Professional Documents

Culture Documents

Income From Salary

Uploaded by

srisaidegree collegeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income From Salary

Uploaded by

srisaidegree collegeCopyright:

Available Formats

GOPALA K R M.

Com, NET, KSET

Assistant Professor of Commerce

Govt First Grade College, Magadi

INCOME FROM SALARY

Any salary accrued to the assessee during the previous year is taxable under the head ‘Income

From Salary’. The tax provision relating to computation of net salary income is laid under section

15, 16 and 17 of The Income Tax Act 1961.

Basis of chargeability Sec 15:

1. Any salary due from an employer or former employer to an assessee in the previous year

whether actually paid or not.

2. Any salary paid or allowed to an assessee during the previous year from an employer

though not due or before it became due.

3. Any arrears of salary paid or allowed to him in the previous year by or on behalf of an

employer, if not charged to income tax for any earlier previous year.

Definition Sec 17(1):

The term ‘salary’ include the following:

a. Wages

b. Any annuity or pension

c. Any gratuity

d. Any fees, commission, perquisites or profits in lieu of or in addition to any salary

e. Any advance salary

f. Any leave encashment received

g. Transferred balance in a recognized provident fund to the extent it is taxable

h. The contribution made by the central Government to the account of an employee under a

notified pension scheme referred to in section 80CCD.

Important points:

1. The relationship between the payer and receiver should be of employer and employee or

master and servant, then only the income is considered as salary income.

2. Salary income is chargeable to tax on the basis of due or receipt whichever is earlier.

3. Salary from more than one source or employer during the same previous year is taxable

under the head salary.

4. Any foregoing of salary by employee included in the salary income.

5. Any surrender of salary to the Central Government as per section 2 of the Voluntary

surrender Act 1961 is exempt from tax.

6. Salary income must be real and not fictitious.

GRN Income Tax -I Page 1

GOPALA K R M.Com, NET, KSET

Assistant Professor of Commerce

Govt First Grade College, Magadi

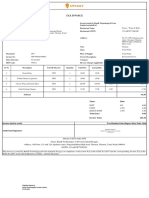

Computation of Net Salary Income

Assessee: Assessment year: 2019-20

Status : OR/NOR/NR Previous year : 2018-19

Category: Govt/Non Govt. PAN:

Particulars Amount Amount

Basic salary XXX

Bonus XXX

Commission XXX

Fees XXX

Interim Relief XXX

Advance Salary XXX

Arrears of salary XXX

Leave salary XXX

Gratuity XXX

Pension XXX

Allowance XXX

Employer’s contribution to RPF XXX

Interest credited to RPF XXX

Perquisites XXX

Profit-in-lieu of salary XXX

GROSS SALARY XXX

Less: Deductions U/S 16: XXX

a. Standard deduction XXX

b. Entertainment Allowance xxx XXX

c. Employment tax or Professional tax paid

XXXX

NET SALARY OR TAXABLE SALARY

Tax Treatment:

1. Basic salary: fully taxable

2. Bonus : fully taxable

3. Commission, Fees, interim relief, advance salary: fully taxable

4. Arrear of salary: it is fully taxable if it is not taxed in any earlier previous year

LEAVE SALARY Sec 10(10AA):

Encashment of leave by surrendering leave standing to one’s credit is known as “leave salary”.

Tax Treatment:

1. Leave salary received during the service period is fully taxable irrespective of the

category of employees.

2. Leave salary received at the time of retirement or leaving the job:

For tax purpose employees are categorized into two kinds, they are:

GRN Income Tax -I Page 2

GOPALA K R M.Com, NET, KSET

Assistant Professor of Commerce

Govt First Grade College, Magadi

a. Government Employees Sec 10(10AA)(i): in the case of a Central or State Government

employee, any amount received as leave salary in respect of period of earned leave at his

credit at the time of his retirement is exempt from tax.

b. Non Government Employees Sec 10(10AA)(ii): in the case of non Government employee

(including an employee of a local authority or public sector undertaking), received leave

salary at the time of his retirement is exempt to the extent of least of the following:

a. Cash equivalent to the leave standing to the credit to the employee at the time of his

retirement based on Average Salary

b. 10 X Average salary

c. Maximum statutory limit Rs. 3,00,000

d. Leave salary received actually

Computation of Taxable leave salary:

Particulars Amount Amount

Actual leave salary received XXX

LESS: Exempt being least of the following:

a. [leave entitled – leave availed] X Average salary XXX

b. 10 X average salary XXX

c. Maximum limit 3,00,000

d. Actual leave salary received XXX XXX

TAXABLE LEAVE SALARY XXX

NOTE:

1. Calculation of leave entitled:

Step-1: Eligible leave entitled;

Leave entitled as per service rule or employment rule xxx

Maximum leave entitled as per income tax rule 30days/1 month

Whichever is lower xxx

Step-2: Leave entitled;

Eligible leave entitled X no. of completed year of service

• Ignore any fraction of year of service

2. Calculation of average salary:

Salary includes Basic salary, Dearness allowance (if the terms of employment provided so)

and fixed rate of commission on turnover achieved by the employee for preceding 10months

from the date of retirement divided by 10.

