Professional Documents

Culture Documents

Ratio Anaylis

Uploaded by

finance.mhotelkigaliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratio Anaylis

Uploaded by

finance.mhotelkigaliCopyright:

Available Formats

ASSIGNMENT ON FINANCIAL STATEMENT ANALYSIS AND INTERPRETATION

(MFIN 605)

Afriwanda

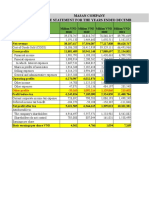

Consolidated and Separate Statement of Profit or Loss and Other

Comprehensive Income for the Year Ended 31 December 2022

In Million Group Group Bank Bank

31 Dec 2022 31 Dec 2021 31 Dec 2022 31 Dec 2021

Interest and similar income 540,166 427,597 448,174 340,388

Interest and similar expense (173,539) (106,793) (153,019) (82,718)

Net interest income 366,627 320,804 295,155 257,670

Impairment charge on financial and (123,252) (59,932) (61,896) (56,175)

non-financial instruments

Net interest income after impairment loss on financial and non- 243,375 260,872 233,259 201,495

financial instruments

Net income on fees and commission 132,795 103,958 110,098 84,185

Trading gains 212,678 167,483 201,645 171,469

Other operating income 35,494 37,594 49,790 53,266

Depreciation of property and equipment (26,630) (25,305) (24,519) (23,204)

Amortisation of intangible assets (3,678) (3,779) (3,045) (3,064)

Personnel expenses (86,412) (79,885) (68,475) (61,123)

Operating expenses (222,972) (180,564) (204,703) (165,857)

Profit before tax 284,650 280,374 294,050 257,167

Income tax expense (60,739) (35,816) (59,457) (24,034)

Profit for the year after tax 223,911 244,558 234,593 233,133

Other comprehensive income:

Items that will never be reclassi!ed to profit or loss:

Fair value movements on equity instruments at FVOCI 8,109 5,599 8,109 5,599

Items that are or may be reclassi!ed to pro!t or loss:

Foreign currency translation differences for foreign operations (28,768) 8,485 - -

Fair value movements on debt securities at FVOCI (6,602) (2,227)

Other comprehensive(loss)/ income for the year net of taxation (27,261) 11,857 8,109 5,599

Total comprehensive income for the year 196,650 256,415 242,702 238,732

Profit (loss) attributable to:

Equity holders of the parent 224,050 244,402 234,593 233,133

Non controlling interest (139) 156

Total comprehensive income attributable to:

Equity holders of the parent 196,981 256,245 242,702 238,732

Non controlling interest (331) 170

Earnings per share

Basic and diluted (Naira) 7.14 7.78 7.47 7.43

Afriwanda Consolidated and Separate Statement of Financial

Position as at 31 December 2022

In Million Group Group Bank Bank

31 Dec 2022 31 Dec 2021 31 Dec 2022 31 Dec 2021

Assets

Cash and balances with central banks 2,201,744 1,488,363 2,102,394 1,397,666

Treasury bills 2,246,538 1,764,946 2,206,668 1,577,647

Assets pledged as collateral 254,663 392,594 254,565 357,000

Due from other banks 1,302,811 691,244 1,132,796 518,053

Derivative assets 49,874 56,187 48,851 57,476

Loans and advances 4,013,705 3,355,728 3,735,676 3,099,452

Investment securities 1,728,334 1,303,725 622,781 477,004

Investment in subsidiaries - - 34,625 34,625

Deferred tax asset 18,343 1,837 - -

Other assets 213,523 168,210 193,792 152,326

Property and equipment 230,843 200,008 214,572 177,501

Intangible assets 25,251 25,001 23,958 23,542

Total assets 12,285,629 9,447,843 10,570,678 7,872,292

Liabilities

Customers' deposits 8,975,653 6,472,054 7,434,806 5,169,199

Derivative liabilities 6,325 14,674 6,040 15,170

Current income tax payable 64,856 16,909 61,655 14,241

Deferred tax liabilities 16,654 11,603 15,911 11,596

Other liabilities 568,559 487,432 546,347 427,876

On-lending facilities 311,192 369,241 311,192 369,241

Borrowings 963,450 750,469 999,580 769,395

Debt securities issued - 45,799 - 45,799

Total liabilitles 10,906,689 8,168,181 9,375,531 6,822,517

Capital and reserves

Share capital 15,698 15,698 15,698 15,698

Share premium 255,047 255,047 255,047 255,047

Retained earnings 625,005 607,203 494,429 466,249

Other reserves 482,377 400,570 429,973 312,781

Attributable to equity holders of the parent 1,378,127 1,278,518 1,195,147 1,049,775

