Professional Documents

Culture Documents

Bond Class 8

Uploaded by

sairad1999Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bond Class 8

Uploaded by

sairad1999Copyright:

Available Formats

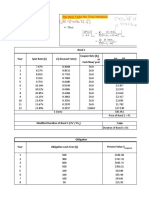

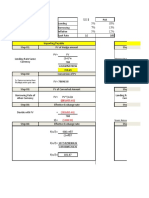

Q Face Value 1000

Coupon rate 12% Payable annually

Maturity 5 years

YTM 14%

Calculate Price,Duration,MD & Convexity

Calculate New Price if yield is expected to fall by 60 bp using

1. Only Duration

2. Duration & Convexity

3. Full Revaluation

Answer

Years (X) Cash Flow DF @ 14%

1 120 $0.8772

2 120 $0.7695

3 120 $0.6750

4 120 $0.5921

5 1120 $0.5194

Price $931.34

Duration 3725.59/931.34 4.00

Modified Duration Duration/1+r 3.51

Modified Convexity Summation (WX*(X+1))/(2*P0*(1+r)^2) 8.513234245277

Forecast r will fall by 60 bp

% change in Price

Duration Effect 2.1054

Convexity Adjustment 0.0306

Total % Change in Price 2.1360

New Price Estimate

using only Duration $950.95

Using Duration & Convexity 951.23

New Price using Full Revaluation @ 13.4% $951.24

PVCF(W) WX WX*(X+1)

$105.26 $105.26 210.53

$92.34 $184.67 554.02

$81.00 $242.99 971.96

$71.05 $284.20 1420.99

$581.69 $2,908.46 17450.79

$931.34 $3,725.59 $20,608.28

You might also like

- Kuis Manajemen Keuangan - Manajemen UIDocument16 pagesKuis Manajemen Keuangan - Manajemen UIjadwal SekjenNo ratings yet

- Chapter 3: Valuation of Bonds and Shares Problem 1: 0 INT YieldDocument25 pagesChapter 3: Valuation of Bonds and Shares Problem 1: 0 INT YieldParth UjjainNo ratings yet

- Lec 15Document9 pagesLec 15Ryan GroffNo ratings yet

- Finance ProblemSets11Document323 pagesFinance ProblemSets11Stefan CN100% (2)

- Book 1Document3 pagesBook 1Naman KapoorNo ratings yet

- Amortized Cost MethodDocument56 pagesAmortized Cost MethodAhmed DesoukiNo ratings yet

- Bond Immunization Using Solver Exercise - EmptyDocument14 pagesBond Immunization Using Solver Exercise - EmptyAdarsh JalanNo ratings yet

- SPSS ProduksiDocument3 pagesSPSS Produksiaprinda lovelaNo ratings yet

- Major AssignementDocument9 pagesMajor AssignementInzamam ul haqNo ratings yet

- Tugas1Document9 pagesTugas1Arsya AldeNo ratings yet

- Valuation of Bonds and Shares: Problem 1Document15 pagesValuation of Bonds and Shares: Problem 1anubha srivastavaNo ratings yet

- Frequencies: Lampiran Hasil SPSS Analisa UnivariatDocument5 pagesFrequencies: Lampiran Hasil SPSS Analisa UnivariatsukmaangNo ratings yet

- PratikumstatlanDocument4 pagesPratikumstatlanDewi PuspitaNo ratings yet

- Bond Value IntroductionDocument4 pagesBond Value IntroductionNikhil BajoriaNo ratings yet

- Regression: Descriptive StatisticsDocument4 pagesRegression: Descriptive StatisticsIlyasa YusufNo ratings yet

- CH SolutionsDocument6 pagesCH SolutionsPink MagentaNo ratings yet

- Abhilash N - FIMDocument6 pagesAbhilash N - FIMAbhilash NNo ratings yet

- Solution To Convexity QuestionDocument2 pagesSolution To Convexity QuestionnatashaNo ratings yet

