Professional Documents

Culture Documents

XII Model Accounting 2nd Term

Uploaded by

shankarharu120 ratings0% found this document useful (0 votes)

6 views8 pages1. Alpha Beta Limited issued 10,000 equity shares of Rs. 100 each at a 10% premium for public subscription. The shares were payable in installments - Rs. 30 on application, Rs. 50 on allotment, and Rs. 30 on final call. Applications were received for 15,000 shares and 2,000 applicants were allotted shares in full, with the remaining allotted on a pro rata basis. The excess money received on application was used towards sums due on allotment. Final call money of Rs. 400 was not received from 400 shares.

2. The trial balance of ABC Company Ltd. as of 31st Chaitra last year is presented. Additional information includes outstanding expenses of

Original Description:

Original Title

XII-Model-Accounting-2nd-Term

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. Alpha Beta Limited issued 10,000 equity shares of Rs. 100 each at a 10% premium for public subscription. The shares were payable in installments - Rs. 30 on application, Rs. 50 on allotment, and Rs. 30 on final call. Applications were received for 15,000 shares and 2,000 applicants were allotted shares in full, with the remaining allotted on a pro rata basis. The excess money received on application was used towards sums due on allotment. Final call money of Rs. 400 was not received from 400 shares.

2. The trial balance of ABC Company Ltd. as of 31st Chaitra last year is presented. Additional information includes outstanding expenses of

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views8 pagesXII Model Accounting 2nd Term

Uploaded by

shankarharu121. Alpha Beta Limited issued 10,000 equity shares of Rs. 100 each at a 10% premium for public subscription. The shares were payable in installments - Rs. 30 on application, Rs. 50 on allotment, and Rs. 30 on final call. Applications were received for 15,000 shares and 2,000 applicants were allotted shares in full, with the remaining allotted on a pro rata basis. The excess money received on application was used towards sums due on allotment. Final call money of Rs. 400 was not received from 400 shares.

2. The trial balance of ABC Company Ltd. as of 31st Chaitra last year is presented. Additional information includes outstanding expenses of

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 8

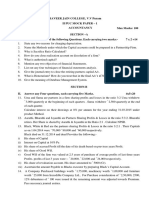

Aroma English Secondary School 14.A. NBL issued 1000 9% debenture of Rs.

1000 each at par redeemable after 5

BHARATPUR-10, CHITWAN years at 5% premium.

. Required: Journal Entries on issues and redemption. (2+1)

Group 'A'

B. A. The time allowed to produce 30 units of output is 3 hours. A worker

Very short answer questions : [11 1=11]

produces 500 units during the month. Wages rate per hours is Rs. 600 per

1. Write the meaning of Prospectus.

hour.

2. Define Public Company.

Required: Monthly wages of worker 2.0

3. States any two contents of memorandum of association.

15. A. Mention any two advantages of centralized purchasing. 2.0

4. Write the meaning of semi-variable overhead.

B. Following are the store related transaction for the month of magh:

5. Write any two features of debenture.

Magh – 1 : Opening Inventory 400 units @ Rs. 5 each.

6. Give the meaning of share capital.

Magh – 15 : Purchases 600 units @ Rs. 6 each.

7. If annual requirement is 60,000, Ordering Cost Rs 400 and carrying Cost Rs 2

Magh – 25 : Purchase 500 units @ Rs. 7 each.

find economic order quantity.

Sales during the month Magh 1200 units.

8. Give the meaning of material control.

Required: Cost of closing inventory and cost of goods sold using FIFO

9. Write two advantages of piece rate system of wages payment.

method under periodic inventory system. 3.0

10. State two limitation of cost accounting.

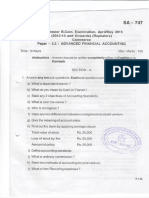

16. B. The trial balance of ABC company Ltd. as on 31st Chaitra last year is given below:

11. Write about codification of material. Particulars Dr. (Rs.) Cr. (Rs.)

Group 'B'

Share capital............................................................................................ 4,00,000

Short answer questions. [58= Reserve fund............................................................................................ 1,00,000

40] Purchase..................................................................................................

12,00,000

Sales........................................................................................................ 15,00,000

12. Alpha Beta Limited issued 10,000 Equity shares of 100 each at 10% Premium

Fixed assets.............................................................................................

7,60,000

for public subscription payable as follows: General expense......................................................................................

1,40,000

On Application Rs. 30 per share on allotment Rs. 50 per share and Rs 30 Profit and loss Appr. Account................................................................. 1,00,000

on final call Total 21,00,000 21,00,000

Additional Information

Applications was received for 15,000 shares. 2000 applicant were allotted in

i. Outstanding expenses Rs. 20,000 ii. Propose 10% dividend on share capital

full and balance application were allotted on prorate basis. The excess money iii. Depreciape Fixed Asset @10%

received on application were utilized towards the sum due on allotment. All Required: Work Sheet 5

the money was duly received except final call money from 400 share. 17. A. A company provides you the following detail of material.

