Professional Documents

Culture Documents

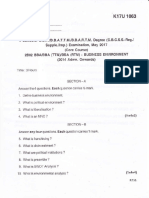

QP Public Economics

Uploaded by

nashidanaashi30Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QP Public Economics

Uploaded by

nashidanaashi30Copyright:

Available Formats

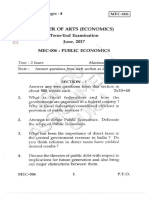

NSS COLLEGE OF ARTS AND SCIENCE, PERAYAM, KOLLAM

SIXTH SEMESTER B.A (ECONOMICS) MODEL EXAMINATION, NOVEMBER 2018

PUBLIC ECONOMICS (EC1643)

Time: 1.5 hours Max.Marks: 40

Part A

Answer all questions. Each question carries one mark.

1. Public Debt

2. Fiscal Policy

3. Taxable Capacity

4. Public Goods

5. Deficit Financing

5 x 1 = 5 Marks

Part B

Answer any four questions. Each question carries two marks.

6. Distinguish between impact, incidence and shifting of a tax?

7. What are the causes of taxation?

8. What is contingency fund?

9. What do you understand by free rider problem?

10. Distinguish between direct and indirect tax?

4 x 2 = 8 Marks

Part C

Answer any three questions. Each question carries four marks.

11. Explain the principles of fiscal fedaralism?

12. Distinguish between private and social goods?

13. Explain the problem of local finance?

14. Discuss the various instruments of fiscal policy?

15. Explain the causes of public expenditure?

3 x 4 = 12 Marks

Part D

Answer any one question. Question carries fifteen marks.

16. Explain the main problems of federal finance?

17. Discuss the various suggestions for improvement in federal financial relationship?

18. What are the objectives of public expenditure?

19. Examine the causes of growth of public expenditure in India?

1 x 15 = 15 Marks

You might also like

- 1st Puc Economics Annual Examination Question Paper Eng Version 2018-MandyaDocument2 pages1st Puc Economics Annual Examination Question Paper Eng Version 2018-MandyaKauser JahanNo ratings yet

- Ecoa (P-Vi)Document2 pagesEcoa (P-Vi)Judhajeet ChoudhuriNo ratings yet

- Gajab Exams Sanjal: Second Terminal ExaminationDocument1 pageGajab Exams Sanjal: Second Terminal ExaminationSantosh AryalNo ratings yet

- Syllabus For 5 SemesterDocument7 pagesSyllabus For 5 SemesterhashikaNo ratings yet

- PARTDocument3 pagesPARTGayathri K.NNo ratings yet

- Bussiness Economics BS IT F19Document1 pageBussiness Economics BS IT F19Waqas KhokharNo ratings yet

- 10th - MOCK TEST PAPER - 4 1654186567120Document5 pages10th - MOCK TEST PAPER - 4 1654186567120Rekha SangwanNo ratings yet

- Quiz SampleDocument1 pageQuiz SampleCrisDBNo ratings yet

- Chap 4Document33 pagesChap 4Lxh2202No ratings yet

- Basic Economic ProblemDocument10 pagesBasic Economic ProblemRashid okeyoNo ratings yet

- English Core Term 2 2Document3 pagesEnglish Core Term 2 2Divyajyoti KumarNo ratings yet

- Indian EconomyDocument1 pageIndian EconomyjeganrajrajNo ratings yet

- Board of Intermediate Education, A.P, Hyderabad Model Question Paper-Economics - I Year (W.E.F.2008-09) Time: 3 Hours Max - Marks:100 Section - ADocument2 pagesBoard of Intermediate Education, A.P, Hyderabad Model Question Paper-Economics - I Year (W.E.F.2008-09) Time: 3 Hours Max - Marks:100 Section - AamrkiplNo ratings yet

- S 08 Social ScienceDocument8 pagesS 08 Social Scienceompurohit85No ratings yet

- Macroeconomics Policy and Practice 2nd Edition Mishkin Test Bank 1Document36 pagesMacroeconomics Policy and Practice 2nd Edition Mishkin Test Bank 1charlessalasnekqjrfzyx100% (19)

- Social Studies School BasedDocument25 pagesSocial Studies School Basedj6whjgrmjfNo ratings yet

- Test Bank For Business in Action 7e by Bovee 0133773892Document23 pagesTest Bank For Business in Action 7e by Bovee 0133773892sporting.pintle.75ba100% (40)

- Economics For Managers: Tutorial Session 01Document31 pagesEconomics For Managers: Tutorial Session 01vishmi avishkaNo ratings yet

- 2 COa J9 MX E0 LJG 8 Fvi 6 TDDocument8 pages2 COa J9 MX E0 LJG 8 Fvi 6 TDraghav06kmuNo ratings yet

- Chapter 04Document26 pagesChapter 04Jieun LeeNo ratings yet

- Unit 11 Vocabulary Quiz For C1 PW3 2022Document3 pagesUnit 11 Vocabulary Quiz For C1 PW3 2022Michael AmaguayaNo ratings yet

- Managing The Public Sector 9th Edition Starling Test BankDocument6 pagesManaging The Public Sector 9th Edition Starling Test BankVictoriaWilliamsdwjie100% (16)

- Wild Ib8 TB 06Document36 pagesWild Ib8 TB 06RAYAN ALNAAMINo ratings yet

- Test Bank For Macroeconomics For Life Smart Choices For All2nd Edition Avi J CohenDocument56 pagesTest Bank For Macroeconomics For Life Smart Choices For All2nd Edition Avi J Cohenmarthaalexandra7xyfu1No ratings yet

- Jain College: Part A 1. Answer The Following Questions in One Sentence Each. 1×10 10Document2 pagesJain College: Part A 1. Answer The Following Questions in One Sentence Each. 1×10 10VikranthNo ratings yet

