Professional Documents

Culture Documents

Order 3520205374545

Order 3520205374545

Uploaded by

UHY HASSAN NAEEM CO.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Order 3520205374545

Order 3520205374545

Uploaded by

UHY HASSAN NAEEM CO.Copyright:

Available Formats

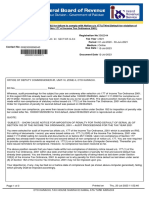

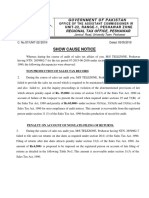

153(4) (Order to grant / refuse reduced rate of withholding on Supplies / Services / Contracts) (FOR GENERIC

EXEMPTION)

Name: AAMER LATIF Registration No 3520205374545

Address: Crest Pack, 57, The Mall, Lahore Tax Year : 2024

Period : 01-Jul-2023 - 31-Dec-2023

Medium : Online

Contact No: 00923008442128 Due Date : 16-Aug-2023

Valid Upto : 31-Dec-2023

Document Date 16-Aug-2023

The taxpayer has filed an application for issuance of exemption certificate u/s 153(4) of the Income Tax Ordinance, 2001.

In support of his contention the taxpayer has provided Enterprise Certificate which reflects the taxpayer is registered

asSmall and Medium Enterprises. Tax u/s 153(1)(a) of the Income Tax Ordinance, 2001 is not minimum rather adjustable

as per rule 8 of the Fourteenth Schedule to the Income Tax Ordinance, 2001. The said rule is reproduced as under:-

“The tax deductible under clause (a) of sub-section 1 of section 153 shall not be minimum tax where payments are

received on sale or supply of goods by SMEs”

Therefore, exemption certificate is hereby issued till 31.12.2022 unless cancelled earlier. Income tax already

deducted/deductible before the issuance of this certificate would not be refunded to the taxpayer but deposited in the

Government treasury.

Withholding Tax

Description Code Rate

Payment for Goods u/s 153(1)(a) @ 1.5% 64060053 0 0 0

Payment for Goods u/s 153(1)(a) @ 2% 64060054 0 0 0

Payment for Services u/s 153(1)(b) @2% 64060154 0 0 0

Attributes

Attribute Value

Decision Granted / Accepted

Attachments

Evidence with 153(4) (Application for reduced rate of withholding on Amir Latif Draft Return 2022.pdf

Supplies / Services / Contracts) (FOR GENERIC EXEMPTION)

Evidence with 153(4) (Application for reduced rate of withholding on Exemption certificate us 153.pdf

Supplies / Services / Contracts) (FOR GENERIC EXEMPTION)

Page 1 of 2 Printed on Fri, 2 Feb 2024 15:50:47

TAX HOUSE SYED MAUJ E DARYA ROAD LAHORE

153(4) (Order to grant / refuse reduced rate of withholding on Supplies / Services / Contracts) (FOR GENERIC

EXEMPTION)

Name: AAMER LATIF Registration No 3520205374545

Address: Crest Pack, 57, The Mall, Lahore Tax Year : 2024

Period : 01-Jul-2023 - 31-Dec-2023

Medium : Online

Contact No: 00923008442128 Due Date : 16-Aug-2023

Valid Upto : 31-Dec-2023

Document Date 16-Aug-2023

Attachments

Evidence with 153(4) (Application for reduced rate of withholding on SMEDA certificate.pdf

Supplies / Services / Contracts) (FOR GENERIC EXEMPTION)

Adnan Ahmad Khan

Commissioner

Inland Revenue, Zone-IV

TAX HOUSE SYED MAUJ E DARYA ROAD

LAHORE

This is a generic exemption order, and it does not require any party additions; this order is applicable to all withholding

agents.

