrying Amount

3,405,000

3,377,400

3,347,592

3,315,399

3,280,631

You might also like

- ACC 557 Week 2 Chapter 3 (E3-6, E3-7, E3-11, P3-2A) 100% ScoredDocument26 pagesACC 557 Week 2 Chapter 3 (E3-6, E3-7, E3-11, P3-2A) 100% ScoredJoseph W. RodgersNo ratings yet

- Bond Investment - FVOCI: Subject Intermediate Accounting Teacher Dessa Dianna MadridDocument23 pagesBond Investment - FVOCI: Subject Intermediate Accounting Teacher Dessa Dianna MadridJohn Warren MestiolaNo ratings yet

- 2020-2021 Financial StatementsDocument51 pages2020-2021 Financial StatementsKyra GillespieNo ratings yet

- Tax 1 Notes PDFDocument17 pagesTax 1 Notes PDFRose Ann BatucanNo ratings yet

- Zeta Company Required1 Required5 2020 Required2Document2 pagesZeta Company Required1 Required5 2020 Required2AnonnNo ratings yet

- Problem 21-1Document7 pagesProblem 21-1camilleescote562No ratings yet

- Problem 6-5 & 6Document2 pagesProblem 6-5 & 6Micah April SabularseNo ratings yet

- Feasibility Study Example 01Document13 pagesFeasibility Study Example 01Wondesen Amsalu KasayeNo ratings yet

- Notes ReceivableDocument2 pagesNotes ReceivableGee Lysa Pascua VilbarNo ratings yet

- Solution Chapter 20 Intermediate Accounting ValixDocument5 pagesSolution Chapter 20 Intermediate Accounting Valixnameless0% (1)

- Activity 5 - Chapter 22 Investment Property (Cash Surrender Value) Problem 22-2 (IFRS)Document6 pagesActivity 5 - Chapter 22 Investment Property (Cash Surrender Value) Problem 22-2 (IFRS)WeStan LegendsNo ratings yet

- Is Excel Participant - Simplified v2Document10 pagesIs Excel Participant - Simplified v2Aaron Pool0% (2)

- Complex Company Required1 Date Interest Received Interest Income Discount Amortization Carrying AmountDocument2 pagesComplex Company Required1 Date Interest Received Interest Income Discount Amortization Carrying AmountAnonnNo ratings yet

- Soledad Company Required1 Date Interest Received Interest Income Discount Amortization Carrying AmountDocument2 pagesSoledad Company Required1 Date Interest Received Interest Income Discount Amortization Carrying AmountAnonnNo ratings yet

- Bond Investment - ActivitiesDocument2 pagesBond Investment - ActivitiesmoreNo ratings yet

- Chapter 20Document26 pagesChapter 20GONZALES, MICA ANGEL A.No ratings yet

- Chapter20 BuenaventuraDocument23 pagesChapter20 BuenaventuraAnonnNo ratings yet

- Cpa Review School of The Philippines ManilaDocument1 pageCpa Review School of The Philippines ManilaMay Grethel Joy PeranteNo ratings yet

- Chapter 20 CompilationDocument41 pagesChapter 20 CompilationMaria Licuanan0% (1)

- Charisma Company Required 1 Date Interest Received Interest Income Discount Amortization Carrying AmountDocument2 pagesCharisma Company Required 1 Date Interest Received Interest Income Discount Amortization Carrying AmountAnonnNo ratings yet

- Chapter 20 - Effective Interest Method (Amortized Cost, FVOCI, FVPL)Document66 pagesChapter 20 - Effective Interest Method (Amortized Cost, FVOCI, FVPL)Never Letting GoNo ratings yet

- 21 Problems - and - Answers - Reclassification - of - Financial - AssetDocument30 pages21 Problems - and - Answers - Reclassification - of - Financial - AssetSheila Grace BajaNo ratings yet

- 1dec22 - Debt InvestmentDocument15 pages1dec22 - Debt InvestmentAmalia AsriningrumNo ratings yet

- Loans ReceivableDocument3 pagesLoans ReceivableGee Lysa Pascua VilbarNo ratings yet

- Trading Securities and FA at FV Through OCI and FA at Amortized Cost (Prob 21-25)Document11 pagesTrading Securities and FA at FV Through OCI and FA at Amortized Cost (Prob 21-25)Lorence Patrick LapidezNo ratings yet

- Financial Assets at Fair ValueDocument15 pagesFinancial Assets at Fair ValueVILLANUEVA Monica ThereseNo ratings yet

- Nasty Bank Date Debit Credit 2020Document18 pagesNasty Bank Date Debit Credit 2020AnonnNo ratings yet

