Professional Documents

Culture Documents

Azarcon Bryan FinancialPlan

Uploaded by

azarcon.bryanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Azarcon Bryan FinancialPlan

Uploaded by

azarcon.bryanCopyright:

Available Formats

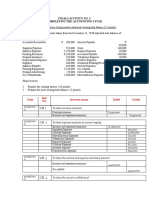

FINANCIAL PLAN

Total Project Cost

The money will be used to create the food cart and to pay for materials, equipment,

working capital, and licenses. Brie's Brownies' overall project cost is displayed in Table 1.

Table 1. Total Project Cost of Brie’s Brownies

Total Project Cost

Particulars Amount (PhP)

Building of Food Cart 9,000.00

Permits and Licenses 3,260.00

Equipment 4,510.00

Inventory 2,335.00

Supplies 2,885.00

Miscellaneous 1,000.00

Total Project Cost 30,690.00

Source of Funds

Brie's Brownies needed money to get started, and that amount is PhP 31,000.00. The

owner will use his or her personal funds and the assistance of the family to fund the firm. The

PhP 10,000.00 in support money bears no interest. The owner will provide P21,000.00. The

funding source for Snack Box is displayed in Table 2.

Table 2. Source of Funds of Brie’s Brownies

Sources of Funds

Particulars Amount (PhP)

Owners’ Investment/Capital 21,000.00

Non-interest Bearing Support (from owners parents) 10,000.00

Total Funds 31,000.00

Financial Statements

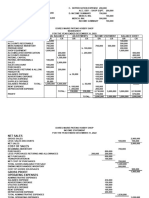

Projected Income Statement

The income statement tells whether the business is profitable or not. Table 3 displays the

anticipated income statement for Brie's Brownies during the following three years. A net profit

of PHP 6,474,000 can be anticipated throughout the first year of operations. In 2024, a net

income of PhP 11,757,000 is anticipated. For the third year of operation, it may have PhP

11,775,000. The Snack Box is responsible for paying the 1% corporation tax or percentage tax.

Table 3. Estimated Income Statement for Brie's Brownies.

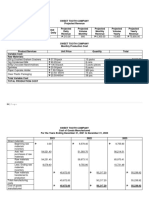

BRIE'S BROWNIES

Projected Income Statement

For the Year Ended December 31, 2023, 2024, and 2025

Year 1 Year 2 Year 3

Net Sales 1,605,600.00 1,942,776.00 2,350,758.96

Less: Cost of Goods Sold 1,106,832.00 1,339,266.72 1,620,512.73

Gross Profit 498,768.00 603,509.28 730,246.23

Less: Selling, General and

Administrative Expense

Salaries Expense 28,800.00 28,800.00 28,800.00

Permits and License 3260 3030 3030

Miscellaneous Expense 1,000.00 1,100.00 1,210.00

Supplies Expense 138,480.00 152,328.00 167,560.80

PPE Depreciation Epense 2,083.33 2,083.33 2,083.33

Total Expenses 173,623.33 187,341.33 202,684.13

Net Income 325,144.67 416,167.95 527,562.10

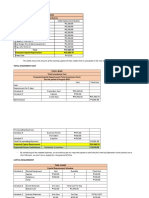

Table 4. Projected Sales

Projected Sales for the Next Three (3) Years

Projected

Price per

Year Number of Sales Amount (PhP)

Product

Per Year

Classic Brownies 4,080.00 120 489,600.00

Flavored Brownies 4,080.00 150 612,000.00

1

Brownies Chips 14,400.00 35 504,000.00

Total 1,605,600.00

Classic Brownies 4,488.00 132 592,416.00

Flavored Brownies 4,488.00 165 740,520.00

2

Brownies Chips 15,840.00 38.5 609,840.00

Total 1,942,776.00

3 Classic Brownies 4,936.80 145.2 716,823.36

Flavored Brownies 4,936.80 181.5 896,029.20

Brownies Chips 17,424.00 42.35 737,906.40

Total 2,350,758.96

Table 5. Cost of Goods Sold

Cost of Goods Sold per Classic Brownies

Year 2 Year 3

Box, Year 1

Particulars Amount (PhP) Amount (PhP) Amount (PhP)

