Professional Documents

Culture Documents

Problems On Business/Profession Income: SEM It Assignment

Uploaded by

Nikhil0 ratings0% found this document useful (0 votes)

38 views9 pagesThis document discusses allowances, types of allowances like house rent allowance, and problems related to calculating house rent allowance tax exemption. It also discusses calculating gratuity amounts for employees, exemptions on gratuity based on whether the employee is government or non-government, and examples of calculating taxable gratuity in different scenarios.

Original Description:

WWE123

Original Title

IT PPT

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses allowances, types of allowances like house rent allowance, and problems related to calculating house rent allowance tax exemption. It also discusses calculating gratuity amounts for employees, exemptions on gratuity based on whether the employee is government or non-government, and examples of calculating taxable gratuity in different scenarios.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

38 views9 pagesProblems On Business/Profession Income: SEM It Assignment

Uploaded by

NikhilThis document discusses allowances, types of allowances like house rent allowance, and problems related to calculating house rent allowance tax exemption. It also discusses calculating gratuity amounts for employees, exemptions on gratuity based on whether the employee is government or non-government, and examples of calculating taxable gratuity in different scenarios.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 9

PROBLEMS ON

BUSINESS/PROFESSION INCOME

B.COM (ACCA) 2ND SEM

IT ASSIGNMENT

ALLOWANCES:-

Allowances is a fixed monetary amount paid by the employer to the

employee for meeting certain expenses, whether personal or for the

performance of his duty.

Types of allowances are :-

House rent allowance

Entertainment allowance

Children education allowance

Children hostel allowance

Transportation allowance

Tribal or schedule area allowance

Underground allowance for workers of coal mines

PROBLEMS ON HRA

IMPORTANT FACTORS TO BE CONSIDERED WHILE CLAIMING HRA TAX EXEMPTION U/S 10 (13A)

:-

Salary

Place of residence

Rent paid

Employment

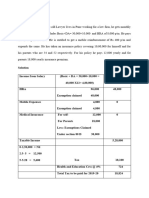

1) Manoj receives salary for the year 2014-15. He resides at Rajkot.The

data for salary is given below:

Particular Amount (annual

data)

Basic 200000

DA 100000

Bonus 50000

HRA 24000 (2000/Month)

Rent paid during the 36000 ( 3000/Month)

year

Calculation of HRA exemption :-

Salary for the purpose of HRA exemption calculation :-

Basic salary - 2,00,000

Dearness allowance -1,00,000

Total -3,00,000

10% of salary -30,000

40% of salary -1,20,000

Particular Amount

Actual HRA received 24,000

Rent paid Less 10% of salary 36,000 – 30,000 = 6,000

40% of salary 1,20,000

Available exemption (lease of the 6,000

above

Taxable HRA 18,000

Income Tax Exemption on Gratuity

Gratuity is a lump sum amount an employee gets when she retires,

resigns, dies or becomes disabled due to an accident or disease,

provided she had worked for at least five continuous years for the

same employer. In other words, it’s a financial reward or gratitude

an employee gets from an employer for rendering her service to the

company for a continuous period.

Companies in specific industries such as mines, oil fields, factories,

shops and plantations or shops having more than 10 employees are

mandatorily required to pay gratuity to their employees under the

Payment of Gratuity Act, 1972. Employers who are not covered by

this Act can also pay gratuity.

There are different rules for calculating gratuity and the tax to be

paid on it, for government employees, for those covered under the

Act and for those not covered under the Act.

Calculating gratuity

Gratuity is calculated based on two factors—the number of years

an employee completes with an organisation and her last drawn

salary at the organisation.

Here, salary includes basic salary and dearness allowance, and all

other components are excluded.

To calculate the amount of gratuity, multiply the total number of

years served with 15 days of salary. But remember 15 days’

salary is arrived at by dividing the last month’s salary by 26 and

multiplying the product by 15. This adjustment is not available for

workers not covered by the Payment of Gratuity Act.

So, if your last drawn salary was ₹50,000 (basic and dearness

allowance) and the employment tenure was 12 years, you will be

eligible for a gratuity of {(50,000/26)x15}x12 or Rs3,46,154.

Problems on gratuity

1) Mr. Ravi retired on 15.6.2109 after completion of 26 years 8 months of service

and received gratuity of Rs.6,00,000. at the time of retirement , his salary was

Basic salary: Rs 5000 pm

Dearness allowance: Rs 3000 pm (60%of which is for retirement benefits)

Commission: 1% of turnover(turnover in the last 12 months was Rs.12,00,000)

Bonus : Rs 12,000 pa

compute his taxable gratuity assuming:

A) He is non-government employee and covered by the payment of gratuity

act,1972.

