Professional Documents

Culture Documents

Exemption 153 TY2021

Uploaded by

Usama AjazOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exemption 153 TY2021

Uploaded by

Usama AjazCopyright:

Available Formats

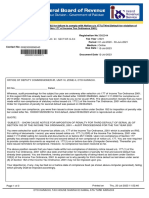

153(4) (Order to grant / refuse reduced rate of withholding on Supplies / Services / Contracts)

(FOR GENERIC EXEMPTION)

Name: DIAMOND METALS Registration 2546890

Address: PLOT#C&C-1 SURVEY#III,DEH ORANGI TAPPO Tax Year : 2021

Period : 01-Jul-2020 - 31-Dec-2020

Medium : Online

Contact No: 00923218292029 Due Date : 30-Sep-2020

Valid Upto : 31-Dec-2020

Document 30-Sep-2020

The taxpayer is allowed to make supply of goods manufactured by him without tax deduction under clause

(a ) of sub-section (1) of Section 153 of the Income Tax Ordinance, 2001.

Tax already deducted before the issuance of this certificate is not refundable and shall be deposited in the

Government Treasury. This exemption is valid for the period mentioned above only, unless cancelled

earlier.

Withholding Tax

Description Code Rate

Payment for Goods u/s 153(1)(a) @4.5% 64060009 0.00 0.00 0.00

Advance tax on persons remitting amounts abroad through

64151905 0.00 0.00 100.00

credit / debit / prepaid cards u/s 236Y

Attributes

Attribute Value

Decision Granted / Accepted

Attachments

Exemption Certificate letter 2021 153.docx

Hammal Baloch

Commissioner (Enforcement)

Inland Revenue, -I

MTO KARACHI

This is a generic exemption order, and it does not require any party additions; this order is applicable to all

withholding agents.

Page 1 of 1 Printed on Wed, 30 Sep 2020 15:37:

MTO KARACHI

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Exemption Poly Pac Valid Up To 31.12.2020 (2) - 1Document1 pageExemption Poly Pac Valid Up To 31.12.2020 (2) - 1khawarNo ratings yet

- Continental Print ExemptionDocument2 pagesContinental Print ExemptionkhawarNo ratings yet

- Exemption Certificate Top Link Upto Dec 2020Document1 pageExemption Certificate Top Link Upto Dec 2020khawarNo ratings yet

- 3rd Floor, Suleman Center, SC-5, (ST-17) Sector-15, Near Brooks Roundabout, KIA,, Karachi East Rasul Flour Mills (Private) LimitedDocument2 pages3rd Floor, Suleman Center, SC-5, (ST-17) Sector-15, Near Brooks Roundabout, KIA,, Karachi East Rasul Flour Mills (Private) LimitedMuhammad HamzaNo ratings yet

- Order 2971112Document2 pagesOrder 2971112Zeeshan KhanNo ratings yet

- Exemption Ali Packages Jan To Jun 2021Document2 pagesExemption Ali Packages Jan To Jun 2021khawarNo ratings yet

- Exemption Certificate Top Link Upto June 2021Document2 pagesExemption Certificate Top Link Upto June 2021khawarNo ratings yet

- Order WHT Exempt, July To Dec 2022Document2 pagesOrder WHT Exempt, July To Dec 2022Roheel HashmiNo ratings yet

- Exemption Certificate Us 159 (1) 153Document2 pagesExemption Certificate Us 159 (1) 153ijazaslam.huaweiNo ratings yet

- 153 Exemption Certificate 01 JUL 23 To 31 DEC 23Document2 pages153 Exemption Certificate 01 JUL 23 To 31 DEC 23athar brotherNo ratings yet

- 02 - Withholding Exemption Certificate Jul-Dec 21Document3 pages02 - Withholding Exemption Certificate Jul-Dec 21Raheel AhmedNo ratings yet

- With Tax Jul 22 To June 23Document2 pagesWith Tax Jul 22 To June 23Mirza Naseer AbbasNo ratings yet

- Exemption Certificate of Ghandhara Industries 2021Document2 pagesExemption Certificate of Ghandhara Industries 2021Waqar RaoNo ratings yet

- Order 3520205374545Document2 pagesOrder 3520205374545UHY HASSAN NAEEM CO.No ratings yet

- Declaration 3840321246075Document7 pagesDeclaration 3840321246075Qais NasirNo ratings yet

- Exemption Certificate Tax On Profit Bannu UniversityDocument2 pagesExemption Certificate Tax On Profit Bannu UniversityHazrat AminNo ratings yet

- Declaration 1610112524911Document4 pagesDeclaration 1610112524911asiashah1975No ratings yet

- Order1522814 Ultra ConstructionDocument2 pagesOrder1522814 Ultra Constructionmeuh54uhNo ratings yet

- Exemption Certificate - SalesDocument2 pagesExemption Certificate - SalesExecutive F&ADADUNo ratings yet

- Order 7268570Document2 pagesOrder 7268570Muhammad SufyanNo ratings yet

- Acknowledgement Slip: 38, Umer Street, Street No 3, HASAN TOWN MULTAN ROAD, Lahore, Iqbal Town. Muhammad ZubairDocument4 pagesAcknowledgement Slip: 38, Umer Street, Street No 3, HASAN TOWN MULTAN ROAD, Lahore, Iqbal Town. Muhammad ZubairMuhammad Dilawar HayatNo ratings yet

