Professional Documents

Culture Documents

Implementation Difficulties & Merits of International Financial Reporting Standard 17 Adoption in Ghana

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Implementation Difficulties & Merits of International Financial Reporting Standard 17 Adoption in Ghana

Copyright:

Available Formats

Volume 9, Issue 3, March – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165 https://doi.org/10.38124/ijisrt/IJISRT24MAR041

Implementation Difficulties & Merits of International

Financial Reporting Standard 17 Adoption in Ghana

Ansong Michael

Valley View University

Abstract:- The study examines the impact of IFRS 17 The global financial and business environment has

implementation and adoption in the Insurance Industry, witnessed rapid development, leading to economic

specifically, a case of the Life Insurance companies. The globalization, and linking worldwide markets. As a result of

objective of the paper is to highlight some key critical this challenge, it has become very difficult to ensure

areas of the implementation of IFRS 17 reference to the transparency in financial reporting and therefore aid

difficulties and merits that will arise from its full adoption economic decisions for stakeholders. The impact of the global

while ensuring the life insurance companies also align financial crisis, coupled with the COVID-19 impact on global

their distribution strategies towards its implementation. business, affected almost all sectors of the economy

worldwide. In Ghana, the financial sector reforms resulted in

I. INTRODUCTION the 2017 banking reforms, where the Bank of Ghana

embarked on a comprehensive reform agenda to clean up the

The IASB is an autonomous, non-governmental banking industry and strengthen the regulatory and

organization responsible for creating and endorsing supervisory framework for a more resilient banking sector.

International Financial Reporting Standards (IFRS). The The impact of the banking sector resulted in the need to

IASB was established in 2001 with the specific aim of undertake significant process and system changes, expand the

supplanting the International Accounting Standards capital base, and invest significantly in technology over the

Committee (IASC). The IASB is in charge of making and medium term, which is crucial to meeting customer demands

releasing IFRSs and exposure drafts, as well as approving and and being profitable in the long run (Price Waterhouse

releasing interpretations from the IFRS interpretations Coopers report, 2019).

committee and creating a single set of high-quality, clear,

enforceable, and globally accepted financial reporting Considering the impact of the banking sector reforms

standards based on clear principles (IAS Plus, Deloitte, 2023; coupled with the increase in minimum capital leading to

and IFRS Foundation, 2014). mergers, acquisitions, and collapses of some banks, it is

realized that the National Insurance Commission initially

Effective January 2023, IFRS 17 has taken the place of postponed the IFRS 17 implementation from 2023 to 2025;

insurance contracts (IFRS 4). The IASB issued the new however, the Commission has brought the date forward after

International Financial Reporting Standard 17 (“Insurance consultation with the Institute of Chartered Accountants

Contracts”) dated 18th May 2017. The deadline for Ghana. Given these challenges, the effect of the debt

implementation was January 2021, but it was later postponed restructuring on the bottom line of most insurance companies,

to January 2023. The purpose of the migration to IFRS 17 is and the time factor, it is expedient that the researcher

attributable to a lack of equity in the reporting and recognition investigates the challenges to be encountered by most

of assets and liabilities in terms of fair and historical valuation insurance companies in Ghana due to the IFRS 17 adoption.

in insurance contracts. According to the IASB, to ensure

standardization in insurance contract reporting and achieve a II. STATEMENT OF THE PROBLEM

higher degree of fairness and transparency in the quality of

financial reports, there is a need to implement IFRS 17. Insurance companies play an important role in the

economy. Even though the insurance sector has low coverage,

In the past decades, many countries have adopted the in recent times, it has witnessed tremendous development

International Financial Reporting Standards as their basis for concerning product development encompassing savings and

reporting. The European Union set the pace in 2015 by risk components. Financial reporting aims to provide high-

mandating all listed companies within their sub-region to start quality financial information based on qualitative

the adoption and implementation of IFRS in their financial characteristics that will help various stakeholders make

reporting. Currently, over 144 countries have adopted or appropriate decisions. There have been some studies on IFRS

converged with IFRS. adoption that include studies that focused on compliance and

disclosures in African countries (Zakari, 2014), compliance

Many developed and developing nations have adopted with IFRS by business entities in Ghana (Yiadom & Atsunyo,

IFRS as an important tool for standardizing international 2014), and the extent of application of IFRS in India (Kapoor

accounting principles (Ramanna & Sletten, 2014). According & Ruhela, 2013). Mbawuni, J. (2018), attempted to examine

to Price Waterhouse Coopers (2019), Ghana is among the first the perceived benefits and challenges of IFRS adoption in

fifteen countries in Africa to adopt or converge on IFRS. Ghana; however, the study focused on broad IFRS adoption

IJISRT24MAR041 www.ijisrt.com 582

Volume 9, Issue 3, March – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165 https://doi.org/10.38124/ijisrt/IJISRT24MAR041

and limited it to the views of Institute of Chartered Savings product, depending on the rules of the product;

Accountants Ghana (ICAG) members. the premium always remains the insured’s property.

