Professional Documents

Culture Documents

Amalgamation Note

Uploaded by

kscbwrsyd50 ratings0% found this document useful (0 votes)

2 views4 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views4 pagesAmalgamation Note

Uploaded by

kscbwrsyd5Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

AMALGAMATION , ABSORPTION AND EXTERNAL RECONSTRUCTION OF COMPANIES.

According to AS-14 amalgamation includes absorption and external reconstruction.

Amalgamation refers to the formation of a new company to purchase two or more existing companies which go into liquidation.

It is the merger of two or more existing companies in to a single company.

Absorption refers to a situation when an existing company take over the business of one or more existing companies

External reconstruction refers to a situation in which a new company is formed to take over the business of an existing company.

Objectives of amalgamation.

1. To eliminate competition 2. To dominate the market 3. To collect additional capital

4. To enjoy the benefits of large scale production 5. To promote research and development 6. To promote better management

7. To save capital expenditure.

Disadvantages.

Possibility of increased wastage , Growth of monopoly, Defects over capitalisation, Difficulty in coordination and control, Lack of

personnel initiative.

Purchase consideration.

Amount payable by the purchasing co. (transferor) to the vendor co. (transferee) as a consideration for the purchase of business

Methods.

Lump sum method, 2. Net payment method, 3. Net asset method, 4. Share exchange method or Intrinsic value method

Intrinsic value of shares means Net assets/no. of shares.

Net assets means all assets – out side liabilities, Assets do not include fictitious assets.

Fraction shares.

At the time of calculating purchase consideration sometimes we may get fraction shares.

shares cannot be issued in fraction, Such shares should be valued at market price (not at face value) and should be settled in

cash.

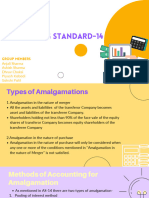

Types of amalgamation.

AS-14 amalgamation is of two types,

1. Amalgamation in the nature of merger, 2. Amalgamation in the nature of purchase.

Amalgamation in the nature of merge .

Conditions,

• All the assets and liabilities of the transferor company should become the assets and liabilities of the transferee

company after amalgamation.

• Share holders holding not less than 90 % of the shares of the transferor company should become the share holders of

the transferee co.

• consideration payable to the transferor company should be made by way of shares only and cash can be paid only for

fraction shares.

• Business of the transferor company is indented to be continued by the transferee co.

• No adjustment is indented to be made in the book value of assets and liabilities, when they are incorporated in the

book of transferee co.

Amalgamation in the nature of purchase.

• Amalgamation which does not satisfy any of the above condition, is termed as amalgamation in the nature of purchase.

• ie. If amalgamation is to be in the nature of merger all the conditions should be satisfied.

• Therefore, majority of the amalgamations are in the nature of purchase.

Accounting in the book of transferee company.

AS-16- accounting procedure differ depending on the type of amalgamation.

1. Pooling of interest method (amalgamation in the nature of merger).

2. Purchase method (amalgamation in the nature of purchase).

Pooling of interest method (amalgamation in the nature of merger).

1. The assets, liabilities, reserves (capital of revenue) should be recorded in the financial statements of the transferee co

at their carrying cost and in the same form as at the date of amalgamation.

2. The difference between the amount recorded ass share capital issued plus any additional consideration payable and

the share capital of the transferor company should be adjusted in the reserves.

3. If at the time of amalgamation , the transferor and transferee companies have conflicting accounting policies, a

uniform set of accounting policy should be followed after amalgamation. (AS- 5).

Purchase method.

is used in the case of amalgamation in the nature of purchase.

Dr. Rajesh Kumar. E. R, Associate Professor of Commerce, N.A.M College, Kallikkandy

Email. rajeshsirnam@gmail.com mob. 9447345214

• Only assets and liabilities which are agreed to be taken over are recorded in the book of transferee company and are

recorded at their agreed value.

• Reserves (capital or revenue) other than statutory reserves are not included in the financial statements of transferee

company.

• difference between purchase consideration and net asset should be recognised as goodwill or capital reserve and

should be brought into the books of the transferee co.

• goodwill arising from the amalgamation should be amortised over its useful life. The period should not exceed five

years unless a longer period is justified.

Statutory reserves required by law like Development allowance reserve, investment allowance etc. should be recorded in the

book of transferee company by using amalgamation adjustment account. Amalgamation adjustment account is disclosed in the

balance sheet as a deduction from statutory reserve. When the statutory reserve is no longer required it should be written off

by crediting the amalgamation adjustment account.

• Difference between pooling of interest method and purchase method.

• Applicability .

• Amalgamation in the nature of merger- amalgamation in the nature of purchase.

• Incorporation of assets and liabilities.

• All assets and liabilities- only agreed assets and liabilities.

• Value of assets and liabilities.

• At book value- at agreed value.

• Aggregation of financial statements.

• All assets, liabilities and reserves – only assets and liabilities agreed and statutory reserve only.

• Goodwill or capital reserve.

• No goodwill or capital reserve - difference between pc and net asset is goodwill or capital reserve.

• Amalgamation adjustment a/c.

• No such account – such account is opened for incorporating statutory reserve.

Disclosure in financial statements

1. For all amalgamations, the following disclosure should be made in the first statements following the amalgamation:-

a. Names and general nature of the amalgamating companies.

b. Effective date of amalgamation.

c. Method of accounting used to reflect the amalgamation.

d. Particulars of schemes sanctioned under statute.

For amalgamation accounted under the pooling of interest method.

a. Description and number of shares issued.

b. The amount of any difference between the consideration and the value of net assets acquired and the treatment

thereof.

For amalgamation under purchase method.

a. Consideration for amalgamation and the description of the consideration paid or payable.

b. Amount of any difference between the consideration and the net assets and the treatment thereof including the period of

amortisation of any goodwill arising on amalgamation.

Dissenting shareholders.

Share holders who has not given their assent to the scheme of amalgamation.

Accounting treatment in the book of transferor company.

1. Transfer the paid up share capital held by the dissenting share holders in to a separate account called dissenting

shareholders a/c.

2. Any premium they receive or any discount they suffer should be transferred to realisation a/c.

3. The profit or loss on realisation and all items relating to reserve and accumulated loss should be transferred to the.

majority share holders a/c.

4. 4. Amount due to dissenting share holders should be settled in cash.

Inter company Owings.

1. At the time of amalgamation when one company owe money to another company it is inter company owing.

2. After amalgamation as both the companies become one entity, this inter company owing should be eliminated in the books of

transferee company.

Sundry creditors a/c Dr.

To, sundry debtors.

Inter-company unrealised profit.

Dr. Rajesh Kumar. E. R, Associate Professor of Commerce, N.A.M College, Kallikkandy

Email. rajeshsirnam@gmail.com mob. 9447345214

1. When the purchasing company has sold goods to the vendor company.

If these goods remain in the stock of vendor company, it will be at selling price (cost +profit to the purchasing company)

A company cannot show its own goods at the financial statement at a profit.

Accounting treatment.

In the book of transferor (vendor) co.

Stock a/c will be closed in the usual manner by transferring it to the realisation a/c.

In the book of transferee (purchasing) co.

While taking over the assets, the stock should be recorded at cost price the difference (unrealised profit) will be automatically

adjusted in the goodwill or capital reserve.

. When the vender company has sold goods to the purchasing company and remain in the stock of purchasing company.

• No adjustment is required in the book of vendor company.

• in the book of purchasing company the unrealised profit in the stock of purchasing company should be adjusted

immediately after amalgamation.

Goodwill/ capital reserve a/c Dr.

To, Stock a/c (with the amount of unrealised profit).

Inter-company holding.

1. Purchasing company holds share in the vendor company.

The purchase consideration payable will be reduced proportionately as a part of the purchase consideration is receivable to the

purchasing company.

Purchasing company pays only the consideration payable to outside share holders.

Accounting treatment.

In the book of transferor co. (vendor).

Purchase consideration calculated for the entire under taking.

Purchasing company account Dr.

To, realisation.

(Full purchase price).

Shares/debentures/cash a/c Dr.

To, Purchasing co.

(amount actually received- out side share holders portion).

The balance in the purchasing co a/c and share holder a/c closed mutually.

Share holders a/c Dr.

To, Purchasing co.

In the book of purchasing co (transferee co).

Entry for purchase of business is passed in the usual manner.

For payment of purchase consideration.

Liquidators of vendor co a/c Dr.

(total purchase consideration)

To, share capital/ Debentures/bank a/c.

(amount payable to outsiders).

To, shares in the vendor co (investment) a/c

(amount due to transferee co).

Any difference in the shares in vendor company account (investment a/c) will be closed by transferring to goodwill or capital

reserve a/c.