Required Entries: Application, Allotment and Final Call (1.5+1.5+1) Consumption: 500 Kg to 800 Kg per day

13.A Himal Company issued shares at Rs 100 each to purchase the following assets Lead time: 4 days to 6 days

and Liabilities Re-order quantity: 3500 kg

Machinery Rs. 165,000; Patent and Trademark Rs. 135,000 Creditors Rs Required: Minimum Stock Level and Maximum Stock level (1+1)

35000, 17. B. BNC Company Ltd forfeited 400 Shares of Rs 100 each issued at 10%

Required: Journal on acquisition and purchase by issuing share (2+1) premium for non-payment final call of Rs 30. The company reissued 200

13. B. Write the meaning of calls in arrears and calls in advance shares to Rajaram Singh for Rs. 90 per share including premium

2 Required: Journal on Forfeiture, Reissue and Transfer 3

Required: Cost sheet showing

a. Material consumed b. Prime cost c. Factory cost

18. Trial balance of a limited company as on December 31, 2015 is given below: d.Production e. Profit

Particulars Debit Credit 21 A trial balance of Apollo Paints Ltd. as on 31st Assar 2078

(Rs.) (Rs.) Particulars Debit Rs. Particulars Credit Rs.

Gross Profit . 375,000

Carriage outward........................................................................... 5,000 Opening stock 100,000 Sales revenue 940,000

Machinery.....................................................................................

400,000 Purchase 500,000 Share capital 200,000

Furniture........................................................................................

110,000

Debtors..........................................................................................

100,000 Wages 40,000 Accounts payable 10,000

Discount........................................................................................

15,000

Insurance.......................................................................................

25,000 Carriage Outward 5000 Bank Loan 100,000

Cash...............................................................................................

55,000 Salaries expenses 60,000 Return Inward 3000

Rent...............................................................................................

40,000 Insurance 25,000 Dividend From 10000

Salaries..........................................................................................

60,000 Subsidiary

Share capital.................................................................................. 2,00,000

Plant and equipment 100,000 Commission 15000

10% Debentures............................................................................ 1,00,000

Creditors........................................................................................ 50,000 Cash 55,000 Reserve 10000

Commission received 15,000 Debtors 15000 Retained Earning 60,000

Reserve.......................................................................................... 10,000 12% Investment in 100,000

P/L appropriation account............................................................. 60,000 Subsidiary

810,000 810,000 Rent expenses 40,000

Additional Information:

Other Selling expenses 4,000

iii. Depreciation on machinery at the rate of 10%

iv. Commission received in advance Rs. 3,000 Machinery 300,000

v. Provision for tax Rs. 20,000 vi. Proposed dividend @ 10% Sales Return 4,000

Required: Total 1348000 Total 1348000

a. Profit and loss account b. P/ L appropriation account Closing stock…Rs. 50,000 Depreciation on Fixed Asset 10%

c. .Balance sheet

Advance Commision Rs. 3000 Income tax rate…25%

Group 'C' Wages outstanding Rs. 3,000 Proposed Dividend Rs 10%

Long answer questions. [2 8 = 16]

Required: i. Multi step Income statement. ii. Statement of RE

20.The details of manufacturing and other costs are as under: iii.Classified balance sheet.

Opening stock of raw material.Rs. 80,000 Purchases.........................Rs. 1,00,000

Carriage on purchases..............Rs. 20,000 Closing stock of raw materials.......Rs.

50,000

Direct wages.........................Rs. 3,00,000 Factory overhead.20% of direct wages

Office overhead.........10% of factory cost Selling and distribution overhead Rs. 5

per unit 22. A. Balance sheet of a company for two years is as follows:

Units produced........................5,000 units Unit sold.............................4,000 units Liabilities Year I Year II Assets Year I Year II

Profit on sale......................................25% Closing stock......................1,000 units (Rs.) (Rs.) (Rs.) (Rs.)

Share capital 4,00,000 5,50,000 Fixed assets 4,35,000 8,60,000 i. 300 shares of Rs. 100 each forfeited for non-payment of Rs. 30 per share on

Share premium – 55,000 Investments 1,10,000 70,000 first call and Rs. 20 per share on final call.

Retained 3,25,000 3,36,000 Inventories 70,000 96,000 ii. The above shares were re-issued @ Rs. 80 per share as fully paid up.

earnings 2,50,000 5,00,000 Debtors 1,25,000 1,45,000 Required: Journal entries for:

10% debentures 1,00,000 1,50,000 Cash and 3,35,000 4,21,000 a. Forfeitureb. Re-issue c. Transfer

Creditors bank 4. Nepal Company Ltd. issued 4,000, 7% debentures of Rs. 100 each. These

Total 10,75,000 15,91,000 Total 10,75,000 15,91,000 debentures are redeemable after 10 years with 5% premium.

Additional Information: Required: Journal entries for issue and redemption of debentures

i. Sale ins second year: Rs. 6,00,000 ii. Cost of goods sold: Rs. 3,37,000 5. A Co. Ltd issued 2,000, 10% debentures of Rs. 100 each at par to be redeemable

iii. Operating expenses: Rs. 1,00,000 iv. Purchase of fixed assets: Rs. 5,75,000 after 3 years at a premium of 5%

Required: Entries for issue and redemption of debenture

v. Sale of fixed assets: Rs. 15,000 vi. Sale of investments: Rs. 52,000

vii.Payment of dividend: Rs. 29,000 6. A company limited redeemed 12,000, 8% debentures of Rs. 100 at par, which

Required: Cash flow statement [4+1+2+1] were issued at 10% premium, by converting them into equity shares of Rs. 100

each issued at par.

Required: Entries for issue of debentures and conversion of debentures into

shares

Ans: Premium on issue of debenture Rs. 120,000

Additional Question for Practice 7. Rs. 1,000, 10% debentures of Rs. 100 each issued at par and redeemable at 5%

premium after 5 years.

