Professional Documents

Culture Documents

Aziacdixon Finance

Uploaded by

goitsemodimoj31Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aziacdixon Finance

Uploaded by

goitsemodimoj31Copyright:

Available Formats

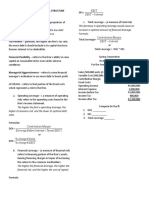

Finance Cheat Sheet

by AziaCDixon via cheatography.com/56245/cs/14915/

Class 1 Class 3 (cont) Class 5 (cont)

Goal: Maximize Firm Value Backwa A firm takes over a supplier.An oil Lifecycle predicts a firm’s financing changes

Terminal Value Pricet+ΔNWC-tc(Pricet- rds transporter buying an oil exploration Theory as it makes the transition from a

integra and production company. start-up firm to a mature firm to a

BV t)

tion declining firm.Start-up firms use

5 Principles of Investment Decisions debt sparingly, then as cash flows

Forwar A firm takes over a customer. An oil

1)Decisions are based on cash flows, not from investments become more

dsinteg transporter buys a set of gasoline

accounting income. predictable, the growing firm

ration stations.

2)Cash flows are based on opportunity costs. begins to use more debt, then

3)The timing of cash flows is important Investment Growths leverage peaks for the mature

4)Cash flows are analyzed on an after-tax firm right before it declines

Organic (Slow growth) - growth is when a firm

basis.

Modigliani predicts capital structure is

grows or develops a new product or capability

5)Financing costs are reflected in the project’s Miller irrelevant for firm value in a world

required rate of return. in-house (less risky, less expensive)

with no taxes, no bankruptcy, no

financing constraints (i.e., all firms

Inorganic (M&A, Fast growth)

Class 2 borrow at same rate), no

Acquisition: buying part of a company

transaction costs, and no market

Leverage (Debt/(Debt+Equity) Merger: entire target

frictions (i.e., efficient prices and

Cost of r e=rfBe (rm-r f) (Fast growing, reduces competition)

no agency costs)

Equity

Class 4 Trade-off VL = VU + PV (tax shields) – PV

WACC weighted average of the cost of

Theory: (bankruptcy costs) – PV

equity and the after-tax cost of Beta Unleveled: (risk-shifting) – PV (managerial

debt. risk aversion) + PV (disciplinary

APV 1)Vunleveled 2)Calulate

((E/V)(Re) + [((D/V)(1-T)(Rd)] PV(SideEffects) 3)TV debt)

E = Market value of the company's equity actual capital structure > optimal capital

TRUE. When leverage increases beta

D = Market value of the company's debt

increases. structure.

V = Total Market Value of the company (E + D)

TRUE. When a firm has no debt the unlevered =overlevered= You want to decrease your debt

Re = Cost of Equity

cost of equity equals the levered cost of equity. levels.

Rd = Cost of Debt

FALSE. When leverage changes sharply, using Financing an investment with debt Increase

T= Tax Rate

the same WACC from the previous period is leverage

still appropriate. Paying off debt with retained earnings

Class 3 Decrease leverage

TRUE. Leverage represents a type of risk

EPS: (Net Income)/(Shares because it affects potential returns on Increasing your regular dividend Increase

Outstanding) investment leverage

Cancelling a share repurchase plan Decrease

PE Ratio (Market Price Per

leverage

Share)/Earnings Per Class 5

Selling some of your assets and using the cash

Share)

Capital is the process of choosing how to to pay down Increase leverage

Equity Market Share price x shares Structure finance a firm’s investments.

Value outstanding

Pecking of raising capital predicts managers

Enterprice Value equity market value + debt Order will finance projects with retained

- cash Theory earnings first, debt, then equity

EV/EBITDA EV=Enterprise Value

"Value-to-Earning

Price/Book= Book Value/Share

By AziaCDixon Not published yet. Sponsored by CrosswordCheats.com

cheatography.com/aziacdixon/ Last updated 28th February, 2018. Learn to solve cryptic crosswords!

Page 1 of 2. http://crosswordcheats.com

Finance Cheat Sheet

by AziaCDixon via cheatography.com/56245/cs/14915/

Class 6

VAT=

GainT=

GainS =

VAT=the post-merger value of combined firm (acquirer + target)

VA =the pre-merger value of acquirer

VT= the pre-merger value of target (note: should be the trading price

before any merger speculation caused the price to jump).

S=are estimated post-merger synergies

C= any cash paid by acquirer to target

TP= take over premium

PT= the price paid for the target

Class 9

Dividends a dividend is a cash distribution to shareholders that occurs

at a regular frequency (e.g., quarterly, annual, etc...)