- Interest Rate Risk NotesDocument157 pagesInterest Rate Risk Notesdaksh.agarwal180No ratings yet

- FrequenciesDocument9 pagesFrequenciescaturNo ratings yet

- Chapter 6Document16 pagesChapter 6Helmi MohrabNo ratings yet

- MGT201 Assignment NO.1 2020Document2 pagesMGT201 Assignment NO.1 2020hk dhamanNo ratings yet

- Colgate Palmolive ModelDocument51 pagesColgate Palmolive ModelAde FajarNo ratings yet

- FINA 4400: Financial Markets and Institutions: End of Chapter Question #4Document13 pagesFINA 4400: Financial Markets and Institutions: End of Chapter Question #4Mr. CopernicusNo ratings yet

- Topics: Convexity Immunization by Matching Convexity in Addition To DurationDocument8 pagesTopics: Convexity Immunization by Matching Convexity in Addition To DurationVeeken ChaglassianNo ratings yet

- Introduction To Financial ModellingDocument9 pagesIntroduction To Financial ModellingHabib AhmadNo ratings yet

- ESCOBER - SQ2 - Time Value of MoneyDocument48 pagesESCOBER - SQ2 - Time Value of MoneyNike Jericho EscoberNo ratings yet

- Type & Size of Cable B.O.M: Product Code: Standard: SPLN 42-10 NFA2X 2x10 mm2Document10 pagesType & Size of Cable B.O.M: Product Code: Standard: SPLN 42-10 NFA2X 2x10 mm2RukimanNo ratings yet

- Module 5 YT-lectureDocument27 pagesModule 5 YT-lectureDavid FaraonNo ratings yet

- Debt Markets N 3Document130 pagesDebt Markets N 3parv salechaNo ratings yet

- Time Value of Money NotesDocument22 pagesTime Value of Money NotesBeatrice Anne CanapiNo ratings yet

- 4) Vid 005-dcf - Discounted-Cash-Flow-Model PDFDocument3 pages4) Vid 005-dcf - Discounted-Cash-Flow-Model PDFAkshit SoniNo ratings yet

- Duration and Bonds - 27 Pages of Q & ANSDocument27 pagesDuration and Bonds - 27 Pages of Q & ANSAbdulaziz FaisalNo ratings yet

- Bond Valuation 22Document8 pagesBond Valuation 22phượng nguyễn thị minhNo ratings yet

- Ebit Capex Change in WC FCF: Risk Free Rate 1.67% Market Return (S&P 500) 9.30% Beta 1.13Document5 pagesEbit Capex Change in WC FCF: Risk Free Rate 1.67% Market Return (S&P 500) 9.30% Beta 1.13Paul GhanimehNo ratings yet

- CobaDocument17 pagesCobaAimNo ratings yet

- Lampiran SPSS 25 Desember 2023Document2 pagesLampiran SPSS 25 Desember 2023rsudhah.isolasiaNo ratings yet

- Sinking Fund (Annuity of A Future Value)Document3 pagesSinking Fund (Annuity of A Future Value)Sandeep Guha NiyogiNo ratings yet

- Debtmarkets - All - Module 2Document20 pagesDebtmarkets - All - Module 2Naman KapoorNo ratings yet

- Chap 3Document18 pagesChap 3Qadirah IsrathNo ratings yet

- BCC620 Business Finance Management Main (JAN) E1 - JUL 2022 - ANSWER SCHEMEDocument5 pagesBCC620 Business Finance Management Main (JAN) E1 - JUL 2022 - ANSWER SCHEMERukshani RefaiNo ratings yet