The National Insurance Commission postponed the The insured is the person or organization covered by

adoption of IFRS 17 due to economic challenges (inflation insurance.

and debt exchange) in the last quarter of 2022 to make it

effective in January 2025. However, after deliberation with Historical cost is the acquisition price or the transaction

the Institute of Chartered Accountants of Ghana (ICAG), the price at which an asset is acquired or a transaction is done. It

effective date has been brought forward to January 2023. It is is the cash or cash equivalent value of an asset at the time of

therefore important to critically examine the difficulty and acquisition.

merit of IFRS 17 adoption by insurance companies from the

perspective of an insurance company with specific data to Fair value is the price that would be received to sell an

review the impact considering the economic challenges asset or paid to transfer a liability in an orderly transaction

encountered as a result of the financial crises, resulting in a between market participants at the measurement date. The

higher impairment of the company’s investment income parties involved act independently of each other. It refers to

(IFRS 9). the market value of an asset or liability agreed upon between

parties.

III. PURPOSE OF THE STUDY

D. Significance of the Study

The purpose of the study is to assess the implementation The study will contribute to the literature on

difficulties and merits of IFRS 17 adoption in Ghana. The International Financial Reporting Standards by providing the

merit of the study is vital since every insurance company difficulties and merits of IFRS 17 adoption in Ghana. The

must apply the standard within a relatively short period. The purpose of this study is to examine the views from the

study will use descriptive research methods to systematically insurance companies’ perspective regarding the

explain the information obtained in describing the implementation of IFRS 17. The research will also help

phenomena. Moreover, secondary data (product mix for the stakeholders become aware of the data quality challenges and

first quarter of 2023 from the National Insurance cost impact of IFRS 17 implementation. Moreover, the study

Commission) will be used in analysing the risk and savings will inform most insurance companies on the product mix to

impact of IFRS 17 adoption in the industry. adopt to be profitable in the long run.

A. Research Objectives IV. LIMITATIONS OF THE STUDY

The objective of this study is to examine the difficulties

and merits of implementing International Financial Reporting In descriptive research, it will be challenging to

Standards (IFRS) 17 for insurance companies in Ghana, with maintain control over the variables because the

a focus on the life insurance industry. questionnaire's wording has an impact. Descriptive research

offers a static view of the present circumstances and is unable

B. Variables to determine causal linkages.

The independent variables will be facets of the

difficulties and merits, and the dependent variable will be the A. Delimitations

IFRS 17 implementation in Ghana. The study will be limited to the technical units of

specific life insurance companies.

C. Definition of Terms

The IFRS Foundation and the IASB have issued IFRS, Theoretical Framework

a set of accounting and financial reporting guidelines that the IFRS 17 aims to provide accurate and uniform

majority of businesses use when preparing financial information that truthfully reflects the impact of insurance

statements. contracts on an entity's financial status, operations, and cash

movements. IFRS 4 defines insurance contracts as

The IFRS Foundation is a non-profit organization that agreements in which an insurance firm assumes the insurance

oversees financial reporting standards. Its main objectives risk of the policyholder (IFRS Foundation, 2020). IFRS 17

include the development and promotion of IFRS. will take the place of IFRS 4, and it will go into effect in

January 2023. The original implementation date of January

IASB is an independent, private sector body (a group of 2021 was postponed to January 2023. IFRS 17 is centered on

experts with an appropriate mix of recent practical establishing guidelines for how insurance contracts should be

experience) that develops and approves IFRS. acknowledged, assessed, and displayed, as well as developing

an accounting framework specifically for insurance contracts.

Data quality is the measure of data conditions, relying According to Al-Mashhadan (2020), “IFRS 4 does not require

on factors useful for a specific purpose, such as completeness, that the assets and liabilities are evaluated in insurance

accuracy, and timeliness. contracts in this way, as the assets are evaluated at their fair

value while liabilities are evaluated based on their historical

The risk policy covers the insured only for the risk of value." However, IFRS 17 brings in the standardization of

the occurrence of the event. unifying assets and liabilities at fair value.

IJISRT24MAR041 www.ijisrt.com 583

Volume 9, Issue 3, March – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165 https://doi.org/10.38124/ijisrt/IJISRT24MAR041

IFRS 4 lacks specific criteria for the initial valuation of V. METHOD

insurance contracts, leading to varying approaches and

inconsistencies between subsidiaries and the parent company The research was conducted in Koforidua, Ghana,

regarding the use of historical value and fair value (Longoni, during the IFRS meeting held for Chief Finance Officers in

2019). IFRS 17 deals with this issue by mandating the first Ghana for Insurance Companies by the National Insurance

recognition of group contracts based on groups within a Commission and in Accra, Ghana. The conference for the

portfolio. Groups of contracts are acknowledged based on the meeting was the right time since the Institute of Chartered

earliest occurrence of the commencement date of the Accountants of Ghana had mandated that all insurance

coverage term, the due date of the first payment from the companies should be compliant by 2023. Due to the global

policyholder, and when a group contract becomes relevance of IFRS 17 adoption, it was prudent to examine the

burdensome. The implementation of IFRS 17 is anticipated to difficulties and merits of IFRS 17 adoption and

enhance transparency regarding both present and future implementation in Ghana.