Non-controlling interest 813 1,144 - -

Total shareholders' equity 1,378,940 1,279,662 1,195,147 1,049,775

Total liabilities and equity 12,285,629 9,447,843 10,570,678 7,872,292

You are required to use the information of the Group in the table above to compute;

A). 4 Activity ratio

B). 3 Liquidity ratio

C). 3 Profitability ratios

D). 3 equity ratios

E). 3 Gearing ratios

Kindly interpret each result after the answer.

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- HBL Financial Statements - December 31, 2022Document251 pagesHBL Financial Statements - December 31, 2022Muhammad MuzammilNo ratings yet

- Pragathi Infra - Financial StatementDocument3 pagesPragathi Infra - Financial StatementAnurag ShuklaNo ratings yet

- MasanDocument46 pagesMasanNgọc BíchNo ratings yet

- Revenue 6% Other Oper 30%Document9 pagesRevenue 6% Other Oper 30%Amit Kumar SinghNo ratings yet

- 10 - AccentureDocument21 pages10 - AccenturePranali SanasNo ratings yet

- AC FS Analysis (2020 - 2022) For UploadDocument90 pagesAC FS Analysis (2020 - 2022) For UploadKenneth Jules GarolNo ratings yet

- Tempe FS Final v3Document5 pagesTempe FS Final v3edgsd05No ratings yet

- Acc319 - Take-Home Act - Financial ModelDocument24 pagesAcc319 - Take-Home Act - Financial Modeljpalisoc204No ratings yet

- UBA FS-31Dec2021Document2 pagesUBA FS-31Dec2021Fuaad DodooNo ratings yet

- Vietnam Dairy Products Joint Stock Company Balance Sheet December 31, 2020Document24 pagesVietnam Dairy Products Joint Stock Company Balance Sheet December 31, 2020Như ThảoNo ratings yet

- NICOL Financial Statement For The Period Ended 30 Sept 2023Document4 pagesNICOL Financial Statement For The Period Ended 30 Sept 2023Uk UkNo ratings yet

- 20230607-Trans-Audited-Financial-State-2022Document4 pages20230607-Trans-Audited-Financial-State-2022Sammy PinagodNo ratings yet

- Atlas Honda (2019 22)Document6 pagesAtlas Honda (2019 22)husnainbutt2025No ratings yet

- SHV Port - FS English 31 Dec 2019 - SignedDocument54 pagesSHV Port - FS English 31 Dec 2019 - SignedNithiaNo ratings yet

- First Bank of Nigeria Unaudited Balance Sheet June 2010Document1 pageFirst Bank of Nigeria Unaudited Balance Sheet June 2010Kunle AdegboyeNo ratings yet

- Financial Publication MarchDocument2 pagesFinancial Publication MarchFuaad DodooNo ratings yet

- Unaudited Financials BSX December 2023Document2 pagesUnaudited Financials BSX December 2023BernewsNo ratings yet

- Philippine Seven Corporation and SubsidiariesDocument4 pagesPhilippine Seven Corporation and Subsidiariesgirlie ValdezNo ratings yet

- Wassim Zhani Texas Roadhouse Financial Statements 2006-2009Document14 pagesWassim Zhani Texas Roadhouse Financial Statements 2006-2009wassim zhaniNo ratings yet

- Suzuki Motor Corporation Balance Sheet AS ON DEC 31 .. AssetsDocument3 pagesSuzuki Motor Corporation Balance Sheet AS ON DEC 31 .. AssetsM Bilal KNo ratings yet

- Askari Bank Limited Financial Statement AnalysisDocument16 pagesAskari Bank Limited Financial Statement AnalysisAleeza FatimaNo ratings yet

- Hotel RoyalDocument28 pagesHotel RoyalFasasi Abdul Qodir AlabiNo ratings yet

- Complete financial model & valuation of ARCCDocument46 pagesComplete financial model & valuation of ARCCgr5yjjbmjsNo ratings yet

- Fsap 8e - Pepsico 2012Document46 pagesFsap 8e - Pepsico 2012Allan Ahmad Sarip100% (1)

- Parcial InglesDocument7 pagesParcial InglesJorge CastilloNo ratings yet

- Ratio Analysis ExcerciseDocument12 pagesRatio Analysis Excercisegaurav makhijaniNo ratings yet

