Professional Documents

Culture Documents

Document

Document

Uploaded by

vineminai0 ratings0% found this document useful (0 votes)

8 views41 pagessjad

Original Title

Document (5)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsjad

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views41 pagesDocument

Document

Uploaded by

vineminaisjad

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 41

PHONE NO: 9419196999

E-MAIL: anilgupta@anphar.com

ANPHAR LABORATORIES PRIVATE LIMITED.

os REGD. OFFICE: INDUSTRIAL EXTENSION AREA, PHASE - Ill, GANGYAL, JAMMU

133112)K1987PTCO00930

metas ‘NOTICE OF ANNUAL GENERAL MEETING

Notice is hereby given that the 36!" Annual General Meeting of the Company will be held at the

registered office of the Company at Industrial Extension Area, Phase ~ i, Gangyal, Jammu on

Saturday the 30 of September, 2023 at 11.00 AM to transact the following business:

‘ORDINARY BUSINESS:

1. Toreceive, consider and addpt the Audited Financial Statement as at 31° of March, 2023 and

Statement of Profit and Lass for the year ended on that date and the Reports of the Board of

Directors and the Auditors thereon and the audited consolidated financial statements of the

company for the financial year ended 31* March, 2023,

By order of the Board

At

Place Jammu ‘ANIL GUPTA

Dated:04.09,2023 DIRECTOR

10897796

NOTES:

vote at the meeting instead of himself. A proxy need not be member of the company. A proxy to be

valid should be deposited with

general meeting of the company.

1. Amember entitled to attend and he at the meeting is entitled to appoint a proxy to attend and

company not tater than forty eight hours before the annual

2. Members/Proxies should All the| Attendance Slip for attending the Meeting and bring their

Attendance Slips to the Meeting.

3, ‘The instrument appointing the proky, in order to be effective, must be deposited at the Corporate

office of the Company, duly completed and signed, not less than 48 HOURS before the

commencement of the meeting, Prdxies submitted on behalf of companies, societies, etc, must be

supported by an appropriate resolution/authority, as applicable, A person can act as proxy on

behalf of shareholders not exceeding Sty (50) and/or holding in the aggregate not more than

10% of the total share capital of the Company. In case a proxy is proposed to be appointed by a

shareholder holding more than 10% of the total share capital of the Company carrying voting

"Fghts, hen such proxy shall not at as proxy for any other person or shareholder.

4, All relevant documents referred in this Notice shall be open for inspection by the Members at the

Registered office of the Company during the business hours on all working days upto the date of

AGM.

5. In terms of the requirements of the Secretarial Standard on General Meetings (SS-2) a route map of

the venue of the AGM is enclosed

PHONE NO: 9419196999

E-MAIL: anilgupta@anphar.com

ANPHAR LABORATORIES PRIVATE LIMITED.

REGD. OFFICE : INDUSTRIAL EXTENSION AREA, PHASE - Ill, GANGYAL, JAMMU

CIN: U33112)K1987PTC000930

DIRECTOR'S REPORT

To

The Members,

Your Directors have pleasure in

Presenting their 36 Annual Report of the Company

together with the Audited Statements of Accounts for the year ended 31st March, 2023,

FINANCIAL RESULTS:

‘The Company's financial performance for the

figures are given hereunder:

PARTICULARS

Revenue From Operations

Other Income

Depreciation/Amortization

Net Profit/Loss before Tax

Provision for Tax

Deferred Tax

Net Profit/Loss after Tax

EPS

APPROPRIATIONS:

Adjustment Relating to Fixed

Assets

Transferred to General Reserve

/Statutory Reserve

Proposed dividend on Equity

Shares

‘Tax on dividend

year under review along with previous years

2023

(Amount in 00's.) (Amount in 00's)

1617288.70 1890073.62

63764.05, 59827.85

105847.36 68849.82

195012.85 416712.50

55876.84 104278.05

(3502.43) 3574.02

142638.43 308860.43

12.00 25.97

NIL NIL

NIL. NIL

NIL NIL

NIL. NIL

The Company has made strategic plans and established the Corporate strategy for ensuring

efficiency in order to increase the revenue from operations of the company.

DIVIDEND:

The Board of Directors of the company have not recommended any dividend for the year

under review

RESERVES:

ie Reserves & Surplus standing in the books of accounts amounting to Rs. 18,96,29,412/-

for the year ended on 31.03.2023

SHARE CAPITAL:

The Authorized Share Capital of the company is Rs. 1,20,00,000/- (Rupees One Crore

‘Twenty Lakh Only) divided into 12,00,000 equity shares of Rs. 10/- (Rupees Ten only) each

and the Paid Up Capital of the Company is Rs,

Lakh and Ninety Thousand and Eight Hundred

Rs. 10/- (Rupees Ten only) each.

1,18,90,800/- (Rupees One Crore Eighteen

Only) divided into 1189080equity shares of

During the Year, the Company has not made any changes in the Authorized or Paid Up Share

Capital of the Company.

MATERIAL CHANGES AND COMMITMENT IF ANY AFFECTING THE FINANCIAL

POSITION OF THE COMPANY OCCURRED BETWEEN THE END OF THE FINANCIAL YEAR

TO WHICH THIS FINANCIAL STATEMENTS RELATE AND THE DATE OF THE REPORT:

No material changes and Commitment affecting the Financial Position of the Company have

occurred.

DIRECTORS RESPONSIBILITY STATEMENT

In accordance with the provisions of Section 134(5) of the Companies Act, 2013, the Board

of Directors hereby submits its responsibility Statement:-

(@) __ Inthe preparation of the annual accounts, the applicable accounting standards had

been followed along with proper explanation relating to material departures,

(b) The Directors had selected such accounting policies and applied them consistently

and made judgments aid estimates that are reasonable and prudent so as to give a

true and fair view of thé state of affairs of the company at the end of the financial

year and of the profit and loss of the company for that period;

(©) The Directors had taken proper and sufficient care for the maintenance of adequate

accounting records in ac¢ordance with the provisions of this Act for safeguarding the

assets of the company and for preventing and detecting fraud and other

irregularities;

(a) The Directors had prepated the annual accounts on a going concern basis; and

(©) The Directors had devised proper systems to ensure compliance with the provisions

ofall applicable laws and that such systems were adequate and operating effectively.

|

FRAUD REPORTING: ~

During the year under review nio instances of fraud were reported by the Company and by

the Statutory Auditors of the Company.

STATEMENT CONCERNING DEVELOPMENT AND IMPLEMENTATION OF RISK

MANAGEMENT POLICY OF THE COMPANY:

Business Risk Assessment procedures have been set in place for self-assessment of business

risks, operating controls and appropriate risk management policies are being framed to

cope up with any type of business risk.

DISCLOSURE:

CONSERVATION OF ENERGY, TECHNOLOGY ABSORPTION, FOREIGN EXCHANGE

EARNINGS AND OUTGO:

‘The information pertaining to conservation of energy, technology absorption, Foreign

exchange Earnings and outgo a¢ required under Section 134 (3)(m) of the Companies Act,

2013 read with Rule 6(3) of the\Companies (Accounts) Rules, 2014 furnished in Annexure 1

Is attached to this report.

DETAILS OF POLICY DEVELOPED AND IMPLEMENTED BY THE COMPANY ON ITS

CORPORATE SOCIAL RESPONSIBILITY INITIATIVES;

Anphar Laboratories Private Limited CSR initiatives and activities are aligned to the

requirements of Section 135 of|the Act. The brief outline of the CSR policy of the Company

and the initiatives undertaken by the Company on CSR activities during the year are set out

in Annexure | of this report in the format prescribed in the Companies (Corporate Social.

Responsibility Policy) Rules, 2014.

PARTICULARS OF LOANS, GUARANTEES OR INVESTMENTS MADE UNDER SECTION 186

OF THE COMPANIES ACT, 2013:

‘The Company has granted a loan of amount of Rs. 3,12,50,000/- to a company, AGRO TECH

AROMATICS PRIVATE LIMITED under Section 186 of the Companies Act, 2013 during the

year under review,

PARTICULARS OF CONTRACTS OR ARRANGEMENTS MADE WITH RELATED PARTIES:

‘The particulars of Contracts or Arrangements made with related parties made pursuant to

Section 188 is furnished in Annexure II is attached to this report.

DISCLOSURE UNDER THE SEXUAL HARASSMENT OF WOMEN AT WORKPLACE

(PREVENTION, PROHIBITION & REDRESSAL), ACT, 2013:

‘The company has always believed in providing a safe and harassment free workplace for

every individual working in the company through various interventions and practices. The

Company always endeavors to| create and provide an environment that is free from

discrimination and harassment |ncluding sexual harassment. The Company has in place a

robust system on prevention of sexual harassment at workpiace and it aims at prevention of

harassment of employees and lays down the guidelines for identification, reporting and

prevention of sexual harassment =

‘There were no complaints reported under the Prevention of Sexual Harassment of Women

at Workplace (Prevention, Proi{ibition and Redressal) Act, 2013 during the year under

review

‘THE DETAIL OF APPLICATION MADE OR ANY PROCEEDINGS PENDING UNDER THE

INSOLVENCY AND BANKRUPTCY CODE, 2016 DURING THE YEAR ALONG WITH THEIR:

STATUS AS AT THE END OF THE FINANCIAL YEAR:

During the year, there was no application made and proceeding initiated/ pending under

the Insolvency and Bankruptcy Gode, 2016, by any Financial and /or Operational Creditors

against your Company.