GRN Income Tax -I Page 3

GOPALA K R M.Com, NET, KSET

Assistant Professor of Commerce

Govt First Grade College, Magadi

GRATUITY

Gratuity refers to gratuitous payment made by the employer to the employee for the past service

rendered.

Tax Provision:

Gratuity received while in service is fully taxable irrespective of the category of employee.

Death-cum-Retirement Gratuity Sec 10(10):

For tax purpose employees are categorized into;

1. Government Employees Sec 10(10) (i): government employees include the employee of

Central/State Government and local authority. These employees received any gratuity at the

time of retirement or in the event of their death are completely exempt from tax.

2. Non Government Employees Sec 10(10)(ii): these employees further divided into

a. Covered under gratuity Payment Act1972: this category includes employees of every

factory, mines, oil field, plantation, port etc., gratuity received by these employees at the

time of retirement or in the event of death is exempt to the extent of least of the

following:

1. 15 days salary for every year of service based on salary last drawn

2. Maximum limit Rs. 20,00,000

3. Gratuity actually received

Computation of taxable gratuity

Particulars Amount Amount

Actual gratuity received XXX

LESS: Exempt being least of the following:

a. 15/26 x No. of years of service x last drawn salary XXX

b. maximum limit 20,00,000

c. Actual gratuity received XXX XXX

TAXABLE GRATUITY XXX

Note:

1. If, any fraction of the year of service more than 6 months, it shall be taken as one full year. If

the period of service is 6months or less than 6 months shall be ignored. Example: 25 years 7

months 20 days shall be taken as 26 years. If it is 25 years 5 months 23days shall be taken as

25 years.

2. Last drawn salary means Basic Salary and Dearness Allowance of the retiring month of the

employee

b. Not covered under Gratuity Payment Act 1972: any gratuity received by these employees at the

time of retirement or in the event of death is exempt to the extent of least of the following:

a. Half months average salary for every completed year of service

b. Maximum limit Rs. 20,00,000

c. Gratuity actually received

GRN Income Tax -I Page 4

GOPALA K R M.Com, NET, KSET

Assistant Professor of Commerce

Govt First Grade College, Magadi

Computation of Taxable Gratuity

Particulars Amount Amount

Actual gratuity received XXX

LESS: Exempt being least of the following:

a. ½ X No. of completed year of service x average

salary XXX

b. maximum limit 20,00,000

c. Actual gratuity received XXX XXX

TAXABLE GRATUITY XXX

Note:

1. any fraction of the year of service shall be ignored

2. average salary means, Basic Salary, Dearness Allowance (if the terms of employment

provided so) and fixed rate of commission on turnover achieved by the employee for 10

months immediately preceding the month of retirement divided by 10.

PENSION Sec 17(1)(ii):

Pension refers to the regular periodical payment made by the employer to the employee after his

retirement. Pension received by the assessee during the previous year is fully taxable irrespective

of category

COMMUTED PENSION Sec 10(10A):

It is a lump sum payment in lieu of periodical payment. An employee may commuted entire his

pension or only a part of it.

TAX TREATMENT:

For tax purpose employees are categorized into

a. Government employees Sec 10(10A)(i): this category includes the employees of

State/Central Government, local authority and statutory corporation. Any commuted

pension received by these employees is completely exempt from tax.

b. Non Government employees Sec 10(10A)(ii): again these employees further divided into:

1. Employees who received gratuity at the time of retirement: it is exempt to the extent

of 1/3 of full value of commuted pension

2. Employees who did not received gratuity: it is exempt to the extent of ½ of full value of

commuted pension.

Note; pension received by the employees of UNO, Judges of high court and supreme

court, family pension received by the family members of armed forces is completely exempt

from tax.

GRN Income Tax -I Page 5

GOPALA K R M.Com, NET, KSET

Assistant Professor of Commerce

Govt First Grade College, Magadi

Compensation Received at the time of Voluntary Retirement Scheme (VRS) Sec. 10(10C)

Computation of Taxable compensation

Particulars Amount Amount

Actual compensation received XXX

LESS: Exempt being least of the following:

a. 3 X No. of completed year of service x salary

b. maximum limit XXX

c. salary at the time of retirement x balance months 5,00,000

of service left before the date of his retirement on XXX

superannuation XXX

TAXABLE COMPENSATION XXX

ALLOWANCES

Allowances refers to a fixed sum of money paid regularly in addition to salary for meeting some

particular requirements connected with the service rendered by the employee.