Raw Materials 81.8 89.98 98.978

Total Cost 81.8 89.98 98.978

Cost of Goods Sold per Flavored Brownies

Year 2 Year 3

Box , Year 1

Particulars Amount (PhP) Amount (PhP) Amount (PhP)

Raw Materials 107.6 118.36 130.196

Total Cost 107.6 118.36 130.196

Cost of Goods Sold per Brownie Chips

Year 2 Year 3

Sachet , Year 1

Particulars Amount (PhP) Amount (PhP) Amount (PhP)

Raw Materials 23.2 25.52 28.072

Total Cost 23.2 25.52 28.072

Projected Balance Sheet

The financial situation of the business shows its assets, liabilities, and equity. The sole

asset that Brie's Brownies has right now is cash. The non-current assets consist of the machinery

and a food cart. The entire settlement of the business liability has already been made. Table 6

shows the anticipated balance statement for Brie's Brownies.

Table 6. Projected Balance Sheet of Brie’s Brownies

TEE CLOTHING

Projected Statement of Financial Position

December 31, 2023, 2024, and 2025

Year 1 Year 2 Year 3

ASSETS

Current Assets

Cash 339,208.00 757,459.28 1,287,104.71

Supplies 0.00 0.00 0.00

Inventories 0.00 0.00 0.00

Total Current Assets 339,208.00 757,459.28 1,287,104.71

Non-Current Assets

Equipment 19,020.00 16,936.67 14,853.33

Depreciation -2,083.33 -2,083.33 -2,083.33

Total Non-Current Assets 16,936.67 14,853.33 12,770.00

Total Assets 356,144.67 772,312.61 1,299,874.71

LIABILITIES

Current Liabilities

Accounts Payables 0 0 0

Total Current Liabilities 0 0 0

Total Liabilities 0 0 0

EQUITY

Surname, Capital 356,144.67 772,312.61 1,299,874.71

Total Equity 356,144.67 772,312.61 1,299,874.71

Total Liabilities and Equity 356,144.67 772,312.61 1,299,874.71

Projected Statement of Cash Flows

The business's financial activity is depicted in the statement of cash flows. Here, it refers

to the cost of the necessary materials, license, etc. The balance at the conclusion of Year 1 is PhP

35,238,000. Snack Box can conclude the second year of commercial operations with a cash

balance of PhP 40,518,000, and in the third year, it may have a cash balance of PhP 46,380,000.

The favorable outcome indicates that the company's cash is growing. Table 7 displays Brie's

Brownies' anticipated statement of cash flows.

Table 7. Projected Balance Sheet of Brie’s Brownies

Projected Statement of Cash Flows

For the Year Ended December 31, 2023, 2024, and 2025

Year 1 Year 2 Year 3

Cash Flows from Operating Activities

Cash received from customers 1,605,600.00 1,942,776.00 2,350,758.96

Payments for Salaries (28,800.00) (28,800.00) (28,800.00)

Payment for Permit and license (3,260.00) (3,030.00) (3,030.00)

Payment for miscelaneous (1,000.00) (1,100.00) (1,210.00)

Payment for supplies (138,480.00) (152,328.00) (167,560.80)

Payment for inventory (1,106,832.00) (1,339,266.72) (1,620,512.73)

Net cash provided by operating activities 327,228.00 418,251.28 529,645.43

Cash Flows from Investing Activities

Payments to acquire for Property, Plant and (19,020.00)

Equipment

Net cash provided by investing activities (19,020.00) 0.00 0.00

Cash Flows from Financing Activities

Cash received from investments by owner 31,000.00 0.00 0.00

Cash received from borrowings 0.00 0.00 0.00

Payments for withdrawals by owner 0.00 0.00 0.00

Net cash provided by financing activities 31,000.00 0.00 0.00

Net Increase (Decrease) in Cash 339,208.00 418,251.28 529,645.43

Cash balance at the beginning of the period 0.00 339,208.00 757,459.28

Cash balance at the end of the period 339,208.00 757,459.28 1,287,104.71

Financial Ratio Analysis

According to the financial ratio, Brie's Brownies generates profit. The predicted financial

ratio for Brie's Brownies is displayed in Table 8.