‘As on the date of this report, there is no application or proceeding pending against your

Company under the Insolvency ad Bankruptcy Code, 2016.

OF ONE TIME SETTLEMENT AND THE VALUATION DONE AT THE TIME OF TAKING

LOANS FROM BANKS OR FINANCIAL INSTITUTIONS ALONG WITH THE REASONS

THEREOF:

‘THE DETAILS OF Pane A THE AMOUNT OF VALUATION AT THE TIME

During the Financial Year 2022-28, the Company has not made any one time settlement with

its Bankers from which it has accepted any term Loan,

‘SECRETARIAL STANDARDS:

The Secretarial Standards Le $S+1& $S-2 relating to meetings of Board of Directors and

General Meeting respectively have been duly followed by the Company.

NUMBER OF BOARD MEETINGS|CONDUCTED DURING THE YEAR UNDER REVIEW:

‘The Company had 06 Board

financial year under review.

DEPOSITS:

‘The Company has neither accepted nor renewed any deposits during the year under review.

jeetings and 02 CSR Committee meeting during the

Particulars of Employees and Related Disclosures:

In terms of provisions of Section 197 of the Companies Act, 2013 read with the Companies

{Appointment and Remuneration of Managerial Personnel) Rules, 2014, during the year

under review there were no employees receiving remuneration in excess of the prescribed

limit as per the provisions of the Companies Act, 2013.

STATUTORY AUDITORS/ AUDITOR'S REPORT:

‘The appointment of M/s Arora|Vohra & Co, Chartered Accountants, Jammu as Statutory

Auditors of the company to hold office for the period of 5 consecutive years i.e until the

conclusion of the 37 Annual Geperal Meeting to be held in the year 2024.

The Company has received a letter from them to the effect that their appointment, if made,

‘would be within the limit prescr

they are not disqualified for su

Companies Act, 2013.

Cost AUDITORS:

‘ped under Section 139 of the Companies Act, 2013 and that

fh appointment within the meaning of Section 141 of the

Pursuant to section 148 of the Spnpanies Act, 2013 read with the Companies (cost Records

and Audit) Amendment Rules, 2

on the Company.

ASSOCIATE COMPANY:

M/s. AGRO TECH AROMATH

ANPHAR LABORATORIES PRI

Act, 2013 which is holding 34,

129(3) read with the rule § of

1 (Annexure-lII} is attached wit

CONSOLIDATED FINANCIAL

/14, the maintenance of Cost Audit records is not applicable

IS PRIVATE LIMITED is a Associate Company of M/s

ATE LIMITED pursuant to Section 2[6) of the Companies

15% of Shares and the Form AOC-1 pursuant to Section

panies (Accounts) Rules, 2014 is furnished in Form AOC-

this report.

FATEMENTS:

In accordance with the Accountjng Standard (AS-21) on Consolidated Financial Statements

read with Accounting Standard

audited consolidated financial st

EXPLANATION OR COMMEN’

REMARKS OR DISCLAIMERS

‘There is no qualification, reser\

Auditors Report.

DIRECTOR

Ms. Sukriti Sharma got app:

review

ACKNOWLEDGEMENTS

(AS-13) on Accounting for Investments in subsidiaries, the

latements are provided in the annual report.

'S ON QUALIFICATIONS, RESERVATIONS OR ADVERSE

DE BY THE AUDITORS IN THEIR REPORTS:

ations or an adverse remark made by the Auditors in their

jnted for the post of directorship during the year under

|

Your Directors place on record their sincere thanks to bankers, business associates,

consultants, and various Goverfament Authorities for their continued support extended to

your Companies activities duri

gratefully the shareholders

ig the year under review. Your Directors also acknowledges

r their unstinted support and significant contributions

towards the growth of the company and confidence reposed in the Company. The Board of

Directors expects to receive the similar support and contribution from everyone in future

also.

Place :Jammu

Dated:04.09.2023

For and on behalf of the Board

\E

a a

ANKIT GUPTA ANIL GUPTA

DIRECTOR DIRECTOR

DIN: 06782180 DIN;00897796

ANPHAR LABORATORIES PRIVATE LIMITED.

REGD. OFFICE : INDUSTRIAL EXTENSION AREA, PHASE - Il, GANGYAL, JAMMU

CIN : U33112JK1987PTCO00930

ANNEX TO DIRECTOR'S REP!

Information as per Section 134(3)(m) of the Companies Act, 2013 read with the Rule

8 of the Companies (Accounts) Rules, 2014 and forming part of the Director's Report

for the year ended 31-03-2023.

a) Conservation of energy

( [the steps taken of impact on conservation of | NIL

energy

(i) | the steps taken By the company for utilizing | NIL

alternate sources of energy 2

(ii) [the capital investment on energy conservation | NIL

equipment’s

(b) Technology absorption

())_| the efforts made towards technology absorption _| NIL ]

(ii) | the benefits derived like product improvement, | NIL |

cost reduction, product development or import

substitution I

(ii) in case of imported technology (imported during | NIL

the last three years reckoned from the beginning

ofthe financial year)-

(a) the details of technology imported NIL

(b) the year of import; ‘NIL

(©) whether the technology been fully absorbed __| NIL

(q) if not fully absorbed, areas where absorption | NIL

has not taken place, and the reasons thereof

(iv) [the expenditure incurred on Research and | NIL

Development

(c) Foreign exchange earnings and Outgo

The Company has foreign exchange inflow of Rs. 593068.79 however the Company has no

foreign exchange earning during the year under review.

For and on behalf of the Board

4 AES

Place Jammu ANKIT GUPTA.

Dated:04.09.2023 DIRECTOR ee

DIN: 06782180 DIN: eed

100897796

13,

14.

15,

16.

ANPHAR LABORATORIES PRIVATE LIMITED

REGD. OFFICE : INDUSTRIAL EXTENSION AREA, PHASE - Ill, GANGYAL, JAMMU

CIN: U33112JK1987PTC000930

AN! = TOR’S Ri

I

conpoRaye SOCIAL RESPONSIBILTY POLICY

A brief outline of the company’s CSR policy, including overview of projects or

programs proposed to be undertaken:

Eradicating hunger, poverty and malnutrition, promotingpreventive health care and

sanitation and making available safe drinking water;

Promoting education, including special education and employment enhancing

vocation skills especially among children, women, elderly and other livelihood

enhancement projects;

Promoting gender eau: empowering women, setting up homes and hostels for

women and orphans; setting up old age homes, day care centers and such other

facilities.

Ensuring environmental sustainability, ecological balanice, protection of flora and

fauna, animal welfare, agro forestry, conservation of natural resources and

ynaintaining quality of soil, air and water;

‘Training to promote rural sports, nationally recognized sports, Paralympics and

Olympic sports;

Contribution to the Prime Minister's National Relief Fund or any other fund set up

by the Central Govern me for socio-economic development and relief and welfare

of the Scheduled Castes,/the Scheduled Tribes, other backward classes, minorities

and women;

Rural developmen pois

To carry out campaign, awareness programmes or public outreach campaign on

COVID-19 Vaccination pfogramme which includes the promotion of health care,

including preventive health care and sanitization, promoting education and disaster

management respectively.