1. P Company Ltd. issued 5000 shares of 100 each at a premium of 20% to Required: Journal entries for issue and redemption of debentures

purchase the following assets and liabilities of Q company Ltd.

8. Define balance sheet and write any two importance of it

Fixed assets............................Rs. 600,000 Loan..................................Rs. 100,000

9. Write two advantages of trial balance

Current assets.........................Rs. 200,000 Creditors...................................50,000 st

Required: Entries for purchase of assets and liabilities. 10. Trial Balance off Ganesh Company Ltd. as on 31 Dec. 2017 is given below:

Particulars Debit Particulars Credit

2. A company limited issued 5,000 equity shares of Rs. 100 each at Rs. 90 payable as (Rs.) (Rs.)

under: Opening stock 10,000 Sales 153,900

On application Rs. 30 On allotment Rs. 30 (including discount) On first and Furniture 50,000 Share capital 1,00,000

final call Rs. 30 Purchase 70,000 Purchase return 1,500

Applications were received for 10,000 shares. The allotment was made as Wages 20,000 Creditors 9,000

follows. Debtors 10,000 Reserve fund 16,000

Group Share applied Share allotted Salaries 15,000 Commission 1,000

I 2,500 2,500 Cash 6,000 Profit and loss a/c 13,600

II 2,500 Nil Machinery 100,000

III 5,000 2,500 Rent 8,000

It was decided to utilize excess application money in part payment of allotment. Insurance 6,000

All money were duly received except a holder who was holding 200 shares, 2,95,000 2,95,000

failed to pay first and final call money. Additional information:

Required: Journal Entries for

a. Application b. Allotment c. First final call i. Depreciation on furniture: by 10% ii. Outstanding wages: Rs. 2,000

3. The following information relating to shares are given, iii. Closing stock: Rs. 18,000 iv. Proposed dividend: 10%

v. Create a provision for bad debts 5% Wages............................................................................................

6,00,00 Profit and loss a/c..............................................

4,00,00

Required: [3+4+1+4+12] Rent...............................................................................................

0 0

Cash...............................................................................................

40,000 10,000

a. Trading account b. Profit and loss account 80,000 1,60,00

c. Profit and loss appropriation account d. Balance sheet 90,000 0

11. Trial Balance of a company as on last year is under: 60,000

Particulars Debit Particulars) Credit(R 12,70,0 12,70,0

(Rs.) s.) 00 00

Opening stock 20,000 Share capital 300,000 Additional Information:

Purchase 430,000 10% Debentures 100,000 i. 10% depreciation is to be charged on fixed assets

Furniture 150,000 Discount received 10,000 ii. Outstanding rent: Rs. 10,000

Machinery 128,000 P & L appropriation 170,000 iii. Prepaid wages: Rs. 15000

Building 300,000 account 6,000 iv. Proposed dividend: 10%

Debtors 40,000 Interest income 4,000 Required: a. Adjustment entries b. Work sheet

Tax paid for last year 3,000 Provision for bad debts 870,000 13. The Balance Sheets of a company as on 31st Ashadh are as under

Cash 15,000 Sales 54,000 14.

Carriage inward 3,000 Creditors Liabilities Year 1 Year 2 (Rs.) Assets Year 1 Year 2

Wages 25,000

(Rs.) (Rs.) (Rs.)

Salaries 50,000

Rent 60,000 Share capital 2,40,000 3,30,000 Machinery 1,20,000 1,35,000

Admin. expense 38,000

Selling expense 32,000 Share – 33,000 Building 1,41,000 3,81,000

Investment 210,000

premium

Interest 10,000 1,95,000 2,01,600 Investments 66,000 42,000

15,14,00 15,14,00 Retained

0 0 1,50,000 3,00,000 Inventories 42,000 57,000

earning

Additional information:

i. Closing stock: Rs. 65,000 ii. Rent payable for two months Long-term 60,000 90,000 Debtors 75,000 87,000

iii. Depreciate machinery and furniture by 10% iv.

loan

Transfer to general reserve: Rs. 20,000 Cash 2,01,000 2,52,000

v. Proposed final dividend: Rs. 50,000 Creditors

Required:

a. Trading account b.Profit and loss account c. Profit and loss appropriation Total 6,45,000 9,54,600 Total 6,45,000 9,54,600

account d. Balance sheet

12. Trial Balance of a company is as under Additional information

i. Sales for the year 2 : Rs. 3,60,000 ii. Cost of goods sold: Rs. 2,02,200

Debit (Rs.) Credit (Rs.) iii. Operating expenses: Rs. 60,000 iv. Sale of investment: Rs. 31,200

Purchase....................................................... v. Machinery purchased: Rs. 1,05,000 vi.

3,00,00 Sales..............................................................................................

6,00,00 Machinery sold: Rs. 9,000

Debtors......................................................... vii.

0 Creditors........................................................................................

0 Dividend distributed Rs. 17,400

Fixed assets..................................................

1,00,00 Share capital..................................................................................

1,00,00 Required: Cash flow statement

Advertisement..............................................

0 Commission..................................................................................

0 15. The Balance sheet of a company as on Ashadh 31 are as follows:

Liabilities 2071 2072 Assets 2071 2072 22. What do you understand by decentralized purchase? Write your answer with

(Rs.) (Rs.) (Rs.) (Rs.) suitable example. - [3]

Share capital............................

3,75,000 4,50,000 Machinery.....................................................................................