Repurcha A repurchase of stock is a distribution in the form of the

ses company buying back its stock from shareholders.

Special large one-time dividend, in case for next class, a preferred

payout stock with fixed dividends, etc...

In reality, excess cash is bad because it works against the goal of

corporate finance:

1)It lowers return on assets (i.e., ROA or profitability).

2)It increases the cost of capital (why? cash is part of equity so will

impact the WACC calculation).

3)It can create an overly confident, undisciplined management team.

If actual value > intrinsic value don’t invest

If actual value < intrinsic value invest

By AziaCDixon Not published yet. Sponsored by CrosswordCheats.com

cheatography.com/aziacdixon/ Last updated 28th February, 2018. Learn to solve cryptic crosswords!

Page 2 of 2. http://crosswordcheats.com

You might also like

- Texas Vehicle Bill of SaleDocument3 pagesTexas Vehicle Bill of SaleDiana ReynaNo ratings yet

- Assets Beta, β: Acid testDocument28 pagesAssets Beta, β: Acid testAdrianaNo ratings yet

- Distress PDFDocument65 pagesDistress PDFKhushal UpraityNo ratings yet

- Cheat Sheet For Valuation (2) - 1Document2 pagesCheat Sheet For Valuation (2) - 1RISHAV BAIDNo ratings yet

- Cheat Sheet Corporate - FinanceDocument2 pagesCheat Sheet Corporate - FinanceAnna BudaevaNo ratings yet

- Script Book - 15 (5) - SanitizedDocument70 pagesScript Book - 15 (5) - SanitizedTudor Grigoras50% (2)

- BFD Business Valuation PDFDocument2 pagesBFD Business Valuation PDFAqeel HanjraNo ratings yet

- Solutions Prada PDFDocument28 pagesSolutions Prada PDFneoss1190% (1)

- Conociendo El BL - CSFEDocument4 pagesConociendo El BL - CSFEStephania EscuderoNo ratings yet

- Damodaran - Discounted Cash Flow ValuationDocument198 pagesDamodaran - Discounted Cash Flow ValuationYến NhiNo ratings yet

- Cost of CapitalDocument114 pagesCost of CapitalNamra ImranNo ratings yet

- K - GRP 7 - Report On Aviation SectorDocument47 pagesK - GRP 7 - Report On Aviation SectorApoorva PattnaikNo ratings yet

- Rise of Digital Banks in Indonesia - MW - March 2021 - Updated May 2021Document26 pagesRise of Digital Banks in Indonesia - MW - March 2021 - Updated May 2021Dimas Surya PrakarsaNo ratings yet

- Corporate FinanceDocument21 pagesCorporate FinanceJust for Silly UseNo ratings yet

- Damodaran - Value CreationDocument27 pagesDamodaran - Value Creationishuch24No ratings yet

- Confirmation Your Receipt: Payment Was Successful - Your Money Has Been SentDocument2 pagesConfirmation Your Receipt: Payment Was Successful - Your Money Has Been SentAhmed KassemNo ratings yet

- Accounting RatiosDocument3 pagesAccounting RatiosAnkit RoyNo ratings yet

- Burger King FDDDocument738 pagesBurger King FDDSamscribdingNo ratings yet

- SmithCompXM Sample Questions1Document13 pagesSmithCompXM Sample Questions1FrankNo ratings yet

- Strategic Management Process - A Case Study - BoschDocument10 pagesStrategic Management Process - A Case Study - BoschBhagat Kamra (RA1911011010044)100% (1)

- Test 2 Formula SheetDocument7 pagesTest 2 Formula Sheetbalal_hossain_1No ratings yet

- AB1201 Financial Management Week 7: The Cost of Capital: Wacc W R (1-T) + W R + W RDocument18 pagesAB1201 Financial Management Week 7: The Cost of Capital: Wacc W R (1-T) + W R + W RElaine TohNo ratings yet

- Financial ManagementDocument18 pagesFinancial ManagementSoon Mei QiNo ratings yet

- Chapter 4 - StudentDocument18 pagesChapter 4 - StudentANIS NATASHA BT ABDULNo ratings yet

- SDFDDocument3 pagesSDFDVel JuneNo ratings yet

- UEU Penilaian Asset Bisnis Pertemuan 14Document67 pagesUEU Penilaian Asset Bisnis Pertemuan 14Saputra SanjayaNo ratings yet

- PE CheatSheetV2Document2 pagesPE CheatSheetV2jitrapaNo ratings yet

- SS - 7-8 - Mindmaps - Corporate FinanceDocument38 pagesSS - 7-8 - Mindmaps - Corporate Financehaoyuting426No ratings yet