- Corporate Finance1Document23 pagesCorporate Finance1Obaid GhouriNo ratings yet

- FM09-CH 03 PDFDocument14 pagesFM09-CH 03 PDFGregNo ratings yet

- Moon LightDocument4 pagesMoon LightAniket PuriNo ratings yet

- Duration FRMDocument4 pagesDuration FRMnidhi pahujaNo ratings yet

- PM - Dec 2012.odsDocument3 pagesPM - Dec 2012.odsFarman ShaikhNo ratings yet

- FADM Phase 2 - Sec 3 - Group 1Document44 pagesFADM Phase 2 - Sec 3 - Group 1Ravi KumarNo ratings yet

- Answers Are Displayed in Red.: Assumptions and Other Problem Notes Are Displayed at The Very BottomDocument13 pagesAnswers Are Displayed in Red.: Assumptions and Other Problem Notes Are Displayed at The Very BottomShekar PalaniNo ratings yet

- 2ND Secure Advance For 100 MDocument1 page2ND Secure Advance For 100 Mnaveed ahmedNo ratings yet

- Int Rate Sensitivities (Int Rate Risk)Document211 pagesInt Rate Sensitivities (Int Rate Risk)Harshit DwivediNo ratings yet

- 4.15 Correct One !!Document6 pages4.15 Correct One !!TarekYehiaNo ratings yet

- Cost of DebtDocument10 pagesCost of DebtOlivier MNo ratings yet

- A Estimation of Forwards & Futures PriceDocument103 pagesA Estimation of Forwards & Futures PriceMUSKAAN BAHLNo ratings yet

- Byjus Base ModelDocument8 pagesByjus Base Modelsharma.kunal70No ratings yet

- Practica Dirigida 5 Finanzas Corporativas 2022 II-SOLDocument31 pagesPractica Dirigida 5 Finanzas Corporativas 2022 II-SOLEdgard FretelNo ratings yet

- Poultry - CBA 123Document9 pagesPoultry - CBA 123johnzenbano120No ratings yet

- FO-003 Uncertainty Estimate - 1621923638Document2 pagesFO-003 Uncertainty Estimate - 1621923638swapon kumar shillNo ratings yet

- B) Price of Bond When YTM Is 6% 1459.90 Price of BondDocument13 pagesB) Price of Bond When YTM Is 6% 1459.90 Price of BondMasab AsifNo ratings yet

- FRM FormulasDocument36 pagesFRM FormulasAre EbaNo ratings yet

- Case Study 3: Alok Industries: Business ValuationDocument6 pagesCase Study 3: Alok Industries: Business Valuationsairad1999No ratings yet

- QUESTION 1: Financing Decision (Debt Equity Swap - Leveraged Buyback)Document4 pagesQUESTION 1: Financing Decision (Debt Equity Swap - Leveraged Buyback)sairad1999No ratings yet

- Advanced Capital Budgeting 4 CWDocument4 pagesAdvanced Capital Budgeting 4 CWsairad1999No ratings yet

- Advanced Capital Budgeting 3 CWDocument3 pagesAdvanced Capital Budgeting 3 CWsairad1999No ratings yet

- Business Valuation Amendment ClassDocument3 pagesBusiness Valuation Amendment Classsairad1999No ratings yet

- May 22 RTPDocument12 pagesMay 22 RTPsairad1999No ratings yet

- Advanced Capital Budgeting 3 HW - Q6Document4 pagesAdvanced Capital Budgeting 3 HW - Q6sairad1999No ratings yet

- Advanced Capital Budgeting 2 CWDocument4 pagesAdvanced Capital Budgeting 2 CWsairad1999No ratings yet

- Peer Review ScannerDocument7 pagesPeer Review Scannersairad1999No ratings yet

- SFM May 2022 Paper Analysis-New Syllabus-Question 2aDocument13 pagesSFM May 2022 Paper Analysis-New Syllabus-Question 2asairad1999No ratings yet

- Steps To Update ULURN Laptop SoftwareDocument2 pagesSteps To Update ULURN Laptop Softwaresairad1999No ratings yet

- 3 Application of ForensicDocument10 pages3 Application of Forensicsairad1999No ratings yet