- Declaration 3966758Document6 pagesDeclaration 3966758mehboob rehmanNo ratings yet

- Order 3362544Document3 pagesOrder 3362544hamza awanNo ratings yet

- 114 (1) (Return of Income For A Person Deriving Income Only From Salary and Other Sources Eligible To File Salary Return) - 2023Document4 pages114 (1) (Return of Income For A Person Deriving Income Only From Salary and Other Sources Eligible To File Salary Return) - 2023maazraza123No ratings yet

- LA0122001372967Document1 pageLA0122001372967bidda samuelNo ratings yet

- I Phone X 256 GB (Space Grey)Document2 pagesI Phone X 256 GB (Space Grey)Omdatt KatariaNo ratings yet

- Declaration 3520228712048Document5 pagesDeclaration 3520228712048hinamuzammil.acaNo ratings yet

- Karachi Steel 2021 Exemption CertificateDocument2 pagesKarachi Steel 2021 Exemption CertificateAqeel ZahidNo ratings yet

- Tax Collector Correspondence3362544Document5 pagesTax Collector Correspondence3362544hamza awanNo ratings yet

- Exemption Certification Jpi Month of July-18 To Dec-18Document1 pageExemption Certification Jpi Month of July-18 To Dec-18syasir85No ratings yet

- Flat No.D2, Yasir View, Gulzar-E-Hijri, Scheme-33, Malir Malir Town Feroza AzmatDocument4 pagesFlat No.D2, Yasir View, Gulzar-E-Hijri, Scheme-33, Malir Malir Town Feroza AzmatferozaNo ratings yet

- Declaration 3710389890025Document2 pagesDeclaration 3710389890025Speed CallNo ratings yet

- With Tax Apr 23 To June 23Document2 pagesWith Tax Apr 23 To June 23Mirza Naseer AbbasNo ratings yet

- 114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Document4 pages114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023MUHAMMAD TABRAIZNo ratings yet

- 114 (1) (Return of Income For A Person Deriving Income Only From Salary and Other Sources Eligible To File Salary Return) - 2023Document4 pages114 (1) (Return of Income For A Person Deriving Income Only From Salary and Other Sources Eligible To File Salary Return) - 2023asiashah1975No ratings yet

- Inv 168452Document1 pageInv 168452salesNo ratings yet

- Declaration6110118446641 2Document4 pagesDeclaration6110118446641 2czeeshan318No ratings yet

- Exemption Order 153 From Jul-Dec-18Document1 pageExemption Order 153 From Jul-Dec-18WaqasBashirNo ratings yet

- 21 - B Faisal Street Ghazi Colony Sanda Road Abdul Basit QureshiDocument4 pages21 - B Faisal Street Ghazi Colony Sanda Road Abdul Basit QureshisahrisNo ratings yet

- Koharian, Dhak Khana Khas, Barki, Lahore Wahgah Town Qasim ShahzadDocument4 pagesKoharian, Dhak Khana Khas, Barki, Lahore Wahgah Town Qasim ShahzadBasit RiazNo ratings yet

- Additonal Storage Invoice: Telephone: +255 22 2113642 Fax +255 22 2113646Document1 pageAdditonal Storage Invoice: Telephone: +255 22 2113642 Fax +255 22 2113646Honest consolidationNo ratings yet

- Eway Bill - Devangi PolymersDocument1 pageEway Bill - Devangi PolymersDeep AgrawalNo ratings yet

- Declaration 3740587110895Document4 pagesDeclaration 3740587110895sakenderNo ratings yet

- Declaration 4250197795633Document4 pagesDeclaration 4250197795633Farhan AliNo ratings yet

- October To December 2022 Activity StatementDocument2 pagesOctober To December 2022 Activity StatementphungvcungNo ratings yet

- Declaration3520115189692 - LahoreDocument5 pagesDeclaration3520115189692 - LahoreFarhan AliNo ratings yet

- Declaration 3710137689404Document4 pagesDeclaration 3710137689404Fizzah Fatimah MinhasNo ratings yet

- Tax StatementDocument3 pagesTax StatementAimen Shoukat 771-FMS/BSAF/S22No ratings yet

- Tax Credit Certificate On Supplies: For General Tax Questions Call Our Toll Free 0800117000 or Log Onto URA Web PortalDocument1 pageTax Credit Certificate On Supplies: For General Tax Questions Call Our Toll Free 0800117000 or Log Onto URA Web Portalmawamajid2No ratings yet

- MADAD KHAN-PunjabDocument6 pagesMADAD KHAN-PunjabFarhan AliNo ratings yet

- Declaration 3310085249835Document4 pagesDeclaration 3310085249835Farhan AliNo ratings yet

- 114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Document4 pages114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023billallahmedNo ratings yet

- 114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Document2 pages114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023BISMA RAFIQNo ratings yet

- 114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Document4 pages114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Muhammad Aamir AbbasNo ratings yet

- 114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2022Document4 pages114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2022billallahmedNo ratings yet

- Declaration. 3740560059248Document4 pagesDeclaration. 3740560059248Fizzah Fatimah MinhasNo ratings yet

- 114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Document5 pages114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Muhammad Siddique Bhatti Advocate HafizabadNo ratings yet

- FVCreport - 2023-02-06T114342.040Document1 pageFVCreport - 2023-02-06T114342.040ओमप्रकाश चौरसियाNo ratings yet