profitability. This will establish comparability by establishing

a standardised framework for all insurance contracts, thereby A. Population and Research Design

reflecting current information on all cash flows generated The population for the study was 50 people in the

from contracts (Swiss Re., 2018). technical and finance departments of various life insurance

companies in Ghana. This included chartered accountants and

Agyei-Mensah (2013) said that implementing actuarial analysts, who are projected to be impacted by IFRS

international financial reporting standards in Ghana will 17 implementation and adoption. It was easier to collect data

improve the quality of financial statement disclosures. The from the respondents because they were all gathered at one

author examined the financial reporting quality in Ghana point in time. A cross-sectional survey was used to get data

before and after implementing IFRS. The study revealed that on the challenges and difficulties of the IFRS 17

adopting IFRS improves the quality of financial disclosures implementation.

and demonstrates adherence to International Financial

Reporting Standards by listed companies. Respondents’ evaluation of the difficulties of IFRS 17

adoption and implementation in Ghana.

In general, the adoption of IFRS 17 is important for

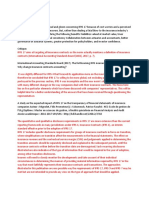

comparability, accountability, and promoting transparency in Table 1: The Table below Shows the Perceived

the insurance sector, enhancing risk management practices, Difficulties of the 50 Respondents

facilitating global harmonization of accounting standards, Indicator Overall Mean

and strengthening investor confidence. Data Quality 3.88

IT Infrastructure 3.81

Conceptual Framework Resource Allocation 3.75

The conceptual framework below shows the link Complexity of Contracts 3.72

between the difficulties and merits of the implementation of Regulatory requirement 3.70

IFRS 17 by life insurance companies in Ghana. Actuarial Assumptions 3.65

Consistency of Accounting methods 3.64

External Market Factors 3.61

Source Data: 2023/4 scale: strongly agree 5, agree – 4,

neutral – 3, disagree – 2, strongly disagree – 1.

From Table 1, it is realized that data quality is ranked as

the highest challenge with a mean of 3.88, followed by IT

infrastructure (mean of 3.81), resource allocation (mean of

3.75), complexity of contracts (mean of 3.72), regulatory

requirements (mean of 3.70), actuarial assumptions (mean of

3.65), consistency of accounting methods (mean of 3.64), and

external market factors (mean of 3.61).

Respondents’ evaluation of the benefits of IFRS 17

implementation in Ghana.

Fig 1: IFRS 17 Implementation (Michael Ansong)

IJISRT24MAR041 www.ijisrt.com 584

Volume 9, Issue 3, March – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165 https://doi.org/10.38124/ijisrt/IJISRT24MAR041

Table 2: The 50 Respondents will Receive external market forces is consistent with the studies of

Benefits, as Shown in the Table Below Yiadom and Atsunyo (2014).

Indicator Overall Mean

Improved transparency and comparability 4.22 B. Benefits of IFRS 17 Implementation and Adoption in

Enhanced Risk Management 4.13 Ghana

Improved Investor Confidence 4.01 The results revealed that the implementation and timely

Consistent Global Standards 3.89 adoption of IFRS 17 in Ghana will result in enormous

Regulatory oversight 3.78 benefits to the insurance industry. The study shows that

Market Efficiency 3.59 classification will lead to easier comparability of financial

Source Data: 2023/4 scale: strongly agree 5, agree – 4, data across borders and enhance transparency. The

neutral – 3, disagree – 2, strongly disagree – 1. respondents were of the view that IFRS 17 introduces a

comprehensive accounting standard for insurance contracts,

From Table 2, it is realized that improved transparency which will allow investors and other stakeholders to make

and comparability are ranked as the highest benefit with a informed decisions. They further stated that IFRS 17

mean of 4.22, followed by enhanced risk management (mean promotes better understanding and effective management of

of 4.13), improved investor confidence (mean of 4.01), insurance risks by requiring insurers to provide more detailed

consistent global standards (mean of 3.89), regulatory information about insurance liabilities and assumptions.

oversight (mean of 3.78), and market efficiency (mean of

3.59). Moreover, the adoption of IFRS 17 enhances investor

confidence through the provision of greater transparency and

VI. DISCUSSION AND FINDINGS reliability of financial information, which will result in

improved access to capital at a lower cost. Other benefits

The purpose of this study is to examine the include consistent global standardization of contracts,

implementation difficulties and merits of IFRS 17 in Ghana, facilitation of regulatory oversight, and enhanced market

specifically in the insurance industry (life businesses). The efficiency.

discussion is divided into two parts: the difficulties and the

benefits afterwards. VII. CONCLUSION

A. Anticipated Difficulties of IFRS 17 Implementation and Implementation and adoption of IFRS 17 show great

Adoption in Ghana achievement in the insurance industry. IFRS 17 aims to

The results of this paper reveal, referring to the technical enhance comparability across insurers worldwide and

and financial teams of the selected life insurance companies, provide various stakeholders with better insights into

that IFRS 17 has brought extensive challenges that call for financial performance and risk exposure. However, its full

stakeholder consultations for resolution. It was shown that the adoption and implementation pose a lot of challenges for the

most prominent challenge is data quality. Data integrity, insurance industry, comprising data management, actuarial

consistency, and reliability, according to the respondents, assumptions, substantial investment in technology and

have a significant impact on data quality. The quality, systems, training of staff, and stakeholder awareness through

accuracy, and completeness of data available to insurance robust communication with stakeholders and intensive

companies play a significant role in implementing IFRS 17. collaboration across various departments within the insurance

Data quality is integral to the successful implementation of companies.