B) He is non-government employee and not covered by payments of gratuity

act,1972.

C) He is a government employee

Answer: Mr Ravi

Retirement data- 15.06.2019

service period – 26 years

Gratuity received – 6,00,000

BASIC ALLOWANCE - 5000PM

DEARNESS ALLOWANCE- 3000PM

COMMUTED 1% OF 12,00,000 = 12,000PA=1000PM

BONUS 12000÷12 PA=1000pm

A)Non- government covered By POGA

EXEMPTION IS LEAST OF AMOUNT

1)GRATUITY RECEIVED 6,00,000

2)GOVERNMENT LIMIT 20,00,000

3)15÷26×(5000+3000) ×27 1,24,615

EXEMPT GRATUITY 1,24,615

B) NON-GOVERNMENT EMPLOYEE COVERED BY POGA

EXEMPTION IS LEAST OF AMOUNT

1)GRATUITY RECEIVED 6,00,000

2)GOVERNMENT LIMIT 10,00,000

3) 1/2×(5000+60%OF 3000) 1,01,400

+1000) ×26

GOVERNMENT EMPLOYEE

PARTICULAR GRATUITY EXEMPT TAXABLE

S

1) Payment of 6,00,000 1,24,616 4,75,385

Gratuity Act

2)NO Payment 6,00,000 1,0,1400 4,98,600

of Gratuity Act

3)GOVERNMENT 6,00,000 6,00,000 0

You might also like

- Salary IllustrationDocument10 pagesSalary IllustrationSarvar Pathan100% (1)

- Previous Year April To June July To March 2016-17 Nil 15000 2017-18 15000 16500 2018-19 16500 18000 2019-20 18000 19500Document4 pagesPrevious Year April To June July To March 2016-17 Nil 15000 2017-18 15000 16500 2018-19 16500 18000 2019-20 18000 19500Sumit PattanaikNo ratings yet

- Problems On Income From Salaries: Tax SupplementDocument20 pagesProblems On Income From Salaries: Tax SupplementJkNo ratings yet

- Retirement BenifitDocument10 pagesRetirement BenifitAyush SarawagiNo ratings yet

- Fifth PartDocument17 pagesFifth PartMahsinur RahmanNo ratings yet

- Assingment 1 Payroll TheoryDocument15 pagesAssingment 1 Payroll TheoryJenmark John JacolbeNo ratings yet

- SCDL - PGDBA - Finance - Sem 4 - TaxationDocument23 pagesSCDL - PGDBA - Finance - Sem 4 - Taxationapi-3762419100% (2)

- M12 Tax ActivityDocument6 pagesM12 Tax ActivityJanna RodriguezNo ratings yet

- SALARYDocument43 pagesSALARYDrishtiNo ratings yet

- Income Tax Salary NotesDocument48 pagesIncome Tax Salary NotesTanya AntilNo ratings yet

- Taxation 2004 SolvedDocument18 pagesTaxation 2004 Solvedapi-3832224100% (2)

- 2.3 Solutions Module - 2 PDFDocument9 pages2.3 Solutions Module - 2 PDFArpita Artani100% (1)

- CH 2.TaxSalary IncomeDocument13 pagesCH 2.TaxSalary IncomeSajid AhmedNo ratings yet

- Income From Salary AssignmentDocument4 pagesIncome From Salary AssignmentJhuma haqueNo ratings yet

- Q1 (A) Discuss Provisions Relating To Taxability of Salary According To Charging Section 15 of The Income Tax ActDocument40 pagesQ1 (A) Discuss Provisions Relating To Taxability of Salary According To Charging Section 15 of The Income Tax ActDhiraj YAdavNo ratings yet

- Income From SalaryDocument5 pagesIncome From Salarydbgdemo6No ratings yet

- Salary 1Document32 pagesSalary 1Divyansh JalkhareNo ratings yet

- Individual-Txation-FY-2018-19-with - JJDocument64 pagesIndividual-Txation-FY-2018-19-with - JJCOMPLETE ACADEMYNo ratings yet

- Problems On Taxable Salary Income-AdditionalDocument24 pagesProblems On Taxable Salary Income-AdditionalBasappaSarkar81% (48)

- Andrew TaxationDocument5 pagesAndrew Taxationkisiige ephraim brianNo ratings yet

- Direct Taxation: Gyanamayee PanigrahiDocument11 pagesDirect Taxation: Gyanamayee PanigrahiAJ WalkerNo ratings yet

- Heads of Income - Income From SalaryDocument10 pagesHeads of Income - Income From SalaryBhavesh KhillareNo ratings yet