- IntAcc GroupingsDocument4 pagesIntAcc GroupingsNikka BigtasNo ratings yet

- 7 8 BuenaventuraDocument4 pages7 8 BuenaventuraAnonnNo ratings yet

- Gerry Company Required1 Required5 2020 Required2Document2 pagesGerry Company Required1 Required5 2020 Required2AnonnNo ratings yet

- ACC101 Notes ReceivableDocument3 pagesACC101 Notes ReceivableJoan GujeldeNo ratings yet

- Chapter 20-Effective Interest Rate: PROBLEM 20-1 Requirement 1Document41 pagesChapter 20-Effective Interest Rate: PROBLEM 20-1 Requirement 1Jodie Ann PajacNo ratings yet

- Bonds Payable Part IIDocument6 pagesBonds Payable Part IIJoefrey Pujadas BalumaNo ratings yet

- Chapter6 BuenaventuraDocument11 pagesChapter6 BuenaventuraAnonnNo ratings yet

- Royalty Company Required1 Required5 2020 Required2Document2 pagesRoyalty Company Required1 Required5 2020 Required2AnonnNo ratings yet

- Juni Sania - 201950493 - Jawaban UTS Aplikasi Audit Ganjil 20Document10 pagesJuni Sania - 201950493 - Jawaban UTS Aplikasi Audit Ganjil 20Cherry VanticaNo ratings yet

- EA6Document54 pagesEA6Chris TVNo ratings yet

- 3.3.1 Notes and Loans Receivable Receivable FinancingDocument14 pages3.3.1 Notes and Loans Receivable Receivable FinancingJan Nelson BayanganNo ratings yet

- Chapter15 BuenaventuraDocument10 pagesChapter15 BuenaventuraAnonnNo ratings yet

- Cebu Ink-Toner Well Sales & Services: Assets Current AssetsDocument4 pagesCebu Ink-Toner Well Sales & Services: Assets Current AssetsJheza Mae PitogoNo ratings yet

- IA 2 Chapter 5 ActivitiesDocument12 pagesIA 2 Chapter 5 ActivitiesShaina TorraineNo ratings yet

- Intermediate Accounting 2: Financial LiabilitiesDocument63 pagesIntermediate Accounting 2: Financial LiabilitiesLyca Mae CubangbangNo ratings yet

- Reign Company Debit Credit 2020Document1 pageReign Company Debit Credit 2020AnonnNo ratings yet

- Mini Exercise Answer KeyDocument3 pagesMini Exercise Answer KeyKaren TumabiniNo ratings yet

- Activity Notes ReceivableDocument2 pagesActivity Notes ReceivableBernadeth Adelaine DomingoNo ratings yet

- Chapter 12Document7 pagesChapter 12Xynith Nicole RamosNo ratings yet

- Aborigine Company Dec31,2020 Debit CreditDocument2 pagesAborigine Company Dec31,2020 Debit CreditAnonnNo ratings yet

- Quiz Quiz 2 Single Entry and Cash Accrual Accounting PDFDocument28 pagesQuiz Quiz 2 Single Entry and Cash Accrual Accounting PDFluismorenteNo ratings yet

- Investment in Associate ExercisesDocument7 pagesInvestment in Associate ExercisesJo KeNo ratings yet

- Problem 5 On Loan ReceivableDocument6 pagesProblem 5 On Loan Receivablebm1ma.allysaamorNo ratings yet

- Problem 4-1: GUILLENA, Isabelle Dynah E. BSA 2-10 Assignment #2: LeasesDocument5 pagesProblem 4-1: GUILLENA, Isabelle Dynah E. BSA 2-10 Assignment #2: LeasesIsabelle GuillenaNo ratings yet

- Accounting For Government Grants and Disclosure of Government AssistanceDocument5 pagesAccounting For Government Grants and Disclosure of Government AssistanceCristine Jane Granaderos OppusNo ratings yet

- Acctg Lab 4Document3 pagesAcctg Lab 4AngieNo ratings yet

- Quiz - Quiz 2 Single Entry and Cash Accrual AccountingDocument27 pagesQuiz - Quiz 2 Single Entry and Cash Accrual AccountingluismorenteNo ratings yet

- FCB Records Summarized 20-22Document8 pagesFCB Records Summarized 20-22Eric HopkinsNo ratings yet

- Payroll Activity Details: Bay Beak Co. From 1 January 2022 To 31 January 2022Document2 pagesPayroll Activity Details: Bay Beak Co. From 1 January 2022 To 31 January 2022Janine Leigh BacalsoNo ratings yet