- Mock 3 Term 2Document6 pagesMock 3 Term 2Miriam JomonNo ratings yet

- Andhra University Question Papers 5 Years LLBDocument11 pagesAndhra University Question Papers 5 Years LLBchandumicrocosm198680% (5)

- Mec-006 EngDocument33 pagesMec-006 EngnitikanehiNo ratings yet

- Joy and Campion Economics 12thDocument4 pagesJoy and Campion Economics 12thkartik guptaNo ratings yet

- An Investment in Knowledge Pays The Best Interest.": Benjamin FranklinDocument121 pagesAn Investment in Knowledge Pays The Best Interest.": Benjamin FranklinPRACHI DASNo ratings yet

- Midterm Exam: Development Economics at ICEFDocument1 pageMidterm Exam: Development Economics at ICEFsashaNo ratings yet

- Name:: Unit 1 Study GuideDocument2 pagesName:: Unit 1 Study GuideJNo ratings yet

- Macroeconomics Policy and Practice 2nd Edition Mishkin Test Bank 1Document24 pagesMacroeconomics Policy and Practice 2nd Edition Mishkin Test Bank 1steven100% (48)

- 10 Classc10 Full SyllabusDocument2 pages10 Classc10 Full SyllabusKhushnuma Shafi Shah100% (1)

- Environment Management and Human Rights Oct 2019Document2 pagesEnvironment Management and Human Rights Oct 2019joe josephNo ratings yet

- Business Environment Nov 2017Document2 pagesBusiness Environment Nov 2017ziyanouziNo ratings yet

- Education Mar 2009 EngDocument4 pagesEducation Mar 2009 EngPrasad C MNo ratings yet

- Test Bank For Financial Management Principles and Applications 11th Edition TitmanDocument36 pagesTest Bank For Financial Management Principles and Applications 11th Edition Titmanuprightteel.rpe20h100% (44)

- Paper 1-Fundamentals of Economics and Management: MTP - Foundation - Syllabus 2012 - June2016 - Set 2Document5 pagesPaper 1-Fundamentals of Economics and Management: MTP - Foundation - Syllabus 2012 - June2016 - Set 2nehaa singhNo ratings yet

- Revision Sheet (1) EconomicsDocument9 pagesRevision Sheet (1) Economicsaaw75069No ratings yet

- Test Bank For Macroeconomics 11th Edition David ColanderDocument73 pagesTest Bank For Macroeconomics 11th Edition David Colanderhilaryfarleyer2No ratings yet

- Eco 12 CBSEDocument2 pagesEco 12 CBSEरजत जाँगडाNo ratings yet

- Tata Consultancy Services Started in 1968. MR.F.C Kohli Who Is Presently The Deputy Chairman Was Entrusted With The Job of Steering TCS. The Early Days Marked TCSDocument7 pagesTata Consultancy Services Started in 1968. MR.F.C Kohli Who Is Presently The Deputy Chairman Was Entrusted With The Job of Steering TCS. The Early Days Marked TCSAshok KumarNo ratings yet

- Society & PoliticsDocument4 pagesSociety & Politicssujata dawadi100% (1)

- Eps-07 Eng PDFDocument54 pagesEps-07 Eng PDFPrashant PatilNo ratings yet

- Business Studies XI PA 1 ADocument5 pagesBusiness Studies XI PA 1 AAshish GangwalNo ratings yet

- Examinations Final 6 Semester 2 Batch Principles of Marketing Time Allowed: 3 Hours /2014 06 / 16 DateDocument6 pagesExaminations Final 6 Semester 2 Batch Principles of Marketing Time Allowed: 3 Hours /2014 06 / 16 DateAli ArnaoutiNo ratings yet

- Chapter 4 Economic Development of Nations: International Business, 8e (Wild/Wild)Document28 pagesChapter 4 Economic Development of Nations: International Business, 8e (Wild/Wild)霍晓琳No ratings yet

- Principles of Applied Economics Learning Activity SheetDocument9 pagesPrinciples of Applied Economics Learning Activity SheetWendel limbagaNo ratings yet

- Principles of Applied Economics Learning Activity SheetDocument9 pagesPrinciples of Applied Economics Learning Activity SheetWendel limbagaNo ratings yet

- Xi Economics Set 3Document2 pagesXi Economics Set 3aashirwad2076No ratings yet

- Ib ch4 TBDocument27 pagesIb ch4 TBb77psmntm2No ratings yet

- Exploring Economics Answer KeyDocument40 pagesExploring Economics Answer KeyElşən Musayev100% (1)

- July 2013 and January 2014 SessionsDocument4 pagesJuly 2013 and January 2014 Sessionsgaurav dixitNo ratings yet

- Paper - Business Economics-Ii: Maharishi Institute of Management, BangaloreDocument3 pagesPaper - Business Economics-Ii: Maharishi Institute of Management, BangaloreDivakara ReddyNo ratings yet

- Luiss Magistrali Scienze Politiche Esempi ENDocument6 pagesLuiss Magistrali Scienze Politiche Esempi ENJana HNo ratings yet

- 01 English 30Document4 pages01 English 30AnjaliNo ratings yet

- Ecoa 01082021 1Document4 pagesEcoa 01082021 1susmita dSGUPTANo ratings yet

- Introducing a New Economics: Pluralist, Sustainable and ProgressiveFrom EverandIntroducing a New Economics: Pluralist, Sustainable and ProgressiveNo ratings yet

- Study Guide to Accompany Gwartney, Stroup, and Clark's Essentials of EconomicsFrom EverandStudy Guide to Accompany Gwartney, Stroup, and Clark's Essentials of EconomicsNo ratings yet