5,00,000 6,50,000 23. Clarify the meaning of bin card. [2]

Loan........................................

1,00,000 60,000 Furniture........................................................................................

75,000 50,000 24. Write in briefly any two objectives of material control. [2]

Creditors..................................

1,20,000 1,50,000 Stock.............................................................................................

1,00,000 60,000 25. Write, what do you understand by material control. [3]

Expenses due...........................

10,000 5,000 Debtors..........................................................................................

20,000 30,000 26. Mention any three essentials of material control. [3]

Retained 1,75,000 2,25,000 Pre-paid.........................................................................................

5,000 10,000

27. State the meaning of centralized and decentralized purchasing. [3]

earning..................................... Cash...............................................................................................

80,000 90,000

28. Write the meaning of purchase order.

Total 7,80,000 8,90,000 Total 7,80,000 8,90,000

29. Following are the transactions of a firm on purchases and issurance of materials

Additional Information:

for the month of Chaitra

i. Sales for the year 2072: Rs. 10,00,000 ii. Cost of goods sold: Rs. 7,05,000

Chaitra 1 Opening balance 1200 units @ Rs. 300

iii. Operating expenses: Rs. 2,25,000 iv. Sales of furniture: Rs. 20,000 Chaitra Purchases 600 Units @ Rs. 350

v. Purchased of machinery: Rs. 1,20,000 vi. Dividend paid: Rs. 45,000 Chaitra 7 Issued 600 units

Required: Cash flow statement Chaitra 14 purchases 400 units @ Rs. 370

Chaitra 20 Issued 400 units

1. Briefly, explain any three objectives of Cost Accounting Chaitra 24 Return from workorder 100 units

2. State any three importances of Cost Accounting. Chaitra 28 Issued 600 units

3. State any three differences between financial accounting and cost accounting. Required: Store ledger under First in First Out (FIFO) Method

4. Clarify the meaning of cost accounting. Also mention any two objectives of cost 30. The store transactions for the month of Bhadra are given below:

accounting. Bhadra 1 Opening stock 400 units @ Rs. 10 each

5. State any three advantages of Cost Account. Bhadra 3 Purchases 1000 units @ Rs. 11 each

6. Write in brief any three functions of cost Accounting.

Bhadra 5 Issued 500 units

Bhadra 7 Purchases 600 units @ Rs. 12 each

7. State any three limitations of cost accounting.

Bhadra 10 Issued 800 units

8. Give any three importance of cost accounting.

Bhadra 12 Return from department 100 units @ Rs. 12 each

9. Write any three objectives of cost accounting in brief. Bhadra 15 Issued 500 units

10. Write the meaning of cost accounting. Required: Stores ledger under FIFO method

11. Write the meaning of indirect expenses with an example [2] [5]

12. Clarify the meaning of direct expenses with a suitable example. [2] 31. Store transactions during the month of Magh are as under:

13. Classify cost according to its function. [2] Opening stock: Magh 1 500 units @ Rs. 10 per unit

Purchased Magh 4 600 units @ Rs. 11 per unit

14. Write the meaning of indirect cost with an example. [2]

Magh 9 600 units @ Rs. 12 per unit

15. Write in brief about the controllable and uncontrollable cost with example. [3] Magh 20 600 @ Rs. 12.50 per unit

16. With suitable example, write the meaning of fixed cost. [2] Issued: Magh 7 500 units

17. What do you mean by direct and indirect materials? [3] Magh 15 500 units

18. Write the meaning of variable cost with examples. [2] Magh 25 500 units

Stock verifications loss: Magh 28 20 units

19. Define variable and semi-variable cost.

32. Required: Stores under LIFO method

20. What do you mean by store control. [2]

33. Following information are given

21. Write any three duties of a storekeeper. [3]

Re-order period.....................8 to 10 days.

Daily consumption..........200 t0 400 units 43. Define piece rate system of wages payment and list out any two disadvantages of

Required: Minimum stock level [2] it.

[2]

34.Followingg information are provided: 44. Mention any two differences between time wage system and piece wage system.

Re-order period........................4 to 6 days [2]

Daily consumption..........400 to 600 units 45. State any two advantages of wage payment under piece rate system [2]

Re-ordering level......................3600 units 46. Mention any two advantages of time wages system. [2]

Required: Minimum stock level [2] 47. Write any three disadvantages of piece wage system

48. Following information relating to wages are given:

35.Following information are given [1+1=2] Time allowed per unit of output: 45 minutes

Maximum consumption per day.200 units Minimum consumption per day.....100 Wages rate per hour: Rs. 240

units Production units: 100 units

Re-order period.......................10-15 days Re-order quantity................1500 units Required: Total wages [2]

Required: Maximum stock level Ans: Rs. 18,000

49. The following information are given:

36.Following information are given Standard time to produce one unit15 minutes

Re-order period.......................4 - 6 weeks Hourly wage rate.............................Rs. 80

Weekly consumption.......2000 - 3000 kgs Total production......................1,000 units

Required: Minimum stock level [2] Required: Wages payable [2]

Ans: Rs. 20,000

37.The following information are given:

50. The working hour off a worker for a week is 40 hours. He worked 50 hours in

Annual requirement: .............36,000 units Ordering cost per order: ............Rs. 60

week. The normal wage rate is Rs. 100 per hour and overtime is paid at 120% of

Cost per unit: ................................Rs. 100 Carrying cost per unit ..............10% of

the normal rate.

inventory cost

Required: Economic Order Quantity [2] Required: Total earning of the worker [2]

Ans: Rs. 5,200

Following information are given in respect of a material:

38. 51. The standard time allowed for one unit of output is 90 minutes. The hournly

Annual requirement:..............50,000 units Cost per unit:...........................Rs. 100 wages rate is Rs. 100 per hour. A worker produced 20 units.