- Retirement Benefits: Taxable Limits and ExemptionsDocument38 pagesRetirement Benefits: Taxable Limits and ExemptionsVineet GargNo ratings yet

- Income Tax: Topic: Gratuity Provident Fund Presented By, Prof - MadhumathiDocument12 pagesIncome Tax: Topic: Gratuity Provident Fund Presented By, Prof - MadhumathimadhumathiNo ratings yet

- Income From SalaryDocument60 pagesIncome From SalaryroopamNo ratings yet

- Save Tax Income ZakiaDocument5 pagesSave Tax Income Zakiakisiige ephraim brianNo ratings yet

- Trainee - Software Developer: Udchalo Campus Offer - Campus Drive 2020 Executive Software DeveloperDocument1 pageTrainee - Software Developer: Udchalo Campus Offer - Campus Drive 2020 Executive Software DeveloperDevenNo ratings yet

- Retirement Benefits - 2023Document6 pagesRetirement Benefits - 2023Given RefilweNo ratings yet

- Income Tax Calculator 2018-19Document15 pagesIncome Tax Calculator 2018-19Raju Ranjan SinghNo ratings yet

- Head Salary PDFDocument48 pagesHead Salary PDFRvi MahayNo ratings yet

- Enhancement in Gratuity Limit Under Payment of Gratuity ActDocument4 pagesEnhancement in Gratuity Limit Under Payment of Gratuity ActPaymaster ServicesNo ratings yet

- Salary SimplifiedDocument16 pagesSalary SimplifiedaruunstalinNo ratings yet

- Questions & Answers: 2 SalariesDocument26 pagesQuestions & Answers: 2 SalariesSabyasachi Ghosh67% (3)

- Chapter-6 (Salary)Document53 pagesChapter-6 (Salary)BoRO TriAngLENo ratings yet

- Unit III - The Payment of Bonus Act, 1965 - Labour LawsDocument13 pagesUnit III - The Payment of Bonus Act, 1965 - Labour Lawspatelia kevalNo ratings yet

- 3.tax Free PDFDocument3 pages3.tax Free PDFArun ShettarNo ratings yet

- Tax Planning For Salaried Employees - Taxguru - inDocument5 pagesTax Planning For Salaried Employees - Taxguru - invthreefriendsNo ratings yet

- Taxation of Employment IncomeDocument7 pagesTaxation of Employment IncomeJamvy Jose FernandezNo ratings yet

- Illustration 1 and 2 Salary - 21-22 Nov 2023Document5 pagesIllustration 1 and 2 Salary - 21-22 Nov 2023Chinmay HarshNo ratings yet

- Salary PDFDocument83 pagesSalary PDFGaurav BeniwalNo ratings yet

- Incone From Salary Ppts - pdf348Document48 pagesIncone From Salary Ppts - pdf348saloniagarwalagarwal3No ratings yet

- Whichever Is Lower: A) DeductionsDocument3 pagesWhichever Is Lower: A) Deductions8151 KATALE PRIYANKANo ratings yet

- Motilal Excel PlanDocument8 pagesMotilal Excel Plansourajit kunduNo ratings yet

- Salary StackDocument3 pagesSalary StackAMIT SINGHNo ratings yet

- Salary StackDocument3 pagesSalary StackAMIT SINGHNo ratings yet

- ATax - 01 Revision Salary IncomeDocument34 pagesATax - 01 Revision Salary IncomeHaseeb Ahmed ShaikhNo ratings yet

- Question Income From Salary Solved in ClassDocument4 pagesQuestion Income From Salary Solved in ClassFozle Rabby 182-11-5893No ratings yet

- Non Taxable Employee BenefitsDocument7 pagesNon Taxable Employee BenefitsGeomari D. BigalbalNo ratings yet

- Apptletter Vepl ApplicationidDocument14 pagesApptletter Vepl ApplicationidRavulapati NagarajuNo ratings yet

- Notice To Taxpayers 20 12 2022Document6 pagesNotice To Taxpayers 20 12 2022Anonymous nyOx1XmqzCNo ratings yet

- Income Under The Head Salaries: (Section 15 - 17)Document55 pagesIncome Under The Head Salaries: (Section 15 - 17)leela naga janaki rajitha attiliNo ratings yet

- Ca Ipcc Taxation Guideline Answer For May 2016 ExamDocument8 pagesCa Ipcc Taxation Guideline Answer For May 2016 Examileshrathod0No ratings yet

- Direct Tax SLE-2 Roll No KSPMCAA012 Dev ShahDocument5 pagesDirect Tax SLE-2 Roll No KSPMCAA012 Dev ShahDev ShahNo ratings yet