Shares held by the vendor co (transferor co) in the purchasing co (transferee co).

The purchasing company cannot purchase its own shares.

If net payment method is adopted, the shares already acquired by the vendor company should be deducted from the

shares to be issued.

The shares already held are treated as a part of purchase consideration.

The investment in shares of the purchasing co (in the book of vendor) will not be taken over by the purchasing co and

should not be closed by transferring to realisation a/c.

Shares received as purchase consideration should be transferred to investment account (debited).

If the issue price of share issued now differ with the previous shares the shares should be re valued and the profit or

loss is to be transferred to share holder’s a/c.

If the purchase consideration is calculated under the net asset method the assets in the form of shares in the

purchasing co should not be taken in to consideration.

Dr. Rajesh Kumar. E. R, Associate Professor of Commerce, N.A.M College, Kallikkandy

Email. rajeshsirnam@gmail.com mob. 9447345214

Shares held by both the companies in each other (mutual holdings or cross holdings).

Calculation of purchase consideration depends on the method of calculating purchase consideration.

Net payment method.

Calculate the number of shares to be issued to the outside share holders in the vendor company.

Calculate the number of shares to be issued to the purchasing co as a a share holder of the vendor co.

( however these shares will not be issued).

Add the above two and obtain the total.

Deduct the number of shares already held by the vendor co.

Shares arrived at above X issue price = purchase consideration.

Net asset method.

Purchase consideration is calculated by using simultaneous equations.

a) Calculate total value of assets of each co by algebraic equation.

b) Deduct the proportionate value of assets available to the transferee company from the total assets of the transferor

company (a).

c) Deduct the shares of transferee company already held by the transferor company.

Dr. Rajesh Kumar. E. R, Associate Professor of Commerce, N.A.M College, Kallikkandy

Email. rajeshsirnam@gmail.com mob. 9447345214

You might also like

- AmalgamationDocument36 pagesAmalgamationvenkumadhaviNo ratings yet

- Accounting For Amalgamation: What Is Amalgamation & Absorption?Document4 pagesAccounting For Amalgamation: What Is Amalgamation & Absorption?Bhuwan GuptaNo ratings yet

- AmalgamationDocument3 pagesAmalgamationKdlr RRNo ratings yet

- Accounting Aspects of Mergers and AcquisitionsDocument19 pagesAccounting Aspects of Mergers and AcquisitionsHiral PatelNo ratings yet

- Methods of Accounting For MergersDocument6 pagesMethods of Accounting For MergersAnwar KhanNo ratings yet

- Divestiture SDocument26 pagesDivestiture SJoshua JoelNo ratings yet

- Corporate Accounting IINotesDocument125 pagesCorporate Accounting IINotesPoonam Sunil Lalwani LalwaniNo ratings yet

- Aca Mergers and Acquitions of CompaniesDocument9 pagesAca Mergers and Acquitions of CompaniesRavichandraNo ratings yet

- Amalgamation TheoryDocument21 pagesAmalgamation TheorySubashVenkataram100% (1)

- CH01SMFDocument52 pagesCH01SMFtoyyibah8134No ratings yet

- Amalgamation VS AbsorptionDocument7 pagesAmalgamation VS AbsorptionAbhinav RandevNo ratings yet

- Purchase Method ConsolidationDocument4 pagesPurchase Method Consolidationsalehin1969No ratings yet

- Amalgamation Absorption ReconstrctionDocument4 pagesAmalgamation Absorption ReconstrctionKaustubh BasuNo ratings yet

- Accounting For Amalgamation - C.W.Document6 pagesAccounting For Amalgamation - C.W.Krish SharmaNo ratings yet

- Amalgamation & AbsorptionDocument11 pagesAmalgamation & AbsorptionSubhra DasNo ratings yet

- Company Secretataryship Training ProjectDocument17 pagesCompany Secretataryship Training ProjectPragati DixitNo ratings yet

- Types of AmalgamationDocument10 pagesTypes of AmalgamationhanumanthaiahgowdaNo ratings yet

- Accounting For PartnershipDocument28 pagesAccounting For PartnershipYakub Ali SalimNo ratings yet

- M&A Accounting ImplicationsDocument32 pagesM&A Accounting ImplicationsPrison PubgNo ratings yet

- AmalagamationDocument3 pagesAmalagamationPavan ReddyNo ratings yet

- Pooling of Interest MethodDocument10 pagesPooling of Interest MethodSreejith ShajiNo ratings yet