IFRS 17 and has far-reaching implications for insurers’

financial responsibility, risk management, decision-making, Even though there are various difficulties, the merits of

compliance, operational efficiency, and stakeholder IFRS 17 cannot be underestimated. Apart from improving

relationships. From the review and responses, it was noted transparency and enhancing comparability, IFRS 17 can help

that all life insurers must prioritize data quality initiatives to stakeholders make better and more informed business

ensure accurate, reliable, and transparent financial decisions, boost investor confidence, and strengthen the

information under the IFRS 17 standard. regulator's position.

The paper also found other major problems related to REFERENCES

IFRS 17 besides the quality of the data. These include IT

infrastructure and the training of different stakeholders [1]. Al-Mashhadani, B. N. A. (2020). Challenges of

through resource allocation. This will lead to the challenge of applying IFRS 17 “Insurance Contracts” in the Iraqi

determining how well users of the financial statements Environment. Tikrit Journal of Administration and

understand the standards and have experience with them. The Economics Science, 16 (49 par 1), 77-96.

other challenges found in this study are the complexity of [2]. International Accounting Standards Board (2018).

contracts (this has to do with the various measurements used), Conceptual Framework for Financial Reporting 2018.

regulatory requirements (which embody cost and penalty for Available at https://www.iasplus.com/en/standards/

non-compliance), actuarial assumptions, consistency of other/framework. Access date 21/08/2023

accounting methods, and external markets. The impact of [3]. International Financial Reporting Standards (IFRS)

Foundation, 2014.

IJISRT24MAR041 www.ijisrt.com 585

Volume 9, Issue 3, March – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165 https://doi.org/10.38124/ijisrt/IJISRT24MAR041

[4]. International Financial, Reporting Standards (IFRS)

Foundation, 2020.

[5]. Kapoor, B. & Ruhela, J. (2013). IFRS Implementation

– Issues and challenges in India. International Journal

of Business and Management Research, 3(2), 103 –

106.

[6]. Longoni, P. (2019). IFRS 17 Insurance Contracts and

Firm Value.

[7]. Mbawun, J. (2018). Perceived Benefits and

Challenges of IFRS Adoption in Ghana: Views of

Member of Institute of Chartered Accountants, Ghana.

International Journal of Financial Research. 9(1).

[8]. Price Waterhouse Coopers Report (2019). An

overview of IFRS, available at IFRS overview 2019

(pwc.com), access date 21/08/2023

[9]. Ramanna K. & Sletten E. (2013). Network effects in

countries’ adoption of IFRS. International Trade

Journal.

[10]. Swiss Re (2018). The impact of IFRS 17, An outside

view, available at: Asia+CFO+Leadership+Forum+-

+IFRS+17+-+Impact+of+IFRS+17.pdf

(swissre.com), access date 21/08/2023.

[11]. Yiadom, E. M. & Atsunyo, W. (2014). Compliance

with International Financial Reporting Standards by

Listed Companies in Ghana. International Journal of

Business and Management, 9 (10), 87 – 100.

[12]. Zakari, M. A. (2014). Challenges of International

Financial Reporting Standards Adoption in Libya.

International Journal of Accounting and Financial

Reporting, 4(2), 390-412.

IJISRT24MAR041 www.ijisrt.com 586

You might also like

- AAUI - General Overview IFRS 17Document117 pagesAAUI - General Overview IFRS 17Tyan Retsa PutriNo ratings yet

- UAE Accounting System vs. IFRS Rules.Document6 pagesUAE Accounting System vs. IFRS Rules.Shibam JhaNo ratings yet

- AAUI - General Overview IFRS 17Document117 pagesAAUI - General Overview IFRS 17Tyan Retsa PutriNo ratings yet

- Sustainability 15 08612 v2Document26 pagesSustainability 15 08612 v2PrashnaaNo ratings yet

- AccountingDocument10 pagesAccountingWissem AdouliNo ratings yet

- HabteDocument5 pagesHabteAsfawosen DingamaNo ratings yet

- 01.introductory Materia... 03-07-2020 7.32 PMDocument20 pages01.introductory Materia... 03-07-2020 7.32 PMوليد محمد فكري عبيدNo ratings yet

- Walid Omar Owais - Readiness and Challenges For Applying IFRS 17 The Case of Jordanian Insurance CompaniesDocument10 pagesWalid Omar Owais - Readiness and Challenges For Applying IFRS 17 The Case of Jordanian Insurance CompaniesMufid SupriyantoNo ratings yet