Cost per order:..............................Rs. 250 Carrying cost per unit:......25% of cost Required: Total wages of the worker [2]

Required: Economic order quantity Ans: Rs. 3000

[2] 52. Standard output in a day of 8 hours is 56 units. Rate per unit is Rs. 100 and a

worker worked 180 hours in a month.

39. The following information is given: Required: Monthly wages of a worker [2]

Annual requirement...................90,000kg Cost per kg.................................Rs. 50

Cost per order...................................Rs. 5 Carrying cost......10% of material cost Ans: Rs. 126,000

Required: Economic order quantity 53. The standard output per hour 10 units. The piece rate is Rs. 20 per unit and

40. Mention any two advantages of time rate system of wage payment. [2] worker worked 240 hours in a month.

41. Define time rate system of wage payment. Also mention any two advantages of it. Required: Monthly wages of worker [2]

[2+1]

42. What do you mean by direct wages and indirect wages? [3] 54. What do you mean by variable overhead and fixed overhead? [3]

55. Write the meaning of indirect expenses with an example. [2]

56. Define variable overhead with a suitable example. [2] Factory overheads: ..................Rs. 50,000 Administrative overheads: .Rs. 70,000

57. What do you mean by allocation of overhead? [2] Selling overheads: ...................Rs. 35,000

Following cost estimation were made for submitting the tender

58. What do you understand by fixed overhead? Mention any two features of it. Direct materials: ...................Rs. 1,20,000 Direct wages: .....................Rs. 80,000

[1+2=3]

Net profit: 10% of sales

59. Write the meaning of overhead. [2] Required: a. Cost sheet b.

60. Clarify the meaning of overhead cost with suitable example Tender sheet [3+7=10]

61. The details of manufacturing and other cost are as follow: Ans: (a) Total cost = Rs. 455,000, Sales = Rs. 5,05,556 (b) Total cost = Rs.

Purchase of raw materials: ...Rs. 2,00,000 Carriage on purchases:.......Rs. 20,000 312,000, Sales = Rs. 346,667

Direct wages:.........................Rs. 100,000 Factory overheads:..............Rs. 50,000 64. A company provides the following information relating to manufacturing 750

Administrative overhead:10% of prime cost Selling overhead:..........Rs. 10 per unit units of goods:

Sales of scrap:............................Rs. 5,000 Production:..........................4000 units Opening stock of raw materials:Rs. 2,50,000 Purchase of raw materialsRs. 4,50,000

Profit: ...................................20% of sales Direct wages............................Rs. 90,000 Depreciation on Machinery Rs. 10,000

Opening and closing stock Fuel and water..........................Rs. 20,000 Office salary.......................Rs. 50,000

Opening Closing Office stationery......................Rs. 15,000 Office expenses..................Rs. 15,000

Raw materials 40,000 Rs. 60,000 Additional Information

Work-in-progress........................................................................

20,000 Rs. 35,000 Selling and Distribution expenses: 2% of cost of production

Finished goods............................................................................

1000 units 2000 units Closing stock of raw materials: Rs. 1,50,000

Required: a. Cost sheet b. Opening stock of finished goods 200 units @ 800 per unit

Profit per unit [9+1 = 10] Closing stock of finished goods 400 units @ 1000 per unit

Ans: Prime cost 300,000; Factory cost Rs. 330,000; Cost of production Profit: 20% (20% of sales)

360,000 & cost of goods sold 270,000; Required: [52 = 10]

Cost of sales/Total cost Rs. 3,00,000 (b) Rs. 25 per unit a. Prime cost b. Factory cost c. Production cost

d. Profit e. Sales price

62. Following particulars are extracted from the records of a manufacturing

65. The net loss as shown by the financial account of a company is Rs. 30,000. On

company.

the reconciliation following facts were disclosed:

Direct material......................Rs. 3,00,000 Direct labour....................Rs. 2,00,000

a. Income tax paid Rs. 40,000 shown in financial account.

Works overhead....................Rs. 1,50,000 Office overhead...............Rs. 1,30,000

b. Administrative expenses over charged in financial account Rs. 20,000

Selling and distribution overheadRs. 65,000

c. Interest on investment credited in financial account Rs. 5,000

The following estimation were made for submitting a tender:

d. Depreciation charged in financial account Rs. 10,000 and in cost account Rs.

Direct material......................Rs. 5,00,000 Direct labour....................Rs. 3,00,000

1,000.

Works overheadOn the basis of direct labour.

Required: Reconciliation statement of cost and financial account [5]

Office overhead as well as selling and distribution overhead: On the basis of factory

cost.

Ans: Net profit as per cost account = Rs. 34,000

Profit ..................20% (20% on total cost)

66. While reconciling the financial and cost accounts, the following facts were

Required: a. Cost Sheet b. Tender sheet

disclosed.