- Tax PresentationDocument40 pagesTax PresentationAshrafulIslamNo ratings yet

- SalaryDocument66 pagesSalaryFurqan AhmedNo ratings yet

- Ias 19 NotesDocument41 pagesIas 19 NotesTanyahl MatumbikeNo ratings yet

- Taxation Full Test 1 Unscheduled May 2023 Solution 1677483923Document38 pagesTaxation Full Test 1 Unscheduled May 2023 Solution 1677483923Vinayak PoddarNo ratings yet

- PDF Document E64dfec87bb0 1Document75 pagesPDF Document E64dfec87bb0 120BRM051 Sukant SNo ratings yet

- Abstract of Labour LawsDocument4 pagesAbstract of Labour LawsVishwesh KoundilyaNo ratings yet

- Best Cruiser in The WorldDocument80 pagesBest Cruiser in The WorldEl PinterNo ratings yet

- Benefit To The Employee (ESI Act & All Format Off Form)Document78 pagesBenefit To The Employee (ESI Act & All Format Off Form)Vijay KumarNo ratings yet

- 07 Seafarer's Agreement Casino (v8) REVISED 1117Document13 pages07 Seafarer's Agreement Casino (v8) REVISED 1117Sunil SinghNo ratings yet

- Labour Code OnSocal Security 2018-03-28Document209 pagesLabour Code OnSocal Security 2018-03-28Jagan MohanNo ratings yet

- Chap7 9 RIT Exclusion and InclusionDocument62 pagesChap7 9 RIT Exclusion and InclusionCarmela Dawn DelfinNo ratings yet

- The Ultimate Guide To Starting Your #1 Ecommerce BusinessDocument86 pagesThe Ultimate Guide To Starting Your #1 Ecommerce BusinessVytas67% (3)

- Payroll in Tally Prime Step by Step Training NotesDocument9 pagesPayroll in Tally Prime Step by Step Training NotesAnkita GuptaNo ratings yet

- Fiji Income Tax Cases 2006-9Document123 pagesFiji Income Tax Cases 2006-9Sara Raj67% (3)

- Salary StructureDocument6 pagesSalary StructureValluru SrinivasNo ratings yet

- Statutory Compliance Guide - Details of All Acts and Labour LawDocument10 pagesStatutory Compliance Guide - Details of All Acts and Labour LawMuthu ManikandanNo ratings yet

- Module 8 - Inclusion of Gross IncomeDocument4 pagesModule 8 - Inclusion of Gross IncomeReicaNo ratings yet

- The Payment of Gratuity Act, 1972Document33 pagesThe Payment of Gratuity Act, 1972madhuhaNo ratings yet

- Vendor ComplianceDocument42 pagesVendor ComplianceRavi KiranNo ratings yet

- Server Training Manual Restaurant OwnerDocument92 pagesServer Training Manual Restaurant OwnerPraveen Sharma100% (6)

- Travel Brochure For ST John Cantius - OberammergauDocument4 pagesTravel Brochure For ST John Cantius - Oberammergaumusic955No ratings yet

- Income TaxDocument21 pagesIncome TaxKhalid Aziz50% (2)

- MCQ - Unit 2Document15 pagesMCQ - Unit 2Niraj PandeyNo ratings yet

- Labor Law Review Midterm Exercise 2ndsem 2017-2018 KeyDocument18 pagesLabor Law Review Midterm Exercise 2ndsem 2017-2018 Keydanilo m.sampaga50% (2)

- AmendmentDocument113 pagesAmendmentrajisumaNo ratings yet

- Gratuity FormDocument17 pagesGratuity Formpanku09No ratings yet

- To The Owner / President / CeoDocument2 pagesTo The Owner / President / CeoChriestal SorianoNo ratings yet

- Rev Pension Order Post 1.1.06Document5 pagesRev Pension Order Post 1.1.06arijit_ghosh_18No ratings yet

- A Study On Income From SalaryDocument65 pagesA Study On Income From SalaryShannon GonsalvesNo ratings yet

- Hyatt Hotel Policies & Procedures - SalesDocument7 pagesHyatt Hotel Policies & Procedures - SalesKirby C. LoberizaNo ratings yet

- Chapter 2 Payroll Accounting 2018Document53 pagesChapter 2 Payroll Accounting 2018Gabi Mihalek100% (1)

- RA Sushi Bar RestaurantDocument1 pageRA Sushi Bar Restaurantkartheeka3No ratings yet

- Zoloto ValvesDocument58 pagesZoloto ValvesManwinder Singh GillNo ratings yet

- Engro Food HR FinalDocument24 pagesEngro Food HR FinalRehan Hassan KhanNo ratings yet

- Income From Personal Services and EmploymentDocument29 pagesIncome From Personal Services and EmploymentTabinda SeherNo ratings yet