Page 2 of 2 Printed on Fri, 2 Feb 2024 15:50:47

TAX HOUSE SYED MAUJ E DARYA ROAD LAHORE

You might also like

- Pay Slip 1Document4 pagesPay Slip 1api-3810267No ratings yet

- Order1522814 Ultra ConstructionDocument2 pagesOrder1522814 Ultra Constructionmeuh54uhNo ratings yet

- 153 Exemption Certificate 01 JUL 23 To 31 DEC 23Document2 pages153 Exemption Certificate 01 JUL 23 To 31 DEC 23athar brotherNo ratings yet

- Order 2971112Document2 pagesOrder 2971112Zeeshan KhanNo ratings yet

- Exemption Certificate of Ghandhara Industries 2021Document2 pagesExemption Certificate of Ghandhara Industries 2021Waqar RaoNo ratings yet

- 3rd Floor, Suleman Center, SC-5, (ST-17) Sector-15, Near Brooks Roundabout, KIA,, Karachi East Rasul Flour Mills (Private) LimitedDocument2 pages3rd Floor, Suleman Center, SC-5, (ST-17) Sector-15, Near Brooks Roundabout, KIA,, Karachi East Rasul Flour Mills (Private) LimitedMuhammad HamzaNo ratings yet

- Exemption Certificate Us 159 (1) 153Document2 pagesExemption Certificate Us 159 (1) 153ijazaslam.huaweiNo ratings yet

- Exemption Certificate - SalesDocument2 pagesExemption Certificate - SalesExecutive F&ADADUNo ratings yet

- Exemption 153 TY2021Document1 pageExemption 153 TY2021Usama AjazNo ratings yet

- Exemption Poly Pac Valid Up To 31.12.2020 (2) - 1Document1 pageExemption Poly Pac Valid Up To 31.12.2020 (2) - 1khawarNo ratings yet

- Order WHT Exempt, July To Dec 2022Document2 pagesOrder WHT Exempt, July To Dec 2022Roheel HashmiNo ratings yet

- Continental Print ExemptionDocument2 pagesContinental Print ExemptionkhawarNo ratings yet

- Tax Collector Correspondence3840409752263Document2 pagesTax Collector Correspondence3840409752263Muzaffar AliNo ratings yet

- With Tax Jul 22 To June 23Document2 pagesWith Tax Jul 22 To June 23Mirza Naseer AbbasNo ratings yet

- 02 - Withholding Exemption Certificate Jul-Dec 21Document3 pages02 - Withholding Exemption Certificate Jul-Dec 21Raheel AhmedNo ratings yet

- Exemption Certificate Top Link Upto Dec 2020Document1 pageExemption Certificate Top Link Upto Dec 2020khawarNo ratings yet

- Internal Corresponence2644435Document1 pageInternal Corresponence2644435Bm ShopNo ratings yet

- Exemption Certification Jpi Month of July-18 To Dec-18Document1 pageExemption Certification Jpi Month of July-18 To Dec-18syasir85No ratings yet

- Internet BillMAR2024Document1 pageInternet BillMAR2024mudhassir.aliNo ratings yet

- Exemption Certificate Tax On Profit Bannu UniversityDocument2 pagesExemption Certificate Tax On Profit Bannu UniversityHazrat AminNo ratings yet

- 114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Document2 pages114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023BISMA RAFIQNo ratings yet

- Muhammad Asif Khan CIR Appeals DocsDocument14 pagesMuhammad Asif Khan CIR Appeals DocsSaad TahirNo ratings yet

- Order 3430212567583Document9 pagesOrder 3430212567583Saad TahirNo ratings yet

- D091963615 16928640576314369 ProposalDocument5 pagesD091963615 16928640576314369 ProposalDevanshu GoswamiNo ratings yet

- 21 - 30221463102456 NCR JhansiDocument2 pages21 - 30221463102456 NCR JhansiAbhishek DahiyaNo ratings yet

- Declaration 3520228712048Document5 pagesDeclaration 3520228712048hinamuzammil.acaNo ratings yet

- FALTA Special Economic Zone Authority - 19620231047623Document15 pagesFALTA Special Economic Zone Authority - 19620231047623shafaquesameen2001No ratings yet

- S Dps HK Sont 0520222023 AddendumDocument1 pageS Dps HK Sont 0520222023 AddendumABBA MALLANo ratings yet

- Tax Exemption Certificate 2023 2024Document1 pageTax Exemption Certificate 2023 2024Rehnuma TrustNo ratings yet