- ACCOUNTING STANDARDSDocument23 pagesACCOUNTING STANDARDSSreeja BalajiNo ratings yet

- Advanced AccDocument12 pagesAdvanced AccchikonhinetsaitrishNo ratings yet

- Section 19Document24 pagesSection 19Abata BageyuNo ratings yet

- Purchase Method ConsolidationDocument3 pagesPurchase Method Consolidationsalehin1969No ratings yet

- M&A Accounting StandardsDocument13 pagesM&A Accounting StandardsNikhil Kasat100% (1)

- Cooperate Accounting PPTDocument8 pagesCooperate Accounting PPTpinukrakasNo ratings yet

- As-1 - Disclosure of Accounting PoliciesDocument7 pagesAs-1 - Disclosure of Accounting PoliciesSiddharth UdyawarNo ratings yet

- Financial Accounting Theory (Sem V) PDFDocument4 pagesFinancial Accounting Theory (Sem V) PDFHarshal JainNo ratings yet

- Sem V Amalgamation - & - AbsorptionDocument3 pagesSem V Amalgamation - & - AbsorptionAnita SoniNo ratings yet

- LMMHA28022017 VVDocument8 pagesLMMHA28022017 VVpinukrakasNo ratings yet

- 14 Easy Way To Learn AmalgamationDocument3 pages14 Easy Way To Learn Amalgamationsudhy009100% (1)

- BBA II Chapter 2 Sale of PartnershipDocument19 pagesBBA II Chapter 2 Sale of PartnershipSiddharth SalgaonkarNo ratings yet

- Mergers and AquisitionsDocument3 pagesMergers and AquisitionsNitesh MattaNo ratings yet

- "Preface" "Hand Book"Document13 pages"Preface" "Hand Book"deepakgrajani_355197No ratings yet

- Task 2Document18 pagesTask 2Yashmi BhanderiNo ratings yet

- Valuationofgoodwillandsharesl 171209084328Document48 pagesValuationofgoodwillandsharesl 171209084328Shweta ShrivastavaNo ratings yet

- Financial Accounting and ReportingDocument31 pagesFinancial Accounting and ReportingBer SchoolNo ratings yet

- Forms of Amalgamation AccountingDocument35 pagesForms of Amalgamation AccountingKaran VyasNo ratings yet

- Fabm1 Lesson 2Document21 pagesFabm1 Lesson 2JoshuaNo ratings yet

- Corporate RestructuringDocument20 pagesCorporate RestructuringHardik UdaniNo ratings yet

- Hilton8e WYRNTK Ch03Document4 pagesHilton8e WYRNTK Ch03jakeNo ratings yet

- Amalgamation of CompaniesDocument3 pagesAmalgamation of CompaniessandeepNo ratings yet

- Bcom QbankDocument13 pagesBcom QbankIshaNo ratings yet

- Acc Assign1Document24 pagesAcc Assign1chandresh_johnsonNo ratings yet

- Ch03 - Financial Statements and Ratio AnalysisDocument26 pagesCh03 - Financial Statements and Ratio Analysisaccswc21No ratings yet

- Financial Accounting Chapter 3Document5 pagesFinancial Accounting Chapter 3NiraniyaNo ratings yet

- FAA FinalDocument52 pagesFAA Finalyatendra13288No ratings yet

- Accounting Standard - 14Document13 pagesAccounting Standard - 14Manav GuptaNo ratings yet

- Unit 1Document50 pagesUnit 1vaniphd3No ratings yet

- Accounting From A Global PerspectiveDocument58 pagesAccounting From A Global PerspectivezelNo ratings yet

- Syllabus: Subject - Corporate AccountDocument17 pagesSyllabus: Subject - Corporate Accountdr SanjayNo ratings yet

- Pra 371Document3 pagesPra 371Nikesh SapkotaNo ratings yet

- Accounting Methods For GoodwillDocument4 pagesAccounting Methods For GoodwillaskmeeNo ratings yet

- Amalgamation of CompaniesDocument22 pagesAmalgamation of CompaniesSmit Shah0% (1)

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- The Layman's Guide To Understanding Financial Statements - How To Read, Analyze, Create & Understand Balance Sheets, Income Statements, Cash Flow & More (2020)Document82 pagesThe Layman's Guide To Understanding Financial Statements - How To Read, Analyze, Create & Understand Balance Sheets, Income Statements, Cash Flow & More (2020)al chemiste100% (2)

