Professional Documents

Culture Documents

1-Consumption Tax Exercises

Uploaded by

Vu Thi ThuongOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1-Consumption Tax Exercises

Uploaded by

Vu Thi ThuongCopyright:

Available Formats

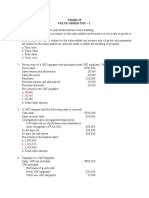

VALUE ADDED TAX EXERCISES

Exercise 1

Enterprise A in the current tax period has the following documents:

1. Opening stock: 50 units of product A, purchased price (VAT-exclusive) of

100,000 VND/unit.

2. Purchases in the tax period

- 5,000 units of product B from a domestic producer with the price (VAT-

exclusive) of 200,000 VND/unit;

- 30 units of product C from a business household; the purchase price writen on

the list of purchased goods at 1,000,000 VND/unit.

3. Products sales in the tax period

- The total 50 units of product A on stock with the selling price (VAT-

exclusive) of 150,000 VND/unit.

- 2,000 units of product B with the selling price (VAT-exclusive) of 220,000

VND/unit. The remaining amount is outwarehoused to an agent (selling goods

and services at set prices) using a VAT invoice. The price written on the

invoice is 220,000 VND/unit. In the tax period, the agent has sold 1,000 units

of product B. The sales commission is 2% of the revenue.

- 25 units of product C with the selling price (VAT-exclusive) of 1,100,000

VND/unit.

Calculate the VAT payable of the enterprise in the tax period. Given:

- Input VAT of other input goods and services serving the business activities in

the tax period (with legitimate invoices and documents): 5 mil VND.

- Product B and C purchased with the payment method of bank transfer.

- VAT rate of A, B, C and commission is 10%.

- The enterprise has registered to pay VAT using the credit-invoice method.

Exercise 2

Enterprise B in the current tax period, has the following activities:

- Sold 3,000 units of product X domestically. The selling price (VAT-exclusive)

written on the VAT invoice is 200,000 VND/unit.

- Sold 1,000 units of product X domestically. On the VAT invoice, only the VAT-

inclusive price of 220,000 VND/unit is written.

- Directly exported 2,000 product X with the FOB price of 240,000 VND/unit. The

exported products are qualified for VAT deduction and refund. Exwarehoused

price: 200,000 (VAT-exclusive price)

- Entrusted exported for Company Y 5,000 product A with the total export value of

1 bil VND. The commission received from this activity is 2% of the export value.

- Used the ex-warehousing-cum-internal transportation bills enclosed with the

internal transfer order, ex-warehoused 500 units of product X to a branch in the

same province; at the end of the tax period, the branch has sold 400 units with the

VAT-exclusive price of 200,000 VND/unit.

Requirements

1. Calculate the VAT payable in the tax period, given:

- Deductible input VAT gathered on legitimate VAT invoices: 200 mil VND.

- VAT rate of product X, A: 10%

2. Suppose for 2,000 units of exported product X, the enterprise can present the tax

declaration form but without the bank transfer documents. Calculate the VAT payable in

the tax period.

Exercise 3

Company X in the tax period has the following information:

1. Entrusted export for company A a machine with the export price of 600 million VND.

The commission received from this activity is 3% of the export price.

2. Act as an agent (selling goods at fixed price) for company B. In the period, X has sold

10,000 products at 50,000 VND/product (VAT-exclusive). The commisison received is

5% of the VAT-exclusive price.

3. Sold a product to company C with the original price of 250 million VND (VAT-

exclusive). However, in the sales contract, both parties agree with the payment method of

installments, company C will pay a total price of 300 million VND (VAT-exclusive) in

the span of 3 years.