- Order 3362544Document3 pagesOrder 3362544hamza awanNo ratings yet

- Eway Bill - Devangi PolymersDocument1 pageEway Bill - Devangi PolymersDeep AgrawalNo ratings yet

- Show Cause NoticeDocument8 pagesShow Cause NoticeinfoNo ratings yet

- 31 2023 2294 PDFDocument2 pages31 2023 2294 PDFLochan PhogatNo ratings yet

- HR45D 0007 EndosDocument1 pageHR45D 0007 Endosstjohnschool41No ratings yet

- With Tax Apr 23 To June 23Document2 pagesWith Tax Apr 23 To June 23Mirza Naseer AbbasNo ratings yet

- Ircon Technical ManpowerDocument101 pagesIrcon Technical ManpowerPriyesh Kumar CNo ratings yet

- Exemption Order 153 From Jul-Dec-18Document1 pageExemption Order 153 From Jul-Dec-18WaqasBashirNo ratings yet

- Robiul Hoque PDFDocument2 pagesRobiul Hoque PDFAMIRUL HAQUENo ratings yet

- Gccv-Public Carriers Other Than Three Wheelers Package Policy - Zone C Motor Insurance Certificate Cum Policy ScheduleDocument3 pagesGccv-Public Carriers Other Than Three Wheelers Package Policy - Zone C Motor Insurance Certificate Cum Policy Schedulefaiz.sf3033No ratings yet

- Certificate 3Document3 pagesCertificate 3Moses VilladelgadoNo ratings yet

- March InvDocument1 pageMarch Invkranthimahesh999No ratings yet

- Internal Corresponence3970701Document1 pageInternal Corresponence3970701Bm ShopNo ratings yet

- Tendernotice 1Document2 pagesTendernotice 1Soundar SNo ratings yet

- INC-24 11 04 2023 Signed PDFDocument4 pagesINC-24 11 04 2023 Signed PDFmazars advisoryNo ratings yet

- Tender For Audit of Accounts of TBB and Field DDOs - AmemdedDocument8 pagesTender For Audit of Accounts of TBB and Field DDOs - AmemdedAnimeshSahaNo ratings yet

- GC No.04-2023Document2 pagesGC No.04-2023Baljeet SinghNo ratings yet

- United India Insurance Company Limited: MR - Jiwan SinghDocument7 pagesUnited India Insurance Company Limited: MR - Jiwan Singhgunjanrawat23621No ratings yet

- Invitation To Tender (ITT)Document48 pagesInvitation To Tender (ITT)Tebogo SadikiNo ratings yet

- Karan MaliyaDocument2 pagesKaran Maliyasales.kayteeautoNo ratings yet

- SOA-Lily Restaurant-1-4-2023 TO 30-4-2023Document1 pageSOA-Lily Restaurant-1-4-2023 TO 30-4-2023Faraz KhanNo ratings yet

- 114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Document4 pages114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023MUHAMMAD TABRAIZNo ratings yet

- United India Insurance Company LimitedDocument7 pagesUnited India Insurance Company Limitedyatishduggal4No ratings yet

- Tax Collector Correspondence3362544Document1 pageTax Collector Correspondence3362544hamza awanNo ratings yet

- LRN LetterDocument2 pagesLRN LettersubratdasbaliNo ratings yet

- Loan Sanction LetterDocument3 pagesLoan Sanction Lettergaurav sondhiNo ratings yet

- INVOICEDocument1 pageINVOICEAshok Kumar PanigrahiNo ratings yet

- Tender Document OHE T003 O1ZSDocument120 pagesTender Document OHE T003 O1ZSchaitanya bholeNo ratings yet

- Vir BahadurDocument4 pagesVir BahadurAkshat JindalNo ratings yet

- 2023 Philgeps Certfiicate WELD Construction CEBU Expire 11.29.2024 Updated 11.15..2023Document3 pages2023 Philgeps Certfiicate WELD Construction CEBU Expire 11.29.2024 Updated 11.15..2023Darvie Joy ElleviraNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- Property Tax ExemptionsDocument1 pageProperty Tax ExemptionsLexi CortesNo ratings yet