- EP Tax Calculation For Online PaymentDocument3 pagesEP Tax Calculation For Online PaymentMgKAGNo ratings yet

- Date of Bonds Date of Issue Interest Payment Dates Marurity Face Value Nominal Rate Effective Interest RateDocument5 pagesDate of Bonds Date of Issue Interest Payment Dates Marurity Face Value Nominal Rate Effective Interest RateJa RedNo ratings yet

- BJ Food QR PDFDocument13 pagesBJ Food QR PDFnkhhhNo ratings yet

- RTCL Properties & Developers LIMITED-2022Document15 pagesRTCL Properties & Developers LIMITED-2022Asad RanaNo ratings yet

- Answer To Phase TestDocument5 pagesAnswer To Phase TestPohYeeLiewNo ratings yet

- Ia 3 ZZZZDocument4 pagesIa 3 ZZZZPRE GNNo ratings yet

- Day BookDocument1 pageDay BookRishi SriNo ratings yet

- IA 1 - Chapter 6 Notes Receivable Problems Part 1Document6 pagesIA 1 - Chapter 6 Notes Receivable Problems Part 1John CentinoNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- Accounting 15Document25 pagesAccounting 15almira garciaNo ratings yet

- 817-Article Text-3053-1-10-20220713Document26 pages817-Article Text-3053-1-10-20220713bouananiNo ratings yet

- Argumentative Essay 1Document5 pagesArgumentative Essay 1api-582831274No ratings yet

- 01 Conceptual Framework (Student)Document23 pages01 Conceptual Framework (Student)Christina DulayNo ratings yet

- Basics of Retailing Practical-1Document6 pagesBasics of Retailing Practical-1Ŕøhãň ĆhNo ratings yet

- The Islamic University of Gaza Faculty of Commerce Department of AccountingDocument8 pagesThe Islamic University of Gaza Faculty of Commerce Department of AccountingAhmed RazaNo ratings yet

- Gross National Product (GNP)Document3 pagesGross National Product (GNP)jitendra.jgec8525No ratings yet

- The Economic Impacts of The California Almond Industry 2Document53 pagesThe Economic Impacts of The California Almond Industry 2amit agarwal gmailNo ratings yet

- Amrik 21 22.Document2 pagesAmrik 21 22.MoghAKaranNo ratings yet

- Toaz - Info Acc 557 Week 2 Chapter 3 E3 6e3 7e3 11p3 2a 100 Scored PRDocument26 pagesToaz - Info Acc 557 Week 2 Chapter 3 E3 6e3 7e3 11p3 2a 100 Scored PRDandy KrisnaNo ratings yet

- Chapter 6Document18 pagesChapter 6marieieiemNo ratings yet

- HRM - CTCDocument9 pagesHRM - CTCRamesh GowdaNo ratings yet

- 16 - DT Assignment - Chapter 15Document21 pages16 - DT Assignment - Chapter 15Sonali AcharyaNo ratings yet

- ETA Star Infopark - WatermarkDocument73 pagesETA Star Infopark - WatermarkRahul KumarNo ratings yet

- Frias Activity 6Document6 pagesFrias Activity 6Lars FriasNo ratings yet

- Entrep Mind Module 6Document10 pagesEntrep Mind Module 6Wynnie RondonNo ratings yet

- Form PDF 114320560260722Document9 pagesForm PDF 114320560260722DeepNo ratings yet

- Hansen AISE TB - Ch16Document50 pagesHansen AISE TB - Ch16clothing shoptalkNo ratings yet

- IAR Auditing ConclusionDocument23 pagesIAR Auditing Conclusionmarlout.sarita100% (1)

- Government Regulation No 58 On PPH 21 (Wef 1 Jan 2024)Document5 pagesGovernment Regulation No 58 On PPH 21 (Wef 1 Jan 2024)pokcayNo ratings yet

- Activity 1 Fundamentals of Accounting ExamsDocument19 pagesActivity 1 Fundamentals of Accounting ExamsLaiza Cristella SarayNo ratings yet

- Cash Flow TemplateDocument11 pagesCash Flow TemplateNOR AIMAN AZIM NOR AZLISHAMNo ratings yet

- TB Chapter03 Analysis of Financial StatementsDocument68 pagesTB Chapter03 Analysis of Financial StatementsReymark BaldoNo ratings yet

- Aqa 83612 SQP PDFDocument18 pagesAqa 83612 SQP PDFT SolomonNo ratings yet

- 6 Financial Statements ReviewDocument21 pages6 Financial Statements Reviewsanu sayedNo ratings yet