Table 8. Projected Financial Ratio Analysis

Projected Financial Ratio Analysis

Year 1 Year 2 Year 3

Gross Profit Margin 31% 31% 31%

Net Profit Margin 20% 21% 22%

Return on Equity 91% 54% 41%

Return on Investment 91% 54% 41%

You might also like

- Financial Plan Computationbulacan 1Document30 pagesFinancial Plan Computationbulacan 1Rhob Reniel ParaisoNo ratings yet

- ENTREP Income AnalysisDocument5 pagesENTREP Income AnalysisMary Rose Bragais OgayonNo ratings yet

- Healthy Bread DelightDocument11 pagesHealthy Bread DelightSetty HakeemaNo ratings yet

- Cutie PIE Statement of Financial PositionDocument7 pagesCutie PIE Statement of Financial PositionJeffrey CardonaNo ratings yet

- TwistdeliDocument24 pagesTwistdeliChristine Margoux SiriosNo ratings yet

- Business Plan 3Document5 pagesBusiness Plan 3Jephone Rizal BarogaNo ratings yet

- ABM Guide Sales Projection Financial Plan - Entrep - RevisedDocument5 pagesABM Guide Sales Projection Financial Plan - Entrep - RevisedKianyaNo ratings yet

- Labong Ice CreamDocument15 pagesLabong Ice Creamdelacruzmarklloyd14No ratings yet

- Business FinanceDocument35 pagesBusiness FinanceAliyah Belleza MusaNo ratings yet

- SiomaiDocument27 pagesSiomaiChristine Margoux SiriosNo ratings yet

- Particulars Unit Cost Amount Equipment Quanti TyDocument9 pagesParticulars Unit Cost Amount Equipment Quanti TyJuziel Rosel PadilloNo ratings yet

- VegemeatDocument29 pagesVegemeatChristine Margoux SiriosNo ratings yet

- Financial Study RevisedDocument20 pagesFinancial Study RevisedDAISY MAE GURRO NAMOCNo ratings yet

- Financial AspectDocument16 pagesFinancial AspectJezeree DichosoNo ratings yet

- Chap 5 Computation v2Document18 pagesChap 5 Computation v2Aileen Mifranum IINo ratings yet

- MARKET RESEARCH MongskieDocument4 pagesMARKET RESEARCH Mongskiejoshua abrioNo ratings yet

- BreakEvenPointAnalysis and Selling PriceDocument8 pagesBreakEvenPointAnalysis and Selling PriceAnonymous zOo2mbaVANo ratings yet

- Sales and Income Projections - Crispy FlakeyDocument11 pagesSales and Income Projections - Crispy FlakeyManuel FailanoNo ratings yet

- Shibori ClothingDocument11 pagesShibori ClothingPAULA MARQUEZNo ratings yet

- PolvoronDocument25 pagesPolvoronChristine Margoux SiriosNo ratings yet

- RevisionDocument16 pagesRevisionKaycee C. San DiegoNo ratings yet

- Wood LaminateDocument26 pagesWood LaminateChristine Margoux SiriosNo ratings yet

- Tarffin BitesDocument24 pagesTarffin BitesChristine Margoux SiriosNo ratings yet

- Ice CreamDocument24 pagesIce CreamChristine Margoux SiriosNo ratings yet

- BALANCED!!!Document72 pagesBALANCED!!!XhaNo ratings yet

- (A) Jorge Company CVP Income Statement (Estimated) For The Year Ending December 31, 2014Document4 pages(A) Jorge Company CVP Income Statement (Estimated) For The Year Ending December 31, 2014Kim QuyênNo ratings yet

- Sales ProjectionDocument3 pagesSales ProjectionChandria SimbulanNo ratings yet

- 5-Year Financial Feasibility Study: Company: Veggie Now S.A.LDocument27 pages5-Year Financial Feasibility Study: Company: Veggie Now S.A.LElie KhawandNo ratings yet

- Sample Financial StatementDocument5 pagesSample Financial StatementKentNo ratings yet

