Professional Documents

Culture Documents

Example Inventory Losses

Example Inventory Losses

Uploaded by

2019045224Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Example Inventory Losses

Example Inventory Losses

Uploaded by

2019045224Copyright:

Available Formats

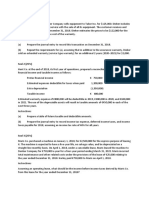

EXAMPLE INVENTORY LOSSES

Mr Shoeboo is the owner of an enterprise selling shoes and boots and he

approaches you regarding a claim for inventory destroyed by fire at his shop on

20 September 2019. He always marks the inventory to realise a profit of 40% on

selling prices before Value Added Tax (VAT). The enterprise is registered for VAT

and VAT is charged at a rate of 15%.

The following information is available:

R

Inventory 1/10/2018 1 050 000

Purchases 1/10/2018 to 20/09/2019 according to invoices from suppliers 24 725 000

Sales 1/10/2018 to 20/09/2019 according to duplicate invoices to 34 500 000

customers

Inventory not destroyed by the fire at marked prices 1 820 834

During January 2019 a sale was held where all inventory were sold by marking

down the marked prices by 25%. The proceeds of sales during the ‘sale’ week was

R862 500.

No adjustment has been made in the records in respect of the following:

a) On the night of 17 February 2019, thieves broke into the store and stole

shoes with marked prices of R115 000. Mr Shoeboo is not insured against

losses of this nature.

b) An assistant, since dismissed, is known to have stolen R5 750 from the cash

takings during May 2019. This money is irrecoverable.

c) An invoice for R8 050, in respect of goods purchased for resale from Suppliers

Ltd. On 18 December 2018, was never recorded in the books.

REQUIRED EXAMPLE

Calculate the inventory loss as a result of the fire on 20 September 2019.

Your answer should comply with IFRSs. Assume that all items and amounts are material

except where the information clearly indicates otherwise. Round off to the nearest Rand.

You might also like

- FAC1502 Assignment 4 2023Document193 pagesFAC1502 Assignment 4 2023Haat My Later100% (1)

- FAC1502 Assignment 4 Semester 2 2023Document192 pagesFAC1502 Assignment 4 Semester 2 2023Haat My Later100% (1)

- PROBLEM 1: P Company Had 90% Ownership Interest Acquired Several Years Ago in S Company. TheDocument4 pagesPROBLEM 1: P Company Had 90% Ownership Interest Acquired Several Years Ago in S Company. TheMargaveth P. Balbin75% (4)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- InventoriesDocument47 pagesInventoriesMarjorie NepomucenoNo ratings yet

- Quiz Activity#2 INTACCDocument7 pagesQuiz Activity#2 INTACCGellie Buenaventura100% (1)

- 1st PB TAX AnsDocument24 pages1st PB TAX AnsDin Rose Gonzales50% (2)

- Universal College of Parañaque: Value Added TaxDocument14 pagesUniversal College of Parañaque: Value Added TaxDin Rose Gonzales67% (3)

- Income & Business Taxation QB3Document8 pagesIncome & Business Taxation QB3Keahlyn Boticario0% (1)

- Problem IV ExamDocument2 pagesProblem IV ExamLJ AggabaoNo ratings yet

- Business & Transfer Taxation CH Reviewer PDFDocument14 pagesBusiness & Transfer Taxation CH Reviewer PDFJessa FelisildaNo ratings yet

- Prelim Examination. AY 2nd SEM 2023 2024Document5 pagesPrelim Examination. AY 2nd SEM 2023 2024amseservices18No ratings yet

- Question. Chapter 4. Trading ProfitDocument6 pagesQuestion. Chapter 4. Trading ProfitTâm TốngNo ratings yet

- Q2FT InventoriesDocument2 pagesQ2FT Inventoriesfrancis dungcaNo ratings yet

- Mock Test Paper 2Document7 pagesMock Test Paper 2FarrukhsgNo ratings yet

- Tax Practices: Certificate in Accounting and Finance Stage ExaminationDocument2 pagesTax Practices: Certificate in Accounting and Finance Stage ExaminationDaniyal AhmedNo ratings yet

- Comprehensive Exercise AjeDocument2 pagesComprehensive Exercise AjeCHRISTEA MAUSISANo ratings yet

- Acct 101 1 Hour QuestionDocument4 pagesAcct 101 1 Hour QuestionAkira MaharajNo ratings yet

- FAR - Inventory Estimation - No AnsDocument2 pagesFAR - Inventory Estimation - No AnsJacob Raphael100% (1)

- Quiz No. 2 - ReceivablesDocument1 pageQuiz No. 2 - ReceivablesJi BaltazarNo ratings yet