- Thesis - The Expected Impact of Applying IFRS (17) Insurance Contracts On The Quality of Financial ReportsDocument11 pagesThesis - The Expected Impact of Applying IFRS (17) Insurance Contracts On The Quality of Financial ReportsTyan Retsa PutriNo ratings yet

- International Financial Reporting Standards 9: Dynamic Forward Looking The South African Banking Credit LandscapeDocument12 pagesInternational Financial Reporting Standards 9: Dynamic Forward Looking The South African Banking Credit LandscapeGuljeeNo ratings yet

- Reserving Seminar 2018 IFRS 17 Overview: A Work in ProgressDocument7 pagesReserving Seminar 2018 IFRS 17 Overview: A Work in ProgressdouglasNo ratings yet

- 04-03auditability of IFRS 17 TEG 20-07-02Document4 pages04-03auditability of IFRS 17 TEG 20-07-02ctprimaNo ratings yet

- Introduction To IFRS 17 May2021 LIMA MoGDocument35 pagesIntroduction To IFRS 17 May2021 LIMA MoGRahul IyerNo ratings yet

- 5 SEM BCOM - International Financial Reporting StandardsDocument49 pages5 SEM BCOM - International Financial Reporting StandardsMadhu kumarNo ratings yet

- Ijsrp p102127Document9 pagesIjsrp p102127Netsanet shiferawNo ratings yet

- Earning MGTDocument27 pagesEarning MGTanubhaNo ratings yet

- PR IASB Completes Reform Financial Instruments Accounting July 2014Document2 pagesPR IASB Completes Reform Financial Instruments Accounting July 2014Jeremiah AriefNo ratings yet

- Ijsrp p102127Document10 pagesIjsrp p102127selman AregaNo ratings yet

- The Applying of IFRS 4 Insurance Contracts in The Insurance Companies of GazaDocument32 pagesThe Applying of IFRS 4 Insurance Contracts in The Insurance Companies of GazaRibka RondonuwuNo ratings yet

- Adoption Guide OverviewDocument10 pagesAdoption Guide OverviewemmaNo ratings yet

- Management Insight: Convergence of Indian Accounting Standards with IFRSDocument11 pagesManagement Insight: Convergence of Indian Accounting Standards with IFRSAman PandeyNo ratings yet

- Rfi Iasb 2023 4 Pir Ifrs 15Document34 pagesRfi Iasb 2023 4 Pir Ifrs 15Andrea MaulanaNo ratings yet

- Supervisory Implications of IFRS 17 Insurance Contracts - Executive SummaryDocument3 pagesSupervisory Implications of IFRS 17 Insurance Contracts - Executive SummaryЙоанна ЗNo ratings yet

- Page-44-71 1412Document28 pagesPage-44-71 1412Nuhu IsahNo ratings yet

- IFRS 17 Presentation " Accounting Treatment": July 2020Document66 pagesIFRS 17 Presentation " Accounting Treatment": July 2020benslama amelNo ratings yet

- 20 19 PBDocument21 pages20 19 PBMuhammed MuazuNo ratings yet

- In Fs Indian Accounting Standards Insurance NoexpDocument4 pagesIn Fs Indian Accounting Standards Insurance Noexpaayush2000phophaliyaNo ratings yet

- Financial Position and Performance in IFRS 17: Scandinavian Actuarial JournalDocument28 pagesFinancial Position and Performance in IFRS 17: Scandinavian Actuarial JournalUncle TeaNo ratings yet

- Adoption of International FinancialDocument16 pagesAdoption of International FinancialGadaa TDhNo ratings yet

- Measurement of Return On Asset ROA Based On CompreDocument13 pagesMeasurement of Return On Asset ROA Based On CompreNeji HergliNo ratings yet

- Addressing Financial Risks From Climate Change 1689415144Document40 pagesAddressing Financial Risks From Climate Change 1689415144yvfrdn5mv9No ratings yet

- Impact of VUCA On Fair Value Accounting: CA Ajit Joshi & CA Rajul MurudkarDocument8 pagesImpact of VUCA On Fair Value Accounting: CA Ajit Joshi & CA Rajul MurudkarResky Andika YuswantoNo ratings yet

- Insurers Are You Ready For Ifrs17 109464Document13 pagesInsurers Are You Ready For Ifrs17 109464Triono BudiawanNo ratings yet

- Percieved Challenges of International Financial Reporting Standards (Ifrs) Adoption in NigeriaDocument11 pagesPercieved Challenges of International Financial Reporting Standards (Ifrs) Adoption in NigeriasaharaReporters headlinesNo ratings yet

- Introduction to IFRS - Issues and ChallengesDocument12 pagesIntroduction to IFRS - Issues and ChallengesAbhisshek GautamNo ratings yet

- International Financial Reporting Standard IFRS 9Document6 pagesInternational Financial Reporting Standard IFRS 9Mariam AlraeesiNo ratings yet

- Revenue Recognition Paradox: A Review of IAS 18 and IFRS 15: SSRN Electronic Journal January 2016Document26 pagesRevenue Recognition Paradox: A Review of IAS 18 and IFRS 15: SSRN Electronic Journal January 2016JohnNo ratings yet