- Flatty FinalDocument8 pagesFlatty FinalKriz BassNo ratings yet

- Chapter 4Document12 pagesChapter 4Rod Cor FelNo ratings yet

- KFC 3 Year Financial Plan (One Franchise)Document4 pagesKFC 3 Year Financial Plan (One Franchise)Genevieve AbuyonNo ratings yet

- Financial BreakevenDocument25 pagesFinancial Breakevenjoan villoNo ratings yet

- Franchisee FinancialDocument15 pagesFranchisee FinancialShara ValleserNo ratings yet

- Coolax Fin StatementDocument14 pagesCoolax Fin StatementElcynjoy DecenaNo ratings yet

- Projected Cash FlowDocument3 pagesProjected Cash FlowAileen Mifranum IINo ratings yet

- Chapter5 FundamentalsoffinancialmanagementDocument25 pagesChapter5 Fundamentalsoffinancialmanagementgiezel francoNo ratings yet

- Cake FSDocument21 pagesCake FSRalph Evander IdulNo ratings yet

- Cash BudgetDocument28 pagesCash BudgetLerrad GutierrezNo ratings yet

- Chapter 5 FinallllllllllllDocument22 pagesChapter 5 Finallllllllllllsv7yyhdmkrNo ratings yet

- FINAL FEASIBDocument177 pagesFINAL FEASIBApril Loureen Dale TalhaNo ratings yet

- Lamiong LumpiaDocument74 pagesLamiong LumpiaJoan AvanzadoNo ratings yet

- Master Budget Assignment SollutionDocument7 pagesMaster Budget Assignment Sollutionatinafu assefaNo ratings yet

- Chapter - V OriginalDocument15 pagesChapter - V OriginalBernadeth CiprianoNo ratings yet

- Pagawa Balance SheetDocument37 pagesPagawa Balance Sheetjoffer idagoNo ratings yet

- Feasib IS - 25022018Document56 pagesFeasib IS - 25022018Llyod Francis LaylayNo ratings yet

- 50 Sow Unit Piggery Business Plan Financials - USDDocument15 pages50 Sow Unit Piggery Business Plan Financials - USDonward marumuraNo ratings yet

- Financial Plan (Finished)Document2 pagesFinancial Plan (Finished)Jessa rebuyasNo ratings yet

- 10 Chapter 8 Financial Plan 4Document12 pages10 Chapter 8 Financial Plan 4moniquemagsanay5No ratings yet

- Group 6 UpdatedDocument27 pagesGroup 6 UpdatedJilyn roqueNo ratings yet

- Financial CisDocument17 pagesFinancial CisBritney Anne H. PasionNo ratings yet

- Financial PlanDocument24 pagesFinancial PlanMarzan AngelaNo ratings yet

- Finch Excel ReportDocument15 pagesFinch Excel ReportshuvorajbhattaNo ratings yet

- Fs FinalDocument14 pagesFs FinalKringlelyn Fikan GandamNo ratings yet

- Chapter V GerylleDocument15 pagesChapter V GerylleBernadeth CiprianoNo ratings yet

- Pre-Cost 3,000,000.00 Pre-Operating ExpensesDocument10 pagesPre-Cost 3,000,000.00 Pre-Operating ExpensesJaselle TantogNo ratings yet

- Financial PlanDocument6 pagesFinancial PlanMarshmallow BurntNo ratings yet

- Business PlanDocument30 pagesBusiness PlanMa. Gemille NopradaNo ratings yet

- Chapter 5 FS CASSAVA PIEDocument16 pagesChapter 5 FS CASSAVA PIEManto RoderickNo ratings yet

- Azarcon Bryan MarketingPlanDocument11 pagesAzarcon Bryan MarketingPlanazarcon.bryanNo ratings yet

- Brie's Brownies BPRDocument20 pagesBrie's Brownies BPRazarcon.bryanNo ratings yet

- SK Resolution No. 002 - Appointment-of-SK-SecDocument2 pagesSK Resolution No. 002 - Appointment-of-SK-Secazarcon.bryanNo ratings yet

- SK Resolution No. 006-Annual Budget 2024Document2 pagesSK Resolution No. 006-Annual Budget 2024azarcon.bryanNo ratings yet