Requirements

Determine the VAT payable of company X in the tax period. Given: X pays VAT using

the credit-invoice method. The VAT rate of products and services is 10%. Input VAT of

other input goods and services serving the business activities in the tax period (with

legitimate invoices and documents): 50 mil VND

You might also like

- 1-Consumption Tax ExercisesDocument2 pages1-Consumption Tax Exercisesngothanhthuy829No ratings yet

- CONSUMPTION TAX EXERCISESDocument6 pagesCONSUMPTION TAX EXERCISESYến Nhi VũNo ratings yet

- Consumption Tax ExercisesDocument8 pagesConsumption Tax ExercisesMinh TuấnNo ratings yet

- Excersice VATDocument2 pagesExcersice VATThu HươngNo ratings yet

- Tax ExercisesDocument15 pagesTax Exercisestrangphap2100No ratings yet

- Excersice 2021Document6 pagesExcersice 2021linhdavedz123No ratings yet

- Excersice VATDocument2 pagesExcersice VATphatprotn6No ratings yet

- Tobacco Factory TaxesDocument4 pagesTobacco Factory TaxesPhương AhnNo ratings yet

- Taxation - Ins 3010: Group 2Document10 pagesTaxation - Ins 3010: Group 2nguyễnthùy dươngNo ratings yet

- Mid ThúeeDocument4 pagesMid Thúeetuanminhyl56No ratings yet

- Bai Tap Thue Gian ThuDocument8 pagesBai Tap Thue Gian ThuTrân VõNo ratings yet

- Taxation - Ins 3010 - Group Working - : Lecturer: Ph.D. Nguyen Thi Thanh HoaiDocument10 pagesTaxation - Ins 3010 - Group Working - : Lecturer: Ph.D. Nguyen Thi Thanh Hoainguyễnthùy dươngNo ratings yet

- 30_Dinh Phuc UyenDocument6 pages30_Dinh Phuc UyenĐinh Phúc UyênNo ratings yet

- VAT Due Calculation for Manufacturing, Services, Imports & ExportsDocument7 pagesVAT Due Calculation for Manufacturing, Services, Imports & ExportsRamez AhmedNo ratings yet

- Exercise EIT and PIT 1Document6 pagesExercise EIT and PIT 1Quỳnh Anh NguyễnNo ratings yet

- Part Two Value Added Tax VATDocument54 pagesPart Two Value Added Tax VATSawsan HatemNo ratings yet

- Accounting for Trading EnterprisesDocument2 pagesAccounting for Trading EnterprisesYến Hoàng LêNo ratings yet

- Import - Export ExerciseDocument2 pagesImport - Export Exercisetdat86860No ratings yet

- Case Study - Chapter 1 2 3 4 - 2Document5 pagesCase Study - Chapter 1 2 3 4 - 2Lê Ngọc Vân NhiNo ratings yet

- Quiz 4 VATDocument3 pagesQuiz 4 VATAsiong Salonga100% (2)

- Tutorial 5 - 2024Document4 pagesTutorial 5 - 2024Giang Dương HươngNo ratings yet

- Test F.A1Document1 pageTest F.A1Đức Mạnh ĐỗNo ratings yet

- VAT, Tax Calculation for Company & Individual ActivitiesDocument5 pagesVAT, Tax Calculation for Company & Individual ActivitiesNguyễn ThươngNo ratings yet

- SV Exercises FA1Document13 pagesSV Exercises FA1Nguyễn Văn AnNo ratings yet

- MID THUẾDocument9 pagesMID THUẾtuanminhyl56No ratings yet

- VAT Problems SolvedDocument3 pagesVAT Problems Solvedtisha10rahman50% (4)

- Excersie ETDocument2 pagesExcersie ETdaoviethung29No ratings yet

- Financial Accounting I: Exercises: Exercise 1: Company H Applies The Deductible VAT Method and The Perpetual InventoryDocument16 pagesFinancial Accounting I: Exercises: Exercise 1: Company H Applies The Deductible VAT Method and The Perpetual InventoryKinomoto Sakura33% (3)

- Group 4 ReportDocument13 pagesGroup 4 Reportnguyễnthùy dươngNo ratings yet

- Chapter 3. Corporate Income TaxDocument90 pagesChapter 3. Corporate Income TaxVu Thi ThuongNo ratings yet