Ans: (a) Prime cost Rs. 5,00,000; Cost of production Rs. 7,80,000; Total cost

Rs. 8,45,000; Sales Rs. 10,14,000; i. Net profit as per fianncial account Rs. 50,000

(b) Total cost Rs. 13,32,500; Sales Rs. 15,99,000 ii. Interest on investment Rs. 5,000

iii. Over valuation of closing stock in cost account Rs. 10,000

63. Cost information of a manufacturing company are given below

iv. Administrative expenses over charged in financial account Rs. 20,000

Direct materials: ...................Rs. 2,00,000 Direct wages: ..................Rs. 1,00,000

v. Depreciation charged in financial account Rs. 10,000 and in cost account Rs. Required: Reconciliation statement between cost and financial account profit

15,000 Ans: Net profit as per financial account Rs. 13,500

Required: Reconciliation statement of cost and financial account 72. The net profit shown by cost account is Rs. 1,20,000. Reconciling the cost and

Ans: Net profit as per cost account Rs. 70,000 financial accounts following descriptions were located:

67. The net profit shown by the financial statement of a company is Rs. 80,000. i. Works overhead recovered: in financial account Rs. 30,000 and in cost

While reconciling the cost and financial accounts the following facts were account Rs. 25,000

disclosed: ii. Depreciation charged in financial account Rs. 20,000 and in cost account Rs.

i. Work overhead Cost account: Rs. 15,000 24,000

Financial account: Rs. 10,000 iii. Income tax paid in financial account Rs. 10,000

ii. Dividend credited to financial a/c: Rs. 8,000 iv. Interest income credited in financial account Rs. 5,000

iii. Depreciation charged Cost account: Rs. 10,000 Required: Reconciliation statement of cost and financial account

Financial account: Rs. 1,000 73. Define prospectus and mention any two contents to be stated in prospectus

iv. Income tax paid: Rs. 6,000 [1+2=3]

68. Required: Reconciliation statement of cost account and financial account 74. What do you mean by private limited company? Mention any two features of a

69. On comparison of cost and financial accounts, the following facts were disclosed: private limited company. [1+2 = 3]

i. Profit as per cost account.............................................Rs. 80,000 75. What do you mean by Memorandum of Association? [2]

ii. Works overhead overcharged in cost account.............Rs. 30,000 76. State any thee features of Public Limited Company [3]

iii. Office overhead overcharged in financial account......Rs. 20,000 77. Write any three features of a company [3]

iv. Interest from investments:...........................................Rs. 10,000 78. Write the meaning of private limited company. 2]

v. Over valuation of opening stock in financial account. Rs. 15,000 79. State any three advantages of company. [3]

Required: Reconciliation statement of cost and financial account [5] 80. Write in brief any three advantages of public limited company. [3]

Ans: Net profit as per financial account = Rs. 85,000 81. State any three differences between private company and public company. [3]

70. The net profit as shown by the cost account is Rs. 1,60,000. On reconciliation the 82. Define company and state any two characteristics of a company.

following discrepancies were located. 83. Write in brief the meaning of issued capital and authorized capital. [2]

i. Factory expenses in financial account Rs. 30,000 and recovered in cost

84. Define ordinary shares. [2]

account Rs. 28,000

ii. Income tax paid in financial account Rs. 12,000 85. Define equity share and preference share.. [3]

iii. Interest income credited in financial account Rs. 3,000 86. State any three differences between equity share and preference share [3]

iv. Administrative expenses over recovered in cost account by Rs. 10,000 87. Define preference share. - [2]

Required: Reconciliation statement of cost and financial account [5] 88. Give the meaning of share capital. [2]

Ans: Net profit as per financial account Rs. 159,000 89. Show any two differences between shares and debentures.

71. Net profit as shown by Cost Account is Rs. 20,500 [5]

On reconciliation with financial account, the following facts were disclosed:

Expenses charged in

Heads of Expenditures Cost Financial

Account Account

Direct wages Rs. 12,000 Rs. 15,000

Factory expenses Rs. 10,000 Rs. 13,000

Admin. expenses Rs. 15,000 Rs. 12,000

Stock valuation at close Rs. 25,000 Rs. 22,000

Bank interest Rs. 1,000

You might also like

- Advanced Accounting: Computer Lab - PracticalDocument37 pagesAdvanced Accounting: Computer Lab - PracticalSaif UddinNo ratings yet

- Mca Accounts Model QuestionDocument2 pagesMca Accounts Model QuestionAnonymous 1ClGHbiT0JNo ratings yet

- 6104 - Accounting For Managers MBA FT 2021Document4 pages6104 - Accounting For Managers MBA FT 2021akshitapaul19No ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- Act 202 Spring 2020 Final AssignmentDocument7 pagesAct 202 Spring 2020 Final AssignmentSaiful Islam HridoyNo ratings yet

- Corrporate ModelDocument10 pagesCorrporate Modelnithinjoseph562005No ratings yet

- MCS MatH QSTN NewDocument7 pagesMCS MatH QSTN NewSrijita SahaNo ratings yet

- Mca Accounts Model QuestionDocument2 pagesMca Accounts Model QuestionAnonymous 1ClGHbiT0JNo ratings yet

- Take Away Assignment Managerial AccountingDocument4 pagesTake Away Assignment Managerial AccountingawalebuuxNo ratings yet

- AssignmentDocument11 pagesAssignmentKBA AMIRNo ratings yet

- Ca QP ModelDocument3 pagesCa QP Modelmahabalu123456789No ratings yet

- Cost & Management Accounting - MGT402 Paper PDFDocument42 pagesCost & Management Accounting - MGT402 Paper PDFArslan QamarNo ratings yet