- Financial ManagementDocument8 pagesFinancial ManagementJwzNo ratings yet

- Degerleme GelismeDocument32 pagesDegerleme GelismeferahNo ratings yet

- Week 4 To 8Document8 pagesWeek 4 To 8Ray MundNo ratings yet

- BBMF4814 FS Lecture NotesDocument71 pagesBBMF4814 FS Lecture NotesTHURGASHINI NAIR A/P RAGAWANNo ratings yet

- Slide 8Document13 pagesSlide 8Akash SinghNo ratings yet

- Discount Rates: III: Relative Risk MeasuresDocument20 pagesDiscount Rates: III: Relative Risk MeasuresElliNo ratings yet

- Trade-Off Theory Vs Pecking Order HypothesisDocument9 pagesTrade-Off Theory Vs Pecking Order HypothesisDS ReishenNo ratings yet

- Assignment 2-Zienab MosabbehDocument3 pagesAssignment 2-Zienab MosabbehZienab MosabbehNo ratings yet

- Valuation: Aswath DamodaranDocument54 pagesValuation: Aswath DamodaranMaxNo ratings yet

- Types of Financial Instrument: Corporate Financial Strategy 4th Edition DR Ruth BenderDocument16 pagesTypes of Financial Instrument: Corporate Financial Strategy 4th Edition DR Ruth BenderAin roseNo ratings yet

- Referencer For Strategic Financial ManagementDocument24 pagesReferencer For Strategic Financial ManagementgauravNo ratings yet

- Chapter 7 Primer On Cash Flow ValuationDocument37 pagesChapter 7 Primer On Cash Flow ValuationK60 Phạm Thị Phương AnhNo ratings yet

- 03 DCF Valuation M&ADocument47 pages03 DCF Valuation M&AI DNo ratings yet

- Mangerial Finance: Business FirmDocument4 pagesMangerial Finance: Business FirmHhh LlllNo ratings yet

- AkuisiDocument33 pagesAkuisiAndreas RendraHadiNo ratings yet

- The Value of Synergy: Aswath DamodaranDocument35 pagesThe Value of Synergy: Aswath DamodaranNeha SharmaNo ratings yet

- Chap10 (Accounts Receivable and Inventory Management) VanHorne&Brigham, CabreaDocument3 pagesChap10 (Accounts Receivable and Inventory Management) VanHorne&Brigham, CabreaJollibee JollibeeeNo ratings yet

- Chapter 2 HandoutsDocument176 pagesChapter 2 Handoutselianamacedo1720No ratings yet

- Session 3 & 4 (CH 2 - Approaches To Valuation - DCF & RV)Document44 pagesSession 3 & 4 (CH 2 - Approaches To Valuation - DCF & RV)Arun KumarNo ratings yet

- Capital Struchoices (Modified)Document16 pagesCapital Struchoices (Modified)mogibol791No ratings yet

- Financial Filings and Annual Reports: Separating The Wheat From The ChaffDocument10 pagesFinancial Filings and Annual Reports: Separating The Wheat From The ChaffsuksesNo ratings yet

- SFM PDFDocument22 pagesSFM PDFZafar IqbalNo ratings yet

- 3.1 Leverage and Capital StructureDocument50 pages3.1 Leverage and Capital StructureLou Brad Nazareno IgnacioNo ratings yet

- MnA ValuationDocument47 pagesMnA ValuationKemal AlNo ratings yet

- Selecting Discount Rate: Minimum Acceptable Rate of ReturnDocument5 pagesSelecting Discount Rate: Minimum Acceptable Rate of ReturnscamfalmNo ratings yet

- The Value of Control: Some General Propositions: Stern School of BusinessDocument37 pagesThe Value of Control: Some General Propositions: Stern School of BusinessNic AurthurNo ratings yet

- Ratios - Financial SectorDocument10 pagesRatios - Financial SectorAnish ShahNo ratings yet

- Buscom 2ND Sem Prelims and Midterms Reviewer 1Document13 pagesBuscom 2ND Sem Prelims and Midterms Reviewer 1Accounting MaterialsNo ratings yet

- IIMC Corp Finance 2018-19Document38 pagesIIMC Corp Finance 2018-19Ambuj AgrawalNo ratings yet

- CF (Collected)Document76 pagesCF (Collected)Akhi Junior JMNo ratings yet

- To Test Name of Ratio Formula Parties Interested Industr y NormDocument4 pagesTo Test Name of Ratio Formula Parties Interested Industr y NormMohit SachdevNo ratings yet