- Financial AccountingDocument5 pagesFinancial AccountingMisteroNo ratings yet

- Group 4 ReportDocument16 pagesGroup 4 Reportnguyễnthùy dươngNo ratings yet

- Excersie ETDocument1 pageExcersie ETphatprotn6No ratings yet

- BUSINESS TAX CALCULATIONSDocument13 pagesBUSINESS TAX CALCULATIONSKathleen AgustinNo ratings yet

- VAT ReviewDocument10 pagesVAT ReviewRachel LeachonNo ratings yet

- ABC Merchandising TransactionsDocument2 pagesABC Merchandising TransactionsAnh Tuyen GiangNo ratings yet

- BT Chương 1-3Document23 pagesBT Chương 1-3Hà Chi NguyễnNo ratings yet

- TAX EXAMINATION SET A SOLUTIONSDocument2 pagesTAX EXAMINATION SET A SOLUTIONSalmira garciaNo ratings yet

- Lecturer. 8.. Income Tax Article .22Document5 pagesLecturer. 8.. Income Tax Article .22AlisyaNo ratings yet

- Calculating CIT Payable for 3 EnterprisesDocument3 pagesCalculating CIT Payable for 3 EnterprisesThu Phương NguyễnNo ratings yet

- Transitional Input VATDocument21 pagesTransitional Input VATJoanne TolentinoNo ratings yet

- Taxable Income: 20% 10000 200000/2 200000000 PIT 200000000 5% 10mDocument32 pagesTaxable Income: 20% 10000 200000/2 200000000 PIT 200000000 5% 10mnga vuNo ratings yet

- Taxation Report Group01Document14 pagesTaxation Report Group01tuanminhyl56No ratings yet

- DocxDocument28 pagesDocxGrace Managuelod GabuyoNo ratings yet

- Test 1Document3 pagesTest 1Tram AnhhNo ratings yet

- Tax 2Document3 pagesTax 2Emmanuel DiyNo ratings yet

- VAT ReviewDocument8 pagesVAT ReviewabbyNo ratings yet

- Chapter 2. VatDocument97 pagesChapter 2. VatVu Thi ThuongNo ratings yet

- Vat 2Document4 pagesVat 2Allen KateNo ratings yet

- Value-Added Tax on Regular Sales and TransactionsDocument38 pagesValue-Added Tax on Regular Sales and TransactionsEmersonNo ratings yet

- Joey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATDocument10 pagesJoey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATLeah Isabelle Nodalo DandoyNo ratings yet

- VAT QuizzerDocument16 pagesVAT QuizzerAnonymous 2ajCCT03VM50% (6)

- 2nd Test 90Document2 pages2nd Test 90Nhung BùiNo ratings yet

- VAT IllustrationsDocument1 pageVAT IllustrationsThu ThuNo ratings yet

- Corporate Income Tax AssignmentDocument1 pageCorporate Income Tax AssignmentNhi Trần ThảoNo ratings yet

- Đề-kiểm-tra-KTTCVN-1-59.22CL.03.LT1Document30 pagesĐề-kiểm-tra-KTTCVN-1-59.22CL.03.LT1nngiahue269No ratings yet

- Taxation Chapter 4 VATDocument54 pagesTaxation Chapter 4 VATTín TrungNo ratings yet

- Solutions To Quiz 2 - VAT PAYABLEDocument4 pagesSolutions To Quiz 2 - VAT PAYABLEMark Emil BaritNo ratings yet

- Assignment VAT ComputationDocument3 pagesAssignment VAT ComputationAngelyn SamandeNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Chapter 1. Tax System and AdminDocument52 pagesChapter 1. Tax System and AdminVu Thi ThuongNo ratings yet

- Tax ExerciseDocument1 pageTax Exercisengothanhthuy829No ratings yet

- 2-Cit ExcercisesDocument4 pages2-Cit Excercisesngothanhthuy829No ratings yet

- 4-FCT ExercisesDocument5 pages4-FCT Exercisesngothanhthuy829No ratings yet

- 3-Pit ExercisesDocument4 pages3-Pit Exercisesngothanhthuy829No ratings yet

- Factsheet Nifty50 ShariahDocument2 pagesFactsheet Nifty50 ShariahMonu GamerNo ratings yet