Contribution to incubators or research and development projects in the field of

science, technology, engineering and medicine, funded by the Central Government or

State Government or Public Sector Undertaking or any agency of the Central

Government or State Govgrnment; and =

Contributions to public fyjnded Universities; Indian Institute of Technology (IITs);

National Laboratories ayd autonomous bodies established under Department of

Atomic Energy (DAE); Department of Biotechnology (DBT); Department of Science

and Technology (DST); Department of Pharmaceuticals; Ministry of Ayurveda, Yoga

and Naturopathy, Unani, Siddha and Homoeopathy (AYUSH); Ministry of Electronics

and Information Techndlogy and other bodies, namely Defense Research and

Development Organisation (DRDO); Indian Council of Agricultural Research (ICAR);

Indian Council of Medical Research (ICMR) and Council of Scientific and Industrial

Research (CSIR), engaged in conducting research in science, technology, engineering

and medicine aimed at promoting Sustainable Development Goals (SDGs),]

17. Any other measures with the approval of Board of Directors on the recommendation

of CSR Committee subjecf to the provisions of Section 135 of Companies Act, 2013

and rules made there-uni

18. CSR VISION {

+ Develop meaningful and effective strategies for engaging with all stakeholders;

= Consult with local communities to identify effective and culturally appropriate

cevelopment goals;

+ Partner with credible | organizations like trusts, foundations ete. including

uon-government organizations;

+ Check and prevent pollition; recycle, manage and reduce waste, manage natural

resources in a sustainabl¢ manner;

+ Ensure efficient use of enfergy and environment friendly technologies;

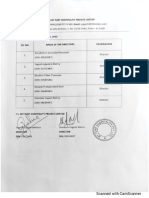

2. ‘The Composition of the CSR Committee consisting of the following members:

Sno NAME OF DESIGNATION | NUMBER OF NUMBER OF

DIRECTOR MEETINGS OF | MEETINGS OF Cs

esncomauTree | COMMITTEE

HELD DURING ‘ATTENDED

{_‘tueyean __/ purine THE yean

OL. ANIL GUPTA, TT CHAIRMAN- 2 2

DIRECTOR |

02] ANKIT GUPTA DIRECTOR | 2 Zz

3. Details of Impact assessment of CSR projects carried out in pursuance of sub-

rule (3) of rule 8 of the Companies (Corporate Social Responsi

2014, if applicable : Not applicable

lity Policy) Rules,

4. Details of the amount available for set off in pursuance of sub-rule (2) of rule 7 of

the Companies (Corporate Social Responsibility Policy) Rules, 2014 and amount

required for set off for the financial year, ifany

S.NO FINANCIAL YEAR AMOUNT AVAILABLE | AMOUNT REQUIRED TO BE

} FOR SET OFF FROM|SET OFF FOR THE

PRECEDING FINANCIAL YEARS, IF ANY

FINANCIAL YEARS

a iL Tai - Nik x

Pursuant to Section 135 the provision of CSR Expenditure is not required to be made as the

net profits of the Company during the previous and current year is less than RS. 5.00 Crores

however the CSR Committee is committed to spend on unspent CSR amount of previous

years in order to fulfill its moral responsibility cowards the society.

‘The Company was required to spent Rs.717646.43 towards Corporate Social Responsibility

being unspent amount of previous years. However the Company has spend Rs.7,50,000/-

in the following areas towards Corporate Social Responsibility.

we

‘SNO [Porrenononafrrs | AMOUNT (INRS)

ol. INDIAN INSTITUTE OF TECHNOLOGY RS.150000/-

|

02 DR.RISHT GUPTA MEMORIAL TRUST RS.2,00,000/-

103. SUNRISE EDUCATION TRUST RS.1,75,000/-

04. LUVIS BRONLLE SGHOOL RS.2,00,000/-

0S, LAGHU UDYOG BHARTI RS.25000/-

TOTAL T RS7,50,000/-

|

5 (a) CSR amount spent or unspent for the financial year:

‘Total Amount | AMOUNT UNSPENT.

Spent For The

Financial Year [Total Amount) Amount transferred to any fund

transferred to Unspent} specified under Schedule VII as per

CSR Accoynt as per | second proviso to Section 135(5) of the

Section 135{6) of the Act _| Act

Amount | Dateot ‘Name of | Amount Date of

ansfer the Fund Transfer

|

NIL nie lak Ni [NIL NIL.

1

b) Details of CSR amount spent against ongoing projects for the financial vear: NIL

ae To Te eT T9 [A © @ By @

Sno | Hane | Hem | Local [Locatio| | Project | Amount | Amount | Amount Mode of [Mode of

ofthe | from J area | nofthe | Duratio | allocated | spentiathe | transferred to | Impleme } impleme

projec | urelise | (¥es/n | project, | n forthe | eurrone —{ UnspentcsR | ntation | ntation-

ve fot ° project | financiat | accouncfor dhe | Direct | Through

aetivitie vyeat projectas per _| (Yes/No) | Impleme

sia Section 135(6) oF ning

Schedul the Act Agency

evitto

_ the Act _|

1 1

EC |

Details vent against other than ongoin, cts ial vea

aye GB) @ G) a (10) ay

S. | Name ofthe ‘item from the Lodai Location of the project ‘Amount ‘Mode of | Mode of

no | protect listof activites | ae Speatfor | tmpleme | tmplementatio

inSehedulevit | (eno) the project | ntaion= | n- Through

tothe act Dice | aplemercing

IL tvesynoy | agency |

I | ‘State/UT District |

lt 4 i c | c

(a) Amount spent in Administrative Overheads: ‘NIL

(e) Amount spent on Impact Assessment, if applicable: NIL

(9) otal amount spent for the Financial Year (86+8¢+8d+8e) : NIL

_{g) Excess amount for set off, any :NIL

S.NO_ PARTICULARS, AMOUNT.

i) ‘Two percent ofavefage net profit of the NIL

Company as per Seétion 135(5) of the Act

ii) ‘Total amount spend for the Financial Year NIL.

iii) Excess amount spept for the financial year NIL

§Gi)-())

i) Surplus arising out of the CSR projects or NIL

programmes or activities of the previous

financial years, ifam

vy) ‘Amount available fbr set offin succeeding NIL

Financial years {(iii)-(iv)]

6 {2} Details of Unspent CSR amount for the preceding three financial years: Rs.

717646.43 |

i

Se PRECEDING ‘moa ‘uount | Amount transforced to any | Amount

No | FINANCIAL YEAR | wansferved | spenein the | fund specified under | remaining

to Ujspene | reporting} Schedule Vit as per Scetion | 29 be spent

CSR Adcoune | Financial | 135(6) ofthe Act ifany m

under Year succeeding

Section 135 ial

i atte years

2020-24 Tora | sae7aza I Ni

2. | 2023-22 350935.99 | 380933.96 NL

TOTAL [rirosgas | 71760645 I i

9. in case of creation or acquisition of capital asset, furnish the details relating to the

asset so created or acquired through CSR spent in the financial year (asset wise

details)

(a) Date of creation or acquisition of the capital asset(s) : None

(b) Amount of CSR spent forlcreation or acquisition of capital asset : NIL

©) Details of the entity or public authority or beneficiary under whose name such

capital asset is registered, their address, etc. : Not Applicable

{d) Provide details of the capital asset(s) created or acquired (including complete

address and location of the capital asset) : Not Applicable

11. Specify the reason(s), if fhe Company has failed to spend two percent of the

average net profit as per Section 135(5) of the Act:

‘this year the Company does not fall under the preview of the provision of CSR as the

profits of the Company are less than Rs.S Crore . However the management is

committed to its social respogsibility and do spend funds in the CSR activities so as

to contribute something for sdcial cause.

For and on behalf of the Board

a Ae

Pface Jammu ANKIT GUPTA ‘ANIL GUPTA

Dated:04.09.2023 DIRECTOR DIRECTOR

DIN: 06782180 DIN:00897796

ANPHAR LABORATORIES PRIVATE LIMITED.

REGD. OFFICE: INDUSTRIAL EXTENSION AREA, PHASE - Ill, GANGYAL, JAMMU

CIN: U33112JK1987PTCO00930

ANNEXU REI TO DIRECTOR'S REPORT

Form AOC-1

{Pursuant to first orovisofo sub-section (3) of section 129 read with rule 5 of

Companies (Accounts) Rules, 2014}

Statement containing salient faatures of the financial statement of subsidiaries/associate

companies/joint ventures

Part "A": Subsidiayies

{Information in respect of each subsidiary to be presented with amounts in Rs.)

S.No. Particulars Details

01. | Name of the subsidiaf NIL |

02. | Reporting period for the subsidiary NIL i]

concerned, if different from the holding

company’s reporting|period |

03. | Reporting currency ahd Exchange rate ason_[ NIL

the last dave of the relevant Financial year in

the case of foreign subsidiaries

04, [Share capital NIL.

| 05._| Reserves & surplus NIL

| 06._| Total assets [ ‘NEL

| 07. | Votal Liabilities NIL.

Q8._| Investments NIL

09, [Turnover NIL

10._| Profit before taxatioh NIL

11.__| Provision for taxation NIL

42. | Profit after taxation | NIL

13. [Proposed Dividend NIL

14. [% of shareholding | NIL.

Notes: The lig inernfon shall be furnished at the end of the statement:

1. Names of subsidiaries whidh are yet to commence operations

2. Names of subsidiaries which have been liquidated or sold during the year.

Part “B": Associates and Joint Ventures

Statement pursuant to Section 129 (3) of the Companies Act,

Associate Companies and Joint Ventures

2013 related to

Name of associates/Joint Ventures AGRO TECH | NIL NIL

AROMATICS

| PYTLTD.