For tax purpose allowances are categorized into:

1. Taxable Allowances: following are the taxable allowances irrespective of the category of

employee;

a. Dearness Allowance (DA)

b. Fixed medical allowance (MA)

c. Tiffin/Lunch allowance

d. Servant allowance

e. Non-practicing allowance

f. Warden allowance

g. Overtime allowance

h. City compensatory allowance (CCA)

i. Project allowance

j. Rural allowance

k. Any special allowance not specified as exempt

2. Partially taxable Allowance:

• House Rent Allowance (HRA) Sec 10(13A): it is an allowance granted an employee to

meet the rental obligation of his residential accommodation. It is exempt to the extent of

least of the following :

a. Actual HRA received during the previous year

b. Excess of rent paid over 10% of salary

c. 40% or 50% of salary

Computation of taxable HRA

Particulars Amount Amount

GRN Income Tax -I Page 6

GOPALA K R M.Com, NET, KSET

Assistant Professor of Commerce

Govt First Grade College, Magadi

Actual HRA received XXX

LESS: Exempt being least of the following:

a. Actual HRA received XXX

b. (Rent paid – 10% salary) XXX

c. 40% OR 50% of salary XXX XXX

TAXABLE HRA XXX

NOTE;

1. Salary means Basic Salary, Dearness Allowance [if the terms of employment so provided]

and fixed rate of commission of turnover achieved by the employee for the period during

which rental accommodation occupied by him in the previous year.

2. 50% of salary is to be considered if the employee resides in Mumbai, Kolkata, Chennai and

Delhi. In other places consider 40% of salary.

3. In the following cases HRA is fully taxable:

a. Employee resides in his own house

b. Employee resides in a house for which he did not pay any rent

c. Actual rent paid by employee is less than 10% of salary

4. In the following cases HRA is fully exempt:

a. Employees of UNO

b. Judges of High Court and Supreme Court

c. Leaders of apposition and officials of parliament

2.children education allowance; it is exempt upto Rs. 100 per month per child for a maximum

of two children.

3. Hostel Expenditure allowance: exemption limited to Rs.300 per month per child for a

maximum of two children

4. Transport Allowance : It is an allowance given to the employees for meeting the expenses

while commuting between place of residence to the place of work. It is exempt only In case of blind

and orthopedically handicapped person exempt upto Rs. 3,200 per month. Any other person it is

fully taxable

5. Allowance to transport employees: it is an allowance granted to the employees who are

working in transport undertakings for meeting their personal expenditure while running between

one place to another. It is exempt to the extent of least of the following ;

a. 70% of such allowance or

b. Rs. 10,000 per month which ever is lower

6. Tribal area allowance or Scheduled area allowance: it is exempt upto Rs. 200 per month if,

the employee working in Madhya Pradesh, Tamilnadu, Uttar Pradesh, Karnataka, Tripura, Assam,

West Bengal, Bihar and Orissa.

GRN Income Tax -I Page 7

GOPALA K R M.Com, NET, KSET

Assistant Professor of Commerce

Govt First Grade College, Magadi

7. Underground allowance: it is an allowance granted to the employees working in unnatural

climates. It is exempt upto Rs.800 per month.

8. High altitude allowance: this allowance given to the members of Armed forces operating in

high altitude. If the altitude between 9000 to 15000 feet exempt upto Rs.1,060 per month. If the

altitude above 15,000 feet exempt upto Rs. 1,600 per month.

9. Counter Insurgency Allowance: it is granted to the member of Armed Force who are operating

away from their permanent base. It is exempt upto Rs. 3,900 per month.

10. Entertainment allowance; it is an allowance given to the employees to meet the expenditure

to entertain the customers and visitors of the company; it is first added to the salary income and

thereafter a deduction is given U/S 16(2) as under;

a. Government employees- (State/Central Government) exempt to the extent of least of the

following:

1. 20% of Basic Salary xxx

2. Maximum Rs. 5,000 note; actual expenditure not to be consider

3. EA actually received xxx

b. Non Government employees- not eligible for exemption, it is fully taxable

3. Tax Free Allowances:

these are the allowances are exempted on the basis of

a. Amount of such allowance xxxx or

b. Amount spent for specific purpose whichever is lower

For which the allowance is given xxxx

Following are tax free allowances;

• Travelling or transfer allowance

• Conveyance allowance

• Daily allowance

• Helper allowance

• Research allowance

• Uniform allowance

4. Exempted allowances: the following allowances are fully exempted:

• Foreign allowance to government employees

• Allowance from UNO

• Allowance to High/Supreme Court Judges

PROVIDENT FUND

Provident fund refers to a scheme established by the Government to provide social security to

the employee after his retirement. Under this scheme a fixed sum is deducted from the salary of the

employee as his contribution towards the fund and the employer also contributes simultaneously to

the same fund. This amount is invested in Gilt Edged Securities and interest earned thereon is also

credited to the PF a/c of the employee. At the time of retirement or at the time leaving the job, the

accumulated balance in the PF a/c is paid to the employee.

GRN Income Tax -I Page 8

GOPALA K R M.Com, NET, KSET

Assistant Professor of Commerce

Govt First Grade College, Magadi

Kinds of Provident Funds:

1. Statutory Provident Fund (SPF): it is a fund established by the Government under the

provision of The Provident Fund Act 1925 for the employees of Government and Semi-

Government .

2. Recognised Provident Fund (RPF): it is a scheme established under the provision of The

Provident Fund Act 1952 for Non Government employees. This scheme is recognised by the

commissioner of Income Tax.

3. Unrecognised Provident Fund (URPF): it is also established under the provision of The

Provident Fund Act 1952 for Non Government organization but it is not recognised by the

commissioner of income tax.

4. Public Provident Fund (PPF): it is a scheme established by the Government for the benefit

of general public to mobilize the personal savings. This fund is administered by SBI.