- MicrosoftDocument11 pagesMicrosoftJannah Victoria AmoraNo ratings yet

- Contoh Laporan Keuangan Sekuritas PaninDocument8 pagesContoh Laporan Keuangan Sekuritas PanincardistszagaNo ratings yet

- United Bank For Africa (Ghana) Limited Summary Financial Statements For The Year Ended 31 December 2020Document2 pagesUnited Bank For Africa (Ghana) Limited Summary Financial Statements For The Year Ended 31 December 2020Fuaad DodooNo ratings yet

- Empire East: Q2/H1 Financial StatementDocument34 pagesEmpire East: Q2/H1 Financial StatementBusinessWorldNo ratings yet

- Greenko - Investment - Company - Audited - Combined - Financial - Statements - FY 2018 - 19Document102 pagesGreenko - Investment - Company - Audited - Combined - Financial - Statements - FY 2018 - 19hNo ratings yet

- Quarterly Report 20200930Document18 pagesQuarterly Report 20200930Ang SHNo ratings yet

- Balance Sheet - Assets: Period EndingDocument3 pagesBalance Sheet - Assets: Period Endingvenu54No ratings yet

- BPI Capital Audited Financial StatementsDocument66 pagesBPI Capital Audited Financial StatementsGes Glai-em BayabordaNo ratings yet

- Corporate Finance AssigmentDocument15 pagesCorporate Finance Assigmentesmailkarimi456No ratings yet

- IFRS FinalDocument69 pagesIFRS FinalHardik SharmaNo ratings yet

- Rafhan Maize Products Company LTDDocument10 pagesRafhan Maize Products Company LTDALI SHER HaidriNo ratings yet

- Nigeria German Chemicals Final Results 2012Document4 pagesNigeria German Chemicals Final Results 2012vatimetro2012No ratings yet

- UnileverDocument5 pagesUnileverKevin PratamaNo ratings yet

- ATA IMS - Q3 2023 Ended 31 Dec 2022 270223 (Final)Document15 pagesATA IMS - Q3 2023 Ended 31 Dec 2022 270223 (Final)eunjoNo ratings yet

- Deferred Tax Asset Retirement Benefit Assets: TotalDocument2 pagesDeferred Tax Asset Retirement Benefit Assets: TotalSrb RNo ratings yet

- ABS-CBN Financial StatementsDocument10 pagesABS-CBN Financial StatementsMark Angelo BustosNo ratings yet

- Purcari Lucru IndividualDocument7 pagesPurcari Lucru IndividualLenuța PapucNo ratings yet

- Netflix Financial ModelDocument23 pagesNetflix Financial ModelPrashant SinghNo ratings yet

- Unaudited Q3 23 Financial StatementDocument24 pagesUnaudited Q3 23 Financial StatementMd. Imran HossainNo ratings yet

- 09 Philguarantee2021 Part1 FsDocument5 pages09 Philguarantee2021 Part1 FsYenNo ratings yet

- 2017 DoubleDragon Properties Corp and SubsidiariesDocument86 pages2017 DoubleDragon Properties Corp and Subsidiariesbackup cmbmpNo ratings yet

- Tyson Foods Income Statement Analysis 2016-2014Document13 pagesTyson Foods Income Statement Analysis 2016-2014Adil SaleemNo ratings yet

- IbfDocument9 pagesIbfMinhal-KukdaNo ratings yet

- Unilever FM TermReportDocument8 pagesUnilever FM TermReportLuCiFeR GamingNo ratings yet

- EbcDocument29 pagesEbcDaviti LabadzeNo ratings yet

- Tugas (TM.5) Manajemen KeuanganDocument12 pagesTugas (TM.5) Manajemen KeuanganFranklyn DavidNo ratings yet

- Income StatementDocument44 pagesIncome Statementyariyevyusif07No ratings yet

- Financial Statement 2020Document3 pagesFinancial Statement 2020Fuaad DodooNo ratings yet

- Suzuki Motor Corporation Annual Reports and Financial Analysis (2014-2016Document12 pagesSuzuki Motor Corporation Annual Reports and Financial Analysis (2014-2016M Bilal K100% (1)

- MPCLDocument4 pagesMPCLRizwan Sikandar 6149-FMS/BBA/F20No ratings yet

- Pt. Garuda Indonesia TBK Balance Sheet 31 DECEMBER 2014,2015, AND 2016Document4 pagesPt. Garuda Indonesia TBK Balance Sheet 31 DECEMBER 2014,2015, AND 2016kanianabilaNo ratings yet