- Chapter 17Document44 pagesChapter 17Hải NhưNo ratings yet

- PAS 27 Separate Financial StatementsDocument16 pagesPAS 27 Separate Financial Statementsrena chavez100% (1)

- Audit TechniquesDocument2 pagesAudit TechniquesyashNo ratings yet

- AC311 Spring 2011 Keating SyllabusDocument5 pagesAC311 Spring 2011 Keating SyllabusvanzorNo ratings yet

- Assignment On IASDocument6 pagesAssignment On IASAsif AzadNo ratings yet

- Final Review Intermediate 1 ProblemsDocument33 pagesFinal Review Intermediate 1 Problemslukes12No ratings yet

- Chapter Three Basic Concepts of Audit PlanningDocument20 pagesChapter Three Basic Concepts of Audit PlanningNigussie BerhanuNo ratings yet

- Revised Chap 1 - AppendixDocument52 pagesRevised Chap 1 - AppendixJOSHUA NAVARRO. COMEROSNo ratings yet

- Understanding SME Accountability PhenomenologyDocument9 pagesUnderstanding SME Accountability PhenomenologyANGIEL ANNNo ratings yet

- Customer Acceptance in R12 Order ManagementDocument17 pagesCustomer Acceptance in R12 Order ManagementJuan carlos Pérez riveroNo ratings yet

- AR DJP 2014-Eng - 2Document192 pagesAR DJP 2014-Eng - 2HenryNo ratings yet

- NIIF 17 - ModificacionesDocument111 pagesNIIF 17 - ModificacionesShark GamerNo ratings yet

- Pamantasan NG Cabuyao: Katapatan Subd., Banay Banay, Cabuyao, LagunaDocument4 pagesPamantasan NG Cabuyao: Katapatan Subd., Banay Banay, Cabuyao, LagunaDan RyanNo ratings yet

- Flexible Budget Practice Questions AnswerDocument4 pagesFlexible Budget Practice Questions AnswerZain-ul- FaridNo ratings yet

- Chapter 14Document6 pagesChapter 14Mychie Lynne MayugaNo ratings yet

- Test 1 Aud679Document2 pagesTest 1 Aud679Izham Asri100% (1)

- Behn MeyerDocument4 pagesBehn MeyerSomnath Mangaraj0% (1)

- Forensic Accounting Power PointDocument18 pagesForensic Accounting Power PointGaurav100% (2)

- Summative Assessment ReviewDocument9 pagesSummative Assessment ReviewHibbah OwaisNo ratings yet

- Cost Accounting BBA MCQsDocument19 pagesCost Accounting BBA MCQsPhanikumar Katuri100% (1)

- Quiz 3 - Questões Erradas Por Aluno (Turma 1) - 1o Sem 2023 v.2Document15 pagesQuiz 3 - Questões Erradas Por Aluno (Turma 1) - 1o Sem 2023 v.2Moshe PicciottoNo ratings yet

- Illustration KK Co. Perpetual ClosingDocument9 pagesIllustration KK Co. Perpetual ClosingNAOL BIFTUNo ratings yet

- Module 1 - External Financial Reporting - Balance Sheet and ValuationDocument12 pagesModule 1 - External Financial Reporting - Balance Sheet and ValuationPatricia AtienzaNo ratings yet

- Accounting Is The Systematic Process ofDocument29 pagesAccounting Is The Systematic Process ofAnnaliza Alcazar ApostolNo ratings yet

- Cash Flow Statement Assignment No. 1 SOLDocument1 pageCash Flow Statement Assignment No. 1 SOLMahmoud IbrahimNo ratings yet

- Ias 10 - Events After Reporting PeriodDocument3 pagesIas 10 - Events After Reporting PeriodMohammad Faizan Farooq Qadri AttariNo ratings yet

- Audit (ISA)Document1 pageAudit (ISA)Wirdha Annisa HasibuanNo ratings yet

- Bachelor of Science in Accountancy (2018) : P U P College of Accountancy and FinanceDocument3 pagesBachelor of Science in Accountancy (2018) : P U P College of Accountancy and FinanceDemonise BloodNo ratings yet

- Statement of Financial Position (SFP) : Quarter 1 - Module 1Document24 pagesStatement of Financial Position (SFP) : Quarter 1 - Module 1Astro Astro100% (6)