TAX TREATMENT;

Particulars SPF RPF URPF PPF

Employer’s Exempt Exempt upto 12% salary* Exempt from tax Employer

contribution from tax in excess of 12% is taxable does not

contribute

Employee’s own Eligible Eligible for deduction U/S Not Eligible for Eligible

contribution for 80C deduction U/S 80C for

deduction deduction

U/S 80C U/S 80C

Interest credited Exempt Exempt upto 9.5% per Exempt from tax Exempt

to PF from tax annum, in excess of 9.5%p.a from tax

is taxable

Lump sum Exempt exempt from tax subject to Payment received in respect Exempt

of employee’s own

payment at the from tax certain conditions, contribution is exempt from from tax

time of otherwise it is treated as tax. interest on employee’s

contribution is taxed as

retirement or URPF ‘income from other sources’

termination of and employer’s contribution

service and interest thereon is taxable

under the head ‘income from

salary’

Note:

1. Salary* means Basic salary, dearness allowance (if the terms of employment so provided)

and fixed rate of commission on turnover achieved by the employee.

2. Lump sum payment from RPF is exempt if the employee satisfied the following conditions:

a. He has rendered continuous service with his employer for a period of 5 years or more.

b. If the employee not able to fulfill the above condition due to his ill health or by the reason

of contraction or discontinuance of employer’s business or due to some other reason

beyond the control of the employee.

3. Transferred balance; an organization maintain URPF, it has obtained recognition to its

provident fund with existing balance from the commissioner of income tax during the

previous year. The amount transferred from URPF to RPF is called Transferred balance.

PERQUISITES

GRN Income Tax -I Page 9

GOPALA K R M.Com, NET, KSET

Assistant Professor of Commerce

Govt First Grade College, Magadi

Perquisites refers to any casual emoluments or benefits attached to an office or position in

addition to salary or wages. It may be provided in cash or in kind.

Definition: Sec 17(2): the term perquisites includes;

a. The value of rent free accommodation provided to the assessee by his employer.

b. The value of accommodation provided to the assessee by his employer at concessional rate.

c. The value of benefits or amenities granted to specified employees.

d. Any personal obligation of assessee paid by the employer.

e. The value of any other fringe benefit or amenities as may be priscribed.

TAX FREE PERQUISITES:

1. Computers, laptops given to an employee for official or personal use

2. Free medical facilities:

Where the treatment is taken Amount of exemption

Treatment taken in India:

a. In government hospital Exempt

b. In employer’s owned hospital Exempt

c. In hospitals recognised by the commission of IT Exempt

d. In unrecognized or private hospitals Nil

Treatment taken in outside India

a. Expenditure of medical treatment It is exempt only to the

extent permitted by the

Reserve Bank India

b. Travelling expenditure It is exempt only in case of an

employee whose gross total

income does not exceed

Rs.2,00,000

3. Employer’s contribution to staff group insurance scheme

4. Telephone facility including mobile phones provided to the employees

5. Leave Travel Concession (LTC)- exempt up to 2 journeys in a Block of 4 years

6. Transfer of movable assets (other than computers, car and electronic items) after using such

assets for more than 10 years by the employer.

7. Interest free loan not exceeding Rs. 20,000.

8. Gift in kind not exceeding Rs. 5,000.

9. Free ration to the members of Armed forces

10. Rent free accommodation to the judges of high/supreme court and to the employees in

remote area.

11. Any fees for refresher or management courses including cost of training to the employee

12. Reimbursement of expenditure for professional books and journals.

TAXABLE PERQUISITES

Following perquisites are taxable to all the employees:

1. Rent free accommodation

2. Accommodation at concessional rent

3. Obligation of employee paid by the employer

1. Rent free accommodation(RFA);

GRN Income Tax -I Page 10

GOPALA K R M.Com, NET, KSET

Assistant Professor of Commerce

Govt First Grade College, Magadi

For valuation of rent free accommodation, employees are categorized into;

a. Government employees

b. Private sector employees or other employees.

A. Unfurnished Rent Free Accommodation:

a. Government Employees: this category includes Central/State Government Employees

only.

Basis of valuation- the value of perquisite in respect of accommodation provided to such

employee is equal to the license fee which would have determined by the Government

in accordance with the rules framed by them for allotment of houses to its officers.

b. Private sector employees or other employees: under this category are covered those

employees who do not fall in the above category.