- Sample Paper Class XII Subject-Accountancy Part ADocument5 pagesSample Paper Class XII Subject-Accountancy Part AKaran BhatnagarNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationDocument4 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationKashifNo ratings yet

- Bcom 3 Sem Corporate Accounting 1 21100518 Mar 2021Document5 pagesBcom 3 Sem Corporate Accounting 1 21100518 Mar 2021abin.com22No ratings yet

- CBSE Class 12 Accountancy Sample Paper 2018Document19 pagesCBSE Class 12 Accountancy Sample Paper 2018Mitesh SethiNo ratings yet

- Accountancy: Pre-Board Examinations 2078Document3 pagesAccountancy: Pre-Board Examinations 2078Herman PecassaNo ratings yet

- Accounting For Managers - QBDocument6 pagesAccounting For Managers - QBIm CandlestickNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034Document3 pagesLoyola College (Autonomous), Chennai - 600 034Harish KapoorNo ratings yet

- Question Compilation - 230316 - 072454Document9 pagesQuestion Compilation - 230316 - 072454Ranjan DhakalNo ratings yet

- Advanced Accounting: Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversityDocument13 pagesAdvanced Accounting: Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversitySaif Uddin33% (3)

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDocument158 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.No ratings yet

- Problems On Redemption of Pref SharesDocument7 pagesProblems On Redemption of Pref SharesYashitha CaverammaNo ratings yet

- Principles of Accounting15-MergedDocument100 pagesPrinciples of Accounting15-MergedMurtaza MustafaNo ratings yet

- Acounts Papaer II Preliminary Examination 2008 - 09Document5 pagesAcounts Papaer II Preliminary Examination 2008 - 09AMIN BUHARI ABDUL KHADERNo ratings yet

- XI Acc Cycle TestDocument1 pageXI Acc Cycle TestgauravNo ratings yet

- SET E XI ACCOUNTS Unit Test MTP 2023-24 by Praful SirDocument5 pagesSET E XI ACCOUNTS Unit Test MTP 2023-24 by Praful SirnisharvishwaNo ratings yet

- Sample Paper-2016 Subject: Class 11: Part - A (Financial Accounting - I)Document4 pagesSample Paper-2016 Subject: Class 11: Part - A (Financial Accounting - I)Šhûbh Šhôûřyâ KâšhyâpNo ratings yet

- Karnataka II PUC Accountancy Model Question Paper 17Document6 pagesKarnataka II PUC Accountancy Model Question Paper 17Kishu KishoreNo ratings yet

- Sample Paper For Class 11 Accountancy Set 1 QuestionsDocument6 pagesSample Paper For Class 11 Accountancy Set 1 Questionsrenu bhattNo ratings yet

- Mid-Term - Financial Accounting For Managers July 2010...Document4 pagesMid-Term - Financial Accounting For Managers July 2010...ApoorvNo ratings yet

- Accounts Ques (2 Files Merged)Document5 pagesAccounts Ques (2 Files Merged)Ishaan TandonNo ratings yet

- +1 Accountancy ONLINE Final Examination 2021Document5 pages+1 Accountancy ONLINE Final Examination 2021Rajwinder BansalNo ratings yet

- Class 12 Account Set 2 Grade Increment Examination Question PaperDocument10 pagesClass 12 Account Set 2 Grade Increment Examination Question PaperPrem RajwanshiNo ratings yet

- Delhi Public School, Nacharam Accountancy - Xi Practice Paper - 4Document4 pagesDelhi Public School, Nacharam Accountancy - Xi Practice Paper - 4lasyaNo ratings yet

- Class XI Practice PaperDocument4 pagesClass XI Practice PaperAyush MathiyanNo ratings yet

- Additional Practical Problems-20Document16 pagesAdditional Practical Problems-20areet2701No ratings yet

- Lovely Professional University Form/LPUO/AP-3 Homework No 2 School: Lovely School of Hospitality Department: ManagementDocument4 pagesLovely Professional University Form/LPUO/AP-3 Homework No 2 School: Lovely School of Hospitality Department: ManagementShan ChauhanNo ratings yet

- Financial ManagementDocument20 pagesFinancial Managementsanthanaaknal22No ratings yet

- Jaya College of Arts and Science Department of ManagDocument4 pagesJaya College of Arts and Science Department of ManagMythili KarthikeyanNo ratings yet

- 2015 Bcom Iisem AfaDocument4 pages2015 Bcom Iisem AfaSanthosh KumarNo ratings yet

- Test of T.B (2 Copies)Document4 pagesTest of T.B (2 Copies)vriddhi kanodiaNo ratings yet

- Practice Question 2Document2 pagesPractice Question 2Prerna AroraNo ratings yet

- Sample Question Paper IN AccountancyDocument7 pagesSample Question Paper IN AccountancyRahul TyagiNo ratings yet

- Accounts TestDocument6 pagesAccounts TestdishaNo ratings yet

- 11th BK Final Exam Quesiton Paper March 2021Document5 pages11th BK Final Exam Quesiton Paper March 2021Harendra Prajapati100% (1)

- Sample Paper - Accountancy XI Term 2Document3 pagesSample Paper - Accountancy XI Term 2Manaswi WareNo ratings yet

- 11 Com Pre-ExamDocument4 pages11 Com Pre-ExamObaid Khan50% (2)

- RE Exam FA Sem I MFM MMM MHRDMDocument4 pagesRE Exam FA Sem I MFM MMM MHRDMPARAM CLOTHINGNo ratings yet