- Bkar3033 A221 Assignment 5Document5 pagesBkar3033 A221 Assignment 5Patricia TangNo ratings yet

- Consultation Paper On Sustainability Reporting: IFRS® FoundationDocument22 pagesConsultation Paper On Sustainability Reporting: IFRS® FoundationSofiya BayraktarovaNo ratings yet

- IFRS 17 IntroductionDocument25 pagesIFRS 17 IntroductionIoanna ZlatevaNo ratings yet

- Extended Implementation of IFRS 15 Integrated ModeDocument16 pagesExtended Implementation of IFRS 15 Integrated ModeMariam AlraeesiNo ratings yet

- Ejaj Disser (1) (1) HYPODocument36 pagesEjaj Disser (1) (1) HYPOEjajNo ratings yet

- GX Ifrs17 What Does It Mean For YouDocument12 pagesGX Ifrs17 What Does It Mean For YouZaid KamalNo ratings yet

- Audit DraftDocument11 pagesAudit DraftIvy Rose ZafraNo ratings yet

- 29 September: Accounting Developments NewsletterDocument4 pages29 September: Accounting Developments Newslettershaharhr1No ratings yet

- hu-seven-reasons-to-focus-IFR S17Document7 pageshu-seven-reasons-to-focus-IFR S17Zaid KamalNo ratings yet

- Adopting IFRS in India for Global CompetitivenessDocument2 pagesAdopting IFRS in India for Global CompetitivenessSahana ShivakumarNo ratings yet

- Oyedokun, G. E. (2017) - Revenue Recognition Paradox A Review of IAS 18 and IFRS 15Document25 pagesOyedokun, G. E. (2017) - Revenue Recognition Paradox A Review of IAS 18 and IFRS 15Davi JDNo ratings yet

- Mazars Approaching The IFRS Sustainability Disclosure StandardsDocument14 pagesMazars Approaching The IFRS Sustainability Disclosure StandardsAhmed KtataNo ratings yet

- EY Market updates on the impact of IFRS 17 and IFRS 9Document31 pagesEY Market updates on the impact of IFRS 17 and IFRS 9ZidnaQoulanTsaqilaNo ratings yet

- E-Technical Update Nov2009Document14 pagesE-Technical Update Nov2009Atif RehmanNo ratings yet

- ICAI Dubai Chapter NPIO Practical Insights to IFRS 9Document23 pagesICAI Dubai Chapter NPIO Practical Insights to IFRS 9Tousief NaqviNo ratings yet

- Insights Into IFRS, 16th Edition 2019-20 Part 1Document32 pagesInsights Into IFRS, 16th Edition 2019-20 Part 1Adham AghaNo ratings yet

- Ifrs 9Document125 pagesIfrs 9hindustani888No ratings yet

- The Growing Need of Corporate Attributes and Timeliness of Financial ReportingDocument13 pagesThe Growing Need of Corporate Attributes and Timeliness of Financial ReportingEditor IJTSRDNo ratings yet

- IPSAS1Document13 pagesIPSAS1Nelson BruceNo ratings yet

- Impact of International Financial Reporting Standards (Ifrs) 5 On Real Earnings Management of Nigerian Listed Manufacturing FirmsDocument13 pagesImpact of International Financial Reporting Standards (Ifrs) 5 On Real Earnings Management of Nigerian Listed Manufacturing FirmsAhmad SyaifudinNo ratings yet

- IFRS Annual Report 2020Document61 pagesIFRS Annual Report 2020Maria M Ñañez RNo ratings yet

- Value Relevance of Accounting Information from PSAK 72Document9 pagesValue Relevance of Accounting Information from PSAK 72Fauzan AdhimNo ratings yet