Basis of Valuation: the value of perquisite in respect of rent free accommodation

depends on salary of the employee and lease rent of the accommodation. This is shown

as under:

Population of city as per 2001 Where the accommodation is Where the accommodation is

census where accommodation is owned by the employer taken on lease or rent by the

provided employer

Exceeding 25 lakh 15% of salary* in respect of Amount of lease rent paid or

which the accommodation is payable or 15% of salary*,

occupied by the employer whichever is lower

Exceeding 10 lakh but not 10% of salary* in respect of Same as above

which the accommodation is

exceeding 25 lakh

occupied by the employer

Any other 7.5% of salary* in respect of Same as above

which the accommodation is

occupied by the employer

Note: salary* means

Basic salary xxx

A. All taxable portion of allowances other than DA xxx

B. Bonus xxx

C. Commission (any) xxx

D. Dearness allowance (if the terms of employment

Provided so) xxx

E. Fees xxx

F. Interim relief xxx

G. Leave salary pertaining to the current year xxx

Salary xxx

B. Furnished Accommodation:

Value as per Rent Free Accommodation (unfurnished) XXX

GRN Income Tax -I Page 11

GOPALA K R M.Com, NET, KSET

Assistant Professor of Commerce

Govt First Grade College, Magadi

ADD: 10% p.a on original Cost of Furniture provided xxx

Actual hire charge of furniture paid by the employer xxx

VALUE OF FURNISHED ACCOMMODATION XXX

2. Value of accommodation at concessional rent:

Value as per RFA xxx

Less: Rent paid by the Employee xxx

Value of perquisites xxx

Note; if the employee is provided with a hotel accommodation exceeding 15 days, the taxable value is 24% of

salary or Hire charges payable by the employer whichever is lower

3. Personal obligation of employee paid by the employer:

The following are the obligation of the employee paid by the employer:

a. Life insurance premium paid by the employer on behalf of employee

b. Income tax, professional tax of employee paid by the employer

c. Gas bill, electricity bill, water bill etc., of employee paid by the employer

d. Domestic servants appointed by the employee but salary of them paid by the employer

e. Reimbursement of employees’ children’s school/college fees

PERQUISITES TAXABLE TO SPECIFIED EMPLOYEES:

Specified employee refers to the employee who fulfill any one of the following conditions:

a. A Director employee in the employer company

b. An employee who has substantial interest in the employer company (who holds atleast 20% voting

power in the employer company)

c. An employee’s monitory receipts under salary income exceeds Rs. 50,000 after allowing

deductions U/S 16

Following are specified perquisites:

A. Domestic servants facility

B. Free Education facility

C. Free gas, water and electricity supply

D. Motor car facility

E. Free transport facility

F. Medical facility

G. Leave travel concession

A. Domestic servants facility: Servants like Cook, Sweeper, Gardner, watchman appointed by

the employer at the residence of the employee is taxable to specified employees’ only at the

value that actual salary paid by the employer to the servants. (if the servants are appointed

by the employee and salary paid by the employer is taxable as obligation of employee paid

by the employer)

B. Free Education Facility:

GRN Income Tax -I Page 12

GOPALA K R M.Com, NET, KSET

Assistant Professor of Commerce

Govt First Grade College, Magadi

1. Education facility provided to the children of employee, it is exempt upto Rs. 1,000

P.M per child (less any amount recovered from the employee)

2. Education facility provided to the other members of his house hold, actual cost incurred

by the employer is taxable (less any amount recovered from the employee).

C. Free gas, water and electricity supply:

1. Supply from own source of the employer: taxable value is equal to the manufacturing

cost per unit incurred by the employer.

2. Supplied from outside source:

a. Connection in the name of the employer – actual cost incurred by the employer is

taxable to specified employees’

b. Connection in the name of the employee – actual cost incurred by the employer is

taxable to all the employees as personal obligation paid by the employer.

D. Motor car facility:

1. If the car owned by the employee but expenses are met by the employer;

Car is used only for official purpose Taxable value is NIL

Car is used only for personal purpose by Actual expenditure incurred by the

the employee employer minus amount recovered from

the employee

Car is used for both official and private Actual expenditure incurred by the

purpose employer minus standard value*

2. If the car is owned by the employer and expenses met by the employer

Car is used only for official purpose Taxable value is NIL

Car is used only for personal purpose by Running and maintenance expenses plus

the employee 10% of original cost of the car minus

amount recovered from the employee

Car is used for both official and private standard value*

purpose

3. If the car is owned by the employer but expenses are met by the employee

Car is used only for official purpose Taxable value is NIL

Car is used only for personal purpose by 10% of original cost of the car (hire

the employee charges if car is on hire) plus driver salary

paid by the employer

Car is used for both official and private standard value**

purpose and expenses for private purpose

are paid by employee

NOTE:

a. if the employee has been provided with more than one car. Only one car must be

treated for tax purpose.

b. Standard value*

Capacity of car Expenses are met by Expenses are met by

employer* employee**

Is 1,600 cc or less Rs. 1,800 per month Rs. 600 per month

GRN Income Tax -I Page 13

GOPALA K R M.Com, NET, KSET

Assistant Professor of Commerce

Govt First Grade College, Magadi

Is more than 1600cc Rs. 2,400 per month Rs. 900 per month

If the driver (chauffeur) facility is also provided Rs. 900 per month is added to the above values.

c. Conveyance between office and residence is not taxable

E. Free transport facility:

Any transport facility provided by the employer to the employee or his family members, then

the taxable value is actual expenditure incurred by the employer minus amount recovered

from the employee.