Latest audited Ralance Sheet Date 51.03.2023 | NIL; NIL

Shares of Associate /Joint Ventures Held by the

company onthe yearend |

No. of shares I 235000 NIL Nit

‘Amount of Investment in Associates/Joint 2350000, ‘NIL NIL

Venture

Extend of Holding % 34.05% NIL Nit

| Description of how there is significant Nile NIL NIL

influence

Reason why the associate/joint venture tsnot_| NIL Wil Nit

consolidated {

[Net worth attributable to shareholding as per | 1993097.662 | NIL NIL

Jatest audited Balance Sheet

[_ NIL NIL NIL

Profit Loss or the year (24268600) _| NIC NIL

(Considered in Consolidation 442606.00 | NIL Nit |

[Not Considered in Consolidation | Ni NIL [NIL J

1. Names of associates or joint

2. Names of associates or joint

\

Place :Jammu

Dated:04.09.2023

entuses which are yet ¢o commence operations.

tures which have been liquidated or sold during the year.

For and on behalf of the Board

}ie oe

ANRIT GUPTA ANIL GUPTA

DIRECTOR DIRECTOR

DIN; 06782180 DIN:00897796

M/s Arora Vohra & Co.,

(Chartered Accountants)

FRN: 09847N

ingh Sethi

‘Accountant)

M.No: 091188

Form for disclosure of particula

ANPHAR L

REGD. OFFICE

ORATORIES PRIVATE LIMITED

INDUSTRIAL EXTENSION AREA, PHASE - III, GANGYAL, JAMMU

CIN: U33112)K1987PTCO00930

| FORM AOC-2

ANNEXURE II TO DIRECTOR'S REPORT.

{Pursuant to clause (h) of sub:section (3) of section 134 of the Act and Rule 8(2) of the

Companies (Accounts) Rules, 2014}

of contracts/ arrangements entered into by the company

with related parties referred to in sub-section (1) of section 188 of the Companies Act, 2013

including certain arm’s length teqnsactions under third proviso thereto.

1. Details of contracts or aruecpers or transactions not at arm’s length basis-NIL

2. Details of contracts or arranger

ents or transactions at arm's length basis:

Name(s) of | Nature of Nature of Duration | Salientterms of | Date(s) of

therelated | relationship | corftracts/ _| of the the contracts or | approval by

party arrangements | contracts/ | arrangements or | the Board/

/ arrangeme | transactions Members of

trahsactions | nts/ indudingthe | the

transactio | value, ifany ‘company

ns

ANILGUPTA | DIRECTOR | SALARY SYEARS | RS. 84,00,000/- | 20.12.2020

ANKIT DIRECTOR | SAUARY SYEARS | RS. 60,00,000/- | 20.12.2020 |

GUPTA

‘ANIL GUPTA | DIRECTOR softs ANNUALLY [RS.7,00,000/- | 05.06.2022

ANKIT DIRECTOR | BONUS ANNUALLY | RS.5,00,000/- | 05.06.2022

GUPTA.

ARPITA CHIEF SALARY SYEARS | RS.6,00,000/- | 05.06.2020

GUPTA EXECUTIVE

OFFICER

ANKIT DIRECTOR | RENT ANNUALLY | Rs, 12,00,000 | 05.06.2022

GUPTA —

‘AGRO TECH | RELATED CORPORATE RS, 5,00,00,000/} 04.03.2020

AROMATICS | CONCERN LOAN

PRIVATE

LIMITED

| For and on behalf of the Board

Place :Jammu ANKIT GUPTA ‘ANIL GUPTA

Dated:04.09.2023 DIRECTOR DIRECTOR

DIN: 06782180

DIN:00897796

ARORA VOHRA & CO.

CHARTERED ACCOUNTANTS

INDEPENDENT AUDITORS’ REPORT

THE MEMBERS OF ANPHAR LABORATORIES

PRIVATE LIMITED

Report on the audit of the financial

statements

Opinion

We have audited the accompanying financial

statements of Anphar Laboraiqries Pvt

{go('the Company", which comprise the

ance sheet as at March 31, 2023, and the

Statement of Profit and Loss: for) the year

then ended, and notes to tne) financial

siatemenis, including a summary of

significant accounting policies ahd other

expianatory information {hereinaftey referred

to as the financial statements)

Tw our opinion and to the best of our

information and according tothe

aeplanations given to us, the aforesaid

financiai Statemenis give tiv information

vert by the Companies et, 2013 (‘Act’)

the manner so required and give a true

fir view in conformity jwith th

accaunting standards provided under

section 152 of the Companies Act 2013 read

with the Companies (Accounting Standacd)

tales 2021 (AS') and. other accounting

principies generaliy accepted in thdia , of

Sota of affairs of the Company as at

ih $1, 2023. and ils profits far the year

for epinion

We conducted our audit in accordance with

the standards on auiditing specified under

section 143 (19) of the Companies Act, 2013

Our responsibililios under those Standards

sed in the) Audlivoe’s

ara f,ither dese

responsibilities for the audit of the financial

statements section of our report. We are

independent of the Company in accordance

with the code of ethics issued by the

Institute of Chartered Accountants of india

‘together with the ethical requirements (ICAI)

that are relevant to our audit of the financial

statements under the provisions of the Act

and the rules made thereunder, and we have

fulfilled our other ethical responsibilities in

accordance with these requirements and the

ICAI code of ethics.

We believe that the audit evidence we have

obtained is sufficient and appropriate to

provide a basis for our opinion on financial

statements,

Emphasis on Matter Paragraph

We draw the attention to Note no: 18

Employee Benefits (Gratuity Plan)

Annexed in Notes forming Part of

Balance sheet:

Company is in process of registration of

Gratuity Teust for Employees Group Gratuity

‘Assurance Scheme entered into with the Life

insurance Corporation of tncia (LIC) trustees

with the Income Tax department as on the

cate cf audit.

Our opinion is not modified on the above

matter.

Key audit matters

Key audit matters are those matters that, in

out professional judgment, were ef most

significance in our audit of the finandal

statements of the current period. These

matters were addressed in the context of our

audit of the financial statements as ¢ whole,

and in forming our opinion thereon, and we

do not provide a separate opinion on these

matters

Page tof

ARORA VOHRA & CO.

CHARTERED ACCOUNTANTS

Reporting of key audit matters ag per SA

701, Key Audit Matters are nat applicable to

the Company as itis an unlisted company.

Information other than the financial

statements and auditors’ report thereon

The Company's board of diréctors is

responsible for the preparation presentation

of its report (hereinafter calied 4s “Board

Report’) which comprises. various

information required under section|134(3) of

the companies Act, 2013THE other

information comprises the information

included in the Board's Report jincluding

Annexures to Board's Repost, | Business

Responsibility Report but does not include

ihe financial statements and our! auditor's

report thereon,

Our opinion on the financial slatements

does not cover the Board Report pnd other

information and we do not copresd any form

of assurance conclusion thereon,

In connection with our audit of the financial

statements, our responsibility is to read

Boards Report and other information and, in

doing 50, consider whether the Board Report

and other information is |materiaily

inconsistent with the financial staiements or

cur knowledge obtained during the course

of our audit or otherwise appears to be

materially misstated.

If, based on the work we have performed, we

conclude that there is a material

misstatement in the Board Repost or other

information, we are required to feport that

fact, We have nothing to repr inthis

tegerd

Management's responsibility for the

financial statements

The Company's board of directors are

responsible for the matters stated in section

134 (5) of the Act with respect to the

preparation of these financial statements

that give a true and fair view of the financial

position financial performance of the

Company in accordance with the accounting

principles generally accepted in India,

including the accounting standards specified

under section 133 of the Act This

responsibility also includes maintenance of

adequate accounting records in accordance

with the provisions of the Act for

safeguarding of the assets of the Company

and for preventing and detecting frauds and

other irrequiarities; selection and application

of appropriate accounting policies, making

judgments and estimates that are reasonable

and prudent; and design, implementation

and maintenance of adequate internal

financial controls, that were operating

effectively for ensuring the accuracy and

completeness of the accounting records,

relevant to the preparation and presentation

of the financial statement that give a true

and fair view and are free from material

misstatement, whether due to fraud or error.

In preparing the financial statements,

management is responsible for assessing the

Company's ability to continue as a going

concern, disclosing, a8 applicable, matters

related to going concern and using the

going concer basis of accounting unless

management either intends to liquidate the

Company or to cease operations, or has no

realistic alternative but to do so.

The board of directors are also responsible

for overseeing the Company's financial

reporting process.

Page 2 of 6

4 | ARORA VOHRA & CO.

CHARTERED ACCOUNTANTS

Auditor's responsibilities for the audit of

the financial statements

Our objectives are to obtain réasonable

assurance about whether the | financial

statements as a whole are free from material

misstatement, whether due te fraud or error,

and to issue an auditor's report that includes

our opinion, Reasonable assurance|is @ high

level of assurance, but is not a guarantee

that an audit conducted in cad ce with

SAs will always detect a | material

misstatement when it exists. Misstatements

can arise from fraud or error and are

considered material if, individually or in the

aggregate, they could reasonably be

expected to influence the ‘Teonomnie

decisions of users taken on the basis of

these financial statements.

As part of an audit in accordance| with SAs

we exercise professional judgment and

maintain professional skepticism throughout

the audit, We also:

nisstatement of the financial spatements,

wivether due to fraud or error, design and

perform audit procedures eee to

those risks, and obtain auait evidence

that is sufficient and appropriate to

provide a basis for our opinion, The risk

of not detecting a material: misstatement

resulting from fraud is higher than for

‘one resulting from error, as fraud may

nvoive collusion, forgery, intentional

‘omissions, mistepresentations, or the

oveitide of internat control

Obtain an understanding of internal

-

RADE PAYABLES -

5) SUNDRY GREDTTORS 288,502.58 121,027.85,

se seer |

38,200.20

39.540,70,

3793 | 88187

23,500.09

to 20

13,082.72

13,082 72]

[|

4163491

34,727.06

72,000.00

[Nore

[ CONS TERWILOANS AND ADVANCES

LOANS AND ADVANGES TO RELATED PARTIES

LOAN YO SUBSIDARY COMPANY

{OROTECH AROMATICS PRIVAYE LINED)

noresg

(CORRENT INVESTMENTS

a

cS

12;500.00

72 500.00 |

“RNPHAR LASORATORIES PRIVATE LWNTED —

"SCHEDULE FORMING PART OF BALANGE SHEET AS

IRieenTORIES : :

RAW MATES 24290838, saa250 78

DRORGINPROGRESS 79.2980 77 080.58

} cifinise0 6000s t 98,342.24 79,351.28

Ec gi stsse | ero 2

TRADE RECEIVABLES: :

‘a1 Seeunod, Considorad goed :

wilh elteu panies .

path ones 35121663 359,008.37

(b) Unsecured, consiseree goos : .

| ch ented partion : :

i

t

wores :

sah thers

{) Douottut :

si cates panies

||

LAST AND CASH COUIVALENTS:

25a, ws BANK siarrer agora

Broetrennd 2739 Pera]

[eo moRamsenp, Hore ¢ ec suazonty 03892

sie 25206

{ sore.

SHORT Ten LOANS AND ADVANCES

SHOANS AND ADVANGES (141) se.seo.0e 19.106 68

SyotenS GOVT 2) bessiose 27000,

_ _ — sre [5,107.28 |

FANPHAR LABORATORIES PRIVATE LIMITED,

| SCHEDULE FORMING PART OF P&L ACCOUNT FOR THEYEAR ENDEO $1-052025

a PARTICULARS | CURRENT YEAR ‘PREVIOUS YEAR

wore

REVENLE HROM OPERATIONS

SAVF-OF PRODUCTS 1.820.788.70 1,990,07362

CESS CREDA NOTE 3500.00, :

c yer 388.70} Tmo]

wore38 =

OTHER INCOME : i

]OTHER NONOPERATING INCOME | 6376405, seers

33,768.05 55.77.85 |

nor

COST OF MaTERIAL CONSUMED i

RAW MATERIAL i

ope niNG S10C« 14425875 180,818.90,

4.28975 169.5180

rurchases gasaanes 863.507 50

O35a28aT “eeu 50750

css CLOSING sT0cK 22908 38 1.95975

I 836,689.87. 889,066.66,

| norsico -

| CHANGE ININVENTORIES :

‘oP, 306K : :

FinsHeD Coops raa5n20 1550000

‘WOK PROCESS 2109058 26,12000

A r ‘wogat.r1 | anzz000|

cLosiNe sT00K :

sr GOODS 55,302.24 7.38123

‘WORKIN PROCESS 73235.00 27.080 54

| 8 “zasrrz4 oo,eat 77

| vaRIATION WisTocK (AB) 29,195 48) zat

(area >

lgPLOVEE BENEFIT EXPENSES. :

| 2) SALARIES & INCENTIVES.

Snuany 49,184.43, 124,097.02

j wages 1420301 “417295

| GoNeYANOE / PETROL EXPENSE 204910 74.50

| tesve sa.aey 201659 4.82500

BONUS STAFF AND OIRECTOR soe 21,973.00

SECURITY 437348 Basra?

OVER TIME 9.13808 81088.00

b} CONTRIBUTIONS TO. :

| ADMINISTRATIVE EXP BF 36601 38487

EMPLOYER CONTR. PF 4.986 95 :

EP S CONTIBUTION PENSION AIC 357390

LINKED WSURANCE 238.81 28.20

INCENTIVES ON SALES 3.23458

| 22OVDENT FuND CONTRIBUTION 4907 89

UIPLOYER CONTR. ES! asrer 2293.42

DIRECTOR REMURERATION 144,000.00, 180.%00.00

ena tiaty CONTRIRUTION 119038

SE waza

"ANPHAR LABORATORIES PRIVATE LIMITED.

‘SCHEDULE FORMING PART OF P&L AIC FOR THE YEAR ENDED 34-03-2023

PARTICULARS CURRENT YEAR | PREVIOUS YEAR

NOTE 17.4

OTHER NON-OPERATING INCOME }

EXPORT INCENTIVE 9.57.38 14,780.49

INTEREST SUBVENTION : 087

INTEREST ACCRUED HDFC/ UCO & PNB 3.53462 :

INTT. RECEIVED ON FDR 25,986.03 23,657.64

EXCISE DUTY REFUND - -

FOREIGN EXCHANGE DIFF 15,862.32 16,182.03

‘GST REFUND 3,332.10 3,841.00

MISC INCOME 5,491.59 4,688.12

REBATE & DISCOUNT / SHORT & EXCESS : 2

| : :

| 63,764.05 58,527, 85

NOTE? rs

INTEREST EXPENSES : :

INTEREST ON CIC | - -

BANK CHARGES 1,351.74 4,607.23

INTT. ON HDFC CAR LOAN AC : 12.43,

INTT. ON AOFC . 1,563.60,

INTT. PNB - -

INTT. ON TIL & POFC AIC 4.74

Tosa 3,185.00

NOTE 22.4 - =

OTHER EXPENSES ~ ~

LABORATORY EXPENSES 8,473.78 8,433.22

COMPUTER EXPENSES 739.62 ‘969.00

OTHERS (INCLUDING AMC} 4,253.75 3,048.20

70,467.14 72,450.42,

CONTRACT WAGES & OTHER SHARGES

WORKMEN WELFARE EXPENSES 4,203.04 4,172.93

4,203.07 4,172.93

FREIGHT & CARTAGE CHARGES =

‘CARRIAGE & FREIGHT 17,758.44

26,847.41

UNLOADING CHARGES 2,519.64 2,181.31

CARRIAGE) FREIGHT ON SALE 4,890.27

7028.72

550.00

300.00

[50.00]

“650.00

PAYMENT TO THE AUDITORS

STATUTORY AUDIT FEE

INTERNAL AUDIT FEE

POWER & FUEL s

OIL & LUBRICANTS 21,774.98 24,419.56

ELECTRICITY EXPENSES 412,634.04 41,176.54

34,409.00 36,596.10

TELEPHONE, POSTAGE & COURIER CHARGES - -

TELEPHONE EXPENSES 649.73 701.01

POSTAGE & COURIER CHARGES 4,226.44 918.73

| 1,876.17 7818.74

TRAVELLING & CONVEYANCE : -

DOMESTIC TRAVELLING EXPENSES 2,555.59 2,565.33

FOREIGN TRAVELLING EXP - -

ANPHAR LABORATORIES PRIVATE LIMITED.

‘SCHEDULE FORMING PART OF P&L A/C FOR THE YEAR ENDED 31-03-2023,

PARTICULARS: CURRENT YEAR | PREVIOUS YEAR

2,555.59 2,565.33

MISCELLANEOUS EXPENSES :

CAR RUNNING & MAINTENANCE 5,808.40

REPAIR AND MAINTENANCE 14,068.64 :

CSR EXPENSES 7,500.00 8,250.00

LEGAL EXPENSES 303.60 1.17785

MISC. EXPENSES 8416.06

FILING FEE CHGS -

MEDICAL REIMBURSEMENT 1,780.50

INCENTIVE ON SALE .

DUTIES & TAXES :

SUBSCRIPTION & MEMBERSHIP FEE 244.00

INPUT TAX REVERSAL IN BOOKS 4430.32

OTHER EXPENSES, 19,876.05

‘SHORT & EXCESS, -

ROUND OFF 3.85

CHARITY AND DONATION 190.00

WATER EXPENSES 308.60

RESEARCH & DEVELOPMENT 498.80

CANDHAR LABORATORIES PRIVATE LIMITED

"SCHEDULE FORMING PAFT OF PAL. ACCOUNT FOR THE YEAR ENDED 34.05.2028

- “PARTICULARS CURRENT YEAR FREVOUSTERR

NOTE :

Financial COSTS :

a) NTEREST exPeNs \ sas 74 38500,

5} CHER BORROWANG COSTS :

EIABPLIGABLE HEY GAINILOSS ON FOREIGN CURRENCY

eansac TIONS AND TRANSLATION

L = Sw

sores

Orne expenses :

EONSUMPTION OF STORES :

OTHER EXPENSES WEG weanise

PACING EXP ascast 400120

EXPORT 21 EARING & FORWAROING 203575 2m

POweA FUEL 342080) 38596.10

REPAlE & MARTENANCE .

BURLING esr8e5 433019

wACHINERY 2526

omires 10467 14 1245042

surance aster «ara

[estat exes 30570 531027,

AoE BERN | 52878 098.34

| snes coumssion pureed nan

EAU: S PROMOTION Exe 21897 :

Least RENT 1200000 2800 09

Rate SHES 4.13078 208 56

snes AND DISCCUNT (259.69)

| feawvetuiesa cowe vance 2588 59 2985.33

PREGGrUCARTAGE CHARGES 228833 soar

[gonsuirener es Tis 8 2397783

PRINTING & STATIONERY \ ‘500.00 e191

| raniext to mk AvonOR 50.00 35000

TELEF ONE, POSTAGE & COURIER CHARGES 1976.7 181074

sMSCELLANEOUS EXPENSES, 6297973, 2299427

| Bir 95325, 59855

TS STS ea eee aE wa

wa | eexect sez coserr — foosies costes woe rat 2801

theses | st esee sossee ressee | Seoooze Seoeez0 wo

sare | soies ‘9629 Woes | soaure rscsve sive 38 99

sssoes | cesseo. su seems | secsne. seacre soreva: wsinance

‘orost seh zisice | iz ior prise seeety manodianoo sw

ore se60 seas” | gases ananeind3 Suis 3

esse 9058 s5 600% woes

| osiee ise zones see

jzoree see feese :

ss wees cosy sees wears

toscor resechs sans oeseazoe seceest 22001 38

Gio. Seone'st eseees 3 ss 59998

oes fore

scare

‘somets

feau 200097 inronnno4)-03Niaoan

sneazua_| Vo oe ee oe oo 1o0e vee “Ssonnoe

boos Groiweze | preerros—————__ae.gou ad

a voor sees : seces ~NangoTnse saree

z 20600 T —

[ eeccense “eoec0%0 | opcove wea reores [eco eOHE VS ays gnciitaoy zur iv sv swnouuve

|saktetan soatoton) Smee autod'aaa aerate | Ssoracsous Bone stoe8

#3108

(.ymiod MAN wad SY) £20z HOUVIN LSLC No sv $138S¥ 93X14 4O SUVLNG

s

GALIWIT BLVARId SANIOLVACAV wYHANY

WN ve ve ww Tuounona Piaso WoL kaesse] rr

yEune:240 S6EIBAYMO] arson

2) aun Gineseco ten" iw |

| Savax snoinatig 01 o34veroo) 5 we eo — agave pared Taba] 4

‘Sy S11d0ud 40 SOWINITHRA NI

‘3e¥34930 OL ano 5) 3aNMA SH

18194 + uum oN oxa6uex ) paKordws|

enseovte: pue tea au aic}aq S8UteS| wud

‘suvaa se “a

‘SNoWIaNA OL O3evAHIOD SY TVS NI

3ey2u920 O1 ANSI BONA.

co suoe805

{Woy anunoy ono xe 948 1014 19

ww fez ua

losouny

(Way arcana Fan ne

ve ° ws ee eiBoza stayscehoreheal

Voy BERNER OL aay oy

ww pe one ar eiasor pur Baseda) oens

rosy SbesNeoNCBONEN Loe ey

a wea shonau|™SE ee te i; zikouanr boo] :

oua3uvanoa sv Sa5™i08Na| | + f2euana swusdions 81009 10 i

Ni 3e¥aNONIOL 3nd $1 BONSKaVA 3H |

‘Suva SNOIASHA OL GaYaNOD|FEE Tore weed T farba) 4

'5¥ S1iJ0}4 40 JO¥LNISuaE i seam oueeusy00r Xe aye OHS ia}

3g yg4037 OF 3nd 61 BONeIEN 3H +

f vw Ww we t ———=

{ !

: i

| Z I 1

\ Ww 9 wr va

‘SUYEA SNOIATUd O1 GaN aROD! HET (see [rr

ave NI 36¥3H030 MUNWLON

(043910 St 3oNvRYA

oueuen desma: Kueiepuey

spuspen sy evoston

| ‘Sv SUL 930 ONY SZGNVTVO!

PRAT Fae wa waz

eve popu ak uy 10

oT HNOTET DOBOEAN

Cie py 1a

-. ANPHAR LABORATORIES PRIVATE LIMITED

” NOTES TO FINANCIAL STATEMENTS

1, STATEMENT OF SIGNIFICANT ACCOUNTING POLICIES TO THE STANDALONE

FINANCIAL STATEMENTS

11 INTRODUCTION

The company is incorporated as a private limited company on under CIN

U33i12)K1987PTC000930 on “potas The company is doing the business of

manufacturing of chemicals. 'Th¢ company is owned and managed by the Directors Sh

Anil Gupta and Sh Ankit Gupta

1.2 Basis of Accounting

These consolidated financial stdtements have been prepared under the historical cost

convention on accrual basis in accordance with the Generally Accepted Accounting,

Principics in India. GAAP Comprises mandatory accounting standards as prescribed

under section 133 of the comp Act, 2013 (‘Act’) read with Rule 7 of the companies

(Accounting) Rules, 2014. Accounting policies have been consistently applied except

where a newly issued account standard is initially adopted or a sevision to an existing

accounting standard requires a change in the accounting policies hitherto in use

1.3. Inventories

Raw materials, packing materials, stores, spares and consumables are valued at lower of

cost, of net realizable value, Cost includes taxes and duties and other incidental expenses

but excludes taxes and duties that are subsequently recoverable from taxing authorities.

ished goods and work-in-prpcess are valued at lower of cost or net realizable value

Cost includes materials, labor and a proportion of appropriate overheads. Cost of

materials has been determined on first in first out basis.

1.4 Property, Plant and Equipment

Property, Plant and Equipment are stated at cost less accumulated depreciation,

impairment, if any. Direct costs pre capitalized until such assets are ready for use.

15 Depreciation and Amortization

Depreciation on tangible assets js provided on Written down Value in accordance with the

provisions of the Companies Aft, 2013 based on the useful lives of assets specified in Part

Cof the Schedule If of the Companies Act, 2013,

I

ANPHAR LABORATORIES PRIVATE LIMITED

Nt OTES TO FINANCIAL STATEMENTS

1 Building Ie 30°Yrs

j

3. Plant &quipments | 15 Yrs

4, Furniture & Fixture : 10 Yrs

5 Electrical Equipments - (5 Yrs

6 Laboratory Equipments - 10 Yrs

7, Computer & Printers/-Intercoms 03-06 Yrs

1.6 Impairment of Assets

‘Aveach Balance sheet date, the Company assesses whether there is any indication that

fixed assets with finite lives may be impaired, If any such indication exists, the

recovecable amount of asset ib estimated in order to determine extent of the

impairment, if any, Where it is not possible to estimate the recoverable amount of

individual asset, the Company estimates the recoverable amount of the cash

generating unit to which the assdt belongs.

As of March 31, 2023, none of the fixed assets were considered impaired

1.7 Revenlue Recognition

Revenue from sale is normally recognized on dispatch of goods to customers. Sales are net

of sales returns and trade dixcquats. All expenses are charged to the statement of profit

and loss as and when they are incurred, Provisions are made for all known losses and

liabilities, Expenses reimbursed or subsidies received from the government are shown as

net from expenses

1.8 Employees Benefits

Short ‘Term

Employee benefits are all fornjs of consideration given by an enterprise in exchange of

services tendered by employdes. Short term Employee benefits include items such as

waxes, salaries and socia! sedurity contributions ete and the expected cost of bonus.

Defined contributions in vespgct of Provident fund are made to funds maintained and

administered by the government at stipulated rates. Such contributions are charged to the

statement of profit and loss of the year in which the contributions to the respective funds

ail duc,

Long Term

In accordance with the provisions of the Employees Provident Funds and Miscellaneous

Provisions, 1952, eligible employees of the company are entitled to receive benefits with

respect to Provident Fund, a defined contribution plan in which both the company and

(

ANPHAR LABORATORIES PRIVATE LIMITED

NOTES TO FINANCIAL STATEMENTS

the employee contribute monthly at a determined rate (currently 12.00% of employee's

basic salary) Company's contribution to Provident Fund is charged to the profit & Lost

Account.

Also leave encashment is being accounted for on payment basis at the time of retirement

of the employee and is being recognized as expense in the year of payment, Since the

liability on account of leave che is not very significant therefore no provision has

been made for the amount dve ab such.

Gratuity Plan

The following table set out the status of the Gratuity Plan as required under AS 15.

Reconwitiation of Opening and closing balances of the present value of the defined benefits

obligation and plan assets! .

Pasti Asat

Particulars Mare 31, 2023 _

Obligations at year beginning 2038267

Seevice Cost 1265.07

Interest Cost ua7774

Actuarial (gain)/ loss on obligations (408.52)

Benefits Paid (605.77)

Obligations at year end antag

Defined benefits obligation liability as at the balance sheet date is fully funded by the Company.

Change in plan assets

lau assets at year beginning, at fajr value 23029.68

Expected return on plan assets 1580.55

Actuarial (gainy/loss on plan assets 00

Contributions 97616.62

Benefits paid (605.77)

Plan assets at year end, at fair value 24980.63_

Reconciliation of present value of the obligation and the fait value of the plan assets

Present value of obligations as at the end of the year 2101.19

Fair valve of plan assets at the end of the year 24980.63

Re- Imbursement (vbligation)/.assdis*

Assetl(Liability) Recognized in the balance sheet

Net gratuity cost for the year ended comprises of the following components: __

Particulars Year ended

March 31,2023

Gratuity cos

Service cost 1265.07

". ANPHAR LABORATORIES PRIVATE LIMITED

NOTES TO FINANCIAL STATEMENTS

1.0

wy

Interest cost | 3477.74

Expected retuen on plan assets (458055)

Net Actuarial (gain)floss recognized in the year (403.52)

Flan amendment amortization |

Net Gratuity cost j

(Revised) on “Employee Benefits” effective January 01, 2007. Since the amount of

contribution made to planned assets is more than 1/5th of the actuarial loss, hence, no

adjustment is required

‘The estimates of future salary increases, considered in actuarial valuation, taking account

of inilarion seniority, promotion|and other relevant factors such as demand and supply in

the employment market

Since the impact of reversal of Net Gratuity cost Rs.75,

Hence no provision has been made during the year.

‘The service cost includes the ce of implementation of Accounting Standard AS-15

is not much in the péel A/c

Company is in process of registration of Gratuity Trust for Employees Group Gratuity

Assurance Scheme entered info with the Life insurance Corporation of India (LIC)

trustees with the Income Tax department as on the date of audit

Cask and Cash Equivaients

Cash. and cash “equivalents comprise cash and cash on deposit with banks and

corporations

‘Taxes on Income

Provision for taxation comprises of Current Tax and Deferred Tax, Current Tax

provision has been made on the basis of reliefs and deductions available under the Income

Tax Act, 1961, Deferred tax rasulting from “timing differences” between taxable and

accounting income is accounted for using the tax tates and Jaws that are enacted or

substantively enacted as on the balance sheet date. The deferred tax asset is recognized

and cacsied forward only {o the extent that there is a reasonable certainty that the assets

can be realized in futnee,

Borrowing Costs

As the fixed assets purchased were ready for intended use at the time of purchase itself,

none of the assets are sulin assets, hence the borrowing costs are charged to

Statement of Profit é Loss

ANPHAR LABORATORIES PRIVATE LIMITED

NOTES TO FINANCIAL STATEMENTS

4.22 Provisions, Contingent Liabilities, Contingent Assets and Significant Events Occurring

after Balance Sheet Date:

A provision is recognized when) an enterprise has a present obligation because of past

events. It is probable that an outflow of resources will be required to settle the obligation,

in respect of which a reliable estimate can be made. Provisions are made based on best

estimates required to settle the obligation at the balance sheet date. These are reviewed at

each balance sheet date and adjusted to reflect the current best estimate. Contingent

liabilities and significant events occurring after balance sheet date are not recognized but

ate disclosed in the notes. Cont}ngent assets ate neither recognized nor disclosed in the

consolidated financial statements

1.13 1.8 Government Grants |

|

The unit is eligible for budgetary support of GST as per J&K Industrial Policy dated 19-04-

2021 (Order No 117-Ind of 2021) and accordingly the claim of Rs 3.33 {acs has been

recognized for the year ending 01-04-2022 to 31-03-2023.

1.14 Effects of changes in Foreign Exchange Rates

Foreign currency transactions are recorded in the reporting currency, by applying to the

foreign curvency amount the exchange rate between the reporting currency and foreign

currency at the date of the transaction.

Foreign currency monetary items are reported at year-end rates, Non-monetary items

which are carcied in terms of historical cost denominated in foreign currency are reported

asing the exchange rate at the date of the transaction:

1

Exchange differences arising on the settlement of monetary items or on reporting

monetary items of Company at rates different from those at whick they were initially

recorded during the yea, or ee in previous financial statements, are recognized as

income or as expenses in the Profit and Loss account in the year in which they arise.

Foreign currency transactions are accounted on the transaction date at RBI reference rate

and the foreign currency liability as on the Balance sheet date has been reinstated to

dian rupees at the RBI reference rate as on that date

ANPHAR LABORATORIES PRIVATE LIMITED

NOTES TO FINANCIAL STATEMENTS:

Detail of foreign exchange ye and outflow has been provided as follows:

Foreign Exchange Earnings (Inflow) Rs 593068.79

15 Statement Showing Quantitative Details of Finished Goods :

Units Quantity

{ | Kes 971

| Cniloride HCL 1PmR/USP, _Amitsalpside|

IP/BP/EP, Chlorpromazine ICL. IP/BP, |

| Haloperiodol IP/BP etc.) |

Closing Stock fp Kes — (755

[amiloride HCL IP/BP/USP, Amilsulpride

1P/BP/EP, Chlorpromazine HCL ine

|

| Haloperiodol IP/BP etc.)

Sales Kes 115012

| (Amiloride HCL TP/BP/USP, | Anime

IP;BP/EP, Chlorpromazine HCL. IP/BP, |

| Haloperiodol IP/BP etc.) |

1.16 Raw Material Consumption. (Maj jor Items)

| Material Name "| Units

Bromo Chio: Tes

a

| 2.2 Chloro Ethoxyethanol ike

| 2-Ftiftuoro Methly Phenothaizine|(2-TP2) TKes

| Guanidine HC i Kgs

‘hly: Piperaine (TFPP)

ANPSAR LABORATORIES PRIVATE LIMITED

NOTES TO FINANCIAL STATEMENTS

| ee

dium Methly Crystals | Kgs

-5-NITROSO,2-4 DIHYDROXY | Kgs

PYRIMIDINE 6 AMINO) |

GLYOXAL ee aa + Kgs |

4 ae ef

1.17 Remuneration to Directors

Details of remuneration paid to oer are given below:

Name of the Directors Nature of Transactions Remuneration paid

2022-23

Anil Gupta Salary Rs.86000.00

Ankit Gupta Salary Rs.60000.00

Avil Gupta Bonus Rs, 7000.00

Ankit Gupta Bonus Rs, 5000.00

1.18 Related Party Disclosures

Details of Related Parties =

Anil Gupta Director

Ankit Gupta Director

Shammi Gupta Wile of Director

Arpita Gupta Daughter of Director

Agrotech Aromatics Private Lid. Subsidiary Company

(CIN;U9L409JK 1996PTCOOTS)4)

Details of Dealing with Related Parties

NAME OF PARTY NATPRE OF TRANSACTION AMOUNT (2022-23)

Arpita Gupta Salary Rs. 6000.00

Ankit Gupta Rent Rs, 1200.00

Agrotech Aromatics Pvt. Ltd. Corporate Loan Rs 231500,00 ©

ANPHAR LABORATORIES PRIVATE LIMITED

NOTES TO FINANCIAL STATEMENTS

1.19 Deferred Tax Asset |

Deferred tax Liability FY 2022-23

{amount 00's)

Total WDV as per Income Tax Act Rs 668701.28

| Total WDV as per Companies Act | Rs 616723.83

| Difference Tt Rs 51977.44

| Deferred Tax Asset @26% (A) Rs 13082,72

‘Opening Deferred Tax Liability Rs 9580.29

Provision for Deferred Tax (Transferred to Profit & loss Rs 3502.42

account)

l -

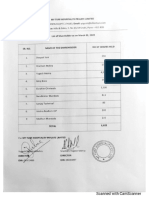

1.20 List of Shareholders holding more than 5% shareholding:-

Shareholders No. of Shares

Anil Gupta 500000. shares

Arpita Gupta 178362 shares

Shammi Gupta 125000 shares

Ankit Gupta 265852 shares

Sukriti Sharma 119866 shares

1.21 Disclosure of Operating Lease |

Disclosure in respect of Land taken on lease 2022-23, 2021-22

a) lease payment projected in the Profit & Loss A/c 900.00 900.00

b) future minimum lease Pajments under non-cancellable operating lease in the

aggregate and for each of thel following periods:

i, not later than one year; 900.00 900.00

ii, later than one year end'not later than five years: 1000.00 1900.00

iii, later than five years 1000.00 1900.00

©) Significant easing agreements:

erenewal of lease deed after 2026

ANPHAR LABORATORIES PRIVATE LIMITED

NOTES TO FINANCIAL SnfTEMEnrs

1.22 Earnings por Share

Basic earnings per shate is calculafed ted by dividing the net consolidated profit or loss for

the period aitributable to equity shareholders by the weighted average number of equity

shares outstanding during the period

For the purpose of calculating diluted earnings per share, the net consolidated profit or

loss for the period attributable tg equity shareholders and the weighted average number

of shaves outstanding during the period are adjusted for the effects of all dilutive potential

equity shares.

1.23 Corporate Social Responsibility (CSR)

As per Section 135 of the companies act,2013, a company, meeting the applicability threshold,

needs to spend al least 2% of its ayerage net profit for the immediately preceding three financial

‘years on corporate social responsibjtity (CSR) activities.

Pursuant lo the MCA nolificatipn daied 20.09.2022, the company is exempted from the

compliance under section 135 of tile Companies Act, 2013 and hence the company has not made

any spending towards CSR duting,the year 2022-23.

1.24 Miscellaneous

+ There is no privr-periot or extraordinary item of income/expenses credited/

debited to the Profit & Lass Account.

impact in the current

year or in the following year.

+ Previous years’ figures have been re-grouped and re-arranged wherever

considered necessary

1.25 Notes on Financial Statements

1 The details of Managerial Remungration paid to Directors is as follows =

« There is no change in a policy which has a mater

Current Year

8700.90

[Name of the Directo

| Anit Gupta

' Ankit Gupta

59500.00

2. Trade veceivables , rade payables , Loans and Advances and Unsecured Loans have_been

laken at their book Value subject tv confirmation and ceconciliation. Loans and Advances are

considered good in respect of which «

mpany does not hold any security other that the

persnnal Guarantee of persons.

ANPHAR LABORATORIES PRIVATE LIMITED

NOTES TO FINANCIAL STATEMENTS,

|

3. Payment to Auditors 2

| Particulars — T 1 Curent Year Previous Year

| Statutory Audit fee

7 380.00 850.00

| |

|

L an |

‘In the opinion of the management the value on realization of current assets, Loans and

Advance in the ordinary course of usiness , will not be less,than the value at which these are,

stated in the Balance Sheet.

5. The SS) status and MSME status of the creditors has not been intimated to the company

thence the information is not given

7. Parsivant to the Taxation Laws ( Amendment Act 2019 ,, with effect from 01-Apr-2019

domestic companies have the optjan te pay Corporate income fax 4 22% plus applicable

surcharge and cess! New Tax a subject to certain conditions. The company has adopted

new scheme from the.applicabie year

2. The company does not have any Benami property, where any proceedings has been initiated

or pending against the company fof holding any Benami property.

3. The Company does not have any transactions with the Companies struck off,

4. The company does not have any charges oF satistaction which is yet to be registered with ROC

beyond the statutory period.

5, The company has riot traded o invested in Crypto currency or Virtual currency ditring the

financial period

6. The Company has not advanced of loaned oF invasted funds te any other person(s) or entity(

ies), including foreign entities ({otermediaries} with the understanding that the intermediary

]

shall

a) directly or indirectly lend or ijvest in other persons or entities identified in any manner

whatsoever by or on behalf of the Company Ultimate Beneficiaries ) or

{b) provide security or the like te ar on behalf of the Ultimate Beneficiaries

7. The company has not received only fund from any person(s) or entity (ies). includiag foreign

entices ( Funding Parly ) with the understanding, ( whether recorded in writing or otherwise)

fixat the company shall |

1) directly oF inctirectly lend or ihvest in other persons or entities identified in any manner

whatscaver by or on behalf of the Funding Party ( Ultimate Beneficiaries )

b) provide any guarantee, security or the like on behalf of the Ultimate Beneficiaries,

3. The Company does not have any transaction which is not recorded in the books of accounts

that lias beer surrendered or disclosed as income duting the year in the ta: (such as, search or

survey or any ather relevant provisions of the Income Tax Act. 1961)

ANPHAR LABORATORIES PRIVATE LIMITED

NOTES TO FINANCIAL STATEMENTS

9. The Company has not been declared willful defaulter by any bank of financial Institution or

other lender }

10, The Company does not have any Sdheme of Arrangements which have been approved by the

Competent Authority in terms of seftions 230 to 237 of the Act.

U1, The Company has complied with the number of layers presctibed under of Section 2(87) of

the Act read with the Companies (Restriction on number of Layers) Rules, 2017.

12, In March 2020 the World Healt Organisation dectared COVID 19 to be a pandemic.

Consequent to this, Government of India declared a national lockeown on 25 March activities

of the Company . The Company has assessed the impact that may result from this pandemic

on its liquidity position , carrylng amounts of other relating to the possible future

uncerfainties in the global economic conditions because of this pandemic , the Company has

considered internal and of approval these financial statements and has assessed its situation

13, in that context and based on the dunvent estimates, the Company believes that COVID 19 is

not likely to have any material fmpact on its financial statements , liquidity or ability to

service ite debt or other obligations. However , the oveall eronomie environment, being

unceslain due to COVID 19, may affect the underlying assumptions and estimates in future ,

which may differ fram those consitlered at the date of approval of these financial statements

date of approval of these financia statements , The Company would closely monitor suck

developments in future economic conditions and consider their impact on the financial

Statements of the relevant periods,

U4, The Audit Trail applicability dite has been extended to 01/04/2023 by the Companies

(Accounts) Second Amendment! Rules, 2022 dated 31/03/2022.

As per our Report of even date

For Arora Vohra & Co, For and on behalf of the Board of Directors

Chartered Accountants

Firm Regn, No. Co

CA. Karah Bir Singh} nt oupta Gupta Ankit Gupta

(Partner) (Managing Director) (itecto:)

Membership No. 091388 DIN:06897796 DIN:08782i80

Place: Jamuna

Date : 04/09/2023,

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- DocumentDocument43 pagesDocumentvineminaiNo ratings yet

- Zerodha Capital Private Limited ANNUAL REPORT 2022-2023Document9 pagesZerodha Capital Private Limited ANNUAL REPORT 2022-2023vineminaiNo ratings yet

- AsdasdasdasdasdaDocument7 pagesAsdasdasdasdasdavineminaiNo ratings yet

- Som Distilleries and Breweries Limited: Assuming Full SubscriptionDocument198 pagesSom Distilleries and Breweries Limited: Assuming Full SubscriptionvineminaiNo ratings yet

- DocumentDocument2 pagesDocumentvineminaiNo ratings yet

- 6 Skin Pharmaceuticals Private Limited: Ordinary BusinessDocument15 pages6 Skin Pharmaceuticals Private Limited: Ordinary BusinessvineminaiNo ratings yet

- ARFY21Document9 pagesARFY21vineminaiNo ratings yet

- IndiaDocument2 pagesIndiavineminaiNo ratings yet

- 6 Skin Pharmaceuticals Private Limited: Ordinary BusinessDocument28 pages6 Skin Pharmaceuticals Private Limited: Ordinary BusinessvineminaiNo ratings yet

- AsdasdDocument2 pagesAsdasdvineminaiNo ratings yet

- 6 Skin Pharmaceuticals Private Limited: Directors' ReportDocument12 pages6 Skin Pharmaceuticals Private Limited: Directors' ReportvineminaiNo ratings yet

- AsdasdasdDocument36 pagesAsdasdasdvineminaiNo ratings yet

- AdsasdDocument49 pagesAdsasdvineminaiNo ratings yet

- Z UABADocument11 pagesZ UABAvineminaiNo ratings yet

- E ANDDocument2 pagesE ANDvineminaiNo ratings yet

- CSA HandbookDocument252 pagesCSA HandbookvineminaiNo ratings yet

- Financial Statement and BRDocument31 pagesFinancial Statement and BRvineminaiNo ratings yet

- UdinDocument1 pageUdinvineminaiNo ratings yet

- Annual and Audit - CDocument29 pagesAnnual and Audit - CvineminaiNo ratings yet

- DocumentDocument15 pagesDocumentvineminaiNo ratings yet

- List of DirectorsDocument1 pageList of DirectorsvineminaiNo ratings yet

- CSA WeightsDocument65 pagesCSA WeightsvineminaiNo ratings yet

- Directors Report Along With AnnexuresDocument17 pagesDirectors Report Along With AnnexuresvineminaiNo ratings yet

- Registered Venture Capital Funds As On Mar 22 2024Document29 pagesRegistered Venture Capital Funds As On Mar 22 2024vineminaiNo ratings yet

- Manappuram Finance LTD - Pick of The Week - Axis Direct - 17022024 - 19-02-2024 - 08Document4 pagesManappuram Finance LTD - Pick of The Week - Axis Direct - 17022024 - 19-02-2024 - 08vineminaiNo ratings yet

- N, MDocument3 pagesN, MvineminaiNo ratings yet

- DocumentDocument10 pagesDocumentvineminaiNo ratings yet

- Directors Report - 2021-22Document8 pagesDirectors Report - 2021-22vineminaiNo ratings yet

- List of ShareholdersDocument1 pageList of ShareholdersvineminaiNo ratings yet

- DocumentDocument1 pageDocumentvineminaiNo ratings yet