- Lobj19 - 0000055 CR 1907 02 A PDFDocument28 pagesLobj19 - 0000055 CR 1907 02 A PDFqqqNo ratings yet

- 2020 1 Accounting in Organisations and Society Assignment-3Document7 pages2020 1 Accounting in Organisations and Society Assignment-3Abs PangaderNo ratings yet

- Accounting Chapter 2Document4 pagesAccounting Chapter 2Ebony Ann delos SantosNo ratings yet

- 2020 CMA P1 A2 Accounts ReceivableDocument32 pages2020 CMA P1 A2 Accounts ReceivableLhenNo ratings yet

- New Chapter 17 - Cash FlowDocument17 pagesNew Chapter 17 - Cash FlowCheyenne Dawhitegurl GuillNo ratings yet

- Problems GeneralDocument9 pagesProblems GeneralAmal BharaliNo ratings yet

- Chapter 3 MCQ Afar 2 CompressDocument73 pagesChapter 3 MCQ Afar 2 Compresstaehyung kimNo ratings yet

- University of The Punjab: PAPER:BC-401Document24 pagesUniversity of The Punjab: PAPER:BC-401asgarNo ratings yet

- Nerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Document3 pagesNerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Mica Mae Correa100% (1)

- This Study Resource WasDocument7 pagesThis Study Resource WasBilly Vince AlquinoNo ratings yet

- Accounting EndtermDocument4 pagesAccounting EndtermNow OnwooNo ratings yet

- Chapter 11Document24 pagesChapter 11eilsel_ljNo ratings yet

- Meiditya Larasati - 01017190019 - PR Pertemuan 03Document9 pagesMeiditya Larasati - 01017190019 - PR Pertemuan 03Haikal RafifNo ratings yet

- 2299815Document9 pages2299815mohitgaba19No ratings yet

- Financial Accounting and ReportingDocument29 pagesFinancial Accounting and ReportingChjxksjsgskNo ratings yet

- Chapter 3Document75 pagesChapter 3melody100% (1)

- DR Lal Path Labs Financial Model - Ayushi JainDocument45 pagesDR Lal Path Labs Financial Model - Ayushi JainTanya SinghNo ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- Case Study - Club MedDocument118 pagesCase Study - Club MedUtsab BagchiNo ratings yet

- Igcse - Extented Tutoring - 2023 - 2024 - Final AccountsDocument7 pagesIgcse - Extented Tutoring - 2023 - 2024 - Final AccountsMUSTHARI KHANNo ratings yet

- Solution To Quiz 2Document4 pagesSolution To Quiz 2GianJoshuaDayritNo ratings yet

- Financial Statements Analysis of "Alhaj Textile Mills Limited"Document24 pagesFinancial Statements Analysis of "Alhaj Textile Mills Limited"Rohol Amin RajuNo ratings yet

- Wey Ifrs 2e CCCDocument19 pagesWey Ifrs 2e CCCAnonymous 1SUDEbgFNo ratings yet

- Final Solution Sybaf Fa QP Code 22810Document11 pagesFinal Solution Sybaf Fa QP Code 22810praveenk1878No ratings yet

- DocxDocument21 pagesDocxDhiananda zhuNo ratings yet

- HOBA - Practice SetDocument5 pagesHOBA - Practice SetCarl Dhaniel Garcia SalenNo ratings yet

- Aurora Company Audrey Company Joel Company 50,710 23,050: July 7 18 24 Total: Total Debit: 73,760 Total Credit: 73,760Document3 pagesAurora Company Audrey Company Joel Company 50,710 23,050: July 7 18 24 Total: Total Debit: 73,760 Total Credit: 73,760Yuki Nakata100% (1)

- Acr 4.2Document21 pagesAcr 4.2ASIKIN AJA0% (1)

- Dayton, Inc. Balance Sheet As of 12/31 (Values in Millions, Except EPS and Share Price)Document4 pagesDayton, Inc. Balance Sheet As of 12/31 (Values in Millions, Except EPS and Share Price)Cattleya DianlestariNo ratings yet

- Case Study - : The Chubb CorporationDocument6 pagesCase Study - : The Chubb Corporationtiko bakashviliNo ratings yet