F. Medical facility - already discussed in tax free perquisites

G. Leave Travel Concession - already discussed in tax free perquisites

FRINGE BENEFITS

Fringe benefits are additional benefits provided to the employee in the course of employment. They

are

1. Interest free loan or concessional loan

2. Use of employer’s movable assets

3. Sale of employer’s movable assets

4. Free holiday home facility

5. Free lunch

6. Gifts

7. Credit card facility 8. Club facility

1. Interest free loan or concessional loan:

Any interest free loan is provided by the employer to employee not exceeding Rs. 20,000 is

not taxable. If the amount of loan is exceeding Rs. 20,000 is taxable at the rate specified by

state Bank of India (any amount of interest recovered from the employee is deduct from the

total interest).

Any loan given for medical treatment of the employee of his family members is not taxable.

2. Use of employer’s movable assets:

Movable assets of employer other than car, computers, laptop, used by the employee is

chargeable to tax at 10% of original cot of the assets (if not owned by the employer consider

Hire charges) minus amount recovered from the employee.

3. Sale of employer’s movable asssets:

Any movable assets used by the employer sold to the employee at concessional rate. The

taxable valued of perquisite is computed as under:

Original cost of the asset xxx

Less; depreciation till the beginning of the year xxx

Xxx

Less; price paid by the employee xxx

Taxable value of perquisites XXX

Note; the rate of depreciation;

a. For computers and printers at 50% on written down value

b. For motor car at 20% on written down value

c. Any other assets is at 10% on original cost

4. Free holiday home facility

GRN Income Tax -I Page 14

GOPALA K R M.Com, NET, KSET

Assistant Professor of Commerce

Govt First Grade College, Magadi

Actual cost incurred by the employer is taxable minus any amount recovered from the

employee.

5. Free lunch/ meal;

If it is provided in office premises or outside the premises through non transferable paid

vouchers during office hours, cost of the meal upto Rs. 50 per meal is exempt in excess of it

is taxable.

6. Gift and gift vouchers:

Any gift in kind in excess of Rs.5, 000 is taxable. If the gift in cash or gift cheque are fully

taxable

7. Credit card facility:

Actual expenditure incurred by the employer is fully taxable

8. Club facility:

Actual expenditure incurred by the employer in respect of club facility used by the employee

or his family members is fully taxable.

Profit in lieu of salary:

‘Profits in lieu of salary’ is defined by section 17(3). These payments are made to an employee in lieu

of or in addition to salary. These are the following:

• Compensation for loss of employment or modification of the employment terms

• Payment from unrecognized provident or superannuation fund

• Payment under Keyman insurance policy

• Any payment before or after employment

• Payment in appreciation of service

Permissible Deductions from salary Sec 16:

a. Standard Deduction (sec 16(i)): it is a compulsory deduction Rs. 50,000 or the amount of

gross salary which ever is lower

b. Entertainment allowance [sec 16(ii)]; as explained earlier, entertainment allowance is first

included in salary and thereafter a deduction is allowed in accordance with the rules

mentioned under the head allowance.

c. Professional Tax or Tax on employment [Sec 16(iii)]; the following points to be kept in

view;

a. Deduction is available only in the year in which professional tax is paid

b. If the employment tax paid by the employer on behalf of an employee, it is first added in

the salary of the employee as ‘perquisite’ and thereafter the same amount is allowed as

deduction on account of ‘professional tax’ from gross salary

c. If the employment tax is paid by the employee it is deducted directly from the gross

salary.

GRN Income Tax -I Page 15

You might also like

- 02 - Taxation - Chapter-2 - Salary Part-1Document27 pages02 - Taxation - Chapter-2 - Salary Part-1apandeyproNo ratings yet

- Income From SalariesDocument15 pagesIncome From SalariesAyesha MominNo ratings yet

- Income From SalariesDocument21 pagesIncome From Salarieskeshav hurkatNo ratings yet

- InTax Formate 2021-22 Nuaman Khalid 03446046421 PDFDocument8 pagesInTax Formate 2021-22 Nuaman Khalid 03446046421 PDFMuhammad sheran sattiNo ratings yet

- Income From SalaryDocument35 pagesIncome From SalaryNistha RayNo ratings yet

- Direct Tax NotesDocument41 pagesDirect Tax NotesRenandNo ratings yet

- Unit - Ii - : Income Under The Head Salaries Definition of The Head 'SalariesDocument36 pagesUnit - Ii - : Income Under The Head Salaries Definition of The Head 'SalariesVENKATESWARLUMCOMNo ratings yet

- On Income From Salary - 20210202100403Document14 pagesOn Income From Salary - 20210202100403AJ WalkerNo ratings yet

- Lecture 4to9 - SalaryDocument15 pagesLecture 4to9 - SalaryVandana VaidyaNo ratings yet

- Taxation Direct and IndirectDocument9 pagesTaxation Direct and IndirectPrince HussainNo ratings yet

- A Study On Income From SalaryDocument65 pagesA Study On Income From SalaryShannon GonsalvesNo ratings yet

- Income From Salary QUESTIONSDocument20 pagesIncome From Salary QUESTIONSSiva SankariNo ratings yet

- Theory On Income From Salary Sybbi 2022 2023 Part 1Document4 pagesTheory On Income From Salary Sybbi 2022 2023 Part 1Rakesh PulishettyNo ratings yet

- Salary HP Liability in Special CasesDocument33 pagesSalary HP Liability in Special CasesMr FunambulistNo ratings yet