- Model-Financial Accounting - Set1 - CZ21ADocument4 pagesModel-Financial Accounting - Set1 - CZ21AJuli SunNo ratings yet

- Tugas Pert.1Document3 pagesTugas Pert.1Hari YantoNo ratings yet

- Pre-Session HandoutDocument6 pagesPre-Session HandoutNavdeep SinghNo ratings yet

- TP2Document9 pagesTP2frenky bayuNo ratings yet

- Paper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Document56 pagesPaper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Basant OjhaNo ratings yet

- Co 2101Document3 pagesCo 2101PRIYA LAKSHMANNo ratings yet

- BBA I Financial Accounting 11007400Document2 pagesBBA I Financial Accounting 11007400Nazif SamdaniNo ratings yet

- Institutional Investment in Infrastructure in Emerging Markets and Developing EconomiesFrom EverandInstitutional Investment in Infrastructure in Emerging Markets and Developing EconomiesNo ratings yet

- Purchasing Power Parities and the Real Size of World EconomiesFrom EverandPurchasing Power Parities and the Real Size of World EconomiesNo ratings yet

- The Boston Institute of Finance Mutual Fund Advisor Course: Series 6 and Series 63 Test PrepFrom EverandThe Boston Institute of Finance Mutual Fund Advisor Course: Series 6 and Series 63 Test PrepNo ratings yet

- Disha: (Constitute of Symbiosis International University)Document1 pageDisha: (Constitute of Symbiosis International University)dishaNo ratings yet

- 0910 Business FarmDocument2 pages0910 Business Farmkeepst.louisfree766No ratings yet

- Ratio 5Document5 pagesRatio 5Edgar LayNo ratings yet

- Atlassian: Sales Case Study: Kamini SinghDocument5 pagesAtlassian: Sales Case Study: Kamini SinghSingh KaminiNo ratings yet

- Country Presentation - Sri LankaDocument28 pagesCountry Presentation - Sri LankaADBI EventsNo ratings yet

- FDD 47 DFBDocument1 pageFDD 47 DFBAmaryNo ratings yet

- Planning Tools and Techniques: With Duane WeaverDocument24 pagesPlanning Tools and Techniques: With Duane WeaverAbdirahmanNo ratings yet

- MKT501 - Major ProjectDocument5 pagesMKT501 - Major ProjectShalini KumarNo ratings yet

- FSI-000020509 - Packing List 20315Document1 pageFSI-000020509 - Packing List 20315Mangesh KadamNo ratings yet

- Your Bofa Core Checking: Account SummaryDocument4 pagesYour Bofa Core Checking: Account Summarychde795100% (1)

- HHW 2Document9 pagesHHW 2pranjalNo ratings yet

- Monopoly - Mid TermDocument15 pagesMonopoly - Mid Termsrikanth_balasubra_1No ratings yet

- Habbyfx Price Action Final 3.1Document41 pagesHabbyfx Price Action Final 3.1kimi75% (4)

- Tutorial 4Document10 pagesTutorial 4Yaonik HimmatramkaNo ratings yet

- Pradesh Milk FederationDocument13 pagesPradesh Milk FederationSandeep Hommardi SNo ratings yet

- RockStarCV-com - Askella Resume TemplateDocument1 pageRockStarCV-com - Askella Resume TemplateKartika WulandariNo ratings yet

- Implementing Merchandise Plans: Retail Management: A Strategic ApproachDocument30 pagesImplementing Merchandise Plans: Retail Management: A Strategic ApproachSanghamitra KalitaNo ratings yet

- Analyzing TransactionsDocument3 pagesAnalyzing TransactionsMark SantosNo ratings yet

- NEC Vs JCT ContractsDocument36 pagesNEC Vs JCT ContractsYash Tohooloo100% (3)

- 2017 Annual ReportDocument160 pages2017 Annual ReportRr.Annisa BudiutamiNo ratings yet

- Samsung - Strategic Marketing FinalDocument17 pagesSamsung - Strategic Marketing FinalRameeza AbdullahNo ratings yet

- The Flat Glass Market 2013-2023Document21 pagesThe Flat Glass Market 2013-2023VisiongainGlobal100% (1)

- Swot Analysis Paper: Third Quarter:Performance Task in Applied EconomicsDocument3 pagesSwot Analysis Paper: Third Quarter:Performance Task in Applied EconomicsHilaryNo ratings yet

- Marks and SpencerDocument32 pagesMarks and Spencermissira19100% (1)

- Case Study - Bordeos, Kristine - Sec 5Document6 pagesCase Study - Bordeos, Kristine - Sec 5Kristine Lirose BordeosNo ratings yet

- BBCT1013 Final ExamDocument23 pagesBBCT1013 Final Examnazirulhzq01No ratings yet

- Problem 1: P Company and Subsidiary Consolidated Working Paper Year Ended December 31, 2017Document6 pagesProblem 1: P Company and Subsidiary Consolidated Working Paper Year Ended December 31, 2017Vincent FrancoNo ratings yet

- CombinepdfDocument833 pagesCombinepdfleonardNo ratings yet

- Cash Against DocumentsDocument4 pagesCash Against DocumentsKureshi Sana100% (2)

- Finite Mathematics and Calculus With Applications 10th Edition by Lial Greenwell and Ritchey ISBN Test BankDocument55 pagesFinite Mathematics and Calculus With Applications 10th Edition by Lial Greenwell and Ritchey ISBN Test Bankcindy100% (25)