- Economics of Strategy 5th Edition Besanko Test BankDocument9 pagesEconomics of Strategy 5th Edition Besanko Test Banklucnathanvuz6hq100% (26)

- Lovoit Company August financial reportDocument8 pagesLovoit Company August financial reportManikangkana BaishyaNo ratings yet

- Unit 2Document38 pagesUnit 2Avinash yesnoNo ratings yet

- Chapter 3 Corporate Liquidation and Reorganization-PROFE01Document3 pagesChapter 3 Corporate Liquidation and Reorganization-PROFE01Steffany RoqueNo ratings yet

- Assumption College Final Exam ReviewDocument7 pagesAssumption College Final Exam ReviewJudithaNo ratings yet

- Underwriting of Shares and DebenturesDocument76 pagesUnderwriting of Shares and DebenturesShamik ChakrabortyNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisKamran Ali AnsariNo ratings yet

- ch01 en IbmDocument57 pagesch01 en IbmDewi Chan曾琦珍No ratings yet

- Final Accounts QuestionDocument12 pagesFinal Accounts Questionadityatiwari122006No ratings yet

- ACT 205 Assignment - Spring 2019-20Document5 pagesACT 205 Assignment - Spring 2019-20Muhammad AhamdNo ratings yet

- Assurance PC 1 PDFDocument2 pagesAssurance PC 1 PDFrui zhangNo ratings yet

- Niches (TG@MoneyBashers)Document64 pagesNiches (TG@MoneyBashers)kosanoc504No ratings yet

- Account Classification and PresentationDocument8 pagesAccount Classification and Presentationariane100% (1)

- Bain - India Private Equity Report 2022Document40 pagesBain - India Private Equity Report 2022Taher JavanNo ratings yet

- Chapter 8 Financial StatementDocument34 pagesChapter 8 Financial StatementMuhammad AfzalNo ratings yet

- 3 Year Cash Flow Projections Mimi's Mobile & Retail ClothingDocument6 pages3 Year Cash Flow Projections Mimi's Mobile & Retail ClothingNgwenya ThabaniNo ratings yet

- Advanced Public Finance and Taxation Strathmore University Notes and Revision KitDocument286 pagesAdvanced Public Finance and Taxation Strathmore University Notes and Revision Kitmillicent odhiamboNo ratings yet

- Ramco WordDocument8 pagesRamco WordSomil GuptaNo ratings yet

- Ultimate Guide To Procurement Cost SavingsDocument38 pagesUltimate Guide To Procurement Cost SavingsLcl KvkNo ratings yet

- Chap 10 PartnershipDocument24 pagesChap 10 PartnershipIvhy Cruz Estrella100% (2)

- Chapter 8 and 10Document4 pagesChapter 8 and 10Glory CrespoNo ratings yet

- Reliance Capital InvestorDocument29 pagesReliance Capital InvestorbubumundaNo ratings yet

- Vegetron Case StudyDocument2 pagesVegetron Case StudyMonika KauraNo ratings yet

- Accounting Class No. 2-3 (Case 4-7)Document2 pagesAccounting Class No. 2-3 (Case 4-7)Мария НиколенкоNo ratings yet

- Chapter 6 Mini Case: SituationDocument9 pagesChapter 6 Mini Case: SituationUsama RajaNo ratings yet

- Solution Manual For Introduction To Accounting An Integrated Approach 6th Edition by AinsworthDocument6 pagesSolution Manual For Introduction To Accounting An Integrated Approach 6th Edition by Ainswortha755883752No ratings yet

- Beams Ch.4Document48 pagesBeams Ch.4Rara Rarara30No ratings yet

- Chap 7Document27 pagesChap 7Joanne Chau100% (1)

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelSSSNIPDNo ratings yet