- Salary HP Liability in Special CasesDocument30 pagesSalary HP Liability in Special CasesParth ThakkarNo ratings yet

- Salary HP Liability in Special CasesDocument33 pagesSalary HP Liability in Special CasesPriyanshu tripathiNo ratings yet

- Income Tax: Ca - Cma - Cs Inter / EPDocument55 pagesIncome Tax: Ca - Cma - Cs Inter / EPINDIRA GHOSHNo ratings yet

- Retirement BenifitDocument10 pagesRetirement BenifitAyush SarawagiNo ratings yet

- Unit - III Income Tax - Salary Income Part - 1Document29 pagesUnit - III Income Tax - Salary Income Part - 1Poojitha BabuNo ratings yet

- Income Tax PPT RutujaDocument9 pagesIncome Tax PPT RutujaRUTUJA RAJPUTNo ratings yet

- Income Tax - SalaryDocument18 pagesIncome Tax - SalaryhanumanthaiahgowdaNo ratings yet

- Tax On Salary IncomeDocument15 pagesTax On Salary Incomeapi-19778412No ratings yet

- AllowancesDocument19 pagesAllowanceshanumanthaiahgowdaNo ratings yet

- Heads of Income - Income From SalaryDocument10 pagesHeads of Income - Income From SalaryBhavesh KhillareNo ratings yet

- Salary Material Py 2017-18Document16 pagesSalary Material Py 2017-18MS editzzNo ratings yet

- SalaryDocument42 pagesSalaryNidhi LathNo ratings yet

- CHAP - 5 SalaryDocument44 pagesCHAP - 5 Salarypriya chauhanNo ratings yet

- Notes - Income From SalaryDocument13 pagesNotes - Income From SalarySajan N ThomasNo ratings yet

- Whichever Is Lower: A) DeductionsDocument3 pagesWhichever Is Lower: A) Deductions8151 KATALE PRIYANKANo ratings yet

- Income From SalariesDocument19 pagesIncome From SalariesTaruna ShandilyaNo ratings yet

- Salary 1Document32 pagesSalary 1Divyansh JalkhareNo ratings yet

- Income From SalariesDocument7 pagesIncome From SalariesSneha PotekarNo ratings yet

- Q1 (A) Discuss Provisions Relating To Taxability of Salary According To Charging Section 15 of The Income Tax ActDocument40 pagesQ1 (A) Discuss Provisions Relating To Taxability of Salary According To Charging Section 15 of The Income Tax ActDhiraj YAdavNo ratings yet

- Computation of Income Tax Due and PayableDocument14 pagesComputation of Income Tax Due and Payablealia fauniNo ratings yet

- Head Salary PDFDocument48 pagesHead Salary PDFRvi MahayNo ratings yet

- Taxation 4Document8 pagesTaxation 4Bossx BellaNo ratings yet

- Income From SalaryDocument60 pagesIncome From SalaryroopamNo ratings yet

- Salary SimplifiedDocument16 pagesSalary SimplifiedaruunstalinNo ratings yet

- Module 09 - Compensation IncomeDocument35 pagesModule 09 - Compensation Incomeairwaller rNo ratings yet

- Income TaxDocument79 pagesIncome TaxRaj HanumanteNo ratings yet

- Module 2 - Income From SalariesDocument22 pagesModule 2 - Income From SalariesAishwarya NNo ratings yet

- ACC202 Employment Income NotesDocument11 pagesACC202 Employment Income NotesPhebieon MukwenhaNo ratings yet

- A18 Siddharth JainDocument46 pagesA18 Siddharth JainDhiraj YAdavNo ratings yet

- Unit 4 Return FillingDocument71 pagesUnit 4 Return FillingAnshu kumarNo ratings yet

- Income From Salaries: CA Final Paper7 Direct Tax Laws Chapter 4 CA - Rachana KumarDocument65 pagesIncome From Salaries: CA Final Paper7 Direct Tax Laws Chapter 4 CA - Rachana KumarRupaliNo ratings yet

- TAX-1001 (Fringe Benefit Tax)Document6 pagesTAX-1001 (Fringe Benefit Tax)Ciarie SalgadoNo ratings yet

- Income Tax RevisionDocument249 pagesIncome Tax Revisionsharmayashi1111No ratings yet

- Incone From Salary Ppts - pdf348Document48 pagesIncone From Salary Ppts - pdf348saloniagarwalagarwal3No ratings yet

- Computation of Total Income & Tax LiabilityDocument5 pagesComputation of Total Income & Tax LiabilityMehtab MalikNo ratings yet

- Direct Taxation: Gyanamayee PanigrahiDocument11 pagesDirect Taxation: Gyanamayee PanigrahiAJ WalkerNo ratings yet

- Taxation - Direct and Indirect - Chapter 4 PPT MkJy53msNBDocument32 pagesTaxation - Direct and Indirect - Chapter 4 PPT MkJy53msNBRupal DalalNo ratings yet

- Block 2Document90 pagesBlock 2Chandra ShekarNo ratings yet

- Problems On Business/Profession Income: SEM It AssignmentDocument9 pagesProblems On Business/Profession Income: SEM It AssignmentNikhilNo ratings yet