- Fostering Regional Cooperation and Integration for Recovery and Resilience: Guidance NoteFrom EverandFostering Regional Cooperation and Integration for Recovery and Resilience: Guidance NoteNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Parastomal Hernia: A Case Report, Repaired by Modified Laparascopic Sugarbaker TechniqueDocument2 pagesParastomal Hernia: A Case Report, Repaired by Modified Laparascopic Sugarbaker TechniqueInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Smart Health Care SystemDocument8 pagesSmart Health Care SystemInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Visual Water: An Integration of App and Web to Understand Chemical ElementsDocument5 pagesVisual Water: An Integration of App and Web to Understand Chemical ElementsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Air Quality Index Prediction using Bi-LSTMDocument8 pagesAir Quality Index Prediction using Bi-LSTMInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Smart Cities: Boosting Economic Growth through Innovation and EfficiencyDocument19 pagesSmart Cities: Boosting Economic Growth through Innovation and EfficiencyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Parkinson’s Detection Using Voice Features and Spiral DrawingsDocument5 pagesParkinson’s Detection Using Voice Features and Spiral DrawingsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Predict the Heart Attack Possibilities Using Machine LearningDocument2 pagesPredict the Heart Attack Possibilities Using Machine LearningInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Impact of Silver Nanoparticles Infused in Blood in a Stenosed Artery under the Effect of Magnetic Field Imp. of Silver Nano. Inf. in Blood in a Sten. Art. Under the Eff. of Mag. FieldDocument6 pagesImpact of Silver Nanoparticles Infused in Blood in a Stenosed Artery under the Effect of Magnetic Field Imp. of Silver Nano. Inf. in Blood in a Sten. Art. Under the Eff. of Mag. FieldInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Analysis on Mental Health Issues among IndividualsDocument6 pagesAn Analysis on Mental Health Issues among IndividualsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Compact and Wearable Ventilator System for Enhanced Patient CareDocument4 pagesCompact and Wearable Ventilator System for Enhanced Patient CareInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Implications of Adnexal Invasions in Primary Extramammary Paget’s Disease: A Systematic ReviewDocument6 pagesImplications of Adnexal Invasions in Primary Extramammary Paget’s Disease: A Systematic ReviewInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Terracing as an Old-Style Scheme of Soil Water Preservation in Djingliya-Mandara Mountains- CameroonDocument14 pagesTerracing as an Old-Style Scheme of Soil Water Preservation in Djingliya-Mandara Mountains- CameroonInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Exploring the Molecular Docking Interactions between the Polyherbal Formulation Ibadhychooranam and Human Aldose Reductase Enzyme as a Novel Approach for Investigating its Potential Efficacy in Management of CataractDocument7 pagesExploring the Molecular Docking Interactions between the Polyherbal Formulation Ibadhychooranam and Human Aldose Reductase Enzyme as a Novel Approach for Investigating its Potential Efficacy in Management of CataractInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Insights into Nipah Virus: A Review of Epidemiology, Pathogenesis, and Therapeutic AdvancesDocument8 pagesInsights into Nipah Virus: A Review of Epidemiology, Pathogenesis, and Therapeutic AdvancesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Harnessing Open Innovation for Translating Global Languages into Indian LanuagesDocument7 pagesHarnessing Open Innovation for Translating Global Languages into Indian LanuagesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Relationship between Teacher Reflective Practice and Students Engagement in the Public Elementary SchoolDocument31 pagesThe Relationship between Teacher Reflective Practice and Students Engagement in the Public Elementary SchoolInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Investigating Factors Influencing Employee Absenteeism: A Case Study of Secondary Schools in MuscatDocument16 pagesInvestigating Factors Influencing Employee Absenteeism: A Case Study of Secondary Schools in MuscatInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Dense Wavelength Division Multiplexing (DWDM) in IT Networks: A Leap Beyond Synchronous Digital Hierarchy (SDH)Document2 pagesDense Wavelength Division Multiplexing (DWDM) in IT Networks: A Leap Beyond Synchronous Digital Hierarchy (SDH)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Diabetic Retinopathy Stage Detection Using CNN and Inception V3Document9 pagesDiabetic Retinopathy Stage Detection Using CNN and Inception V3International Journal of Innovative Science and Research TechnologyNo ratings yet

- Advancing Healthcare Predictions: Harnessing Machine Learning for Accurate Health Index PrognosisDocument8 pagesAdvancing Healthcare Predictions: Harnessing Machine Learning for Accurate Health Index PrognosisInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Auto Encoder Driven Hybrid Pipelines for Image Deblurring using NAFNETDocument6 pagesAuto Encoder Driven Hybrid Pipelines for Image Deblurring using NAFNETInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Formulation and Evaluation of Poly Herbal Body ScrubDocument6 pagesFormulation and Evaluation of Poly Herbal Body ScrubInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Utilization of Date Palm (Phoenix dactylifera) Leaf Fiber as a Main Component in Making an Improvised Water FilterDocument11 pagesThe Utilization of Date Palm (Phoenix dactylifera) Leaf Fiber as a Main Component in Making an Improvised Water FilterInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Making of Object Recognition Eyeglasses for the Visually Impaired using Image AIDocument6 pagesThe Making of Object Recognition Eyeglasses for the Visually Impaired using Image AIInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Impact of Digital Marketing Dimensions on Customer SatisfactionDocument6 pagesThe Impact of Digital Marketing Dimensions on Customer SatisfactionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Electro-Optics Properties of Intact Cocoa Beans based on Near Infrared TechnologyDocument7 pagesElectro-Optics Properties of Intact Cocoa Beans based on Near Infrared TechnologyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Survey of the Plastic Waste used in Paving BlocksDocument4 pagesA Survey of the Plastic Waste used in Paving BlocksInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Cyberbullying: Legal and Ethical Implications, Challenges and Opportunities for Policy DevelopmentDocument7 pagesCyberbullying: Legal and Ethical Implications, Challenges and Opportunities for Policy DevelopmentInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Comparatively Design and Analyze Elevated Rectangular Water Reservoir with and without Bracing for Different Stagging HeightDocument4 pagesComparatively Design and Analyze Elevated Rectangular Water Reservoir with and without Bracing for Different Stagging HeightInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Design, Development and Evaluation of Methi-Shikakai Herbal ShampooDocument8 pagesDesign, Development and Evaluation of Methi-Shikakai Herbal ShampooInternational Journal of Innovative Science and Research Technology100% (3)