- Finance NFL & MitchelsDocument10 pagesFinance NFL & Mitchelsrimshaanwar617No ratings yet

- Tesla FSAPDocument20 pagesTesla FSAPSihongYanNo ratings yet

- 3g-Income-Statement FinalDocument13 pages3g-Income-Statement FinalPERCIVAL DOMINGONo ratings yet

- Strat SheetDocument1 pageStrat Sheetcourier12No ratings yet

- 96th RMFI Questions AnalysisDocument4 pages96th RMFI Questions Analysischayon mondolNo ratings yet

- AuditDocument5 pagesAuditKyanna Mae LecarosNo ratings yet

- Order Blocks #2: Identifying Breaker BlocksDocument12 pagesOrder Blocks #2: Identifying Breaker BlocksS Wavesurfer100% (1)

- Financial Ratio Analysis 1682974149 PDFDocument55 pagesFinancial Ratio Analysis 1682974149 PDFMerve Köse100% (1)

- Copia Zuleyka Gabriela Gonzalez Sanchez - ESB III Quarter Exam Review VocabularyDocument4 pagesCopia Zuleyka Gabriela Gonzalez Sanchez - ESB III Quarter Exam Review Vocabularyzulegaby1409No ratings yet

- Credit and Collection Midterm ReviewerDocument41 pagesCredit and Collection Midterm ReviewerRhenzo ManayanNo ratings yet

- FM - EcoDocument352 pagesFM - EcoKinjal Jain100% (1)

- Job Ad - CSODocument1 pageJob Ad - CSOMuhammad AdnanNo ratings yet

- M5 e Text BookDocument534 pagesM5 e Text BookMalvin TanNo ratings yet

- Internship ReportDocument38 pagesInternship ReportManasvi DoshiNo ratings yet

- MBA 4th Sem IM Unit I Probs On Risk and ReturnDocument5 pagesMBA 4th Sem IM Unit I Probs On Risk and ReturnMoheed UddinNo ratings yet

- Inv. Ch-5&6-1Document76 pagesInv. Ch-5&6-1Mahamoud HassenNo ratings yet

- Block 2Document82 pagesBlock 2Shreya PansariNo ratings yet

- 73e8ab49-e63b-48d0-9dc5-2459547fe32aDocument1 page73e8ab49-e63b-48d0-9dc5-2459547fe32arexhvelajdiamantNo ratings yet

- Axis BankDocument19 pagesAxis Bankathul jobyNo ratings yet

- 3.1 Slide Life Insurance Benefit - Part 1Document15 pages3.1 Slide Life Insurance Benefit - Part 1caramel latteNo ratings yet

- Marketing Management: Kotler and Keller The Arab World EditionDocument46 pagesMarketing Management: Kotler and Keller The Arab World EditionOmar ShededNo ratings yet

- Unit 2 - 3 Buying and Handling MerchandiseDocument27 pagesUnit 2 - 3 Buying and Handling MerchandiseroyalmayankojhaNo ratings yet

- Social Media, Its Effect On SME's in Kano, NigeriaDocument39 pagesSocial Media, Its Effect On SME's in Kano, Nigeriamarkchima8No ratings yet

- Bpi Pera FaqDocument7 pagesBpi Pera FaqHana DumpayanNo ratings yet

- USA State Wise Email Leads PDFDocument7 pagesUSA State Wise Email Leads PDFBriltex Industries0% (1)

- Ultimate Social Enterprise Pitch Deck TemplateDocument31 pagesUltimate Social Enterprise Pitch Deck TemplatejaishitaNo ratings yet

- 3032 Main ProjectDocument71 pages3032 Main Projectamanmukri1No ratings yet

- FN3023 Commentary 2022Document16 pagesFN3023 Commentary 2022Aishwarya PotdarNo ratings yet

- MarksonDocument2 pagesMarksonyaregalNo ratings yet

- Financial Statement 1124Document135 pagesFinancial Statement 1124Prima MeilisaNo ratings yet

- Account Statement 100323 280323Document5 pagesAccount Statement 100323 280323Mainak BhattacharjeeNo ratings yet

- Acct Statement - XX9657 - 19122023nxDocument29 pagesAcct Statement - XX9657 - 19122023nxdepiha5135No ratings yet