- CARELIFT - BIR Form 2550Q VAT RETURN - 4Q 2021Document1 pageCARELIFT - BIR Form 2550Q VAT RETURN - 4Q 2021Jay Mark DimaanoNo ratings yet

- State Land Investment Corporation v. Cir DigestDocument2 pagesState Land Investment Corporation v. Cir DigestAlan Gultia100% (1)

- 187 Lucky Hardware 23 24Document1 page187 Lucky Hardware 23 24REZAUL KARIMNo ratings yet

- Attention:: Not File Copy A Downloaded From This Website. The Official Printed Version of This IRS Form IsDocument6 pagesAttention:: Not File Copy A Downloaded From This Website. The Official Printed Version of This IRS Form IsBenne James50% (2)

- Acabar Payslip 2Document1 pageAcabar Payslip 2Niña Rica SembrinoNo ratings yet

- MU Syllabus Taxation-2 Transfer-TaxesDocument3 pagesMU Syllabus Taxation-2 Transfer-TaxesDJabNo ratings yet

- Answer For Payroll ProblemsDocument21 pagesAnswer For Payroll ProblemsAnonymous Lz2qH7No ratings yet

- Sales Exclusive Tax Rate &Document3 pagesSales Exclusive Tax Rate &HaripriyaNo ratings yet

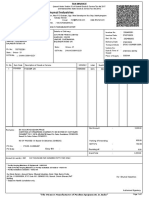

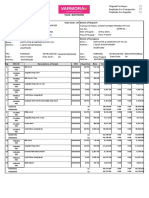

- Tax Invoice: VARMORA INTERNATIONAL, Dhuva, Gujarat. State Code: 24 Details of DispatchDocument3 pagesTax Invoice: VARMORA INTERNATIONAL, Dhuva, Gujarat. State Code: 24 Details of Dispatchparvezahmad04No ratings yet

- Salaryslip June 2022Document2 pagesSalaryslip June 2022Suman KumarNo ratings yet

- Show Cause Notice: Government of PakistanDocument3 pagesShow Cause Notice: Government of PakistanFAIZ AliNo ratings yet

- Declaration Form (22-23)Document4 pagesDeclaration Form (22-23)vasavi kNo ratings yet

- 2223TPG0008835Document2 pages2223TPG0008835Huskee CokNo ratings yet

- Creation PuOd 274 133709Document1 pageCreation PuOd 274 133709emamoddin ahemadNo ratings yet

- Philamlife vs. SOFDocument1 pagePhilamlife vs. SOFMichelleNo ratings yet

- CHAPTER 15 Transfer Business TaxDocument9 pagesCHAPTER 15 Transfer Business TaxJamaica DavidNo ratings yet

- Conneqt Business Solutions Limited: 286124 Siddhant Murari SharmaDocument1 pageConneqt Business Solutions Limited: 286124 Siddhant Murari SharmaRadha SharmaNo ratings yet

- Salary September2023Document2 pagesSalary September2023depiha5135No ratings yet

- Up23t 4849Document3 pagesUp23t 4849arshadnsdl8No ratings yet

- SICOM P2 Defect64 CanadaInvoice 16mar20Document1 pageSICOM P2 Defect64 CanadaInvoice 16mar20Prem KumarNo ratings yet

- Invoice 5371888557Document2 pagesInvoice 5371888557vaibhav agrawalNo ratings yet

- University of Management and Technology Quotation Master Paints 01-08-2023Document2 pagesUniversity of Management and Technology Quotation Master Paints 01-08-2023usman khanNo ratings yet

- YdryDocument2 pagesYdryVinodhkumar Shanmugam100% (1)

- Ka 2324 3148073Document3 pagesKa 2324 3148073GAURAV CHITTORANo ratings yet

- Feb 1Document1 pageFeb 1vishnuvardhan reddyNo ratings yet

- 1604-CFDocument8 pages1604-CFmamasita25No ratings yet

- Tally SOP-3 Solution (Final Without Errors)Document3 pagesTally SOP-3 Solution (Final Without Errors)Diya -plays hereNo ratings yet

- Tax267 Ex3Document4 pagesTax267 Ex3SITI NUR DIANA SELAMATNo ratings yet