- Aptitude Software IFRS 17 Solution Factsheet June 2021Document4 pagesAptitude Software IFRS 17 Solution Factsheet June 2021BenjaminNo ratings yet

- IFRS 17 Discount Rates and Cash Flow Considerations For Property and Casualty Insurance ContractsDocument40 pagesIFRS 17 Discount Rates and Cash Flow Considerations For Property and Casualty Insurance ContractsWubneh AlemuNo ratings yet

- Ila LFM CanadaDocument8 pagesIla LFM CanadaJ JuniorNo ratings yet

- IFRS 17 - Insurance ContractsDocument8 pagesIFRS 17 - Insurance ContractsSaba Masood0% (1)

- Implementing IFRS 17 Discount Curves Theoretical and Practical ChallengesDocument6 pagesImplementing IFRS 17 Discount Curves Theoretical and Practical ChallengesAnna ZubovaNo ratings yet

- EY Market updates on the impact of IFRS 17 and IFRS 9Document31 pagesEY Market updates on the impact of IFRS 17 and IFRS 9ZidnaQoulanTsaqilaNo ratings yet

- IFRS 17 Market Consistent Valuation of Financial Guarantees For Life and Health Insurance ContractsDocument34 pagesIFRS 17 Market Consistent Valuation of Financial Guarantees For Life and Health Insurance ContractsWubneh AlemuNo ratings yet

- Ifrs 17 e Learning For Insurers PDFDocument4 pagesIfrs 17 e Learning For Insurers PDFyycfttttNo ratings yet

- Prof Elective 1 Final RequirementDocument4 pagesProf Elective 1 Final RequirementCarla Jane ApolinarioNo ratings yet

- Changes To Key Performance Indicators Under IFRS 17: Interesting Thought Is About Which Regime Will Become LeadingDocument1 pageChanges To Key Performance Indicators Under IFRS 17: Interesting Thought Is About Which Regime Will Become LeadingMuhammad KholiqNo ratings yet

- Disclaimer: International Financial Reporting Standards (IFRS) 17 Insurance Contracts ExampleDocument41 pagesDisclaimer: International Financial Reporting Standards (IFRS) 17 Insurance Contracts ExampleYen HoangNo ratings yet

- Whitepaper Ifrs17 Accounting Turning Theory Into PracticeDocument10 pagesWhitepaper Ifrs17 Accounting Turning Theory Into PracticeVarian CitrajayaNo ratings yet

- KPMG Ifrs17Document186 pagesKPMG Ifrs17nvtcmnNo ratings yet

- 2020 Ifs InsuranceDocument262 pages2020 Ifs InsuranceSensi CTPrima100% (1)

- IFRS17 Replaces IFRS4Document10 pagesIFRS17 Replaces IFRS4Micaella DanoNo ratings yet

- Ie Ifrs 17 First ImpressionsDocument202 pagesIe Ifrs 17 First ImpressionsVarian CitrajayaNo ratings yet

- IFRS 17 in South AfricaDocument12 pagesIFRS 17 in South AfricaDanielNo ratings yet

- Issues and Challenges Faced in Insurance Industry inDocument25 pagesIssues and Challenges Faced in Insurance Industry invrayNo ratings yet

- Sesi - 04 - Wendy Wibowo & Edwin Jingga - IFRS17-Challenges & Observation During ImplementationDocument13 pagesSesi - 04 - Wendy Wibowo & Edwin Jingga - IFRS17-Challenges & Observation During ImplementationCandra DwiartoNo ratings yet

- Reserving Seminar 2018 IFRS 17 Overview: A Work in ProgressDocument7 pagesReserving Seminar 2018 IFRS 17 Overview: A Work in ProgressdouglasNo ratings yet

- Premium Allocation Approach - Annual ReportingDocument13 pagesPremium Allocation Approach - Annual ReportingEdwin Mudzamiri04No ratings yet

- Hammilton IFRS17Document12 pagesHammilton IFRS17Hary AntoNo ratings yet

- Using Solvency II To Implement IFRSDocument40 pagesUsing Solvency II To Implement IFRSМансур ШарафутдиновNo ratings yet

- Deloitte - May 2019Document6 pagesDeloitte - May 2019Bahaa ArafaNo ratings yet

- Ifrs at A GlanceDocument8 pagesIfrs at A GlanceRafael Renz DayaoNo ratings yet

- Kotak Mahindra Life Insurance Company LimitedDocument208 pagesKotak Mahindra Life Insurance Company Limitedgulatisrishti15No ratings yet

- Knowledge Base Care Ifrs 17 (LRC)Document33 pagesKnowledge Base Care Ifrs 17 (LRC)grace sijabatNo ratings yet

- IFRS 17 Expenses: Explanatory ReportDocument35 pagesIFRS 17 Expenses: Explanatory ReportWubneh AlemuNo ratings yet

- Address All Ifrs 17 Calculations Across The Organization W Ith A Unified PlatformDocument4 pagesAddress All Ifrs 17 Calculations Across The Organization W Ith A Unified Platformthe sulistyoNo ratings yet