- 08 Handout 1 PDFDocument6 pages08 Handout 1 PDFJanleoRosalesPraxidesNo ratings yet

- MTP RTP InventoriesDocument4 pagesMTP RTP Inventoriessejaldharamshi1909No ratings yet

- Quiz 405Document3 pagesQuiz 405Shaika HaceenaNo ratings yet

- Business Tax AnsDocument12 pagesBusiness Tax AnsLars FriasNo ratings yet

- VAT AND OPT Monthly EXAMDocument20 pagesVAT AND OPT Monthly EXAMAlexandra Nicole IsaacNo ratings yet

- Project in FinAccDocument15 pagesProject in FinAccBrod Lee SantosNo ratings yet

- BUS207Document2 pagesBUS207palashndcNo ratings yet

- Homework On Current LiabilitiesDocument3 pagesHomework On Current LiabilitiesalyssaNo ratings yet

- Cash Flow Analysis Indirect VS Direct MethodDocument1 pageCash Flow Analysis Indirect VS Direct MethodMaricar San AntonioNo ratings yet

- Accounting I Nov 2019 Exam Final PaperDocument8 pagesAccounting I Nov 2019 Exam Final Paper2603803No ratings yet

- SOAL Kuis Materi UAS Inter 2Document2 pagesSOAL Kuis Materi UAS Inter 2vania 322019087No ratings yet

- SOAL Kuis Materi UAS Inter 2Document2 pagesSOAL Kuis Materi UAS Inter 2vania 322019087No ratings yet

- TAXDocument1 pageTAXIvy SaliseNo ratings yet

- Value Added Tax PracticeDocument7 pagesValue Added Tax PracticeSelene DimlaNo ratings yet

- QUIZ1Document1 pageQUIZ1Janysse CalderonNo ratings yet

- QUIZ1Document1 pageQUIZ1Janysse CalderonNo ratings yet

- Sales Tax Test 2Document2 pagesSales Tax Test 2Daniyal AhmedNo ratings yet

- Cost of Good SaleDocument6 pagesCost of Good SaleArvin VillanuevaNo ratings yet

- Cost of Good SaleDocument6 pagesCost of Good SaleArvin VillanuevaNo ratings yet

- Quiz 3 ABC 25 ITEMSDocument8 pagesQuiz 3 ABC 25 ITEMSAndrew wiggin0% (1)

- Methods of Estimating The Amount of Inventory:: Sales DiscountDocument4 pagesMethods of Estimating The Amount of Inventory:: Sales Discountellaine villafaniaNo ratings yet

- Prae03 HoDocument3 pagesPrae03 HoDiane MagnayeNo ratings yet

- 93-13 - VatDocument19 pages93-13 - VatJuan Miguel UngsodNo ratings yet

- Multiple Choice QuestionsDocument14 pagesMultiple Choice QuestionsVince ManahanNo ratings yet

- Additional Vat MSQ PDFDocument14 pagesAdditional Vat MSQ PDFPrincesNo ratings yet

- Chapter 5 Sales TaxDocument5 pagesChapter 5 Sales Taxali_sattar15No ratings yet

- CHAPTER 3 - Transfer and Business TaxDocument6 pagesCHAPTER 3 - Transfer and Business TaxKatKat Olarte0% (1)

- VAT ReviewDocument8 pagesVAT ReviewabbyNo ratings yet

- VAT ReviewDocument10 pagesVAT ReviewRachel LeachonNo ratings yet

- AP Inventories 2ndsetDocument7 pagesAP Inventories 2ndsetMaritessNo ratings yet

- 8th PICPA National Accounting Quiz ShowdownDocument28 pages8th PICPA National Accounting Quiz Showdownrcaa04No ratings yet

- VAT (Theory & Problem)Document10 pagesVAT (Theory & Problem)dimpy dNo ratings yet

- F6 Progress Test 2 - 2018Document11 pagesF6 Progress Test 2 - 2018chanellvdb1No ratings yet

- Taxation CPALE by WMGDocument19 pagesTaxation CPALE by WMGJona Celle Castillo100% (1)

- Tax RevDocument4 pagesTax RevCanapi AmerahNo ratings yet

- Assignment Do It Yourself (Diy)Document3 pagesAssignment Do It Yourself (Diy)Marites AmorsoloNo ratings yet

- DU B.com (H) First Year (Financial Acc.) - Q Paper 2010Document7 pagesDU B.com (H) First Year (Financial Acc.) - Q Paper 2010mouryastudypointNo ratings yet

- Icaew Cfab Pot 2018 Sample ExamDocument30 pagesIcaew Cfab Pot 2018 Sample ExamAnonymous ulFku1vNo ratings yet

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet