Professional Documents

Culture Documents

Document

Document

Uploaded by

vineminai0 ratings0% found this document useful (0 votes)

13 views43 pagesOriginal Title

Document (19)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views43 pagesDocument

Document

Uploaded by

vineminaiCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 43

Tarai & Co.

Cx Charted Accountant

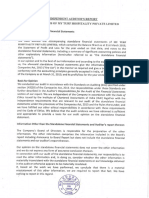

Independent Auditor's Report

To the Members of M/s. Zerodha Capital Private Limited

Report on the standalone Financial Statements

| have audited the accompanying Standalone financial statements of M/s. Zerodha Capital Private

Limited which comprises the Balance Sheet as at 31" March, 2023, the Statement of Profit and Loss for

the year the ended 31 March, 2023 and notes to the financial statements, including a summary of

significant accounting policies and other explanatory information,

In my opinion and to the best of my information and according to the explanations given to me, the

aforesaid standalone financial statements give the information required by the Act in the manner so

required and give a true and fair view in conformity with the accounting principles generally accepted in

India, of the state of affairs of the Company as at 31% March, 2023, and profit for the year ended on that

date

ion

Basis for Opi

‘conducted my audit in accordance with the Standards on Auditing (SAs) specified under sectian 143(10)

of the Companies Act, 2013. My responsibilities under those Standards are further described in the

Auditor’s Responsibilities for the Audit of the Financial Statements section of my report. Lam indepersiert

of the Company in accordance with the Code of Ethics issued by the Institute of Chartered Accountants of

India together with the ethical requirements that are relevant to my audit of the financial statements

Under the provisions of the Companies Act, 2013 and the Rules thereunder, and I have fulfilled my other

ethical responsibilities in accordance with these requirements and the Code of Ethics. | believe that the

audit evidence | have obtained is sufficient and appropriate to provide a basis for my opinion

Key Audit Matters

Key audit matters are those matters that, in my professional judgment, were of most significance in my

audit of the financial statements of the current period. These matters were addressed in the context of

‘my audit of the financial statements as a whole, and in forming my opinion thereon, and | do not provide

separate opinion on these matters. During the year the company has not cartied any business

Reporting of Key Audit Matters as per SA 701, Key Audit Matter are not applicable to the company as itis

an unlisted company.

Information Other than the Standalone Financial Statements and Auditor's Report Thereon

The company's board of directors is responsible for the other information, The other information

Comprises the information included in the Management Discussion and Analysis, Board's report including

‘No: 12/3, 32D FLOOR, SRI SATHYA SAI KRUPA, VANI VILASH ROAD, VV PURAM, NEAR LALBAGH WESTGATE, OPP To.

KAVERI PETROL BUNK, BASAVANAGUDI, BENGALURU, KARNATAKA, 560004 Email Id: Bijayaktarsig@Gmail.Com| M #91

63635 90420

Tarai & Co,

“Wn Charted Accountant

‘Annexure to the Board's Report, Business Responsibility Report, Corporate Governance and Shareholders’

Information, but does not include the standalone financial statements and my auditor's report thereon.

My opinion on the standalone financial statements does not cover the other information and | do not

express any form of assurance conclusion thereon

In connection with my audit of the standalone financial statements, my responsibility is to read the other

information and in doing so, consider whether the other information is materially inconsistent with the

standalone financial statement, or my knowledge obtained during the course of my audit or otherwise

appears to be materially misstated.

Hf, based on the work I have performed, | conclude that there is a material misstatement of this other

information; !am required to report that fact. | have nothing to report in this regard.

Responsibility of Management for the Standalone Financial Statements

‘The Company's Board of Directors is responsible for the matters stated in section 134(5) of the Companies

Act, 2013 ("the Act"} with respect to the preparation of these standalone financial statements that give a

true and fair view of the financial position and financial performance of the Company in accordance with

the accounting principles generally accepted in India, including the accounting Standards specified under

section 133 of the Act. This responsibilty also includes maintenance of adequate accounting records in

accordance with the provisions of the Act for safeguarding of the assets of the Company and for

preventing and detecting frauds and other irregularities; selection and application of appropriate

implementation and maintenance of accounting policies; making judgments and estimates that are

reasonable and prudent; and design, implementation and maintenance of adequate internal financial

controls, that were operating effectively for ensuring the accuracy and completeness of the accounting

records, relevant to the preparation and presentation of the financial statement that give a true and fair

view and are free from material misstatement, whether due to fraud or error

In preparing the financial statements, management is responsible for assessing the Company's ability to

Continue as a going concern, disclosing, as applicable, matters related to going concern and using the

Boing concern basis of accounting unless management either intends to liquidate the Company or to cease

operations, or has no realistic alternative but to do so.

The Board of Directors are also responsible for overseeing the company’s financial reporting process

Auditor's Responsibility for the Audit of the Financial Statements

My objectives are to obtain reasonable assurance about whether the financial statements as a whole are

free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that

includes my opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an

audit conducted in accordance with SAs will always detect a material misstatement when it exists

Misstatements can arise from fraud or error and are considered material if, individually or in the

‘No: 12/3, 3RD FLOOR, SRI SATHYA SAI KRUPA, VANI VILASH ROAD, WV PURAM, NEAR LALBAGH WESTGATE, OPP TO.

KAVER! PETROL BUNK, BASAVANAGUDI, BENGALURU, KARNATAKA, 560004 Email Id: Bjayahtarai@Gmeil.Com| M: +91

63635 90420

Tarai & Co.

( / \ Charted Accountant

aggregate, they could reasonably be expected to influence the economic decisions of users taken on the

basis of these financial statements.

‘As part of an audit in accordance with SAs, | exercise professional judgment and maintain professional

skepticism throughout the audit. | also:

Identify and assess the risks of material misstatement of the financial statements, whether due to

fraud or error, design and perform audit procedures responsive to those risks, and obtain audit

evidence that is sufficient and appropriate to provide a basis for my opinion. The risk of not

detecting a material misstatement resulting from fraud is higher than for one resulting from error,

as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override

of internal control.

li, Obtain an understanding of internal control relevant to the audit in order to design audit

procedures that are appropriate in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of the entity’s internal control.

ili Evaluate the appropriateness of accounting policies used and the reasonableness of accounting

estimates and related disclosures made by management.

iv. Conclude on the appropriateness of management's use of the going concern basis of accounting

and, based on the audit evidence obtained, whether a material uncertainty exists related to events

‘oF conditions that may cast significant doubt on the Company's ability to continue as a going

concer. If | conclude that a material uncertainty exists, | am required to draw attention in my

auditor's report to the related disclosures in the financial statements or, if such disclosures are

inadequate, to modify my opinion. My conclusions are based on the audit evidence obtained up to

the date of my auditor’s report. However, future events or conditions may cause the Company to

ease Lo continue as a going concern

v. Evaluate the overall presentation, structure and content of the financial statements, including the

disclosures, and whether the financial statements represent the underlying transactions and events

ina manner that achieves fair presentation. | communicate with those charged with governance

regarding, among other matters, the planned scope and timing of the audit and significant audit

findings, including any significant deficiencies in internal control that | identify during my audit, |

also provide those charged with governance with a statement that I have complied with relevant

ethical requirements regarding independence, and to communicate with them all relationships and

29 other matters that may reasonably be thought to bear on my independence, and where

applicable, related safeguards. From the matters communicated with those charged with

governance, | determine those matters that were of most significance in the audit ol the financial

statements of the current period and are therefore the key audit matters. | describe these matters

in my auditor’s report unless law or regulation precludes public disclosure about the matter or

when, in extremely rare circumstances, | determine that a matter should not be communicated in

my report because the adverse consequences of doing so would reasonably be expected to

outweigh the public interest benefits of such communication.

No: 12/3, 3RD FLOOR, SRI SATHYA SAI KRUPA, VAN! VILASH ROAD, VV PURAM, NEAR LALBAGH WESTGATE, OPP TO.

KAVERI PETROL BUNK, BASAVANAGUDI, BENGALURU, KARNATAKA, 560004 Email Id: Biayaktarai@GmaiCom | M: +94

53635 90820

Tarai & Co.

Y Charted Accountant

Report on Other Legal and Regulatory Requirements

As required by the Companies (Auditor’s Report) Order, 2016 (“the Order"), issued by the Central

Government of India in terms of sub-section (11) of section 143 of the Companies Act, 2013, | give in the

Annexure a statement on the matters specified in paragraphs 3 and 4 of the Order, to the extent

applicable.

AAs required by Section 143(3) of the Act, | report that:

a) | have sought and obtained all the information and explanations which to the best of my

knowledge and belief were necessary for the purpose of my audit.

b)_ In my opinion, proper books of account as required by law have been kept by the company so far

as appears from my examination of those books.

©) The Balance Sheet and the Statement of Profit and Loss dealt with by this Report are in agreement

with the books of account,

4d} In my opinion, the aforesaid standalone financial statements comply with the Accounting

Standards specified under Section 133 of the Act, read with Rule 7 of the Companies (Accounts}

Rules, 2014,

2} On the basis of the written representations received from the directors as on1st April, 2021 taken

on record by the Board of Directors, none of the directors is disqualified as on 31st March, 2022

from being appointed as a director in terms of Section 164 (2} of the Act.

{} With respect to the adequacy of the internal financial controls over financial reporting of the

Company and the operating effectiveness of such controls: The Same is not Applicable

2) With respect to the other matters to be included in the Auditor’s Report in accordance with Rule

1 of the Companies (Audit and Auditors) Rules, 2014, in my opinion and to the best of my

information and according to the explanations given to me’

i, The Company has disclosed the impact of pending litigations on its financial position in its

financial statements ~ Not Applicable.

ji, The Company has made provision, as required under the applicable law or accounting

standards, for material foreseeable losses, if any, on long-term contracts including derivative

contracts - Not Applicable

ii, There has been no delay in transferring amounts, required to be transferred, to the Investor

Education and Protection Fund by the Company

wv,

a) The management has represented that, to the best of its knowledge and belief, other than as

disclosed in the notes to the accounts, no funds have been advanced or loaned or invested (either

No: 12/3, SRO FLOOR, SRI SATHYA SAI KRUPA, VANI VILASH ROAD, WW PURAM, NEAR LALBAGH WESTGATE, OPP TO

KAVERI PETROL BUNK, BASAVANAGUD), BENGALURU, KARNATAKA, 560004 Email ld: Bjayaktaraig@Gmail Com | M’ +84

53635 90820

Tarai & Co,

Charted Accountant

from borrowed funds or share premium or any other sources or kind of funds) by the company to or

in any other person or entity, including foreign entities (“intermediaries”), with the understanding,

whether recorded in writing or otherwise, that the Intermediary shall, whether, directly or indirectly

lend or invest in other persons or entities identified in any manner whatsoever by or on behalf of the

company (“Ultimate Beneficiaries”) or provide any guarantee, security or the like on behalf of the

Ultimate Beneficiaries;

b) The management has represented, that, to the best of its knowledge and belief, other than as

disclosed in the notes to the accounts, no funds have been received by the company from any person

or entity, including foreign entities ("Funding Parties"), with the understanding, whether recorded in

writing or otherwise, that the company shall, whether, directly or indirectly, lend or invest in other

persons or entities identified in any manner whatsoever by or an behalf of the Funding Party

(“Ultimate Beneficiaries”) or provide any guarantee, security or the like on behalf of the Ultimate

Beneficiaries; and

J] Based on audit procedures which We have considered reasonable and appropriate in the

circumstances, nothing has come to their notice that has caused them to believe that the

representations under sub-clause (i) and (ii) contain any material misstatement

V. The company has not declared or paid any dividend during the year in contravention of the

provisions of section 123 af the Companies Act, 2013

For Tarai & Co

Chartered Accountant

FR No. 0221665,

Bijaya Kumar Tarat

Proprietor

MNo.: 254032

Place: Bangalore

Date: 30/06/2023

UDIN: 23254032BGUBFK9291

No: 1218, 3RD FLOOR, SRI SATHYA SAI KRUPA, VANI VILASH ROAD, VV PURAM, NEAR LALBAGH WESTGATE, OPP TO

KAVERI PETROL BUNK, BASAVANAGUDI, BENGALURU, KARNATAKA, 560004 Ema! Id: Bljayaktarai@Gmail,Com| tt +91

63635 90420

A

Tarai & Co.

Charted Accountant

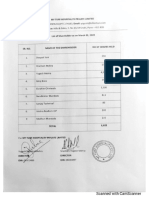

ANNEXURE 1 TO THE INDEPENDENT AUDITOR'S REPORT OF EVEN DATE ON THE STANDALONE

FINANCIAL STATEMENTS OF M/s. ZERODHA CAPITAL PRIVATE LIMITED

Clause

Sub

Whether the company is maintaining

proper records showing full particulars,

including, quantitative details. and

situation of Property, Plant and

Equipment

(a) (8)

{c)

Whether the company is maintaining

proper records showing full particulars of

intangible assets;

Whether these Property, Plant and

Equipment have bee

by

intervals;

the management at reasonable

whether any material

discrepancies were noticed on such

verification and if so, whether the same

have been properly dealt with in the

books of account;

Whether the title deeds of all the

(other than

properties where the company is the

lessee and the lease agreements are duly

executed in favour of the lessee) disclosed

immovable properties

in the financial statements are held in the

name of the company;

physically verified |

| The Company has maintained proper |

records showing full particulars,

including quantitative details and

situation of Property plant and

of

equipment.

As per the

explanation given to me and based on

the audit verification done by me, the

company maintaining proper |

records, showing full particulars of

Information and

is

intangible asset.

‘As per the Information and |

explanation given to me and based on |

| the audit verification done by me the |

Property, Plant and Equipment have

| been physically verified by the |

| management at reasonable intervals;

No any material discrepancies were

noticed on such verification.

|

[As per the information and |

explanation given to me and based on

the audit verification done by me the

company does not posses any

Immovable properties in the name of |

the company , $0 this clause will not

| be applicable to the company

‘No: 4213, 3RD FLOOR, SRI SATHYA SAI KRUPA, VANI VILASH ROAD, VV PURAM, NEAR LALBAGH WESTGATE, OPP TO.

KAVERI PETROL BUNK, BASAVANAGUDI, BENGALURU, KARNATAKA, 560004 Email Id: Bijayaktarai@Gmail,Comn | it:+94

63635 90420

Tarai & Co,

Charted Accountant

@

| (Prohibition) Act, 1988 (45 of 1988) and

Whether the company has revalued its

Property, Plant and Equipment (including

Right of Use assets) or intangible assets or

|

both during the year and, ifs0, whether | company has not revalued its

the revaluation fs based on the valuation | Property, Plant and Equipment

by a Registered Valour; specify the | (including Right of Use assets) or

amount of change, if change is 10% or

‘more in the aggregate of the net carrying

value of each class of Property, Plant and |

Equipment or intangible assets,

Whether any proceedings have been

initiated or are pending against the

company for holding any benami property |

under the Benami Transactions

rules made thereunder,

As per the Information and |

explanation given to me and based on

the audit verification done by me the

intangible assets or both during the

year.

‘As per the Information and |

explanation given to me and based on

the audit verification done by me. No |

proceedings have been initiated or are

pending against the company for

holding any benami property under

the Benami Transactions (Prohibition) |

Act, 1988 (45 of 1988) and rules made

thereunder. Hence this clause will not

be applicable to the company

| verification

Whether physical verification of inventory

has been conducted at reasonable

intervals. by the management and

whether, in the opinion of the auditor, the

coverage

and procedure of such

by the management is |

appropriate; whether any discrepancies

of 10% or more in the aggregate for each

class of inventory were noticed and if so, |

whether they have been properly dealt

with in the books of account;

The Company is in to the business of

lending Money, hence the Company

does not possess any inventory during |

the year, so this clause will not be |

applicable to the company,

No: 12/3, 8D FLOOR, SRI SATHYA SAI KRUPA, VANI VILASH ROAD, VV PURAM, NEAR LALBAGH WESTGATE, OPP TO

KAVERI PETROL BUNK, BASAVANAGUDI, BENGALURU, KARNATAKA, 650004 Email: Bijayaktarai@Gmail,Com | M: +91

62635 90420

Tarai & Co.

Charted Accountant

(o)

Whether during any point of time of the

year, the company has been sanctioned

working capital limits in excess of five |

Crore rupees, in aggregate, from banks or |

financial institutions on the basis of

security of current assets, whether the

quarterly returns or statements filed by

the company with such banks or financial |

institutions are in agreement with the |

books of account of the Company, if not, |

give details;

Whether during the year the company has

made investments in, provided any |

guarantee or security or granted any loans

for advances in the nature of loans,

secured or unsecured, to companies, |

firms, Limited Liability Partnerships or any

other parties i

In my Opinion and the explanation

provided by the management, the

company has not be sanctioned the

‘working capital limits from the bank or

financial institutions, hence the said

clause will not be applicable to the

company

As per the Information and

explanation given to me and based on

the audit verification done by me, the

company has granted

advances in nature of loan, both |

other

loans or

secured or

parties

unsecured, 16

(a)

(b)

ce

Whether during the year the company has

provided loans or provided advances in

the nature of loans, or stood guarantee, or

provided security to any other entity {not |

applicable to companies. whose principal |

business is to give loans),

Whether the investments made, |

guarantees provided, security given and

the terms and conditions of the grant of |

all loans and advances in the nature of

loans and guarantees provided are not

prejudicial to the company's interest;

In respect of loans and advances in the

nature of loans, whether the schedule of

repayment of principal and payment of

interest has been stipulated and whether

the repayments or receipts are regular;

The Company is in to the business of

lending Money, so this clause will not |

be applicable to the company

tn my Opinion and the explanation |

provided by the management, The

loans and advances granted by the

company are not prejudicial to the

interest of the company.

As per the Information and

explanation given to me and based on

‘the audit verification done by me , in

respect of loans and advances in the |

nature of loans, the schedule of

‘No: 12/5, 3RD FLOOR, SRI SATHYA SAI KRUPA, VANI VILASH ROAD, VV PURAW, NEAR LALBAGH WESTGATE, OPP TO

KAVERI PETROL BUNK, BASAVANAGUDI, BENGALURU, KARNATAKA, 560004 Email Id: Bijayaktarai@Gma.Com | M: 484

63635 90420

Tarai & Co.

Charted Accountant

o

(ea

amount overdue for more than ninety

days, and whether reasonable steps have

been taken by the company for recovery

of the principal and interest;

Whether any loan or advance in the

nature of loan granted which has fallen

extended or fresh loans granted to settle

the over dues of existing loans given to the

same parties, if so, specify the aggregate

amount of such dues renewed or

extended or settled by fresh loans and the

percentage of the aggregate to the total

loans or advances in the nature of loans

granted during the year [not applicable to

companies whose principal business is to

give loans];

"| Whether the company has granted any

loans or advances in the nature of loans

either repayable on demand or without

specifying any terms or period of

repayment, if so, specify the aggregate

amount, percentage thereof to the total

loans granted, aggregate amount of loans

granted to Promoters, related parties as

defined in clause

‘the amount is overdue, state the total |

Aue during the year, has been renewed or |

repayment of principal and payment

| of interest has been stipulated and the

repayments or receipts are regularly

except in the case of assets classified

as Non-Performing Assets,

per the Information and |

| explanation given to me and based on |

[As

the audit verification done by me

| loans or advances of Rs 9,61,90,472,

where either interest amount or the

principal is due more than ninety days

» the company has taken reasonable

| steps for recovery of the principal and

| interest |

The Company is in to the business of

lending Money, s0 this clause will not

be applicable to the company

as por and |

| explanation given to me and based on

the audit verification done by me, the

| company has not granted any loans or

advances in the nature of loans either |

| repayable on demand or without

specifying any terms or period of

| repayment, aggregate amount of

loans granted to Promoters, related

parties as defined in clause

the Information

No: 12, 3RD FLOOR, SRI SATHYA SAI KRUPA, VANI VILASH ROAD, VV PURAM, NEAR LALBAGH WESTGATE, OPP TO

KAVERI PETROL BUNK, BASAVANAGUDI, BENGALURU, KARNATAKA, 560004 Email Id: Bijayaktarai@mai.Com | i: +91

63635 90420

respect of loans, investments,

guarantees, and security, whether

provisions of sections 185 and 186 of the

Companies Act have been complied with

In respect of deposits accepted by the

company or amounts which are deemed

to be deposits, whether the directives

issued by the Reserve Bank of India and

the provisions of sections 73 to 76 or any

other of the

Companies Act and the rules made

thereunder, where applicable, have been

complied with

relevant provisions

‘Whether maintenance of cost records has

been specified by the Central Government

under subsection (1) of section 148 of the

Companies Act and whether such

accounts and records have been so made

and maintained

Whether the company is regular

depositing undisputed statutory dues

including Goods and Services Tax,

provident fund, employees’ state

insurance, income-tax, sales-tax, service

tax, duty of customs, duty of excise, value |

added tax, cess and any other statutory

dues to the appropriate authorities

Tarai & Co.

Charted Accountant

In my Opinion and the information |

and explanation provided, the

| company has compiled with Section

185 & 186 of the companies act of

2013 with respect to the loans and

| advances provided by the company |

| during the year. '

ln my Opinion and the information

and explanation provided the

company has not accepted the

deposits or there are no amounts in

| the company which is deemed to b

| deposits during the year hence the

said clause will not be applicable

‘The entity is not in a manufacturing

sector, hence the said clause is not

| applicable |

The Company is generally regular in |

| depositing undisputed statutory dues

| including GST, Cess and other

statutory dues with the appropriate

| authorities to the extent applicable to |

it. |

There are no undisputed amounts

payable in respect of income tax which |

| have remained outstanding as. at

March 31, 2022 for a period of more

than 6 months from the date they

| became payable. |

No; 12, 3RD FLOOR, SRI SATHYA SAI KRUPA, VANI VILASH ROAD, VW PURAM, NEAR LALBAGH WESTGATE, OFP TO

KAVERI PETROL BUNK, BASAVANAGUDI, BENGALURU, KARNATAKA, 860004 Email I: Bijayaktarai@Gmall.Gom | hs +91

63635 90420

Tarai & Co.

Charted Accountant

According to the information and |

have

and

f (b) | Where statutory dues referred to in sub-

clause (a) have not been deposited on | explanations given to me, there are no |

account of any dispute, then the amounts | any statutory dues referred in sub

involved and the forum where dispute is | clause (a) which have not been

| pending shall be mentioned | deposited on account of any dispute

ic | Whether anywansaciont not recorded According to the formation and

the books of account have been | explanations given tome, there are no

surrendered or disclosed as income | any transaction that not recorded in

during the year in the tax assessments | the books of account which

under the Income Tax Act, 1961 (43 of | been surrendered or disclosed as

1961), if so, whether the previously | income during the year in the tax

unrecorded income has been properly , assessments under the Income Tax

recorded in the books of account during | Act, 1961 (43 of 1961)

the year

ios cal Whether the company has defaulted in | According to the information and’

Fepayment of loans or other borrowings | explanations given to me and in my |

} | oF in the payment of interest thereon to | opinion the company has not been |

| | | any lender | defauted in repayment of loans or |

i | other borrowings or in the payment of

| interest thereon to any lender.

| (0) | Whether the company isa declared wilful Based on the information

defaulter by any bank or financial | explanation provided by the company |

institution or other lender; | to me and in my opinion the company |

is not declared as a wilful defaulter by

Bank oF Financial institution

{c) | Whether term loans were applied for the | in my opinion and according to the

Purpose for which the loans were | information and explanations given to

obtained; me, the company has not taken any

| | ‘term loan during the year , hence this

| | clause will not be applicable to the |

' company.

| |

(d) | Whether funds raised on short term basis | in my opinion and according to the |

have been utilized forlong term purposes, | information and explanations given,

funds raised on short term basis have

No: 12, 3RO FLOOR, SRI SATHYA SA KRUPA, VANI VILASH ROAD, VV PURAM, NEAR LALBAGH WESTGATE, OPP TO

KAVERI PETROL BUNK, BASAVANAGUDI, BENGALURU, KARNATAKA, 860004 Enail il: Bijayaktarai@GmaiLCom | Mi +91

63635 90420

Tarai & Co.

Charted Accountant

[not been utilized for long teem |

Purposes,

ro) Whether the company, has taken any | in my opinion and according to the |

| funds from any entity or person on | information and explanations given, |

j account of or to meet the obligations of its | the company does not have any |

subsidiaries, associates or joint ventures | subsidiaries, associates or joint

ventures, hence this clause will not be |

applicable to the company.

(| Whether the company has raised loans |in my opinion and ‘according to the |

during the year on the pledge of securities | information and explanations given,

held in its subsidiaries, joint ventures or | the company does not have any

associate companies, subsidiaries, associates or joint

ventures, hence this clause will not be

applicable to the company.

hie. (2) | Whether moneys raised by way of initial | According to the information and

| public offer or further public offer explanations given to me, the |

(including debt instruments) during the | company has not raised by way by way |

| year were applied for the purposes for | of initial public offer or further public |

which those are raised, if not, the details | offer (including debt instruments)

together with delays or default and | during the year

| subsequent rectification

(0) [Whether the company has made any| The company has allotted

preferential allotment or private | Compulsorily Convertible Preference

placement of shares or convertible | shares through Preferential allotment

debentures (fully, partially or optionally | on private placement basis and |

Convertible) during the year and if so, | requirement on section 42 and section |

| whether the requirements of section 42 | 62 of the Companies Act, 2013 have |

| and section 62 of the Companies Act, 2013 | been complied with and the funds

| have been complied with and the funds | raised have been used for the

raised have been used for the purposes | purposes for which the funds were |

for which the funds were raised raised,

nn. [a Whether any fraud — on the information and |

fraud on the company has been noticed or | explanation provided by the company

i reported during the year, if yes, the | to me, there are no case of fraud by

[the company or any fraud on the |

‘No: 12/8, RD FLOOR, SRI SATHYA SAI KRUPA, VANI VILASH ROAD, VV PURAM, NEAR LALBAGH WESTGATE, OPP TO

KAVERI PETROL BUNK, BASAVANAGUDI, BENGALURU, KARNATAKA, 560004 Ema Mf: Bijayaktarai@Gmail Com |

63635 99420

“91

“nature and the amount involved is to be |

indicated;

(b)

2,

I

| |

| |

)

|

(a)

Whether any report under sub-section |

(12) of section 143 of the Companies Act |

has been filed by the auditors in Form |

ADT-4 as prescribed under rule 13 of

Companies (Audit and Auditors) Rules, |

2014 with the Central Government; |

whistle-blower complaints, if

received during the year by the company;

any,

Whether the Nidhi Company has

complied with the Net Owned Funds to

Deposits in the ratio of 1: 20 to meet out

the liability; |

(Whether the Nidhi Company

‘maintaining ten per cent. unencumbered

the Nidhi

ity;

is

term deposits as specified

Rules, 2014 to meet out the lial

Whether there has been any default in |

payment of interest on deposits or

repayment thereof for any period and if

50, the details thereof;

During the year no report under sub

Whether the auditor has considered | As auditor, 1 did not receive any

| applicable to the company

Tarai & Co.

Charted Accountant

‘Company during the year, Hence this |

clause will not be applicable to the

company,

section (12) of section 143 of the

Companies Act has been filed by the

auditors in Form ADT-4 as prescribed

under rule 13 of Companies (Audit and

Auditors) Rules, 2014 with the Central |

Government. Hence this clause will

not be applicable to the company,

whistle-blower complaint during the

year. Hence the said clause is not

applicable to the company

The company is not a Nidhi Company.

Hence the said provisions are not

The company is not a Nidhi Company,

Hence the sald provisions are not |

applicable to the company

The company is not a Nidhi Company. |

Hence the said provisions are not |

applicable to the company

Whether all transactions with the related

parties are in compliance with sections |

177 and 188 of Companies Act where

applicable and the details have been

disclosed in the financial statements.

information and |

me

As per the

explanations received to

transactions with the related parties

are in compliance with sections 177

and 188 of Companies Act where

applicable, and the details have been

disclosed in the financial statements,

etc., as required by the applicable ,

accounting standards

all

No; 1213, 3RD FLOOR, SR SATHYA SAI KRUPA, VANI VILASH ROAD, VW PURAM, NEAR LALBAGH WESTGATE, OPP TO

KAVERI PETROL BUNK, BASAVANAGUDI, BENGALURU, KARNATAKA, 560004 Email Id: Bijayaktaraig@Gmal. Con | Mi +94

63635 90420

14,

16.

(a

audit system commensurate with the size

and nature of its business

(b) | Whether the reports of the Internal

Auditors for the period under audit were

considered by the statutory auditor;

Whether the company has entered into

any non-cash transactions with directors

or persons connected with him and if so,

whether the provisions of section 192 of

Companies Act have been complied with;

Whether the company is required to be

registered under section 45-1A of the

Reserve Bank of India Act, 1934 (2 of

1934)

b)

Whether the company has conducted any

Non-Banking Financial or Housing Finance

activities without a valid Certificate of

Registration (CoR) from the Reserve Bank

of India as per the Reserve Bank of India

‘Act, 1934;

whether the company is a Core

Investment Company (CIC) as defined in

the regulations made by the Reserve Bank

of India, if so, whether it continues to fulfil

the criteria of a CIC, and in case the

company is an exempted or unregistered

CIC, whether it continues to fulfil such

criteria

Whether the company has an internal |

Tarai & Co.

Charted Accountant

As per the information and

explanations received to me , the

company has internal audit system

commensurate with the size and

nature of its business

The reports of the internal Auditors

for the period under audit were

considered by the statutory auditor.

| The Company has not entered into any

| non-cash transactions with directors |

or persons connected with him for the

year, hence the clause are not

| applicable to the Company

are

In my opinion and the information ,

explanation given to me by the |

the

obtained registration under section |

45-1A of the Reserve Bank of india

Act,1934 |

management company has

the company has obtained

registration under section 45-18 of the |

Reserve Bank of India Act,1934.

‘The Company is not a Core Investment

| Company (CIC) as defined in the

regulations made by the Reserve Bank

The Company is not a Core Investment

Company (CIC) as defined in the

regulations made by the Reserve Bank

| of India, this Disclosure |

| requirement will not be applicable to

the company.

Hence

No: 1218, 3RD FLOOR, SRI SATHYA SAI KRUPA, VANI VILASH ROAD, VV PURAM, NEAR LALBAGH WESTGATE, OPP TO

KAVERI PETROL BUNK, BASAVANAGUDI, BENGALURU, KARNATAKA, 560004 Email ld: Bijayaktarai@Gmail Com | M +94

63635 90820

Tarai & Co.

Charted Accountant

whether the Group has more than one CIC

as part of the Group, if yes, indicate the

number of CICs which are part of the

Group; |

‘AS per information and explanation

given to me and based on verification

done by me, the group does not have

any CIC as part of the Group. Hence |

this clause of the order is not

applicable. |

17

j 9.

20. | (a)

Whether the company has incurred cash

losses in the financial year and in the

immediately preceding financial year, if

50, state the amount of cash losses;

Whether there has been any resignation |

of the statutory auditors during the year,

if 50, whether the auditor has taken into

consideration the issues, objections or

‘concerns raised by the outgoing auditors;

On the basis of the financial ratios, ageing |

and expected dates of realisation of |

financial assets and payment of financial |

liabilities, other information

accompanying the financial statements,

the auditor's knowledge of the Board of

Directors and management plans,

whether the auditor is of the opinion that |

no material uncertainty exists as on the

date of the audit report that company is

capable of meeting its liabilities existing at

the date of balance sheet as and when

they fall due within a period of one year

from the balance sheet date.

Whether, in respect of other than ongoing

projects, the company has transferred

unspent amount to a Fund specified in

Schedule Vil to the Companies Act within

There has been no resignation of the

The company has not feared cash

loss in current financial year as well in

immediately preceding Financial year,

Hence

applicable to the company,

the said clauses won't be

previous statutory auditors during the

year, Hence the said clauses won't be

applicable to the company,

On the basis of the financial ratios,

ageing and expected dates of

realisation of financial assets and |

payment of financial liabilities, other

information accompanying the

financial statements, the auditor's |

knowledge of the Board of Directors

and management plans, | am of the

opinion that no material uncertainty

exists as on the date of the audit

report that company is capable of

meeting its liabilities existing at the

date of balance sheet as and when

they fall due within a period of one

year from the balance sheet date;

ere is no liability on the company

under the provisions of section 135 of

the Companies Act, 2013 relating to

Corporate Social Responsibility, Hence

No: 12/3, 3RO FLOOR, SRI SATHYA SA! KRUPA, VANI VILASH ROAD, VV PURAM, NEAR LALBAGH WESTGATE, OPP 10

KAVERI PETROL BUNK, BASAVANAGUDI, BENGALURU, KARNATAKA, 560004 Email ld: Bijayaktarai@Gmail Com tt: #91

153635 90420

Tarai & Co.

Charted Accountant

@ period of six months of the expiry of the | the Provisions of the said clause will

financial year in compliance with second | not applicable to the company

proviso to sub-section (5) of section 135 of

the said Act;

| Whether any amount remaining unspent | There is no liability on the company |

Under sub-section (5) of section 135 of the | under the provisions of section 135 of

Companies Act, pursuant to any ongoing | the Companies Act, 2013 relating to

Project, has been transferred to special | Corporate Social Responsibility, Hence

account in compliance with the provision | the Provisions of the said clause will

of sub-section (6) of section 135 of the | not applicable to the company j

said Act;

a Whether there have been any| The Company has not made any

Gualifcations or adverse remarks by the | investments which compels the

| Tespective auditors in the Companies | company to prepare the consolidated

(Auditor's Report) Order (CARO} reports | financial statements during the year, |

of the companies included in the | Hence this disclosure requirement wil |

Consolidated financial statements, if yes, | not be applicable tothe company |

| indicate the details of the companies

| the paragraph numbers of the CARO

report containing the qualifications or

adverse remarks. |

For Tarai & Co

Chartered Accountant

FR No. 0221665

hae

Bijaya Kumar Tarai

Proprietor

MNo.: 254032

Place: Bangalore

Date: 30/06/2023,

UDIN: 232540328GUBFK9291

‘No: 1213, 3RD FLOOR, SRI SATHYA SAI KRUPA, VANI VILASH ROAD, VV PURAM, NEAR LALBAGH WESTGATE, OPP TO

KAVER PETROL BUNK, BASAVANAGUDI, BENGALURU, KARNATAKA, 580004 Cait: Bljayaktarai@Gmall,Com M: +91

63635 90420

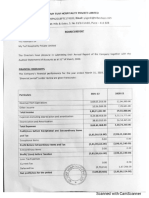

"ZERODIA CAPITAL PRIVATE LIMITED

‘IN; Us7200KAz014PTCO76s3,

BALANCE SHEET AS AT 3181 MARCH, 2023

Particulars

| €QUITY AND LIABILITIES

(2) Sboreholder’s Funds

Amount in R

‘March

asses

02) Current assets

(0) Share Capt sass oises

(o) Reserves and Surplus 3 6689.77 345i 26

(2) Non Current Assets

(o} Long Tem Borrowings 1,000.00

(ch Detered Tx Lai Net 5 187 056

(2) currencies

(a Trade Payables 6 a2

{b) Shor Ter Provisions 7 23.00

(clother Cument abl a urs

— otal a v9.5 |

(2) Nom current Assets

(a} Property, Plant & Eauioment ad intangible Assets 9

{i Property, Plant & Equipment 3 126

{ita asses ° 2988 a

(b) Lon term loans and avances ~finaning atity 10 954 soias

{a short-tem Loans and advances ~ financing aetity a 93820 3.27580

{b) Cast and cash equivalents 2 659.13 26798

2 07 164

Total - Baa0.68 085.93

Significant Accounting Paiies and Notes to Financial Statement

Sper our Report of even date

For Tarai & Co

Chartered Accountant

FRNoonees RTE

As,

Bijaya Kumar Tara

Proprietor

Mio: 254032.

Place Bangalore

Date: 30/06/2023

‘uoin : 232540328GUBFK9291

1

For oF Onbehalt of Board of Director

ia eae eee teers

es

AEN

3 P20. \8 Ay

Nitkin Kamath

sot

onceaias35 bincossbaco

jase

ect

Company stray

Hrs £19 SS0

[BERODHN CaPTAL PRIVATE LITE

‘IN: Us7o0KAzoraPTco73653

PROFIT & LOSS STATEMIENT FOR THE YEAR ENDED 31ST MARCH, 2023

Amount iaRs Lakhs __ Amount ns Laie

antes Totes 2022.23 ~ 2023.22

eam

| Revenue fom operations te 539.6),

other Income 15

Total neome (1)

W Epense

[Employee Benefit Expense 16 28

Finance Cost 7 116

Depreciation and Amortization Expense 8 240

ther Expenses 1B 30.49

Total Expenses ona

Profit before excoptional and extraordinary items and ax {V)

VL Bxceptional tems

Vil Profit before extraordinary items and tax {V -VA) as

Extraordinary tems

Profit before tax (Vi Vi 38025

K Taxexpense:

(0) Current rox 105.02 ze

(2) Deferred tox 431 9:9

(2) come Tax Fr Earlier Years (204)

1 profitoss forthe pero from canting operations (HX) 387 - ain)

2X11 Profittoss) rom discontinuing operator

Xl Tax Expense of Discoatinuing operations :

iW Profit/(Loss} from biscontinuing aperations (after tax) (KiLXM)

XV _Profit/(Loss) forthe period {XIXIV) 25197 6.14

XW Caring per equity share:

Basie 9 570 in

__(2)biuced _

Sigficant Accounting Policies and Notes to Financial Stavoment

AS per aur Report of even date

For Tarai Co aa

‘Chartered Accountant For or Onbehalt of Board of Director

FRNo. 0723665,

* =

iy Kuma aa Kasionan oa

Propet binresez5e5 bin geaaa

wns 2082 Draco

Pac angtre :

Deve 3fa/a003

UDI: 2s40nBcuKG281 sor

Metin

Company Secretary

Mo, [aS

TERODWR CAPITAL PRIVATE UTED.

‘av: Usrz00KA2014PrC073653

Cath Flow Statement forthe period March 31,2023,

Amountia Rs aks ‘Amount in Lake

- Particulars 302.23 - waves

[A CASHFLOW FROM OPERATING ACTIVITIES a |

Net Profit after Tax aess7 aoa

Aciustments fo:

Depreciation & Amontsation Expenses 451 240

Firace cost, nas 16

Tax bsaense

Provision of neome Tax 1065.02 area

Deferred Tax an __aa2e 919 2056

‘Operating Prof before Working Capital Changes 03.25 ~ wen

Adjustments for:

Decrease/inrease in Other Curent Assets (3.43) 295

Decroase{inrease in Loans & Advances (2,906.13) (2.99800)

Decrease inreasein Trade ReceWable 627

Increas/{Oecrease in Payables (242) (0.86)

IncreaseDecrease in Provisions soar 1507

Inrease/Detrease) in Other Curent Usbiltes 033 (3.61.24) _ (027)

Casi generated from operations 13.458 58)

Income Tax Paid 108 96

Net cash flow rom Operating actutes (3,583.4) 870.0)

lb casistow FRom investing acmvimies

Purchase of Property Pant and Equipments (0.91)

Purchase of intangible Assets (32.70) -

ash generated from investonents era] a |

Ic casi Low FROM FINANCING ACTIVES

Proceed rm alotment of Shares 2996.79 150.09

Proceeds om Long ern Borrowings 2000.00

Payment of interest (as) (2.16)

Net Cash used in Flaaneing activites _ 38534 17a

Net increase in cash & Cash Equbalents 39119 1a.12208)

Cash and Cash equivalents a8 at Begining ofthe Period 26798 129000

Cash and Cash equivalents os at End ofthe Pion

‘cosh Cash Equluatons

Cashin Han

Cosi at Bank

thers

Cash & Cash equivalents as stated

‘son 31.03.2023 As on 4.08.2

son 31052022 Asn 41

652.25 257.94 207.90

a7

won 35794 ra

For Tarai €o

1 (oth: 25402

qs «VY ERA BANGALORE

Proprietor

‘No: 254032

Place Bangalore

Date: 30/06/2023

piv: 2325a03206uBFK9201

hot oon (rector

tea

a

(2 (oan

of

Ica nbd Hinan Det

ow: 03142935 bin; 06687440

Directors

b

gettin

Company Secretary

Dna f lasse ~.

‘ZERODHA CAPITAL PRIVATE LIMITED

‘Schedule to the Balance Sheet as on 31st March 2023

[as prescribed under Paragraph 19 of Non-Banking Financial Company - Non-Systemically

Important Non-Deposit taking Company (Reserve Bank) Directions, 2016},

Amount in Rs Lakhs

ABILITIES

IDE

‘Amount

outstanding _A™@UNt Overdue

Loans and advances availed by the non-banking financlal

a) Debentures

>> Secured

>> Unsecured :

(other than falling within the meaning

of public deposits*)

) Deferred Credits

«} Term toans

4) Inter-corporate loans and borrowing

@) Commercial Paper :

f) Public Deposits* - .

8) Other Loans [Specify Nature} Director Loan 41,000

Please see Note J below

Break-up of (1)(f) above (Outstanding public deposits inclusive

of interest accrued thereon but not paid) :

a) In the form of Unsecured debentures

) In the form of partly secured debentures ie. debentures -

¢} Other public deposits

ASSET SIDE :

Break-up of Loans and Advances including bills receivables Amount

[other than those included in (4) below]

a) Secured rerecs17318

b) Unsecured 816 06

Break up of Leased Assets and stock on hire and other assets

counting towards AFC activities

| Lease assets includling lease rentals under sundry debtors

a} Financial lease

b) Operating lease

li) Stock on hire including hire charges under sundry debtors

a) Assets on hire :

b) Repossessed Assets

iil) Other loans counting towards AFC activities

a} Loans where assets have been repossessed

b} Loans other than (a) above

Break-up of Investments :

rent investment:

ZERODHA CAPITAL PRIVATE LIMITED

Schedule to the Balance Sheet as on 31st March 2023

[as prescribed under Paragraph 19 of Non-Banking Financial Company - Non-Systemically

important Non-Deposit Taking Company (Reserve Bank) Directions, 2016]

1) Quoted - -

i) Shares

(a) Equity -

{b) Preference

Ii) Debentures and Bonds

it) Units of mutual funds

iv) Government Securities

v)_ Others (Please Specify)

2) Unquoted

i) Shares

(a) Equity

(b) Preference

li) Debentures and Bonds

ii) Units of mutual funds

iv} Government Securities

v) Others (Please Specify)

‘Long Term Investments :

1) Quoted Amount

Outstanding

i) Shares -

(a) Equity

(b} Preference

ii) Debentures and Bonds

iii) Units of mutual funds

iv) Government Securities

vv) Others (Please Specify)

2) Unquoted

i) Shares

(a) Equity :

(b) Preference :

ii) Debentures and Bonds

iil) Units of mutual funds

iv) Government Securities

vy} Others (Please Specify)

‘Total Investments

Borrower group-wise classification of assets

Please see Note 2 below

Category ‘Amount Net of Provisions

Secured Unsecured Total

2) Related Parties **

a) Subsidiaries

b) Companies in the same group

Notes :

a

2

3)

‘ZERODHA CAPITAL PRIVATE LIMITED

Schedule to the Balance Sheet as on 31st March 2023

[as prescribed under Paragraph 19 of Non-Banking Financial Company - Non-Systemically

Important Non-Deposit Taking Company (Reserve Bank} Directions, 2016]

¢) Other related parties - :

2)_Other than related parties 6,851.82 807.67 7,659.49

Total 6,851.82 807.67 7,659.49

7 Investor group-wise classification of all investments (current and long term) in shares and securities

(both quoted and unquoted):

Please see Note 3 below

Category ‘Market Value / Book Value (Net

Break up or fair of Provisions)

value or NAV

1) Related Parties **

a) Subsidiaries : .

b) Companies in the same group

c) Other related parties

2) Other than related parties

___Total :

** As per Accounting Standard of ICAI (Please see Note 3)

Other information

Particulars

a ‘Amount

i) Gross Non-Performing Assets

a) Related parties

) Other than related parties 559.51 559.51

) Net Non-Performing Assets

a) Related parties

b) Other than related parties 503.56 503.56

ii) Assets acquired in satisfaction of debt

‘As defined in point (xix) of paragraph 3 of Chapter 2 of the Non-Banking Financial Company - Non

Systemically Important Non-Deposit Taking Company (Reserve Bank) Directions, 2016,

Provisioning norms applicable are as’ prescribed in the Non-Banking Financial Company - Non.

Systemically important Non-Deposit Taking Company (Reserve Bank) Directions, 2016.

All Accounting Standards and Guidance Notes issued by ICAI are applicable including for valuation of

investments and other assets as also assets acquired in satisfaction of debt. However, market value: in

respect of quoted investments and break up value/fair value/NAV in respect of Unquoted investments

are disclosed irrespective of whether they are classified as long term or current in (5) above.

ZERODHA CAPITAL PRIVATE LIMITED

CIN: U67100KA2014PTCO73653

Notes Forming Integral Part of the financials statements as at 31st March 2023

STATEMENT OF SIGNIFICANT ACCOUNTING POLICIES

jew:

Zerodha Capital Private Limited is a private limited company incorporated on 14 February 2014 under

the provisions of the Companies Act, 2013 with Registrar of Companies, Bangalore bearing CIN

U67100KA2014PTC073653. Company also holds a certificate of registration from Reserve Bank of india

as a non-deposit accepting Non-Banking Financial Company (‘NBFC-ND’) has got classified as a Base

Layer Non-Banking Financial Company- vide registration no. 02.00283 dated 01/06/2017. The Activity

of company includes providing Finance & is engaged in activities auxiliary to financial intermediation,

except insurance and pension funding,

2) Significant accounting policies

2.01 Basis of preparation of financial statements

The financial statements of the Company have been prepared in accordance with the generally

accepted accounting principles in india, (Indian GAAP). The Company has prepared these

financial statements to comply in all material respects with the Accounting Standards notified

under section 133 at the Companies Act, 2013 (‘the Act’), read together with rule 7 of the

Companies (Accounts) Rules, 2014 (as amended) and stipulated in the directions issued by

Reserve Bank of India (RB!) in its Master Direction- Non-Banking Financial Company —Non-

Systemically Important Non-Deposit taking Company (Reserve Bank) Directions, 2016 to the

extent applicable to the Company.

‘The financial statements have been prepared on an accrual basis and under the historical cost

convention. The accounting policies adopted in the preparation of the financial statements are

in consistent with those of previous year

The financial statements have been prepared based on the going concern concept.

All assets and liabilities have been classified as current or non-current as per the Company's

normal operating cycle and other criteria set out in the Schedule I! to the Companies Act, 2013.

Based on the nature of products and the time between the acquisition of assets for processing,

and their realization in cash and cash equivalents, Company has ascertained its operating cycle

as 12 months for the purpose of current ~non-current classification of assets and liabilities.

2.02, Use of estimates

The preparation of financial statements in conformity with Indian Generally Accepted

Accounting Policies requires management to make certain estimates and assumptions that

affect the reported amounts of assets, liabilities and disclosure of contingent assets and

liabilities at the date of financial statements and reported amounts of revenue and expenses

during the reported period, Although such estimates are made on a reasonable and prudent

basis taking into account all available information, actual results could differ from those

estimates.

2.03 Revenue Recognition

Revenue is recognized to the extent that it is probable that the economic benefits will flow to

the company and revenue can be reliably measured. The company follows the accruai system

of accounting for its income and expenditure except income on assets classified as. non.

performing asset (NPA), which is in accordance with the guidelines issued by the Reserve Bank

of India for Non-Banking Finance Companies, is recognised on receipt basis,

Income from financing activities is recognized on the basis of internal rate of return on time

Proportion basis. All other charges relating to financing activities are recognized on accrual

basis,

Interest income is recognised on an accrual basis by applying the rate of interest implicit in the

loan contract over the contract period,

toan Closure charges and other service charges is recognised as per the terms of the contract.

Dividend income is recognized when the right to receive the dividend is established,

2.04 Loans & Advances and Provisions thereon

Loans and Advances are stated at the amount advanced including finance charges accrued and

expenses recoverable, up to the Balance Sheet date as reduced by the amounts received and

loans securitized,

Non-performing loans are written off/provided for, as per management estimates, subject to

the minimum provision required as per Master Direction - Non-Banking Financial Company ~

Non-Systemically Important Non-Deposit taking Company and Deposit taking Company

{Reserve Bank) Directions, 2016 as and when amended. Delinquencies on assets

securitized/assigned are provided for based on management estimates.

Master Direction - Non-Banking Financial Company - Systemically Important Non-Deposit taking

Company and Deposit taking Company (Reserve Bank) Directions, 2016 Provisioning norms are

given below:

Gasification of Assets [rite ForGassfieation | _Brovlson Se

‘As per prudential Norms of

Jo fee | Ret |

| Standard Asset Standard asset shall mean the | 0.25%

asset in respect of which, no |

| default in repayment of

| principal or payment of

interest is perceived and

which does not disclose any

problem or carry more than |

j normal-risk attached to the |

[business _

Sub-standard asset An asset which has been 10%

Classified as non-performing

asset for a period not

- | exceeding 18 months, i

Doubtful asset i

‘An asset which remains a sub- |

standard asset for a period

exceeding 18 months

Secured: Upto 1 Year

From 1 to 3 Years

Above 3 Years

Unsecured

Loss Assets | Loss asset shall mean an asset

which has been identified as |

loss asset by the non-banking i

financial company or its |

internal or external auditor or

| by the Bank during the

inspection of the applicable

_Lnere | i

2.05 Investments.

'nvestment that are readily realisable and intended to be held for not more than one year from

the date in which such Investments are made are classified as current investments. All other

investments are classified as long-term investments, Current investments are carried at lowes

of cost or fair value, long term investments are carried at cost. However, provision for

diminution in value is made to recognise a decline other than temporary in the value of long-

term investments,

2.06 Employee Benefits

2.06.01 Short-term employee benefits: The undiscounted amount of short-term employee

benefits expected to be paid in exchange for the services rendered by employees are recognised

Guring the year when the employees.render the service. These benefits include performance

incentive and compensated absences which are expected to occur within twelve months after

the end of the period in which the employee renders the related service.

2.06.02 Provident fund: Provident Fund Contribution is accounted on actual liability basis and

Paid to the Government managed Employees! Provident Fund Organization. PF contribution

from Employee and Employer is calculated on the basic salary of the Employee, The treatment

for the Provident fund is given as per the Employees Provident Fund and Miscellaneous

Provisions Act-1952.

2.06.03 Employees State Insurance: Employees State Insurance premium is paid as per the Act

St contribution from Employee and Employer is calculated on the basic salary of the Employee.

‘The treatment for the ESI is given as per the Employees State Insurance Act -1961.

2.06.04 Gratuity: This is a defined benefit plan Gratuity liability is provided based on actuarial

valuation using Projected Unit Credit Method. Actuarial Gains and Losses comprising of

experience adjustments and the effects of changes in actuarial assumptions, are recognise!

immediately in the Profit and Loss Account as income or expenses.

2.07 intangible assets and Amortisation

Intangible assets acquired separately are measured on initial recognition at cost, The cost of

intangible assets acquired in an amalgamation in the nature of purchase is their fair value as at

the date of amalgamation. Following initial recognition, intangible assets are carried at cost less

accumulated amortization and accumulated impairment losses, if any. internally generated

intangible assets, excluding capitalized development costs, are not capitalized and expenditure

is reflected in the statement of profit and loss in the year in which the expenditure is incurred.

Intangible assets are amortized on a straight-line basis over the estimated useful economic life.

The Company uses a rebuttable presumption that the useful life of an intangible asset will not

exceed ten years from the date when the asset is available for use. If the perstasive evidence

exists to the affect that useful life of an intangible asset exceeds ten years, the Company

amortizes the intangible asset over the best estimate of its useful life. Such intangible assets

and intangible assets not yet available for use are tested for impairment annually, either

individually or at the cash-generating unit level. All other intangible assets are assessed for

impairment whenever there is an indication that the intangible asset ray be impaired,

The amortization period and the amortization method are reviewed at least at each financial

year end. If the expected useful life of the asset is significantly different from previous

estimates, the amortization year is changed accordingly. if there has been a significant change

in the expected pattern of economic benefits from the asset, the amortization method i

changed to refiect the changed pattern. Such changes are accounted for in accordance with AS

5 Net Profit or Loss for the Period, Prior Period items and Changes in Accounting Policies

Gains or losses arising from derecognition of an intangible asset are measured as the difference

between the net disposal proceeds and the carrying amount of the asset and are recognized in

the statement of profit and loss when the asset is derecognized

2.08 Expenses

The Company provides for all expenses comprising of Employee Benefit Expenses and Other

Expenses on accrual basis,

2.09 Cash Flow Statement

The cash flow statement is prepared in accordance with the indirect method prescribed in

Accounting Standard 3. The Cash flow from operating, Investing and financing activities of the

Company are segregated based on available information, Cash comprises of cash on hand and

demand deposits with Banks Cash equivalents are short term balances (with an obligation

maturity of three month or less from the date of acquisition), highly liquid investments that are

readily convertible into known amounts of cash and which are subject to insignificant risks of

changes in value.

2.10 Borrowing Cost

All Borrowing cost are expensed in the period they occur. Borrowing cost consists of interest

and other cost that an entity incurs in the connection with the borrowing of the funds

Borrowing costs that are attributable to the acquisition or construction of qualifying assets are

Capitalized as part of the cost of such assets. All other borrowing costs are charged to revenue.

2.11 Taxes on Income

Income Taxes Tax expense comprises of current and deferred tax Current income tax is

measured al the amount expected to be paid to the tax authorities in accordance with the

Income-Tax Act, 1961 enacted in India, Provision for current lax is made based on the liability

computed in accordance with the relevant tax rates and tax laws.

Deferred income taxes reflect the impact of current year timing differences between Taxable

income and accounting Income originating during the year and reversal of timing differences of

earlier years, Deferred tax is measured based on the tax rates and the tax laws enacted o1

substantively enacted at the Balance Sheet date.

Deferred tax liabilities are recognised for all the taxable timing differences. Deferred tax assets

are recognised only to the extent that there is reasonable certainty that sufficient future taxable

income will be available against which such deferred tax assets can be realised. tn

situations where the Company has unabsorbed depreciation or carry forward tax losses, all

deferred tax assets are recognised only if there is virtual certainly supported by convincing

evidence that they can be realised against future taxable profits

2.12 Operating Leases

Leases, where the lessor electively retains substantially all the risks and benefits of ownership

of the leased item, are classified as operating leases. Lease rentals in respect of assets taken on

operating lease are charged to the Statement of Profit and Loss ona straight-line basis over the

tease term, The company does not have any lease transaction during the year.

2.13 Asset classification

‘These are classified as standard assets, sub-standard assets, doubtful assets, loss assets in terms

of Reserve Bank of India directions as laid down in "Master Direction - Non-Banking Financial

Company -Non-Systemically Important Non-Deposit taking Company (Reserve Bank) Directions,

2016"

2.14 Earnings Per share

Earnings per share Basic earnings per share are calculated by dividing the net profit or loss for

the period attributable to equity shareholders by the weighted average number of equity shares

outstanding during the year. For the purpose of calculating diluted earnings per share, the net

Profit or loss for the period attributable to equity shareholders and the weighted average

‘number of shares outstanding during the period are adjusted for the effects of all dilutive

potential equity shares,

2.15 Provisions, Contingent Liabilities and Contingent Assets

Provisions involving a substantial degree of estimation in measurement are recognized when

‘there is a present obligation as a result of past events and it is probable that there will be an

Outflow or resources. Contingent liabilities are not recognized but are disclosed in the accounts

by way of a note. Contingent assets are neither recognized nor disclosed in the financial

statements.

2.16 Segment Information

The Company operates in a single reportable segment ice. lending activity, which has similar

risks and returns for the purpose of reporting under AS-17 Segment Reporting! The Company

primarily operates in india and does not have any reportable geographical segment.

2.17 Disclosure in respect of Related Parties/ Related Parties Transaction as prescribed by the

accounting Standard 18 issued by ICAI for the year ended 31%" March 2022 is as given below:

a) List of Related par

[Name

i Straddle Capital Private | Shareholder —— |

Umited

| 2. [Hanan Abdul Delvi_ Director

| 3. | Venu MadhaviS | Director

——3._| Venu Madi |

4. _| Within Kamath Director

—_5._| Nikhil Kamath =| Dire

6._| Seema Patil Direc ae j

7._| Kailash Nadh _[KMP& Shareholder a +

| 8. [Zerodha Broking Limited | Share Holder _ |

[~9.~F austin Global Ventures | shareholder - : |

| Private Limited

40. | ETS Securities Private | Group Company under common Biomoies /

Limited (Formerly | Directors |

Zerodha Securities Private

i

Limited) _ '

411, | Zerodha Commodities Pvt | Group Company under common Promoters /

| ud Directors

12. | Zerodha Technology Pvt | Group Company under common Promoters / |

lL td | Directors _ |

B Group Company under common Promoters / |

1 Rainmatter Capital Pvt Ltd | Directors

(14. | Wksquared Investment | Group Company “under “common Promoters /

. Private Limited | Directors

415. | Rainmatter Land | Group Company under common Promoters /

Development Private | Directors

_| timitea |

16. | True Beacon investment | Group Company under common Promoters / |

___[Advisorsup | Directors

17. | zerodha (FSC) Private | Group Company under common Promoters 4

| Limited Directors |

18. | Zeroaha Trustee Private | Group Company under common Promoters 7|

| tinted | Directors |

19. | Zerodha Asset Monagement | Group Company under common Promoters /

Private Limited piers

20. | Trustx intemet Private | Group Company under common Promoters /

Limited Directors _

21 Group Company under common Promoters /|

Nithin Kamath HUF Directors

22. | Kamath Associates | Group Company under common Promoters /

Karnataka Directors _|

[3 Sroup Company under” common Promoters /|

Directors

a Group Company under common Promoters /

Rainmatter Foundation _| Directors

25. Group Company under common’ Promoters /

Nksquared Reality LLP__| Directors

26. Group Company under common Promoters /

Zerodha Cares Directors

||] es Group Company under common Promoters /

Vs Directors |

28. | | Group Company under common Promoters /

reer es |

eea Group Company under common Promoters /|

Irae tctnoogyur_ [se

130. | | Group Company under common Promoters /

Zerodha Mutual Fund _| Directors .

31. | NK Enterprises Holding | Group Company under common Promoters /

Limited Directors a 2

b) Name of the Related Parties with whom transaction were carried out during the year And

description of relationship

Relationship __[NameofRelated Party ]

Enterprises in KIMP/ Relative of KMP| 1. zerodha Broking Limited

| exercises significant influence 2.__Zerodha Technology Pyt itd

| Key Management Personnel’s | 1 Nikhil Kamath

ie a 2._Nithin Kamath

¢) Summary of Transaction with Related

Parties during the year.

(Amounts in Rs.

Lakhs)

| Transaction | Name of the | Key © [Relative of | Enterprises in

related Party | Management | key | KMP/ Relative of

Personnel’s | Management | KMP exercises

Personnel’s | significant

| - i influence

‘Reimbursement | Zerodha ae 6.76)

of Expenses _| Broking Limited

Loan taken Nikhil Kamath | _

loanTaken | Nithin Kamath | _|

Interest P Interest Paid |

Interest Paid | Interest Paid_ - __ |}

Issue of Series A | Zerodha 2,996.79

| cces Broking Limited

jPurchase of |Zerodha. 15.93 |

Services (| Technology Put |

Including Taxes) | Utd

Purchase of | Zerodha 35.40

Software _( | Technology Pvt

Including Taxes) | Ltd | I

4) _Disclosue as per RBI Guidelines

rene — eid Pay : Toil

arent | Sibsidiaies | aatoctee) | Key Management Tater okay oie

(es. per seine Personne, Management Personnel

onnesh ventures

Por

contr —

op papa ja pa ter WF or Wr apr la fw

orawin PC PE | RIC PIE PEPE] LRRD Wi Bo05s [rac IC] | Sano

sstaten ©.

[Boronia |i | wi wee TC sooo PwC PEP | Sa

sgRepald _— = - | _

Oeposts Rw wie Wwe iL in ait wi wi

Piocamen PNP NP WLP WP NP NE Ni wi NL We

tot

eposts .

ET TT TT Si i cm wi aw Pw

Purchase [A PML WL] WLP NIC | NY NL Ni 3520 [mi wie PLP. AL

of 0

feat

sale of PAT PAL [Rae PR PEPE | pac Cn rs nie ie PP

feeann

[interest Pac ae Pe mR ~ wie Pac Pa ra aa

° 6

Interest ie PE | | wi nie wa wa Pm fw

reeened |

isueot [Rie PAIL WAL [WEY NCP we wi IER TTR TT 38 | T5000 |

sewese | %5 |

cons _ _ _

Fembus WE | WEY RIC | ERP wi 76 737 wa Pe

ementaf

a _ z = | Z

[Prorcase [ac Pa [ie Pa PPP Wi BaP wep wp

of 3

Series _

2.18 Exposure to Capital Market

(Amounts in Rs. Lakhs)

Particulars a Current Year

Previous Year

direct investment in equity shares, convertible bonds, | -

convertible debentures and units of equity-oriented

mutual funds the corpus of which is not exclusively

invested in corporate debt;

advances against shares / bonds / debentures or other | -

securities or on clean basis to individuals for investment in

shares including IPOs / ESOPs), convertible bonds,

convertible debentures, and units of equity-oriented

mutual funds;

convertible bonds or convertible debentures or units of

equity oriented mutual funds are taken as primary.

security;

advances for any other purposes where shares or | 6,917.31

3,250.84

advances for any other purposes to the extent secured by

the collateral security of shares or convertible bonds or

convertible debentures or units of equity oriented mutual

funds i.e. where the primary security other than shares /

convertible bonds / convertible debentures / units of

equity oriented mutual funds does not fully cover the

advances;

secured and unsecured advances to stockbrokers and

guarantees issued on behalf of stockbrokers and market

makers;

loans sanctioned to corporates against the security of

shares / bonds / debentures or other securities or on clean

basis for meeting promoter's contribution to the equity of

new companies in anticipation of raising resources;

bridge loans to companies against expected equity flows /

sues;

all exposures to Venture Capital Funds (both registered

and unregistered)

‘Total Exposure to Capital Market

2.19 Exposure to Real estate

3,250.84

Category

a) Residential Mortgages —

Lending fully secured by mortgages on residential

property that is or will be occupied by the borrower or that

is rented. Exposure would also include non-fund based

(NFB) limits.

i) Direct exposure

Current Year

NIL

ba

Previous Year

b) Commercial Real Estate —

Lending secured by mortgages on commercial real estate

{office buildings, retail space, multipurpose commercial

premises, multifamily residential buildings, multi tenanted

commercial premises, industrial or warehouse space,

hotels, land acquisition, development and construction,

etc). Exposure would also include non-fund based (NFB)

limits.

NIL

NIL

¢) Investments in Mortgage-Backed Securities (MBS) and

other securitized exposures ~

i. Residential

ii, Commercial Real Estate

NIL

NIL

| ii) Indirect Exposure =

Fund based and non-fund-based exposures on National