- ING - Equity ValDocument42 pagesING - Equity ValoladipupotijaniNo ratings yet

- Strategic Financial Management: A Capsule For Quick RevisionDocument22 pagesStrategic Financial Management: A Capsule For Quick RevisionدهانوجﻛﻮﻣﺎﺭNo ratings yet

- Valuation Lecture I: WACC vs. APV and Capital Structure DecisionsDocument14 pagesValuation Lecture I: WACC vs. APV and Capital Structure DecisionsJuan Manuel VeronNo ratings yet

- Ebit EBIT Interest: % Change Sales % Change EBITDocument1 pageEbit EBIT Interest: % Change Sales % Change EBITJade Berlyn AgcaoiliNo ratings yet

- Week 04 Risk ManagementDocument16 pagesWeek 04 Risk ManagementChristian Emmanuel DenteNo ratings yet

- Slide 11Document45 pagesSlide 11Akash SinghNo ratings yet

- UEU Penilaian Asset Bisnis Pertemuan 12Document37 pagesUEU Penilaian Asset Bisnis Pertemuan 12Saputra SanjayaNo ratings yet

- Fsa c2 - Balance Sheet - Long-Lived Asset AnalysisDocument2 pagesFsa c2 - Balance Sheet - Long-Lived Asset AnalysisK59 LE NGUYEN HA ANHNo ratings yet

- Sri Lanka Media Audience Study 2019Document64 pagesSri Lanka Media Audience Study 2019methlalNo ratings yet

- A Study On Financial Planning For Salaried Employee and For Tax Saving at Smik Systems, Coimbatore CityDocument5 pagesA Study On Financial Planning For Salaried Employee and For Tax Saving at Smik Systems, Coimbatore CityAniket MoreNo ratings yet

- Perhaps The Has Already Been Born.: Real India'Document210 pagesPerhaps The Has Already Been Born.: Real India'SudhanshuNo ratings yet

- Quiz 2 - Integrated Review AFARDocument9 pagesQuiz 2 - Integrated Review AFAROjims Christjohn C CadungganNo ratings yet

- Quotation Kanematsu 2401027784Document3 pagesQuotation Kanematsu 2401027784sofianro.sitepuNo ratings yet

- ITC Covered Call Option Strategy - 24112020-1606213764Document3 pagesITC Covered Call Option Strategy - 24112020-1606213764Bobby TNo ratings yet

- 419-Article Text-1018-1-10-20191118Document12 pages419-Article Text-1018-1-10-20191118Rejjal As-SaqqāfNo ratings yet

- COBECON Practice Exercise 4 - #S 1, 2, 3, 13Document3 pagesCOBECON Practice Exercise 4 - #S 1, 2, 3, 13Van TisbeNo ratings yet

- Fdi and Its Impact On Indian EconomyDocument22 pagesFdi and Its Impact On Indian EconomyYash AgarwalNo ratings yet

- Or Practice SheetDocument15 pagesOr Practice SheetSATISHNo ratings yet

- Tata Steel Social MarketingDocument11 pagesTata Steel Social MarketingMuskan BhartiaNo ratings yet

- Mba Finance Thesis ProposalDocument5 pagesMba Finance Thesis Proposalafbtkukvd100% (2)

- Coffee Business For SaleDocument1 pageCoffee Business For SaleAnonymous 4i7o8ENo ratings yet

- MARK2007 - Spring 2021 Course SupplementDocument3 pagesMARK2007 - Spring 2021 Course SupplementRaquel Stroher ManoNo ratings yet

- Sample 2 Aircraft PurchaseDocument4 pagesSample 2 Aircraft PurchaseApril mitaNo ratings yet

- Mean, Median, Mode and Range - Gaming AveragesDocument3 pagesMean, Median, Mode and Range - Gaming AveragesAnnie AliNo ratings yet

- Quality of Health Care - Gashaw PDFDocument76 pagesQuality of Health Care - Gashaw PDFKokebu MekonnenNo ratings yet

- Kurlon, History, About UsDocument2 pagesKurlon, History, About UsVidya Sagar100% (2)

- M-14 Conduct On Site Supervision of BEIDocument172 pagesM-14 Conduct On Site Supervision of BEIkassamammukaNo ratings yet

- Olansi Catalogue 1Document16 pagesOlansi Catalogue 1Duy NamNo ratings yet

- Entry, Capacity, Investment and Oligopolistic Pricing (A J) 1977Document12 pagesEntry, Capacity, Investment and Oligopolistic Pricing (A J) 1977pedronuno20No ratings yet