- TAX-1001 (Fringe Benefit Tax)Document5 pagesTAX-1001 (Fringe Benefit Tax)Hilo MethodNo ratings yet

- Chapter 4a PDFDocument14 pagesChapter 4a PDFBrinda RNo ratings yet

- Salary TaxDocument8 pagesSalary TaxRasel AshrafulNo ratings yet

- Salary Income LawDocument25 pagesSalary Income Lawvishal singhNo ratings yet

- About The Charts: CA Pooja Kamdar DateDocument8 pagesAbout The Charts: CA Pooja Kamdar DatekbalakarthikaNo ratings yet

- Income From SalaryDocument19 pagesIncome From SalaryAbhishek SinghNo ratings yet

- Income Taxation Module Compilation FinalsDocument107 pagesIncome Taxation Module Compilation FinalsJasmine CardinalNo ratings yet

- Disbur Form Series 100-500, 800 & 801Document12 pagesDisbur Form Series 100-500, 800 & 801Geno GottschallNo ratings yet

- 172 CIR v. ManningDocument5 pages172 CIR v. ManningPio MathayNo ratings yet

- Sample Development AppraisalDocument5 pagesSample Development AppraisalchrispittmanNo ratings yet

- Subh LabhDocument16 pagesSubh LabhKulbhushan BhagatNo ratings yet

- FBR Preparation Notes 1Document86 pagesFBR Preparation Notes 1Jąhąnząib Khąn KąkąrNo ratings yet

- Excel To TallyDocument5 pagesExcel To TallystuffidNo ratings yet

- Data DictionaryDocument2 pagesData DictionarysailushaNo ratings yet

- PT. Torabika Eka Semesta: Description PODocument1 pagePT. Torabika Eka Semesta: Description POicayunita ciklat0% (1)

- Alberta Garnishee Worksheet Per Pay PeriodDocument1 pageAlberta Garnishee Worksheet Per Pay PeriodJason MyerNo ratings yet

- CO 8000020836, B000672 - STANDARD FORMS & TUBES, Delivery - 00001 - STANDARD FORMS & TUBES, Buyer's Ref 300519Document1 pageCO 8000020836, B000672 - STANDARD FORMS & TUBES, Delivery - 00001 - STANDARD FORMS & TUBES, Buyer's Ref 300519ashishvaidNo ratings yet

- Rpmo October Payroll16Document22 pagesRpmo October Payroll16mennaldzNo ratings yet

- Taco 0067596020700018Document1 pageTaco 0067596020700018Meera CompanyNo ratings yet

- VAT LetterDocument2 pagesVAT Letterrhea CabillanNo ratings yet

- Sri Sai Electricals: Tax Invoice Cash/CreditDocument2 pagesSri Sai Electricals: Tax Invoice Cash/CreditKesava KumarNo ratings yet

- Inter CA DT JKSC Mumbai-Prof - Aagam Dalal (May 23 Nov 23)Document176 pagesInter CA DT JKSC Mumbai-Prof - Aagam Dalal (May 23 Nov 23)pradeep ozaNo ratings yet

- Adobe Scan 03 Apr 2022Document1 pageAdobe Scan 03 Apr 2022Venkatesh KumarNo ratings yet

- Account Holder name:MD BILLAL HOSSAIN Address: House No 132 Road No 08, Andolbaria Chuadanga-7221, BangladeshDocument1 pageAccount Holder name:MD BILLAL HOSSAIN Address: House No 132 Road No 08, Andolbaria Chuadanga-7221, Bangladeshshohag ranaNo ratings yet

- Surya YasaDocument2 pagesSurya YasaAh MuhayNo ratings yet

- Government Accounting: Accounting For Income and Other Cash ReceiptsDocument18 pagesGovernment Accounting: Accounting For Income and Other Cash ReceiptsJoan May PeraltaNo ratings yet

- 7713 16122023150018 UnlockedDocument12 pages7713 16122023150018 Unlockedloanbackend1997No ratings yet

- Common Questions TaxationDocument5 pagesCommon Questions TaxationChris TineNo ratings yet

- AprilDocument6 pagesAprilcindy pecañaNo ratings yet

- MT103, Kinpro vs. Claudio de SanctisDocument1 pageMT103, Kinpro vs. Claudio de SanctisGrehim IT consulting and Training LtdNo ratings yet

- E-Ticket For Agra Fort: Important InformationDocument3 pagesE-Ticket For Agra Fort: Important InformationAshish RaiNo ratings yet

- Disbursement VoucherDocument1 pageDisbursement VoucherGeorgina Intia100% (1)

- Business Taxation TutorialDocument36 pagesBusiness Taxation Tutorialchirag randhirNo ratings yet

- Dinner For Kirsten GillibrandDocument2 pagesDinner For Kirsten GillibrandSunlight FoundationNo ratings yet

- SBI Fee & ChargesDocument16 pagesSBI Fee & ChargesAks SomvanshiNo ratings yet

- Top 500 Taxpayers in The Philippines 2011Document10 pagesTop 500 Taxpayers in The Philippines 2011Mykiru IsyuseroNo ratings yet